MICROCOSM: GILTS > Quick Update - UKT 0E28s Tap Tomorrow

GILTS... UKT 0E28s

> UKT 0E28s £3bn Tap tomorrow - ONLY one this qtr.

> Tone of Gilts market is bullish:

* Several dealers now looking for an MPC rate cut in Feb or ramping up of pace of QE flows as lock down weighs on activity and vaccine rollout proves slow.

* Tenreyo's speech @ 2pm today likely to be neg-rates positive which helps to explain bid to front-end this am.

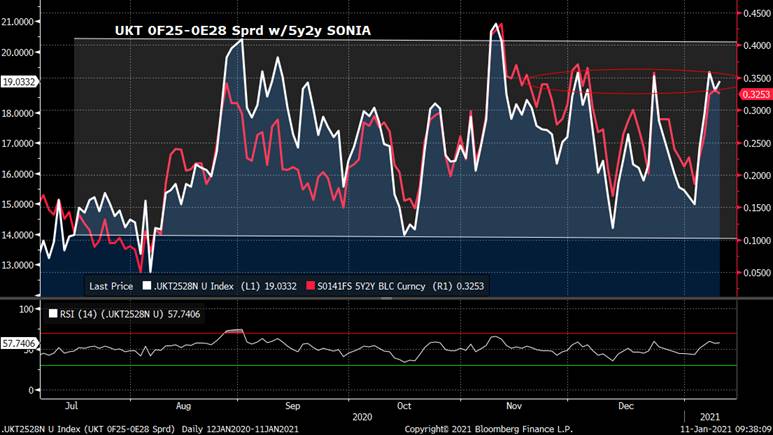

> UKT 0F25-0E28 (or 0E26-0E28) flattener. We're still at the cheap end of the range, despite the .5bp flattening since last Thur's note. Chart below shows the strong correlation to fwd SONIA levels.

> Buy 0E28 vs MM Sonia - last at +3.4bps mid. Off the wides but still 3bps cheaper than the end of 2020.

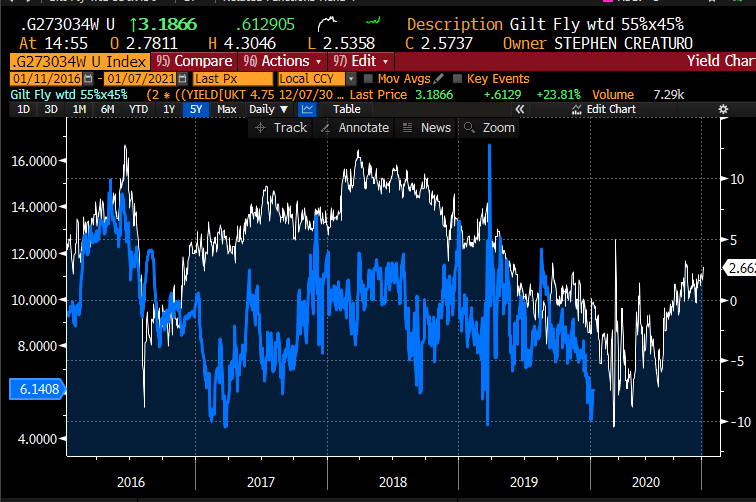

> UKT 124-0E28-0Q31 fly. Chart below shows the fly making new wides (cheap) as the 31s have traded very well since the start of 2021. This 4.5bps cheapening of the fly looks overdone here, especially with the 10yr sector lagging.

Copy of last Thursday's note attached.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

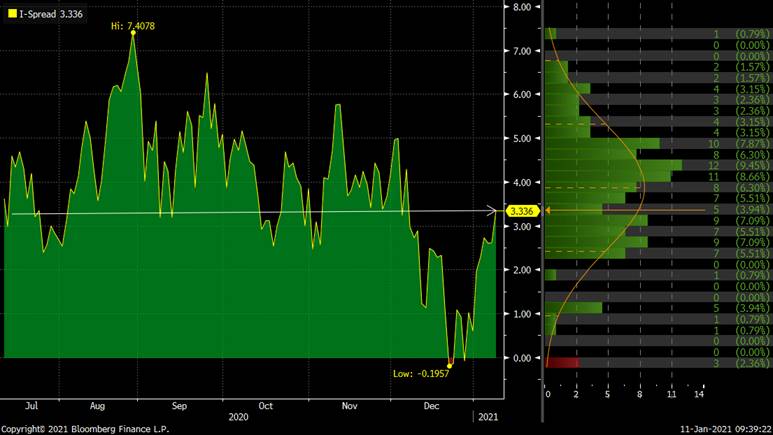

US BREAKEVENS, METALS AND BITCOIN : BREAKEVENS HAVE BEEN STRETCHED FOR SOME TIME AND FINALLY LOOKS LIKE STALLING. 30YR IS FLAGGING FOR THE FIRST TIME IN A WHILE.

US BREAKEVENS, METALS AND BITCOIN : BREAKEVENS HAVE BEEN STRETCHED FOR SOME TIME AND FINALLY LOOKS LIKE STALLING. 30YR IS FLAGGING FOR THE FIRST TIME IN A WHILE.

