EU supply

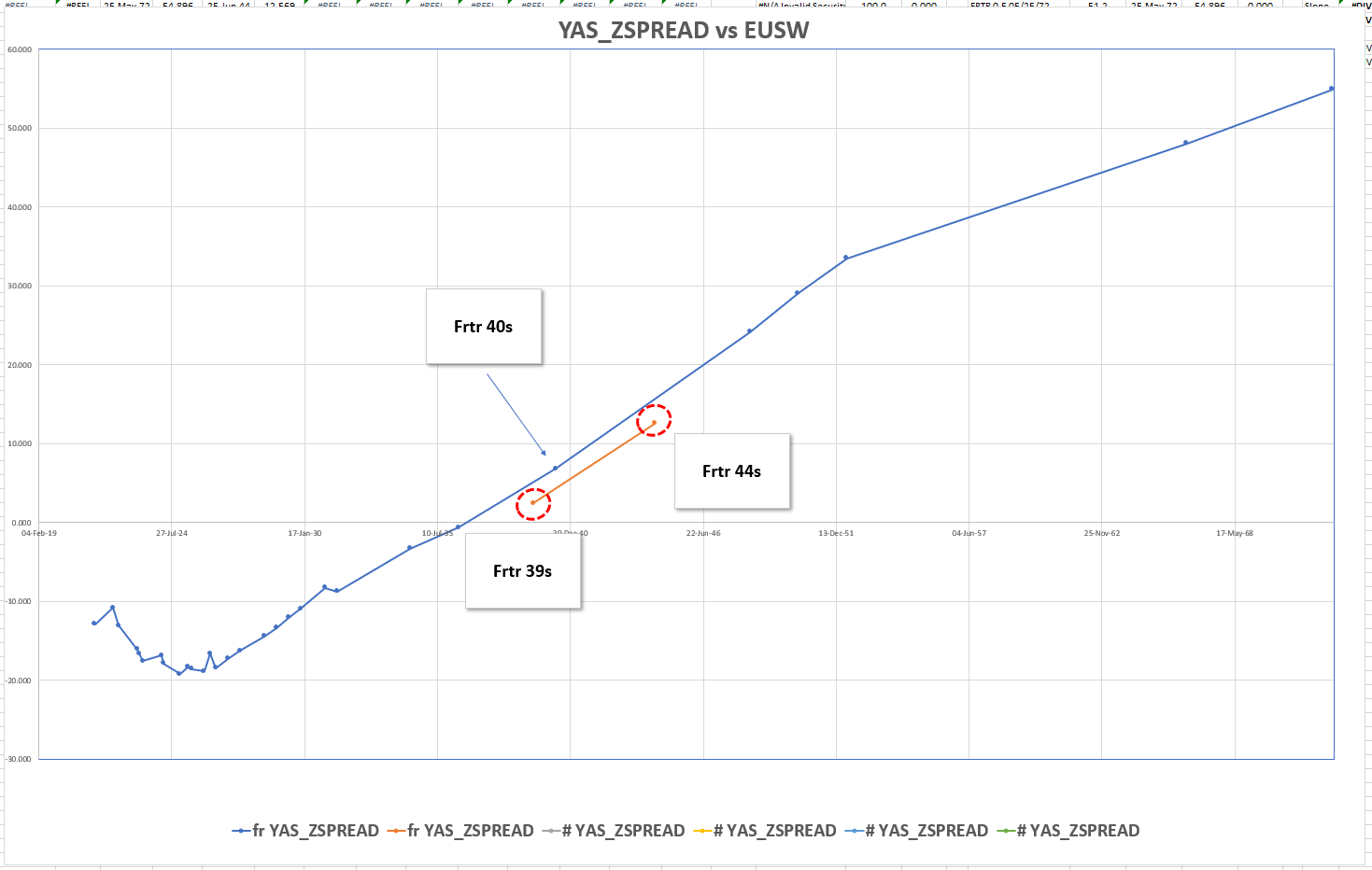

Fwiw - am guessing a 5 (ish) y and 25y EU bond may come

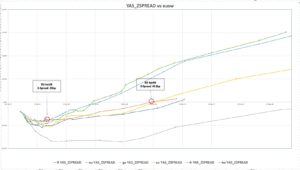

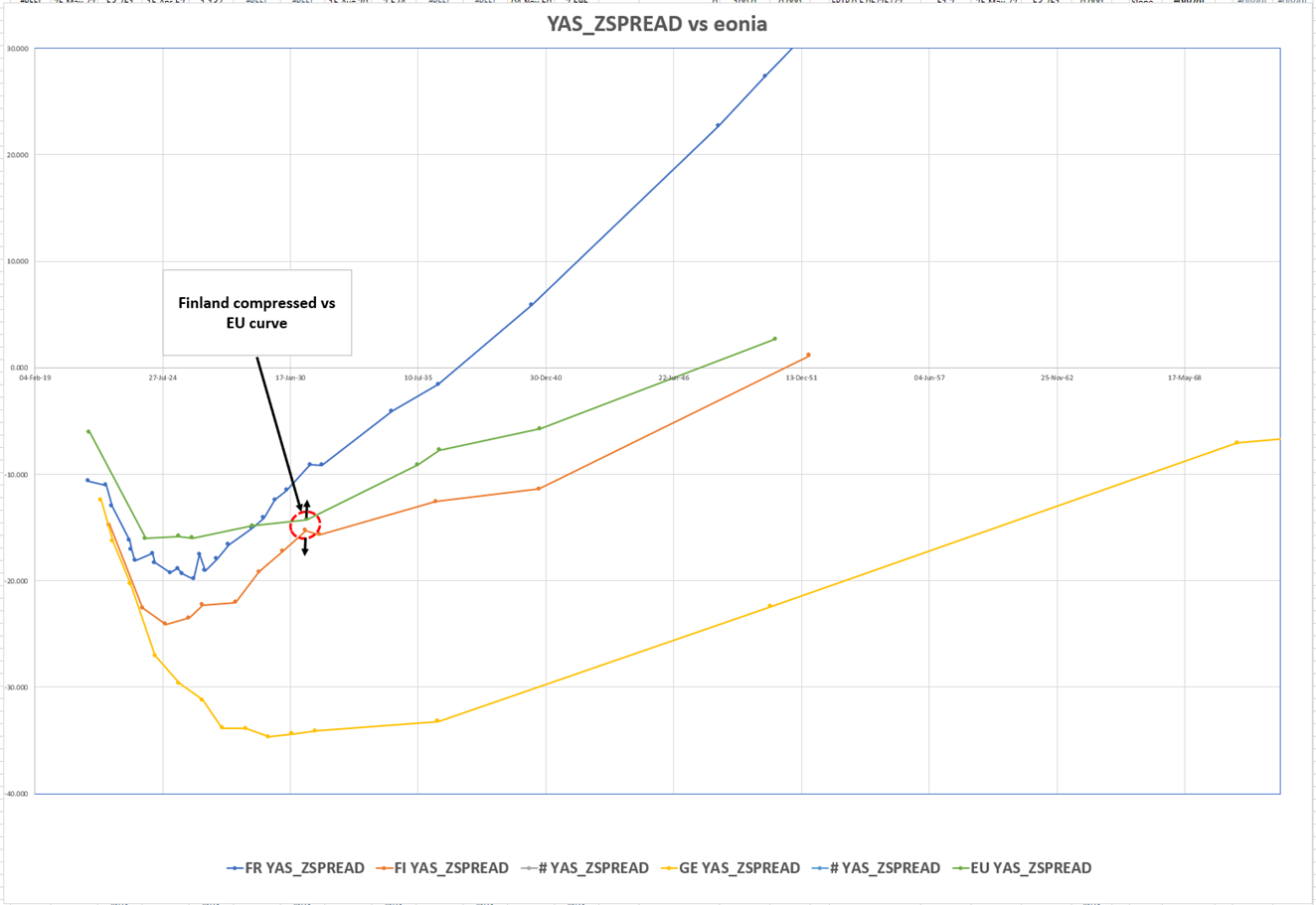

Here's how the EU curve (and others) might look given some notion of 'fair' for the possible EU issues

Makes me want want to sell May26 France - old 10y that will look rich - large issuer and EU in that segment trades super cheap - (the Feb26 otr 5y is much cheaper)

Also can;t help thinking it makes the RFGB 2047 as a little rich - given that rfgb 2030 vs EU30 is Flat - even give n the fact the the EU curve is generally a flatter

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Movers and Shakers - Euro RV, Will & James Astor Ridge

A few things we're looking at in Euro RV

Belgium 2035s have popped up cheap after the supply announcement

Supply: Next Monday 5y, 10y and 20y

Belgium is a scarce issuer favoured by the Capital Key / France a more frequent borrower

Belgium is through France in the sub 10y space. In longer tenors it has cheapened recently. Our puck would be to do the extension out of OAT contract s and maybe hedge the curve too

Oat contracts into BGB 2035s…

Belgium + Europe Z-Spreads

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

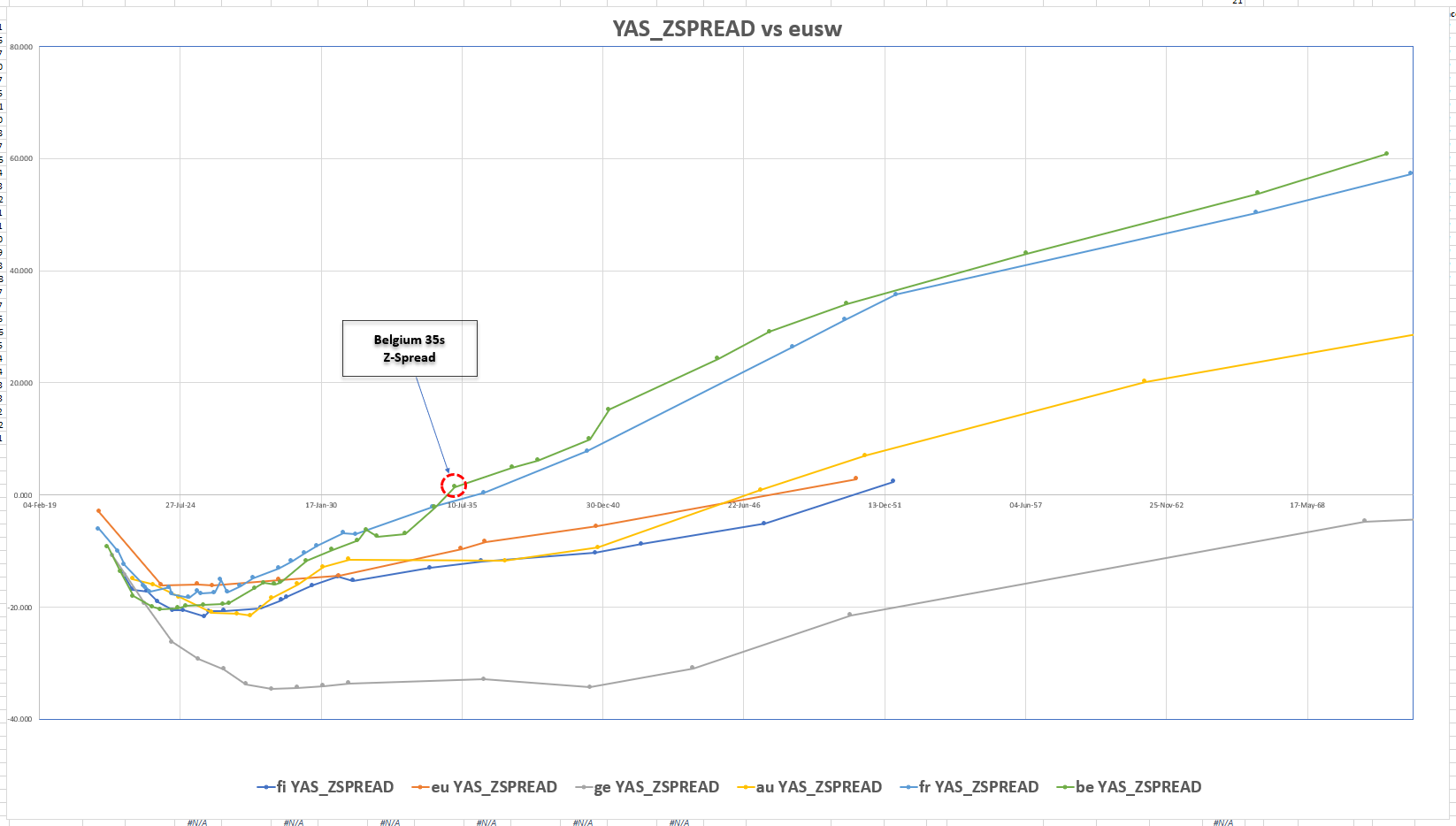

BOND UPDATE : BOND YIELDS CONTINUE TO GRIND HIGHER THIS DESPITE NEARLY “ALL” WEEKLY RSI’S NOW BEING STRETCHED TO 1994 STATUS!

BOND UPDATE : BOND YIELDS CONTINUE TO GRIND HIGHER THIS DESPITE NEARLY “ALL” WEEKLY RSI’S NOW BEING STRETCHED TO 1994 STATUS! THIS ESSENTIALLY IS A VERY “RARE” SITUATION THAT WONT BE HELPING BOND LONGS. OBVIOUSLY AND NORMALLY HISTORY REGULARLY REPEATS ITSELF GIVEN THAT ON MOST OCCASIONS POST 1994 THIS EXTENT OF RSI DISLOCATION IS FOLLOWED BY A MAJOR YIELD FALL. IT HIGHLIGHTS THAT SOME ONE OFF, “LEFT FIELD” NEWS IS COMING OR AS MENTIONED PREVIOUSLY STOCKS FAIL.

ESSENTIALLY THESE TECHNICAL DISLOCATIONS ARE HISTORICALLY UNSUSTAINABLE.

IT HAS AND IS A PAINFUL WAIT BUT ACCORDING TO THE RSI DISLOCATIONS IT “WILL HAPPEN”! THESE SIGNALS WONT ABATE.

US 30YR YIELDS HAVE NOW SPENT 4 WEEKS FAILING THE 200 PERIOD WEEKLY MOVING AVERAGE 2.4530.

US 10YR YIELD RSI DISLOCATION IS THE MOST SINCE “1994”!

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades & fades, Movers & Shakers - James & Will @ Astor Ridge

Stuff we’re looking at… !!!!

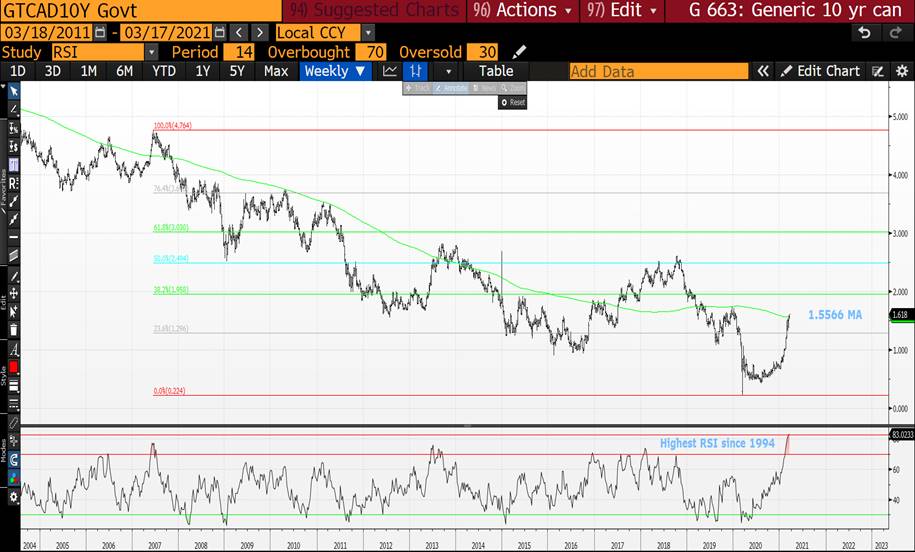

Green France

Trade – buy 20y France vs 10y and 30y

France announced a new bond – Frtr Green 25th June 2044

Initial Price Talk: Frtr Green Jun 39 +20bp, MS +14.4bp

Fair: Frtr May40 +18.5 bp

I’m expecting a 0.5% coupon. There’s already a Frtr 1.75% June 39 green issue of €28,9Bln, which trades rich to the curve from which it is being priced

Pricing

Let’s cut to the chase – we’re expecting the bond to settle @ Frtr Green Jun39 +18.5 bp. The pricing seems a bit tight given its initial guidance

Fair: Frtr Jun39 +18.5 bp

Premium to curve: -2.5bp (approx)

Value: scarcity as Green bond, MS +12.7 bp, Z-Spread +13.1 bp

Graph of Z-spread anomalies vs French Benchmark curve…

@ Jun39 +18.5bp

Summary

Decompose this trade into

a) 23y France

b) green premium

- I don’t mind the 20y point in France

On a .3 / 1 / .7 fly (var weighted, all x2)

It looks ok vs Oat contracts and the 30y…

200 * (YIELD[FRTR 0.5 05/25/40 Corp] - 0.3 * YIELD[FRTR 2.5 05/25/30 Corp] - 0.7 * YIELD[FRTR 0.75 05/25/52 Corp])

And the same fly vs swaps shows it has cheapened a bit more than the generic curve – so there’s a bit of edge

2 * (SP210[FRTR 0.5 05/25/40 Corp] - 0.3 * SP210[FRTR 2.5 05/25/30 Corp] - 0.7 * SP210[FRTR 0.75 05/25/52 Corp])

France vs Swaps

Graph of Z-Spreads for France

Arguably we could see the French 20y cheapen another basis point – although it looks ok on the curve, switch hedging could push it another 1 – 1.5bp cheaper as the lead mgr prepares the market orders on spread and outright

- Green Premium – not a big fan – given it’s 2-3bp elsewhere am a tactical buyer @ -1.5 bp and go flat @ richer than -2.5bp

Buy Frtr May40 vs OATA and Frtr 52

Levels – I think this is two-fold. 20y France is a bit sold with recent supply in 15y – 20y in Europe

- I’d buy 33% of my risk on the timing of the new issue

+20y -OATA and -30y

.3 / 1 / .7

- and the balance with this fly @ -2.5bp ,at which point the Frtr may40 are cheap vs yield / Z-spread / cash-flow discounting on a zero curve

If you want to mutate that into the new bond then you need to tweak the weightings as we fully expect the 2044 green bond to track the 30y a little more than the on the run 20y – call me for those weightings to keep the var low as curve has been a bit hairy

All the best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND UPDATE : DESPITE THE PRICE ACTION THE WEEKLY CHARTS AND RSI’S CONTINUE TO CALL FOR YIELDS TO “STALL”.

BOND UPDATE : DESPITE THE PRICE ACTION THE WEEKLY CHARTS AND RSI’S CONTINUE TO CALL FOR YIELDS TO “STALL”. IT HAS AND IS A PAINFUL WAIT BUT ACCORDING TO THE RSI DISLOCATIONS IT “WILL HAPPEN”! THESE SIGNALS WONT ABATE.

US 30YR YIELDS HAVE NOW SPENT 4 WEEKS FAILING THEIR MULTI YEAR 61.8% RET 2.4065.

US 10YR YIELD RSI DISLOCATION IS THE MOST SINCE “1994”!

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

WE STILL REQUIRE THAT ALL IMPORTANT “DRIVER” FOR THE MOVE AND SINGLE STOCKS REMAIN THE TECHNICAL FAVOURITES!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: GILTS > Quick Supply and MPC Meeting Rundown - TRADES UPDATE

Quick GILTS...

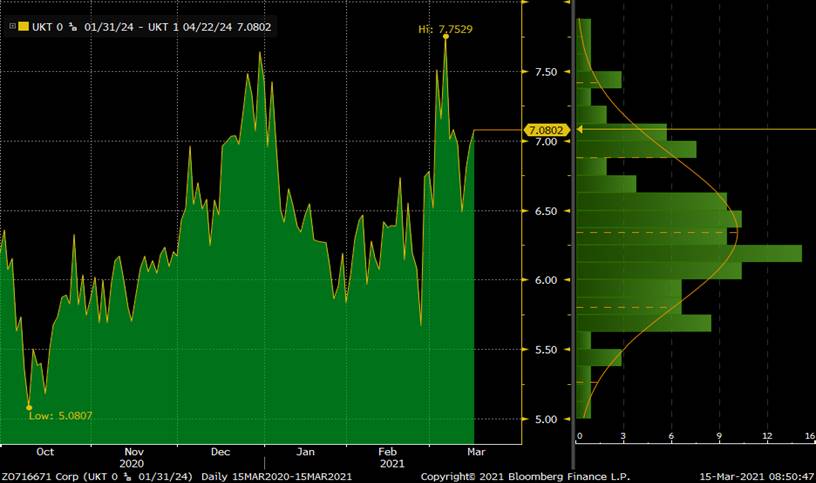

- Last BUSY supply week this month with £3.5bn 0E24s and £1.5bn 1F54s tomorrow and £2.5bn 0F35s Wed. We've also got a much anticipated MPC meeting on Thursday.

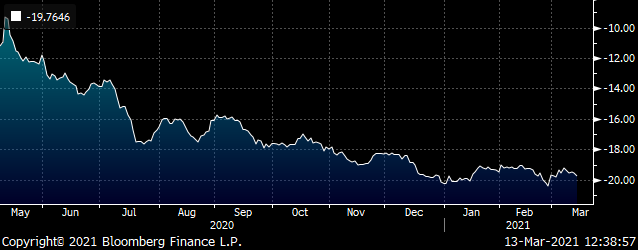

- 0E24s - Roll vs 124s got to -3.6bps before 124s richened back to -4.25bps. We're seeing interest to roll back up the curve into this tap. More 0E24s to come next qtr. The 124s will fall out of the shorts APF bucket after their April cpn payments (22nd).

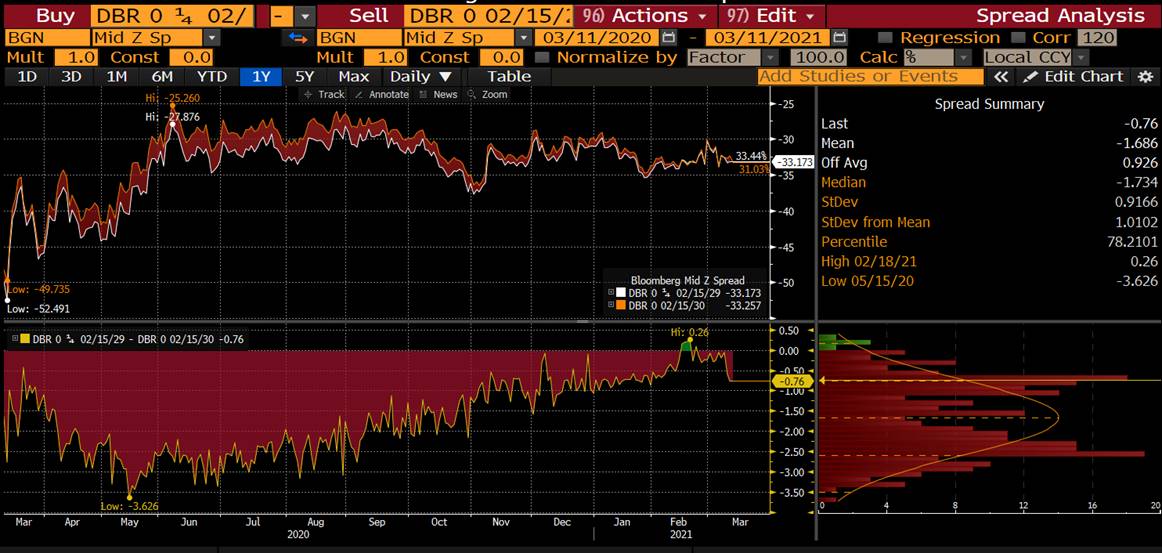

UKT 1 24 into UKT 0E24s Z-sprd

- 1F54s - LAST TAP EVER (we'll see!) has the issue on the cheap side in micro-RV. The 3T52-1F54 Z-sprd is at the steep end of its range, despite the recent curve flattening bias and the 52-54-55 fly is cheap. The 41-45-54 fly remains rich, even with confirmation of 3 0S46 taps next qtr.

- 0F35s - These gilts have traded like toxic waste since last Thursday morning, cheapening massively on the curve as GEMMs price in a huge concession for this tap (and the 3 to come next qtr!). The 0R30-4H34 steepener we recommended mid last week is now +21bps, 2.4bps in the money and the 30-35-41 fly we liked at +18.5bps is now +19.8bps. This move is flushing a lot of RV longs which we HOPE will clear the decks for the issue/ sector to settle down. The 0F35-0F50 sprd is at its all time flattest, despite a 25yr+ heavy auction calendar in April.

- 0R26s – Following the DMO's confirmation of 3 taps of the UKT 0.375 10/26s Friday we advocated taking profits on the recent outperformance of the 0R26s which occurred even with the issue ineligible for QE. We still think this makes sense as the issue's a bit 'frothy' given its stage in the auction cycle. The popular 0E26-0R26-1Q27 fly is opening at +5.7bps this am and we see it cheapening into the mid-upper 8s into April, exacerbated by the repo richness of the other issues in the sector.

- 0F50s – The DMO announced a new 2051s syndication for April which, as highlighted Friday morning, should free up the 0F50s to complete their 'cycle' by richening to the curve. We like the 1T49-0F50 roll as a simple expression of this but we've seen interest in other issues in the 44s-47s sector too given how rich they've been trading. Either way, we still think the 50s have 1-1.5bps of richening to come.

1T49-0F50 yield sprd

- MPC MEETING Thursday – This morning's FT Article entitled "Problems mount for Bank of England governor after weathering Covid storm' (click Here) raises some rather prickly issues that Governor Bailey is going to have to answer for, ranging from the MPC's handling of the negative rates shambles, his growing disdain for Brexit, the uncertain outlook and impact of QE and his own mini-fiasco while at the FCA. While these are certainly providing a distraction he, the rest of the MPC and the markets can surely do without, there's still the business of central banking to attend to.

This meeting is likely to be more about answering for the gilts-market meltdown in February, the MPC's outlook for inflation/growth and confirmation of their plans for QE, at least until the end of Q1 21/22. Most dealers expect the MPC to leave QE as-is given the chunky net gilts supply this fiscal year (highest since 2011) and the turbulence they've helped to cause for most of this quarter. There seems to be more division than usual within their ranks so corralling his governors into a unified message would provide some much-needed leadership and calm.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades, Movers & Shakers Week of Feb March 15th, James & Will at Astor Ridge

Some thoughts for the week ahead

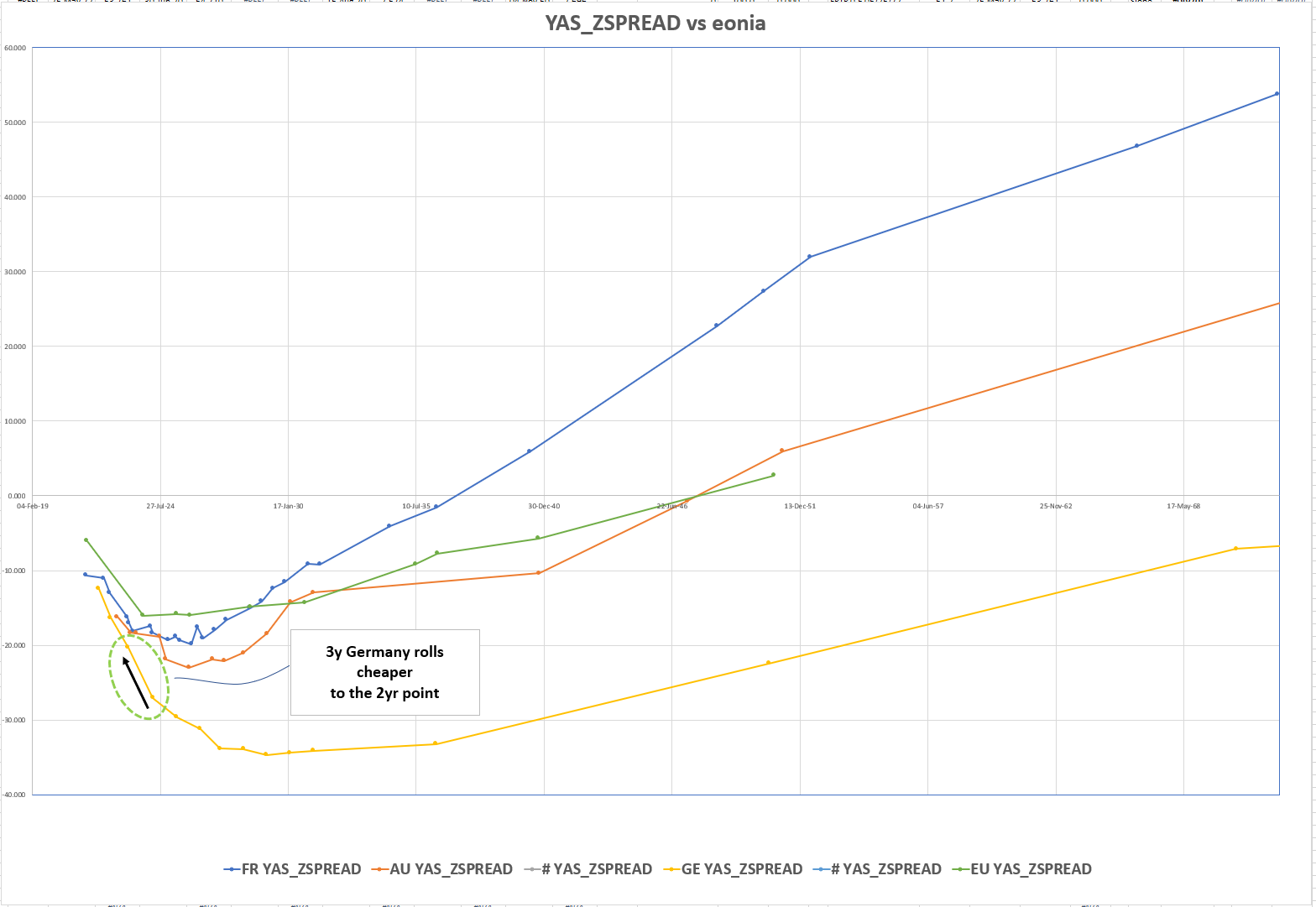

The Big Fade

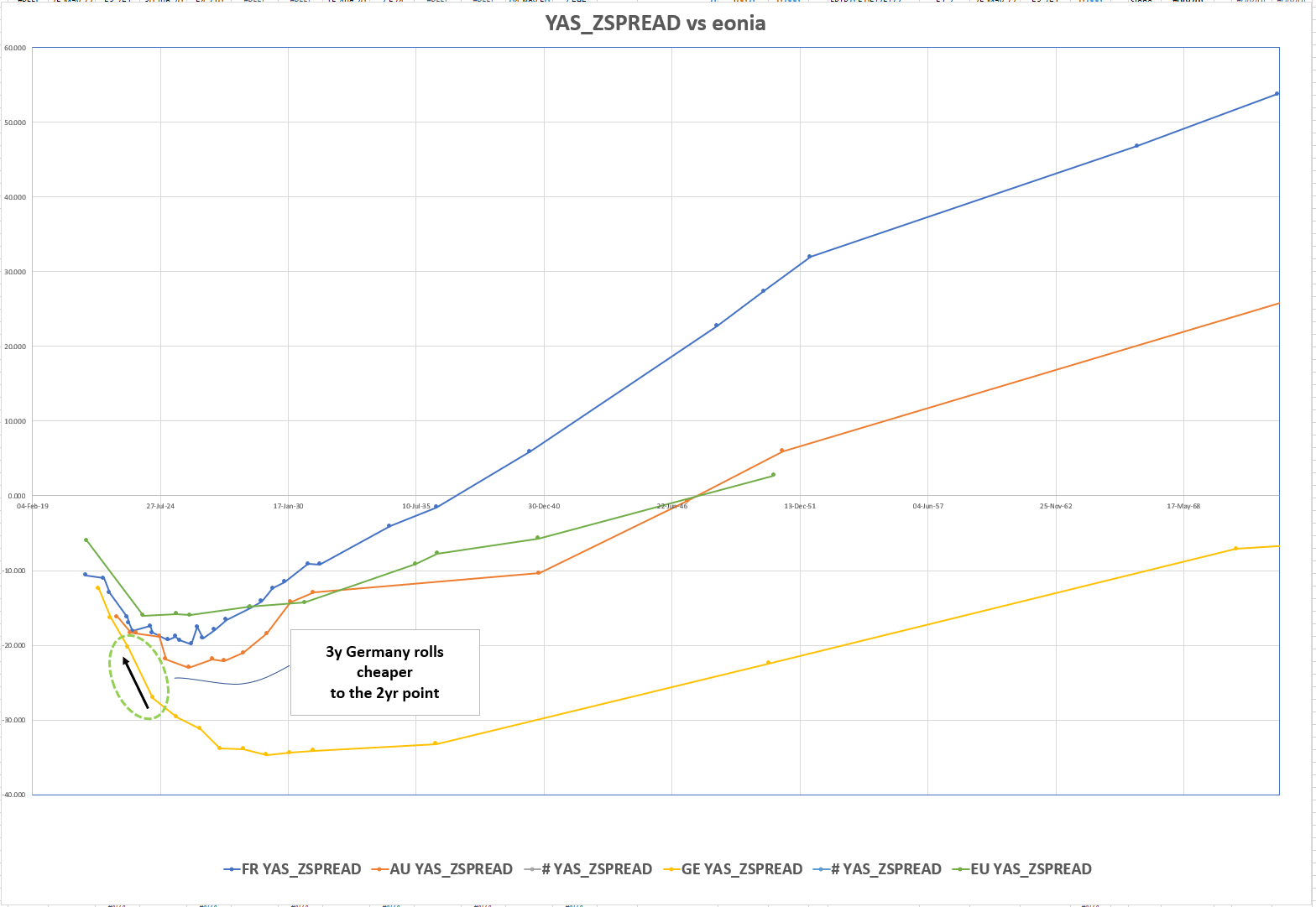

Dead simple – we’re looking for steeper forward curves – typically in the 3y to 10y range. As an approximation, this would be buying cheap bullets and selling wings, which at first seems counterintuitive in a bear steepening.

Trick is, I want to pay zero premium for this trade. So we’re looking for structures where forwards are flat and then as high as than the longer tenors. It’s bit of a tall order, but then what’s the point in having your cake and not eating it, really?

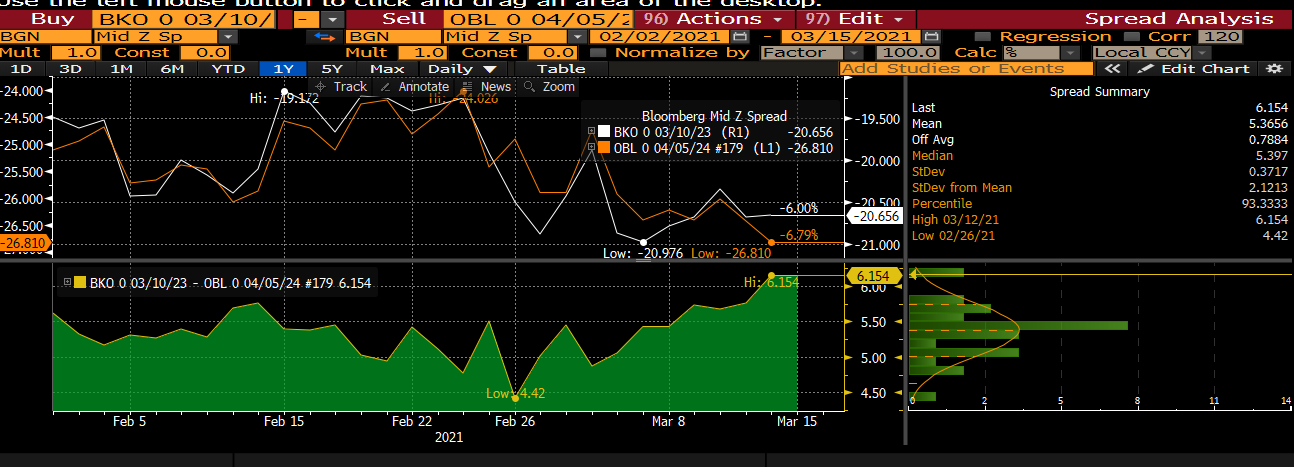

Germany 2s 3s steepener vs swaps

- We have supply in the German 2y on Tuesday 16th March, €5Bln Schatze (BKO ticker) Mar23, CTD to the German 2year contract

- The roll is most punitive in the 3y to the 2y – see graph below of Euro Z-Spreads vs Eonia – 2y vs 3y looks contextually out of line (3y rich and 2y cheap) and generally I like this then as I think it’s a relic of this sense that ECB could cut

Trade – buy 2y Schatze, sell 3y obl vs swaps

History on Z-Spread…

Targets

Target is slim: 1.5 to 2bp brings it back into line

But I like the theme across the whole curve as we could lose any rate cut expectations in Germany and that could give it another 1 to 2bp

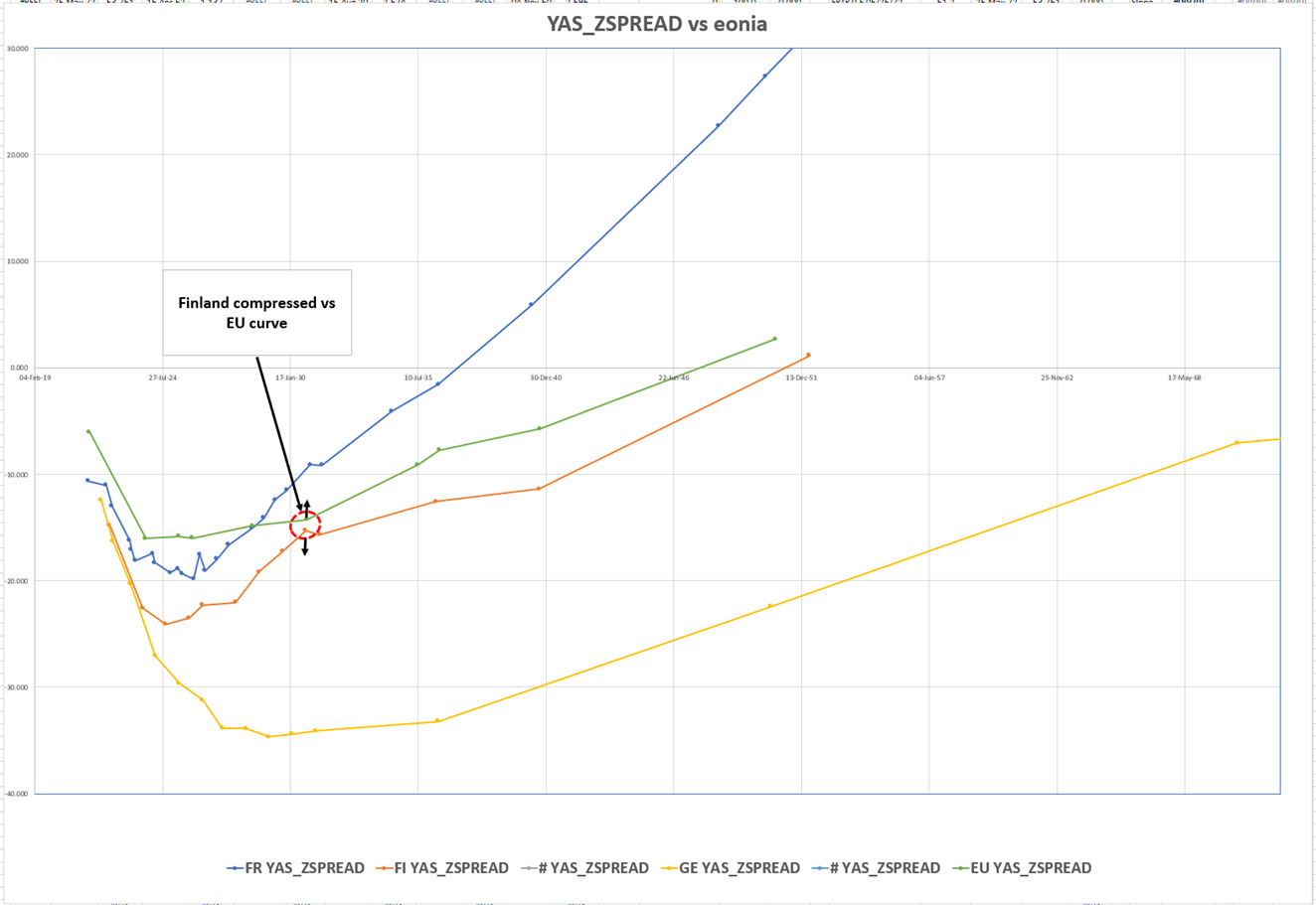

Sell 10y EU, buy Finland 10y, spread widener

On Tuesday we have supply in Finland 10y (Sep2030) and 30y: Total €1bln

Always a small and scarce issuer, Finland trades with a modest premium to France in that tenor: -Frtr30 / +Rfgb30 is -7.4bp

You can spin this two ways, yeah it’s scarce and favoured by the Pepp capital-key but also it’s a bit less liquid and it’s only these liquidity events, however small, that let you get in

Conversely the EU program has approx another €28 Bln to issue to finish the quarter. Now although 5y and 25y might be possibilities, this should impact the EU across the curve.

I see 10y EU as rich and the 9y (2030 maturity) Finland as cheap and over these events we could see a widening – large issuer vs small, with the back drop of the term premium being wider elsewhere

Z-Spread differentials…

7y Finland / EU: -4.3bp

10y Finland / EU: -1bp

15y Finland / EU: -4.8bp

Target: -4.5bp

Graph of Z-Spreads Europe…

Germany

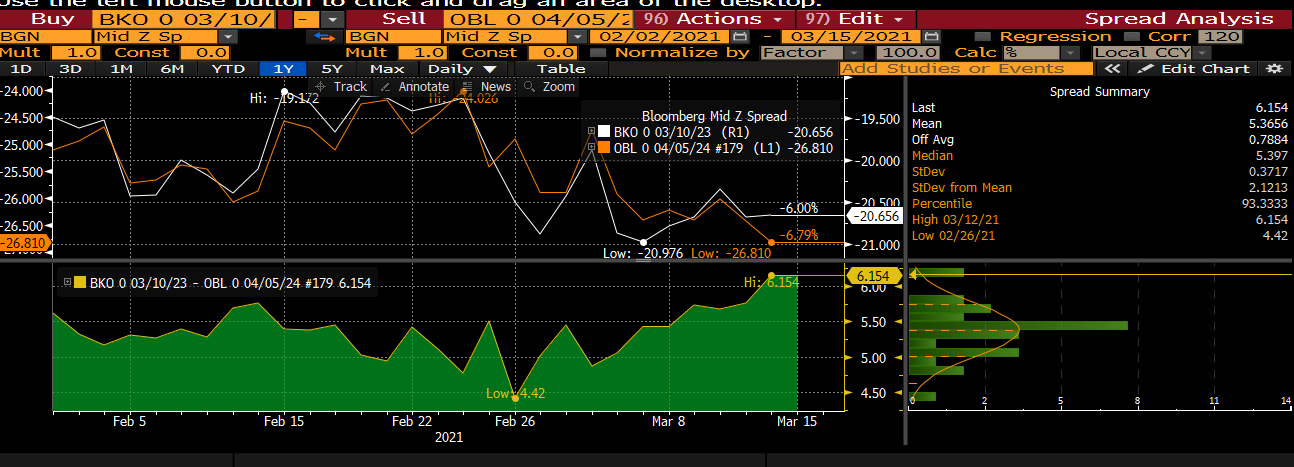

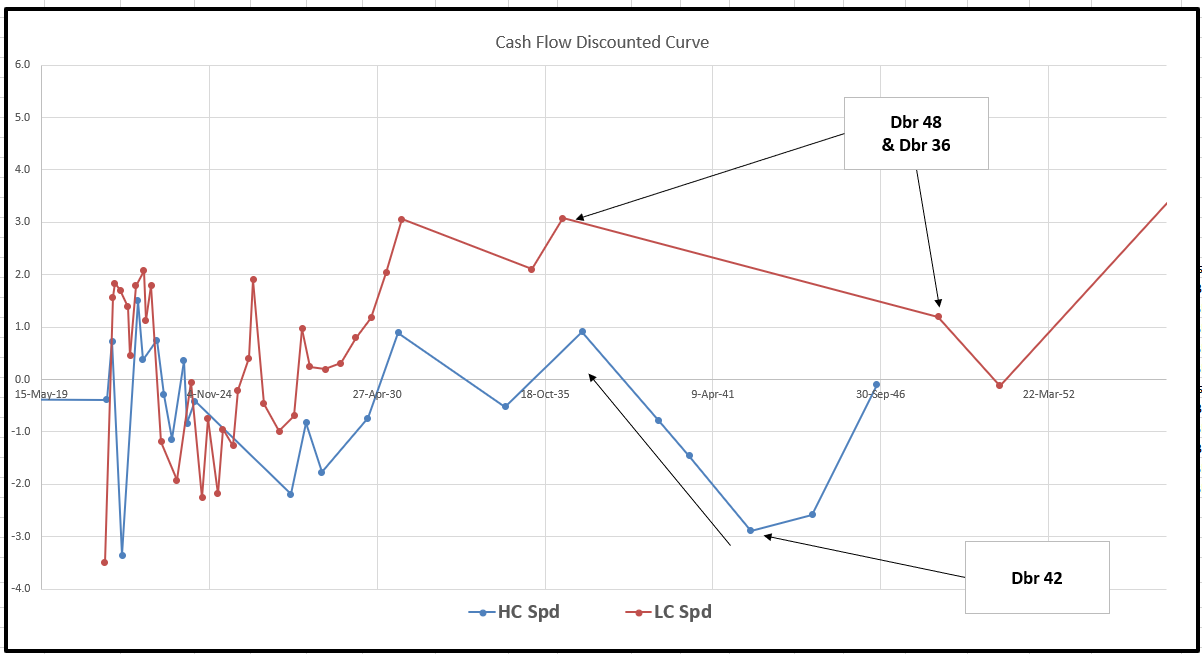

Sell Germany 21y vs 15y and old 30y

Supply

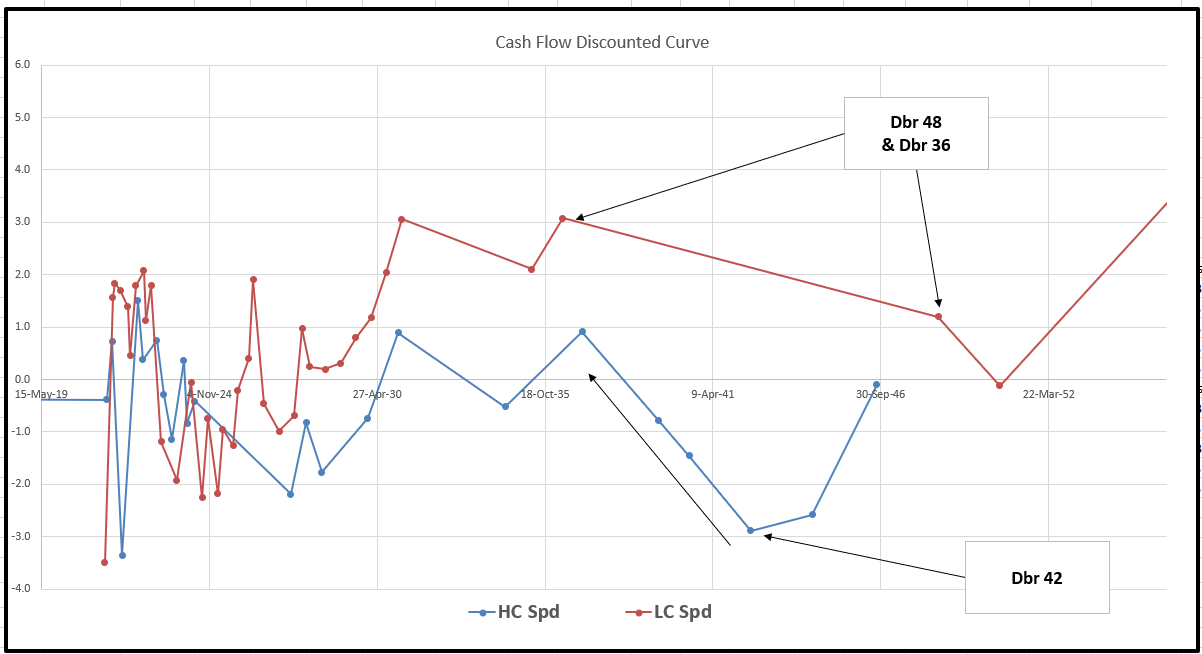

On Wednesday March 17th we have supply in Dbr 2050, we see both the 30y and old 30y Aug47 as cheap vs high coupons

Although 20s 30s has steepened in the last month, it has actually modestly flattened vs swaps

Here we’re looking at High coupon 20yrs vs on the run 15y and 30y

Generally high coupons ‘appear’ rich when subject to simple yield analysis. They can even appear so in Z-Spread terms. For a real confidence in shorting this stuff I really like to add the Cash-flow discounted spread (BBG: BB_SPRD_TO_SPLINE_EXPONENTIAL) just to be sure

So although the PEPP had been buying these issues, it doesn’t mean they’re gonna depart from the curve – the ECB makes them available for securities Repurchase and lending and we just have to sell them when they are truly rich, which we believe they are

Trade:

Sell Dbr 21y vs 15y and old 30y

Mis-weighted: call for weightings

Levels

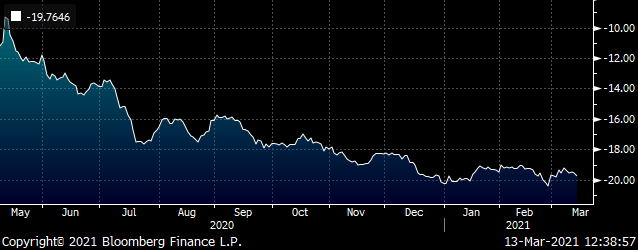

Current: -19.75 bp

Enter: -19.5 bp

Target: -12 bp (Long Term)

Graph of Anomalies in Germany (Fully discounted Cashflows vs German curve)

BBG

Cix: using old 15y dbr 35 (has more history)

Call for exact details

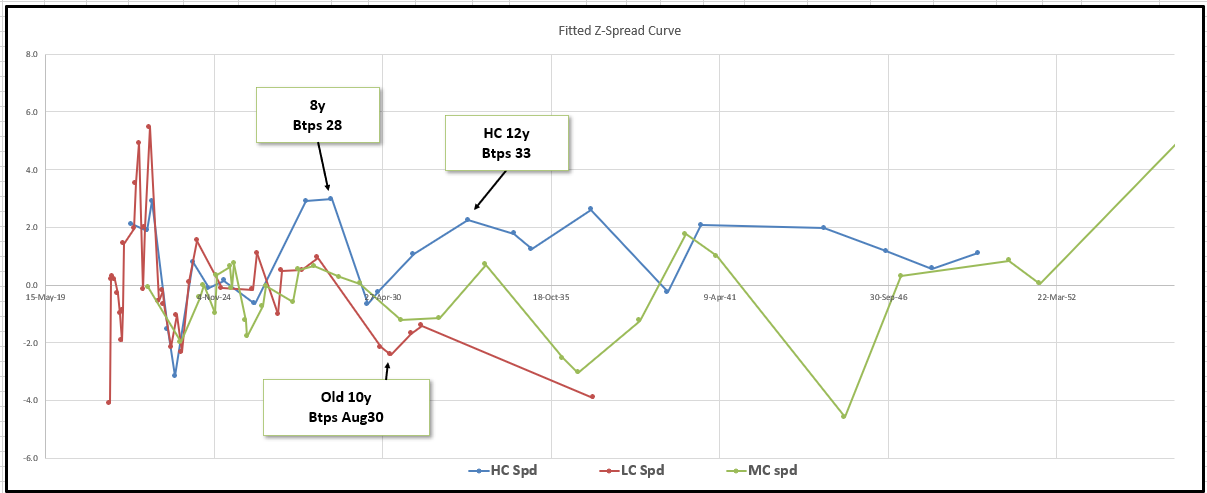

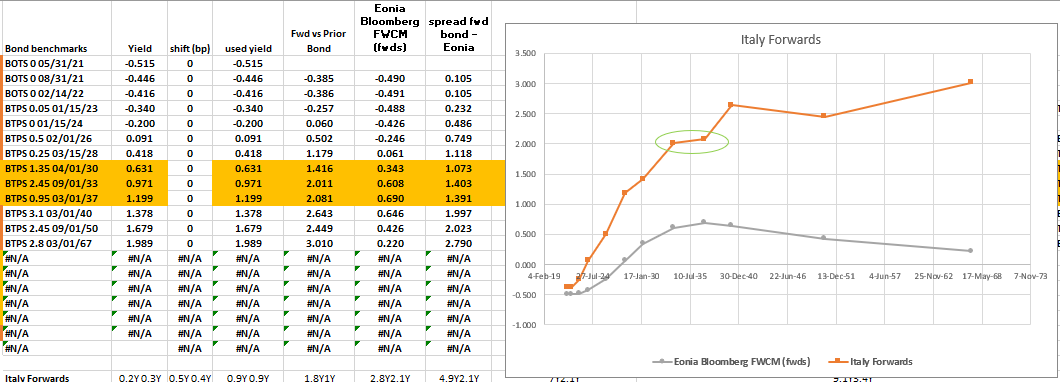

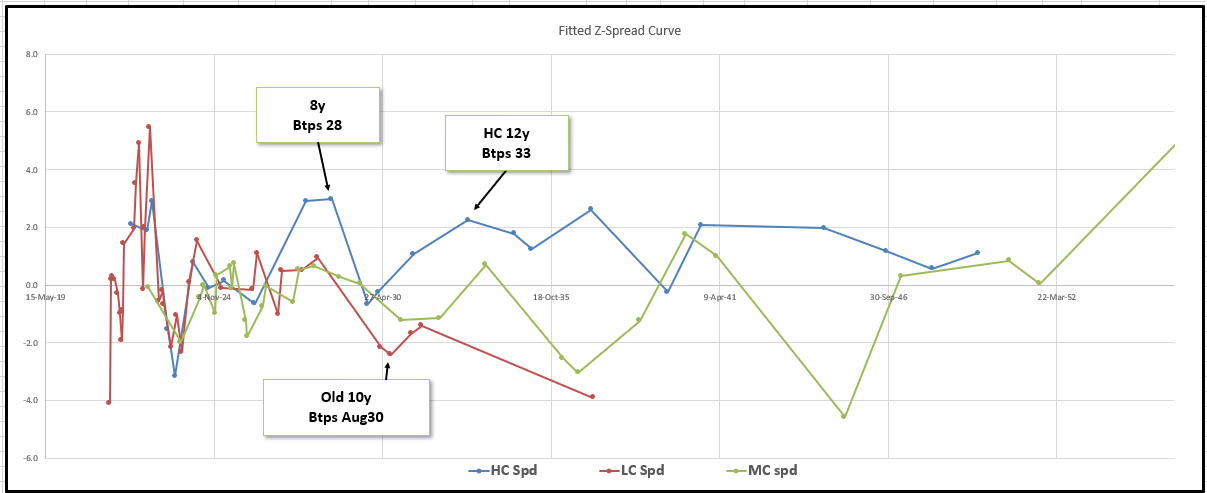

Italy

– on our Radar, with the ix/rx spread settling into what seems to be a benign phase – we want to grab as much carry as we can. Similarly, we expect buying to be find high coupons irresistible in terms of carry & true value, with lower coupons out of favour

Btps Aug30 are a rich low coupon (0.95%) bond, but whose position as lowest coupon 10y has been superseded by the newer Btps 0.9% of Apr31

Trade

Long High Coupon 8y and 12y vs rich Low Coupon 9 ½ y

Carry: +0.6bp /3mo after 5bp repo spread

Roll: Flat

BBG history is not stellar but we have to remember that bullets have been hit hard generically

But when we look at the structure vs swaps, to remove the generic movement in risk-free curves – it looks more compelling…

Levels

Am targetting 1bp richer in the belly / worth 2bp on the fly (double counting middles)

Keep you posted?

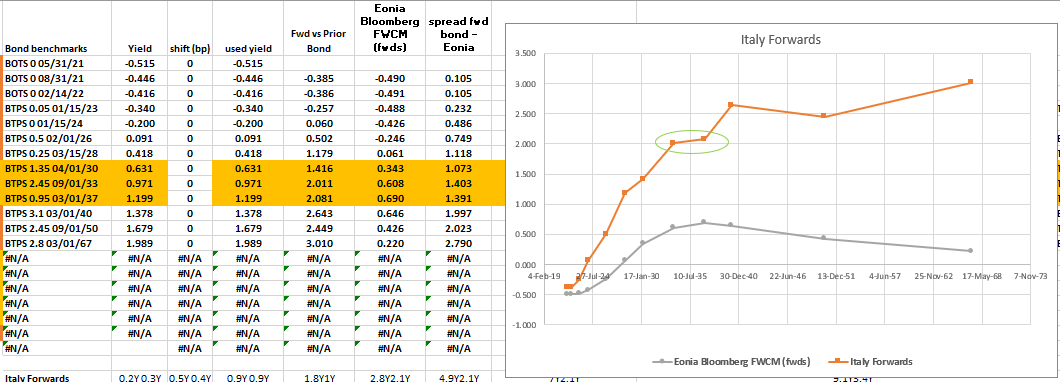

Italy

Forwards Flat in Italian Curve - otherwise positively sloped

If we’re kicking the Covid can down the road then forwards shouldn’t be inverted or even flat over larger non-highly leveraged gaps

Consider the forwards in the Italian bond curve..

This means that apr30 vs sep33 is too steep And/Or sep33 vs mar37 is too flat

Give us a call to see the exact structure but this fly should have 5-6 bp in it to get to fair

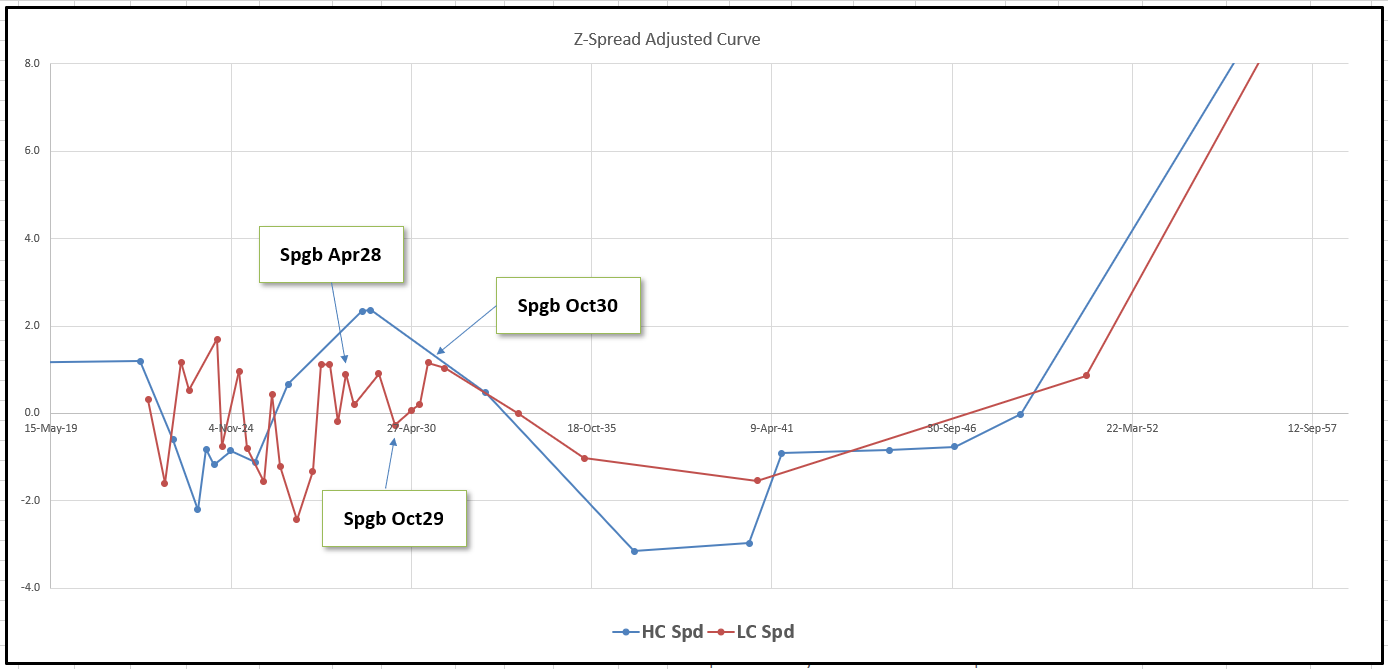

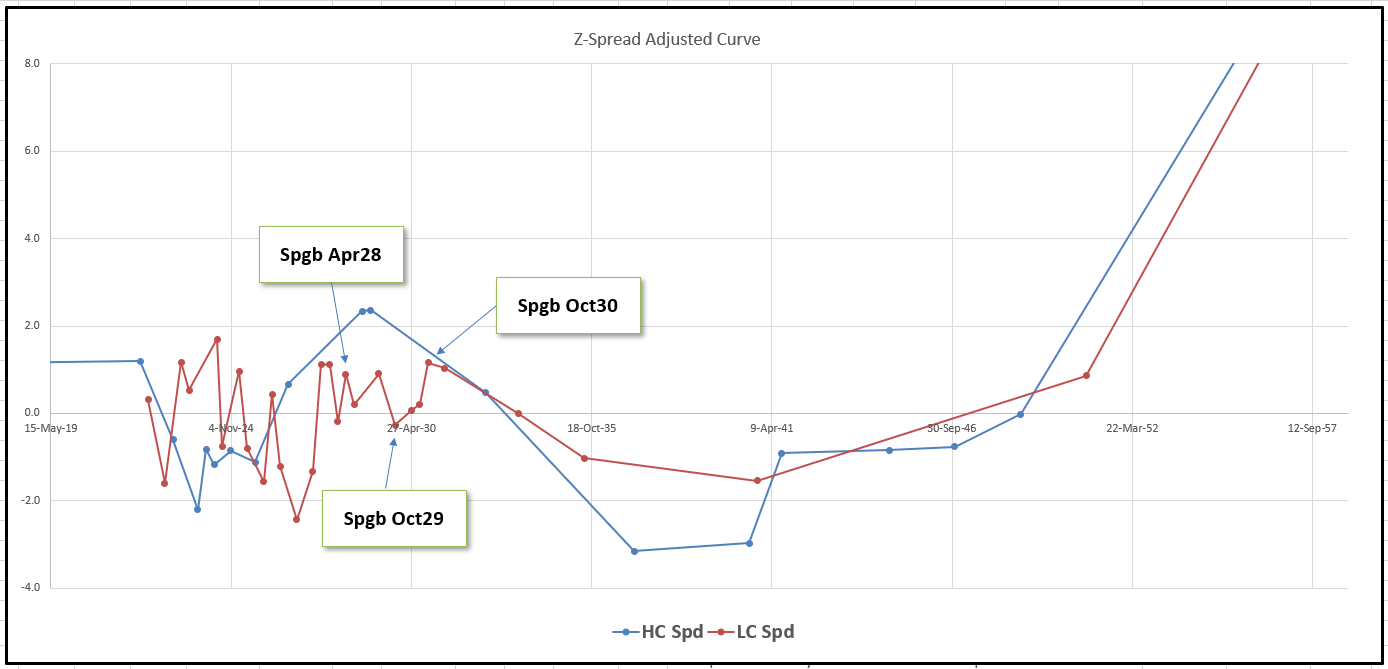

Spain

We’ve got a tap of the new 0% coupon 7y Jan28 on Thursday March 18th

we’re on the side-lines on this one, with an ugly 0% coupon it just doesn’t carry well and as a tap bond will probably stay cheap

What we do see is this is popping out the old 1.4% April 28 cheap and we like the roll of -Oct29 vs +oct30

Put ‘em together and what have you got?

Trade

+Apr28 -Oct29 +Oct30

Apr28: cheap 7y (old 10y)

Oct29: Expensive 9y

Oct30: Cheap old 10y no more taps while they issue apr31s we think

It’s got intrinsic value – see Z-fitted anomalies..

Ugly History

But makes sense given what the curve has done – here’s vs swaps

2 * (SP210[SPGB 0.6 10/31/29 Corp] - 0.5 * SP210[SPGB 1.4 04/30/28 Corp] - 0.5 * SP210[SPGB 1.25 10/31/30 Corp])

We need the fly richer by 1bp for it to be solid vs swaps (even though am advocating just a bond fly – the whole curvature is in adifferent place now)

So we sit and wait for the wing to cheapen 2bp into supply

Interested?

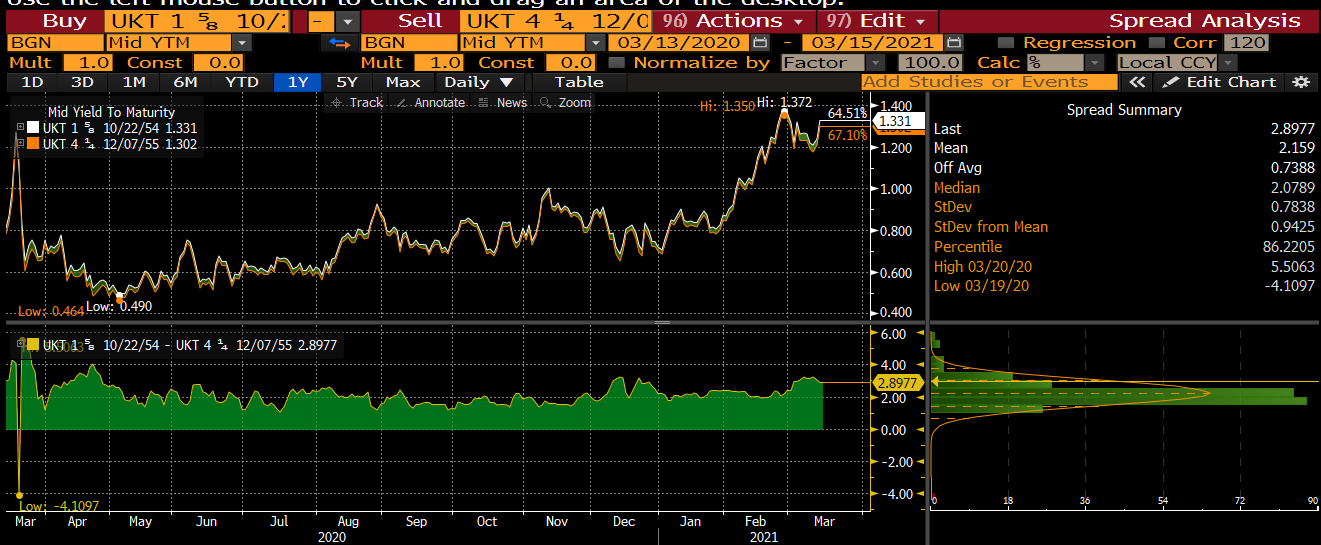

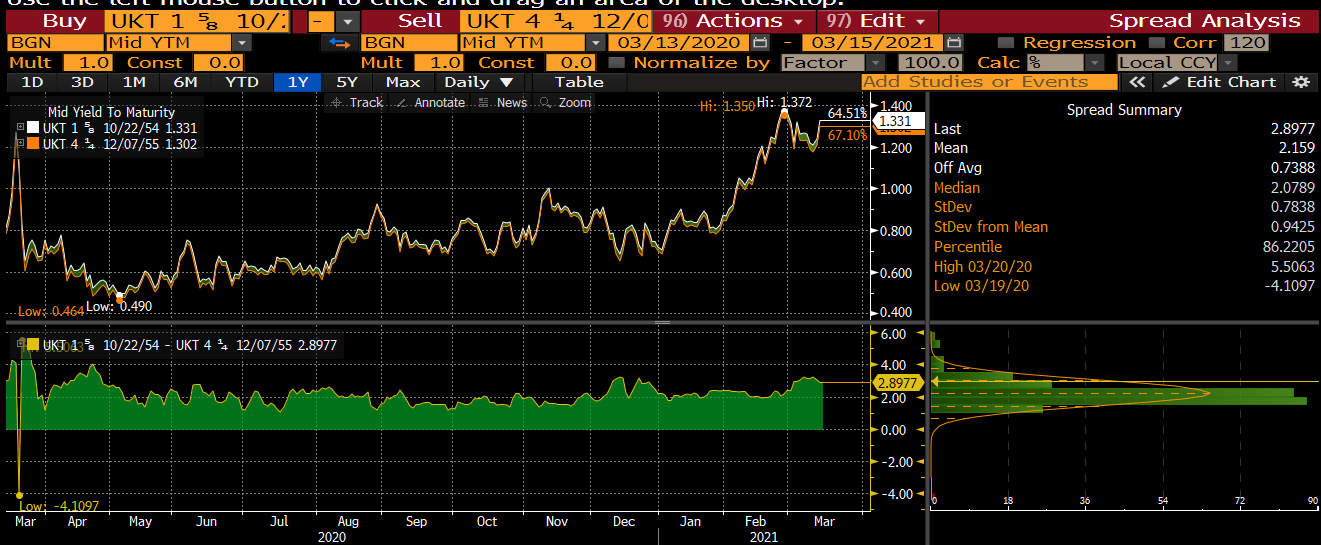

Never complete without the UK

Steepener -Ukt 55 +Ukt 44s

>+3bp

UK has supply in UKT 54s on Tuesday 16th March

As a low coupon curve they are over the high coupon curve

If I turn calc the forward between them and the 55s it comes out at -0.28%, even if I adjust for coupon (turn them into par bonds) the fwd is +0.55% which is lower than Sonia

In last week’s funding announcement they telegraphed and April & a June tap of 2071s – which to me makes me want to pay any long forwards which were both low and close to Sonia – so steepeners it is!!!

I flagged this one this week at +3bp – but > +2.75bp has intrinsic value above beyond the simple history and think it should be a touch lower at +1.5bp

Small beans but, hey…

As always have a fab week

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trades & Fades, Movers & Shakers Week of Feb March 15th, James & Will at Astor Ridge

Some thoughts for the week ahead

The Big Fade

Dead Simple – we’re looking for steeper forward curves – typically in the 3y to 10y range. As an approximation, this would be buying cheap bullets and selling wings, which at first seems counterintuitive in a bear steepening.

Trick is, I want to pay zero premium for this trade. So we’re looking for structures where forwards are flat and then high as they might be in v longer tenors. It’s bit of a tall order, but then what’s the point in having your cake and not eating it, really?

Germany 2s 3s steepener vs swaps

- We have supply in the German 2y on Tuesday 16th March, €5Bln Schatze (BKO ticker) Mar23, CTD to the German 2year contract

- The roll is most punitive in the 3y to the 2y – see graph below of Euro Z-Spreads vs Eonia – 2y vs 3y looks contextually out of line (3y rich and 2y cheap) and generally I like this then as I think it’s a relic of this sense that ECB could cut

Spreads vs Eonia…

France, Austria, Germany, EU

Trade – buy 2y Schatze, sell 3y obl vs swaps

History on Z-Spread…

Targets

Target is slim: 1.5 to 2bp brings it back into line

But I like the theme across the whole curve as we could lose any rate cut expectations in Germany and that could give it another 1 to 2bp

Sell 10y EU, buy Finland 10y, spread widener

On Tuesday we have supply in Finland 10y (Sep2030) and 30y: Total €1bln

Always a small and scarce issuer, Finland trades with a modest premium to France in that tenor: -Frtr30 / +Rfgb30 is -7.4bp

You can spin this two ways, yeah Finland is scarce and favoured by the Pepp capital-key but also it’s a bit less liquid and it’s only these liquidity events, however small, that let you get in

Conversely the EU program has approx another €28 Bln to issue to finish the quarter. Now although 5y and 25y might be possibilities, this should impact the EU across the curve.

I see 10y EU as rich in the 9y (2030 maturity)& Finland as cheap and over these events we could see a widening – large issuer vs small, with the back drop of the term premium being wider elsewhere…

Z-Spread differentials…

7y Finland / EU: -4.3bp

10y Finland / EU: -1bp

15y Finland / EU: -4.8bp

Target: -4.5bp

Graph of Z-Spreads Europe…

Germany

Sell Germany 21y vs Buy 15y and Buy old 30y

Supply

On Wednesday March 17th we have supply in Dbr 2050, we see both the 30y and old 30y Aug48 as cheap vs high coupons

Although 20s 30s has steepened in the last month, it has actually modestly flattened vs swaps

Here we’re looking at High coupon 21yrs vs on the run 15y and 30y

Generally high coupons ‘appear’ rich when subject to simple yield analysis. They even appear so in Z-Spread terms. For a real confidence in shorting this stuffm I really like to add the Cash-flow discounted spread (BBG: BB_SPRD_TO_SPLINE_EXPONENTIAL) just to be sure

So although the PEPP had been buying these issues, it doesn’t mean they’re gonna depart from the curve and leave the building, you only have to see other high coupons in other names to see that just ain’t so – the ECB makes them available for securities Repurchase and lending and we have to sell them when they are truly rich, which we believe they are

Trade:

Sell Dbr 21y vs 15y and old 30y

Mis-weighted: call for weightings

Levels

Current: -19.75 bp

Enter: -19.5 bp

Target: -12 bp (Long Term)

Graph of Anomalies in Germany (Fully discounted Cashflows vs German curve)

BBG

Cix: using old 15y dbr 35 (has more history)

Call for exact details

Italy – Sell 9y vs HC 8y and 12y for carry

– on our Radar, with the ix/rx spread setlting into what seems to be a benign phase – we want to grab as much carry as we can. Similarly we expect buying to be find high coupons irresistible in terms of carry & true value, with lower coupons out of favour

Btps Aug30 are a rich low coupon (0.95%) bond, but whose position as lowest coupon 10y has been superseded by the newer Btps 0.9% of Apr31

Trade

Long High Coupon 8y and 12y vs rich Low Coupon 9 ½ y

Carry: +0.6bp /3mo after 5bp repo spread

Roll: Flat

BBG history is not stellar but we have to remember that bullets have been hit hard generally

When we look at the structure vs swaps, to remove the generic movement in risk-free curves – it looks a bit more compelling…

Levels

Am targetting 1bp richer in the belly / worth 2bp on the fly (double counting middles)

Keep you posted?

Italy

Buy Sep33 vs Apr30 and Mar37

Weighting 50/50:

Forwards Flat in Italian Curve - otherwise positively sloped

If we’re kicking the Covid can down the road then forwards shouldn’t be inverted over larger non-highly leveraged gaps

Consider the forwards in the Italian bond curve.. I’ve highlighted Apr30/sep33 vs Sep33/Mar37 => 2.02% vs 2.08% almost no slope – so the belly is cheap – this is what we’re looking for as a theme

This means that apr30 vs sep33 is too steep And/Or sep33 vs mar37 is too flat

Give us a call to see the exact structure but this fly should have 5-6 bp in it to get to fair

Spain

On Hold for

Sell Oct29 vs

Buy Apr28 and Buy Oct30

We’ve got a tap of the new 0% coupon 7y Jan28 on Thursday March 18th

we’re on the side-lines on this one, with an ugly 0% coupon it just doesn’t carry well and as a tap bond will probably stay cheap

What we do see is this is popping out the old 1.4% April 28 cheap and we like the roll of -Oct29 vs +oct30

Put ‘em together and what have you got?

Trade

+Apr28 -Oct29 +Oct30

Apr28: cheap 7y (old 10y)

Oct29: Expensive 9y

Oct30: Cheap old 10y no more taps while they issue apr31s we think

It’s got intrinsic value – see Z-fitted anomalies..

Ugly History.. am doubting myself

But makes a bit more sense given what the curve has done – here’s vs swaps

2 * (SP210[SPGB 0.6 10/31/29 Corp] - 0.5 * SP210[SPGB 1.4 04/30/28 Corp] - 0.5 * SP210[SPGB 1.25 10/31/30 Corp])

We need the fly richer by 1bp for it to be solid vs swaps (even though am advocating just a bond fly – the whole curvature is in adifferent place now)

So we sit and wait for the wing to cheapen 2bp into supply

Interested?

UK

Never complete without the UK!

Steepener -Ukt 55 +Ukt 54s

>+3bp

UK has supply in UKT 54s on Tuesday 16th March

As a low coupon bond they are over the interpolated high coupon curve in any metric

If I calc the forward between them and the 55s it comes out at -0.28%, even if I adjust for coupon (turn them into par bonds first) the fwd is +0.55% which is still lower than Sonia

In last week’s funding announcement they telegraphed an April & a June tap of 2071s – which to me makes me want to pay any long forwards which were both low and close to Sonia – so steepeners it is!!!

I flagged this one this week at +3bp – but > +2.75bp has intrinsic value above beyond the simple history and think it should be a touch lower at +1.5bp

Small beans but, hey…

As always have a fab week

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BOND UPDATE : IT HAS BEEN A DIFFICULT PERIOD CALLING BOND YIELDS LOWER BUT THE CHART RSI’S (ESPECIALLY WEEKLY) CONTINUE TO REMAIN FIRMLY IN FAVOUR OF THAT.

BOND UPDATE : IT HAS BEEN A DIFFICULT PERIOD CALLING BOND YIELDS LOWER BUT THE CHART RSI’S (ESPECIALLY WEEKLY) CONTINUE TO REMAIN FIRMLY IN FAVOUR OF THAT.

US 30YR YIELDS HAVE NOW SPENT 3 WEEKS FAILING THEIR MULTI YEAR 61.8% RET 2.4065.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Movers & Shakers - Euro RV, James & Will at Astor Ridge

Germany starting to see Dbr feb29 basis as cheap – in that sense we're seeing the RXM1 contract as richening but not rich enough vs wings

Here it is vs contracts on Z-Spread, RXM1/dbr feb29on Z-Spread

France -

Still like Frtr Nov 30 basis – bond is cheap

Italy – we're getting close but not quite on shorting Btps May31 back into medium coupons –The Nov29 as a former long bond, were never deliverable but richened when Aug 29 were ctd. So...

Btps May31 are well on the same journey – if I had them I'd roll them into longer, high coupons or back into something like the idiosyncratic Btps Mar32

High coupon Spain looking cheap and too steep

-Spgb 10/25 +Spgb jul26

UKT -HC 36 to buy LC 35s – looking for +1.75bp – on full cashflow discounting this finally has value, tap in 35s on the 17th March

As we get ready for new Green 20y France – Frtr May34 have cheapened

Looking at BGB 32 (high coupon) rolls into cheaper 10y sector vs Frtr May34

Ireland

with supply in 10y and 30y it's hardly surprising that 31s 33s is too flat in the context of other Euro Issuers but we see that starting to work vs Swaps

Ragb 28 into Finland 28

We're getting close here – but it's a tight trade so gotta work to get this on – but Austria is just not as rare as Finland but the ratings are similar

Germany Dbr 37 as a high coupon got a little over sold into the new Dbr36 issuance

somehow I want to get to…

-dbr 34 +dbr37

vs 20% of +rx / dbr 42

Have sympathy with all sides of that trade – but fear B/O may require a simpler expression – or we will have to leg into this

100 * ((YIELD[DBR 4 01/04/37 Corp] - YIELD[DBR 4.75 07/04/34 Corp]) - 0.2 * (YIELD[DBR 3.25 07/04/42 Corp] - YIELD[DBR 0 02/15/30 Corp]))

Just ask for any further detail on the analysis

Enjoy

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796