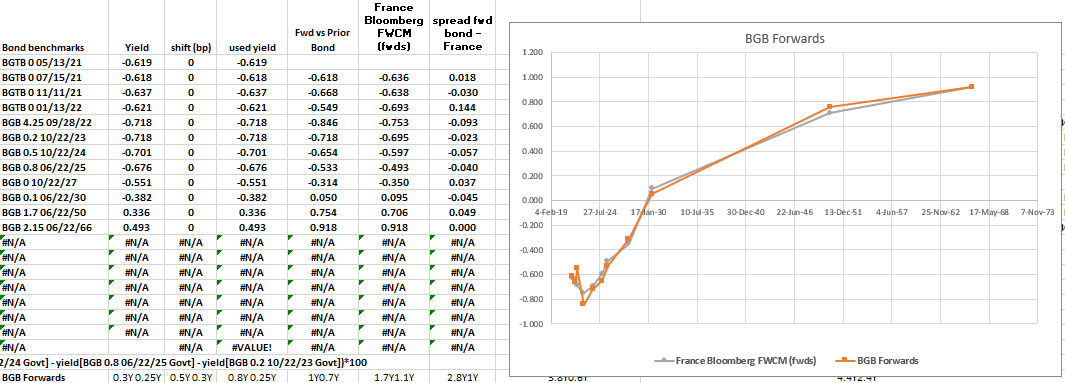

Trade Radar BGB 66's - Preparing for the 50y Syndication in France

On our Trade Radar – not quite at my level….

Belgium 66's – Cheapened by expectations of 50y Belgium & France syndications

Belgium the smaller Issuer the better pick of the two…

'Tis better to travel than to arrive…

- France announced a 50y syndication in its 2021 supply communique – 'AFT will also examine, together with the primary dealers, the prospect of a syndicated issue of a new 50-year bond depending on market conditions'

https://www.aft.gouv.fr/en/publications/communiques-presse/20201209-State-financing-programme-2021

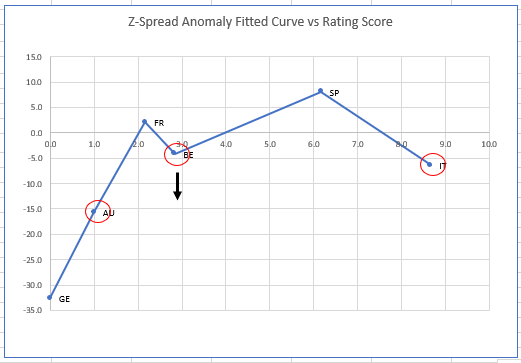

- While the French 50y has cheapened, and taken Belgium with it too - the 30y20y is now above the 10y20y, indicating in absolute terms the move is close to over

- Versus Austria 50y, Belgium & France have value – we can hedge the slight credit difference with Italy both issuers have positive cashflow characteristics after allowing for the PEPP

- We expect Belgium will bring a longer 50y OLO – 'Given the objective to lengthen the average life of the debt portfolio, but taking into account the starting point of the average life and possibly a new very long syndicated transaction, the BDA will have options to issue OLOs in the auctions in any part of the curve.'

- Syndications have massive oversubscription and we expect any discount in these tenors to be short lived – notwithstanding they are not part of the PEPP

Trade Structure

Buy Belgium 2.15% Jun66

Sell 90% Austria 3.8% Jan62

Sell 10% Italy 2.8% Mar67

Levels:

Current: +15.5bp

Enter: +17bp (33% risk)

Add: +23bp (67% risk)

Target: +7bp

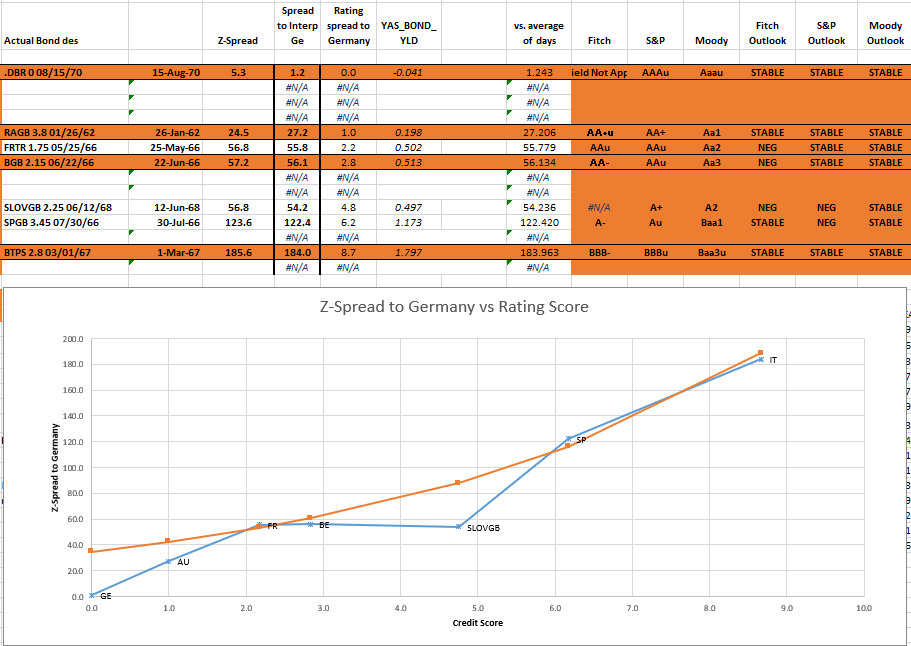

I've set Enter and Add around absolute value to the credit surface – the add level is where there is no premium for Belgium even vs France and Spain – given the paucity of issuance relative to PEPP

Cix:

100*(yield[BGB 2.15 06/22/66 Govt]-0.9*yield[RAGB 3.8 01/26/62 Govt]-0.1*yield[BTPS 2.8 03/01/67 Govt])

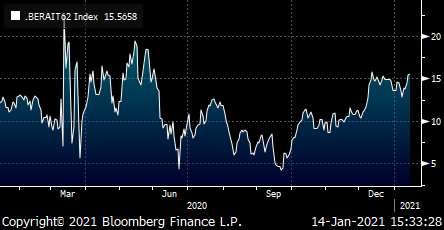

Graph 1 – Belgium vs 90% Austria and 10% Italy

Credit Surface – Z-spread to Interpolated German Curve

Orange – Fitted Curve

Blue - Actual Credit spreads

Graph 2 – European 50y Z-Spread to Germany*

*Hypothetical German 50y @ -0.04% yield for valuation purposes (needed for interpolation)

Typically we see Germany as a special case and not part of the Credit Curve fit – more it forms the baseline of the valuation for spreads as the issuer least likely to default / redenominate

Fit is performed to Fit the Major issuers with nett cash requirements in Europe – Italy, France, Spain

Rationale

- Austria has is rich

- Belgium is Fair (it's a small / scarce issuer)

- Italy is slightly rich and provides a credit anchor / hedge

- Once we get past the 50y issuance

Graph 3 –

Rich / Cheap Credits: Anomaly of Z-spread vs Fitted Curve (50yrs)

Bid/Offer

33% of Structure Bid/Offer estimate: 1bp

.9 / 1 / .1 weightings to the bid offer

French & Belgian Forwards

30y20y vs 10y20y is positive in both Belgium and France

Risks

- A wholesale de-risking could drag Belgium cheaper with Spain and Italy and the 10% Italy hedge may not be sufficient for extreme credit pressures

If you'd like to discuss further, or set a level that makes sense (see Entry Level above) please let us know. Further details on request

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Italy 1/30 Box vs Short 2yr Spread - Unwind 2yr spread portion

2y Spreads has reached first target – near the 100d MA. And is 15bp on sides.

10/30 Box – now 1.5pbs lower.

My thinking is unwind the 2y spread trade as this is the first major bearish move for BTPS in a long while.

Sentiment for the vast majority of traders/investors is to buy the dip(maybe that is a risk itself – crowded)

But while the trade is meant to be contingent – I look at it as – any further blow-up in BTPs and 10/30s reverts back to credit sensitivity and performs

more like a credit curve than a sovereign curve. If this recent move is just a wobble to push out weak longs and the calvary comes to buy the dip, 2y

spreads recover and 10/30 box gives up small.

* the 2y portion of the trade has just allowed you to get into the box trade almost 4bps cheaper than the entry level if you monetise 2y spreads here.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

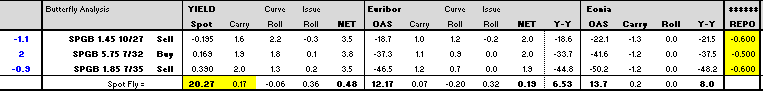

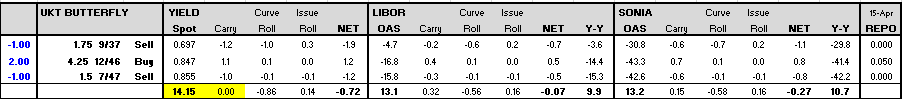

3 HC vs LC Fly's that Solve for DVO1 Neutral, Duration Neutral, Carry Positive to Flat. Two in UK and one in Spain.

Solving for:

* Range trade - spread at or near the highs

* Carry must be neutral to positive, assuming a negative funding differential between longs and shorts

* DVO1 neutral but weights must display symmetrical distribution of duration in both wings to mitigate either direction or curve input

Trades:

Spain: Buy 5.75% 32 vs selling 1.45% 27 & 1.85% 35 wtd 1.1x2x0.9

UK : Buy 4.75% 30 vs selling 0.125 28 & 0.375% 30 wtd 1x2x1

Buy 4.5% 46 vs selling 1.75% 37 & 1.5% 47 wtd 1x2x1

Rationale:

* markets confined to range trade in 2021 with CBs heavily involved in keeping bond volatility low throughout the year

- Using duration metric for distribution of risk which favours HCs more so in the UK(ie HCs cheap when compared to duration)

- Identifying trades/fly that are either non-correlated to level or slope, and/or those fly's that are mispriced from level and

slope, giving better entry to what is the base assumption that we are in a range trade for most of the year.

Risks:

* Regime shift in rate structure in 2021 whereby we move to significantly higher rates and steeper curve, long belly trades out of favour

* Liquidity for some of the high coupons is poor and/or funding differential overly punitive that produces a negative carry scenario

See Trades below: Charts show: a) Fly vs level and slope, b) Carry metrics, c) duration distribution being symmetrical

Spain: Buy 5.75% 32 vs selling 1.45% 27 & 1.85% 35 wtd 1.1x2x0.9

Entry: Gross +20bps with weights 1.1x.9

Add +23bps

Stop +25bps

Target + 12bps( mid-point of old range prior to Covid)

Carry +0.17bps for 3mos assuming 10bps funding differential

Chart below: Spain Fly 27/32/35 vs Level and Slope

Carry Metrics

Chart below is Duration Distribution in Risk format to include wtd 1.1x0.9

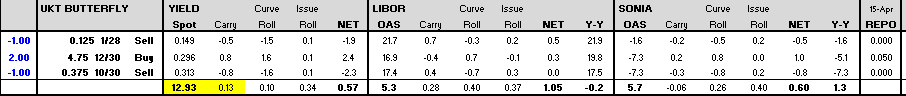

UK : Buy 4.75% 30 vs selling 0.125 28 & 0.375% 30 wtd 1x2x1

Entry: Gross +12.9bps

Add +14bps

Stop +15bps

Target +8bps

Carry: +0.13bps 3mos assuming 5bps negative funding differential

Chart below: Gilt Fly 12/30 vs 1/28 and 10/30 50x50 wtd

vs Level and Slope

Carry Metrics

Duration Distribution Metric

Gilt Trade: Buy 4.5% 46 vs selling 1.75% 37 & 1.5% 47 wtd 1x2x1

Entry: +14.0bps Gross

Add: +15.5bps

Stop: +16.5bps

Target: +9bps

Carry: Flat assuming 5bps negative funding differential

Chart below: UK FLY: 37/46/47

vs Level and Slope

Carry Metrics

Duration Distribution metrics

Happy to discuss.

Creo

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

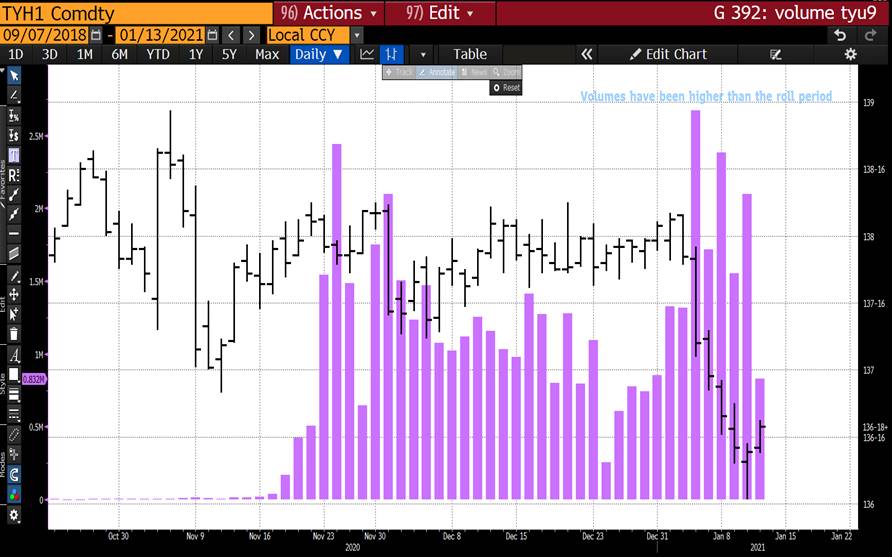

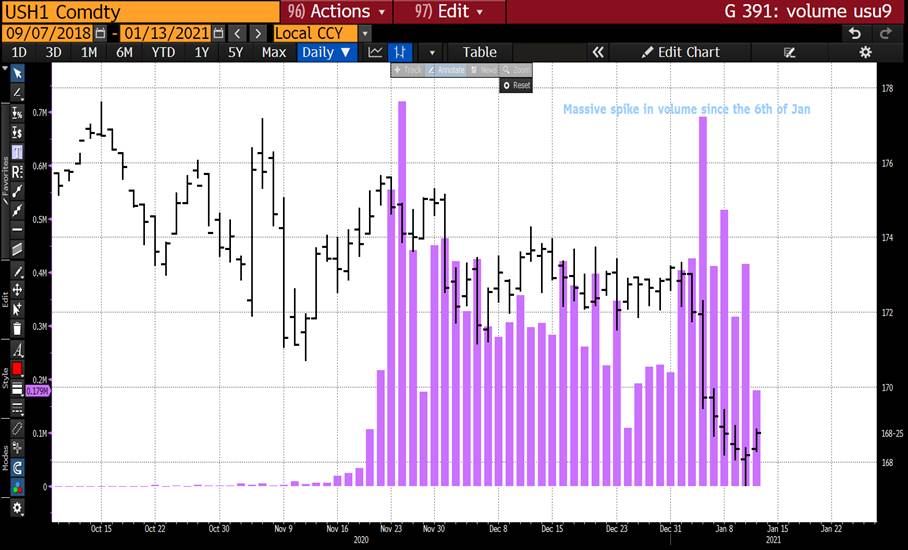

**SPECIAL VOLUME AND OPEN INTEREST** : WORTH NOTING THE SUBSTANTIAL VOLUME THAT WENT THROUGH ON THE MARKETS ON 6TH OF JANUARY WITH THE US 10YR EXCEEDING THE ROLL PERIOD.

VOLUME AND OPEN INTEREST : WORTH NOTING THE SUBSTANTIAL VOLUME THAT WENT THROUGH ON THE MARKETS ON 6TH OF JANUARY WITH THE US 10YR EXCEEDING THE ROLL PERIOD.

OPEN INTEREST LEVELS WITNESSED SOME "REASONABLE" CHANGES LAST YEAR SO WILL WATCH THAT OVER THE NEXT FEW MONTHS!

OPEN INTEREST SUFFERED A SIGNIFICANT DROP SINCE MANY NATURAL REAL MONEY "LONGS" TOOK PROFITS (MARCH 2020). WE ARE STILL WITNESSING SOME BUYERS OF BOND DIPS BUT AS A WHOLE THE DEMAND IS LOWER WITH LONG HOLDERS HISTORICALLY REDUCED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

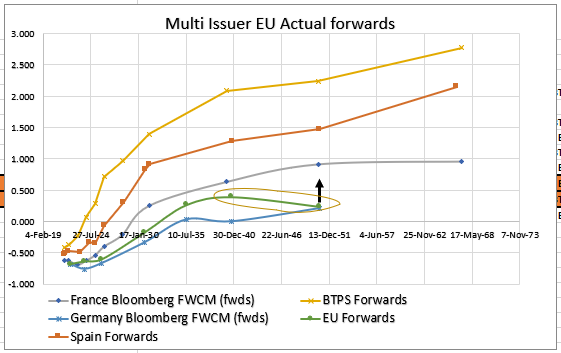

EU 20s30s steepener for an issuer with supply

EU 20s30s too flat vs RX/UB

- EU (SURE) is an issuer, along with France, Italy & Spain set to require cash from the market even after PEPP estimates

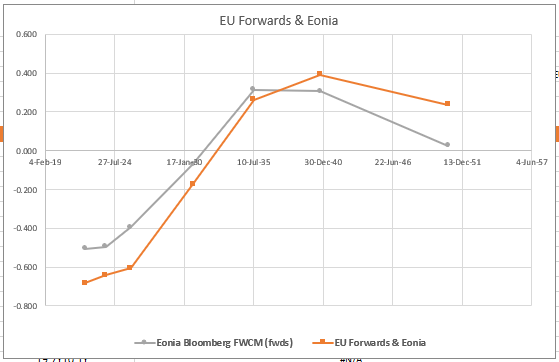

- Major Supply issuers have forwards curves that are upward sloping that represent a need to raise debt under credit constraints – Don't be deceived by 'swap blindness' with Eonia forwards – the receiving, margining and marginal operators are quite different in that market

- That slaveish following of the swap market can be to our advantage – further issuance in long EU bonds makes them look rich to shorter tenors – In short EU 20s30s is too flat, forcing forwards to be too low

- The fade from last year is 'pay long forwards at flat or inverted to shorter ones', for issuers that must still raise funds. This still makes sense, particularly in those issuers where issuance outweighs the capital key based, PEPP buying

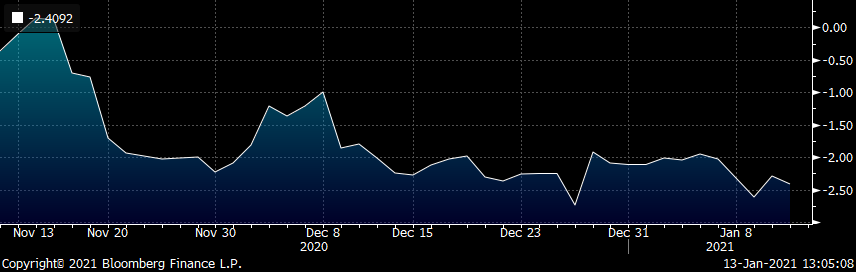

Graph 1 – European Forward Rates

Germany, EU, France, Spain and Italy

The EU forwards rates are dragged lower in the long tenors by the use of Eonia as a valuation metric….

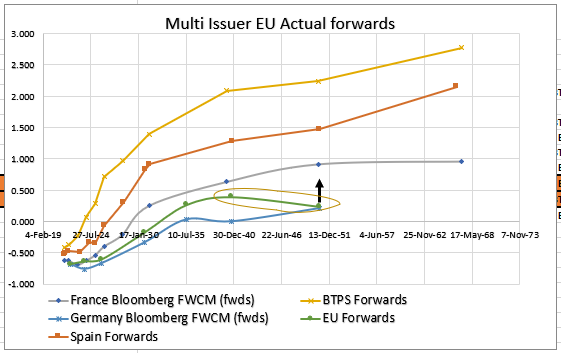

Graph 2 – Eu forwards and Eonia forwards

Trade Structure

+EU20y -EU30y

vs

30% -RXH1 / UBH1

Levels

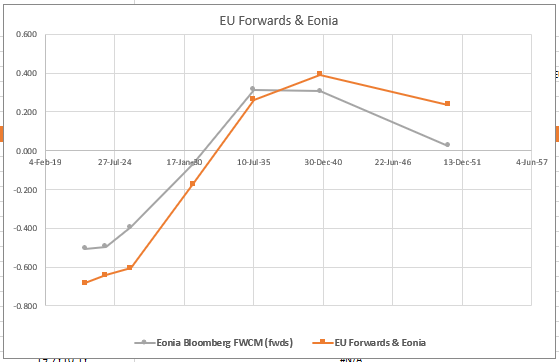

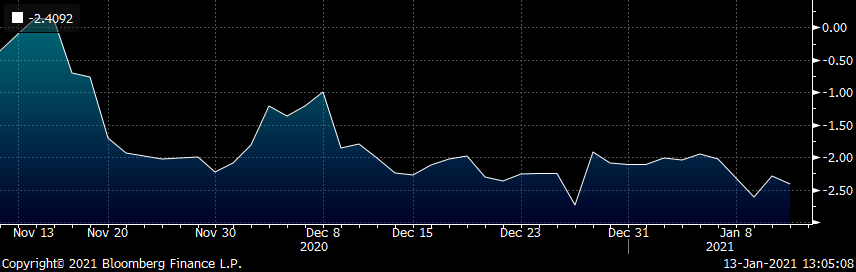

Current: -2.4bp (pay)

Add: -4bp

Target: 0

Carry

EU 20s30s: carry +0.1bp /3mo @-10bp repo spread

RX/UB expressed in futures – no carry

Cix: 100*((yield[EU 0.3 11/04/50 Govt ]-yield[EU 0.1 10/04/40 Govt ])-0.3*(yield[DBR 2.5 08/15/46 Govt ]-yield[DBR 0 02/15/30 Govt ]))

Graph 3 – Cix history – shows EU 30y outperforming the EU 20y in the context of a 30% RX/UB hedge

Rationale

- At this level the curve is almost inverted as the Eonia forwards

- The add level equates to the same fwd rate of inversion

- As more EU supply comes on board this curve should normalise

More Details on request

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EU 20s30s steepener for an issuer with supply

EU 20s30s too flat vs RX/UB

- EU (SURE) is an issuer, along with France, Italy & Spain set to require cash from the market even after PEPP estimates

- Major Supply issuers have forwards curves that are upward sloping that represent a need to raise debt under credit constraints – Don't be deceived by 'swap blindness' with Eonia forwards – the receiving, margining and marginal operators are quite different in that market

- That slavish following of the swap market can be to our advantage – further issuance in long EU bonds makes them look rich to shorter tenors – In short EU 20s30s is too flat, forcing forwards to be too low

- The fade from last year is 'pay long forwards at flat or inverted to shorter ones', for issuers that must still raise funds. This still makes sense, particularly in those issuers where issuance outweighs the capital key based, PEPP buying

Graph 1 – European Forward Rates

Germany, EU, France, Spain and Italy

The EU forwards rates are dragged lower in the long tenors by the use of Eonia as a valuation metric….

Graph 2 – Eu forwards and Eonia forwards

Trade Structure

+EU20y -EU30y

vs

30% -RXH1 / UBH1

Levels

Current: -2.4bp (pay)

Add: -4bp

Target: 0

Carry

EU 20s30s: carry +0.1bp /3mo @-10bp repo spread

RX/UB expressed in futures – no carry

Cix: 100*((yield[EU 0.3 11/04/50 Govt ]-yield[EU 0.1 10/04/40 Govt ])-0.3*(yield[DBR 2.5 08/15/46 Govt ]-yield[DBR 0 02/15/30 Govt ]))

Graph 3 – Cix history – shows EU 30y outperforming the EU 20y in the context of a 30% RX/UB hedge

Rationale

- At this level the curve is almost inverted as the Eonia forwards

- The add level equates to the same fwd rate of inversion

- As more EU supply comes on board this curve should normalise

More Details on request

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

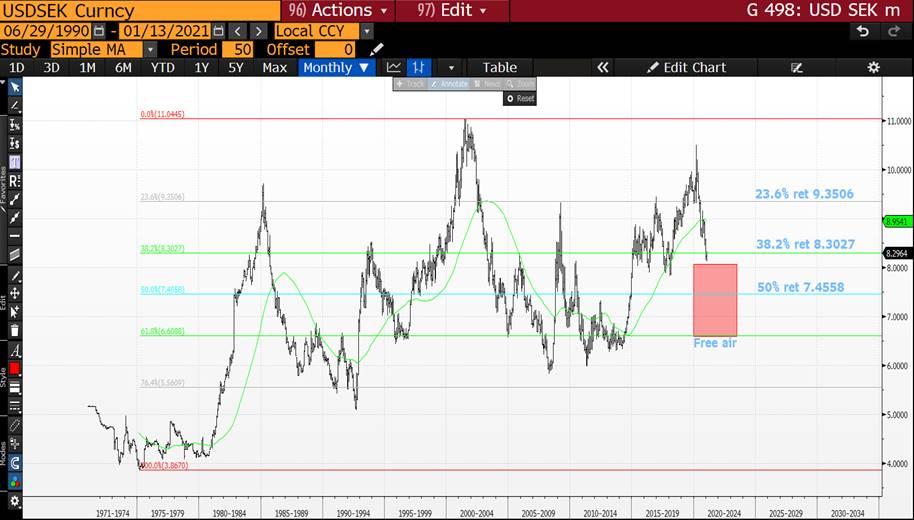

FX UPDATE : USD WEAKNESS BACK IN PLAY! THE LATEST USD BOUNCE SEEMS TO BE WANING ALREADY IF SO IT SPEAKS VOLUMES ABOUT THE OVERALL BIAS-TREND!

FX UPDATE : USD WEAKNESS BACK IN PLAY! THE LATEST USD BOUNCE SEEMS TO BE WANING ALREADY IF SO IT SPEAKS VOLUMES ABOUT THE OVERALL BIAS-TREND!

THE AUD HAS PAUSED BUT STILL HAS SIGNIFICANT UPSIDE POTENTIAL.

USDSEK HAS BREACHED ITS LONGSTANDING 38.2% RET 8.3027 THUS SHOULD BE GOOD RESISTANCE ON THE LATEST BOUNCE. USDNOK IS HOLDING ITS 50% RET 8.3959 BUT HOPEFULLY BREACHED THIS WEEK.

USD MXN IS STILL TEASING ITS 50 PERIOD MOVING AVERAGE-38.2% RET 19.7005.

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

USDTRY HAS A PERFECT FAILURE AT ITS MAJOR 2001 TRENDLINE 8.0084 AND POISED TO HEAD A LOT LOWER.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

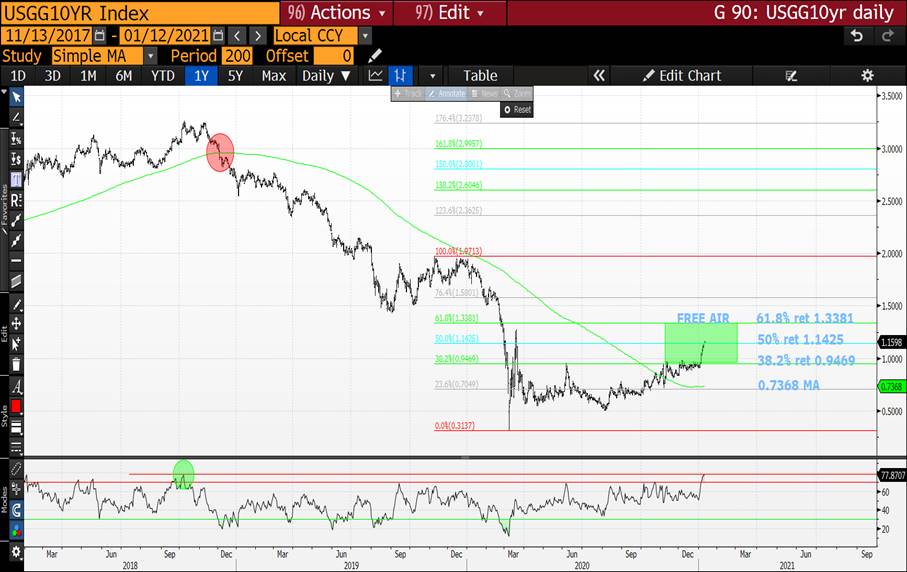

BONDS YIELDS : FOR THE FIRST TIME IN A WHILE I HAVE INCLUDED DAILY RSI’S AS A RESULT ALL ARE “TOO” EXTENDED, THUS SHOULD SEE THE YIELD RECOVERY “PAUSE”!

BONDS YIELDS : FOR THE FIRST TIME IN A WHILE I HAVE INCLUDED DAILY RSI’S AS A RESULT ALL ARE “TOO” EXTENDED, THUS SHOULD SEE THE YIELD RECOVERY “PAUSE”!

THIS PAUSE DOES NOT DETRACT FROM THE OVERALL YIELD HIGHER CALL, BUT POIGNANT TO REDUCE POSITIONING.

THE MONTHLY CHARTS STILL FORECAST MUCH HIGHER YIELDS FOR THE ENTIRE YEAR!

**DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

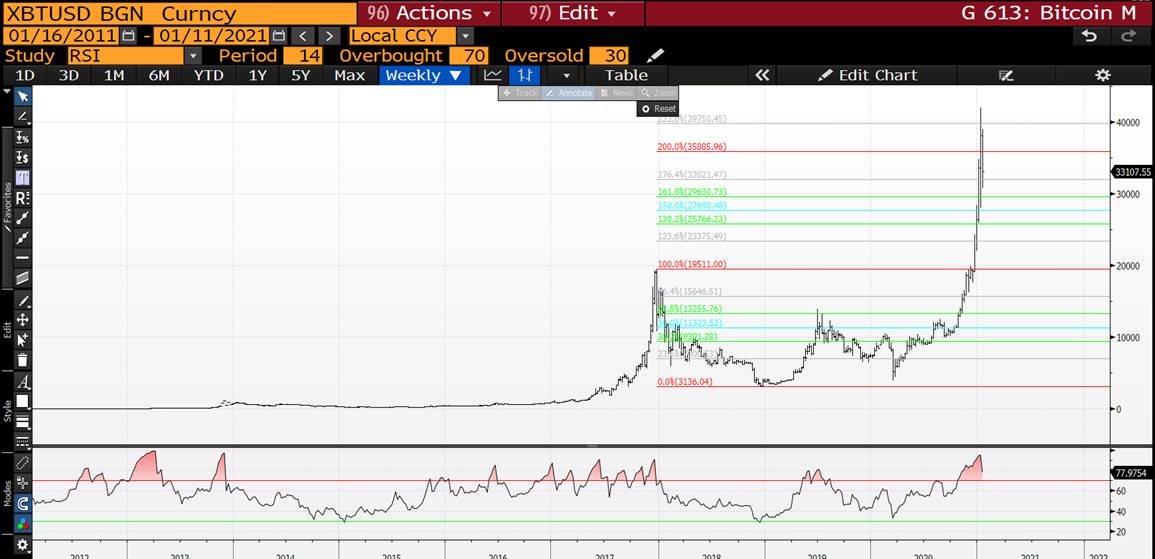

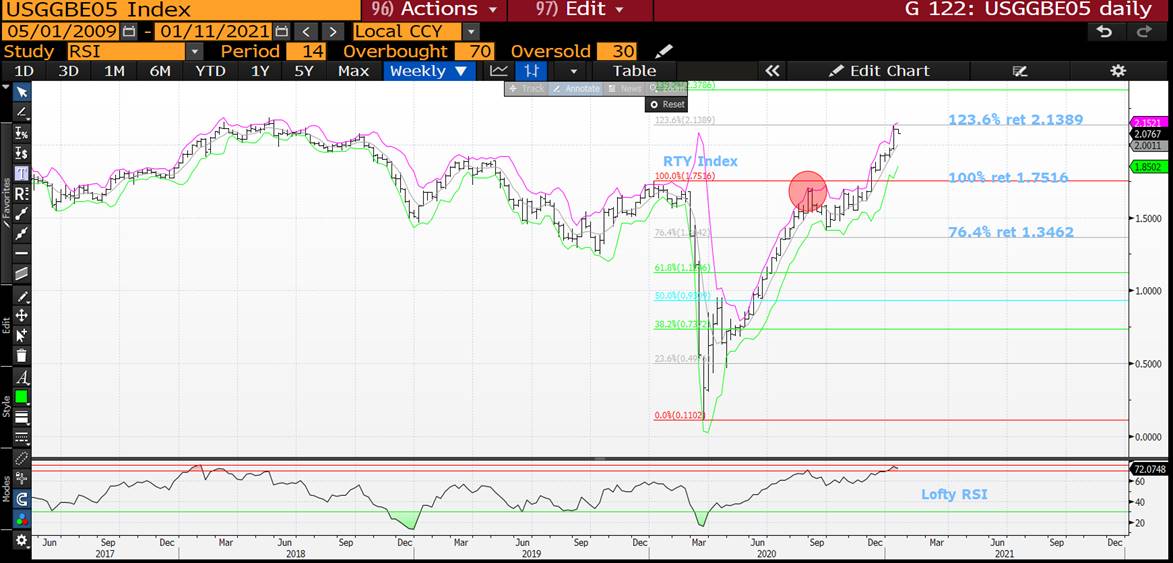

US BREAKEVENS, METALS AND BITCOIN : IT NOW LOOKS WE MIGHT “FINALLY” HAVE A LONGTERM BREAKEVEN TOP AND SIMILAR IN METALS-BITCOIN.

US BREAKEVENS, METALS AND BITCOIN : IT NOW LOOKS WE MIGHT “FINALLY” HAVE A LONGTERM BREAKEVEN TOP AND SIMILAR IN METALS-BITCOIN.

**ALL 3 DURATIONS OF BREAKEVEN CHARTS HAVE RSI’S THAT COMPLIMENT EACH OTHER.**

US 30YR BREAKEVENS THE ONES TO WATCH : WE ARE “FORMING” A NEGATIVE UPSIDE BOLLINGER PIERCE, FULL CONFIRMATION OF FAILURE WILL COME IF WE BREACH THE MULTI YEAR 61.8% RET 2.0221.

I HAVE ENCLOSED SOME OF LAST WEEKS METALS CHARTS GIVEN THEY LOOK TO BE “CRACKING” TODAY!

US 5YR BREAKEVENS HAVE HIT AND STALLING A MAJOR 123.6% RET 2.1389!

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

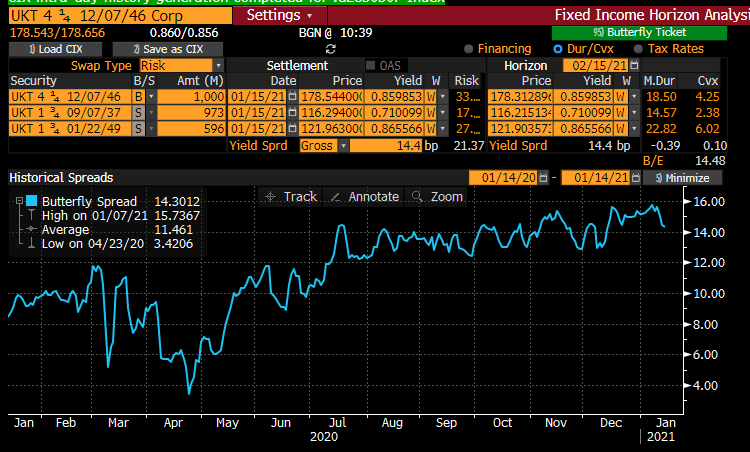

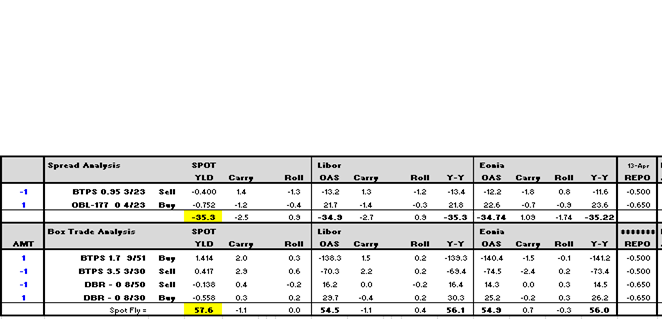

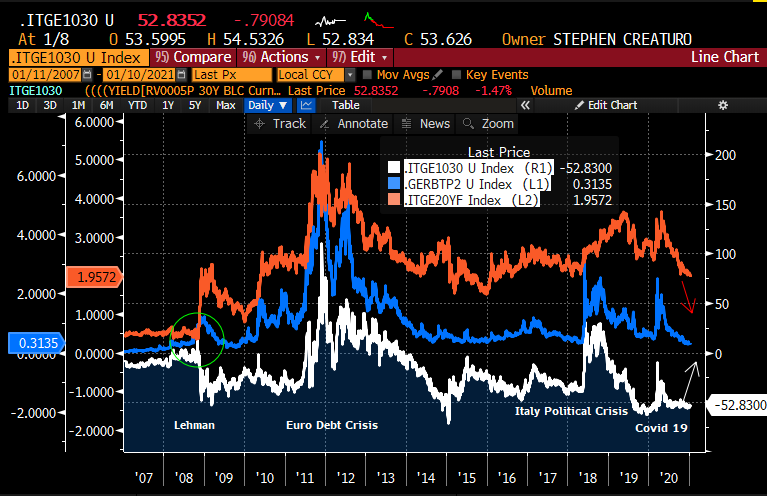

Macro Trade: Italy/ Germany 10-30 box, with 30% short risk in 2y BTP/DBR risk now added.

Trade: 10/30 Flattener Italy vs 10/30 Steeper Germany DVO1 Neutral 100k, plus 30% Short Risk 2yr Italy vs Germany – 30k DVO1

Italy: sell 3/30 vs buying 9/51 +100k

Germany: sell 8/50 vs buying 8/30 -100k

(Have recommended this trade with slightly shorter bonds back in Oct.(75k) – rationale at the time was playing for more of a risk-off trade,

and currently 1.5bps on-side. yet with more ECB support, there is a different dynamic introduced – adding to risk in the event of risk-off, while

introducing partial hedge 2y risk and playing the range(lows) for a slow grind trade that compresses credit risk premium.

Entry: +57bps

Add: +60bps

Stop: +63bps

Target: +30bps

2y Spread Short: sell 3/23 BTPs vs buying OB177 4/23 – -30k(~beta adjusted risk – 2y spd vs 10/30 box)

(contingent)

Entry: -35.5bps

Add: -30.5bps

Stop: -25.0bps

Rationale:

- 10/30 Box has been stable at the higher level amid further tightening of spreads in all tenors from 2yrs to 30yrs

- 20yrFwd 10y spread Italy vs Germany still has room to compress – ie 10/30 flattening Italy relative to 10/30 Germany

(an ~20bps flattening in BTPS in the 10/30y curve will achieve a target in forward 10y spread closer to 155bps) - At each event risk since the Sovg Debt Crisis, Italian spread weakness has proven to be lower and recovery quicker

- ECB and PEPP has produced a new paradigm whereby risk mitigation allows for investors to seek higher returns other than core investments

- With this back-drop we could be embarking on the pre-Lehman levels of lower risk, lower vol. compression, whereby credit term premium

is reduced further out the curve

- Although we may not get back to pre-Lehman levels exactly where there was little in the way of differentiating credit risk, can see a scenario

whereby there is more room for compression further out the curve - Event episodes in the past generally have been favourable to 10/30 flattening in Italy on currency opt-out/default scenario. If no

event risk, then we should see further compression out the curve. If Event risk, 2y spreads will widen and more likely 10/30 box will

flatten as well so a win on both sides.

Risk:

* Supply and benchmark syndication expected for long end Italy sometime over the next month or two will require larger concession in the long end of BTPS

- Market accepts new regime and allow for a permanent adjustment of credit risk premium with sovereign curves, even with spreads overall continuing to compress

Carry&Roll: Here is the rub – negative -0.85bps/mos net overall on the trade. Much of this comes from short 2y Italy vs Germany with a funding differential expected of 15bps.

(hence one of the reasons for not believing we fully go back to pre-Lehman levels when markets were basically funding all sovereigns equally and making no credit adjustment).

If we are in the slow grind tighter with no volatility and/or no risk event, it will be challenging but not impossible to make up C&R on a 3-6mos basis, and will clearly eat into the trade.

But with the potential for more volatility(political event?), C&R will be a fraction of potential upside on the trade.

Chart Below: 10/30 Box(Generic Splines) Italy/Germany INVERTED White Line (at the lows(ie cheap on the box)

Italy/Germany 2y Spread – Generic Spline – Blue (at the lows)

Italy/Germany 10y Spread,20y Fwd at +195bps with a target of 155bps

* Basically new paradigm – ECB/PEPP forces lower risk, lower vol trade similar to pre-Lehman levels

Chart Below:

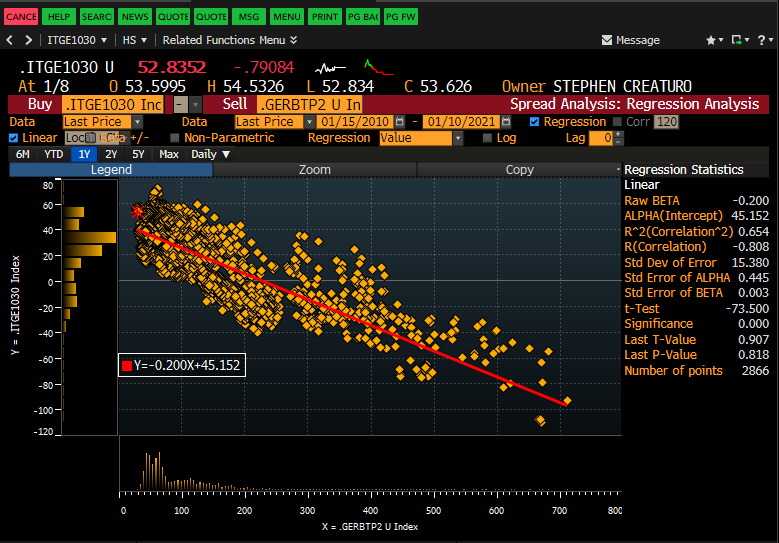

Regression of 2yrs Spreads and 10/30 Italy/Germany Box – 10yrs to capture risk events. – 10/30 cheap.

Using beta+ added risk for 2yrs spreads vs box 30x100 wtd

Happy to discuss.

Creo

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796