**ALL 3 DURATIONS OF CHARTS HAVE RSI'S THAT COMPLIMENT EACH OTHER ACROSS THE BREAKEVEN CURVE.**

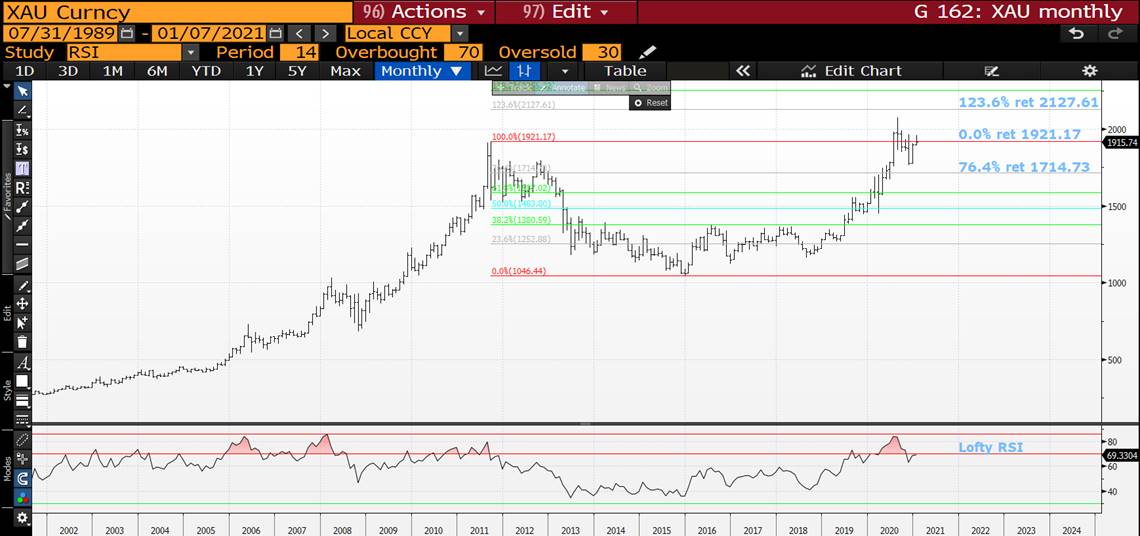

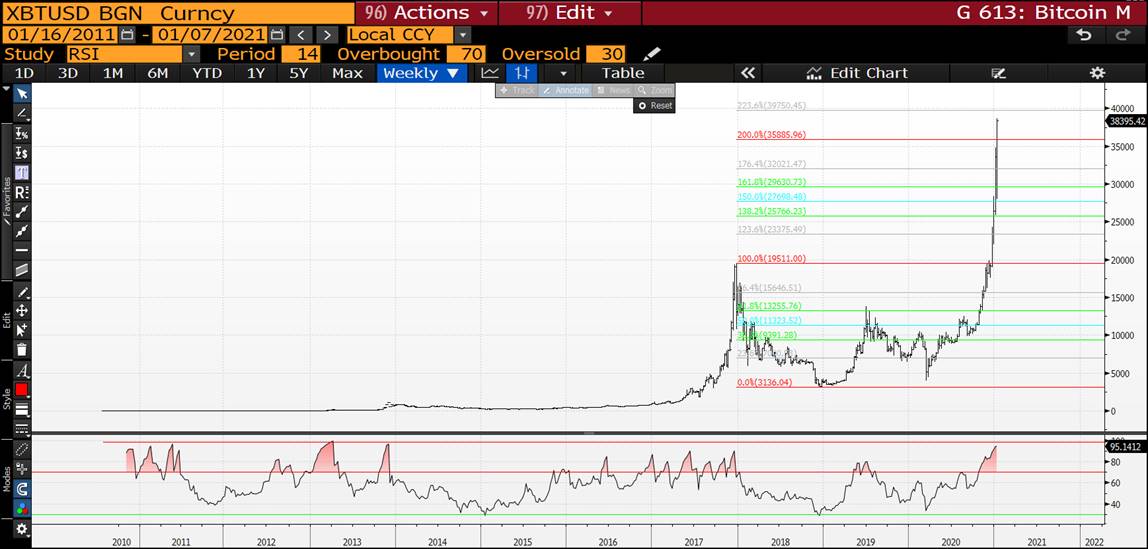

I HAVE ENCLOSED SOME OF YESTERDAYS COMMODITY-METALS CHARTS GIVEN THEY LOOK TO BE "CRACKING" TODAY!

METALS AND BITCOIN : WE ARE STARTING TO WITNESS THE TOP TO GOLD, SILVER AND OTHERS TODAY WITH THE POSSIBILITY OF A SIZEABLE TRAJECTORY LOWER.

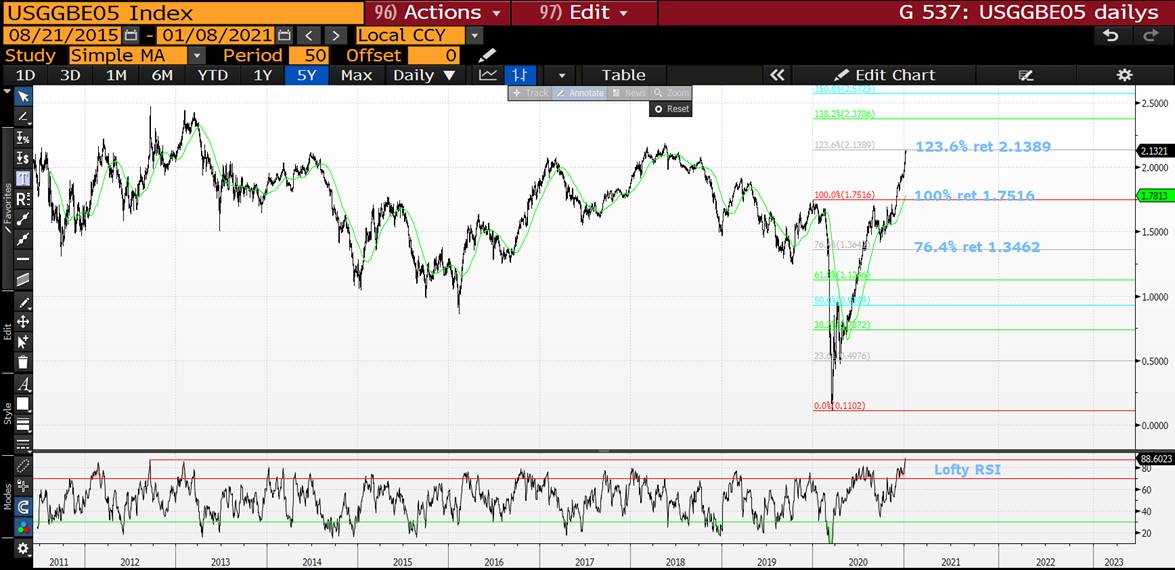

US 5YR BREAKEVENS COULD BE THE ONE TO WATCH GIVEN THEY ARE STALLING HITTING A MAJOR 123.6% RET 2.1389.

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI'S LOOK HISTORICALLY LOFTY AND ADDITIONALLY MOVING AVERAGE RESISTANCE.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

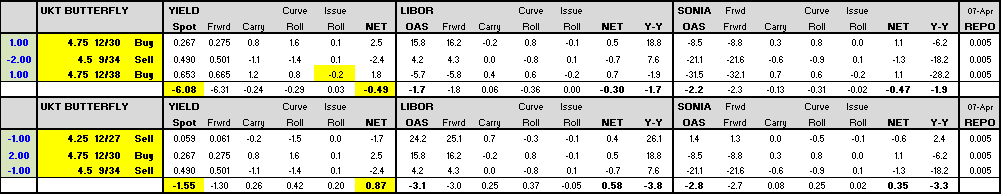

Gilt Trade - HC Micro RV 30-34-38 - Short Belly

With respect John maybe you're right, but just don't see them as rich as the model suggest. I am trying to put forward and easily symmetric approach to equal weights on 4y gaps to take out of the

equation to some degree level and slope….can look at LC in surrounding bonds as cheaper, but the trade becomes a little bit different ie more directional and more curve bias.

But I appreciate the feed back – and believe me I did take into account your analysis before writing this up, but still came to the conclusion the trade works if you believe we are in a range.

From: John Wentzell <John.wentzell@astorridge.com>;

Sent: 07 January 2021 15:17

To: Stephen Creaturo <stephen.creaturo@astorridge.com>;; Jim Lockard <Jim.lockard@astorridge.com>;; Mark Funsch <mark.funsch@astorridge.com>;; Marc Lamoureux <Marc.Lamoureux@astorridge.com>;; George Whitehead <George.Whitehead@astorridge.com>;; David Sansom <David.Sansom@astorridge.com>;; Robert Baida <robert.baida@astorridge.com>;; Chris Williams <Chris.Williams@astorridge.com>;; James Rice <James.Rice@astorridge.com>;; Will Scott <Will.Scott@astorridge.com>;; Gareth Edwards <gareth.edwards@astorridge.com>;; Peter Joos <Peter.Joos@astorridge.com>;

Cc: Research <research@astorridge.com>;

Subject: RE: Gilt Trade - HC Micro RV 30-34-38 - Short Belly

No one will buy 38's. 2nd richest bond on the curve

John Wentzell

CEO / Founding Partner

Astor Ridge

O: +44 (0) 203 - 143 - 4800

M US: +1 (630) 965 - 3522

M UK: +44 (0) 779 - 505 - 0313

E: John.Wentzell@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 60 Rumson Road, Rumson, NJ, 07760

From: Stephen Creaturo <stephen.creaturo@astorridge.com>

Sent: Thursday, January 7, 2021 9:05 AM

To: Jim Lockard <Jim.lockard@astorridge.com>; John Wentzell <John.wentzell@astorridge.com>; Mark Funsch <mark.funsch@astorridge.com>; Marc Lamoureux <Marc.Lamoureux@astorridge.com>; George Whitehead <George.Whitehead@astorridge.com>; David Sansom <David.Sansom@astorridge.com>; Robert Baida <robert.baida@astorridge.com>; Chris Williams <Chris.Williams@astorridge.com>; James Rice <James.Rice@astorridge.com>; Will Scott <Will.Scott@astorridge.com>; Gareth Edwards <gareth.edwards@astorridge.com>; Peter Joos <Peter.Joos@astorridge.com>

Cc: Research <research@astorridge.com>

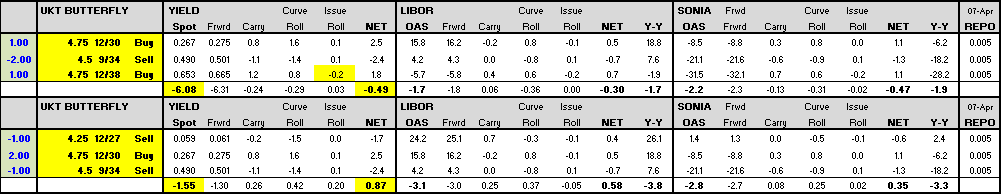

Subject: Gilt Trade - HC Micro RV 30-34-38 - Short Belly

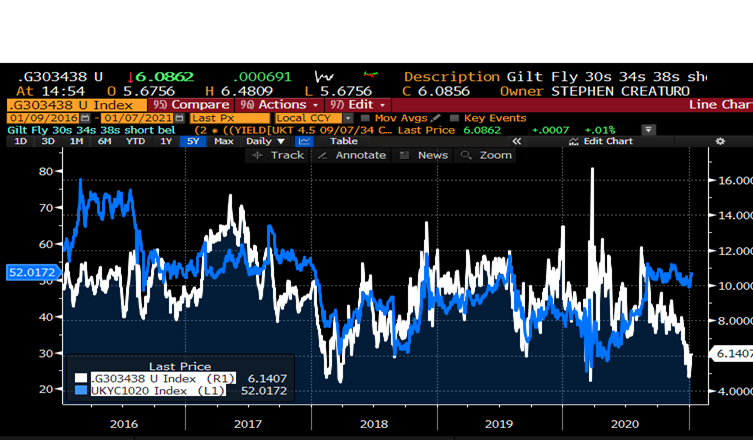

Trade: Sell 4.5% 34 vs buying 4.75% 30(ctd) & 4.75% 38 50x50wtd

Tactical 3mo hold to mitigate carry.

Rationale: Playing the Range – Spread at multi-year lows, currently +6.1bps(range ~4.5 – 15bps)

Curvature of HC rich relative to slope of 10/20 curve generically, but relationship has been less clear post March Covid event

10y CTD 30s underperformer in Q4 – hedge instrument for many locking in rates into year end, should reverse, 10y CTD cheap in curvature relative to level of rates

No imminent impact rolling into and out of DLV Basket, IE long way to go for consideration – range should prevail first before impact of CTD bonds influencing spread

APF has exhausted 30s, but only marginal float remains for both 34s and 38s ~2bl

3x35s taps this qtr will weigh on 34s

Risk: APF exhaust 34s first, similar to pattern of the HC 27s, then 30s.

10/20 curve Flattens on risk event,(but see marginal impact to fly as the level already reflects flatter curve)

AR Model approach suggest 38s from an RV perspective are richer on the curve and begins to adjust 1-2bps for this.

(much of the richness coming from maturity metrics – but when looking at mod duration which we are doing to

achieve a more symmetrical distribution of risk along the curve – this is sharply reduced)

Carry&Roll: Negative -.5bps/3mos – would highlight though half of this is coming from the negative roll-down of models input. Looking

at it another way, we are using 30/34/38s for symmetry in the distribution of risk along the curve, hence 10/20 curve wider

than what Fly implies, if you back out the bond specific roll – you get Neg C&R 1bps/Ann

Entry: +6.15bps(short belly)

Add: +4bps

Stop: +3.25bps

Target: +11.bp

Carry & Roll – 3mos

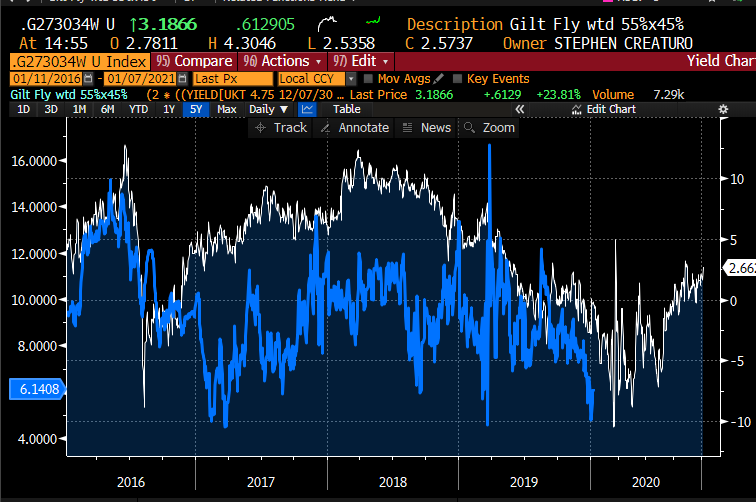

Spread below: Gilts 30/34/38(HC) vs 10/20 Gilt Curve – Generic Spline

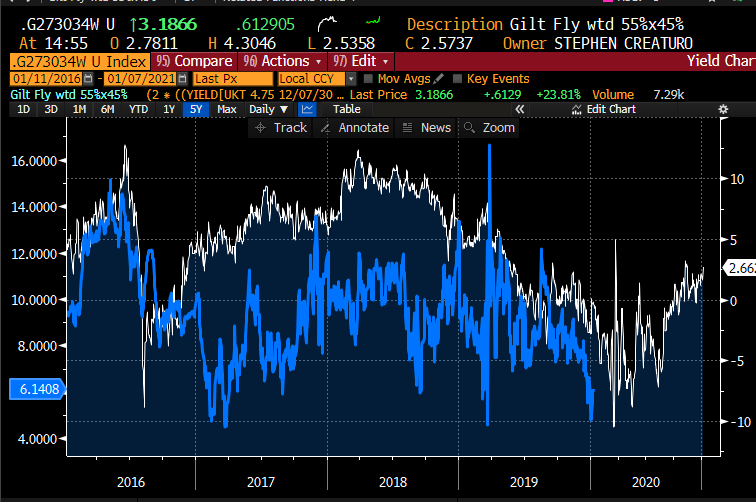

Graph Below: 30/34/38s LAGGED ONE YEAR. vs 27/30/34s wtd 55%x45% to maintain Duration Neutral to assess long term

rolling down of similar structure.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

CRB, METALS AND BITCOIN : THE FOLLOWING ARE NOW VERY MUCH IN THE CROSS HAIRS GIVEN NEARLY ALL HAVE HISTORICALLY DISLOCATED RSI’S AND POISED TO STALL.

CRB, METALS AND BITCOIN : THE FOLLOWING ARE NOW VERY MUCH IN THE CROSS HAIRS GIVEN NEARLY ALL HAVE HISTORICALLY DISLOCATED RSI’S AND POISED TO STALL.

AS SOMEONE MENTIONED TODAY THIS COULD BE AN “ALL OR NOTHING” FIRST QUARTER SO WORTH BEARING IN MIND WHERE SOME OF THESE CONTRACTS ARE HISTORICALLY!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Gilt Trade - HC Micro RV 30-34-38 - Short Belly

No one will buy 38's. 2nd richest bond on the curve

John Wentzell

CEO / Founding Partner

Astor Ridge

O: +44 (0) 203 - 143 - 4800

M US: +1 (630) 965 - 3522

M UK: +44 (0) 779 - 505 - 0313

E: John.Wentzell@AstorRidge.com

UK: Dowgate Hill House, 14-16 Dowgate Hill, London, EC4R 2SU

US: 60 Rumson Road, Rumson, NJ, 07760

From: Stephen Creaturo <stephen.creaturo@astorridge.com>;

Sent: Thursday, January 7, 2021 9:05 AM

To: Jim Lockard <Jim.lockard@astorridge.com>;; John Wentzell <John.wentzell@astorridge.com>;; Mark Funsch <mark.funsch@astorridge.com>;; Marc Lamoureux <Marc.Lamoureux@astorridge.com>;; George Whitehead <George.Whitehead@astorridge.com>;; David Sansom <David.Sansom@astorridge.com>;; Robert Baida <robert.baida@astorridge.com>;; Chris Williams <Chris.Williams@astorridge.com>;; James Rice <James.Rice@astorridge.com>;; Will Scott <Will.Scott@astorridge.com>;; Gareth Edwards <gareth.edwards@astorridge.com>;; Peter Joos <Peter.Joos@astorridge.com>;

Cc: Research <research@astorridge.com>;

Subject: Gilt Trade - HC Micro RV 30-34-38 - Short Belly

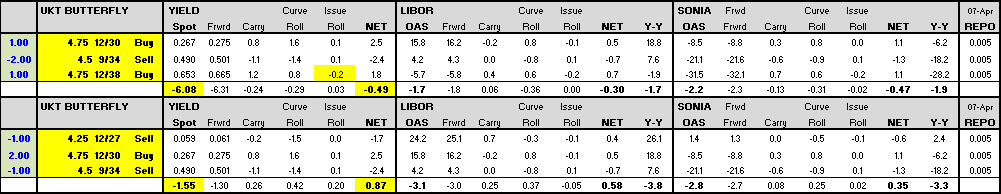

Trade: Sell 4.5% 34 vs buying 4.75% 30(ctd) & 4.75% 38 50x50wtd

Tactical 3mo hold to mitigate carry.

Rationale: Playing the Range – Spread at multi-year lows, currently +6.1bps(range ~4.5 – 15bps)

Curvature of HC rich relative to slope of 10/20 curve generically, but relationship has been less clear post March Covid event

10y CTD 30s underperformer in Q4 – hedge instrument for many locking in rates into year end, should reverse, 10y CTD cheap in curvature relative to level of rates

No imminent impact rolling into and out of DLV Basket, IE long way to go for consideration – range should prevail first before impact of CTD bonds influencing spread

APF has exhausted 30s, but only marginal float remains for both 34s and 38s ~2bl

3x35s taps this qtr will weigh on 34s

Risk: APF exhaust 34s first, similar to pattern of the HC 27s, then 30s.

10/20 curve Flattens on risk event,(but see marginal impact to fly as the level already reflects flatter curve)

AR Model approach suggest 38s from an RV perspective are richer on the curve and begins to adjust 1-2bps for this.

(much of the richness coming from maturity metrics – but when looking at mod duration which we are doing to

achieve a more symmetrical distribution of risk along the curve – this is sharply reduced)

Carry&Roll: Negative -.5bps/3mos – would highlight though half of this is coming from the negative roll-down of models input. Looking

at it another way, we are using 30/34/38s for symmetry in the distribution of risk along the curve, hence 10/20 curve wider

than what Fly implies, if you back out the bond specific roll – you get Neg C&R 1bps/Ann

Entry: +6.15bps(short belly)

Add: +4bps

Stop: +3.25bps

Target: +11.bp

Carry & Roll – 3mos

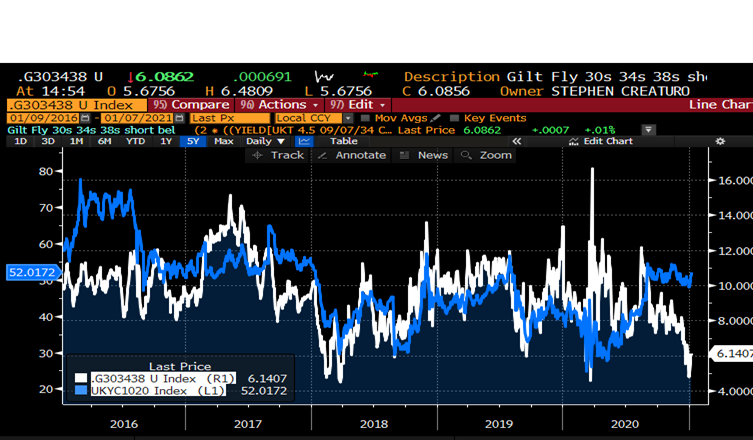

Spread below: Gilts 30/34/38(HC) vs 10/20 Gilt Curve – Generic Spline

Graph Below: 30/34/38s LAGGED ONE YEAR. vs 27/30/34s wtd 55%x45% to maintain Duration Neutral to assess long term

rolling down of similar structure.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Gilt Trade - HC Micro RV 30-34-38 - Short Belly

Trade: Sell 4.5% 34 vs buying 4.75% 30(ctd) & 4.75% 38 50x50wtd

Tactical 3mo hold to mitigate carry.

Rationale: Playing the Range – Spread at multi-year lows, currently +6.1bps(range ~4.5 – 15bps)

Curvature of HC rich relative to slope of 10/20 curve generically, but relationship has been less clear post March Covid event

10y CTD 30s underperformer in Q4 – hedge instrument for many locking in rates into year end, should reverse, 10y CTD cheap in curvature relative to level of rates

No imminent impact rolling into and out of DLV Basket, IE long way to go for consideration – range should prevail first before impact of CTD bonds influencing spread

APF has exhausted 30s, but only marginal float remains for both 34s and 38s ~2bl

3x35s taps this qtr will weigh on 34s

Risk: APF exhaust 34s first, similar to pattern of the HC 27s, then 30s.

10/20 curve Flattens on risk event,(but see marginal impact to fly as the level already reflects flatter curve)

AR Model approach suggest 38s from an RV perspective are richer on the curve and begins to adjust 1-2bps for this.

(much of the richness coming from maturity metrics – but when looking at mod duration which we are doing to

achieve a more symmetrical distribution of risk along the curve – this is sharply reduced)

Carry&Roll: Negative -.5bps/3mos – would highlight though half of this is coming from the negative roll-down of models input. Looking

at it another way, we are using 30/34/38s for symmetry in the distribution of risk along the curve, hence 10/20 curve wider

than what Fly implies, if you back out the bond specific roll – you get Neg C&R 1bps/Ann

Entry: +6.15bps(short belly)

Add: +4bps

Stop: +3.25bps

Target: +11.bp

Carry & Roll – 3mos

Spread below: Gilts 30/34/38(HC) vs 10/20 Gilt Curve – Generic Spline

Graph Below: 30/34/38s LAGGED ONE YEAR. vs 27/30/34s wtd 55%x45% to maintain Duration Neutral to assess long term

rolling down of similar structure.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

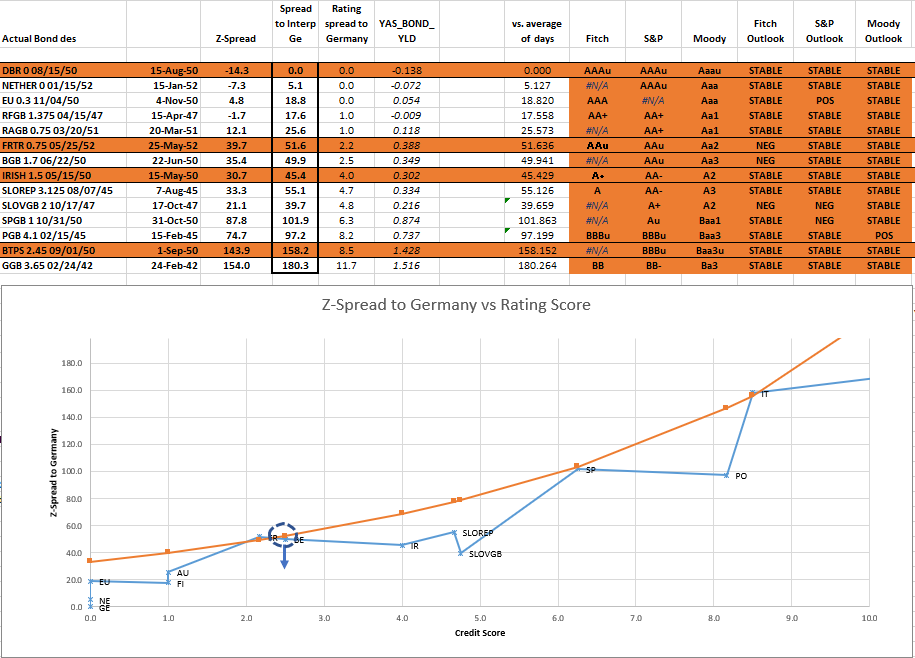

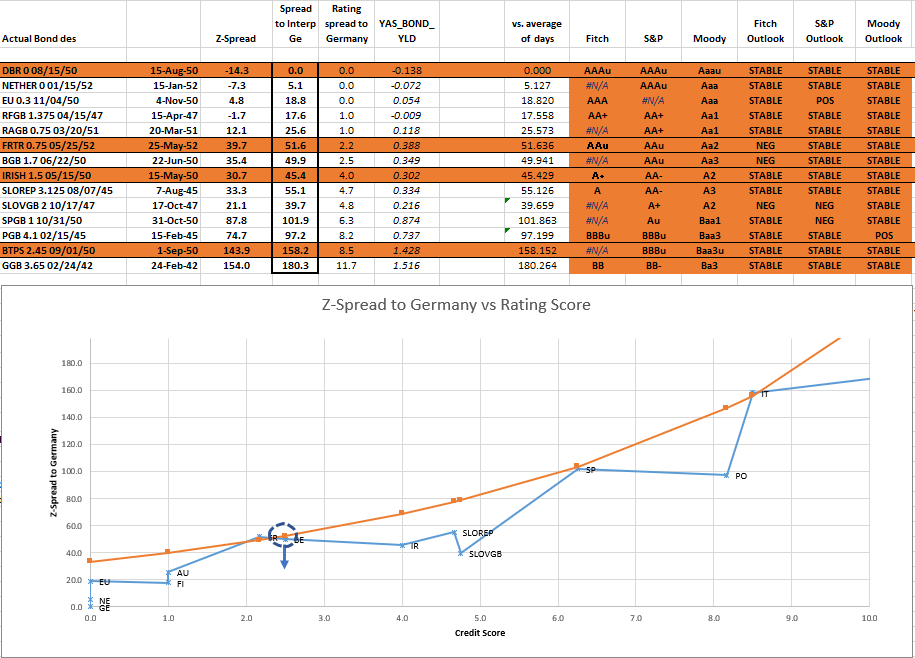

Selling the Big Issue - Belgium 30y Trade idea as a credit

Buy 30y Belgium as a Credit vs EU and Spain

- ‘Sell the Big Issuers’ –has to be one of the main leans or ‘fades’ for trading in 2021 has to be long the rare issuers and short the big issuers

- The backdrop of the PEPP in powerplay mode has dragged all credits tighter to the risk-free rate. The smaller issuers , favoured by the Capital Key – Ireland, Belgium, Finland, Austria & Portugal will continue to outperform

- Now, the thought of buying rich bonds to sell them even richer, is nothing other than the ‘greater fool theory’ writ large. And as a value trader that makes me feel somewhat queasy. So we have to tread carefully – we still have to eke out value – by looking at the credit surface – see below

- The ‘Big Issuers’ – Italy, France, Spain, Germany and EU are names that will continue to define the fair value curve and the weight of their issuance, less QE means they’re much less likely to go walkabout

Here’s the credit surface in 30 years – it’s really one on of the last games in town, as the 30y at least still has some tangible vestiges of credit / rating risk for each issuer. We have plotted Euro Z-spread vs Interpolated Germany on the y-axis and ‘Credit Score’* on the x-axis

*Credit Score is an amalgamation of the rating for an issuer under Fitch, Moody’s and S&P with minor adjustments for ‘credit outlook’ too

The Credit Surface (30yrs)

In this fit we have allowed France, Spain and Italy to define the credit curve – as you can see the smaller issuers all trade rich to that Orange (fitted) line

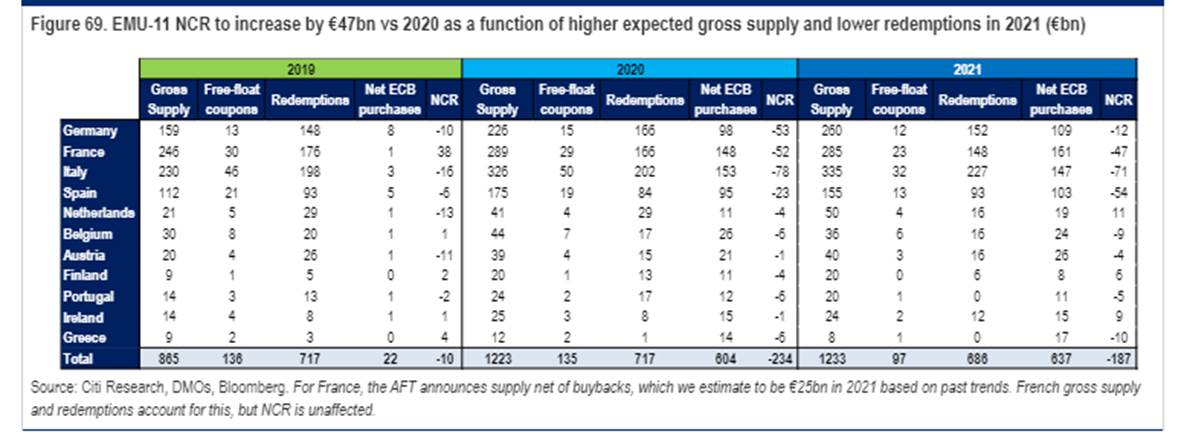

The exception is 30y Belgium - It has been dragged cheaper by its major comparator, France – However the flows for Belgium post PEPP are still positive with a modest 9yd cash requirement (Citi recent estimate)

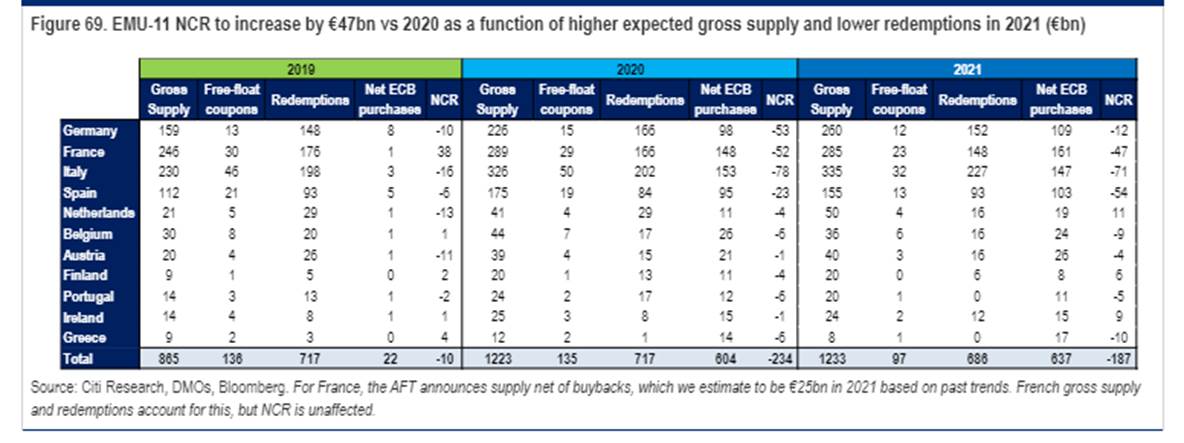

Net Cash Requirement (as per Citi)

- Belgium has a tiny requirement of 9bln – witness what the €9bln surplus did for the recent Irish 10y syndication!!!!

- Conversely the EU 30y has the property of trading rich to the rest of the curve, which we account to a dearth of issuance of a AAA nature in that Tenor – yet they will continue to supply and issuance at close to zero yield in long tenors is as closed to debt forgiveness as we can get!

- Using weightings derived from our smooth Credit Curve and selecting optimal issues…

Trade Structure

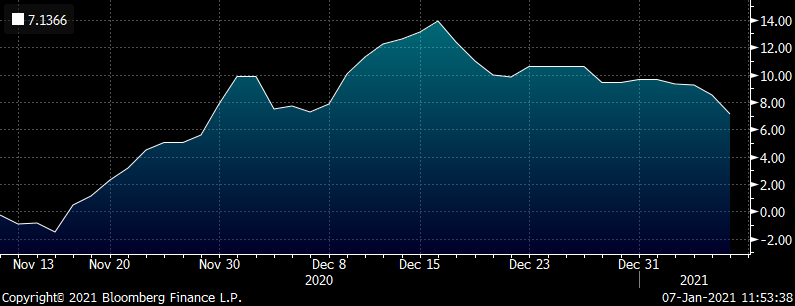

Buy Belgium 30y sell 75% EU 30y and 25% Spain 30y

cix:

100 * (YIELD[BGB 1.7 06/22/50 Corp] - 0.75 * YIELD[EU 0.3 11/04/50 Corp] - 0.25 * YIELD[SPGB 1 10/31/50 Corp])

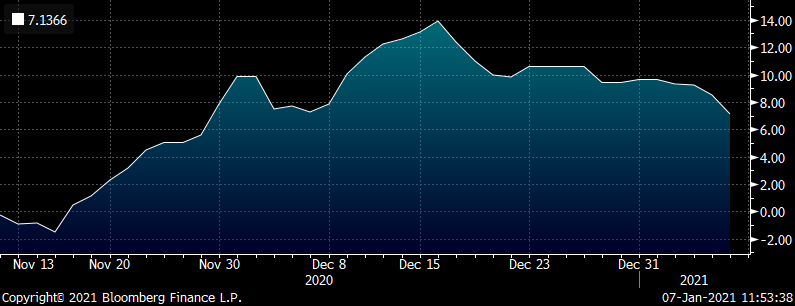

Graph

I see this as having the prospect of richening up to 15bp from current levels to represent a scarce issuer in a low supply / high PEPP environment

Let me know your thoughts

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Selling the Big Issue - Belgium Long Trade idea

Buy 30y Belgium as a Credit vs EU and Spain

- ‘Sell the Big Issuers’ –has to be one of the main leans or ‘fades’ for trading in 2021 has to be long the rare issuers and short the big issuers

- The backdrop of the PEPP in powerplay mode has dragged all credits tighter to the risk-free rate. The smaller issuers , favoured by the Capital Key – Ireland, Belgium, Finland, Austria & Portugal will continue to outperform

- Now, the thought of buying rich bonds to sell them even richer, is nothing other than the ‘greater fool theory’ writ large. And as a value trader that makes me feel somewhat queasy. So we have to tread carefully – we still have to eke out value – by looking at the credit surface – see below

- The ‘Big Issuers’ – Italy, France, Spain, Germany and EU are names that will continue to define the fair value curve and the weight of their issuance, less QE means they’re much less likely to go walkabout

Here’s the credit surface in 30 years – it’s really one on of the last games in town, as the 30y at least still has some tangible vestiges of credit / rating risk for each issuer. We have plotted Euro Z-spread vs Interpolated Germany on the y-axis and ‘Credit Score’* on the x-axis

*Credit Score is an amalgamation of the rating for an issuer under Fitch, Moody’s and S&P with minor adjustments for ‘credit outlook’ too

The Credit Surface (30yrs)

In this fit we have allowed France, Spain and Italy to define the credit curve – as you can see the smaller issuers all trade rich to that Orange (fitted) line

The exception is 30y Belgium - It has been dragged cheaper by its major comparator, France – However the flows for Belgium post PEPP are still positive with a modest 9yd cash requirement (Citi recent estimate)

Net Cash Requirement (as per Citi)

- Belgium has a tiny requirement of 9bln – witness what the €9bln surplus did for the recent Irish 10y syndication!!!!

- Conversely the EU 30y has the property of trading rich to the rest of the curve, which we account to a dearth of issuance of a AAA nature in that Tenor – yet they will continue to supply and issuance at close to zero yield in long tenors is as closed to debt forgiveness as we can get!

- Using weightings derived from our smooth Credit Curve and selecting optimal issues…

Trade Structure

Buy Belgium 30y sell 75% EU 30y and 25% Spain 30y

cix:

100 * (YIELD[BGB 1.7 06/22/50 Corp] - 0.75 * YIELD[EU 0.3 11/04/50 Corp] - 0.25 * YIELD[SPGB 1 10/31/50 Corp])

Graph

I see this as having the prospect of richening up to 15bp from current levels to represent a scarce issuer in a low supply / high PEPP environment

Let me know your thoughts

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

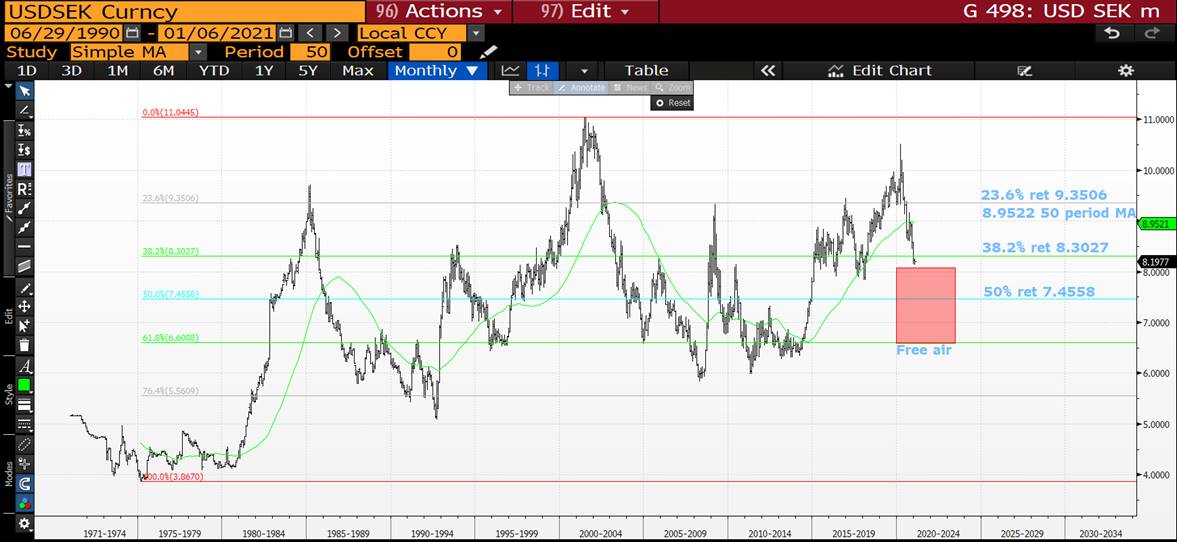

*******PLEASE READ : IS JANUARY TO BE A MASSIVELY EXPLOSIVE MONTH? **********

PLEASE READ : IS JANUARY TO BE A MASSIVELY EXPLOSIVE MONTH?

I DON'T NORMALLY COLLATE THIS NUMBER OF CHARTS IN ONE PIECE BUT FEEL IT IS WORTH IT THIS TIME. THERE ARE "SO MANY" CHARTS WITH "FREE AIR" OR CAPACITY FOR "FREE AIR" LOOMING. JANUARY REALLY COULD BE A ONE DIMENSION MONTH AND TIME TO MAKE A YEARS ALPHA!

IN THIS PRESENTATION IS BOND YIELDS, FX AND BREAKEVENS TO GO SOMEWAY TO HIGHLIGHT THE ONCE IN A LIFETIME RSI DISLOCATIONS AND POTENTIAL MONTH WE MAY HAVE!

BOND YIELDS : YESTERDAYS YIELD UPDATE WAS A SHOCK GIVEN THE INSTANT RESPONSE BUT DOES HIGHLIGHT JANUARY COULD BE THE MONTH TO CATCH EVERYONE OUT!

OBVIOUSLY THIS IS A BIG CALL GIVEN WE ARE 6 DAYS INTO THE NEW YEAR-MONTH BUT IT IS WORTH CLARIFYING THE "ROOM" MANY LONGTERM CHARTS HAVE!

IT GOES WITH OUT SAYING THAT THE WEEKLY CLOSES WILL NEED TO REFLECT THE TREND AND IDEALLY IT IS A STRAIGHT LINE MOVE, CERTAINLY ONE TO PONDER-DISCUSS.

FX : I HAVE MENTION USD WEAKNESS AS A MAJOR CONCERN FOR SOME TIME GIVEN THE ONCE IN A LIFETIME RSI DISLOCATIONS FORMULATED IN MARCH LAST YEAR. WE STILL HAVE CONCIDERABLE ROOM FOR FURTHER WEAKNESS AND THAT MAY CAUSE A RUN ON THE USD THIS MONTH. MANY KEY LONGTERM LEVELS HAVE OR ARE ABOUT TO BE BREACHED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Thoughts on the new bund - feb 31, coming today

Apols – I forgot the attachment – see above tks

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Apols I mee

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796