The week ahead - European RV, James & Will at Astor Ridge

European RV – A brief summary Greg, Dan and Team, of things that might be of interest

Belgium 47s – we like Belgium as a credit. It’s oversold vs Germany and Italy – it has been washed out with France but doesn’t suffer the same issuance surplus given its Cap Key

As a credit…

Belg 47s vs Buxl and Btps 44s

cix: 100 * (YIELD[BGB 1.6 06/22/47 Corp] - 0.8 * YIELD[DBR 2.5 08/15/46 Corp] - 0.2 * YIELD[BTPS 4.75 09/01/44 Corp])

We also see it as one of the cheapest semi-core issues cheap on the general term structure of semi- and core

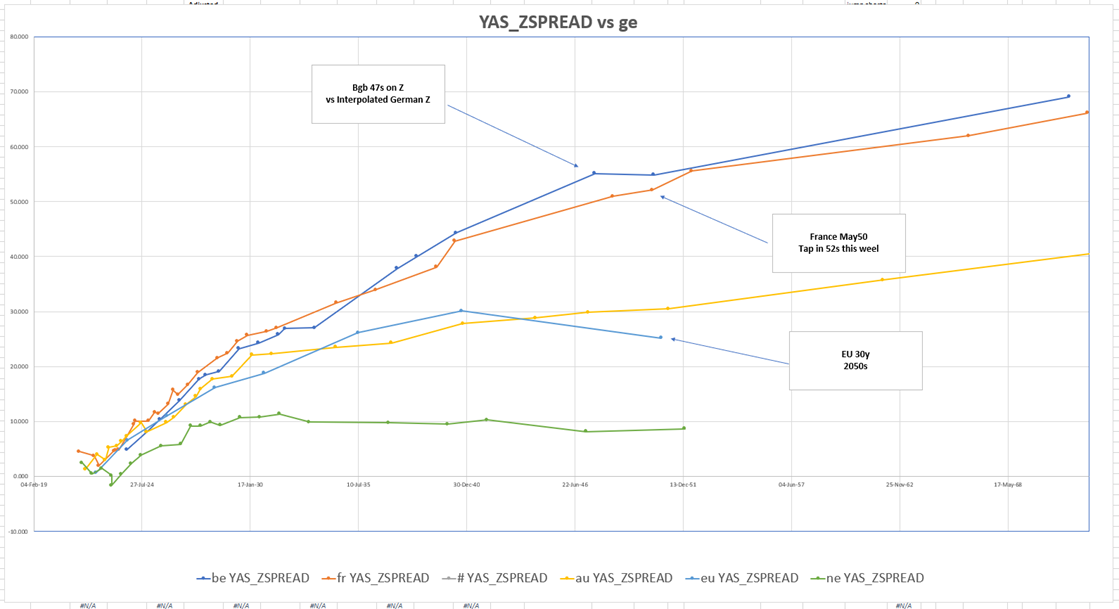

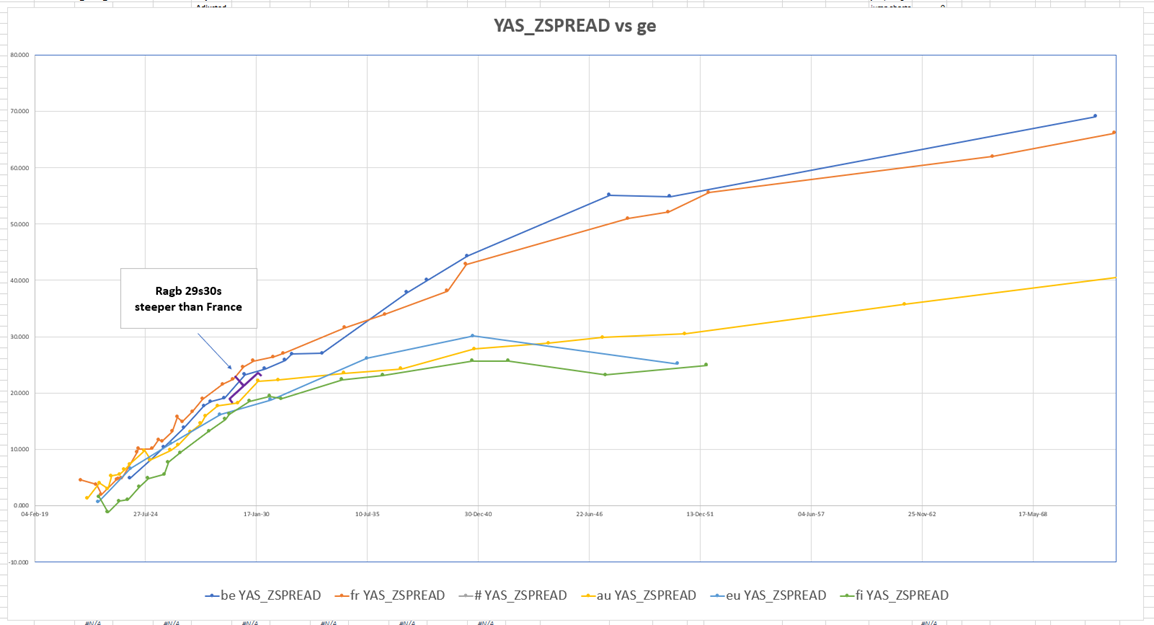

Graph of Z-spreads over Interpolated Germany

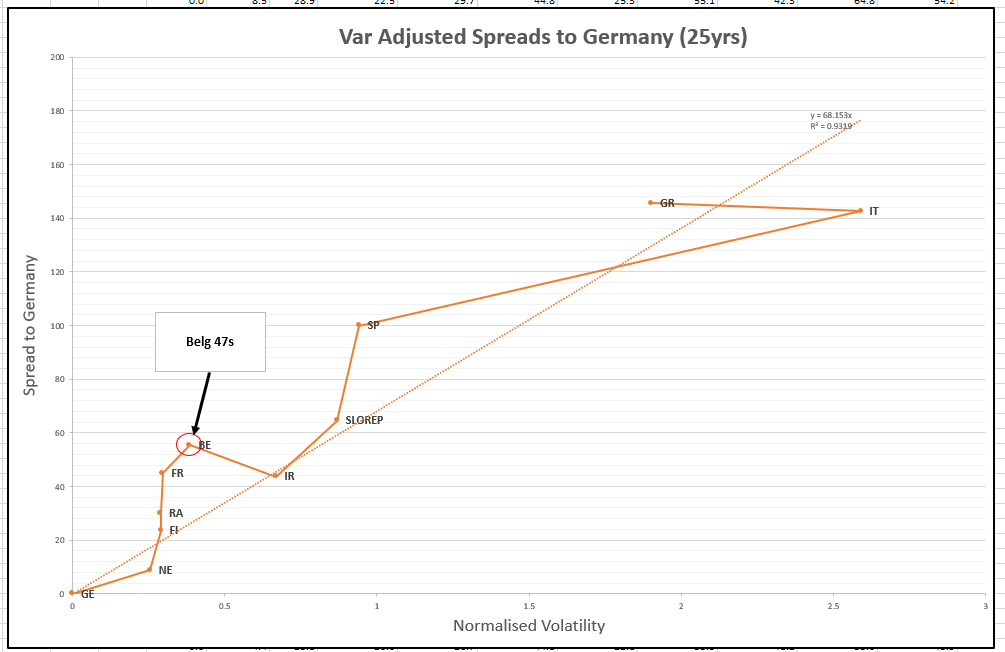

The PEPPP has compressed the vol on some issuers to make them ‘trade like better credits’ – from a RM point of view we can use a vol adjustment to see how the apparent reduced risk might change the view of the market

Buy looking at Var adjusted spreads to Germany (gives a sense of ‘how the credit trades’) then Belgium offers value vs its immediate peer group

We’ll leave you to think about the best expression given the moves in 10s30s – I think we are in a paradigm shift for global curves – but a bounce seems to have brought a flattening whereas I had thought we would see a bear flattening in 10s30s if 5y got heavily sold

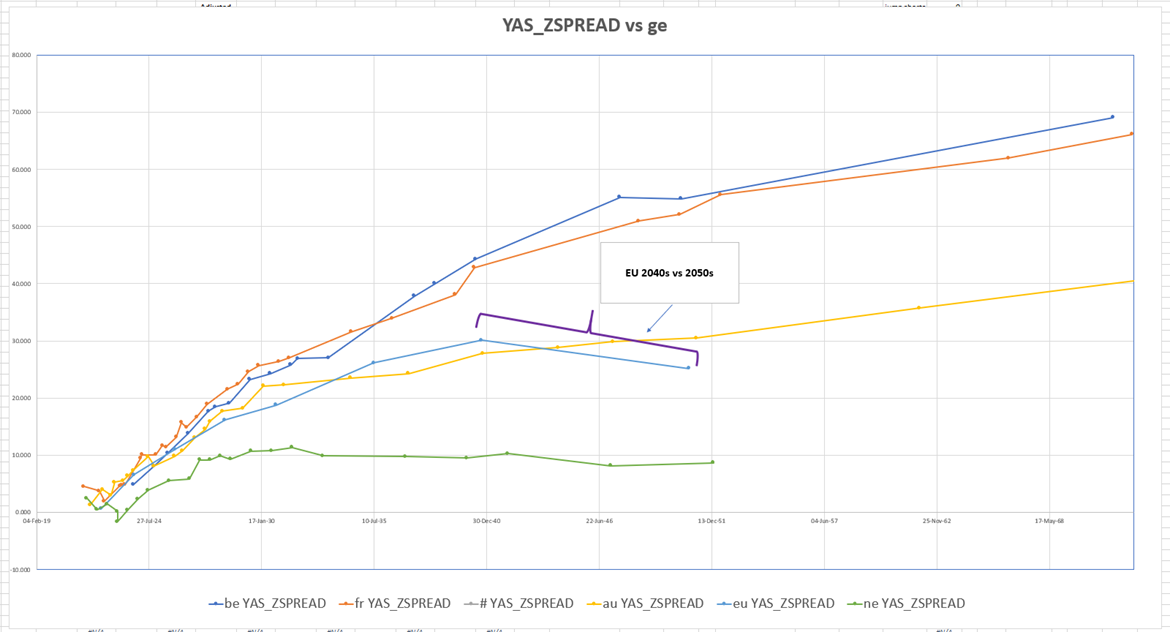

EU 20s30s steepening

EU Sell 30y vs Buy 20y

Up until Thursday we saw aggressive steepening – talk of a 15y EU has pushed out the 10y t0 20y range of EU

The EU curve now has a very similar slope except in 20s30s where it’s too flat – although it is a triple A issuer and inherits some characteristics from the swap curve, it should not be flatter than the German Curve

See the graph of Z-spreads vs Germany (Z vs interpolated German Z)

Here’s how EU 2040s / 2050s has performed vs the similar maturity German Dbr

100*((yield[EU 0.3 11/04/50 Govt ]-yield[EU 0.1 10/04/40 Govt ])-(yield[DBR 0 08/15/50 Govt ]-yield[DBR 4.75 07/04/40 Govt ]))

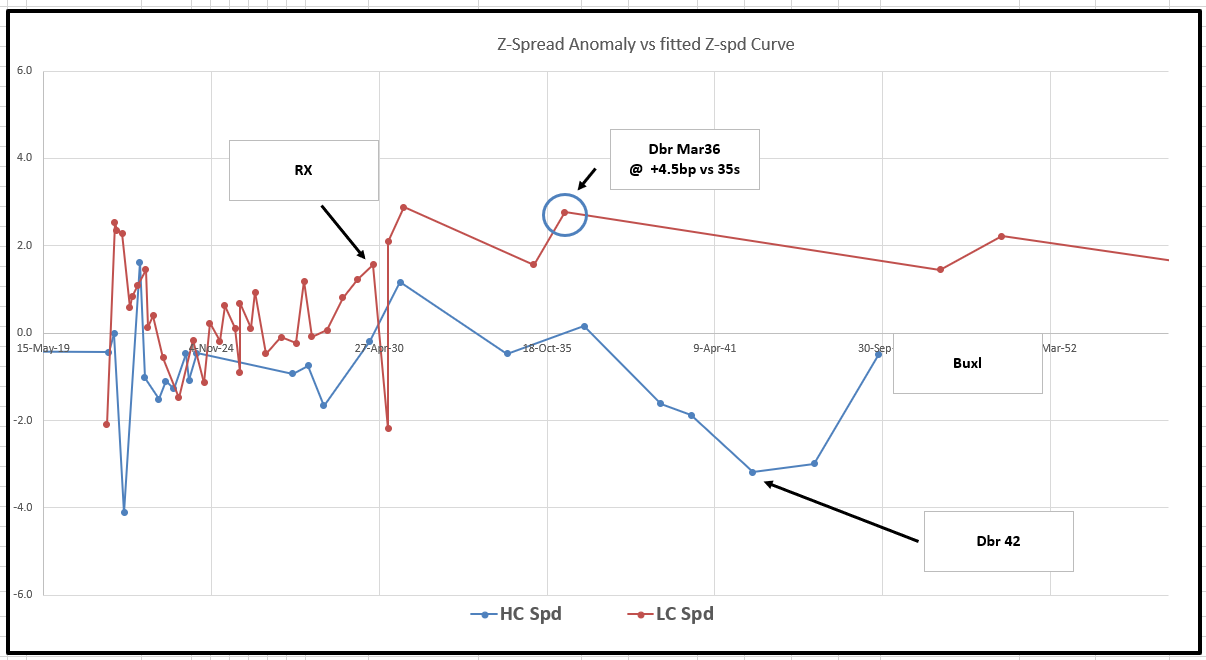

We’re getting the point where German 2050s are finally cheap on Z- too – having been too rich (due to their low coupon) they finally gave up ground in the steepening last week

Supply coming

With supply from Austria, France, Spain and Germany – it’s tough to call 10s30s but I like that steepener as a counter for any flatteners we might put on from either French longs or German new 15y

Credit perspective

Personally I’d take some Ragb Feb30s if they soften with the tap of 2031s (2030s are a good bit cheaper) and be short the EU 2050s and be having Belgium 30s 47s flattener against it

Am avoiding the 20y France as I think it’s optically cheap on yield but its very low coupon is just not as good as some of the higher coupon Frtr such as May48 or May31 when we strip the curve using par and zero rates

New German 15y coming next week - €3bln Mar36 on Wednesday

The German 15y Mar36 was priced at +6bp / -4.25bp in the street on Friday – that’s gonna be a really cheap point on the 15y – the 2035s have been offered only in the street and are close to the bottom vs contract wings. The level of spread means 36s will be cheap and that could cheapen every core and semi core issue in that sector – it’s starting to look pretty cheap already and therefore it makes Nether 33s, Ragb 34s and 37s, Finland 31s and yes, Ireland 31s and 34s look rich

Here’s how I see German Z-spreads vs a smoothed out curve – Germany only

Austria 2031s tap (along with 2024s) €1,4bln for the two issues – on Tuesday

Ragb 2030s looking too cheap – buy as on spread vs Ragb2029 OR buy as a credit vs France (French supply coming on Thursday)

The heavy selling in Ragb 2031s has actually adversely impacted the Ragb30s more than the the 31s

29s30s too steep..

-Ragb 2029 +Ragb 2030

vs

10% of +Back month Bobl (dbr feb26) / -old 15y Germany (dbr 34)

It’s only a 10% hedge and so friction not too severe – I have real sympathy with the hedge too – back month OEM1 Ctd, feb 26 looks to have cheapened. On Z, the Dbr 34s look rich vs the forthcoming 2036 issue and the existing curve

Risks

The thing that could steepen Austria is the forthcoming French supply in Nov30 – but to me, there’s some buffer in the Austrian slope to counter that – Austria as a better credit should trade flatter as it does in a very exaggerated way in the long end

Cix:

100 * ((YIELD[RAGB 0 02/20/30 Corp] - YIELD[RAGB 0.5 02/20/29 Corp]) - 0.1 * (YIELD[DBR 4.75 07/04/34 Corp] - YIELD[DBR 0.5 02/15/26 Corp]))

Graph:

We’ve also looked at – Ragb34 – Ragb 30s vs Ragb 34s is a nice steepener coming out of Tuesday and going into Wednesday’s German supply

As a credit

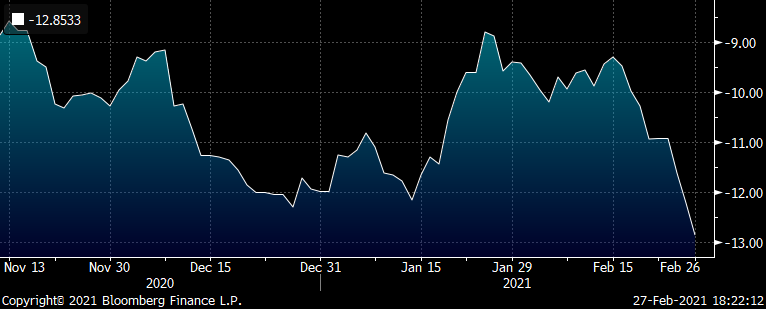

I like France Nov30 into Ragb Feb30 at anything better than -9bp

Currently -9.8 bp

Range: -13.7 bp / -8.3 bp

At which point on Z it would be -4.25bp

Graph of Z-Spread History, France Nov30 into Ragb Feb30

In Germany, our plan is to end the week with +2036 -2042 +2050,

which if I plot history with 2035 on the short leg, shows no signs of the belly having cheapened, whereas it has with most other issues..

I would weight this fly on expected Var…

One third vs two-thirds…

GE

+Dbr2036 -Dbr 2042 +Dbr2050

Weights: +0.33 / -1 / +0.67 (all x 2 for comparison to other flys)

cix:

200 * (yield[DBR 3.25 07/04/42 Govt]-0.3*yield[DBR 0 05/15/35 Govt]-0.7*yield[DBR 0 08/15/50 Govt])

And the same struture on Z….

I think this is a slow burner – in any flattener, the high coupons will look richer on Z – the risk to this one would be a more extreme steepening of 10s30s – and generally the 42s surf cheaper from being rich – the wings are just plain cheap

Still like Spain vs Italy 30y/20y forward as per last week…

100 * (G0061 30Y20Y BLC2 Curncy - G0040 30Y20Y BLC2 Curncy)

As always have a fab week ahead

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

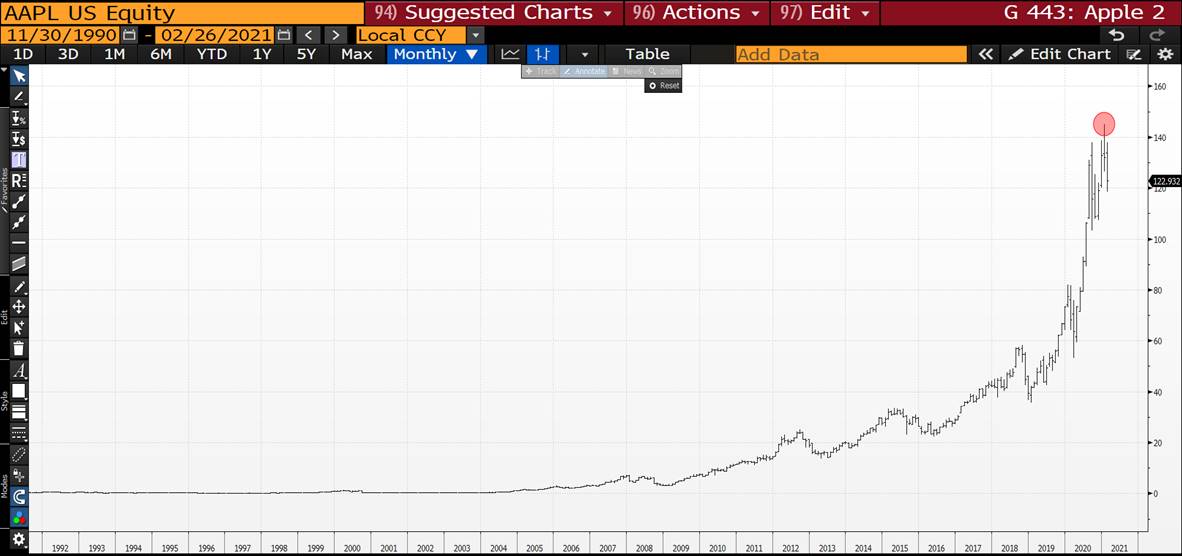

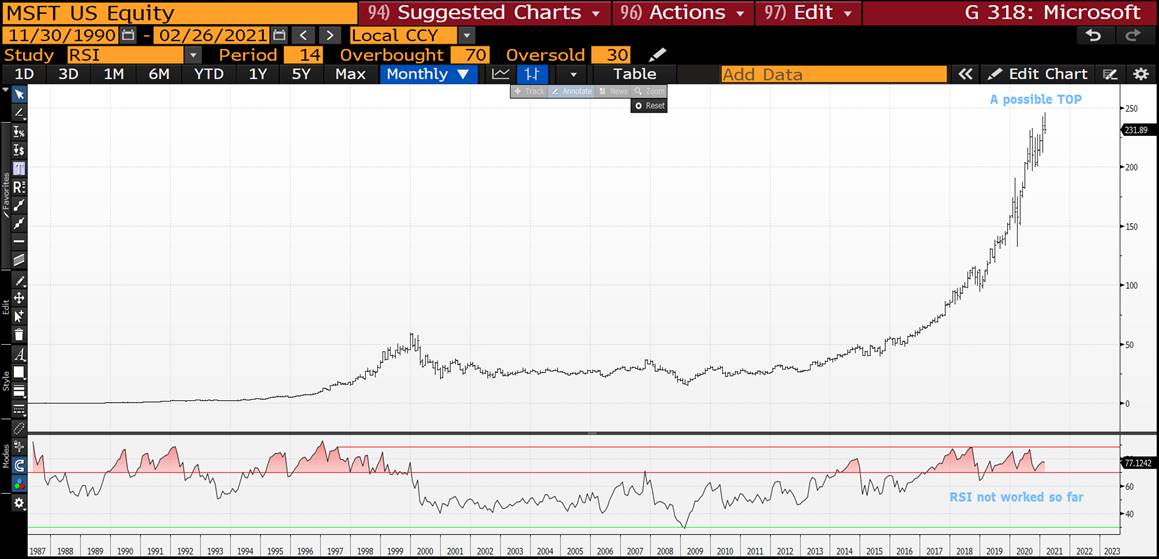

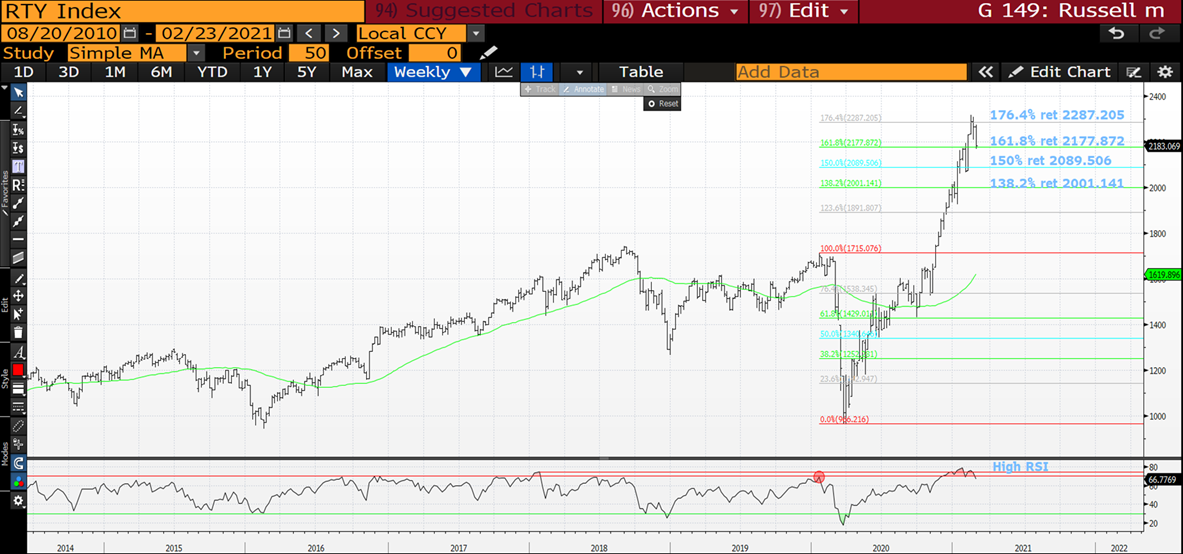

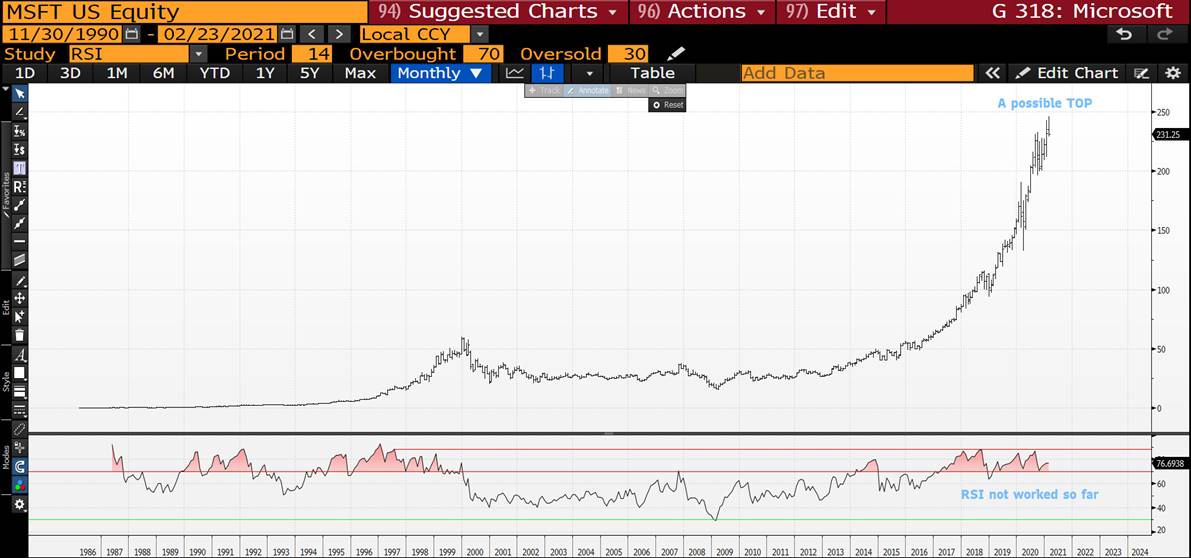

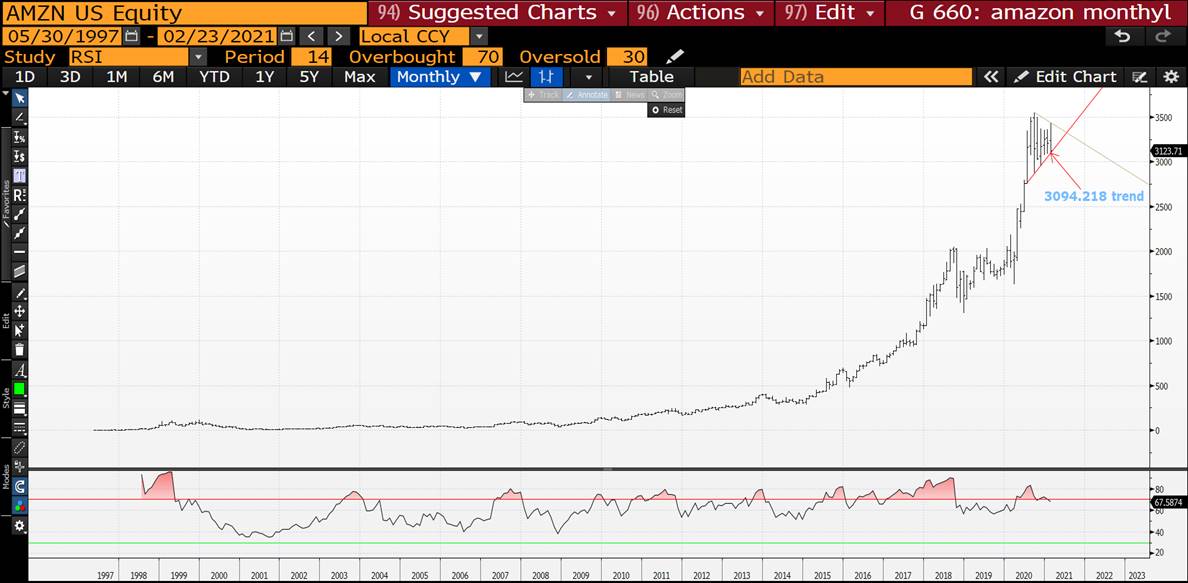

STOCKS : NO MAJOR LEVELS HAVE BEEN BREACHED “YET” BUT WE ARE EDGING CLOSER TO HAVING SOME MAJOR ONES ASSITED BY SIMILAR EXTENDED RSI’S.

STOCKS : NO MAJOR LEVELS HAVE BEEN BREACHED “YET” BUT WE ARE EDGING CLOSER TO HAVING SOME MAJOR ONES ASSITED BY SIMILAR EXTENDED RSI’S.

THE MOVE LOWER IN BOND YIELDS IS PREDICTED TO BE VERY SIZEABLE SO THIS WOULD IMPLY THE SAME FOR THE STOCK SELL-OFF.

THE RUSSELL WEEKLY CHART HAS A VERY DISLOACTED RSI SIMILAR TO EARLY 2020.

“THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK”. ALL OBVIOUSLY VERY OVER EXTENDED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

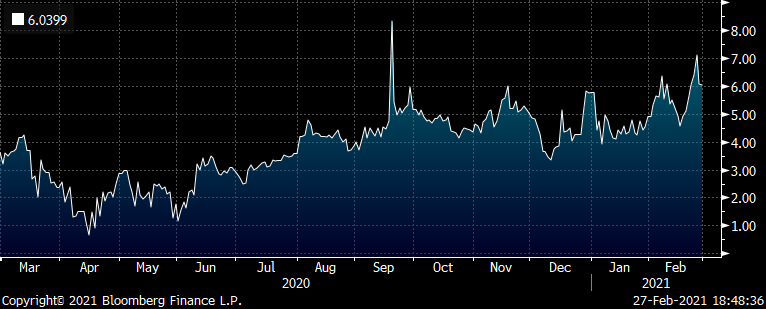

MACROCOSM: Will Frantic February Mean Manic March? Some Thoughts...

YIKES! If February's markets mayhem is what happens with the post-pandemic outlook improves, I am not sure it's worth it!

In no particular order, we saw:

- Oil rallied 20%, copper rallied 19% and the S&P rallied another 6% (before dipping on moves into bonds)

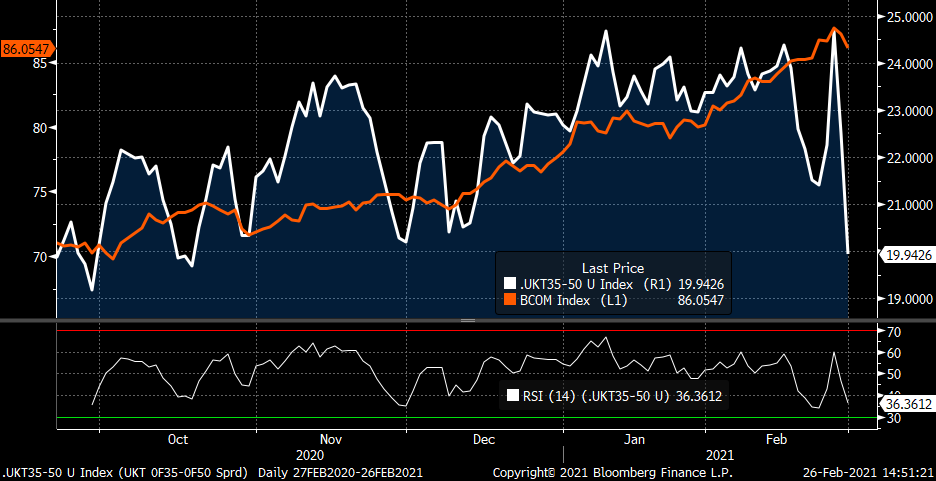

- Gilts under perform UST and DBRs by 30bps (10yrs) as 10yr gilts sold off 50bps!

- GBP 10-30s swaps have flattened 11.5bps since 3pm yesterday, far outpacing the gilts move and reversing Z-sprds sharply.

- USTs 5-30s steepened 23.5bps before flattening 18bps yesterday afternoon!

- Central bankers "forward guidance" became "forward futility" as the BoE and ECB's baffling messages exacerbate illiquidity.

- Bitcoin rallies 76% before giving back 35% of the move.

- USD 2y1y OIS sells off 43bps despite the FED's insistence that rates are staying put.

- Fears of negative rates in the UK are long gone with 1y1y SONIA +17bps and cuts priced out of the curve.

- The MOVE index of implied vol rallied 60% in 8 days to 74, a huge move in that short a span.

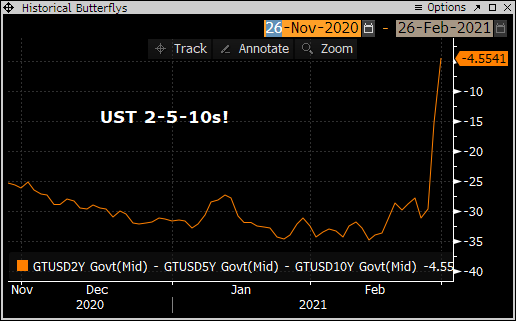

- The UST 2-5-10 fly cheapened over 20bps in 2 hours yesterday following an ugly 7yr auction!

Let's preview what's on tap for March:

- Biden's stimulus bill should pass in the House and hit the Senate soon with approval likely by mid-month. Unlikely to be $1.9trln but will certainly set records for fiscal spending. This week's market rejection of the 5yr and 7yr suggest appetite for more USTs is shaky at best – where's the money coming from then?

- The UK budget on the 3rd, according to the pundits, should provide additional spending and extension of current schemes until at least mid-summer. The bigger the check, the faster Q2/Q3.

- ECB meeting on the 11th, FOMC meeting on the 17th, MPC meeting on the 18th. Fan the flames or calm our nerves?

- Vaccinations will continue building pace, especially across Europe where delivery has been relatively slow.

- Economic data in March should continue to show signs of sluggishness, especially in Europe where much of the region is under severe restrictions. Market trades like it's old news but what will central bankers say if the data's ugly?

- Issuance in Europe and the UK should slow from the torrid pace of Jan/Feb. The UK DMO announces the Apr-Jun calendar and EGB syndications will abate, supported by solid cash flows into April.

The last two days of this month were a whirlwind with remarkable curve, spread and yield swings that were exacerbated by lighter than average dealer balance sheets after recognizing that they were not being compensated for the liquidity they were providing. While the massive bid to the long-end of the UST and UKT curves of the last 24hrs was clearly driven by month-end asset allocations that caught the market unprepared (even though there were expectations of these flows), one has to now ask whether this long-end bid will abate now that their month-end index needs have been met.

The market spent much of February trying to rationalize the remarkable yield/curve moves we were seeing, especially in gilts. Needless to say, it's been a very long time since we've seen a 50bps cheapening of 10yr gilts in one month, especially in an environment of such extraordinary economic fragility and uncertainty. With commodities surging higher and covid-cases declining as vaccination rates climbed, the curve/yield moves became more reasonable, even if they seemed relentless at times.

Here's a question for you: Is the next 10bps in the UST 5-30s curve flatter or steeper? Or what about the UKT 10-30s yield spread which steepened 7.5bps over February, only to end the month FLATTER than where we began…?

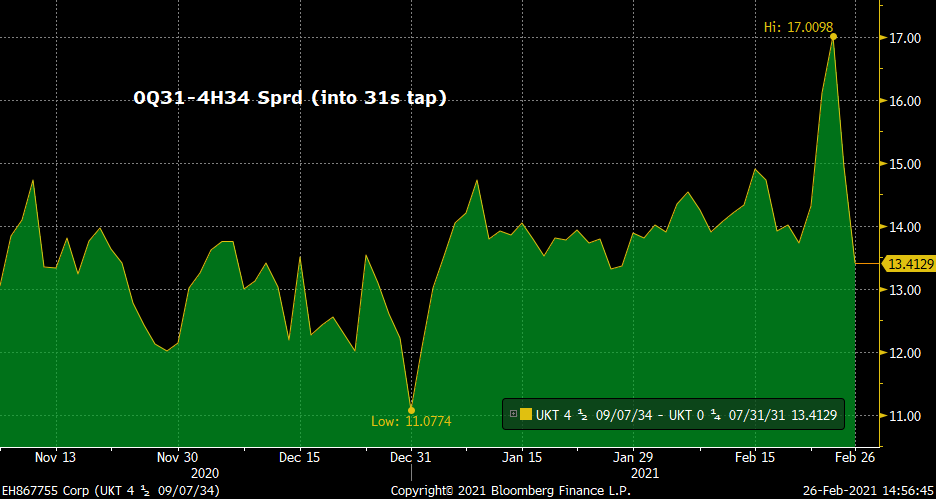

As for Gilts, we'll find out where we stand pretty soon. The DMO will be auctioning £1.25bn of the LONGEST DURATION issue on the whole curve on Tuesday – 32k G M1 worth of her majesty's finest. We'll also get £3bn of a shiny new UKT 0375 10/26s issue that will be sandwiched between issues that have cheapened 35bps in February and have given up over 13bps vs 30yrs in the last 24hrs. Then on Thursday, after Wednesday's budget, we get another £2.75bn of the UKT 0.25% 31s.

Personally, I think this end of month curve move is a great opportunity to get back into steepeners.

UKT 0F35-0F50s steepener

UKT 0Q31 – UKT 4H34 yield sprd. The 4T30-0Q31 sprd peaked at +11bps (our target into the tap).

1Q41-3H45 sprd

Etc etc…

Have a great weekend – let's talk Monday.

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

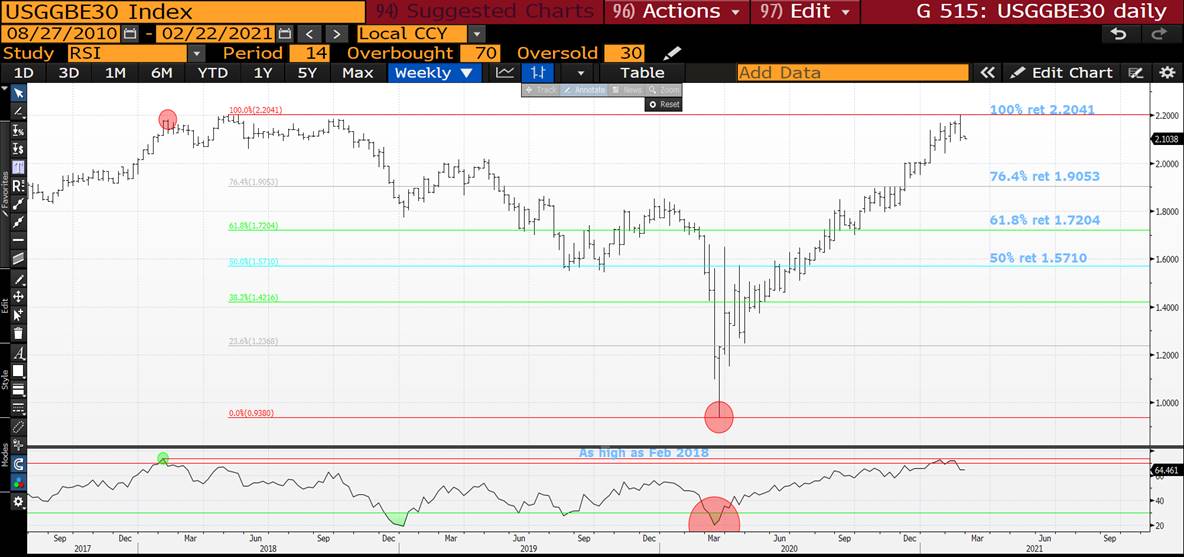

US BREAKEVENS : NOT TO BE LEFT OUT FROM THE MONTHS EVENTS BREAKEVENS LOOK LIKE FORMING A LONGTERM TOP ASSOSIATED WITH HISTORICALLY DISLOCATED RSI’S!

US BREAKEVENS : NOT TO BE LEFT OUT FROM THE MONTHS EVENTS BREAKEVENS LOOK LIKE FORMING A LONGTERM TOP ASSOSIATED WITH HISTORICALLY DISLOCATED RSI’S!

KEY CONFIRMATION HAS OCCURRED IN THE 30YR BREAKEVEN GIVEN IT BREACHED ITS 50 DAY MOVING AVERAGE 2.0847.

**ALL 3 DURATIONS OF CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

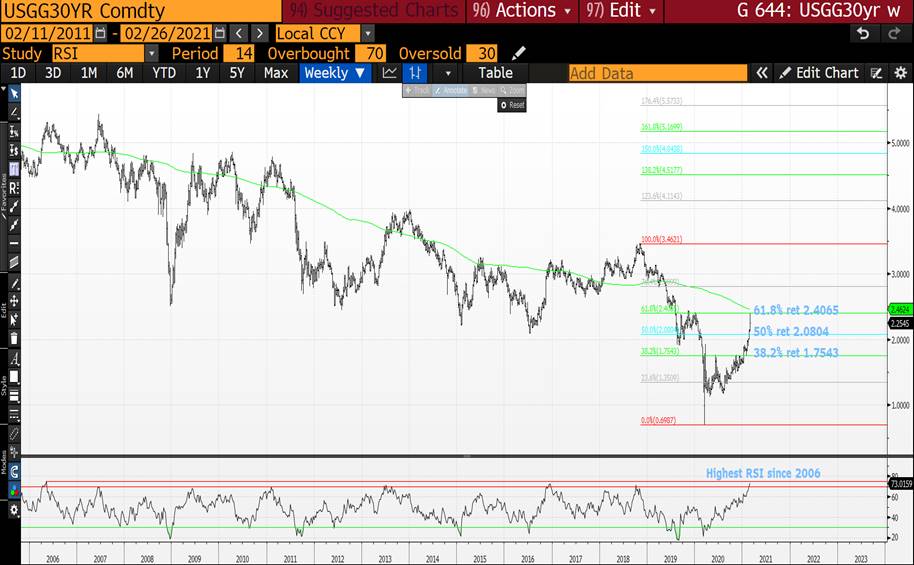

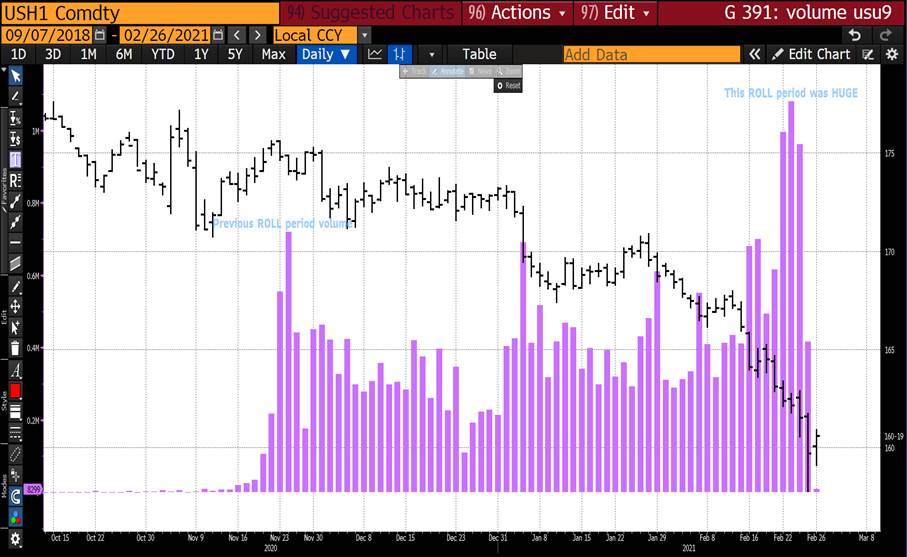

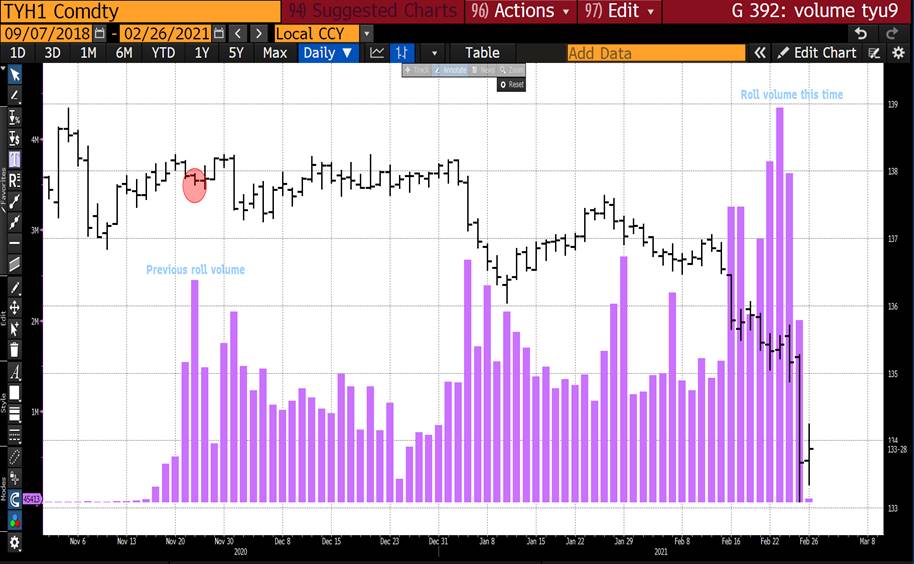

**PLEASE READ ** BOND UPDATE : YESTERDAY WAS HUGE DAY ENDORSING SOME VERY MAJOR TECHNICAL LEVELS ESPECIALLY IN US CURVES-SWAPS CURVES.

BOND UPDATE : YESTERDAY WAS HUGE DAY ENDORSING SOME VERY MAJOR TECHNICAL LEVELS ESPECIALLY IN US CURVES-SWAPS CURVES, NOW ITS TIME TO ADDRESS THE YIELD DISLOCATION AND POTENTIALLY TRAPPED VOLUME SHORTS!

ALSO "TAKE NOTE" WHEN LOOKING AT THE MONTHLY SWAPS AND CURVE CHARTS WHAT HAPPENED IN 2008! NEARLY ALL CHARTS HAVE THE SAME RSI DISLOCATION AS THEN, THIS IS A "TURNING POINT".

***A MAJOR STAND-OUT IS THE MONUMENTAL VOLUMES ROLLED THIS TIME AGAINST LAST NOVEMBERS ROLL! IT HAS BEEN WELL DOCUMENTED THE VOLUME IS FRESH SHORTS, CTA'S HAVE BEEN MUSHROOMED THEIR POSITIONING. THIS SQUEEZE COULD HURT AND AS PER THE SWAPS 102030 FLY THE 20YR SECTOR OFFERS THE GREATEST VALUE. ***

THE NEXT BIG QUESTION IS WHAT WILL DRIVE A BOND RALLY NOW THAT THE CURVES HAVE PEAKED, ALL EYES SHOULD NOW BE FIRMLY ON STOCKS, THESE COULD SEE A MAJOR FALL FROM GRACE.

How Ugly Will It Get: CTAs Are The Most Short Treasury's Since 2018... And Getting Shorter

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

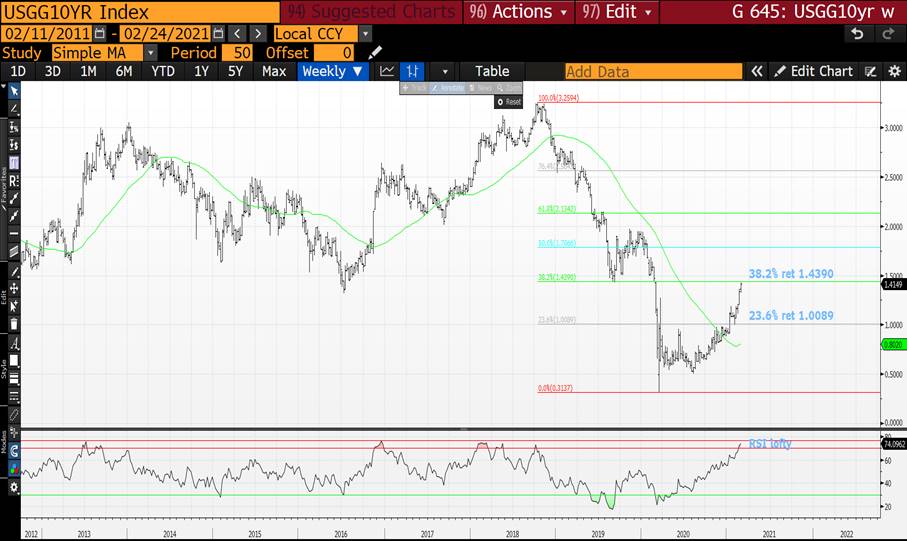

BOND UPDATE : YIELDS HAVE NEW HIGHS BUT THIS STRETCHES THE RSI’S FURTHER AND THE SNAP BACK WILL BE PAINFUL.

BOND UPDATE : YIELDS HAVE NEW HIGHS BUT THIS STRETCHES THE RSI’S FURTHER AND THE SNAP BACK WILL BE PAINFUL. ONE HELPFUL ADDITION IS THE CURVES ARE TOPPING OUT DESPITE THE NEW YIELD HIGHS, THE CURVES COULD BE THE KEY!

I HAVE INCLUDED A CHART OF THE US 5-30 CURVE OVERLAID WITH INVERSE US 10YR YILEDS AND THE CURRENT DISPARITY NEVER LASTS (PAGE 5).

How Ugly Will It Get: CTAs Are The Most Short Treasury's Since 2018... And Getting Shorter

IN THE CASE OF CANADIAN 10YR LAST SEEN SINCE 1994! THIS CANNOT BE SUSTAINED SO STILL CALLING FOR A BOND YIELD “DROP”!

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : YIELDS CONTINUE TO “RISE” GOING AGAINST THE CURRENT CALL FORCING MANY RSI’S INTO NEW OR VERY HISTORICAL TERRITORY.

BOND UPDATE : YIELDS CONTINUE TO “RISE” GOING AGAINST THE CURRENT CALL FORCING MANY RSI’S INTO NEW OR VERY HISTORICAL TERRITORY.

IN THE CASE OF CANADIAN 10YR LAST SEEN SINCE 1994! THIS CANNOT BE SUSTAINED SO STILL CALLING FOR A BOND YIELD “DROP”!

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

STOCKS : I HAVE BEEN NEEDING A CATALYST FOR THE BOND YIELD CALL TO START WORKING, “NOT WISHING TO TEMPT FATE” IT MAY COME FROM STOCKS!

STOCKS : I HAVE BEEN NEEDING A CATALYST FOR THE BOND YIELD CALL TO START WORKING, “NOT WISHING TO TEMPT FATE” IT MAY COME FROM STOCKS!

THE MOVE LOWER IN BOND YIELDS IS PREDICTED TO BE VERY SIZEABLE SO THIS WOULD IMPLY THE SAME FOR THE STOCK SELL-OFF.

THE RUSSELL WEEKLY CHART HAS A VERY DISLOACTED RSI SIMILAR TO EARLY 2020.

“THE MOST WIDELY HELD STOCKS AT MUTUAL AND HEDGE FUNDS IN 4Q 2020 WAS MICROSOFT, AMAZON AND FACEBOOK”. ALL OBVIOUSLY VERY OVER EXTENDED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

US BREAKEVENS : THIS COULD BE A VERY IMPORTANT SET OF CLOSES GIVEN WE MAYBE “FINALLY” BE FORMING THAT LONGTERM TOP!

US BREAKEVENS : THIS COULD BE A VERY IMPORTANT SET OF CLOSES GIVEN WE MAYBE “FINALLY” BE FORMING THAT LONGTERM TOP!

IF WE DO SEE A TOP THIS MAY ALSO ASSIST THE CALL FOR LOWER BOND YIELDS.

DEFINITELY WORTH NOTING THE CLOSES THIS MONTH.

KEY CONFIRMATION IS LIKELY TO BE THE 30YR BREAKEVEN BREACHING ITS 50 DAY MOVING AVERAGE 2.0741.

**ALL 3 DURATIONS OF CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BOND UPDATE : THE YEILD FALL HAS TO HAPPEN TODAY, THE RECENT “YIELD RISE” HAS CONFOUNDED ALL TECHNICALS!

BOND UPDATE : THE YEILD FALL HAS TO HAPPEN TODAY, THE RECENT “YIELD RISE” HAS CONFOUNDED ALL TECHNICALS! IT DOES LOOK LIKE OPEN INTEREST IS REPRESENTING A REDUCTION OF BOND SHORTS. THIS SHOULD EASE TENSIONS IN THE ROLLS.

US BOND AND SWAP CURVES CONTINUE TO “SCREAM” FOR A MAJOR FLATTENING GIVEN THE HISTORICAL RSI DISLOCATION. THE OTHER POINTER IS THE 102030 SWAP CURVES CONTINUES TO INDICATE THE 20YR IS “OUT OF LINE” WITH THE WINGS!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris