Trades & Fades - European RV, James & Will at Astor Ridge

A few thoughts on European RV for the forthcoming week

Fade: Fed and ECB policy will be to focus on 'average inflation', or as I read it the integral of inflation

Result: The result will be an initial lack of action and then a dramatic response later in time

Search: forward rate steepeners / buying bullets & selling wings

Trade:

Buy Frtr May34

Sell Frtr May31 & sell Frtr Oct38

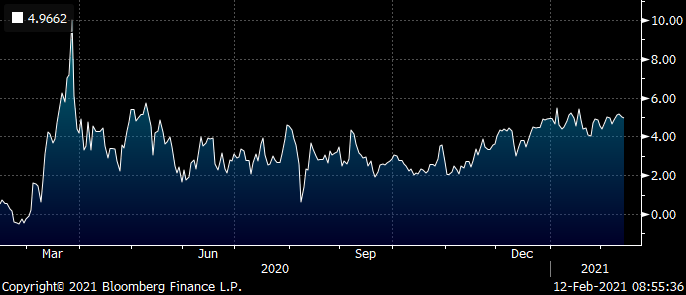

Graph:

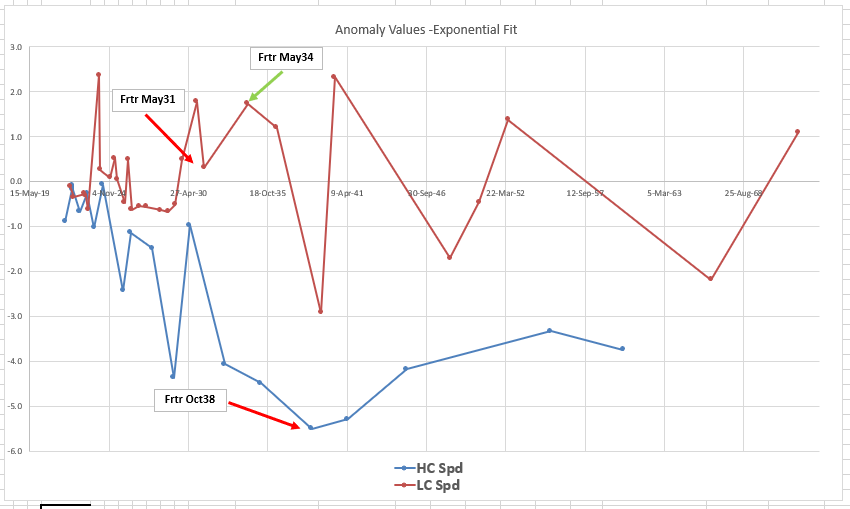

Levels

Current: +5 bp

Enter: +5bp (33%)

Add : +7bp

Target: +1bp (Long Term), take profit on a proportion at +2 bp

Rationale

- Trade has intrinsic value beyond history – see anomaly values versus fitted curve

- The Frtr May31 rolls towards the 10y issuance point and looks rich

- The Frtr Oct38 is a rich high coupon

- The trade satisfies our constraint of approximating long a forward and then a short a forward

Forward rates between bonds…

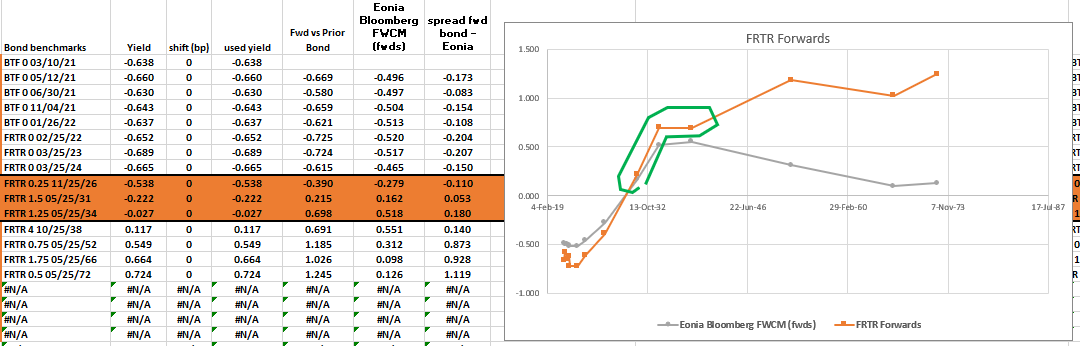

Trade:

Buy Germany Dbr Feb31

Sell Dbr Aug28 & Dbr Jan37

Levels:

First Entry: Flat

Current: -2.6bp

Target: -5 bp (Med Term) / -8.5bp (Long Term)

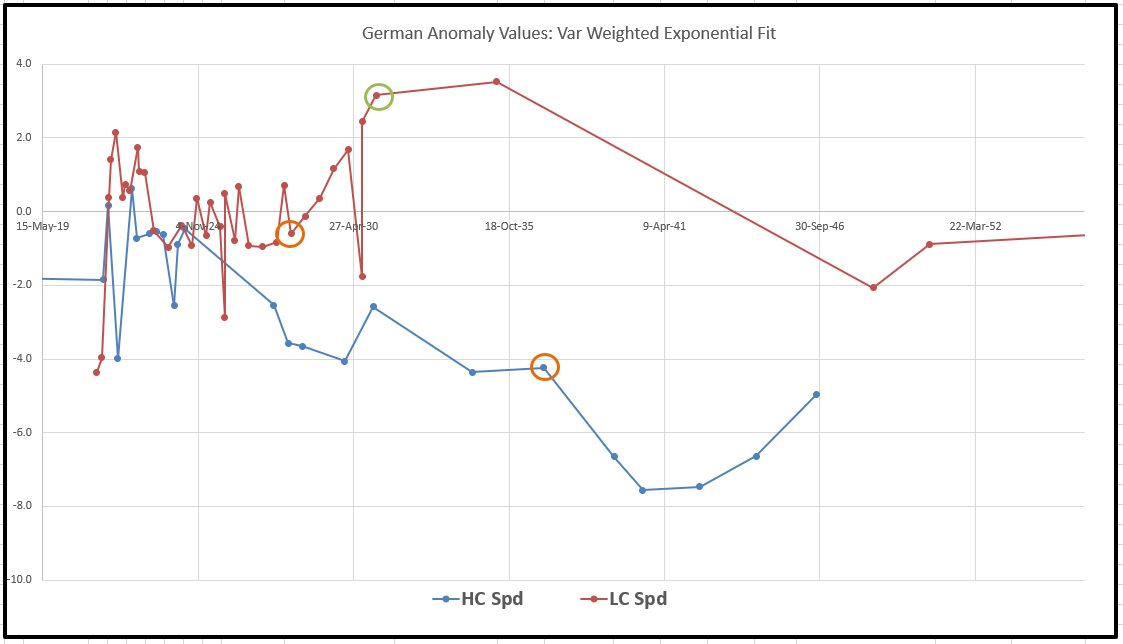

This is a theme we're sticking with from before – bags of intrinsic value above beyond simply staring at history

Given it has moved a lot it's tough to add much other than a small portion here

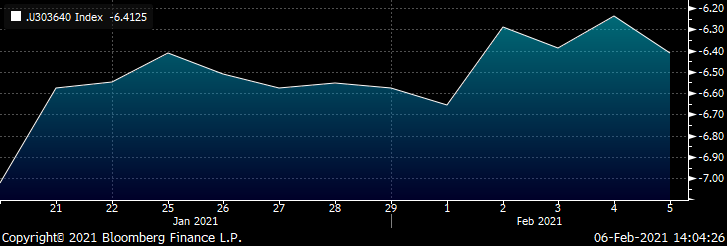

Graph

Mutation

What I would recommend is re-balancing the structure

From : -.5 / +1 / -.5 (x2)

To

To -.65 / +1 / -.35 (x2)

Rationale

- Anomaly Value – see graph

- Forward Rate Value – see graph

- Supply Edge – New 7y and 15y coming (27th April & 3rd March) makes the shorts look rich and possibly cheapen

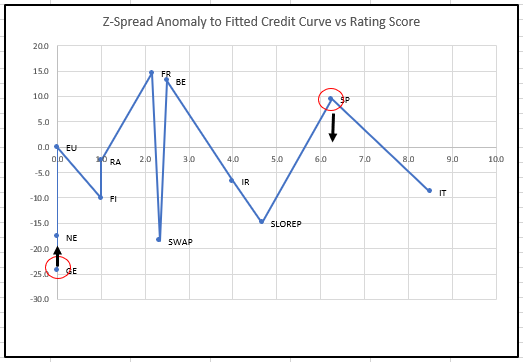

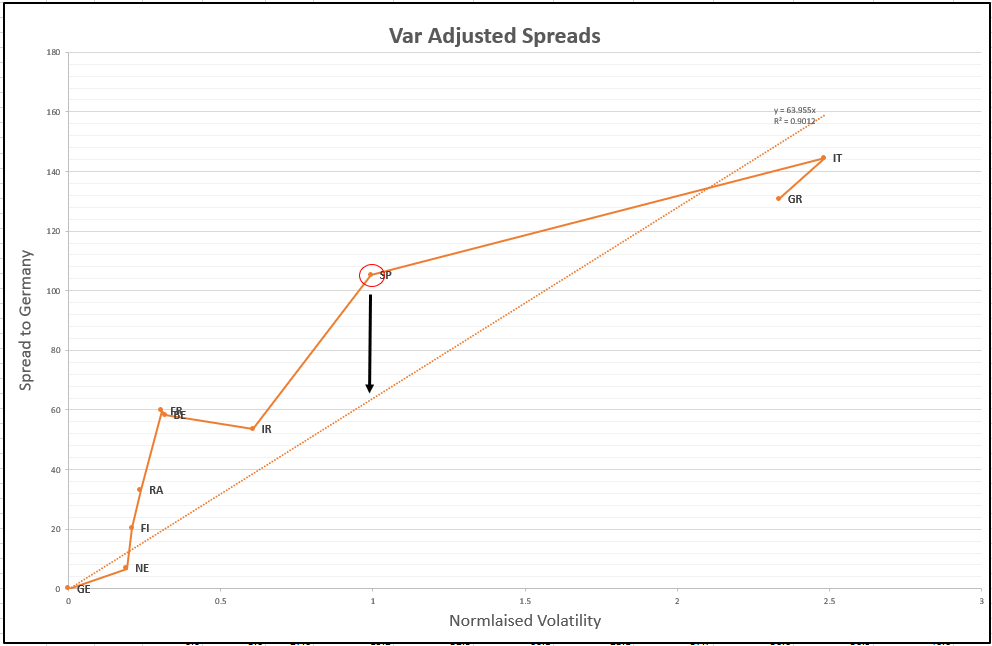

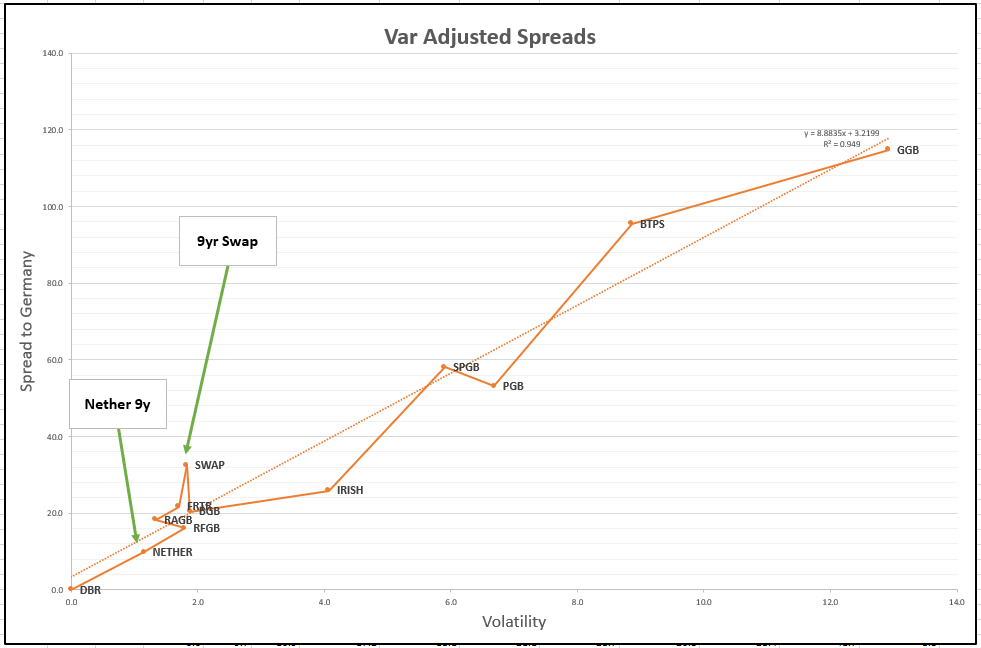

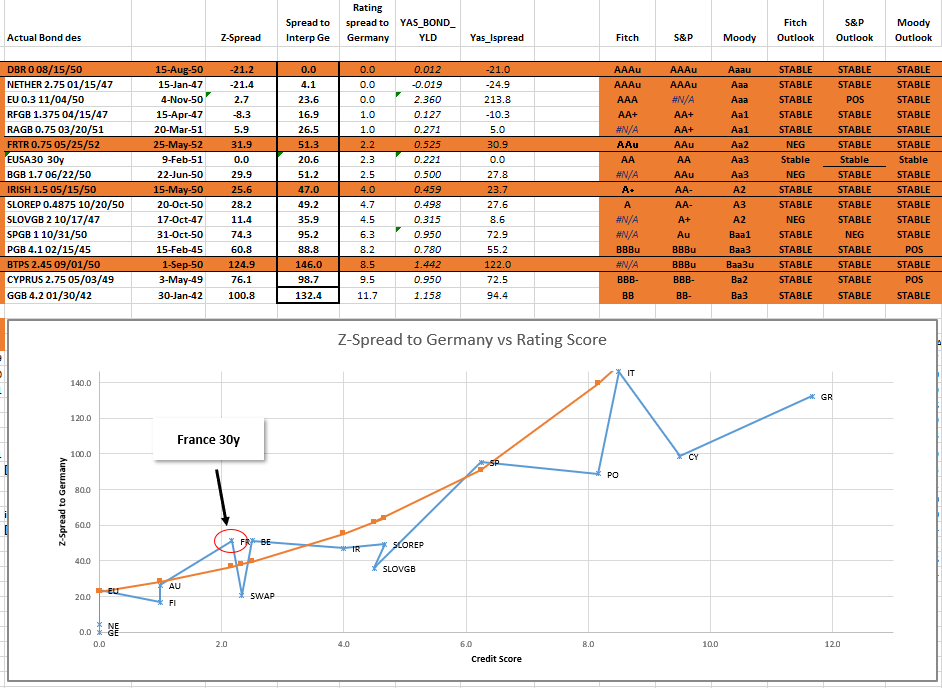

Fade: ECB / PEPP buying has aggressively bought low credit names

Result: weaker credits 'appear' to trade like better names, but if we volatility adjust we can see some as still rich – Semi core and Spain have been left as cheap due to recent long end (50y)

Supply

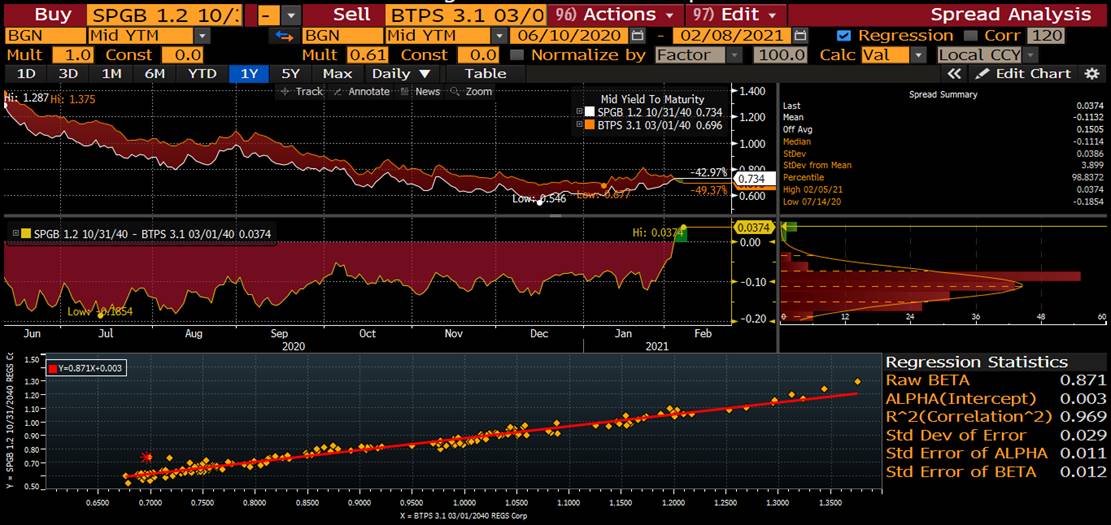

Search: Buy better ranked mid-credit names vs selling a mix of Germany and Italy. Need to see reasonable correlation in the components and solid value away from the simplistic history of 'how it has traded'

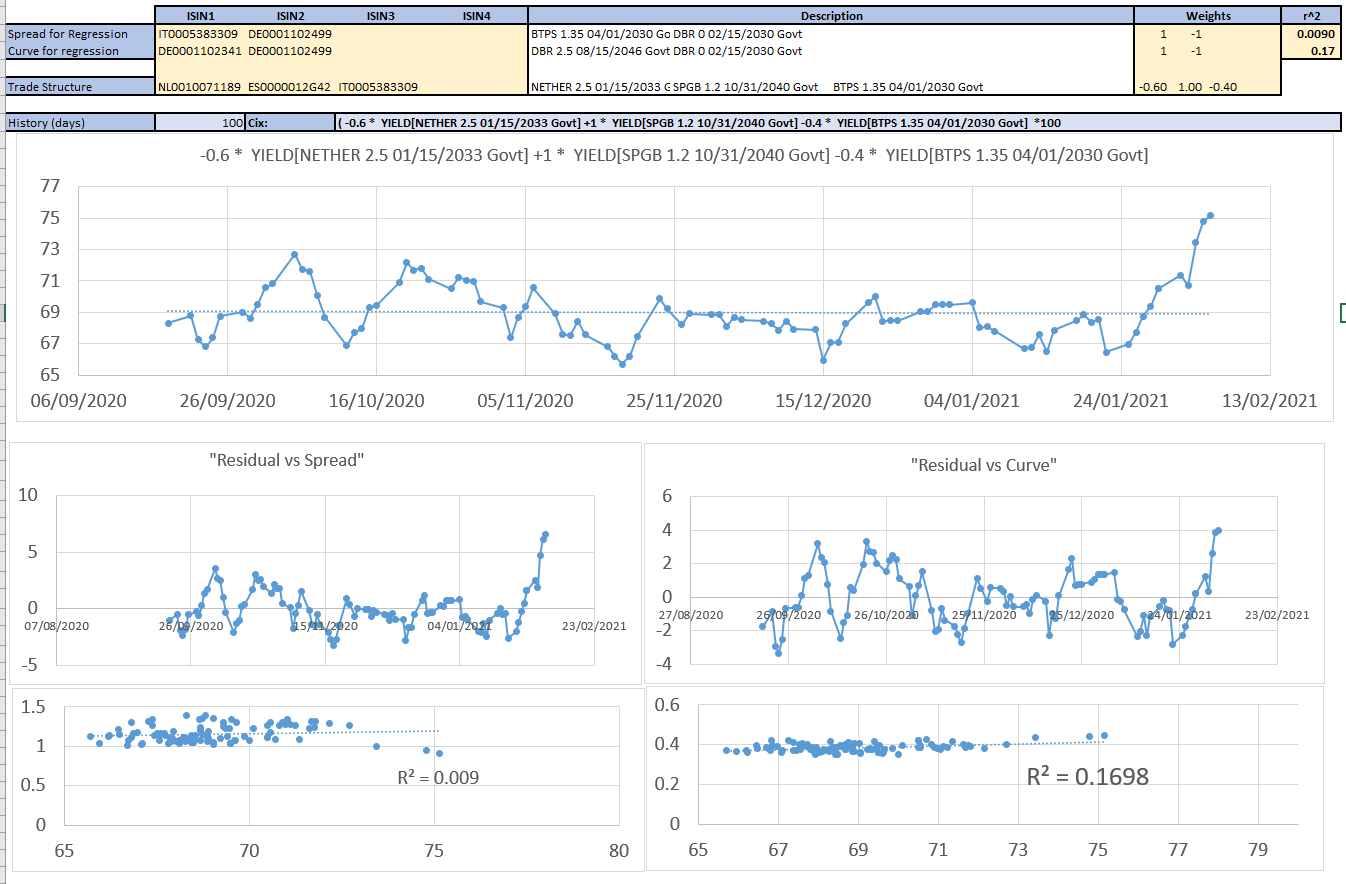

Trade

Buy Spanish 30yr

Vs Selling Italian 30y and German 30y (UBH1)

Levels

Enter: +56.5 (33% of risk)

Add: +65 (67% of risk)

Stop +70bp

Target: < 50bp

cix:

100 * (YIELD[SPGB 1 10/31/50 Corp] - 0.65 * YIELD[DBR 2.5 08/15/46 Corp] - 0.35 * YIELD[BTPS 2.45 09/01/50 Corp])

Graph:

Rationale

- Spain looks cheap based on our graph of Issuer spreads vs Credit Score

- Spain is still cheap - On Volatility / Var weighting (helps adjust for the compression caused by APP buying)

- Spain / Germany remains correlated to Italy Germany

Slope 0.36, r2 0.82

120 days regression if relative swap spreads (Spain – Germany) vs (Italy – Germany)

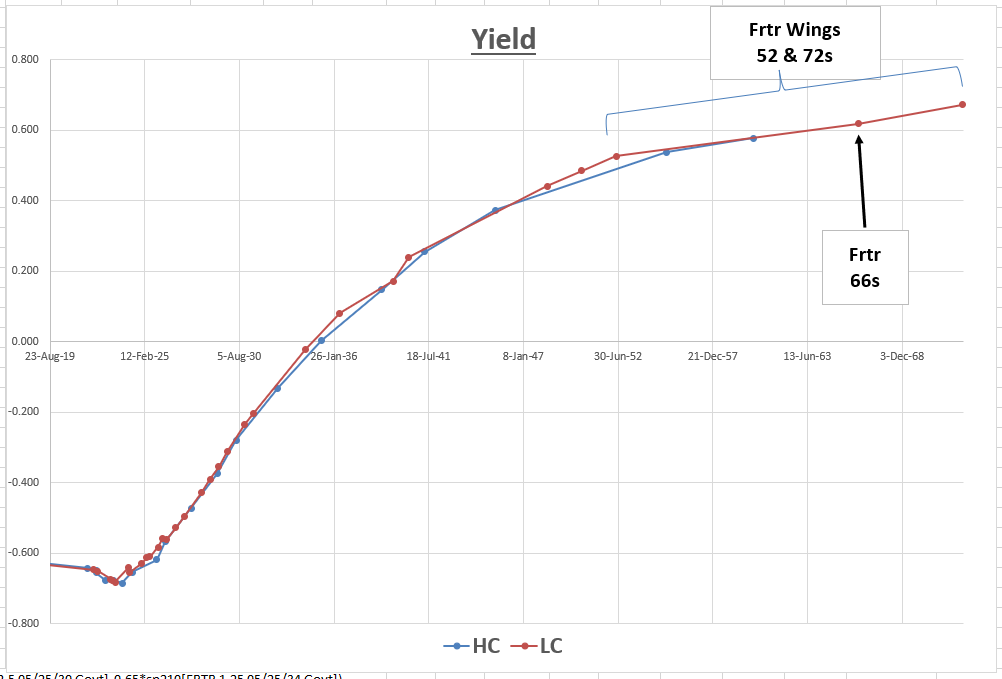

Fade: ECB buys tenors up to 31yrs only

Result: Seek to be nett long ECB PEPP buckets

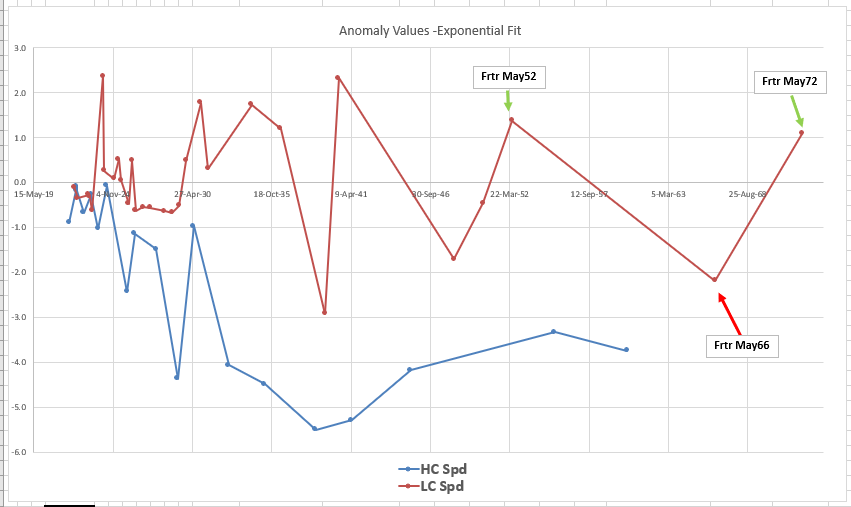

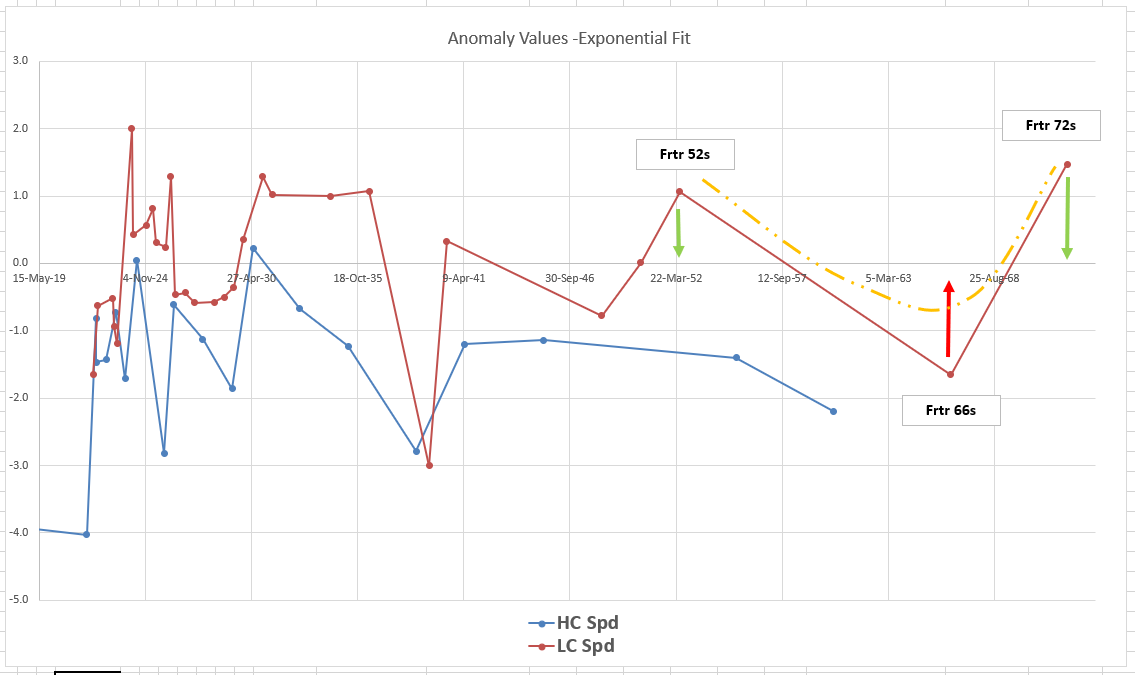

Search: recent cheap 50y France allows us to be long 52s (goes into PEPP in May) and 72s vs the richer 66s

Sell France Frtr 66

Buy France Frtr 52 and Frtr 72

+.15 / -1 / +.85

Levels:

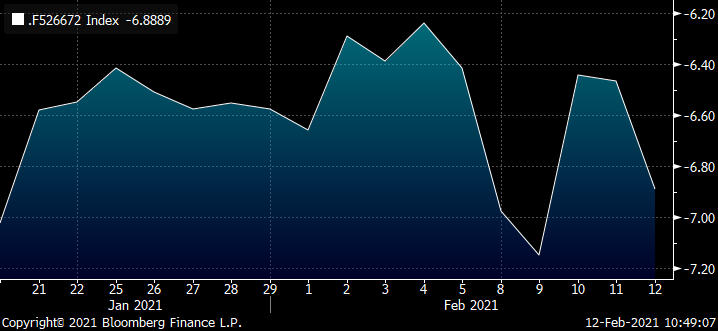

Current: -6.9bp

Enter: -6.5bp (pay the spread 33% of total risk)

Target: -2.5bp

Cix:

200 * (YIELD[FRTR 1.75 05/25/66 Corp] - 0.15 * YIELD[FRTR 0.75 05/25/52 Corp] - 0.85 * YIELD[FRTR 0.5 05/25/72 Corp])

Graph:

Graph of Anomalies vs Fitted Curve

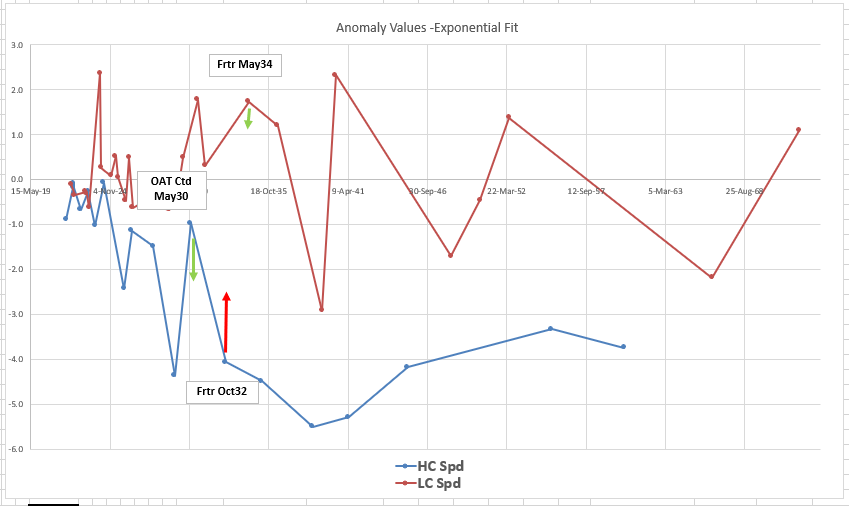

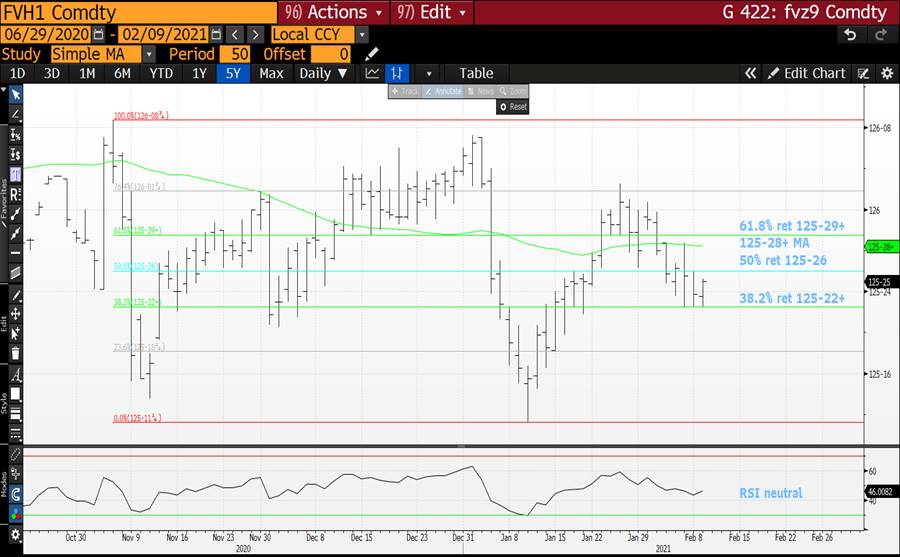

French Contracts CTD a lurking problem as a High Coupon CTD

The average coupon of my French curve build is 2.12%

High coupon CTDs have a habit of trading rich when they drop out of delivery as there street float is more limited – sometimes that's from a rich bas. They can richen on the drop out if being CTD has forced them cheap – note here we're talking about rich/cheap in absolute terms – not just how it has moved

Buy France CTD May and Frtr May34

Sell High coupon Frtr Oct32

Cix:

100 * (YIELD[FRTR 5.75 10/25/32 Corp] - 0.35 * YIELD[FRTR 2.5 05/25/30 Corp] - 0.65 * YIELD[FRTR 1.25 05/25/34 Corp])

Graph:

French anomalies

Rationale

- French OAT contracts have been heavily used to hedge issuance in Semi-core. In the long haul I want to roll positions to be long or at worst case flat

On my radar

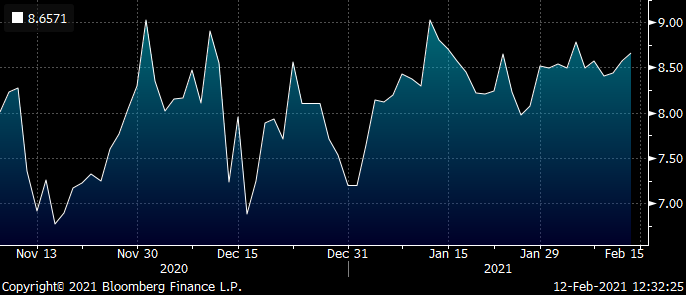

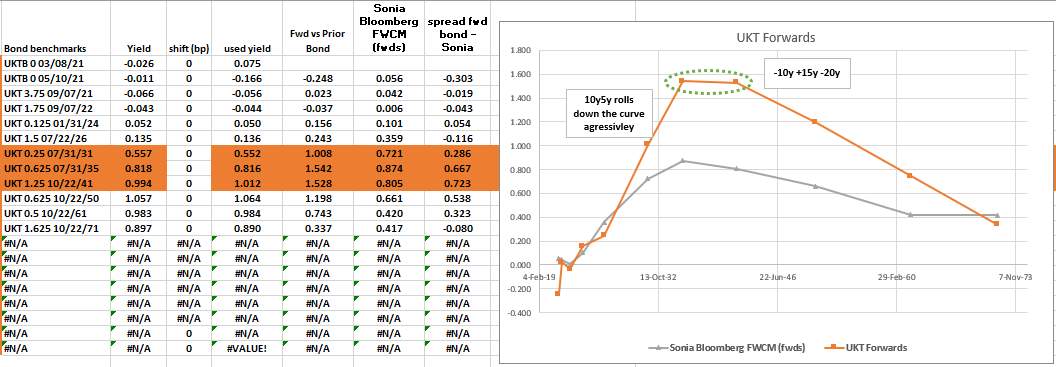

UKT 35s remain top of forwards curve

Buy Ukt 5e35

Sell UKT 1q31 (10y) and UKT 1q41

Level: +8.6bp

Enter: +8.5bp (small)

Strong Add: > +9bp

Target: < 7bp

200 * (YIELD[UKT 0.625 07/31/35 Corp] - 0.5 * YIELD[UKT 0.25 07/31/31 Corp] - 0.5 * YIELD[UKT 1.25 10/22/41 Corp])

Based on forwards we need another half a bp on this so at any level > +9bp looks really sound to me and keeps us short a supply bond

Forwards

Seeing gilt market on pure technicals as oversold, so don't mind buying a bullet vs wings here…

As always – call us for any further info

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy Auction Preview - 11-Feb-2021

Tomorrow Italy will auction the following:

Jan-2024 , 3bn

Mar-2028 , 4bn

Mar-2041, 2bn

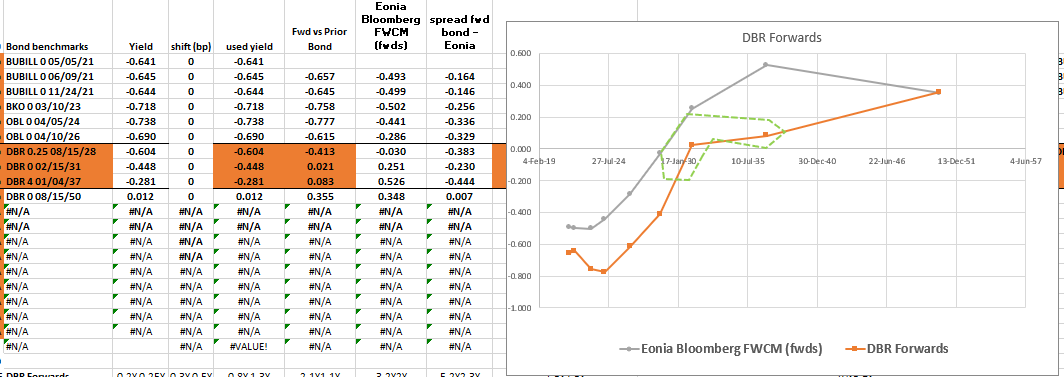

Given the rally in IK/RX over the past couple of weeks we think that tomorrow's auctions will be viewed as a liquidity point to add risk, not least because the on-the-run paper is still trading at something of a discount to the rest of the curve.

Bigger picture the curves look pretty fairly priced, but if micro RV is all that's left then these are our favourite iterations below:

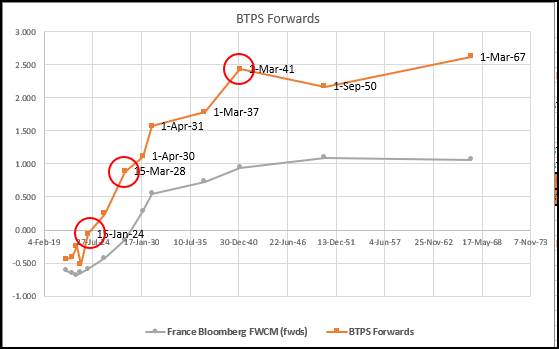

Italy Forwards – on the run bonds all trading cheap to the curve still

BTPS Jan-24

Buy BTPS 1-24 vs BTSH1 or BTPS 15/3/2023

- This will likely be the last tap of the bond (currently 13.8bn).

- We see it as marginally rich both outright and on maturity weighted fly based on history

- However, it still has around 2 bpts of benchmark discount which will disappear once it goes off the run

- Additionally it can serve as a cheap-ish vehicle to hold a short in front month BTS, which we think has a growing long base that will put pressure on the roll

- We look for a ~ 0.5bp concession to enter the trade

Enter: 9.5 bp

Add: 10.5 bp

Current: 9.25 bp

Take Profit: 6 bp (into roll)

BTPS Mar-28

- Whilst this will no doubt see solid buying outright there is little RV angle to play here

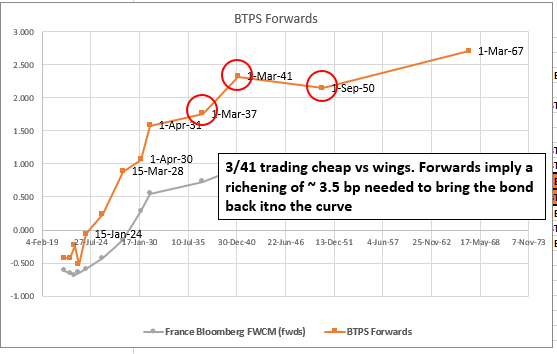

BTPS Mar-2041

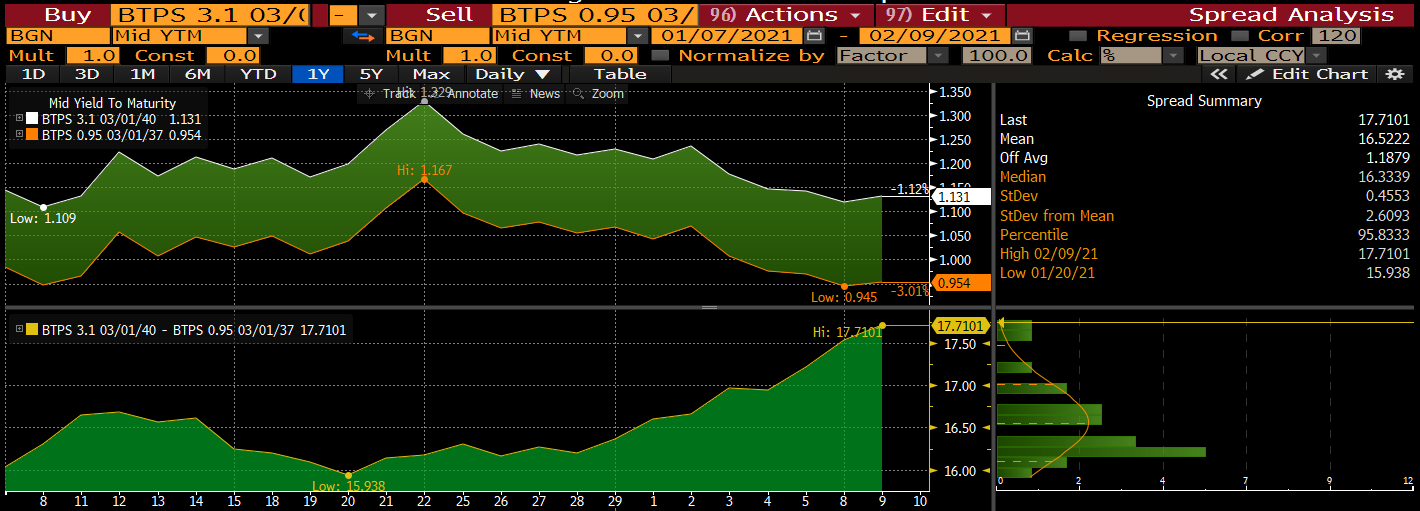

Buy BTPS 3/41 vs BTPS 3/37

- As per the below chart the 3/41 is trading cheap relative to surroundings

- Granted, some of this is the expectation of a 20y Green bond at some point, but syndications this year have shown this to be a catalyst for performance rather than underperformance

- Given the recent steepening we like owning the flattener with a view to mutating it into 31/37/41 fly as we head into 10y supply at the end of the month

Enter: 23.4

Current: 23.4

Take profit: 20 bpts

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 – 441 -7709

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

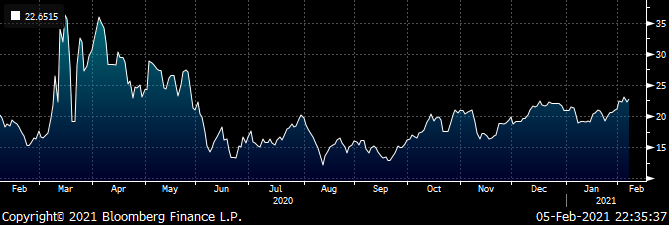

***PLEASE READ *** BOND UPDATE : “FULL RACING HARNESS ON”, BONDS ARE ABOUT TO BECOME EXPLOSIVE!

BOND UPDATE : “FULL RACING HARNESS ON”, BONDS ARE ABOUT TO BECOME EXPLOSIVE!

“Auctions Are Duration Test With Treasury Short Squeeze Brewing

By Edward Bolingbroke

(Bloomberg) -- Outright short positions surged to the most since September 2018, according to Tuesday’s JPMorgan Treasury client survey”.

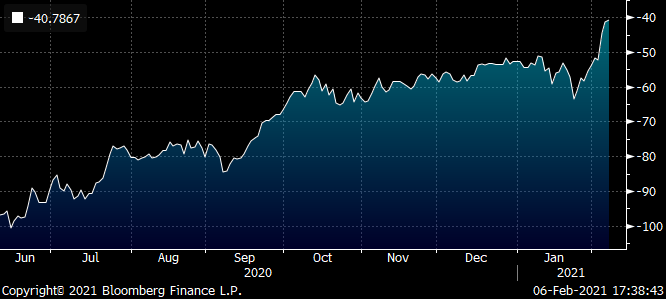

LOOKING AT VOLUME, OPEN INTEREST AND LAST WEEKS SWAP CHARTS WE ARE COILING FOR A VERY “VOLATILE” MONTH.

RECENTLY WE HAVE WITNESSED MONUMENTAL VOLUME SHORTS, ONLY JUST INITIATED WHILST THERE IS GROWING SIGNS FOR A YIELD PAUSE! ADD TO THIS VOLATILE COCKTAIL OF THE CALENDER ROLLS AND ITS “HIGH ALERT” TIME.

THE PAINED LEVELS FOR SHORTS WILL BE THE VAP (VOLUME AT PRICE) PEAKS AND THE FUTURES 50 DAY MOVING AVERAGE, THESE AIDED THE SELLOFF ON MANY OCCASIONS.

THIS COULD GET “EXTREMLY MESSY” AND WONT BE EASY FOR REAL MONEY!

“Auctions Are Duration Test With Treasury Short Squeeze Brewing

By Edward Bolingbroke

(Bloomberg) -- Outright short positions surged to the most since September 2018, according to Tuesday’s JPMorgan Treasury client survey”.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

FX UPDATE : A DECISIVE MONTH FOR THE USD AS WE CONTINUE TO LANQUISH AT THE LOWS, LETS SEE IF IT CAN BREACH THEM OR NOT!

FX UPDATE : A DECISIVE MONTH FOR THE USD AS WE CONTINUE TO LANQUISH AT THE LOWS, LETS SEE IF IT CAN BREACH THEM OR NOT!

**WE HAVE WITNESSED A WEAKENING USD ASSOCIATED WITH THE BOND YIELD RISE, IF YIELDS STALL DOES THIS MEAN THE USD HOLDS THESE FOCAL LEVELS-LOWS.**

USD MXN HAS HELD ITS 50 PERIOD MOVING AVERAGE-38.2% RET 19.7005 SO LETS SEE IF RE-BREACHED.

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

USDTRY HAS A PERFECT FAILURE AT ITS MAJOR 2001 TRENDLINE 8.0084 AND MAKING ITS "OWN" EFFORTS LOWER.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Our plan going forward - James & will Euro RV

Structurally where we're trying to get to with Euro RV positions….

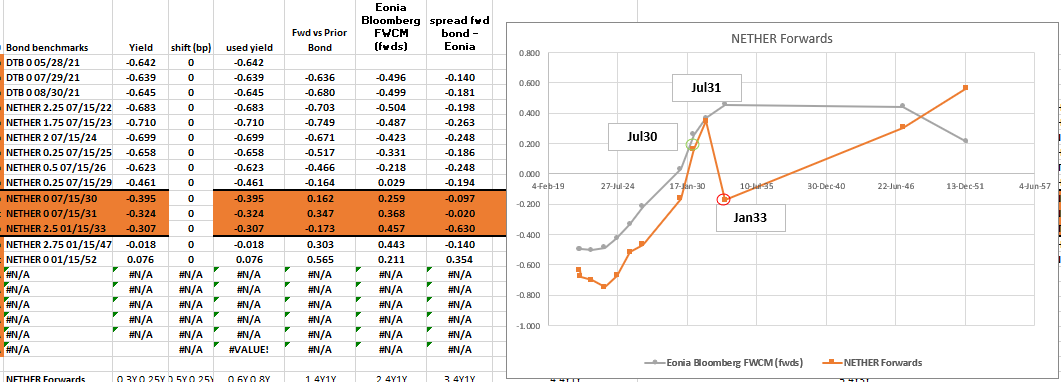

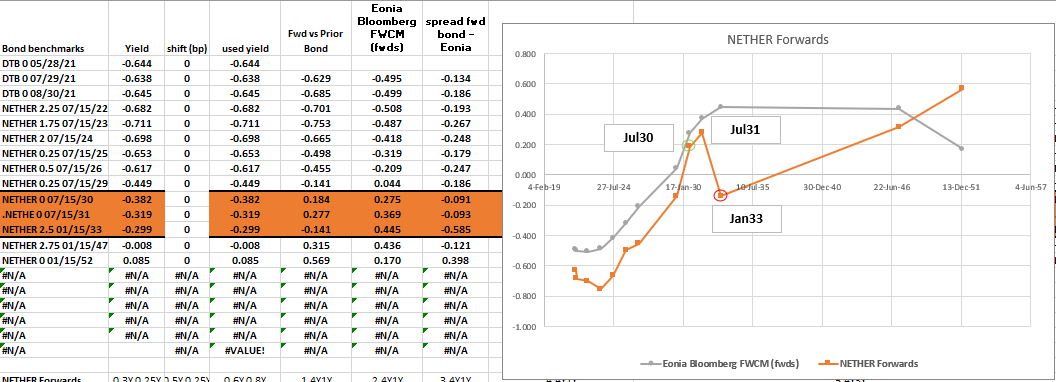

Nether

+Nether jul31s -Nether jan33 @-1.9bp

Plus some curve hedge: 5 – 10% -rx / +ub

Spain – syndication today in 50y – Spain heavily discounted

+50y Spain

vs France and Btps

100 * (YIELD[SPGB 3.45 07/30/66 Corp] - 0.5 * YIELD[FRTR 1.75 05/25/66 Corp] - 0.5 * YIELD[BTPS 2.8 03/01/67 Corp])

Plus long Spain 50y vs old 50y @ > +12bp

-66s +71s

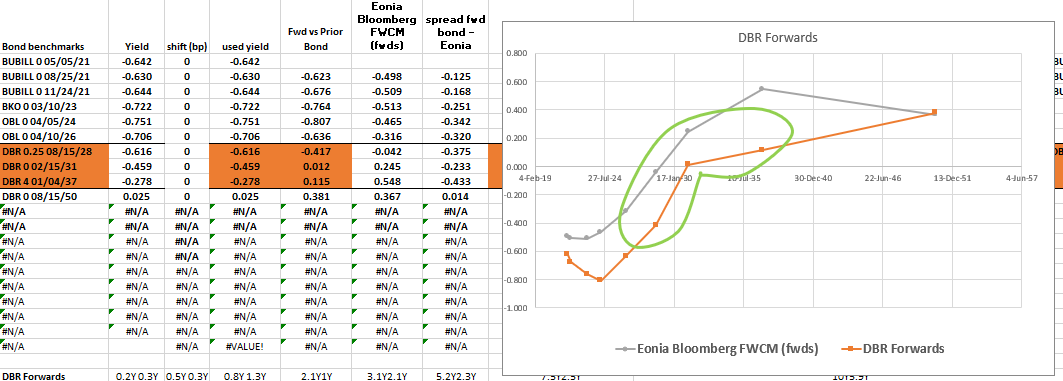

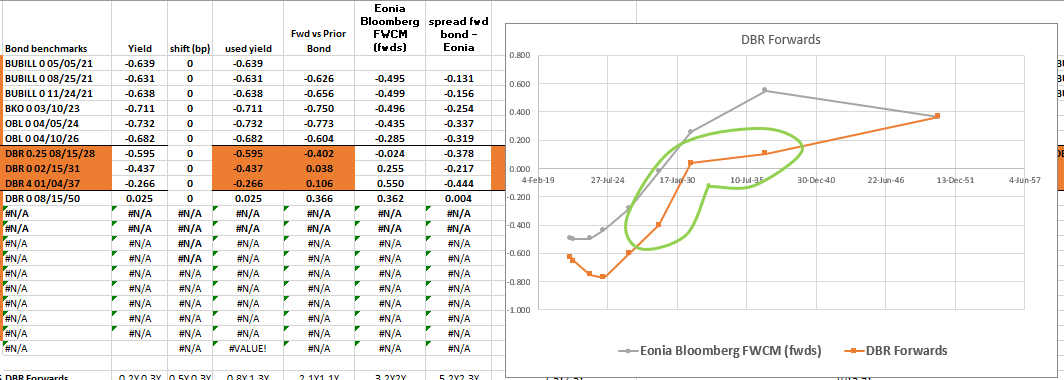

Germany

Still chasing the +10y vs -7y and -16y

(2 * YIELD[DBR 0 02/15/31 Corp] - YIELD[DBR 4 01/04/37 Corp] - YIELD[DBR 0.25 08/15/28 Corp]) * 100

Gilt contract finally has value in terms of anomaly vs other high coupons

{GB} -4q27 +GH1 -4t38

200 * (yield[UKT 4.75 12/07/30 Govt]-0.65*yield[UKT 4.25 12/07/27 Govt]-0.35*yield[UKT 4.75 12/07/38 Govt])

Italy to sell 2041s on Thursday

Buy Mar40 vs Mar37

Like selling on the run 15y Mar37 to buy old 20y Btps 3.1% mar40 – curve has steepened a little into Spanish long end supply and like the flattener for positive carry here

Get this on a timing basis – Wednesday, day before supply

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

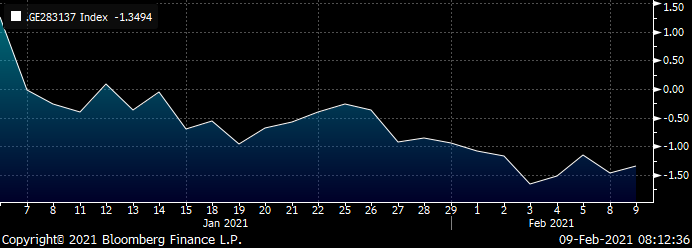

***PLEASE READ AS CHANGE IN DIRECTION **** BONDS YIELDS : TECHNICALS ARE CALLING FOR A PAUSE THE YIELD RALLY INITIATED IN MARCH 2020!

BONDS YIELDS : TECHNICALS ARE CALLING FOR A PAUSE THE YIELD RALLY INITIATED IN MARCH 2020!

LAST WEEK I DISCOVERED THAT 20YR US BONDS WERE TECHNICALLY-HISTORICALLY "OUT OF SYNC" WITH 10'S AND 30'S, IF 20YRS BONDS BOUNCE THEN THE YIELD RALLY SHOULD STALL AND WE MUST BE DUE FOR A CORRECTION BY NOW.

A STEEPENING CURVE HAS ALWAYS BEEN AN "ASSIST" TO THE YIELD CALL HIGHER BUT THAT TOO IS NOW OVER BOUGHT!

WEEKLY YIELD RSI'S ARE THE KEY, ESPECIALLY IN THE BACKEND AS THEY HAVE FINALLY BECOME OVERBOUGHT.

THE MONTHLY CHARTS STILL FORECAST HIGHER YIELDS FOR THE LATER PART OF THE YEAR!

ALL EYES ON THE DBR 46, THIS HAS ALWAYS BEEN A TECHNICAL FAVOURITE AND IT NOW HAS A RARE RSI DISLOCATION AS IT HITS A MULTI YEAR 38.2% RET 165.087.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades & Fades - Mon 8th - Fri 12th Feb, James & will at Astor Ridge

The week ahead Euro Govt RV

· Supply slows down

· Recent sell-off may precipitate syndications

· Possibly:

Spain 15y

Italy longs (50y?)

France, Green 20y

Buy Old 10y NETHER 7/30 vs NETHER 1/33 @ -8.25 bp

Ahead of next Tuesday's new issue Nether July 2031….

· The curve has already started to steepen

· 33s normally a rich bond now appear even dearer considering…

1) Cheapness of new 31s (traded on Friday vs 30s @ +6.3bp)

2) Tap of the Green the 20y coming - NETHER 1/40, scheduled Feb/Mar

· The forwards shows 2033s as rich – can cheapen a further 2 - 3 bp

· New 10y roll (7/30 vs 7/31) trading at 6.3 in grey market.

We see value in the roll at +7 bp. If it gets +7bp we would mutate the position +Jul/31 vs -Jan/33 at only -1.25bp

Absorbing Dutch supply from a credit / var perspective…

Sell 9y Nether vs Receiving Swaps

So here we have looked at the spread of each issuer vs Germany and adjusted it for the Var (Std Dev - 90 days)

This clarifies issuers that are trading rich, despite poor credit ratings. Their volatility is compressed to give the semblance of a less risky issuer

The PEPP has compressed the volatility of small Issuers (for whom the capital key implies net buying flows)

In doing so they make these names 'trade like better credits' – so how to value that?.... after all, less vol means it's less risky, right? But am I being rewarded enough for that?

– to know if they are truly 'rich' from an asset allocation standpoint, we look at volatility/var adjusted spreads – When we do that. we get a clearer lens with which we can view the anomalies of each issuer and how they trade

The graph shows Nether as somewhat rich and swaps, with a similar vol, as cheap

Graph – Var adjusted Spreads to Germany

Similarly, despite the aggressive steepening of the swap curve, as an asset, sub15y Swaps have value given their vol – extending in longer tenors still exhibits a strong inversion from either, receiving last March or possibly the implied vol and convexity value in longer dated forwards. That may still unravel further and we're cautious about using long swaps as a part of our supply rotation portfolio

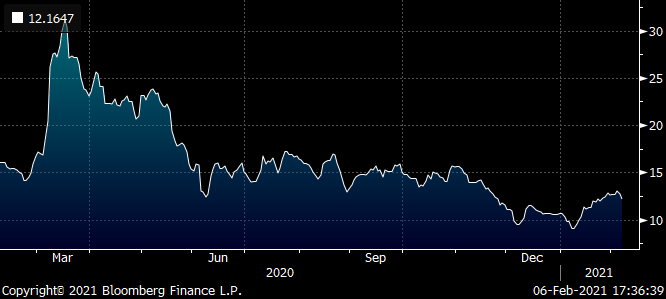

But we do see value in the 9y swap. Bond/Swap spreads look very stretched (bonds rich) throughout the tenor range on a simple chart of history

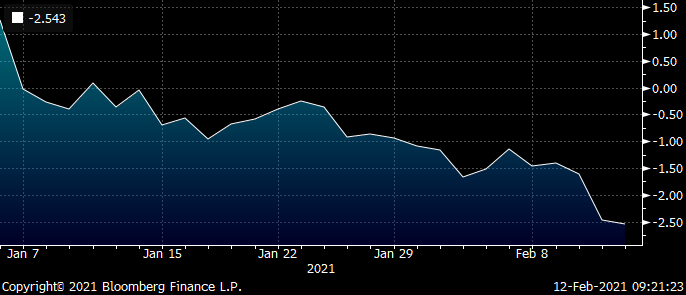

Graph – Nether Swap Spread

Alternatively – we expect Holland to continue to underperform on a credit fly…

Structure:

Short Nether Jul30

Long 90% RXH1

Long 10% IKH1

Current: +3bp

Target: +5.5bp

Last week's French long end and Belgian 50y syndications have left 30y France cheap vs Germany and Italy

Although not at crisis levels, we see Frtr, even as a larger issuer – cheap vs Bunds and Btps..

cix:

100*(yield[FRTR 0.75 05/25/52 Govt]-0.8*yield[DBR 0 08/15/50 Govt]-0.2*yield[BTPS 2.45 09/01/50 Govt])

Bloomberg History

Not at Covid levels but cheap as it has been since last June

Graph of Z-spreads EU spreads to Germany with their Credit Rating (Score) on the x-axis

*Rating score is composed of current ratings and outlooks

Enter: +22.5bp

Target +15bp

Buy SPGB 10/40 vs NETHER 1/33 & BTPS 4/30 on .6/1/.4 fly

· Spain 40s cheapened up anticipating supply in the 15-20y sector

· Holland to issue new 10y next week and tap the 20y Green bond at the end of the month

· Italy massively outperforming on a cross issuer basis

· The r2's show little correlation to the spread level or the curve

France – Frtr Fly – sell the Belly in old 50y…

Long 52s – Short 66s – Long 72s

- Anomaly looks good to buy newer issues (wings)

- Nett long PEPP, forward out of May – 52s drop into the PEPP basket as they go sub 31y maturity

We want to always have this one on – it may get stretched into supply but it's long convexity

Just take a look at the yield curve

And if I fit a yield curve and subtract actual yields, I can see the anomalies in the French curve…

It becomes even more clear we need to be short the belly

*Fit weighted to reduce SUM{[anomalyi* vari])^2}on current coupon bonds

We need to mis-weight slightly to get the balance of curvature just right and there's a brief history…

I like this trade here (50% of our risk): pay @ -6.25bp

and using forwards I think the hard boundary is close to this level – so I want some on

adding would be function of timing around the next 50y supply in 72s but I would not be shy to have this

Germany -10yrs cheap, get set for 15y supply in March, 7y supply in April & catch 8s10s roll-down

One we've been watching and really like is

Long Dbr Feb31

Short Dbr Aug28 and Short Jan37

but to be honest seems to be getting away

BBG History

- DbrFeb31 from a 'knee' of the forwards curve – they're so cheap implying rates rise and then level out – implausible in a generally rising yield curve (for large gaps)

- New Nov28 Bond coming on April 27th makes Aug28 look rich

- New May26 Bond coming March3rd makes jan37 look rich

I liked this trade at flat, I still feel we should have some here – next tap of the Feb31 10y is 24th Feb – so it's timing gig around that date or before

Spain – 20y vs Nether and Italy

- Spain as a credit has been underperforming in longer tenors

- var adjusted spread it's cheap in the absolute AND historical

- Nether, Green 2040s Supply coming in 20y offers limited upside coupled with the volatility not dis-similar to semi-core

- Italy 20y feeling a little stretched in terms of spread – but is only a 'wing' to the trade

20y is a more common tap point for Euro Markets and so we're taking advantage of rotating our book around supply and value

That said Spain seems to trade like a long syndic is coming – but tbh these order books seem to leave RV in the dust and expose true demand for blocks of bonds with positive yield..

BBG History on the fly

Holland always trades rich in longs – there's a natural demand there – but with the PEPP in operation Nether 40s are just 12.2bp over the Dbr Jul40 and don't really have much more to go in terms of tightening

Conversely in the massive Btp rally, Spain has been a huge laggard -going from -60bp to -41bp vs Italy

Even if we regress Spain vs Italy on yield differences – a quick 1y analysis shows a Beta of 61% the residual looks compelling (r2 = 0.97)

*Note the Beta is derived from regressing yield changes (0.61 slope). Then the regression of absolutes is recomputed using that slope in the 'Mult' entry on Bloomberg.

Residual is +3.7bp at the extreme of the distribution for this leg

I like this trade – a little cautious of supply

As always,

Have a fabulous week ahead and look forward to speaking

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

CRB, METALS AND BITCOIN : ALL NOW ARE POISED TO HEAD A LOT LOWER ESPECIALLY SILVER POST ITS RECENT “UPDRAFT” FORMULATING A NICE “DOUBLE” TOP.

CRB, METALS AND BITCOIN : ALL NOW ARE POISED TO HEAD A LOT LOWER ESPECIALLY SILVER POST ITS RECENT “UPDRAFT” FORMULATING A NICE “DOUBLE” TOP.

AS SOMEONE MENTIONED TODAY THIS COULD BE AN “ALL OR NOTHING” FIRST QUARTER SO WORTH BEARING IN MIND WHERE SOME OF THESE CONTRACTS ARE HISTORICALLY!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BONDS YIELDS : YIELDS CONTINUE TO GRIND HIGHER POST YESTERDAYS VOLUME AND OPEN INTEREST PIECE HIGHLIGHTING THIS TO BE A “HIGH VOLUME” BACKED MOVE.

BONDS YIELDS : YIELDS CONTINUE TO GRIND HIGHER POST YESTERDAYS VOLUME AND OPEN INTEREST PIECE HIGHLIGHTING THIS TO BE A “HIGH VOLUME” BACKED MOVE.

DAILY YIELD RSI’S HAVE YET TO BECOME OEVBOUGHT.

THE MONTHLY CHARTS STILL FORECAST MUCH HIGHER YIELDS FOR THE ENTIRE YEAR!

**DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

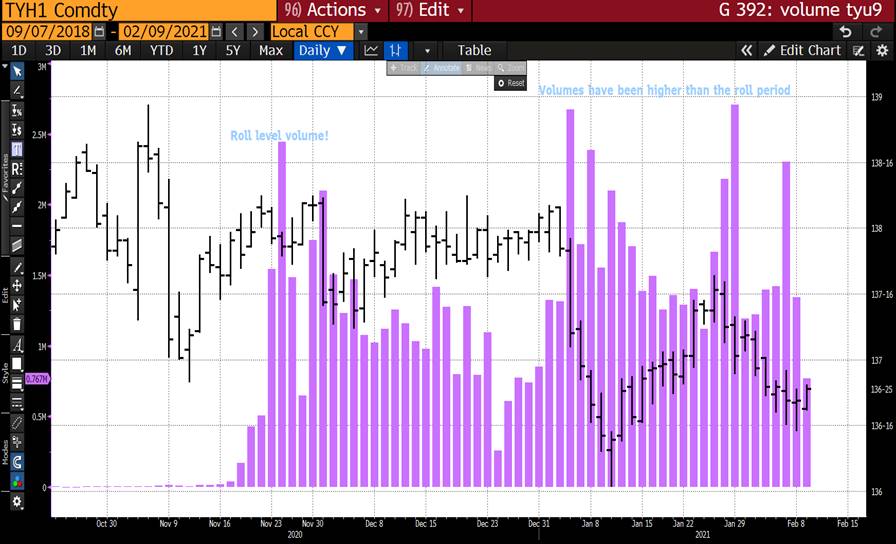

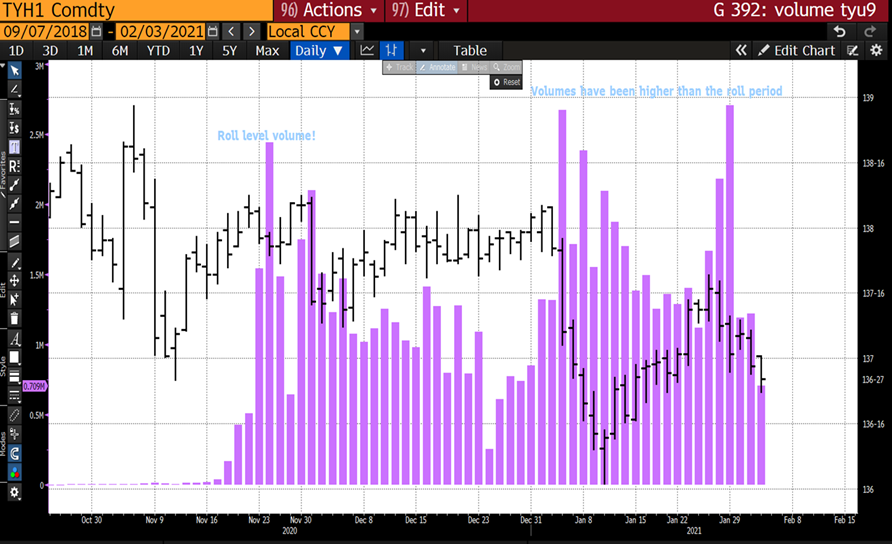

***SPECIAL*** VOLUME AND OPEN INTEREST : I THINK IF SHORT FUTURES THIS WILL ONE TIME TO ROLL EARLY!

VOLUME AND OPEN INTEREST : I THINK IF SHORT FUTURES THIS WILL ONE TIME TO ROLL EARLY! "THIS IS MY TAKE" ON THE CURRENT HIGH VOLUME AND OPEN INTEREST INCREASE, I'D HAPPY TO BE CORRECTED.

**CERTAINLY IF YIELDS CONTINUE TO RISE**

US 10YR HAS WITNESSED THE GREATEST VOLUME LEAP SO MAYBE THE ONE TO

WATCH- ROLL AT THE EARLIEST OPPORTUNITY.

OPEN INTEREST LEVELS WITNESSED SOME "REASONABLE" CHANGES LAST YEAR BUT ARE NOW ON THE INCREASE AS WE SEE FUTURES MOVE LOWER. THE ADDED "KICKER" IS THE SIZEABLE VOLUME JUMPS WE HAVE SEEN HIGHER THAN PREVIOUS ROLL PERIODS.

"MY READ ON THIS IS THAT THE LOWER BONDS GO ASSISTED BY HIGH VOLUME THEN THE DEMAND TO ROLL SHORT POSITIONS INTO JUNE CONTRACTS WILL BE SIGNIFICANT".

OPEN INTEREST SUFFERED A SIGNIFICANT DROP SINCE MANY NATURAL REAL MONEY "LONGS" TOOK PROFITS (MARCH 2020).

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris