Trades & Fades - James & Will @Astor Ridge

EU (SURE) Supply next week – 7y and 10y – New Issues

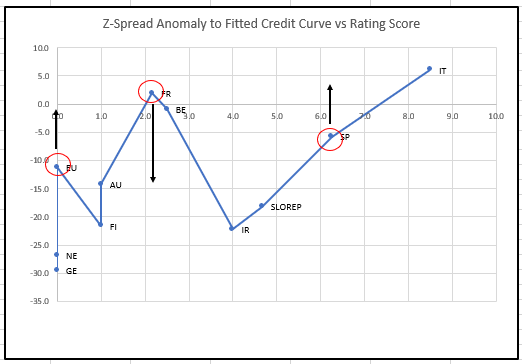

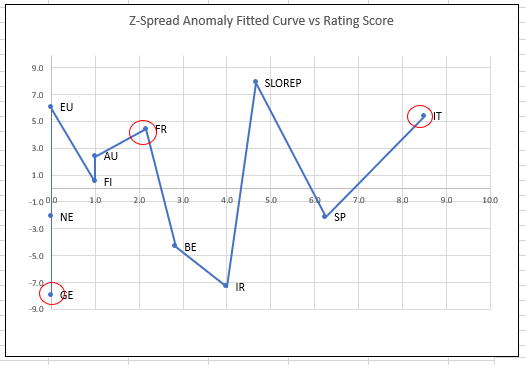

30y EU trades rich like other High Credit Quality names

Graph – 30y Europe: Z-Spread to Interp. Germany vs Credit Score*

*Credit score uses Ratings and outlook from three agencies: Germany is not included in weighting the fit

x-axis: credit score

y-axis: z-spread vs interpolated Germany

Trade 1 – Long France 30y, Short EU and Spain 30y

Trade is starting to work

Level

Current: +14.1bp

Target: < +8bp

Cix:

100*(yield[FRTR 1.5 05/25/50 Govt]-0.8*yield[EU 0.3 11/04/50 Govt]-0.2*yield[PGB 4.1 02/15/45 Govt])

Weightings:

(as per shape of fitted credit curve)

80 / 100 / 20

Rationale

- EU will continue to be a large Issuer and is rich

- France has got through the 50y syndication

- France trades Cheap

- Spain not really cheapening with deterioration in Italy spread and starts to look rich

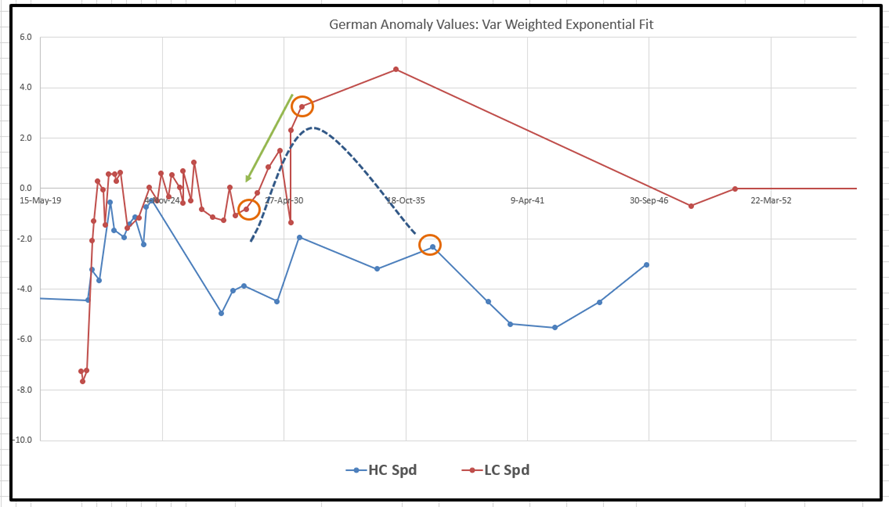

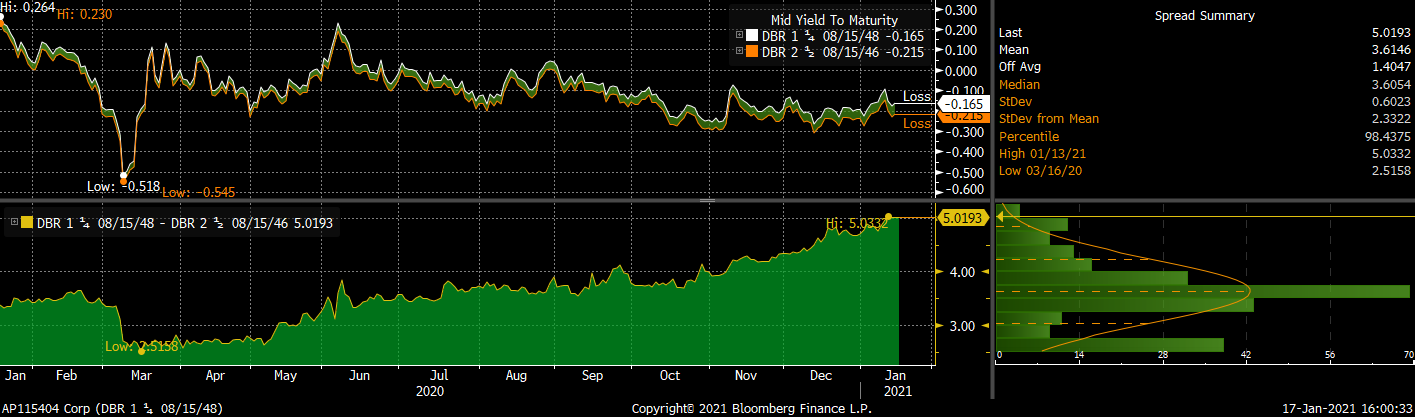

Germany 10y 0% Feb31 supply next week

German Feb31s and 35s are top of the anomaly to the fitted curve

*curve fit to var weighted smooth yields

Graph – German Anomaly Values vs fitted curve

Cix:

(2 * YIELD[DBR 0 02/15/31 Corp] - YIELD[DBR 0.25 08/15/28 Corp] - YIELD[DBR 4 01/04/37 Corp]) * 100

Levels

Current: -0.3bp

Enter: 0.5bp (33% risk)

Add: +2.5bp (67% risk)

Target: -3bp

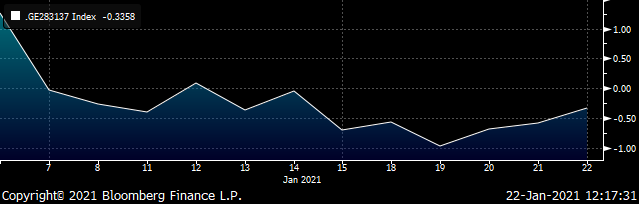

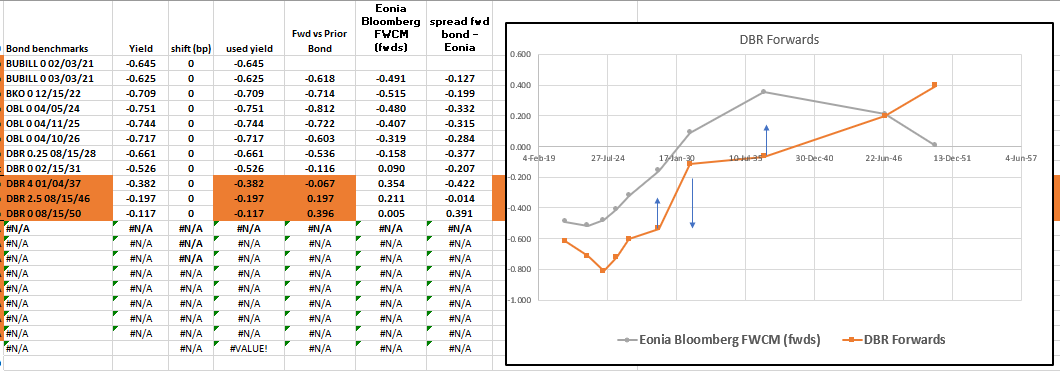

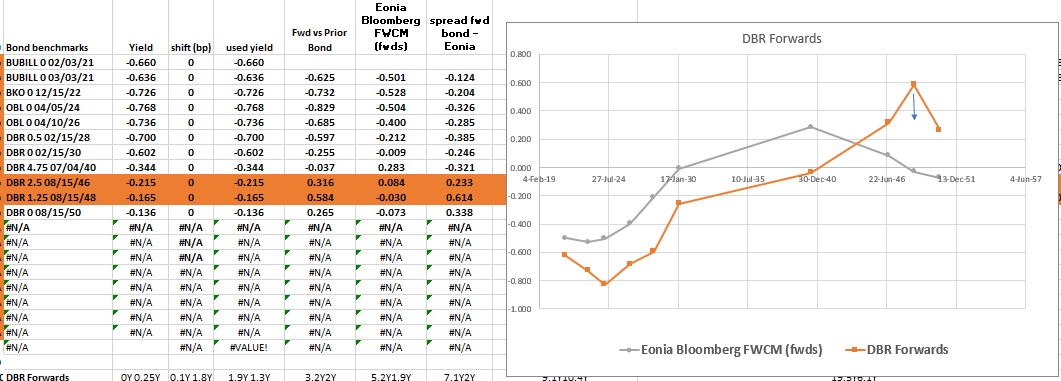

Graph –Actual German Forwards

Rationale

- Dbr 0% Feb 31 is best point in forwards give absolute value and forwards roll

- Supply is being discounted via this mechanism

- Aug 28 rolls into the 7y segment – new Dbr Nov 2028 7y coming on April 28th

- Dbr 37s rolls towards the 15y point – New 15y Dbr May 2036 on March 3rd

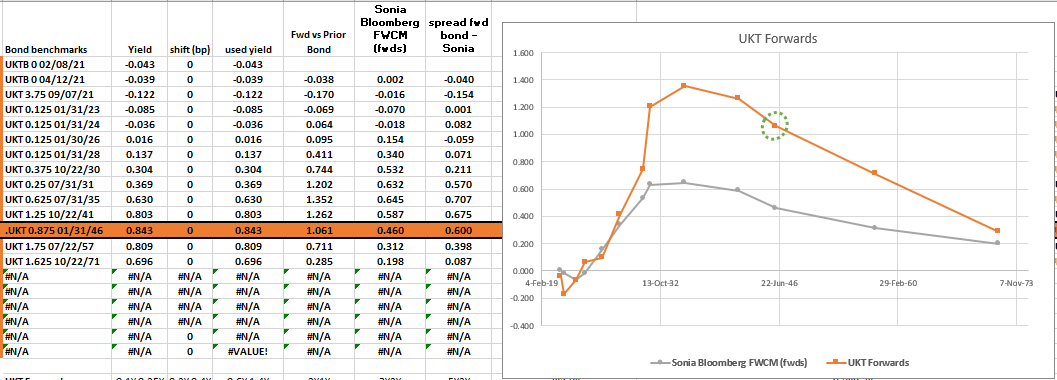

Btps High / Low coupons have almost converged

In some sectors when we discount all the cashflows using a BTP zero coupon curve , we find almost no true premium for low price bonds, which suffer less in an exogenous shock to the BTP curve

With Conte risking an election this is a good time to access default / redenomination trades on long tenors for close to zero premium

Buy Btps 3.1 Mar40 Sell Btps Aug39

Levels

Current: +7bp

Enter: +6.8bp

Target: +2bp

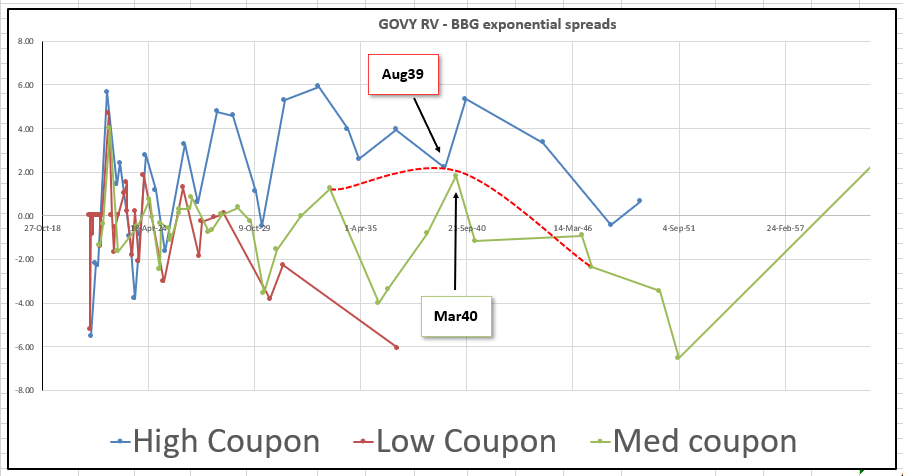

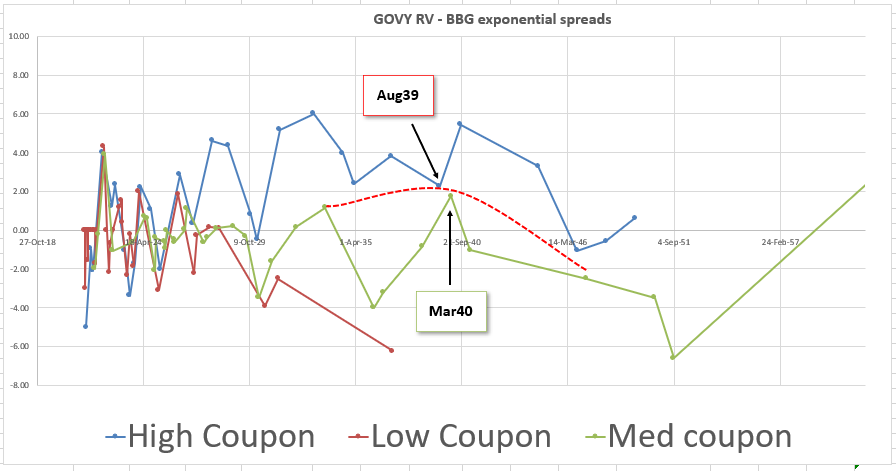

Graph – BBG govt exponential Spline spreads – cashflows fully discounted to Italian theoretical curve

Rationale

- On a fully discounted cash-flow basis the Mar40 are ‘fair’ to the higher coupon Btps Aug39 – this represents close to zero premium for Low coupon vs High coupon

- Mar 40 are no longer the tap bond 20y and roll to a richer medium segment of the curve

- Aug39 are high coupon and roll towards cheaper Btps Feb37

- Spread is close to it’s all time wide

- The trade is an extension in modified duration terms of 1.5 yrs – we favour flatteners in a weak credit environment

Spread History

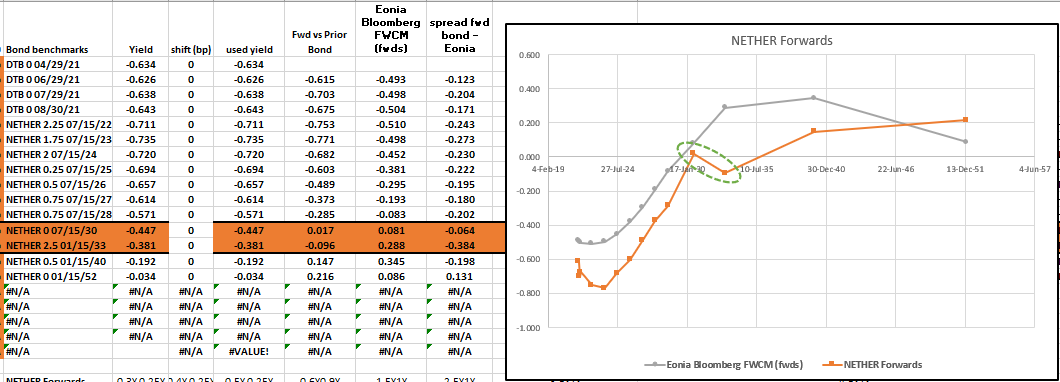

Holland

Nether: new 10y announced – Nether Jul 31s € 4-6 bln

Coupon TBA Feb 8th 2021 DTSA:

https://english.dsta.nl/news/news/2021/01/20/new-10-year-benchmark-bond-reopening-dsl-2025-and-update-issuance-calendar-first-quarter-2021

The discount in New 10yrs makes 12y look rich

Nether 2.5% jan33 already look rich to the Nether 30 – see forwards graph….

If we add in the new Nether jul31 at a spread of +6.4bp (equal to the old roll of nether 29s/30s) – we can see how the 33s look even richer to the new 31s….

Trade:

Nether Buy outgoing 10y / Short Nether 33

current level -6.6bp

enter: -7bp

Target: -11bp

Rationale

- The old ten yr rolls down the curve

- The new issue even at the old roll spread will avail the 33’s as rich

Any other thoughts and questions pls give us a call

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

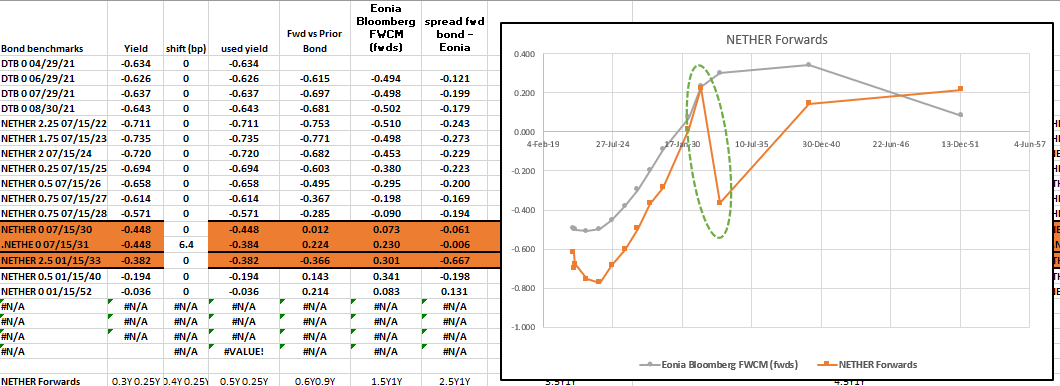

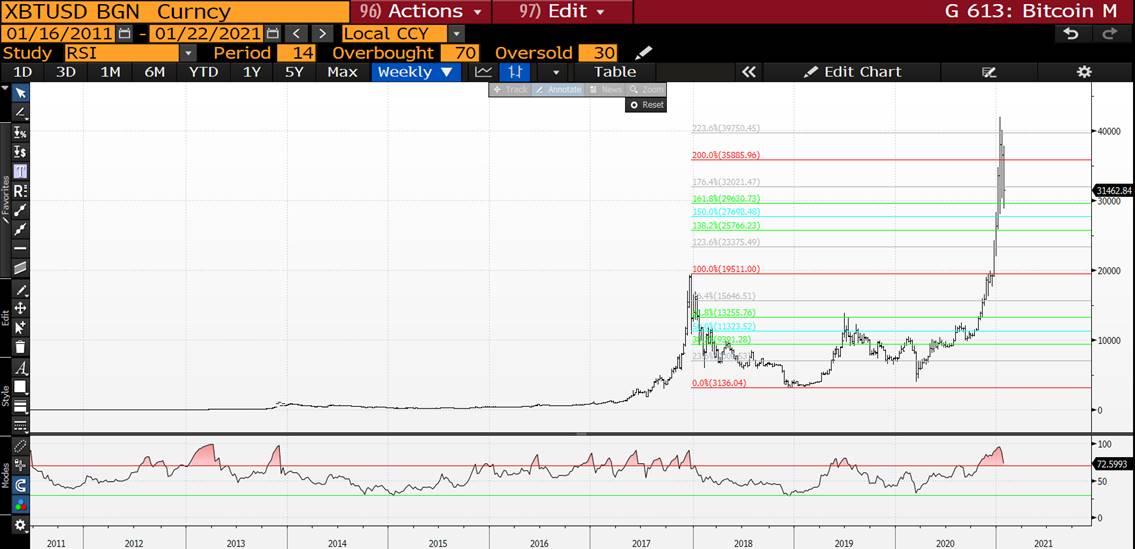

US BREAKEVENS, METALS AND BITCOIN : ALTHOUGH BREAKEVENS HAVE MOVED HIGHER THEY CONTINUE TO REMAIN VERY MUCH ON BORROWED TIME!

US BREAKEVENS, METALS AND BITCOIN : ALTHOUGH BREAKEVENS HAVE MOVED HIGHER THEY CONTINUE TO REMAIN VERY MUCH ON BORROWED TIME!

**MIGHT SOUND LIKE A BROKEN RECORD BUT WE HAVE TO FAIL EVENTUALLY GIVEN THE RSI EXTENSIONS ACROSS ALL DURATIONS.**

I HAVE ENCLOSED METALS AND BITCOIN CHART, GIVEN THEY LOOK TO BE "CRACKING"!

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI'S LOOK HISTORICALLY LOFTY AND ADDITIONALLY MOVING AVERAGE RESISTANCE.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Lagarde/ECB and EUR + Yield Curve

Lagarde Update: My Take

* Went out of her way to highlight persistent low and even lower inflation then they would like to see. In part, a return to target is going to take longer.

* No Targeting of spreads nor any form of YCC, but EPPs flexibility and large unused envelope gives

them lots of room to fight on two fronts: a) unnecessary fragmentation and b) rise in term premium ie supression of long rates and volatility of rates.

* Monetary conditions tightening - it is difficult for Monetary policy alone to respond to the financial condition within Europe right now -

hence - PLEASE HELP MORE ON THE FISCAL FRONT

* The EUR is clearly on their minds right now and a sticky issue because they do not want to be held hostage to its moves, but clearly the

Euros strength has impacted future expectations for growth and INFLATION.

******************************************************************************************************************************

SO what can the ECB do to solve for lifting inflation, weakening the currency(albeit not a vocal strategy) and keeping long yields supressed to benefit long term growth.

Basically how does the ECB sharply lower REAL RATES.

* For me, I would say against all logic, is to lower short rates even more - unimanginable....impact to real rates, lower EUR, Steeper curves while

keeping long bond yields low and stable.

* Bitter pill to swallow and while steepeners may be negative carry, the flip side may not be enough cushion to warrant holding flatteners

while the ECB is faced with such a dilemma.

* Just a thought.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FX UPDATE : THE USD COULD SOON BE IN A LOT OF TROUBLE AS WE APPROACH “VERY” SIGNIFICANT LEVELS PREVIOUSLY TESTED.

FX UPDATE : THE USD COULD SOON BE IN A LOT OF TROUBLE AS WE APPROACH “VERY” SIGNIFICANT LEVELS PREVIOUSLY TESTED. SUB THESE LEVELS ARE MAJOR POCKETS OF “FREE AIR” AND THIS SHOULD AID THE BOND YIELD HIGHER CALL!

THE AUD HAS PAUSED BUT STILL HAS SIGNIFICANT UPSIDE POTENTIAL.

USD MXN IS STILL FINALLY SUB ITS 50 PERIOD MOVING AVERAGE-38.2% RET 19.7005.

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

USDTRY HAS A PERFECT FAILURE AT ITS MAJOR 2001 TRENDLINE 8.0084 AND POISED TO HEAD A LOT LOWER.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

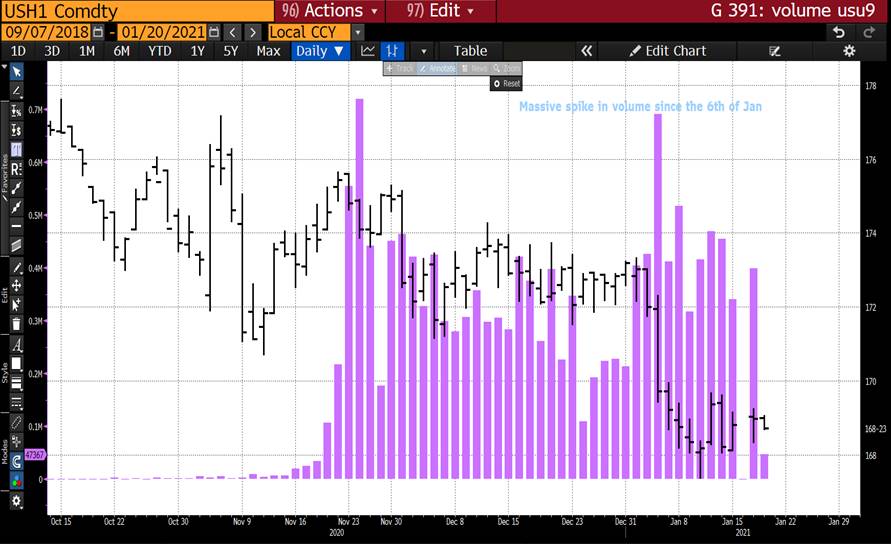

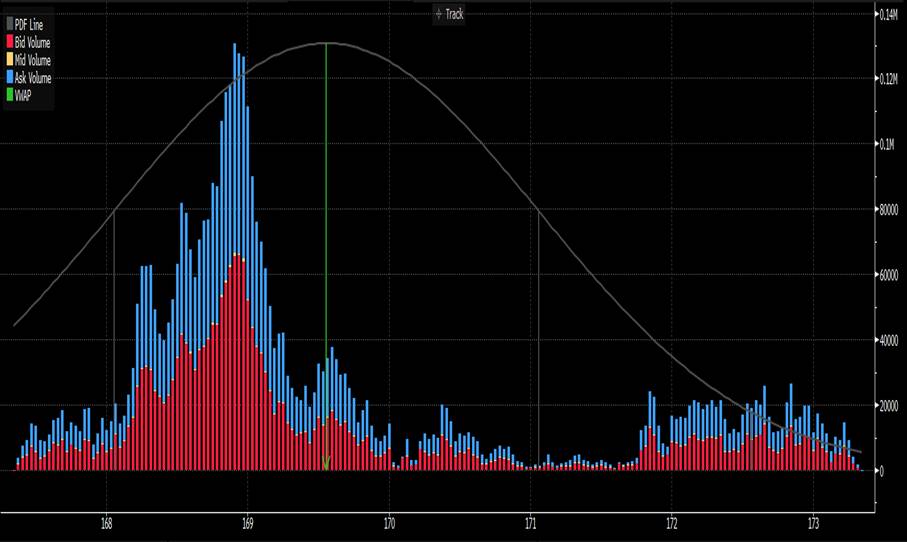

BOND FUTURES AND VOLUMES : IT IS KEY THAT BOND FUTURES START HEADING LOWER FROM HERE GIVEN THAT WE ARE SUB—TEASING BELOW THE “SUBSTANTIAL VOLUME” INITIATED EARLIER IN THE MONTH.

BOND FUTURES AND VOLUMES : IT IS KEY THAT BOND FUTURES START HEADING LOWER FROM HERE GIVEN THAT WE ARE SUB—TEASING BELOW THE “SUBSTANTIAL VOLUME” INITIATED EARLIER IN THE MONTH.

THE DAILY RSI’S ARE NOW VERY MUTED.

THE MONTHLY CHARTS STILL FORECAST MUCH HIGHER YIELDS FOR THE ENTIRE YEAR!

**DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: EU SURE vs EGBs > Where's the Demand?

E-zone> EGBs vs EU SURE

- This BBG Article was posted around 5am today:

EU's Bond Spree Risks Chipping Away at Demand for Members' Debt

- Huge issuance of EU joint paper to create allocation upheaval

- Investors looking to drop French, Belgian debt to make room

- If you missed it, have a quick read. It got me thinking about demand for the EU SURE paper vs EGBs so I asked a friend who trades SSAs at a big bank the following: "When EU paper gets big enough, does it get included in the EGB indexes?"

- Well, I opened up Pandora's Box with this one. On the outside looking in, the EU SURE program doesn't get automatic support from the powerful EGB-indexed real money community who are the EU's target audience. As an off-index bet each purchase of these EU issues requires special permission and plays havoc with their portfolios. As a non-EGB issuer their SSAs are supposed to have ample alpha to make the purchase worthwhile but the AAA rating of the EU SURE program and it's relative liquidity versus most smaller issuers has them trading at spreads that are through OATs and cheap to DBRs. That's hallowed ground that will be tough to hold onto unless their status morphs into a quasi-sovereign issue.

- As the article details, demand for this new EU SURE program is coming from all over the place. Covered bond buyers are shifting some of their risk into EU paper as a more liquid, similarly rated alternative at similar yields. SSA desks are handing over trading of them to EGB desks to be traded alongside OATs and OLOs. Hedge funds are in the wings, waiting for a few more issues to fill in the gaps so they'll have ample liquidity to trade them in size.

- In order for the EU program to be welcomed into the government bond indexes, the index providers have to re-write their rule books to include an issuer that IS a sovereign, technically speaking, only it's an amalgamation of ALL of the EU's issuers. There are a few potential potholes to consider:

o Do the end-users WANT EU bonds in their index? The short answer appears to be a resounding 'YES!' given the ECB's perpetual QE program and its impact on liquidity and volatility. A new, liquid, AAA name that will give them a viable alternative to OATs and DBRs? Why not?

o Do the other EGB issuers want the EU program in the index? This is a little more complicated. The smaller issuers like Ireland, Finland, Austria, Holland and Belgium already have very small weights relative to the majors within these indexes so it's not clear that going from 5% to 2.5% (for example) will make much difference. The EU's program shouldn't change their capital key much so QE demand should remain enough to prevent a material cheapening of their bonds vs DBRs. Perhaps most importantly, however, the funds the SURE program raises will be distributed to ALL the EU nations which in most cases will mean less issuance.

Ø If so, when? Do the index providers wait until there's a viable curve or do they adjust their allocation every month until the curve's fully constructed?

Ø Access to EU SURE bonds… The inaugural SURE syndication broke records for the size of its book, well above Eur 130bn. Despite the enormous demand, much of the market was shut out of the syndication process where the 'easy money' can often be made as the issues tighten post pricing. The article above says the EU SURE program will conduct AUCTIONs to supplement their existing issues. So, a nice syndication followed by taps via auctions. This is not only a more inclusive approach to their issuance but will only improve demand and liquidity, especially among the hedge fund community.

Ø The mere fact that this EU SURE program warrants an email like this one is surely positive for the program and its relevance for the rates market in the years to come. In a back-door way, it could even help keep the European Union from financial collapse altogether. The EU has to be mindful of the crowding out of other issuers, however, for the next year (at least), the ECB will likely buy the OATs that are sold to roll into EU SURE issues. From a relative-value perspective, however, we're looking forward to the opportunities this issuance will provide our clients.

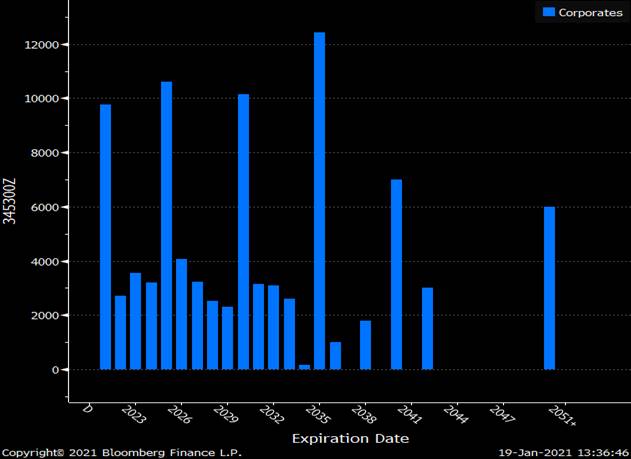

Charts:

Current outstanding EU issues. Expect those gaps to be filled in due course.

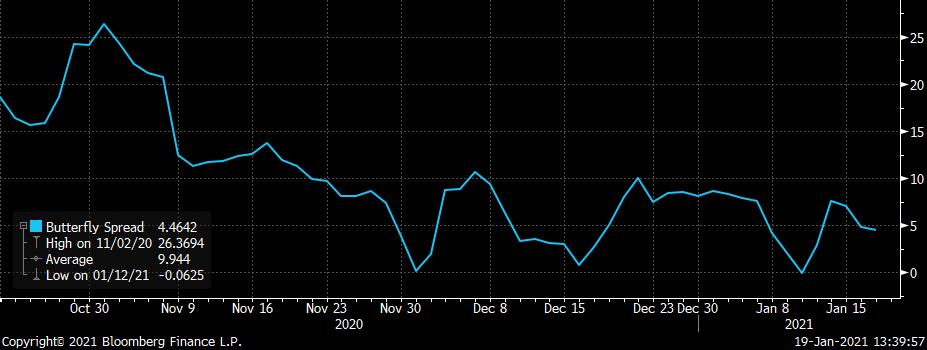

DBR 8/30-EU 10/30-FRTR 11/30 1-2-1 blend is a mere +4.4bps.

More to come.

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

RV Update - James & Will @ Astor Ridge

Hi,

Some thoughts on RV trades

Trade 1

Italy – IK/RX more choppy, loses its momentum

- Long Medium Coupon / Short High Coupon for low Cost of Carry and Longer Time-Value

- Buy Btps 3.1% Mar40, Sell Btps 5% Aug39

Level : +6.8bp

Target: +3.75bp, first level

Graph 1 – Yield spread -Aug39 +Mar40

On a fully Cashflow discounted Basis (BBG Exponential Spline) – the High Coupon Aug39 is at the boundary condition (dotted red line) created by richer, Medium coupons

Graph 2 – BBG exponential spline spreads (cashflows fully discounted to Italian Discount Curve)

Carry

COC -0.4bp / 3mo @-10 repo spread

IF you want to have a go at working this please let us know

If these emails are not your flavour, or indeed you need us to look at other stuff please let us know

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BONDS YIELDS : ALTHOUGH TODAY IS A US HOLIDAY IT STILL RAISES CONCERNS YIELDS COULD BE POISED TO HEAD HIGHER FROM HERE.

BONDS YIELDS : ALTHOUGH TODAY IS A US HOLIDAY IT STILL RAISES CONCERNS YIELDS COULD BE POISED TO HEAD HIGHER FROM HERE. THIS MAYBE THE SHORTEST PAUSE IN HISTORY BUT THERE IS A MONSTER "VOLUME" TREND IN PLAY.

THE DAILY RSI'S ARE NOW VERY MUTED.

THIS PAUSE DOES NOT DETRACT FROM THE OVERALL YIELD HIGHER CALL, BUT POIGNANT TO REDUCE POSITIONING.

THE MONTHLY CHARTS STILL FORECAST MUCH HIGHER YIELDS FOR THE ENTIRE YEAR!

**DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EU Trade Radar , Jan 18th - Jan 22nd - Will & James @Astor Ridge

RV Trades on our Radar for the coming week

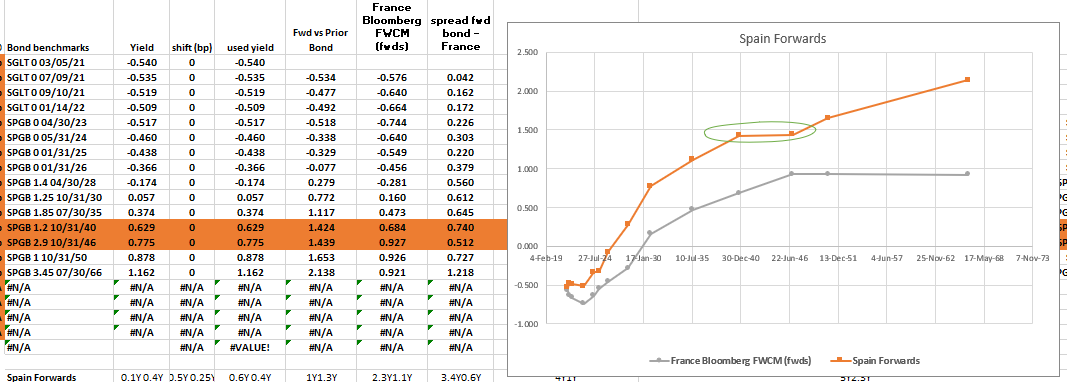

Spain

- Supply on Thursday – 2026, 2027, 2035, 2040

- Has richened as a credit after the heavily subscribed 10y Syndication but did trade much richer last year

As a credit…

Spain vs France (OATH1) & Italy (IKH1)

Graph of long SP vs FR & IT

100*(yield[SPGB 1.25 10/31/30 Govt]-0.5*yield[FRTR 2.5 05/25/30 Govt]-0.5*yield[BTPS 3.5 03/01/30 Govt])

- As a tactical trade, if you’re bearish Spain as a name, we have Finland 9y coming on Tuesday, which offers the chance to dramatically improve credit quality on one side of a credit fly…

Trade Radar 1…

Short Spain, Long Finland and Italy (IKH1) – 9y maturities

The Long, Finland - scarce issuer

The Short, Spain – Large issuer with the need to raise funds even after PEPP is taken into account

Also Long Italy Credit - protect against the ECB being on the buy-path

Graph of long Spain vs short Finland & Italy – we want to get short Spain

cix: 100 * (YIELD[SPGB 1.25 10/31/30 Corp] - 0.5 * YIELD[RFGB 0 09/15/30 Corp] - 0.5 * YIELD[BTPS 3.5 03/01/30 Corp])

Looking for < -1.5 bp to get on board

Trade Radar 2…

On the curve, shortening up looks too flat in terms of forwards -

Our trade is Sell Spgb 46 & Buy Spgb 1.2% 40 (tap bond) – looks totally boring in terms of history but there’s hidden value

Levels:

Current: -14.5 bp

Target: -13.75 bp

Range: -15.5 / -13 bp

Target beyond bottom of Range – the forwards are just plain wrong

Forwards

In France on Thursday, we have supply 2024, 2026, 2028 – € 8,5 – 10 Bln

Not a lot to say here – in France the 28s are a touch rich to the fit (-0.2bp BBG Expo Spline fit) but nothing major

At the margin, I’d be taking France down vs Spain and Germany on a 50/50 weighting but there’s not a lot of var and tough to constrain the trade without a lot of bid/offer

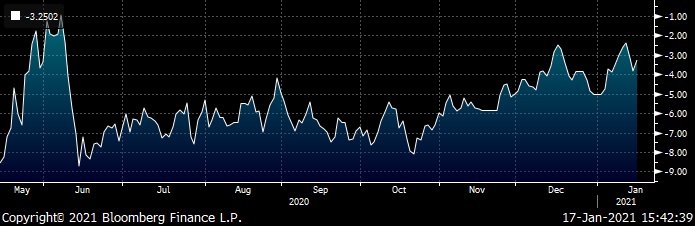

Graph - Long France 28s vs Germany 7y and Spain…

100 * (YIELD[FRTR 0.75 11/25/28 Corp] - 0.5 * YIELD[DBR 0 11/15/27 Corp] - 0.5 * YIELD[SPGB 1.4 04/30/28 Corp])

Current lvl: -3.25 bp

Enter: -1.5 bp

At this entry level, France would look really cheap vs neighbouring issuers in terms of credit quality. This is for a quick reversion to -5bp and no more. I’m struggling to see how to cover Friction costs

One way to handle it is to…

Trade Radar 3 …

+France Nov28 – Germany Nov27

& 20% -ik/+rx

The credit hedge (-ik/+rx) is super liquid, so we just have to do France/Germany into supply…

Love a Wednesday trade in France!

Cix:

100 * ((YIELD[FRTR 0.75 11/25/28 Corp] - YIELD[DBR 0 11/15/27 Corp]) - 0.2 * (YIELD[BTPS 3.5 03/01/30 Corp] - YIELD[DBR 0 02/15/30 Corp]))

Graph – Long France 28 vs Germany 27 with 20% ik/rx hedge

Levels

Enter: +2bp and +3bp,

These look great levels to enter and we know we only need another 1bp or 2bp to make the Bond look cheap to other similarly rated names – see the credit anomaly Graph

Target: -1.5bp

Graph – Credit Anomaly, Z-spread vs Rating Score 7-8y Europe

One to keep an eye on, and this kinda more micro trading might be our stock in trade for a low VAR 2021, who knows!

Germany

On Wednesday we get a tap of the German 30y – Dbr 0% 50, € 1,5 Bln

We’ve seen a decent steepening in the 25s 30s yld spread – the buxl CTD (Dbr 46) into the Dbr 48 looks a decent pick to us

The 2048s will be tapped on February the 17th (€ 1,5Bln) so am looking to scale into this one – but on these leveraged spreads in the back end, it’s tough to move the yield spread much more without a big move in the forward

Trade Radar 4 …

-UBH1 / +Dbr 48

Levels

Enter: +5 bp

Add: +5.75 bp

Target: +3.75 bp

At +3.75bp the forwards look smooth

Forwards…

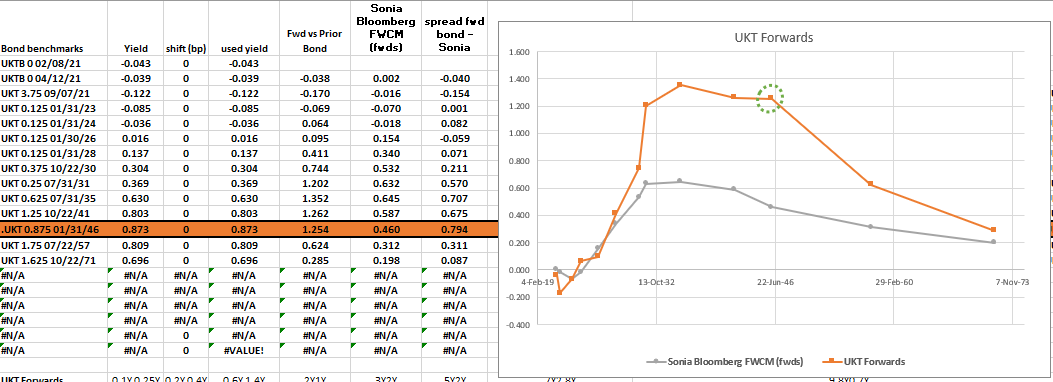

UK, Next week brings the syndication of the UKT 0.875% Jan 31 2046

https://www.dmo.gov.uk/media/17210/pr120121a.pdf

On forwards I see Fair value @ +4.5bp vs the UKT 41

Forwards @ 41s +4.5bp…

Where it comes, I leave to the experts but it has value to 41s @ around +7bp – that would give you forwards flat from 41s to 46s which is inverted on the rest of the bond curve and Sonia curve

Forwards @ 41s +7bp…

We have to be a little careful in selling some of the nearby high coupons – they’re low duration bonds, and their relatively high coupons have value in a positive curve that simply looking at yield does not reveal

When we adjust for discounting according the correct zero rates for maturity only the HC 4.75 38 look truly rich

For me the structure would be

+UKT 46s

-Ukt 41s & -ukt57s

33% of risk @ > +7bp to 41s

67% of risk @ > +8.5bp to 41s

If it doesn’t get there?... Move along, nothing to see..

All the Best & let us know your thoughts

Here to transact

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

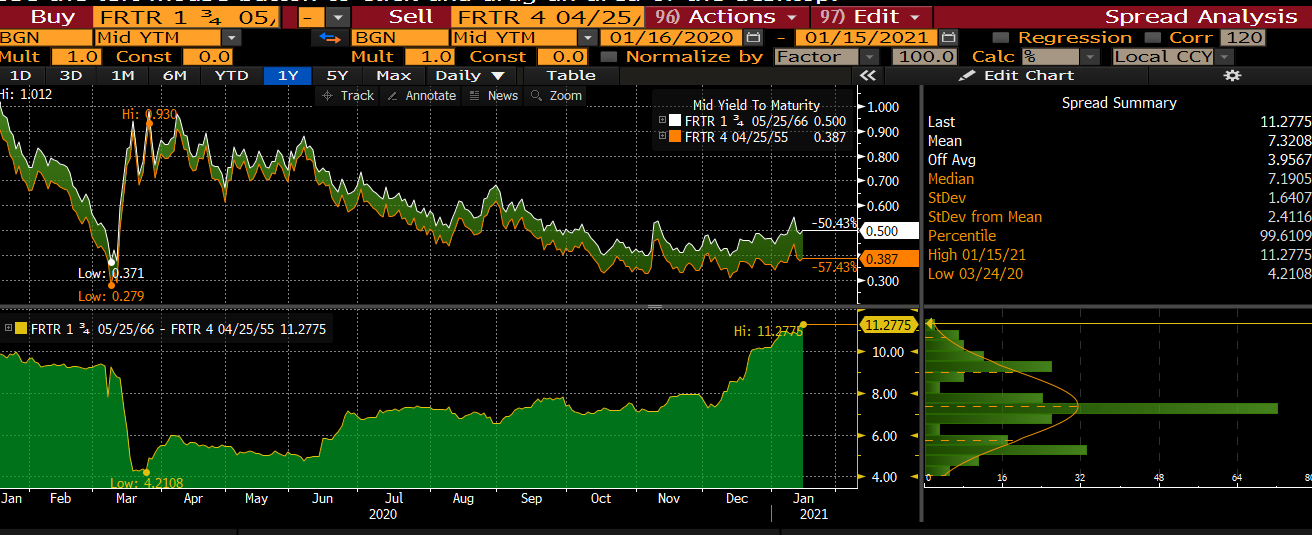

France - 55s rich

Am looking at Frtr 55s

See them as rich on the curve and no prospect of being in pepp

Whereas Frtr 52 go into PEPP in May

I also think that the 66s are cheap and fully represent the prospect of the new 50y syndic in France, which more than likely be massively over subscribed…

Looking at -frtr 55 into frtr 66 as too steep at +11.25bp

Or butterfly

+52s -55s +66s…

– with softer play buying the 50% 66s ahead of new 50y in France –

- – 'AFT will also examine, together with the primary dealers, the prospect of a syndicated issue of a new 50-year bond depending on market conditions'

https://www.aft.gouv.fr/en/publications/communiques-presse/20201209-State-financing-programme-2021

200 * (YIELD[FRTR 4 04/25/55 Corp] - 0.5 * YIELD[FRTR 0.75 05/25/52 Corp] - 0.5 * YIELD[FRTR 1.75 05/25/66 Corp])

Best

Will and James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796