Trades & Fades - James Rice & Will Scott at Astor Ridge week 22nd Feb

Some thoughts on European RV for the forthcoming week

UK – supply and contracts

Belgium – credit fly

Netherlands – green Bond

Spain/Italy - 30y20y

– something for everyone here

UK

Supply

23rd Feb – 30y tap

2nd Mar – New 5y (Oct 26 end date)

2nd Mar – 40y tap

4th Mar – 10y tap

9th Mar – 20y tap

Contract Corner – are contracts cheap? CTD is UKT 4.75% 2030

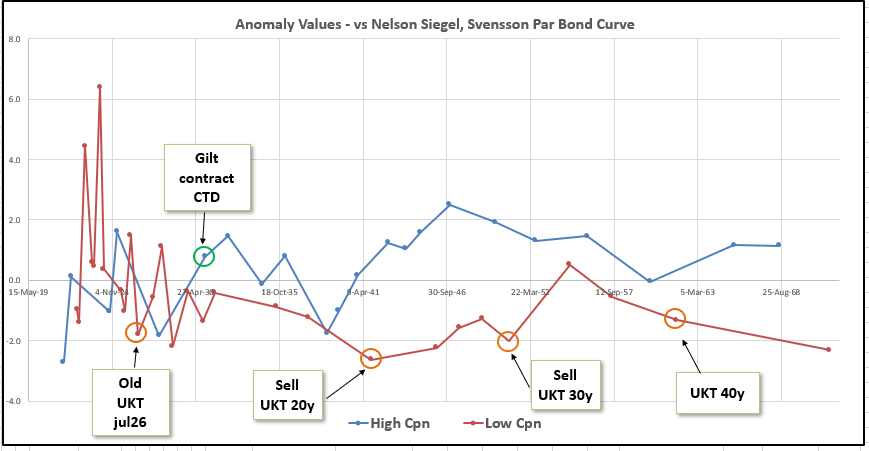

Recent big movers in RV Value 2036s and 2057s – both historically cheap

Analysis

· Fit a Nelson Siegel, Svensson curve to par Rates

· Calculate the PV of cashflows of every bond

· Compute Rich/Cheap based on Cash-Flow Value

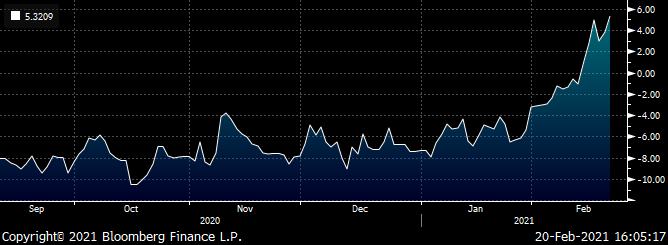

- Sell 30y & 40y vs Buying UKT Oct54

Weighting: 0.67 / 1 / 0.33 (twice as much front wing as back to match the maturity and curve dynamic – all times by 2 to compare vs other flys)

200 * (YIELD[UKT 1.625 10/22/54 Corp] - 0.67 * YIELD[UKT 0.625 10/22/50 Corp] - 0.33 * YIELD[UKT 0.5 10/22/61 Corp])

On swap spread to show a little bit of edge vs swap curve too…

2 * (SP210[UKT 1.625 10/22/54 Corp] - 0.67 * SP210[UKT 0.625 10/22/50 Corp] - 0.33 * SP210[UKT 0.5 10/22/61 Corp])

Level: Like some @ +1.75bp

Strong Add : > +2bp

Target : + 0.5bp

Fair Value: -0.25bp

We respect that this fly implies the 54s has always traded a bit cheap but has intrinsic value down below flat

With supply in both wings this one has a good probability of < +0.5bp and beyond

Graph

Anomalies (fully cash-flow discounted to fitted par curve – NSS model)

Trade #2 – 20y starting to look rich on cash-flow valuation – supply trade

· Sell Ukt 20y

· Buy Ukt HC 36 and Ukt HC 46

· Level: +15bp

holding out for +15bp (pay the spread)

Nice pick up in carry where the surrounding high coupons have ‘hidden’ value (C&R on request) - essentially these shorter, lower modified duration bonds should have performed even better in the steepening curve

200 * (YIELD[UKT 1.25 10/22/41 Corp] - 0.5 * YIELD[UKT 4.25 03/07/36 Corp] - 0.5 * YIELD[UKT 4.25 12/07/46 Corp])

And vs Swaps…

2 * (SP210[UKT 1.25 10/22/41 Corp] - 0.2 * SP210[UKT 4.25 03/07/36 Corp] - 0.8 * SP210[UKT 4.25 12/07/46 Corp])

Tells us we can wait for our level as this one has been super stable – 0.5 bp on the middle is 1bp on the fly – so makes sense to hold out for +15bp on the yield structure

Trade #3 – Gilt contracts finally cheap

· Buy Gilt contracts (CTD – 4.75% 2030)

· Sell Ukt 1.5% 2026 – expensive bond and lovely prep for new 5y

· Sell UKT 2035 – on the run 15y tapped in mid-March – optically on yield valuations, Nelson Siegel, Svensson says ‘not so much’ !

you could supplant 2035 with HC 2034, as optically they are rich and gives some balance to keep it relatively high coupon like the Gilt CTD

Gilt contracts have been slammed in the reversal of the market – and at the lows in yield we were talking ourselves into the multi contract deliverable explanation of their richness – now it’s about finding a boundary condition for their cheapness

Looking at the anomaly graph, then plus or minus more than 2bp of anomaly vs the stripped value of cashflows and the forwards look out of whack for this issuer

I like being short the jul26 – they’re almost as rich as the 1.625% of 28 and we have a proximate new oct2026 coming soon – Gilts are finally cheap and on the long leg? – well you pays your money and you takes your choice.

Optically the 2035 looks cheap and I wouldn’t say it was rich but it gives curve balance, but if want to stay high coupon then you gotta be selling the 2034s which should suffer as the HC 2036 seem very offered

200 * (yield[UKT 4.75 12/07/30 Govt]-0.5*yield[UKT 1.5 07/22/26 Govt]-0.5*yield[UKT 0.625 07/31/35 Govt])

Do we have edge here? Vs swaps…

Seems so

2 * (SP210[UKT 4.75 12/07/30 Corp] - 0.5 * SP210[UKT 1.5 07/22/26 Corp] - 0.5 * SP210[UKT 0.625 07/31/35 Corp])

Level: +5bp (all-in)

Var is obvs higher now so scale accordingly

Fly vulnerable to vicious sell-off so check forwards with us make sure we give nothing away

Supply

Monday 22nd Feb

Bgb 0.8% 2025

Bgb 0.8% 2028

Bgb 1.25% 2033

Belgium as a Credit Trades close to France – Generally it’s a worse rated issuer but benefits from higher capital key buying

My Fade is to try and buy it vs large issuers

The whole semi-core segment has underperformed a blend of Germany and Italy – so I would try to…

Buy Belgium

Sell Germany and Italy

Here’s how that looks in 9yrs (close to the contracts, RX & IK)

100*(yield[BGB 0.1 06/22/30 Govt]-0.8*yield[DBR 0 02/15/30 Govt]-0.2*yield[BTPS 3.5 03/01/30 Govt])

The two spreads;

Regressing changes in the component spreads for that trade to see how well they hedge each other over 120 trading days

Belgium/Germany vs Italy/Germany…

Slope: 18%

R2: 0.747

We see the recent under-performance of semi-core as indigestion in the face of supply and additionally long Spain has impacted all the credits rated between Italy and Germany.

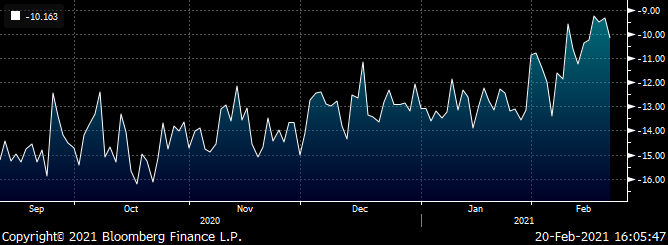

Looking at the Belgian curve on its own, the bonds of real Note in terms of value are

20y Belgium 0.4% 2040 – rich

Old High coupon Belgium 4.25% 2041 – cheap

Of the supply bonds, the BGB 33’s are rich but are a green bond and we see their 2bp premium as in line with other green issues

Trade#4 – LC 20y rich / HC 20y Cheap it’s just gonna keep going?....

Sell Belgium 40s to buy Belgium 41s

(YIELD[BGB 4.25 03/28/41 Corp] - YIELD[BGB 0.4 06/22/40 Corp])

Level: +1bp

Add +2bp

Again the carry is positive here still +0.2bp /3mo after 10bp repo spread

And the cash flow value of the 40s is truly revealed when we discount all cash-flows using a fitted Belgian curve – we’ve steepened a lot recently and the move from +2 to +1 doesn’t fully compensate for the additional value of the high coupons in a steep curve

definitely add @ +2bp and there’s always a chance the lower coupon bond is tapped

Target: -1bp

As a credit, I like the following trade

Trade#5

Buy cheap Belgium HC 4.25% 41

Sell Germany HC 3.25% 42

Sell Italian HC 5% 39

I’ve tried to pack every bit of value into this one – and the weightings are

-0.7 / +1 / -0.3 (all times by 2 to normalise it vs other flys)

100 * (YIELD[BGB 4.25 03/28/41 Corp] - 0.7 * YIELD[DBR 3.25 07/04/42 Corp] - 0.3 * YIELD[BTPS 5 08/01/39 Corp])

Decent var so scale accordingly. The 42s in Germany are a touch rich and the Aug39 in Italy I see as fair and a nice high coupon short if ever Italy gets a wobble

Back to pre-Covid levels here which is a surprise

Tuesday, Netherlands to Sell up to €2,5Bln 0.5% 2040 green Bond

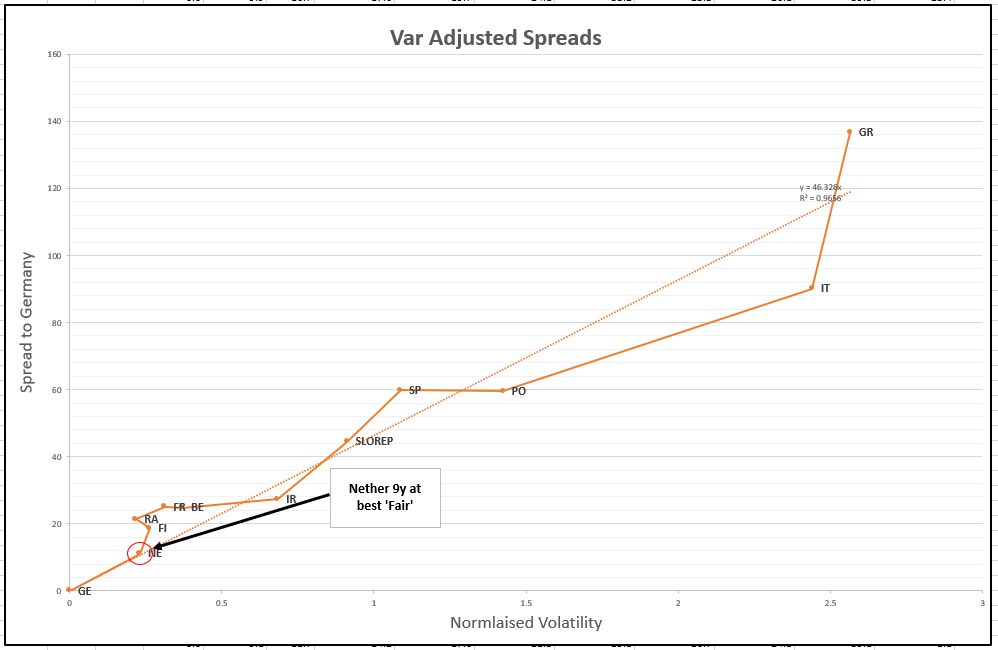

AS a credit Netherlands has cheapened as it digested the new 10yr July 2031, but if I ‘var adjust’ the spreads of European issuers vs Germany I still don’t see Nether as cheap…

