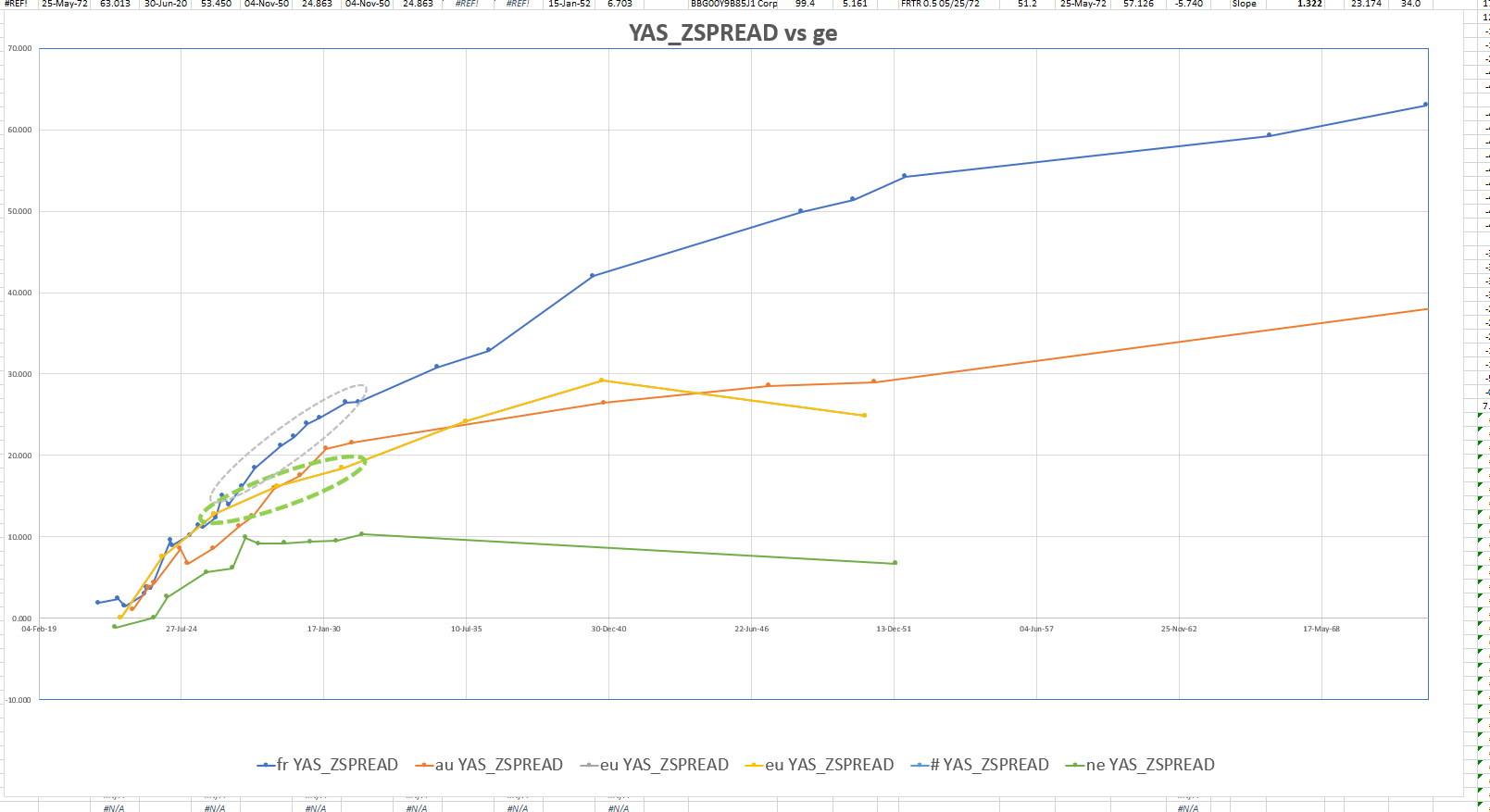

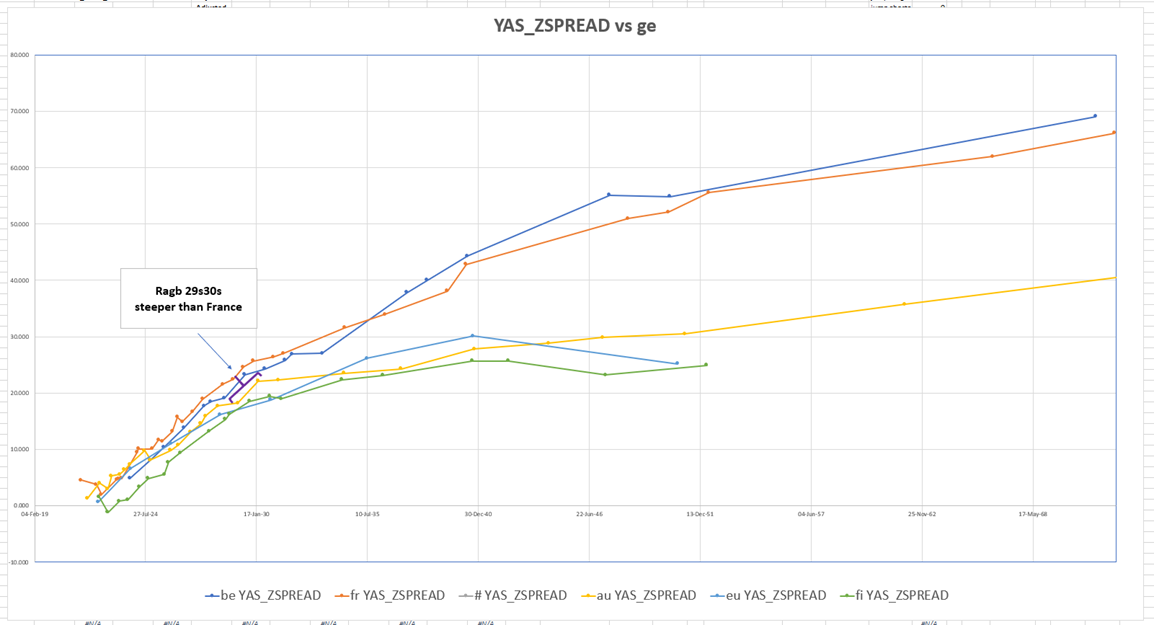

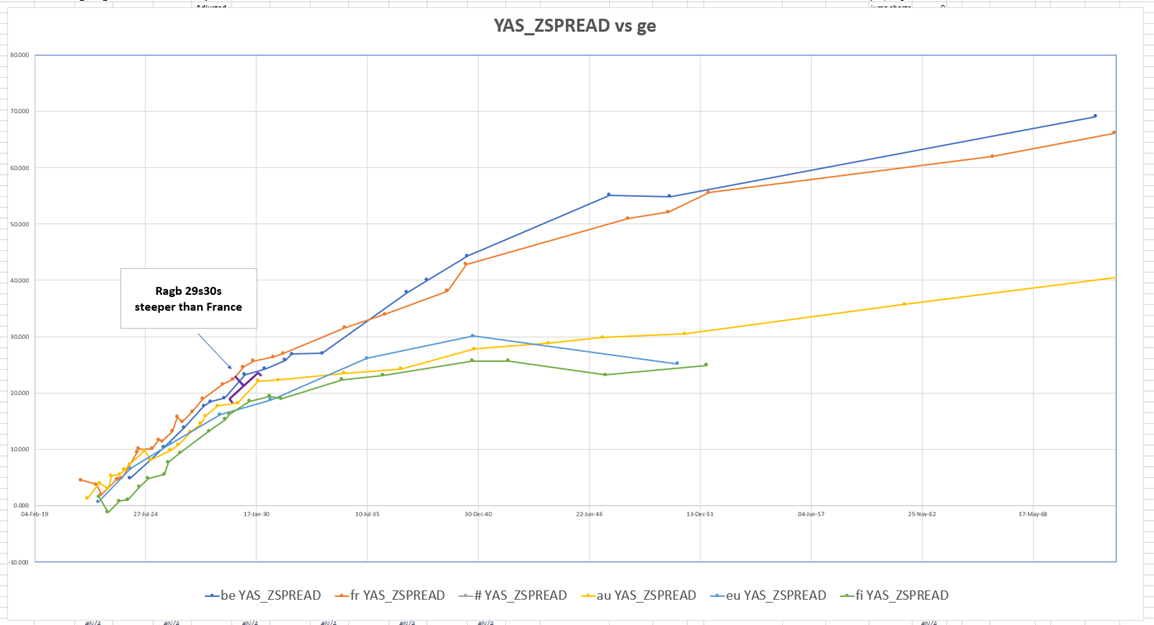

EU Curve too flat

EU curve definitely looks pretty flat vs rest of Europe

In tenors shorter than 5yrs, the EU bonds seem to trade really cheap – and am guessing they inherit a lot of pricing structure from swaps

I see there's great roll in flatteners in France 5s10s vs Steepeners in EU 5s10s

Graph of European Z-spreads vs Germany – EU 5s10s too flat to France

This is a bearish structure to some degree on the EU credit – as the shorter paper is quite stubborn – but with EU issuance the curves could well re-align

Cix:

100 * ((YIELD[EU 0 10/04/30 Corp] - YIELD[EU 0 11/04/25 Corp]) - 1 * (YIELD[FRTR 0 11/25/30 Corp] - YIELD[FRTR 0 02/25/26 Corp]))

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

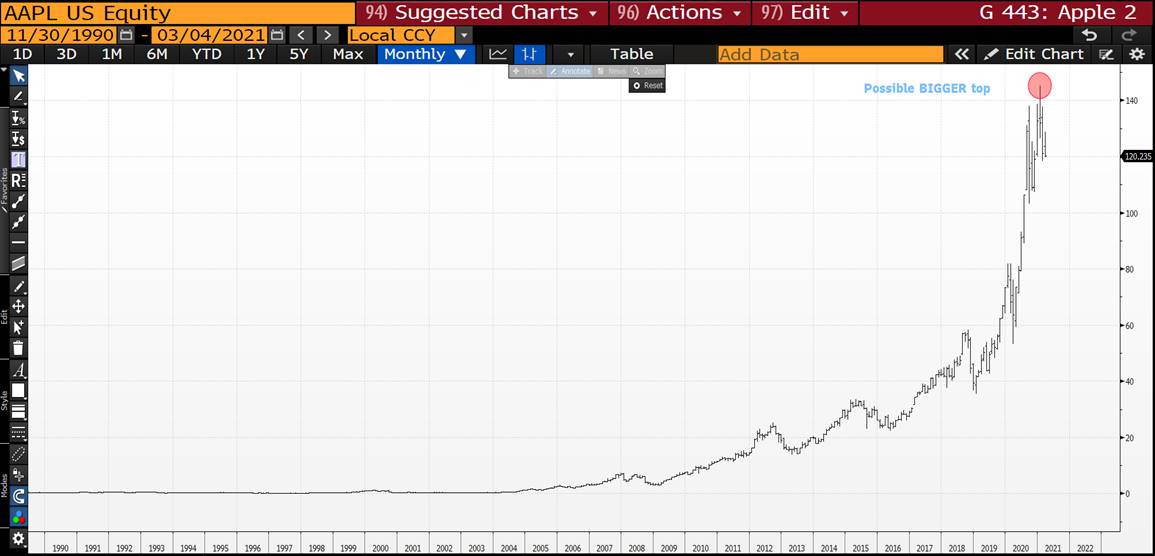

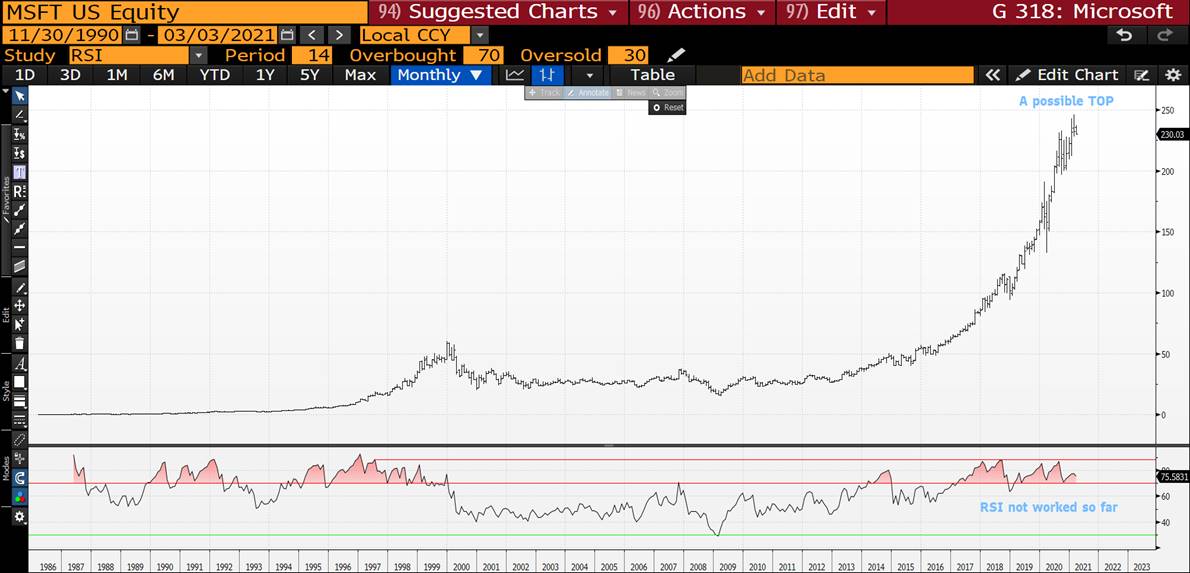

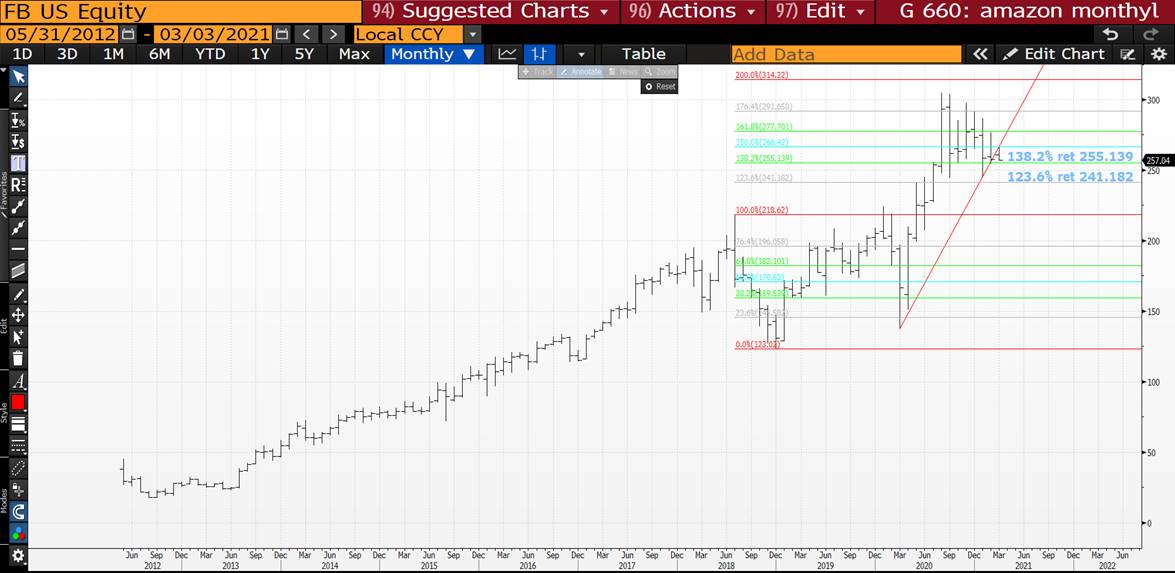

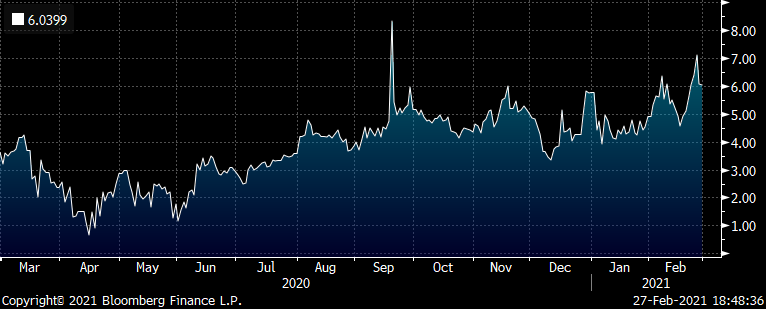

STOCKS : EQUITIES ARE GENUINELY NOW LOOKING VERY TROUBLED, WE HAVE BREACHED SOME IMPORTANT LEVELS-MOVING AVERAGES.

STOCKS : EQUITIES ARE GENUINELY NOW LOOKING VERY TROUBLED, WE HAVE BREACHED SOME IMPORTANT LEVELS-MOVING AVERAGES.

WE ARE FORMING SOME VERY LONGTERM TOPS!

THE SINGLE STOCKS ARE MORE OF A CONCERN AS THERE IS SO MUCH OF A MISREPRESENTATION IN SOME OF THE VALUATIONS.

THE MOVE LOWER IN BOND YIELDS IS PREDICTED TO BE VERY SIZEABLE SO THIS WOULD IMPLY THE SAME FOR THE STOCK SELL-OFF.

THE RUSSELL WEEKLY CHART HAS A VERY DISLOACTED RSI SIMILAR TO EARLY 2020.

"THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK". ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

STOCKS : WE ARE POISED FOR SOME SERIOUS MOVES ESPECIALLY IN MAJOR SINGLE STOCKS.

STOCKS : WE ARE POISED FOR SOME SERIOUS MOVES ESPECIALLY IN MAJOR SINGLE STOCKS.

I WAS ASKED TODAY IF I STILL BELIEVED IN THE AGGRESIVELY LOWER BOND YIELD CALL,

THE ANSWER REMAINS "YES". THE BIGGEST STRUGGLE FOR THE PAST FEW WEEKS HAS BEEN FINDING A DRIVER FOR THIS BUT STOCKS ARE IT! IT SHOULD BE A "SHOCK" TYPE MAGNITUDE, SOMETHING NO ONE EXPECTS. THINK IT WILL MANIFEST ITSELF IN THOSE WIDELY INVESTED SINGLE STOCKS SUCH AS MICROSOFT, APPLE,FACEBOOK AND TESLA!

THE SINGLE STOCKS ARE MORE OF A CONCERN AS THERE IS SO MUCH OF A MISREPRESENTATION IN SOME OF THE VALUATIONS.

THE MOVE LOWER IN BOND YIELDS IS PREDICTED TO BE VERY SIZEABLE SO THIS WOULD IMPLY THE SAME FOR THE STOCK SELL-OFF.

THE RUSSELL WEEKLY CHART HAS A VERY DISLOACTED RSI SIMILAR TO EARLY 2020.

"THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK". ALL OBVIOUSLY VERY OVER EXTENDED.

TESLA, AMAZON AND APPLE ARE WORTH MORE THAN THE FINANCIALS, ENERGYAND METALS SECTORS COMBINED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

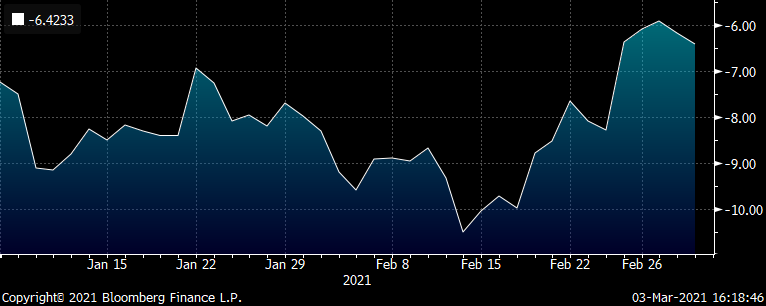

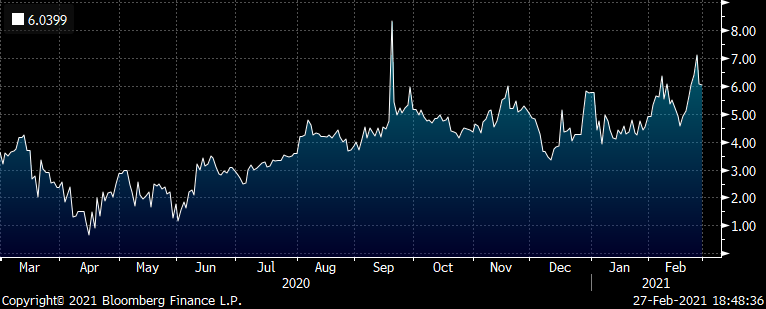

Italy 20y vs 10y and 30y

We just saw the cheapening in Italy 20y (MAR41) as the syndicate priced the new Btps Green Apr45

We prefer the old 20y.. Mar40

Buy Btps Mar2040

vs Sell Btps Apr31 and Btps Sep51

Weighted (as per expected var): -0.3 / +1 / -0.7

Here's how -10y +20y -30y looks on History… - using the older higher coupon Mar40, which have better carry and cash-flow value

2 * (yield[BTPS 3.1 03/01/40 Govt]-0.3*yield[BTPS 0.9 04/01/31 Govt]-0.7*yield[BTPS 1.7 09/01/51 Govt])*100

