**PLEASE READ** BONDS YIELDS AND VOLUMES : ITS NOW OR NEVER FOR YIELDS TO HEAD HIGHER, WE HAVE SO MANY LEVELS “IN PLAY”!

BONDS YIELDS AND VOLUMES : ITS NOW OR NEVER FOR YIELDS TO HEAD HIGHER, WE HAVE SO MANY LEVELS “IN PLAY”! ITS SHOULD HAPPEN TODAY GIVEN THE NUMBER OF LEVELS BEING TESTED.

US 30YR YIELD IS TESTING A KEY 38.2% RET SUPPORT AT 1.7533.

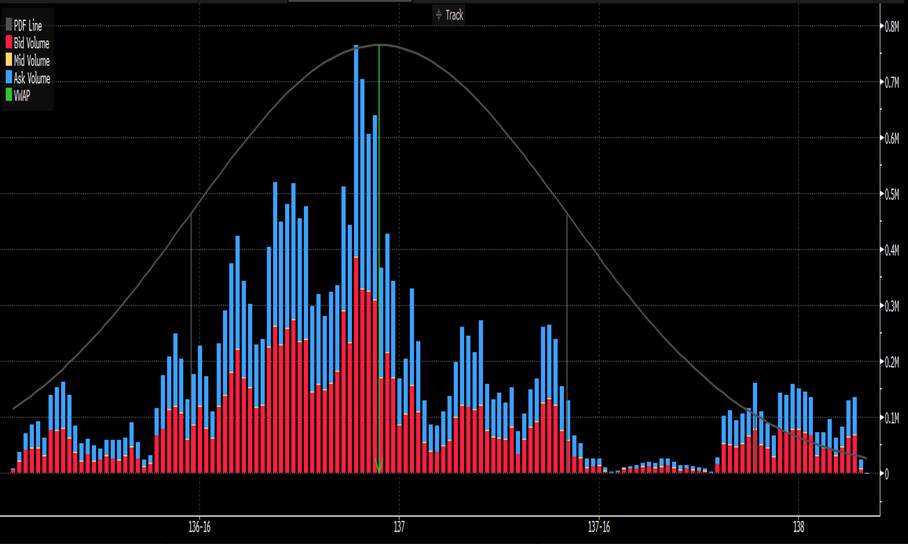

US 10YR FUTURES ARE FAILING THEIR 50 DAY MOVING AVERAGE 137-18.

THE DAILY RSI’S ARE NOW VERY MUTED.

THIS PAUSE DOES NOT DETRACT FROM THE OVERALL YIELD HIGHER CALL.

THE MONTHLY CHARTS STILL FORECAST MUCH HIGHER YIELDS FOR THE ENTIRE YEAR!

**DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

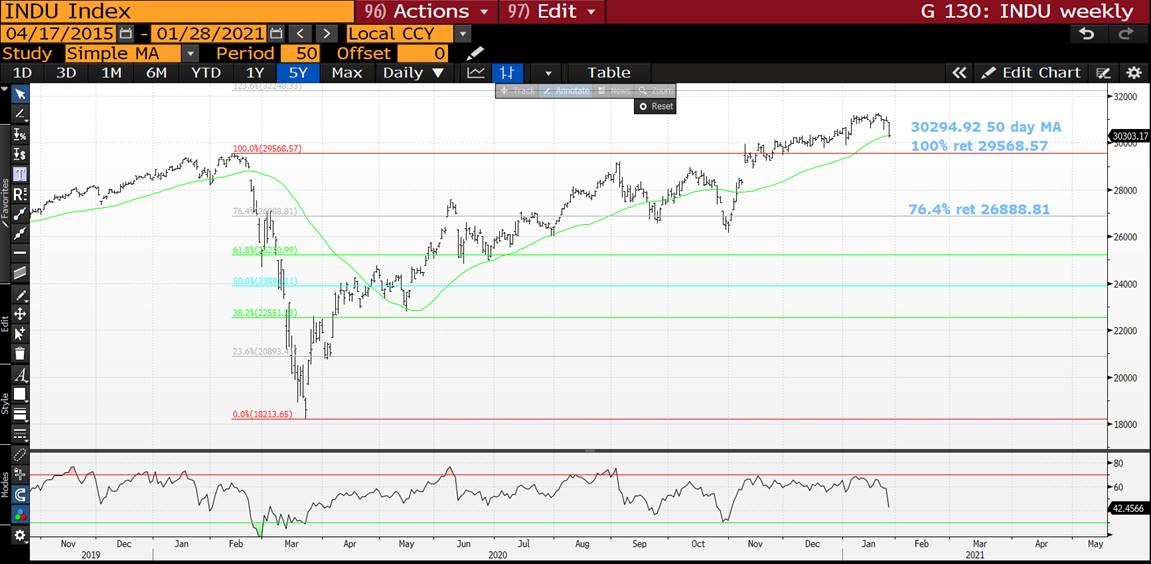

STOCKS : A DIP YESTERDAY BREACHING SOME 50 DAY MOVING AVERAGES BUT HARD TO GET CARRIED AWAY GIVEN WE NEVER SEEM TO FOLLOW THROUGH.

STOCKS : A DIP YESTERDAY BREACHING SOME 50 DAY MOVING AVERAGES BUT HARD TO GET CARRIED AWAY GIVEN WE NEVER SEEM TO FOLLOW THROUGH.

THE DAILY RSI'S ARE ALL NOW VERY OVER BOUGHT.

THE RUSSELL WEEKLY CHART HAS A VERY DISLOACTED RSI SIMILAR TO EARLY 2020.

I DO BELIEVE WE WILL ONLY SEE THE REAL ECONOMIC IMPACT NEXT YEAR.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

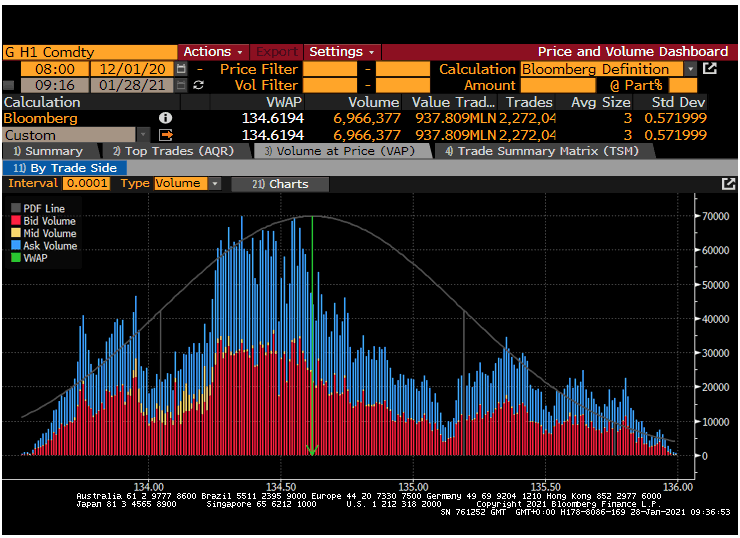

MICROCOSM: GILTS > G H1 Poised to Break Higher

GILTS > G H1 Chart

> Last night's VAP chart highlighted the volume zone between 134.25 and 134.65 as a key support/ resistance area.

> Since the start of '21, open interest has been rising steadily after the Dec balance sheet cut. With G H1 now 134.90, much of that exposure is well below here - good news for the bulls but not great for the bears.

> With the FED still quite dovish and the ECB keeping another rate cut on the table (back door EUR mgmt?), the market's assuming the MPC will fall into line and also bang the dovish drum next week by officially putting neg rates on the table.

> Daily chart below shows we're poised to take out a key resistance level that's supported by the 5/20day MA crossing to the upside.

> Despite the front-end support a cut to neg rates provides, we're seeing this move as generating more bull flattening as we've done this am. Next Tuesday's 31s and 71s taps should be well supported...

UKT bull flattening this am…

Keep an eye on this area - a break opens the door for a move to 135.50...

More soon…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

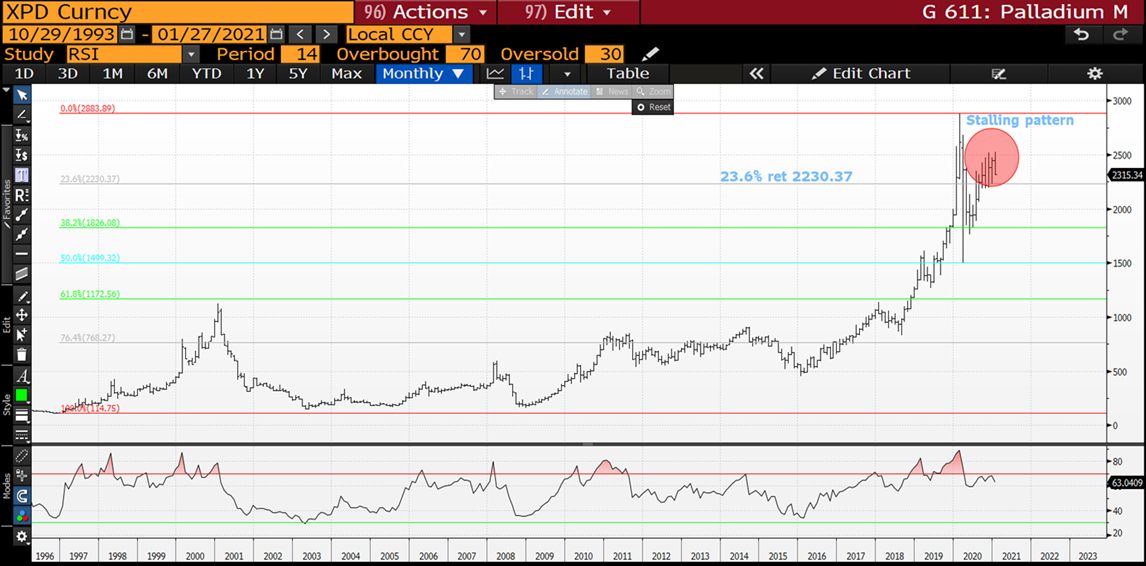

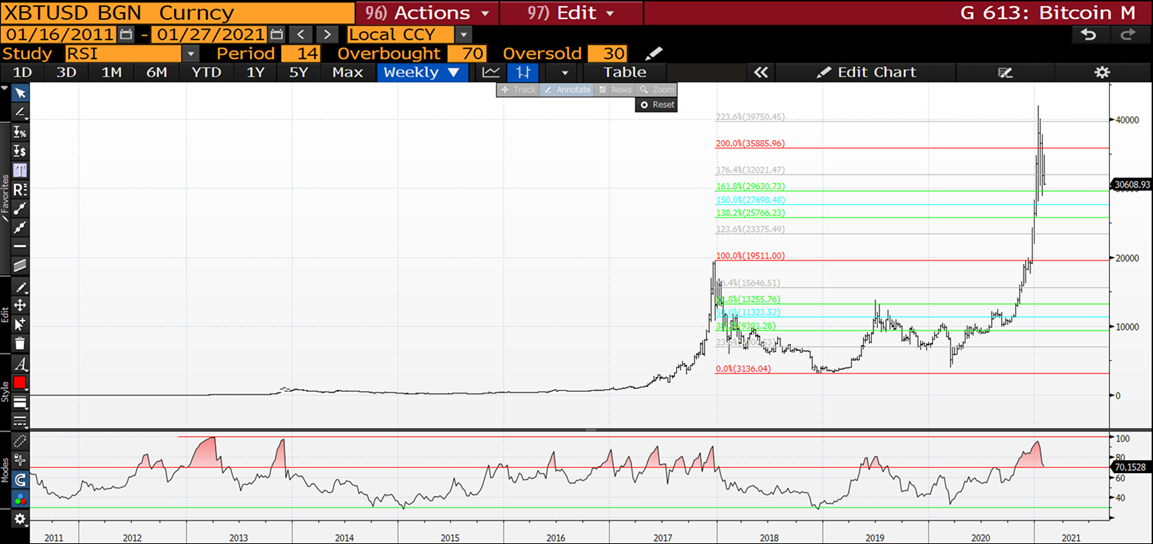

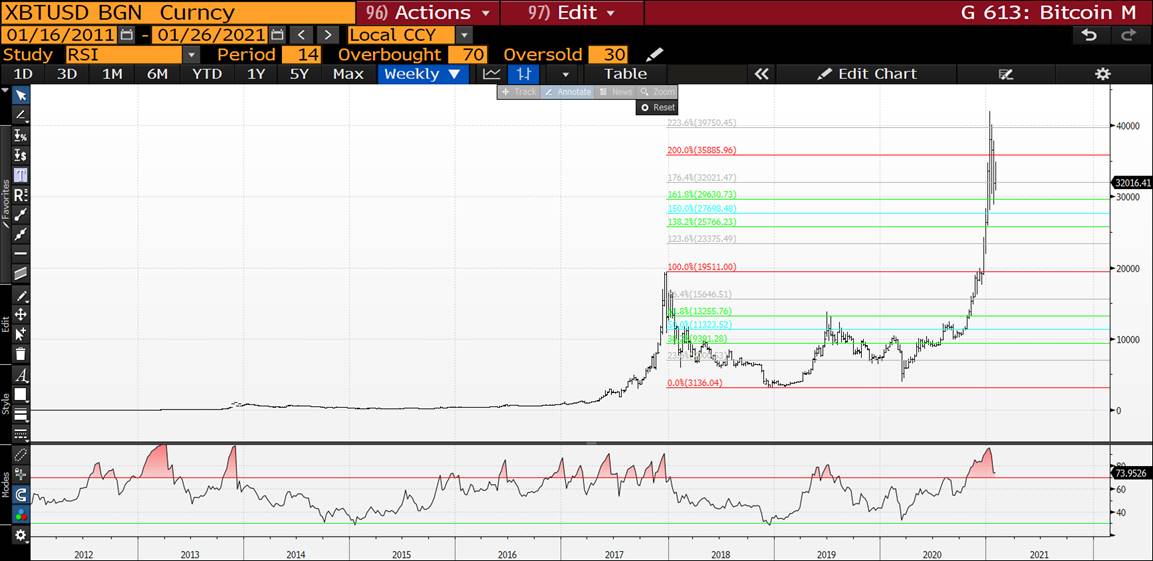

SPECIAL CRB, METALS AND BITCOIN : I HAVE CHOSEN TO UPDATE THIS PREVIOUS PIECE GIVEN WE SHOULD BE LOOKING AT “MAJOR” LONGTERM PRICE DROPS IN ALL OF THE ABOVE!

SPECIAL CRB, METALS AND BITCOIN : I HAVE CHOSEN TO UPDATE THIS PREVIOUS PIECE GIVEN WE SHOULD BE LOOKING AT “MAJOR” LONGTERM PRICE DROPS IN ALL OF THE ABOVE!

AS SOMEONE MENTIONED TODAY THIS COULD BE AN “ALL OR NOTHING” FIRST QUARTER SO WORTH BEARING IN MIND WHERE SOME OF THESE CONTRACTS ARE HISTORICALLY!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

US BREAKEVENS, METALS AND BITCOIN : BREAKEVENS CHARTS ARE POISED TO FINALLY FORM THE “TOP” THAT HAS ILLUDED THE DISLOCATED RSI’S.

US BREAKEVENS, METALS AND BITCOIN : BREAKEVENS CHARTS ARE POISED TO FINALLY FORM THE “TOP” THAT HAS ILLUDED THE DISLOCATED RSI’S. (THIS WITH THE CHANGES IN BONDS).

**ALL 3 DURATIONS OF CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

I HAVE ENCLOSED SOME OF YESTERDAYS COMMODITY-METALS CHARTS GIVEN THEY LOOK TO BE “CRACKING” TODAY!

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI’S LOOK HISTORICALLY LOFTY AND ADDITIONALLY MOVING AVERAGE RESISTANCE.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

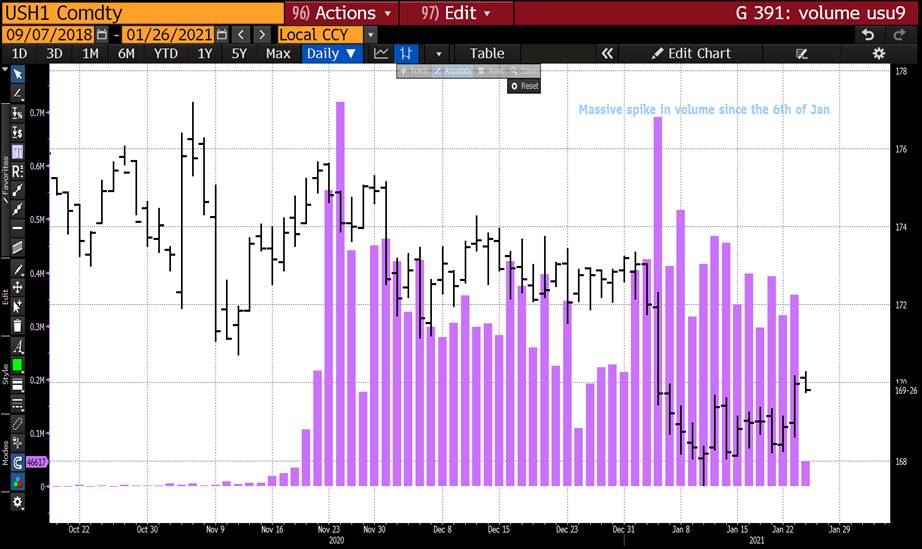

SWAPS IDEA EUUS1020 INDEX : WE ARE EDGING CLOSER TO CONFIRMING A MULTI-YEAR TOP!

SWAPS IDEA EUUS1020 INDEX : WE ARE EDGING CLOSER TO CONFIRMING A MULTI-YEAR TOP! IT HAS TAKEN TIME BUT WE ARE BREACHING ALL THE RIGHT LEVELS.

IDEALLY THE WEEKLY CLOSE IS BELOW THE 2010 HIGH OF 169.8800.

** DUE TO THIS ONLY BEING AVAILABLE AS A LINE CHART SOME OF THE WEEKLY HIGHS ARE DIFFERENT TO THE DAILY PEAKS**

THIS DOES NOT TAKEAWAY FROM THE FACT THAT THIS IS A RARE OCCURANCE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

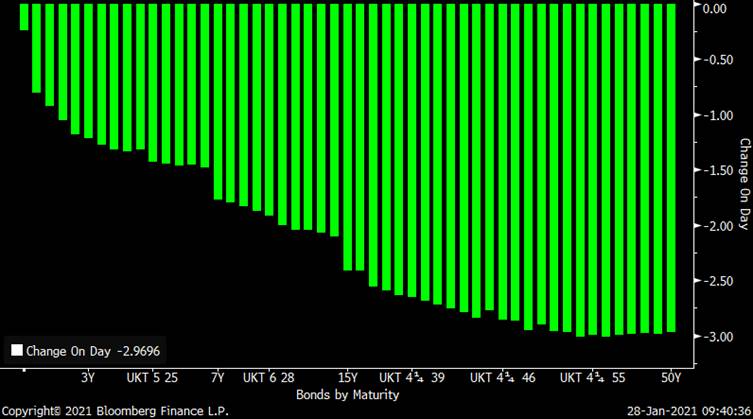

BOND FUTURES AND VOLUMES : BONDS HAVE RECOVERED “SOME” GROUND BUT WE ARE STRAIGHT INTO SOLID RESISTANCE.

BOND FUTURES AND VOLUMES : BONDS HAVE RECOVERED “SOME” GROUND BUT WE ARE STRAIGHT INTO SOLID RESISTANCE. THE FUTURES 50 DAY MOVING AVERAGES HAVE BEEN STAUNCH RESISTANCE PREVIOUSLY AND NEED TO WORK NOW!

THE DAILY RSI’S ARE VERY MUTED.

ONE ADDITIONAL AND MAJOR PROBLEM IS WE ARE ABOVE THE SIZEABLE VOLUME FROM EARLY JANUARY SO NEED TO FAIL THROUGH THAT VOLUME BARRIER INTO MONTH END.

THE MONTHLY CHARTS STILL FORECAST MUCH HIGHER YIELDS FOR THE ENTIRE YEAR!

**DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades & Fades - James & Will @Astor Ridge

EU (SURE) Supply next week – 7y and 10y – New Issues

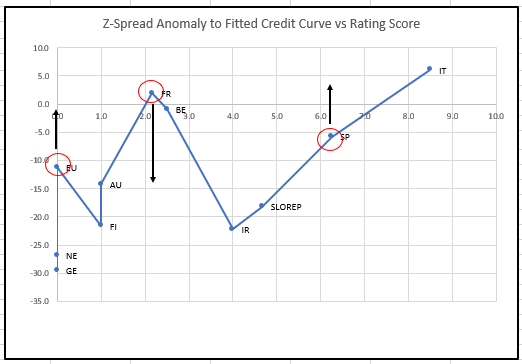

30y EU trades rich like other High Credit Quality names

Graph – 30y Europe: Z-Spread to Interp. Germany vs Credit Score*

*Credit score uses Ratings and outlook from three agencies: Germany is not included in weighting the fit

x-axis: credit score

y-axis: z-spread vs interpolated Germany

Trade 1 – Long France 30y, Short EU and Spain 30y

Trade is starting to work

Level

Current: +14.1bp

Target: < +8bp

Cix:

100*(yield[FRTR 1.5 05/25/50 Govt]-0.8*yield[EU 0.3 11/04/50 Govt]-0.2*yield[PGB 4.1 02/15/45 Govt])

Weightings:

(as per shape of fitted credit curve)

80 / 100 / 20

Rationale

- EU will continue to be a large Issuer and is rich

- France has got through the 50y syndication

- France trades Cheap

- Spain not really cheapening with deterioration in Italy spread and starts to look rich

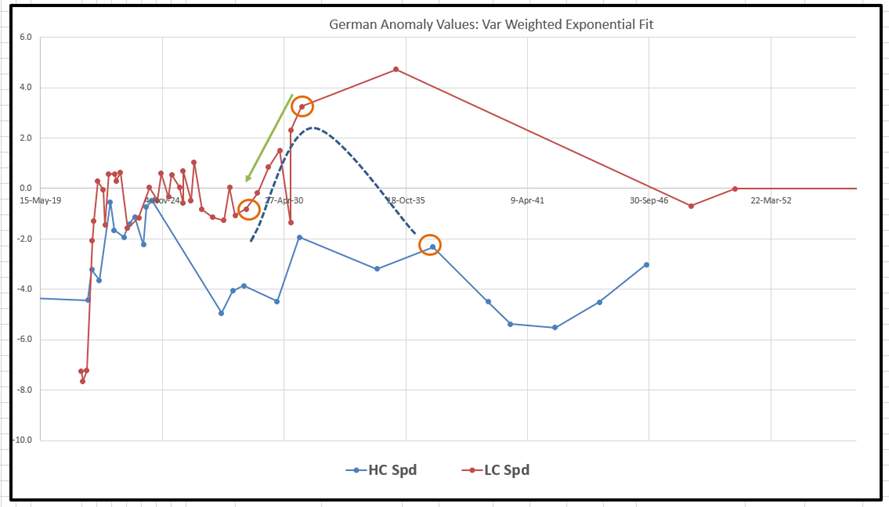

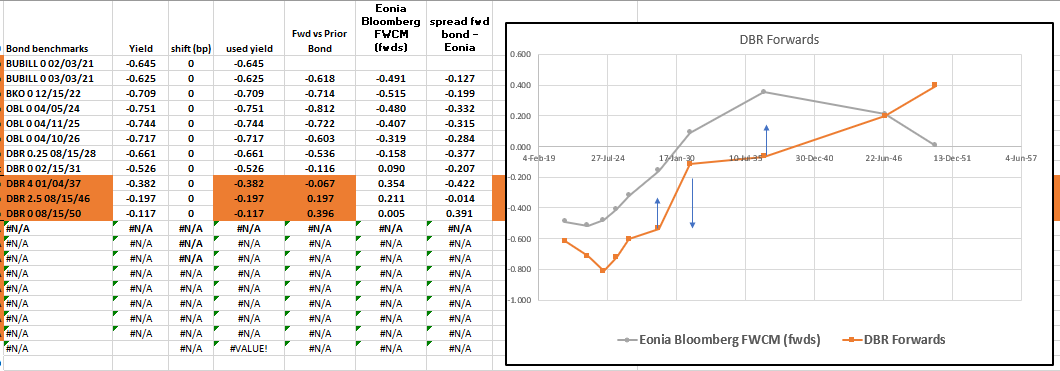

Germany 10y 0% Feb31 supply next week

German Feb31s and 35s are top of the anomaly to the fitted curve

*curve fit to var weighted smooth yields

Graph – German Anomaly Values vs fitted curve

Cix:

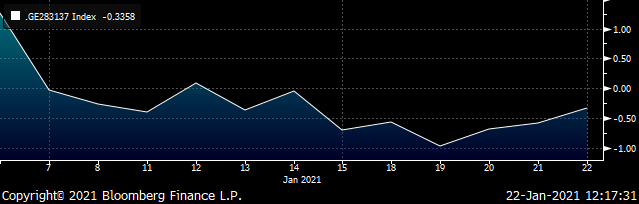

(2 * YIELD[DBR 0 02/15/31 Corp] - YIELD[DBR 0.25 08/15/28 Corp] - YIELD[DBR 4 01/04/37 Corp]) * 100

Levels

Current: -0.3bp

Enter: 0.5bp (33% risk)

Add: +2.5bp (67% risk)

Target: -3bp

Graph –Actual German Forwards

Rationale

- Dbr 0% Feb 31 is best point in forwards give absolute value and forwards roll

- Supply is being discounted via this mechanism

- Aug 28 rolls into the 7y segment – new Dbr Nov 2028 7y coming on April 28th

- Dbr 37s rolls towards the 15y point – New 15y Dbr May 2036 on March 3rd

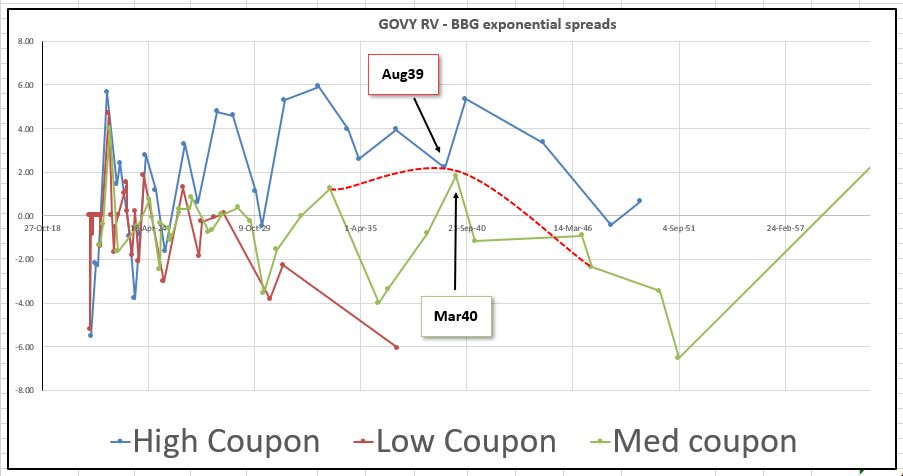

Btps High / Low coupons have almost converged

In some sectors when we discount all the cashflows using a BTP zero coupon curve , we find almost no true premium for low price bonds, which suffer less in an exogenous shock to the BTP curve

With Conte risking an election this is a good time to access default / redenomination trades on long tenors for close to zero premium

Buy Btps 3.1 Mar40 Sell Btps Aug39

Levels

Current: +7bp

Enter: +6.8bp

Target: +2bp

Graph – BBG govt exponential Spline spreads – cashflows fully discounted to Italian theoretical curve

Rationale

- On a fully discounted cash-flow basis the Mar40 are ‘fair’ to the higher coupon Btps Aug39 – this represents close to zero premium for Low coupon vs High coupon

- Mar 40 are no longer the tap bond 20y and roll to a richer medium segment of the curve

- Aug39 are high coupon and roll towards cheaper Btps Feb37

- Spread is close to it’s all time wide

- The trade is an extension in modified duration terms of 1.5 yrs – we favour flatteners in a weak credit environment

Spread History

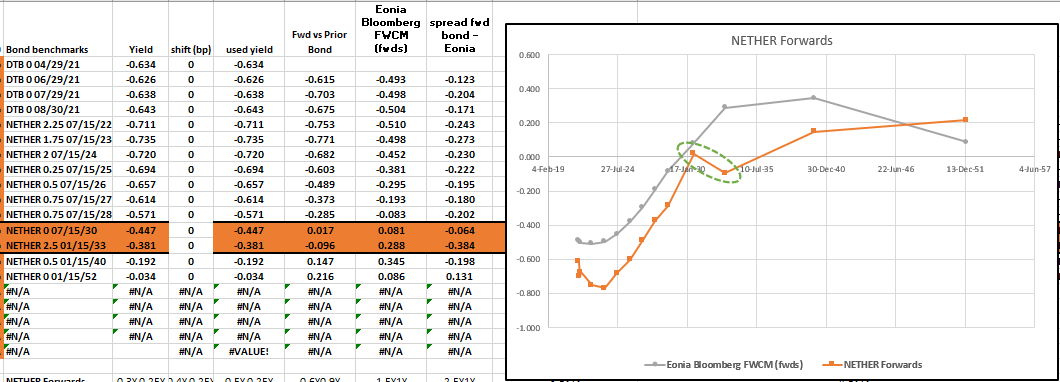

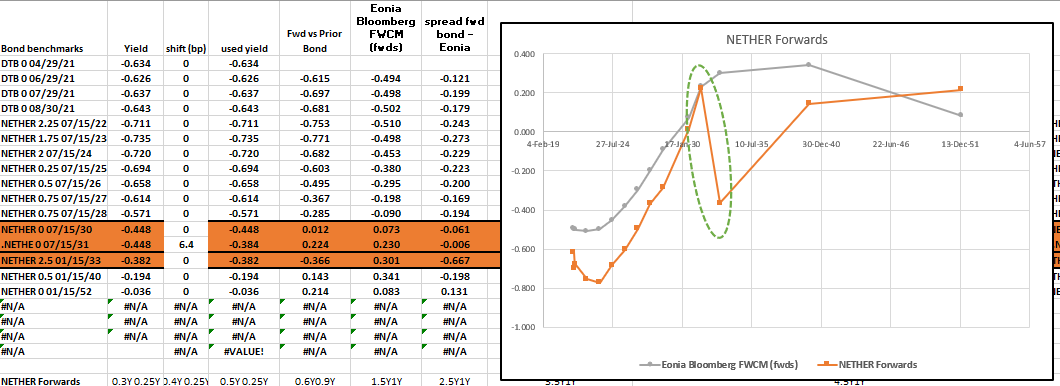

Holland

Nether: new 10y announced – Nether Jul 31s € 4-6 bln

Coupon TBA Feb 8th 2021 DTSA:

https://english.dsta.nl/news/news/2021/01/20/new-10-year-benchmark-bond-reopening-dsl-2025-and-update-issuance-calendar-first-quarter-2021

The discount in New 10yrs makes 12y look rich

Nether 2.5% jan33 already look rich to the Nether 30 – see forwards graph….

If we add in the new Nether jul31 at a spread of +6.4bp (equal to the old roll of nether 29s/30s) – we can see how the 33s look even richer to the new 31s….

Trade:

Nether Buy outgoing 10y / Short Nether 33

current level -6.6bp

enter: -7bp

Target: -11bp

Rationale

- The old ten yr rolls down the curve

- The new issue even at the old roll spread will avail the 33’s as rich

Any other thoughts and questions pls give us a call

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

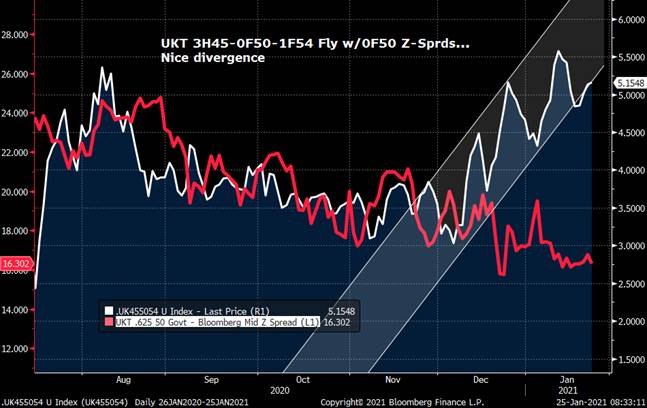

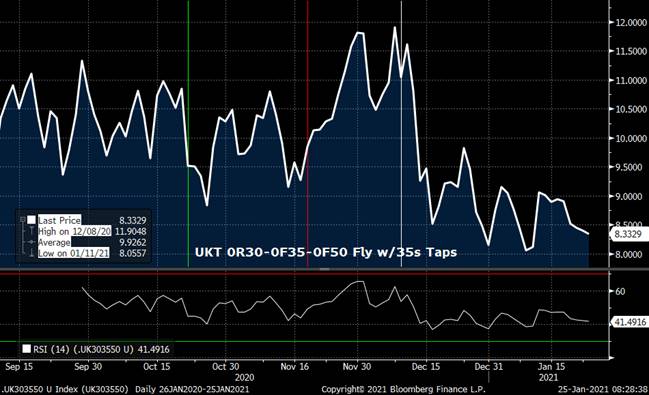

MICROCOSM: GILTS > UKT 0F35s/0F50s Tap Tomorrow - Quick Rundown

GILTS > Quick Thoughts

> 0F35 & 0F50s taps tomorrow are this week's main risk event in the conventional Gilts market. The £2.5bn 35s and £1.75bn 50s are close to 70,000 G H1 equivalents so expect a bit of last minute jockeying on the curve by the GEMMs to make room for them.

> As noted in our rundowns last week, the 0F50s look cheap to us on flies like 45-50-54s, having given back the .5bp post-46s richening by the end of the week. At £26.3bn we're closing in on the end of their cycle.

> The 0F35s have traded relatively well, showing few signs of the sharp cheapening we saw into their last tap on Dec 9th. There's a tap of them every month this qtr as we build from their £16bn total. With the 0R30-0F35-0F50 fly (our core posn) at +8.4bps mid (just .2bp off their richest level), they're holding in well on the curve.

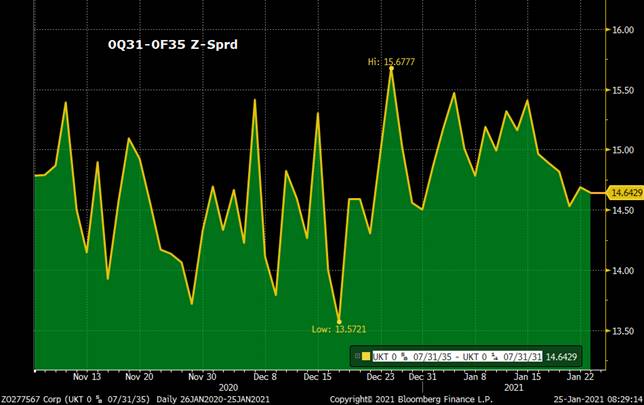

> The 0Q31-0F35 Z-sprd has flattened 0.9bps in the last 3 days with the range low 13.5bps. We're watching this sprd closely, not just for a chance to buy the 35s cheaply but because the 31s will be tapped next week and could generate some selling into the event.

UKT 0F50-DBR 0 8/52 sprd has been capped at +100bps for most of the last 2 months so with the sprd at +98.25bps, location looks good here to add to long UKTs. Long-end supply in Europe this week is relatively light with the exception of the EU SURE deal (TBC).

More to come...

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

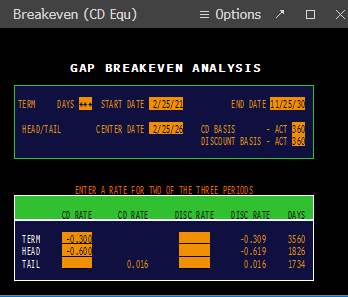

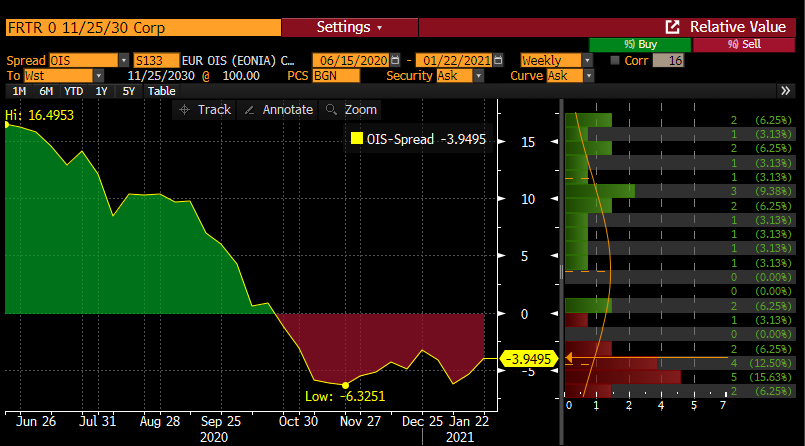

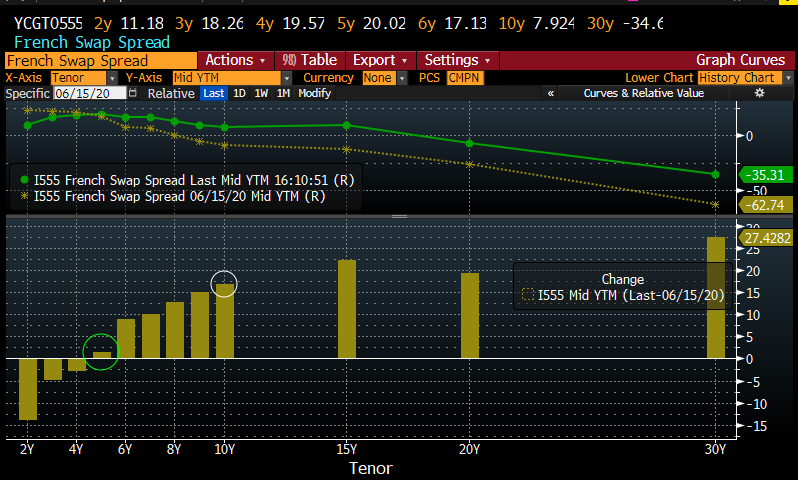

French 10yr Spreads Expensive - Best Expression - Pay Spread in 5y5yfwd.

Trade: Buy 2/26 OAT 100m, Sell 11/30 OAT 100m – Net DVO1 Short Risk Eur 48,700

REC 5y5yfwd in OIS(eonia) DV01 Risk Long Eur 48,700

Forward Yield implied on bond side: +0.016bps

Forward Yield of Swap: -0.023bps

Forward Spread implicit 5y5y: +0.039bps

Spot 10y Spread Ref: Invoice OATH1 at -7.0bps

Carry Bond side 1x1 notional: Negative 0.28bps/Month

Carry/Roll Swap: Positive 0.8bps/Month(current 5y5yfwd -0.0265 vs 5y4yfwd -0.133)

Net Carry Positive 0.52bps/Month

Rational:

- 10y French Spreads at long term wides(ie Bonds expensive to OIS)

- 5/10y Curve Flat in both Yield and in ASW spread, move over last 6mos has seen sharp move in Spread curve

- Looking at the trade in forward terms improve funding of the trade from negative to positive.

- French ASW is function of two spreads: a) Bund Spreads, plus b) OAT vs Bund country spread, and while bund

spreads can be volatile in the short run, I believe longer term spreads will go the direction of Deficits. Also

10y OAT vs Bund spread at or near historical lows over the last decade. - Seasonal input from Jan/Feb given large issuance, generally favours lower rates and tighter spreads s/t to be followed by

wider spreads in the second half of the quarter. - France continues to be the largest net issuer of Debt in EGB space for many years running. Also new big competitor in town – EU.

Risk:

* PEPP and continued liquidity push keeps rates low and stable acting as a compressor of all EGB bond yields. More PEPP?

- The DMO looks to shorten the duration of their issuance and we see increased supply in the short end in 2021.

- ECB enters into a period of YCC to suppress long rates from rising and intentionally flattens the curve.

Entry: +0.039bps

Add: 0.00bps

Stop: -0.01bps

Target: +20.0bps

See Supporting Charts Below:

Generic 5y5yfwd France vs 5y5yfwd OIS – Long History as a guide for Trade Specific.

Gap Analysis for Implied Forward rate France 2/26 vs 11/30

Long Term Level of OAT Invoice Spreads vs OIS

Move in 10y 11/30s vs OIS since June.

Change in French ASW Spreads over 6mos

Happy to discuss.

Creo