Var Adjusted Spreads to Germany – 9yr Maturity, 120 days trading history

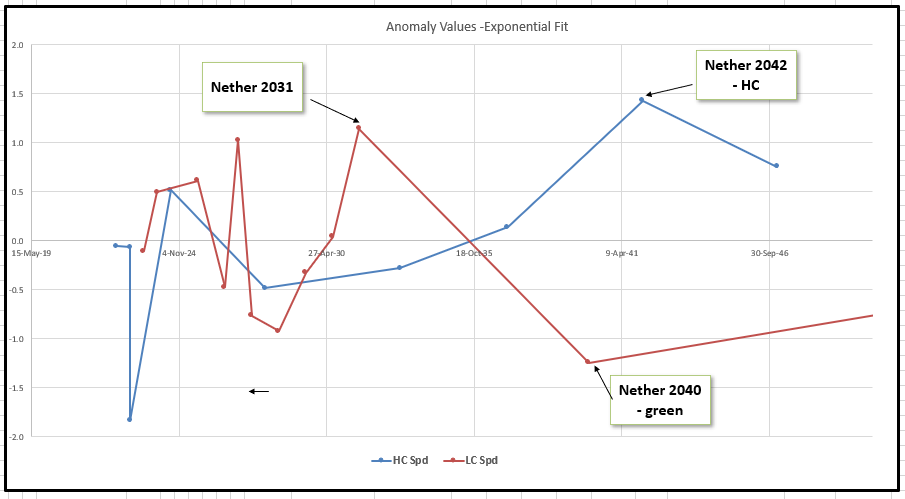

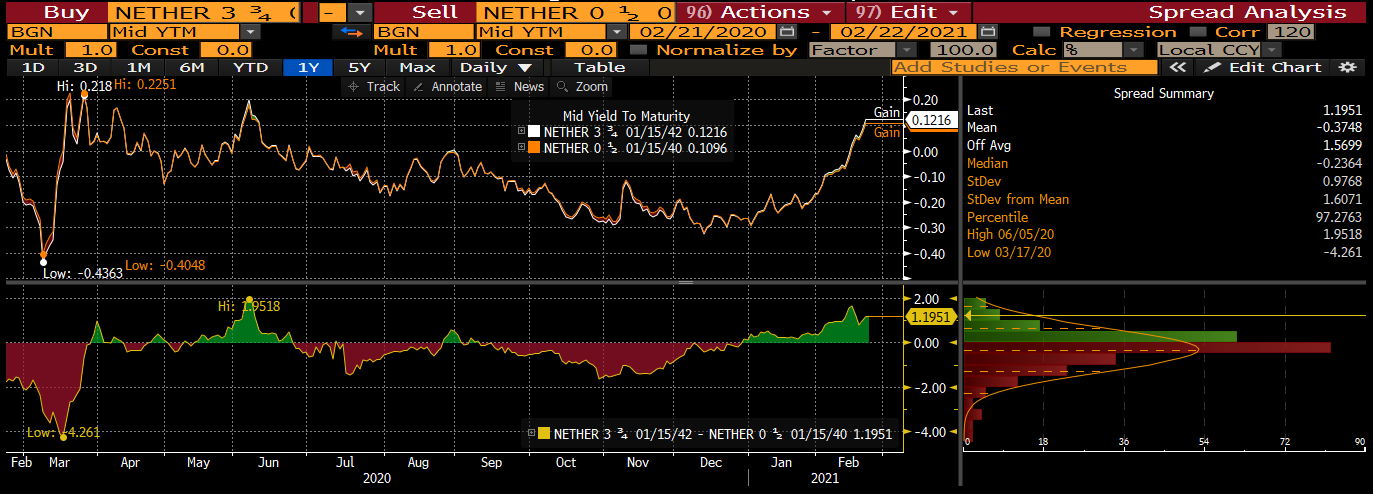

Now we know that the green nature of the current 2040s will give it a little premium but to me it’s too excessive when we compare it again the cheaper higher coupon 2042s

Here we have discounted all cashflows to a double exponential curve to compute the anomaly values…

I like the straight switch out of 2040s into 2042s – with an absence of value in Holland as an issuer, and a bountiful supply of cheap 10yrs then I think the market will have ‘make room’ for this issue and we will see a compression of the 2042s over the 2040s

Trade #6 – Green Bond supply and the cheaper HC

Sell Nether 40

Buy Nether 42

Level: +1.2bp

Target: Flat

Italy

On Monday night they announce the M+L supply for Thursday - Typically we expect 5y & 10y

And on Tuesday we get the las tap of a Ctz (ticker: ICTZ) zero coupon sep22 as they change their issuance structure to a more regular 2y Btps style bond

Italian forwards are generally smooth …

So not a lot to say here

But I do like the fly -10y +20y -30y

Supply in the new low coupon 10y means the old low coupon Aug30s lose their lustre

The old 20y Mar40 have decent carry and are no longer the tap bond

And the on the run Sep51 30y is only 10 Bln in size whereas the prior Sep50 got to 16Bln

Level: +36.6bp

Enter: +36.5bp (25% risk)

Add: +39bp (75% risk)

Target: +33bp (I have fair at +30bp, based on forwards so this had intrinsic value beyond history – always important)

2 * (YIELD[BTPS 3.1 03/01/40 Corp] - 0.5 * YIELD[BTPS 0. Corp] - 0.5 * YIELD[BTPS 1.7 09/01/51 Corp]) * 10095 08/01/30

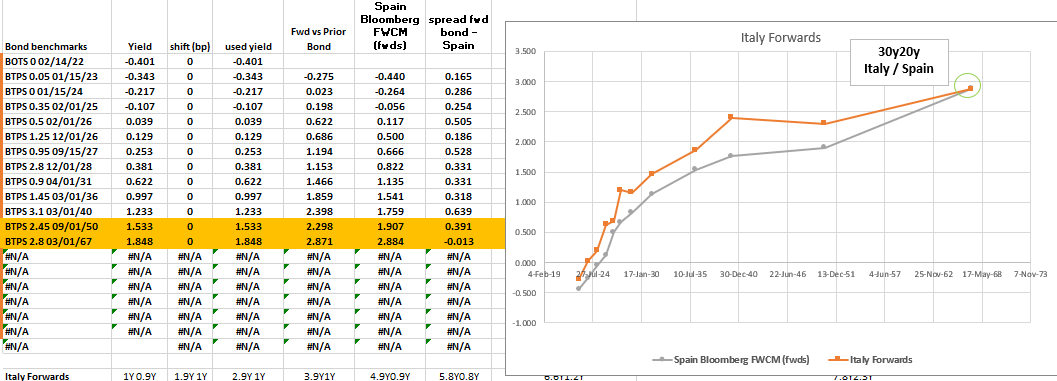

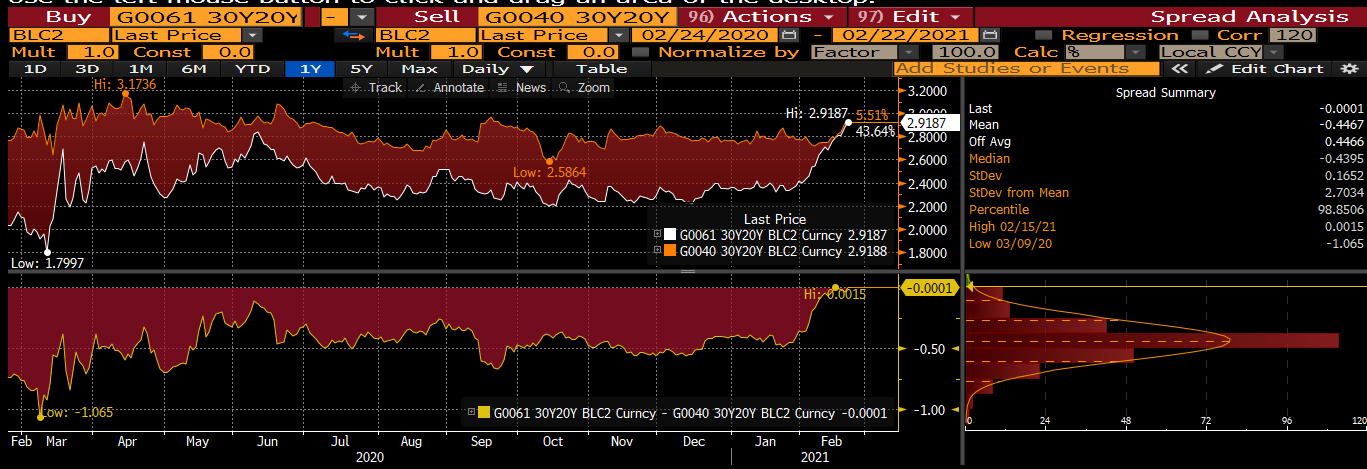

Trade #7 – Long Spain 30y20y vs Italy

Looking at Italian forwards vs Spain we can see that the unloved 50y Spain has not been absorbed and 30y20y Spain looks flat to Italy..

We can simulate the spread of two forwards by mis-weighting two yield spreads but then keeping the whole structure Duration Matched…

For history we use the old 50y bonds vs old 30ys

Changes in Spain 30y20y is approximated by:

(YIELD[SPGB 3.45 07/30/66 Corp] - 0.75 * YIELD[SPGB 1 10/31/50 Corp]) * 100

Changes in Italy 30y20y is approximated by:

(YIELD[BTPS 2.8 03/01/67 Corp] - 0.75 * YIELD[BTPS 2.45 09/01/50 Corp]) * 100

If we then subtract Italy 30y20y from Spain 30y20y we can see how this nett index has moved…

And here’s the History of the CMB points on Bloomberg for confirmation of the absolute value level

-Spain 30y20y vs +Italy 30y20y @0bp!!!!