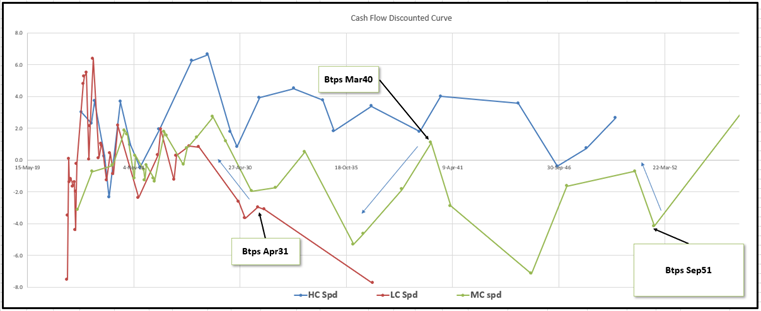

Looking at Cash-flow discounted, Italian Anomalies here's how we see those bonds

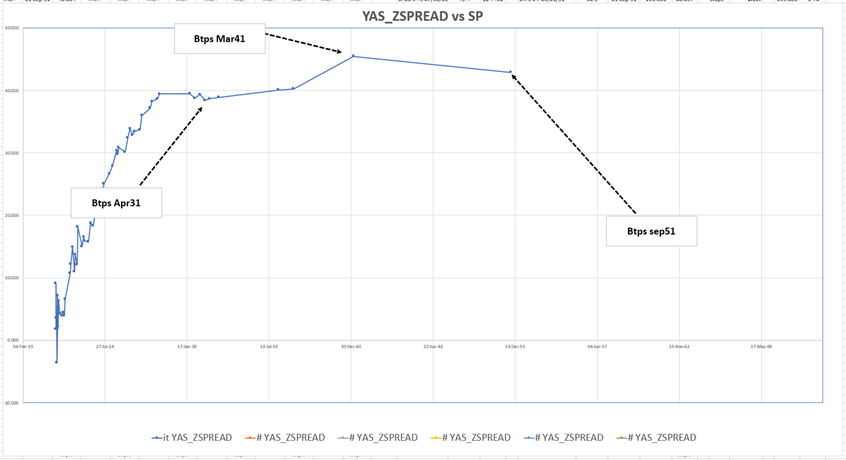

Here's how we see Low Coupon Btps on Z-Spread vs Spain (Benchmark) as the Baseline on Z

Showing Mar41 but we believe Mar 40 to offer value relatively

Let me know any thoughts or questions

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FX UPDATE : THE USD LOOKS POISED TO HOLD AND THIS SHOULD ASSIST BONDS TO BOUNCE.

FX UPDATE : THE USD LOOKS POISED TO HOLD AND THIS SHOULD ASSIST BONDS TO BOUNCE.

TOO MANY GOOD LEVELS ARE HOLDING.

ALL CROSSES HAVE FALLEN SHY OF THE MAJOR "FREE AIR" LEVELS, KEY LEVELS HAVE HELD.

IF THE USD HOLDS THEN BOND YIELDS SHOULD STALL.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

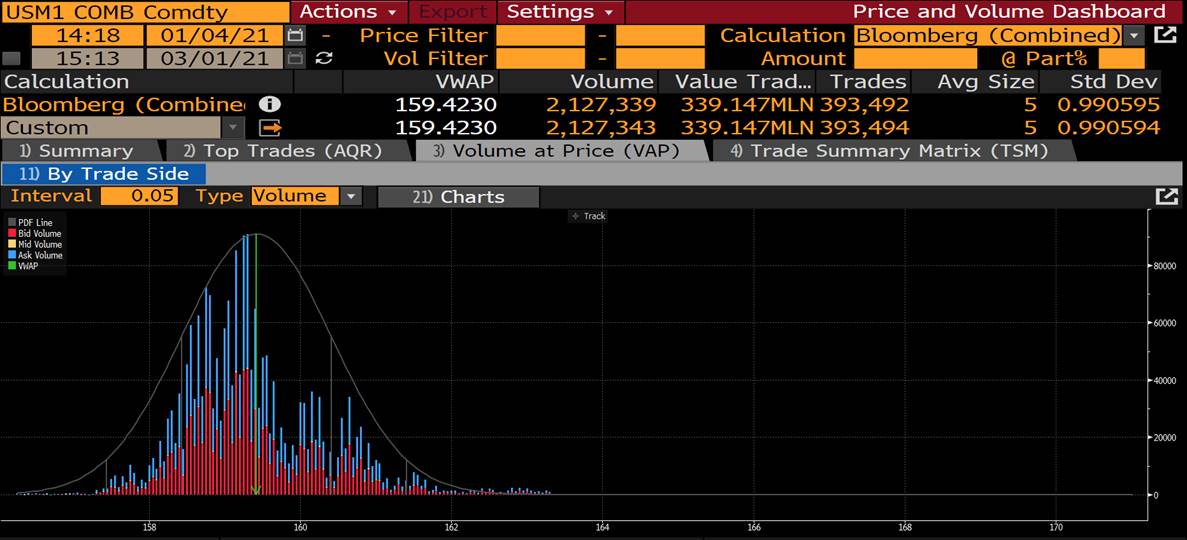

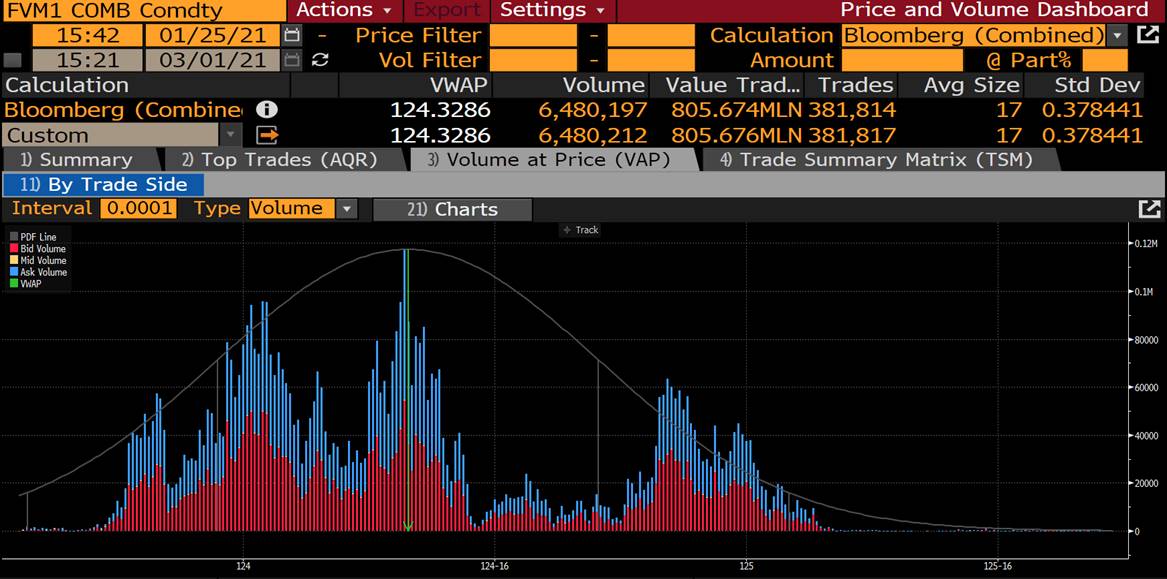

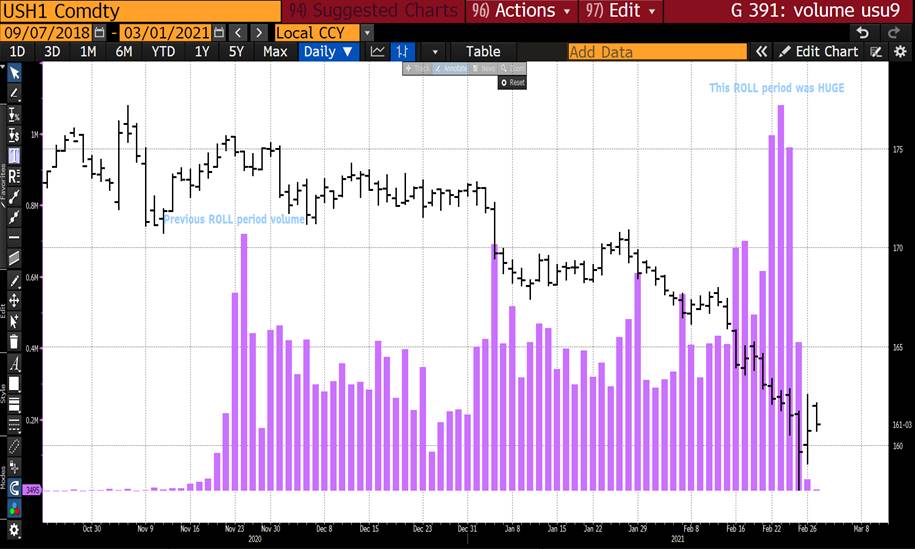

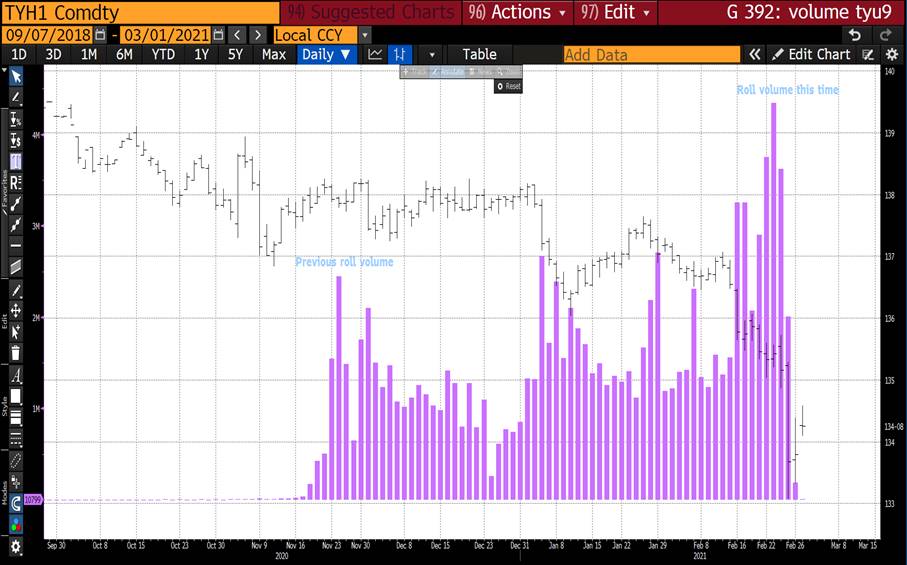

BOND VOLUMES (VAP) VOLUME AT PRICE : WE ARE NOW ABOVE MOST OF THE JUNE ROLLED VOLUME PEAKS THUS BONDS SHOULD CONTINUE A SLOW GRIND HIGHER!

BOND VOLUMES (VAP) VOLUME AT PRICE : WE ARE NOW ABOVE MOST OF THE JUNE ROLLED VOLUME PEAKS THUS BONDS SHOULD CONTINUE A SLOW GRIND HIGHER!

WE NOW HAVE PLENTY OF CLEAR AIR TO SEE BONDS RALLY!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : BONDS ARE AT A MAJOR JUNCTURE AND IDEALLY OVER THE NEXT FEW WEEKS WE SEE YIELDS “FALL”.

BOND UPDATE : BONDS ARE AT A MAJOR JUNCTURE AND IDEALLY OVER THE NEXT FEW WEEKS WE SEE YIELDS “FALL”, THE INTERESTING PART OF THAT IS THE CTA’S ARE SHORT IN SIZEABLE VOLUME.

US 30YR YIELDS HAVE FAILED A KEY 61.8% RET 2.4065 ASSISTED BY A LOFTY RSI (PAGE 6).

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

I HAVE INCLUDED THE FUTURES VOLUME CHARTS AS THEY HIGHLIGHT THE EXCEPTIONAL VOLUMES ROLLED, PRETTY MUCH INCREASED CTA SHORTS AS WELL DOCUMENTED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: GILTS > 3 Auctions to Test Our Resolve

Morning… Happy March… Best of luck…

TRADE IDEAS in the sections…

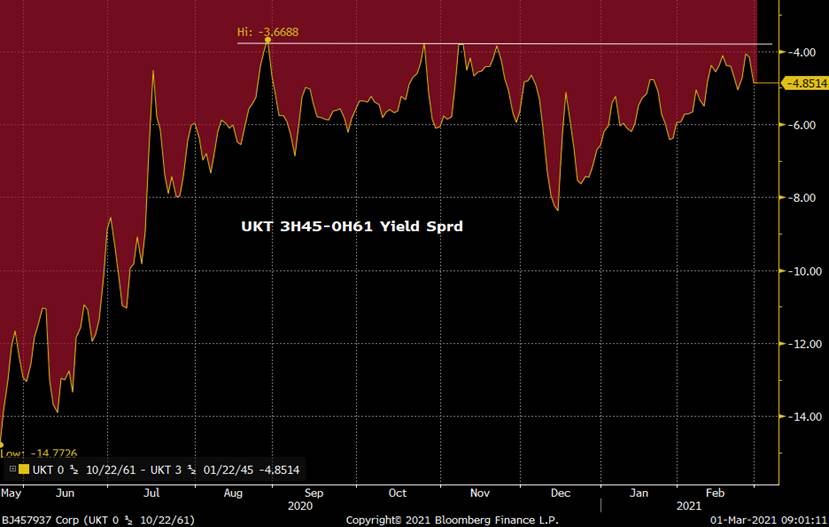

In Friday's note (attached), we looked at some of the macro/micro influences on the rates markets and measured the market's appetite for more bull flattening. We concluded that the 'perfect storm' of stocks into bonds, much worse than usual liquidity conditions and overdone technicals drove long-end demand for US/UK/EUR rates (govts AND swaps) that prompted a high volume dash for the exits. Just what the market didn't need after a very challenging month. Our conclusion was that it was time to wade back into steepeners and fade this move.

We've got three important auctions in gilts this week sandwiched around the new 0R26s and 0H61s tomorrow and the 0Q31s on Thursday.

Some quick thoughts:

- £3bn 0.375 10/26s at 10am

- Inaugural auction of the eventual new 5yr benchmark.

- 0E26-0R26 roll opening at +10.2bps mid, .2 steeper than the opening sprd last week.

- As the 5yr benchmark, the roll will be quoted vs the 0E26s but there will likely be good interest to buy them vs the 1H26s (ineligible for QE, still a bit rich to the curve and we've got a flattener ~+5.5bps on Z-sprd to roll fwd) and the 1Q27s 9mos steepener at just -3.2bps (1Q27-0E28s is -7.4bps for a 6mos sprd).

- The UKT 2-5-10s fly cheapened mightily last week, taking it to levels that we think will attract some demand, especially in steepeners.

- While the market might be inclined to look for more auction concession into this new issue, we expect support will be solid, especially with short-end supply in the budget likely to be smaller than 20/21 as a percentage of issuance AND the recent back-up in rates.

UKT 2-5-10s fly

- £1.25bn UKT 0.50 10/61s Tap Tomorrow at 11:30am.

- 31.6k G M1 equivalents

- The UKT 3H45-0H61 sprd has been a popular one with some of our leveraged clients as the 25-27yr sector has been well anchored while ultras have been a challenge as the curve steepened.

- Even after last week's late gap flatter on the curve, the 45-61s yield sprd only flattened .3bp, just off their cheapest levels since August.

- In the attached note, we advocate getting back into steepeners and as you can see from this am's curve moves, 10-30s has already begun to retrace Friday's massive move. So, we're less keen to own these 0H61s vs 45s. Where we think it makes A LOT of sense, however, is to buy the 0H61s vs swaps as either a SONIA OIS box vs 3H45s/0F50s or just buy them vs swaps outright. We can see that as a result of the massive flattening of 10-30s swaps (outpacing the gilts curve move by 4-5bps), these 61s shot cheaper vs SONIA, backing up 8bps on the day which we are in the process of unwinding right now.

0H61 vs SONIA

3H45-0H61 Z-Sprd box

- Thur 10am £2.75bn tap of 0Q31s

- This issue's been all over the map of late, cheapening up to our +11bps target last week, a combination of the overall steepening bias, the richening of the 4T30s into Mar-Jun rolls and the expected tap of the 31s this week.

- We can see from the chart below that Friday's flattening bias took the yield sprd back to the 10.2bps area and with a handful more taps of the 31s coming AND our resumption of steepening call, we're inclined to look for the sprd to inch back to the 10.5bps area.

- Much of where the spread will be Thursday will depend on the budget so tough to make a call on them right now, however, if the pundits are right and mediums supply into 2021/22 is at or smaller than 20/21's share of the slate then these 31s will be well bid, especially given their APF room and their room vs the Z-sprd curve.

- So, buy the bounce on the curve…

More to come!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

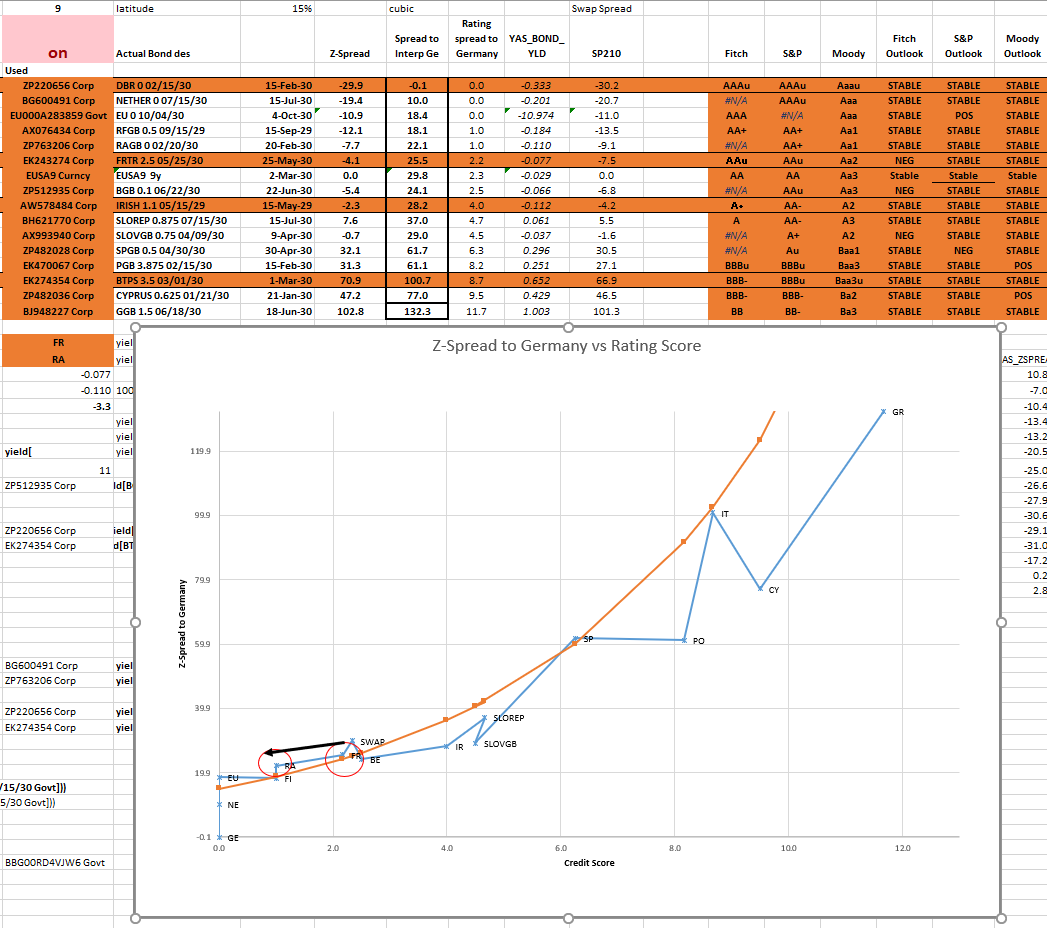

European RV, James & Will at Astor Ridge

XP

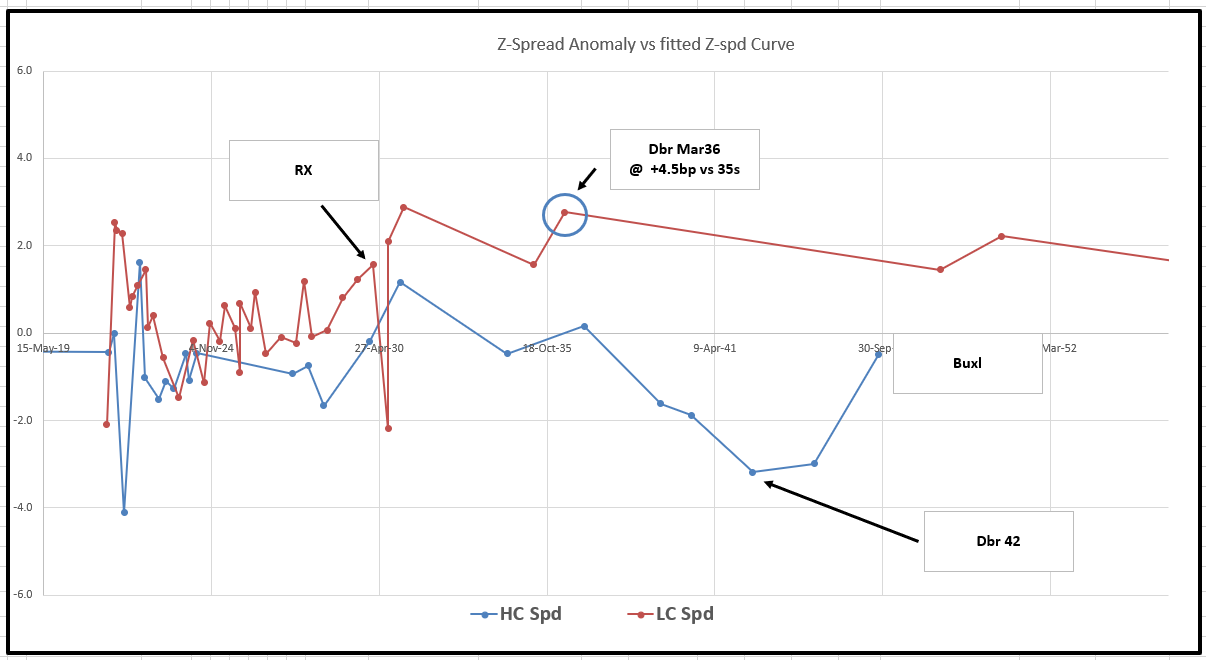

A tough week – one that saw a structural shift in the Bond markets – and most pointedly an increase in curvature. With a new 15y coming in Germany next week – Dbr Mar36 - the street got caught very long the old 15yr Dbr Mar35

By way of illustration..

Long Dbr 35s

vs Short RX (feb30) and Short UB (aug46)

– curvature was added which we can see on this graph

200 * (YIELD[DBR 0 05/15/35 Corp] - 0.5 * YIELD[DBR 0 02/15/30 Corp] - 0.5 * YIELD[DBR 2.5 08/15/46 Corp])

And this was reflected in the other structures in European Curves as bullets sagged vs wings

Up until Friday the bonds were adding curvature more rapidly than the swap curve!!!!

SP210 is the code for a BOND vs Matched Maturity Swap

This index shows the same fly but with swap hedges – it’s rv is pure bond anomaly and really doesn’t move much

200 * (SP210[DBR 0 05/15/35 Corp] - 0.5 * SP210[DBR 0 02/15/30 Corp] - 0.5 * SP210[DBR 2.5 08/15/46 Corp])

So going forward there are two takeaways

- firstly that we look for ‘edge’ vs swaps as well as in yield space and vs a fitted curve.

That both on History and in terms of absolute value our structures hold value

For example looking at the fitted German Swap Spreads (Using Z-spread) to have a better analysis of coupon differences or even stripping with a Par Curve build

Here’s how my anomaly fitted Z-spread curve looks for Germany…

- Secondly we need to think about how to hedge out the effect of steeper (or flatter curves) on structures that we might normally view on a 1/2/1 weighting.

Assuming anomaly value is distinct from generic curve moves, then we can use the fitted curve to determine our weightings so that they are more robust in changes of curve slope

Consider French 10s/20s/30s

Fitted curve yields

|

FRTR 0.75 05/25/52 |

25-May-52 |

0.735 |

|

FRTR 0.5 05/25/40 |

25-May-40 |

0.442 |

|

FRTR 0 11/25/30 |

25-Nov-30 |

-0.049 |

So

10s20s is 49.1 basis points

10s30s is 78.4 basis points

In this case we would expect slope of 10s20s to be expressed as the percentage of 10s30s

And it’s roughly 63 %

If 10s30s steepened by 10bp we would see curvature as unchanged IF 10s20s steepened by 6.3bp –

If our hedging captures that, we reduce var and capture the true value of the anomalies

Now we can compare two versions of Frances 10s20s30s

1) 50/50 weighted: 200 * (YIELD[FRTR 0.5 05/25/40 Corp] - 0.5 * YIELD[FRTR 0 11/25/30 Corp] - 0.5 * YIELD[FRTR 0.75 05/25/52 Corp])

2) 37/63 weighted (fitted curve shape): 200 * (YIELD[FRTR 0.5 05/25/40 Corp] - 0.37 * YIELD[FRTR 0 11/25/30 Corp] - 0.63 * YIELD[FRTR 0.75 05/25/52 Corp])

So the second expression suffered less Var as the curve slope changed – reaching only 3bp from the mean under duress , rather than 6bp

and this mechanism can be employed Euro, UK, US all markets

with the caveat that it generally requires monotonic curves –

‘After removing anomaly value, bonds track the fitted curve and it’s relative shape’

And this does not require constant rebalancing unless the curve dramatically changes its curvature, but that would be the same if we 50/50 weighted our structures too

For reference, French fitted curve – Yield (IRR) no cash-flow discounting or Zero Rates employed

Looking ahead

New German 15y coming next week - €3bln Mar36 on Wednesday

The German 15y Mar36 was priced at +6bp / -4.25bp in the street on Friday – that’s gonna be a really cheap point on the 15y – the 2035s have been offered only in the street and are close to the bottom vs contract wings. The level of spread means 36s will be cheap and that could cheapen every core and semi core issue in that sector – it’s starting to look pretty good already and therefore it makes Nether 33s, Ragb 34s and 37s, Finland 31s and Ireland 31s and 34s look rich

Here’s how I see German Z-spreads vs a smoothed out curve – Germany only

Strategy

I think we want to come out of next week with -Feb30 (RX CTD for Mar & June), Long Mar35 or Mar36 (if they are cheap enough) & Short Dbr 42s

Here’s history on

Long Dbr 35s

vs short Feb30 and short Dbr 42s

Again, we’ve used our weightings of the shape of the fitted curve (40/60)

200 * (YIELD[DBR 0 05/15/35 Corp] - 0.4 * YIELD[DBR 0 02/15/30 Corp] - 0.6 * YIELD[DBR 3.25 07/04/42 Corp])

The German 15y Mar36 was priced at +6bp / -4.25bp in the street on Friday – that’s gonna be a really cheap point on the 15y – the 2035s have been offered only in the street and are close to the bottom vs contract wings. The level of spread means 36s will be cheap and that could give us a chance to get a really cheap new issue vs Feb30 (which stay contract CTD into June) & Dbr 2042s ,which starts to roll up the value curve from an expensive point

Austria 2031s tap (along with 2024s) €1,4bln for the two issues – on Tuesday

Ragb 2030s looking too cheap – buy as on spread vs Ragb2029 OR buy as a credit vs France (French supply coming on Thursday)

The heavy selling in Ragb 2031s has actually adversely impacted the Ragb30s more than the the 31s

29s30s too steep..

-Ragb 2029 +Ragb 2030

vs

10% of +Back month Bobl (dbr feb26) / -old 15y Germany (dbr 34)

It’s only a 10% hedge and so friction not too severe – I have real sympathy with the hedge too – back month OEM1 Ctd, feb 26 looks to have cheapened. On Z, the Dbr 34s look rich vs the forthcoming 2036 issue and the existing curve

Risks

The thing that could steepen Austria is the forthcoming French supply in Nov30 – but to me, there’s some buffer in the Austrian slope to counter that – Austria as a better credit should trade flatter as it does in a very exaggerated way in the long end

Cix:

100 * ((YIELD[RAGB 0 02/20/30 Corp] - YIELD[RAGB 0.5 02/20/29 Corp]) - 0.1 * (YIELD[DBR 4.75 07/04/34 Corp] - YIELD[DBR 0.5 02/15/26 Corp]))

Graph:

We’ve also looked at – Ragb34 – Ragb 30s vs Ragb 34s is a nice steepener coming out of Tuesday and going into Wednesday’s German supply

As a credit

I like France Nov30 into Ragb Feb30 at anything better than -9bp

Currently -9.8 bp

Range: -13.7 bp / -8.3 bp

At which point on Z it would be -4.25bp

Graph of Z-Spread History, France Nov30 into Ragb Feb30

We’re also looking at another small anomaly that should have a quick 2.5bp of normalisation

Sell Nether 26s to buy Nether 2027s

Yield Spread

& vs a hedge of 10% +June Obl / -RX

100 * ((YIELD[NETHER 0 01/15/27 Corp] - YIELD[NETHER 0.5 07/15/26 Corp]) - 0.1 * (YIELD[DBR 0 02/15/30 Corp] - YIELD[DBR 0.5 02/15/26 Corp]))

Target +3.25 bp to get this on with some form of curve hedge for mean reversion to +2bp to be consistent with the curve

As always

Have a good week

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

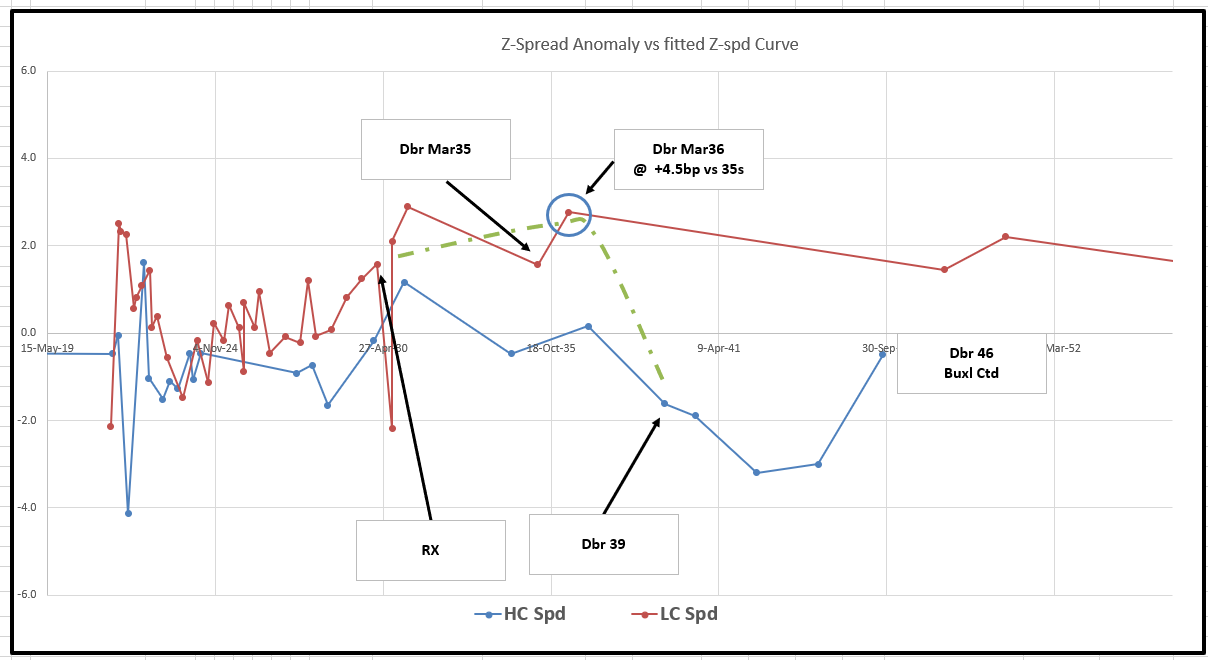

The week ahead - European RV, James & Will at Astor Ridge

Kalyan and Team – some thoughts on the week ahead in RV

Looking at your structure +35s -39s +46s,

We saw curvature added to the 15y and 20y substantially as global curves edge towards some sort of paradigm shift from last year’s modality

Although the street was caught Long 35s – this actually worked in favour of your trade as it dragged all the other 15 -20y paper out and essentially you have been short a bullet and long wings, which as a theme worked

By way of illustration..

Long Dbr 35s

vs Short RX (feb30) and Short UB (aug46)

– curvature was added

200 * (YIELD[DBR 0 05/15/35 Corp] - 0.5 * YIELD[DBR 0 02/15/30 Corp] - 0.5 * YIELD[DBR 2.5 08/15/46 Corp])

I think we’re getting close to the bottom so I think it’s definitely time to take the trade off – or better still mutate it into something that keeps yielding value…

Here’s how my anomaly fitted Z-spread curve looks for Germany…

Strategy

I think we want to come out of next week with -Feb30 (RX CTD for Mar & June), Long Mar35 or Mar36 (if they are cheap enough) & Short Dbr 39s and flat the 46s

Currently your risk is approx:

Dbr 35s: +53k

Dbr 39s: -106k

Dbr 46d: +53k

And I think the right expected var weighting for

-feb30 +dbr35s -dbr39s is

-0.33 / +1 / -0.67

So basically twice the risk in the back leg as it is about half as volatile

Here’s how that fly has performed…

200 * (YIELD[DBR 0 05/15/35 Corp] - 0.33 * YIELD[DBR 0 02/15/30 Corp] - 0.67 * YIELD[DBR 4.25 07/04/39 Corp])

So assuming we don’t waste liquidity trying to get the 39s back then we leave that at -107k position

Then our final risk should be something like

Dbr 30s: -53k (new position)

Dbr 35s: 160k (more)

Dbr 39s: -107k unchanged

finally the difference between that end state and where we are now means we will

Sell Dbr 30s: -53k

Buy additional Dbr 35s OR Dbr36s: 106k

Sell Dbr 46s: -53k

So actually this makes us a buyer of that very first fly at the top of the message – right on the all time cheap as we come into supply next week – furthermore – if you like the spread of the 36s relatively we can supplant 2035s with 2036s instead - Street had 2036s vs 2035s spread at +6bp / -4.25bp vs the 2035s on Friday. I see +4.5bp as decent value to both the 35s and the wider curve

So once again – thanks for bearing through on this trade – Will and I appreciate your working with us on this one – but I think we can mutate it into something even better – as per the first chart

Other stuff!!!...

Ragb 29s30s flattener

Austria 2031s tap (along with 2024s) €1,4bln for the two issues – on Tuesday

Ragb 2030s looking too cheap – buy as on spread vs Ragb2029 OR buy as a credit vs France (French supply coming on Thursday)

The heavy selling in Ragb 2031s has actually adversely impacted the Ragb30s more than the 2031s

29s30s too steep..

Sell Ragb 2029 & Buy Ragb 2030

vs

10% of +Back month Buy Bobl (dbr feb26) / Sell old 15y Germany (dbr 34)

It’s only a 10% hedge and so friction not too severe – I have real sympathy with the hedge too – back month OEM1 Ctd, Dbr Feb 26 looks to have cheapened. On Z, the Dbr 34s look rich vs the forthcoming 2036 issue and the existing curve

Risks

The thing that could steepen Austria is the forthcoming French supply in Nov30 – but to me, there’s some buffer in the Austrian slope to counter that – Austria as a better credit should trade flatter as it does in a very exaggerated way in the long end

Cix:

100 * ((YIELD[RAGB 0 02/20/30 Corp] - YIELD[RAGB 0.5 02/20/29 Corp]) - 0.1 * (YIELD[DBR 4.75 07/04/34 Corp] - YIELD[DBR 0.5 02/15/26 Corp]))

Graph:

We’ve also looked at – Ragb34 – Ragb 30s vs Ragb 34s is a nice steepener coming out of Tuesday and going into Wednesday’s German supply

As a credit

I like France Nov30 into Ragb Feb30 at anything better than -9bp

Currently -9.8 bp

Range: -13.7 bp / -8.3 bp

At which point on Z it would be -4.25bp

Graph of Z-Spread History, France Nov30 into Ragb Feb30

And here’s how we see it as a credit vs France in the 9y Tenor

France into Austria is a basic tactical trade – currently -3.3bp – we have supply in France on Thursday – two days After Austria

Trade is super stable but if we can get it on at better than -2.5bp over supply, I think it has intrinsic value and can at least pop back to -4bp

100 * (YIELD[RAGB 0 02/20/30 Corp] - YIELD[FRTR 2.5 05/25/30 Corp])

We’re also looking at another small anomaly that should have a quick 2.5bp of normalisation

Sell Nether 26s to buy Nether 2027s

Yield Spread

& vs a hedge of 10% +June Obl / -RX

100 * ((YIELD[NETHER 0 01/15/27 Corp] - YIELD[NETHER 0.5 07/15/26 Corp]) - 0.1 * (YIELD[DBR 0 02/15/30 Corp] - YIELD[DBR 0.5 02/15/26 Corp]))

Target +3.25 to get this on with some form of curve hedge for mean reversion to +2bp to be consistent with the curve

We’ve got some interesting stuff in UKT Gilts too – look forward to speaking

As always have a fab week and speak on Monday

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796