- Spain is fundamentally a better credit rating - S&P A, Moody’s Baa1

Italy is BBB, Baa3

- I like this one – and I prefer the forward rate expression – var weighting suggests Italy as a credit gone too far and Spain has just about absorbed the 50y throughout its tenor structure

- There’s always a chance Italy comes with a new 50y and there’s a decent 50bp in the forward to be made here if we’re patient. Again this has entered a new era of volatility and scale accordingly – give us a call to check you weightings on this one

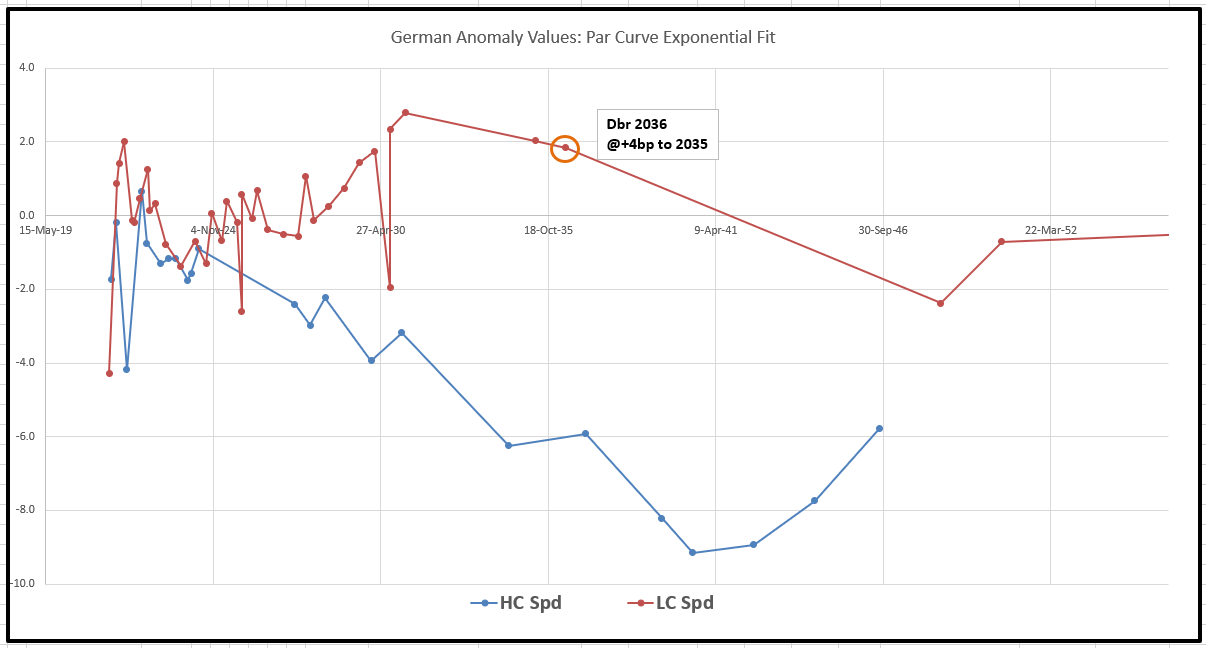

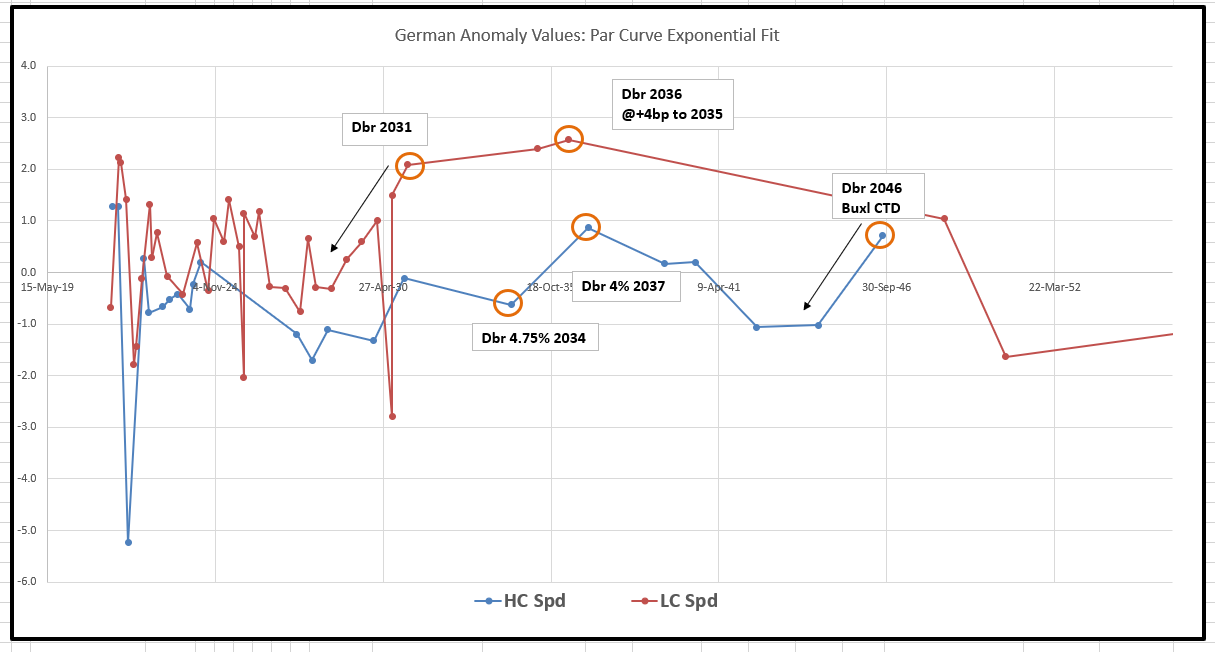

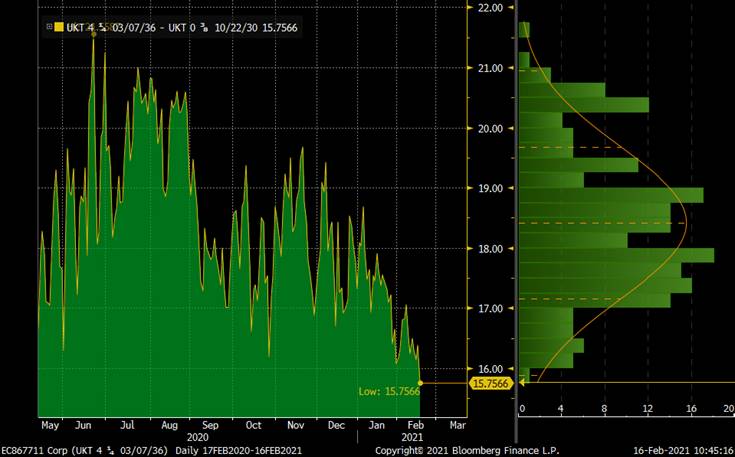

Germany

German Supply – new 20y 2036 on Wednesday March 3rd

The prior 15y May35 was initiated with 7,5Bln syndication and traded poorly, only richening into the curve towards fair value as it came to the end of its tap cycle – this was new issuance tenor for the Germany

So although ‘fair’ seems to be about +4bp over the outgoing 2035s it may be a little cheaper

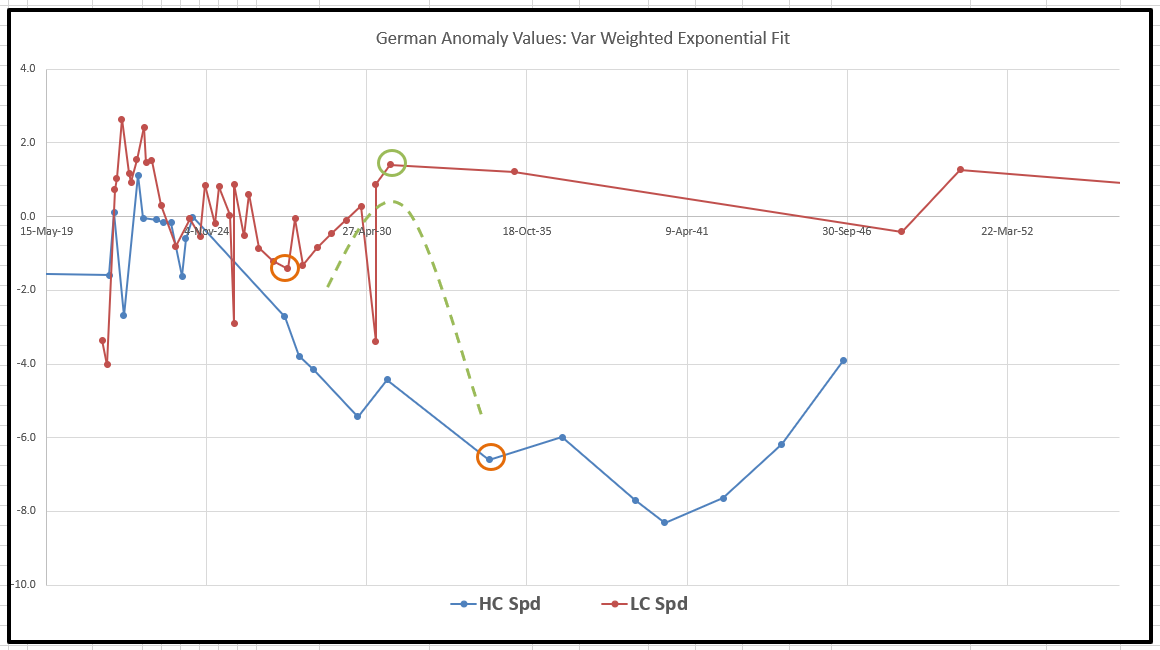

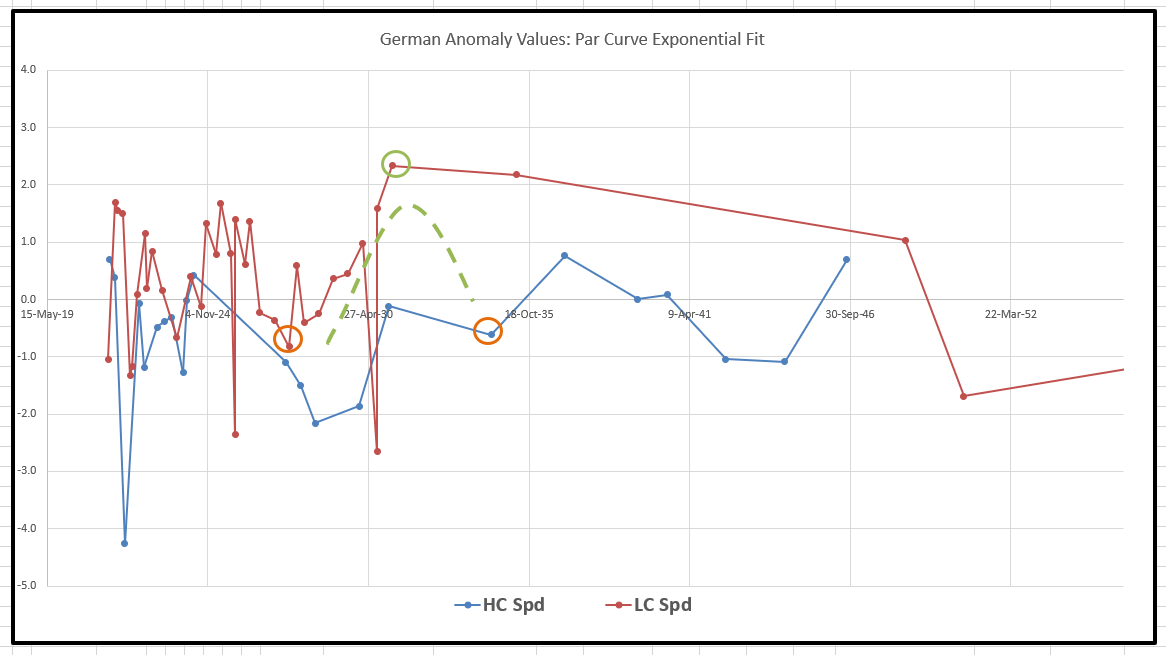

Consider the following two graphs when grappling with the German curve...

1. German Bond Anomalies (bp) - Yield minus Fitted Curve

2. German Bond Cash-Flows PV’s vs fitted par Curve valuation (bp)

Observations

- Yes the old 15y 2035 is cheap but for roll? the on the run (feb31) 10y beats it hands down!

- The old High coupon Bonds that appear ‘optically’ rich under simple yield analysis are actually pretty fair in reality. If we want to trade this sector we need to properly discount the cashflows using a German Zero Curve to analyse rich/cheap

- In fact the 2037s have already cheapened a little in anticipation of the 2036

- It’s the high coupon 4.75% 2034 that have the farthest to cheapen

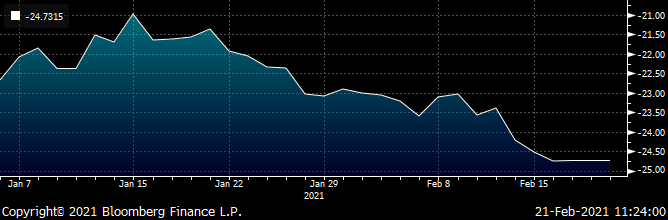

Trade #8 – Long German 10y and Buxl contract vs short Dbr Jul34

200 * (YIELD[DBR 4.75 07/04/34 Corp] - 0.5 * YIELD[DBR 0 02/15/31 Corp] - 0.5 * YIELD[DBR 2.5 08/15/46 Corp])

Level: -24.75 bp

Add: -26.25 bp

Target: -21.5 bp

As always – have fab week and speak soon

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FX UPDATE : THE USD LOOKS LIKE ITS FALL FROM GRACE IS TO TAKE A PAUSE, NOT 100% CONFIRMED YET BUT LOOKING MORE LIKELY.

FX UPDATE : THE USD LOOKS LIKE ITS FALL FROM GRACE IS TO TAKE A PAUSE, NOT 100% CONFIRMED YET BUT LOOKING MORE LIKELY. IF SO THEN GIVEN RECENT HISTORY BONDS SHOULD BOUNCE!

TOO MANY GOOD LEVELS ARE HOLDING.

ALL CROSSES HAVE FALLEN SHY OF THE MAJOR "FREE AIR" LEVELS, KEY LEVELS HAVE HELD.

IF THE USD HOLDS THEN BOND YIELDS SHOULD STALL.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

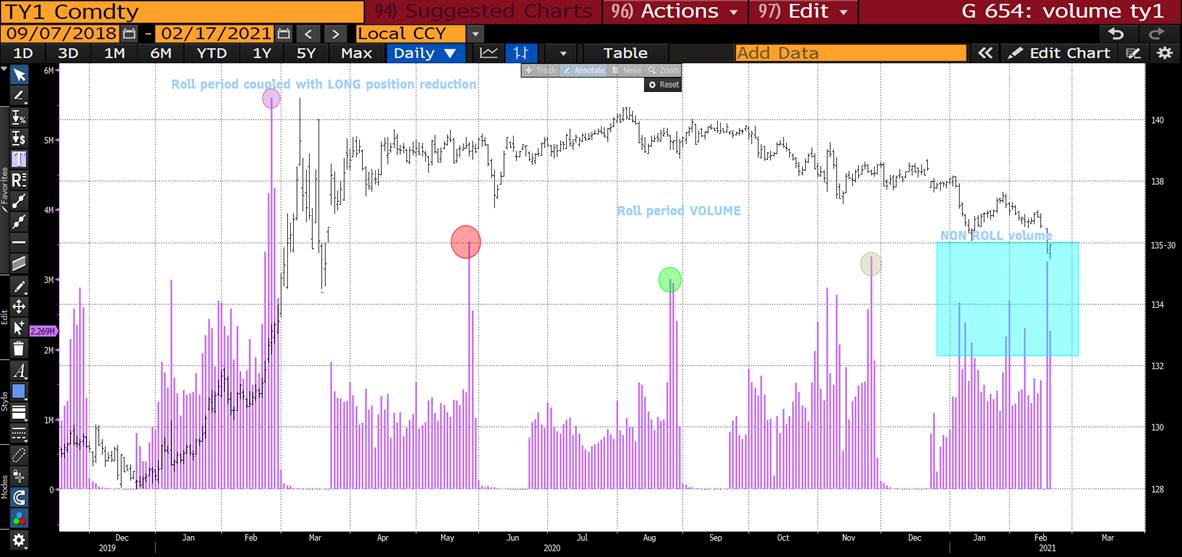

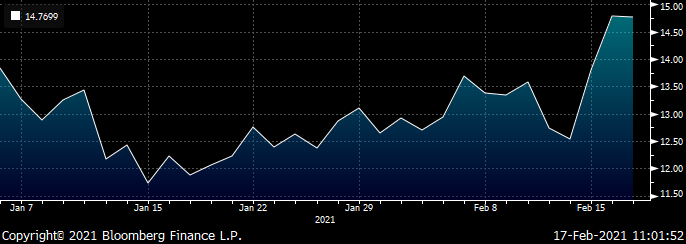

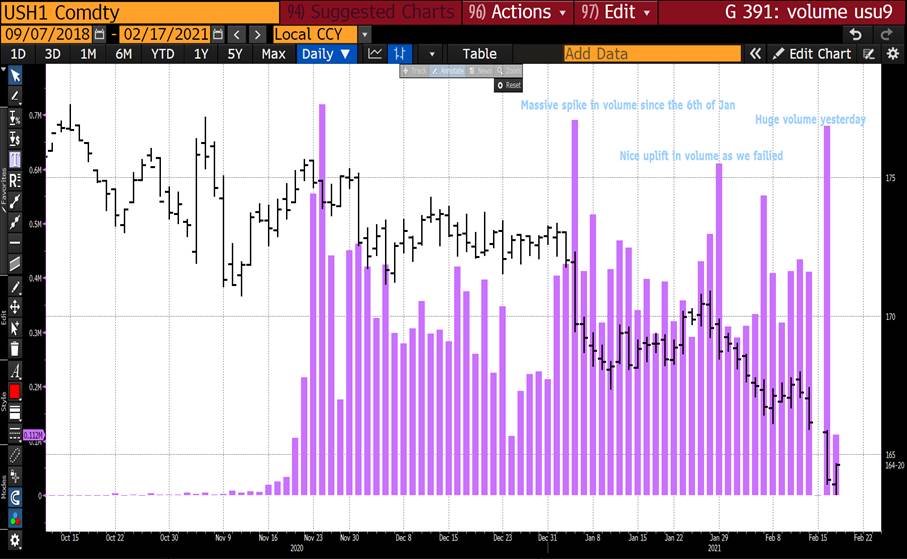

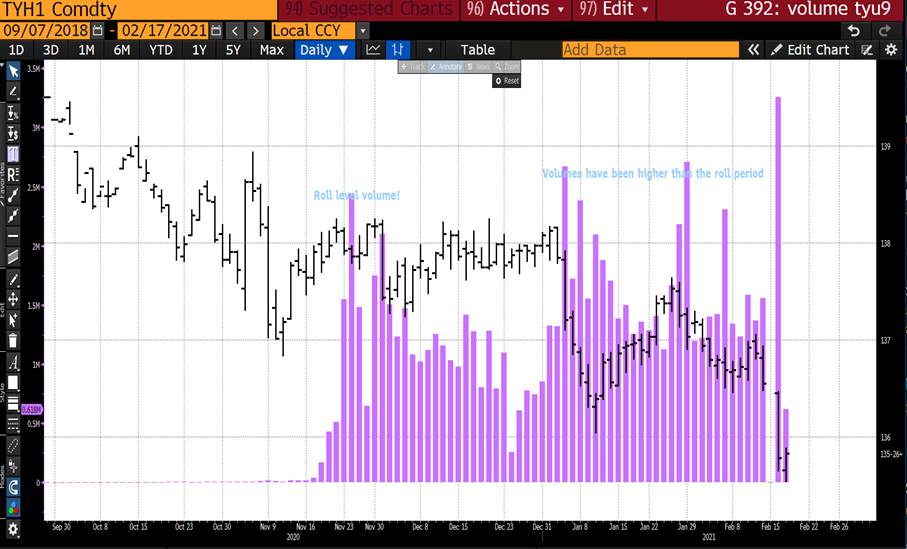

SPECIAL PIECE CALENDAR ROLL VOLUME VERSES THIS QUARTER : THE LATEST VOLUMES COMPARED OVER A YEAR.

SPECIAL PIECE CALENDAR ROLL VOLUME VERSES THIS QUARTER : THE LATEST VOLUMES COMPARED OVER A YEAR.

10YR VOLUME STANDS OUT LIKE A SORE THUMB HISTORICALLY ALREADY MATCHING THAT OF A ROLL PERIOD!

GIVEN THE VOLUMES OF LATE IT IS WORTH HIGHLIGHTING HOW IT LOOKS COMPARED TO PREVIOUS ROLL PERIODS, IT DEMONSTRATES THESE LATEST NUMBERS ARE HUGE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades & Fades - Will & James

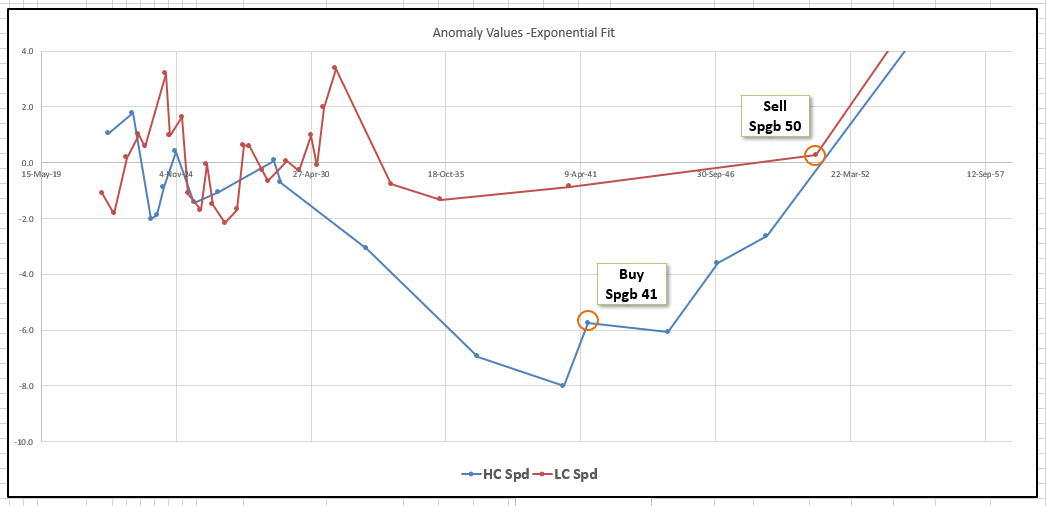

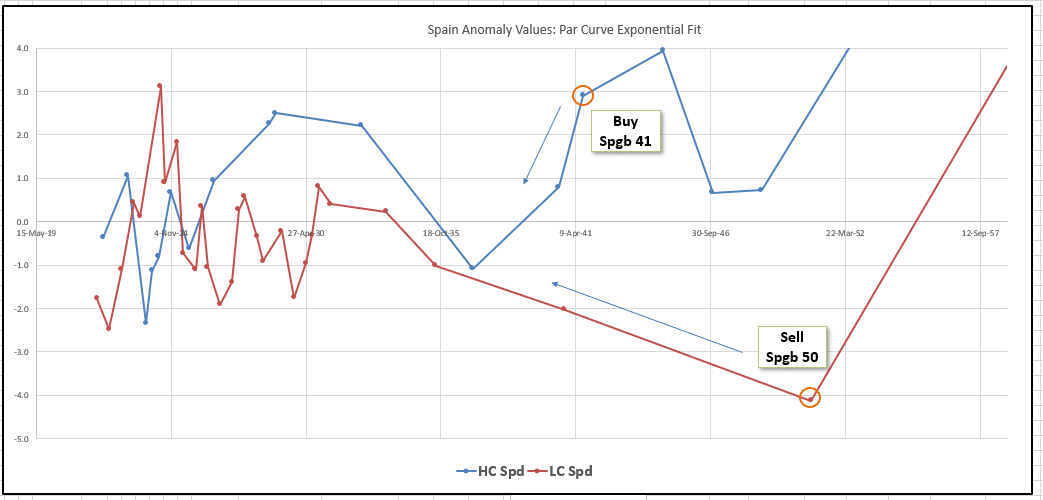

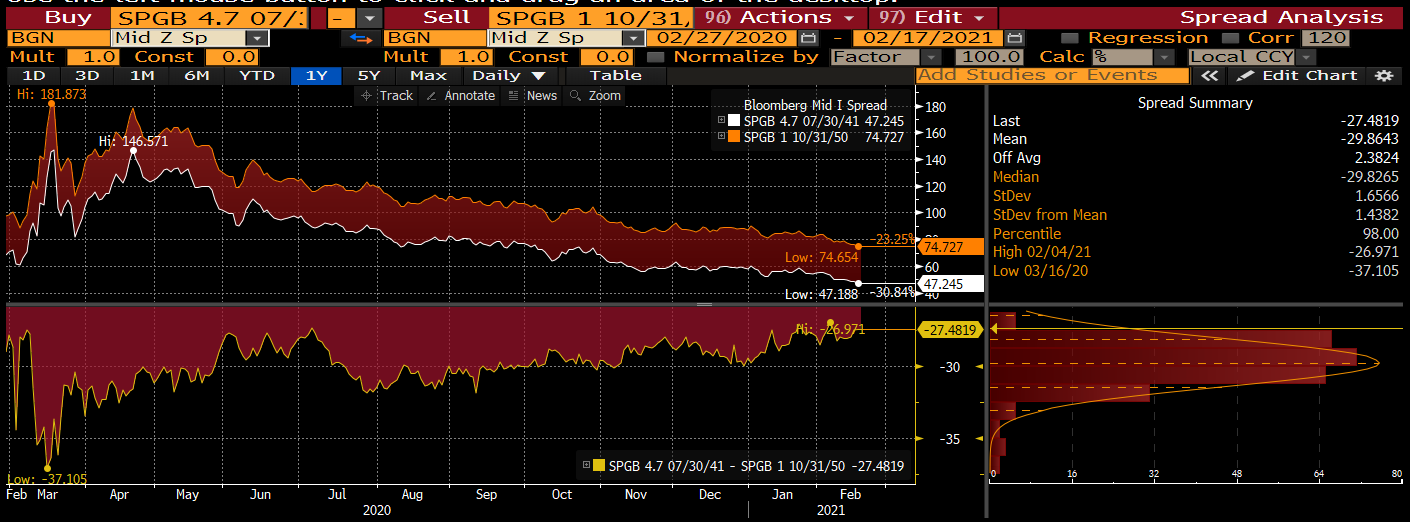

Spain – 20s30s steepener vs Swaps

Tap of high Coupon Spgb Jul40…

leaves high coupon 4.7% 41s looking cheap vs Low Coupon Spgb 1% 2050

On the run 30y Spain is rich with poor carry characteristics

Trade:

Sell Spgb 50 to buy Spgb 41

On the face of it, why would you do this trade? - to the fitted curve the 30y looks fair and the High coupons appear rich…

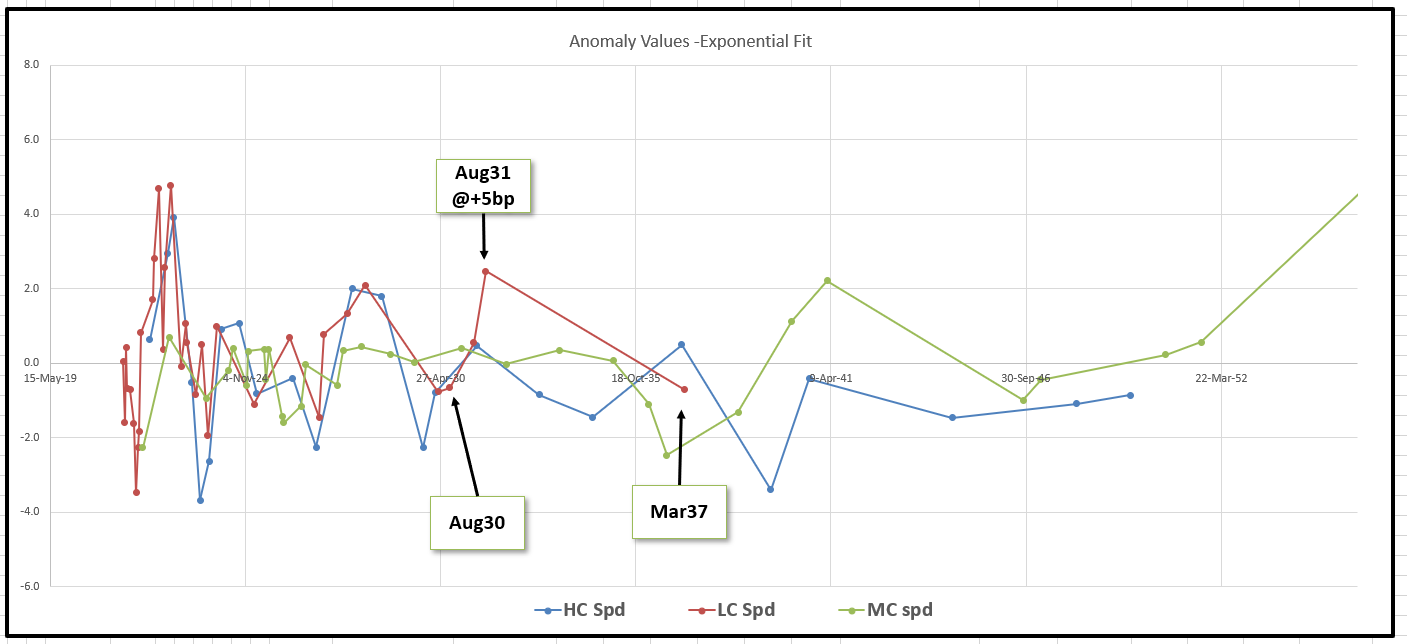

Basic Anomalies vs fitted curve… yield – minus fitted curve

However, if we discount the cashflows in the Spanish curve we have the lens with which the market sees value…

The High coupons in the 41s are revealed as shorter in modified duration terms. Or put another way – the early cashflows of the High coupon bond present much more value than the low coupon for the run 30y

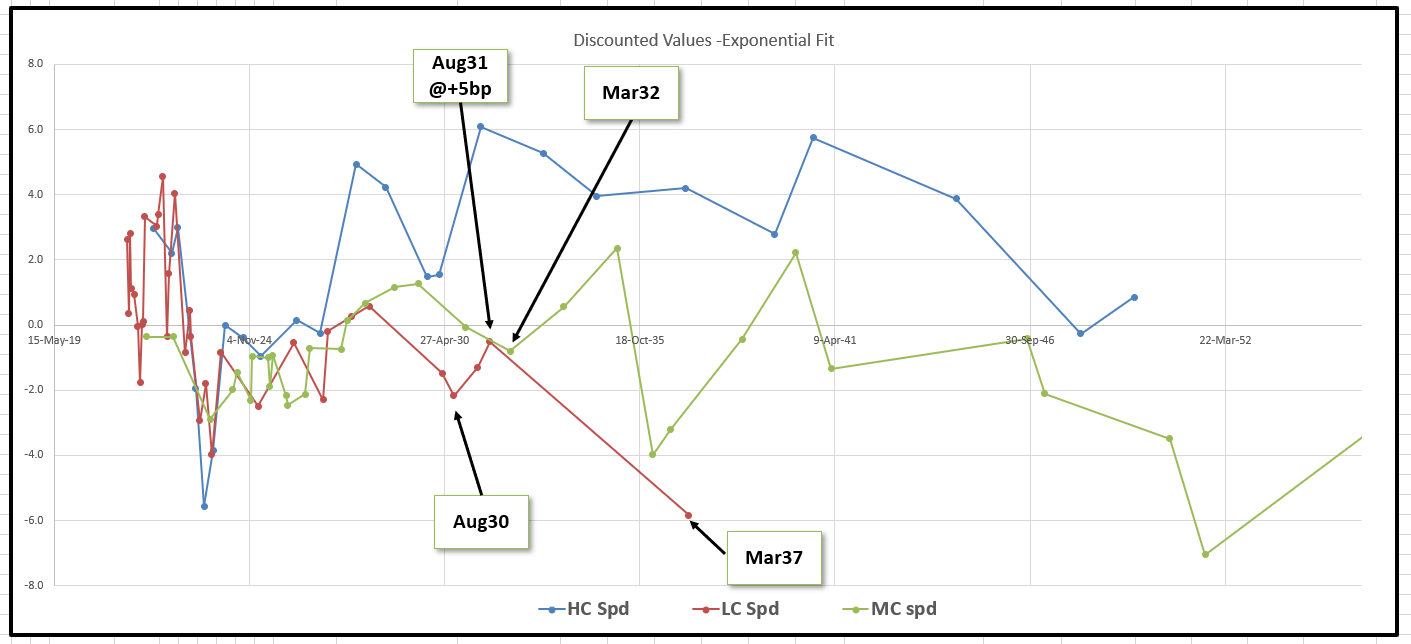

Full Valuation method - Anomalies after Stripping the Cash-Flows vs Par Bond Curve – discounted PV minus market dirty price

We use Swaps to control the curve risk

+20y (HIGH Coupon) / -30y steepener vs MMS

@ -27.5bp

Curr: -27.5bp

Target: -30bp

Carry & Roll ( /3mo)

Bonds: Carry +0.5bp, Roll +0.5bp (-0.1bp spread)

Swaps: Roll -0.45bp

Graph…

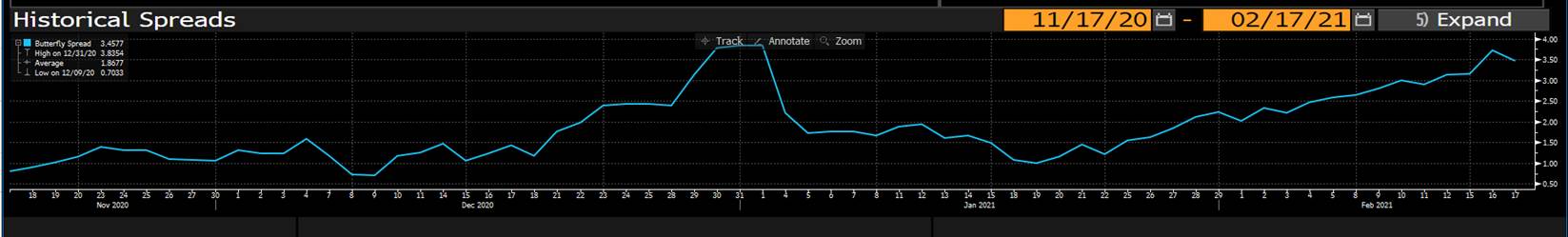

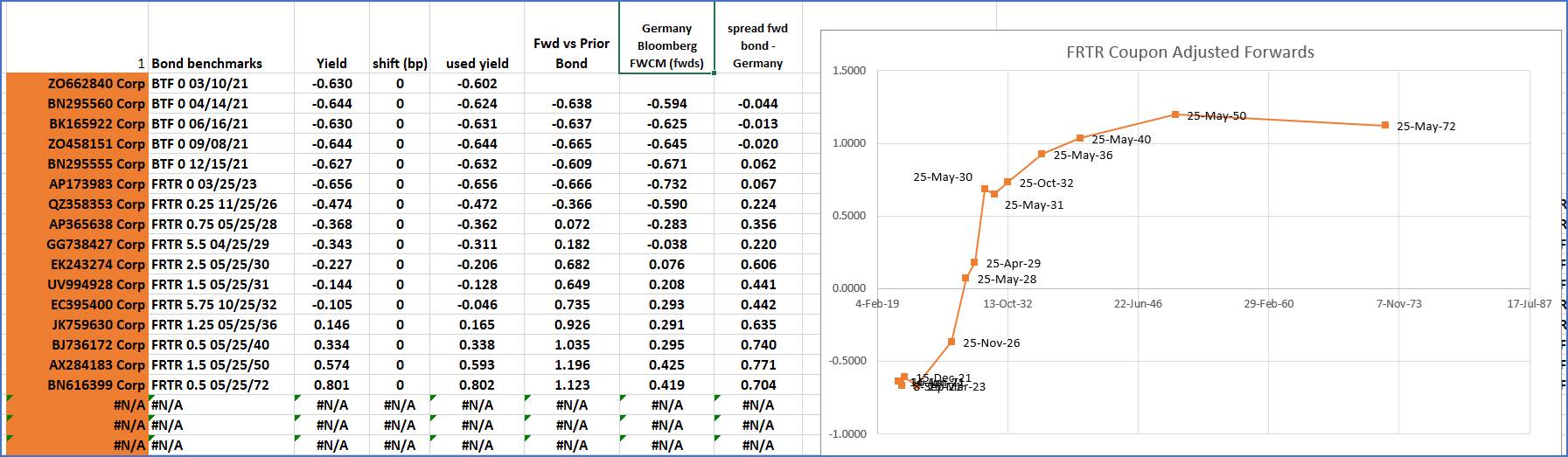

Buy FRTR 5/30 (CTD to OATH1) vs FRTR 4/29 & FRTR 5/31

Enter: 3.5bp

Add: 4.0bp

Profit target: 1.5bp

Long FRTR 5/30 vs 4/29 & 5/31 on 1:2:1 fly

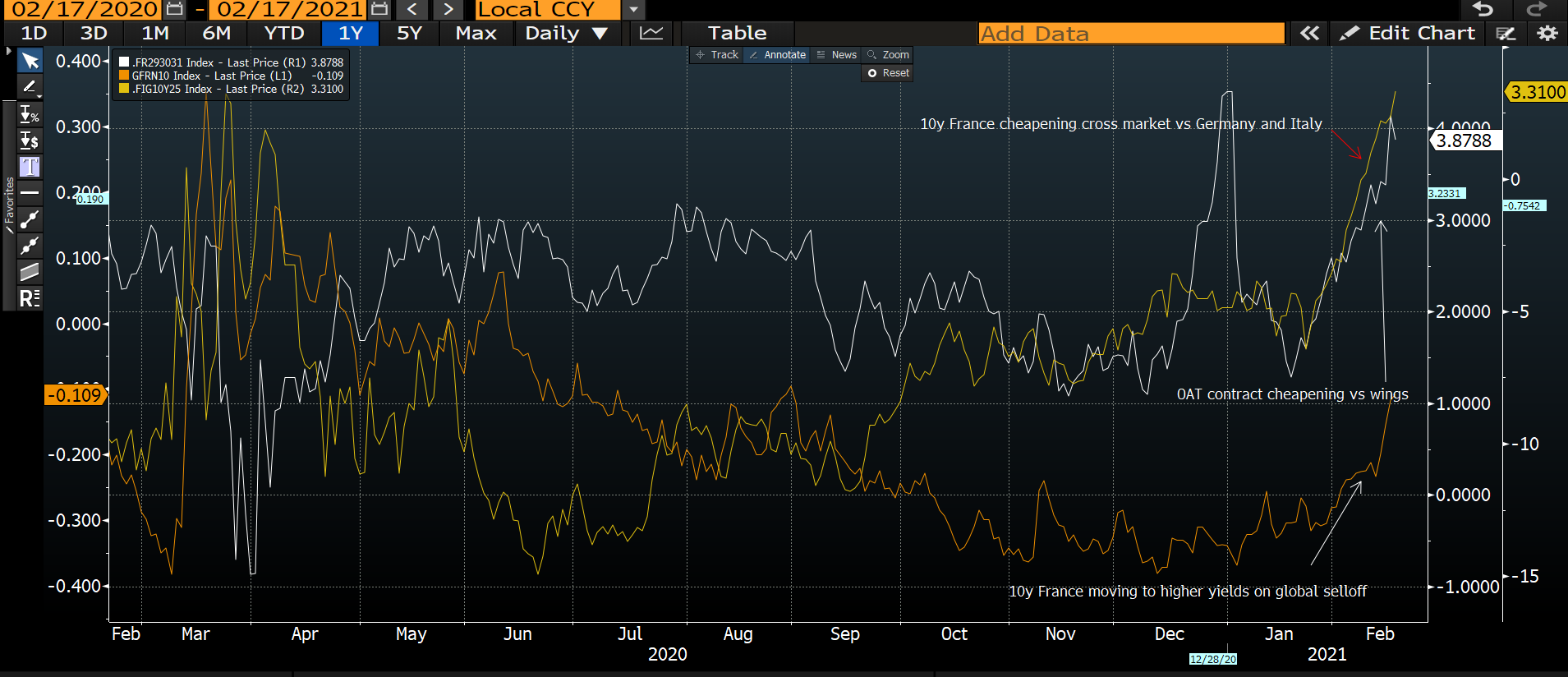

· OAT contracts have taken the brunt not only of hedging flows for new issuance this year, but also as the liquid point on the French curve on the selloff in rates

· As a result the FRTR 5/30, which is CTD to the OAT future, has cheapened too much vs wings

· As can be seen from the below forwards:

o FRTR 4/29 vs 5/30 is the steepest part of the OAT curve

o FRTR 5/30 vs 5/31 is too flat

· On top of this we will get a new 10y (likely 11/31) in the new few months, which should weigh on the 5/31

· Also towards the end of this month we have coupons and redemptions in France totalling EUR 24.7bn, which should be supportive of the issuer

· In addition, syndicated supply should slow down, easing the pressure on the OAT contract as a semi-core hedge

· OAT rolls could also be supportive of this trade as speculative shorts in semi-core may choose to close positions into the roll given the performance of Italy

German on the run Feb31 10y still cheap – moving the value wings to narrower dates

Trade:

Buy Dbr Feb31

Sell Dbr Aug27 and Dbr Jul34

Curr: +14.75 bp

Target: +12.5 bp

Weighted Roll and Carry: -0.1bp / 3mo (-10bp repo spread)

BBG Graph

On regular analysis this we can see the on the run 10y is offering itself as cheap to be absorbed…

Basic Anomalies vs fitted curve… yield – minus fitted curve

But we need to understand the Longer High Coupons and value them after adjusting for their coupons…

Full Valuation method - Anomalies after Stripping the Cash-Flows vs Par Bond Curve – discounted PV minus market dirty price

So interestingly – the High coupon Bonds in 12y to 25y Germany make much more 'sense' when we correctly discount all their cash-flows

– even after doing so the Jul34s are still rich

We'll call, these look like opportunities

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

**PLEASE READ ** BOND UPDATE : THERE IS A NEAR “PERFECT STORM” BREWING TECNICALLY!

BOND UPDATE : THERE IS A NEAR “PERFECT STORM” BREWING TECNICALLY!

FIRST MAJOR POINT IS THAT THE TRADING VOLUMES OF THIS MONTH, THEY OUTSTRIP THAT OF THE STANDARD ROLL PERIOD WHICH I CANNOT SAY I HAVE SEEN BEFORE.

SECOND POINT IS THAT BOND YIELDS LOOK LIKELY TO STALL GIVEN WE HAVE HIT MANY KEY LEVELS AND SEEN “FURTHER” RSI EXTENSIONS.

WE HAVE “HUGE” TRADING VOLUMES AND THE ROLL PERIOD WILL BE AN ACCELERANT FOR AN EXPLOSIVE TIME! WE COULD BE IN FOR A DIFFICULT ROLL PERIOD GIVEN THE MAGNITUDE OF SHORTS AND A MARKET POISED FOR BOND YIELDS TO “FALL”!

IT “FINALLY” LOOKS LIKE BONDS ARE TO BASE WITH THE ADDED BONUS OF MAJOR RSI DISLOCATIONS AND YET MORE VOLUME!

LOOKING AT VOLUME, OPEN INTEREST AND LAST WEEKS SWAP CHARTS WE ARE COILING FOR A VERY “VOLATILE” END TO THIS MONTH.

THE OPEN INTEREST HAS STALLED THUS SOME SHORTS MAY OF COVERED BUT THE REMAINDER HAVE SIGNIFICANT SHORT POSITIONS.

THIS COULD GET “EXTREMLY MESSY” AND WONT BE EASY FOR REAL MONEY!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

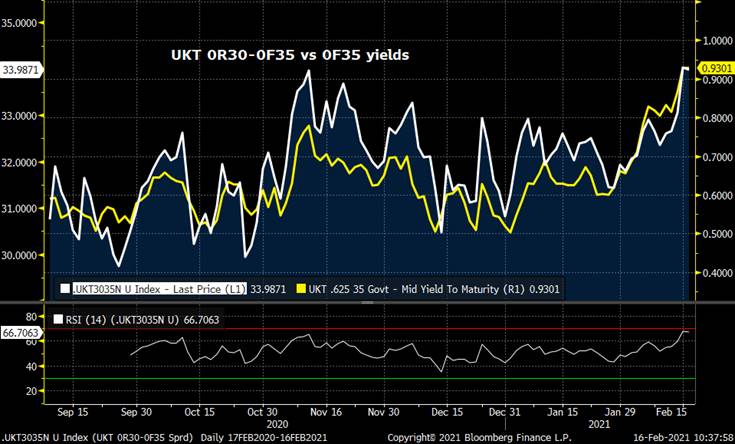

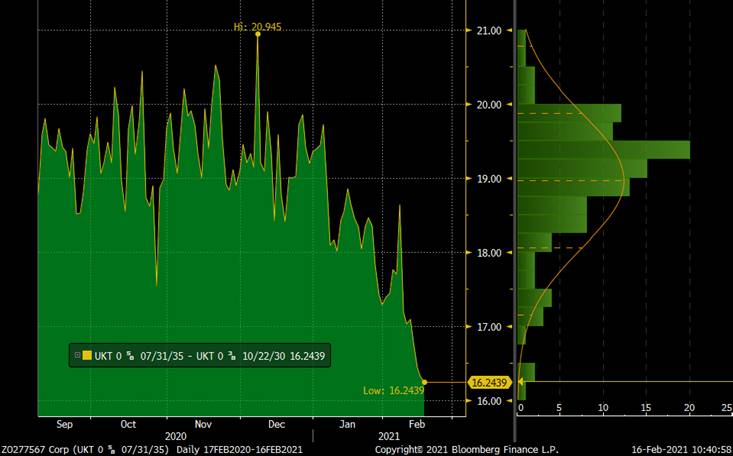

MICROCOSM: GILTS > Caution Into UKT 0F35s Tap Tomorrow

This is a follow-up to yesterday's Gilts note where we highlighted the 0R30-0F35-0F50 fly dynamics into tomorrow's tap. Upon closer inspection, we think a bit of caution could be warranted into this one…

GILTS... 0F35s Tomorrow AM

- We get a £2.5bn tap of the 0F35s tomorrow which will take them to ~£21.5bn. Tomorrow's tap will be followed by another on Mar 17th.

- This is a tale of two charts, yields and Z-spreads.

- The 0R30-0F35-0F50 yield fly (first chart) shows the fly cheapening back up towards the +10bps level (9.8bp mid now), cheapest since mid-Dec. The chart shows, however, the complete disengagement of the fly from the 0F35s yield level, having been reasonably well correlated for the first 3 mos of the 0F35s life. From this perspective, one could argue the 35s look on the rich side here.

- From a plain vanilla yield curve perspective, the 0R30-0F35 sprd has steepened nicely, back to the early Nov wides, despite the under performance of the 10yr sector on the curve. The alignment of the sprd level with 0F35 yields also suggests the 35s are fairly priced and, while not necessarily cheap into their tap, they aren't 'out of whack'.

> The Z-sprd charts are where things get a bit more complicated. While the steepening of the 0R30-0F35 yield sprd looks enticing for buyers of the 0F35s - the Z-sprd tells a completely different story as we're making new lows this am at 16.2bps, 2.5bps flatter since the MPC meeting and almost 5bps flatter since mid-Dec.

We can see below that this Z-sprd is only .5bps cheaper than the 0R30-4Q36 sprd.

- The 0R30-0F35-0F50 Z-sprd fly is 2.1bps mid this am, 1bp cheaper in the last 2 days but a lot richer than it's +6.5bps wides in mid-Dec.

- Scatter plot of Z-sprds in the 10y-18y sector show the 0F35s are still a bit cheap to the curve but not glaringly so, especially since the 34s and 36s have also cheapened up into this tap.

> So! While the 0F35s could see demand on an outright yield or even cross market basis (they're +111.5 bp cheap to DBR 0 35s this am!) and even richen a touch more as they normalize to the curve, we can see this tap getting recycled post-auction unless they cheapen some more on the curve…

More soon…

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy new issue and revisiting bond curve value

Team G – we've been busy looking at Bond RV and trying to improve our understanding of valuations

Conclusion

Low coupons 'appear' cheap in regular yield analysis

If we discount the cash-flows using a par bond curve we see that the Aug31 will offer value at a spread to the old bond at around +5bp

Our favoured trades would be to sell Aug30 AND / OR Btps Mar37

As a boundary condition this issue should put a cap on the old 15y Btps Mar32

More importantly –

New Italy Btps 10y 0.6% coupon (???) Aug 31

We have plumped for +5bp's our starting spread vs the Apr31

Method 1 - Simple yield curve fit – bond yields minus smooth curve…

Aug31 – look great value, and in prep I like being short Aug30

When is a cheap bond not a cheap bond? – when it is rich?

Par bond analysis…

Method 2 - Par Bond Curve Fit – Discounting ALL Cash-Flows with a smooth, Italian Zero Curve

The low coupon bonds, in an upward sloping curve have limited value vs the Medium coupons normally – but at similar spreads they are a 'true' buy as we have accurately valued all the flows

We do see pressure on Aug30s and Mar37s as rich – but also the old Btps 1.65 Mar32 should now be bounded by this new Bond which even after adjusting for its cashflow has the same value

NB – none of this analysis assesses the default / redenomination value – if we buy a low coupon at the same cashflow value to a higher coupon – we get that option for zero premium

Happy to Chat

James and William

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

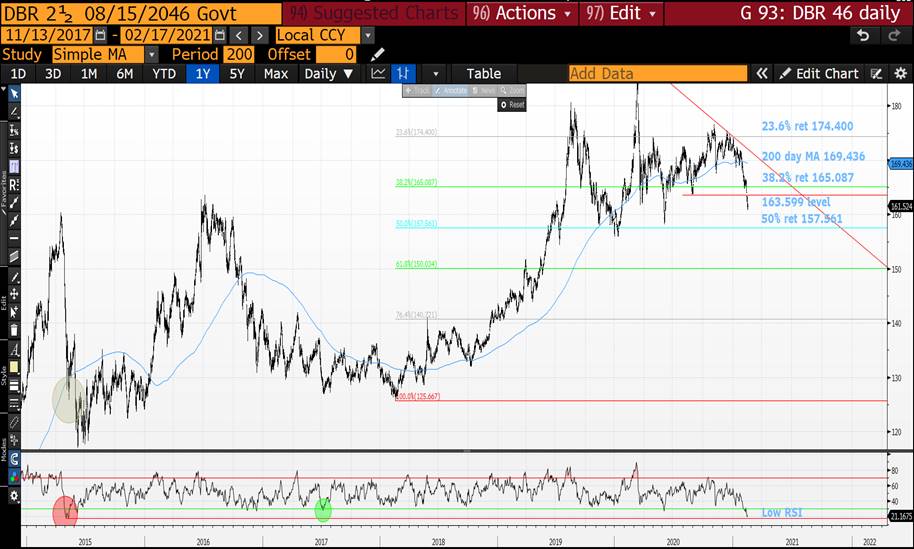

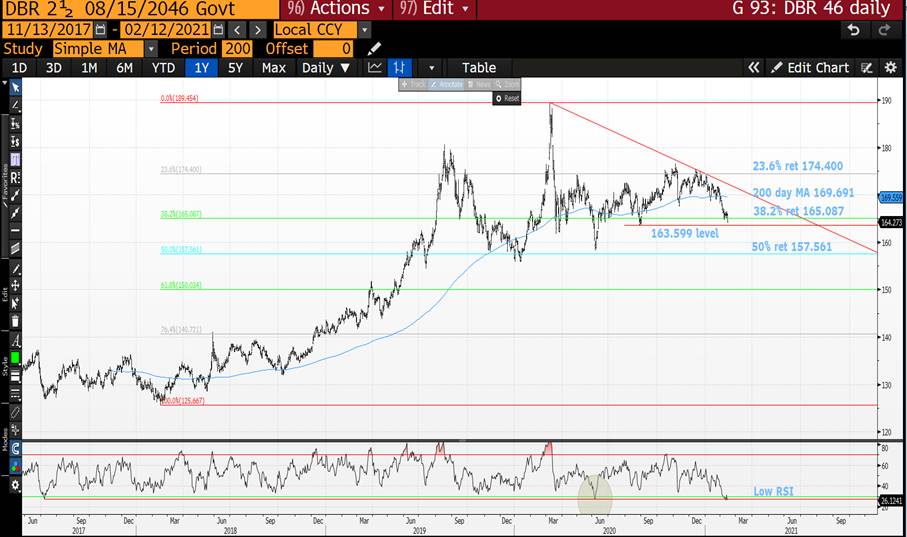

BONDS YIELDS : I APPEAR TO BE A COUPLE OF DAYS EARLY IN CALLING A YIELD TOP BUT THIS NOW MEANS THE DAILY RSI’S ARE FURTHER STRETCHED.

BONDS YIELDS : I APPEAR TO BE A COUPLE OF DAYS EARLY IN CALLING A YIELD TOP BUT THIS NOW MEANS THE DAILY RSI’S ARE FURTHER STRETCHED.

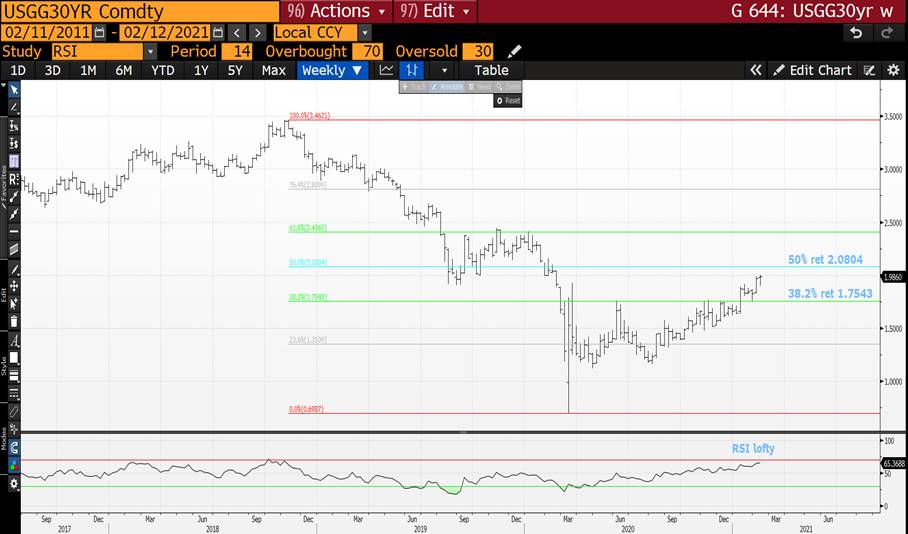

THE US CURVES AND 102030 FLY CONTINUES TO HAVE VERY DISLOCATED RSI AND SEVERAL MAJOR LEVELS IN PLAY.

LAST WEEK I DISCOVERED THAT 20YR US BONDS WERE TECHNICALLY-HISTORICALLY

“OUT OF SYNC” WITH 10’S AND 30’S, IF 20YRS BONDS BOUNCE THEN THE YIELD RALLY SHOULD STALL AND WE MUST BE DUE FOR A CORRECTION BY NOW.

A STEEPENING CURVE HAS ALWAYS BEEN AN “ASSIST” TO THE YIELD CALL HIGHER BUT THAT TOO IS NOW OVER BOUGHT!

I HAVE MENTIONED GILTS GIVEN THEY HAVE A LOW RSI AND GAPPED OPENINIG.

ALL EYES ON THE DBR 46, THIS HAS ALWAYS BEEN A TECHNICAL FAVOURITE AND IT NOW HAS A RARE RSI DISLOCATION AS IT HITS A MULTI YEAR 38.2% RET 165.087.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: Quick GILTS > Crazy Start to 2021! Update w/IDEAS

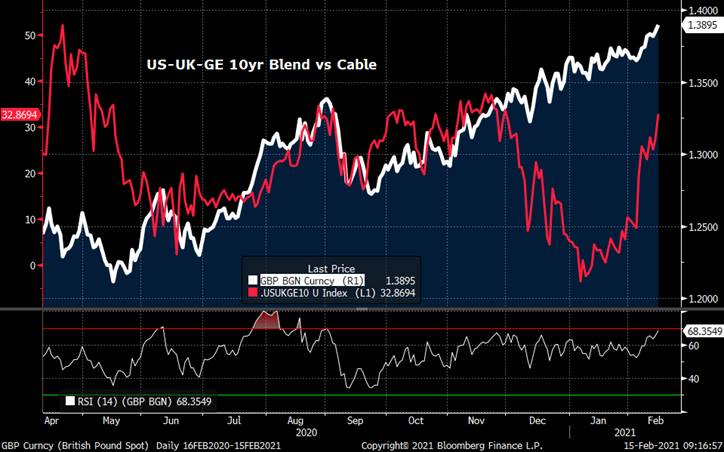

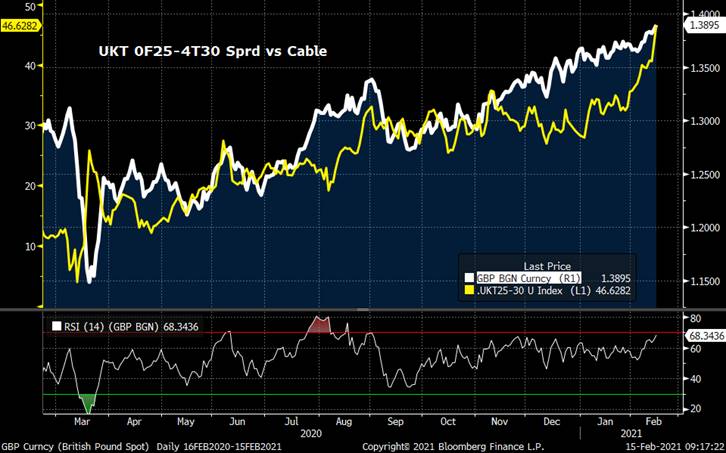

Quick GILTS... Cable! Vaccinations! Yields!

- UK vaccinations surge past 15mm and are now targeting 65yr olds and above. Talk of lifting the lockdown by March 8th is gathering steam as new cases and mortality levels decline. Kids are expected back to school soon (AMEN!). This is helping to drive another surge higher in the pound, dragging the FTSE and gilts yields higher too. Despite the market's post-MPC meeting temper-tantrum, the tone of the GBP rates markets is little changed since.

- Charts below show after a Dec-Jan wobble, the correlation of the 5y-10y curve and the US-UK-GE 10yr blend to cable have resumed. All three of these measures are looking rich from a momentum perspective, especially the US-UK-GE blend which has cheapened almost 35bps since early January, back near the Aug-Nov highs.

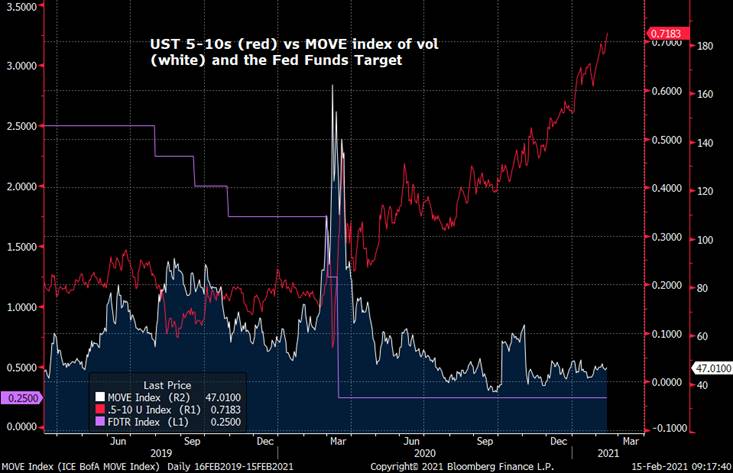

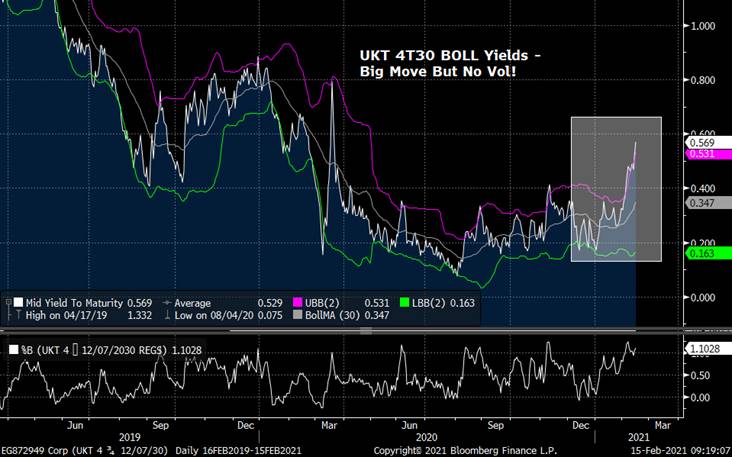

- The 'main-event', however, has simply been the sharp cheapening of the 10yr point (the 4T30s) which, as of this am, is now 40bps cheaper since early January. This remarkable move has come during a lockdown and amidst worries of a double-dip recession. Even more remarkable is rates vol has barely budged with both swaptions and bond vol flat-lining. While the US and EGB curves continue their march steeper, the long-end of the UK curve has been quite stable with some GEMMS reporting LDI demand for ultra-long gilts a they surged past 1%, the 1T57s now 1.117%, their cheapest level since March.

- This week's conventionals issuance is relatively busy compared to last week with a tap of the 1T57s tomorrow and the 0F35s on Wednesday, in line with their APF sector operations. The next two weeks are relatively long-end heavy as 3 of the 6 auctions are 30yrs and longer (1T57s, 0F50s and 0H61s), followed by a two-week lull before we close out March with 1F54s on the 16th and 1T49s on the 23rd.

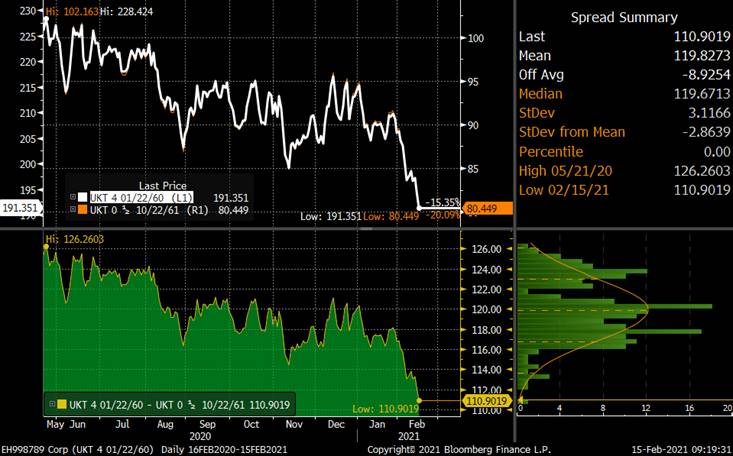

- From an end-user perspective, we're expecting the 0H61s (and, to a lesser extent, the 1T57s) to find solid support due to the widening chasm between their relative prices and the reinvestment advantages of taking out 111 points has for LDI investors. This helps explain why the higher cpn issues within the sector continue to trade cheap on a relative basis and until this gap has closed substantially, it should persist.

- Positions:

- UKT 4T30-4H34-1T37 (and 1Q41) fly – sell the belly. The combination of a very oversold 10yr AND the scheduled tap of the 0F35s on Wednesday has helped to cheapen the belly on both flies. We can see from the charts below, however, that there's still plenty of room to run on these should we crack these technical hurdles.

- UKT 0R30-0F35-0F50 fly - We've been long the belly of this fly as a 'core' position for much of the second half of 2020. We can see from the chart below that the correlation of this fly to 10y5y SONIA was 'OK' from Sep until December as both the levels were relatively stable. Since January, however, the sharp cheapening of the SONIA forward hasn't been mimicked by the fly since the movements of the wings have been small. That said, we're back to the fly's cheapest level since December and we'd expect any break cheaper up to around the +10bps level would attract RV demand.

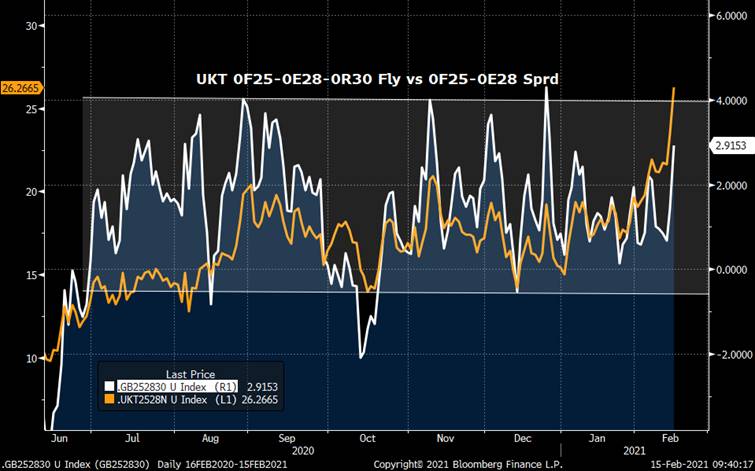

- UKT 0F25-0E28-0R30 Fly – This is a relatively well-behaved fly in a volatile sector of the curve. The slight lean towards the short leg in a 1-2-1 weighting gives this fly a modest directionality, cheapening in a sell-off. That said, the 25-28s sprd has steepened about 11bps since Jan 4 and the fly is still in a tight 0-4bps range. Medium-term, we like the 0E28s and expect this range to hold for now, so any move into the +3.5-4.0bps range is a buy in our view.

- CHARTS:

Ratio of UKT 460 to UKT 0H61 Prices – 61s very cheap…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BONDS YIELDS : DESPITE THE ADVERSE FRIDAY PRICE ACTION WE ARE STILL IN THE RIGHT AREA FOR BOND YIELDS TO STALL. I.E. NOTHING REALLY HAS CHANGED

BONDS YIELDS : DESPITE THE ADVERSE FRIDAY PRICE ACTION WE ARE STILL IN THE RIGHT AREA FOR BOND YIELDS TO STALL. I.E. NOTHING REALLY HAS CHANGED BUT MONDAYS US HOLIDAY MIGHT JUST HELP. THE US CURVES AND 102030 FLY CONTINUES TO HAVE VERY DISLOCATED RSI AND SEVERAL MAJOR LEVELS IN PLAY.

LAST WEEK I DISCOVERED THAT 20YR US BONDS WERE TECHNICALLY-HISTORICALLY

"OUT OF SYNC" WITH 10'S AND 30'S, IF 20YRS BONDS BOUNCE THEN THE YIELD RALLY SHOULD STALL AND WE MUST BE DUE FOR A CORRECTION BY NOW.

A STEEPENING CURVE HAS ALWAYS BEEN AN "ASSIST" TO THE YIELD CALL HIGHER BUT THAT TOO IS NOW OVER BOUGHT!

WEEKLY YIELD RSI'S ARE THE KEY, ESPECIALLY IN THE BACKEND AS THEY HAVE FINALLY BECOME OVERBOUGHT.

ALL EYES ON THE DBR 46, THIS HAS ALWAYS BEEN A TECHNICAL FAVOURITE AND IT NOW HAS A RARE RSI DISLOCATION AS IT HITS A MULTI YEAR 38.2% RET 165.087.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris