FX UPDATE : THE USD CONTINUES TO WEAKEN AND IS APPROACHING SOME VERY KEY LEVELS, EVEN THROUGH IN SOME CASES.

FX UPDATE : THE USD CONTINUES TO WEAKEN AND IS APPROACHING SOME VERY KEY LEVELS, EVEN THROUGH IN SOME CASES. THIS SHOULD AID A BOND YIELD RALLY!

THE AUD IS WELL ON ITS WAY HIGHER GIVEN THE "FREE AIR" SPACE ABOVE!

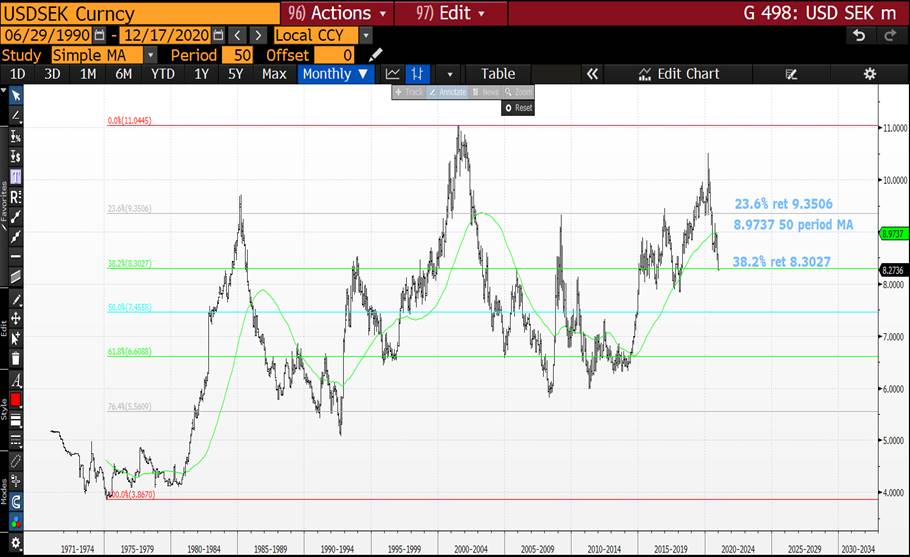

USDSEK HAS BREACHED ITS LONGSTANDING 38.2% RET 8.3027.

USD MXN IS ONE TO WATCH GIVEN WE ARE POISED TO BREACH THE 50 PERIOD MOVING AVERAGE-38.2% RET 19.7005.

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

USDTRY HAS A PERFECT FAILURE AT ITS MAJOR 2001 TRENDLINE 8.0084.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: The Fed and The BoE > Today's MPC Meeting - Quick Comment

The FED and the BoE

> "We don't think the economy suffers from a lack of highly accommodative financial conditions, we think it's suffering from the pandemic," Powell said (at yesterday's FOMC meeting).

> This comment was in response to doubts cast on whether the Fed was missing an oppty by not extending the maturity and size of their $120bn QE program that's currently in place.

> The Fed's forecasts for next year are solid/strong for the second part of the year and with another stimulus bill imminent (we think!) they decided they could stand pat while assuring they CAN do more if needed.

> The BoE's MPC meets today with their announcement due at noon. While the UK has the double-whammy of both Covid AND Brexit, the BoE's job is a bit more tricky than the FED's and surely explains the recent volatility of gilts vs USTs and DBRs.

> That said, the actions of the FED and BoE are often in 'sympatico', suggesting that Powell's patient approach could be reflected in Bailey & Co's stance today. With odds of a pre-Xmas Brexit deal the best we've seen yet, the odds have risen that the MPC does nothing today while repeating the 'we'll do what we have to' mantra yet again.

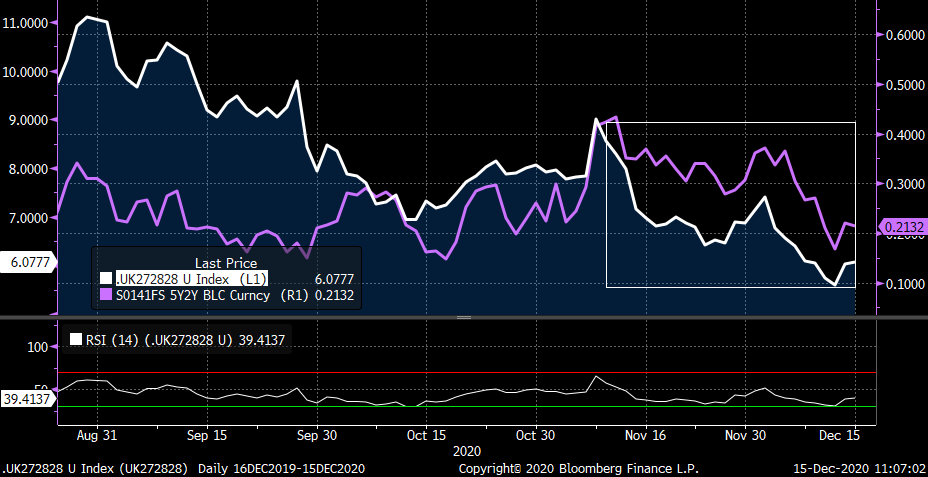

> The FX markets have placed their bets on the outcome of today's MPC meeting as cable climbed to new 2020 highs of 1.3574 on the open this am. This is being reflected in the bear steepening of the SONIA fwds (like 2y1y – see chart below) but has yet to be reflected to the same degree on the gilts curve.

> The knee-jerk reaction will probably be a modest bear-steepening of the gilts curve, continuing the bias seen since the start of the week.

More later...

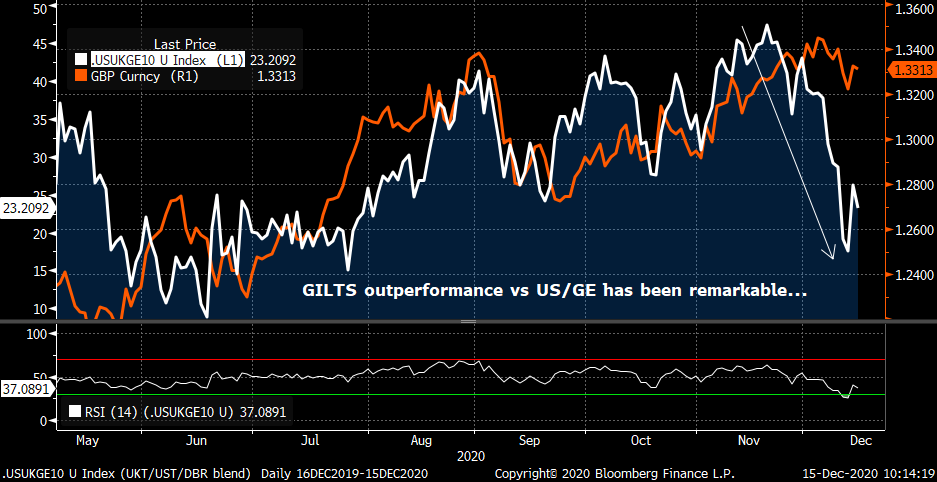

US-UK-GE 10yr Blend – Volatile couple weeks with gilts outperforming sharply into Dec…

More soon….

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

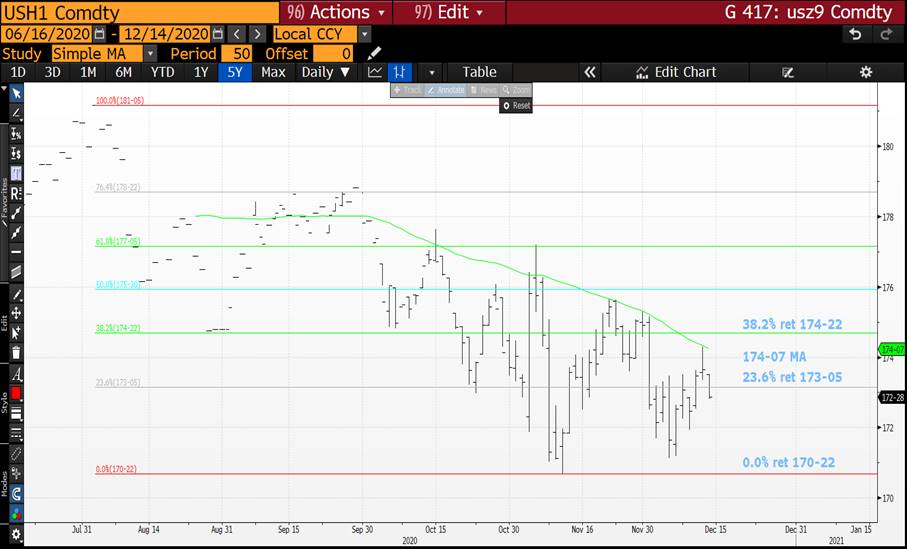

BONDS YIELDS : YIELDS HEADING HIGHER AS YET AGAIN THE FUTURES 50 DAY MOVING AVERAGES DID THEIR JOB.

BONDS YIELDS : YIELDS HEADING HIGHER AS YET AGAIN THE FUTURES 50 DAY MOVING AVERAGES DID THEIR JOB. THAT SAID THIS MOMENTUM NEEDS TO BE MAINTAINED INTO YEAR END.

**DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.** JUST NEED THIS YIELD UP MOVE TO CONTINUE ALL MONTH!

**WE HAVE PLENTY OF PROMINENT LEVELS TO WATCH FOR.**

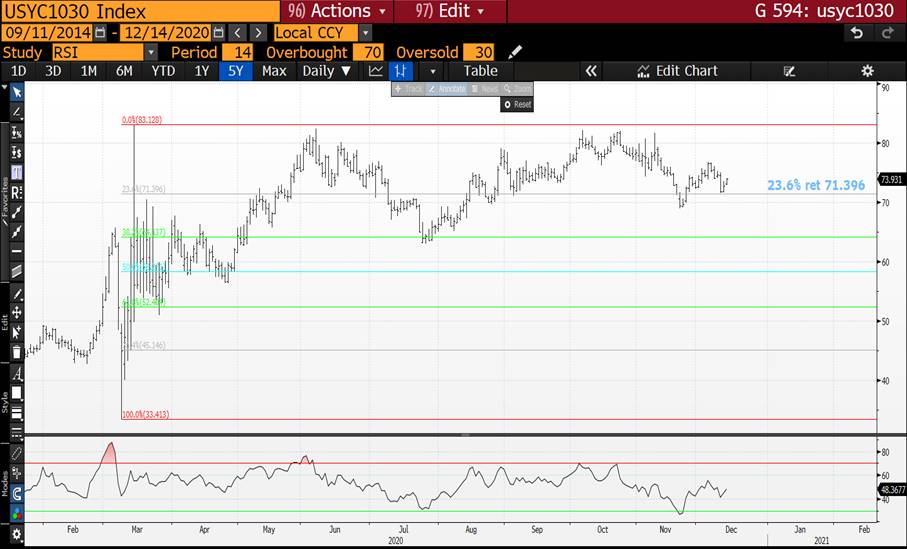

US 10-30 CURVE HAS BEEN A GREAT HELP ESPECIALLY AS WE HAVE JUST HELD THE

23.6% RET 71.396.

US 30YR YIELD AS WE CONTINUE TO REMAIN ABOVE THE 1.4382 2OO DAY MOVING AVERAGE THE NEXT BIG LEVEL TO BREACH LOOMS I.E. THE MULTI YEAR 38.2% RET 1.7533, SHOULD THIS BE BREACHED WE "FLY".

US 10YR YIELD HAS HELD ABOVE ITS 0.7292 2OO DAY MOVING AVERAGE AND POISED TO BREACH ITS 38.2% RET 0.9469.

US 5YR YIELD HAS JOINED THE 30YR - 10YR BY BREACHING ITS LONG STANDING 200 DAY MOVING AVERAGE 0.3644. ADDITIONALLY ITS QUARTERLY CHART (PAGE 9) HIGHLIGHTS HOW MUCH FURTHER WE HAVE TO GO GIVEN THE RSI EXTENSION SIMILAR TO 1998, 2003 AND 2008!

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS, ESPECIALLY IN THE FRONT END.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

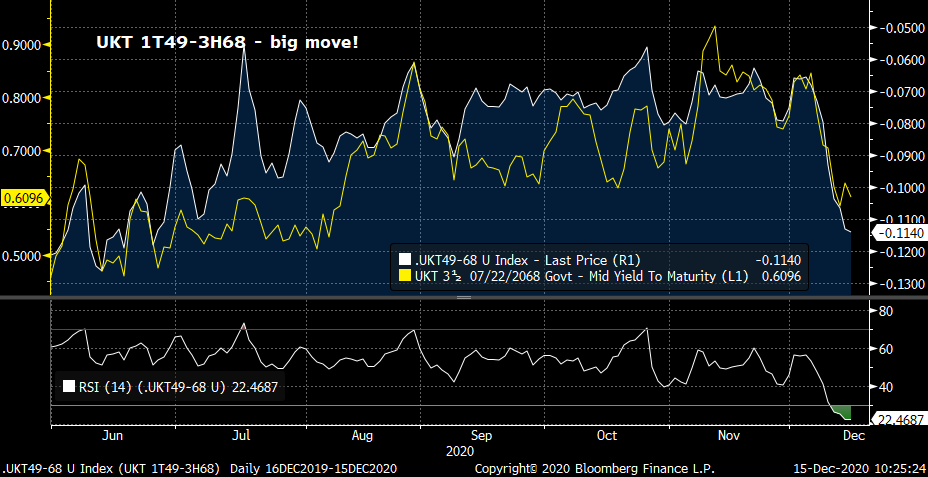

MICROCOSM: The Next Two Days in the GILTS Market are KEY... CHART BOOK

- Despite the market's eagerness to put 2020 behind us and move on, there's still too much going on to close up shop yet. Here's a quick rundown:

- London enters into Tier 3 restrictions as of tomorrow which means pubs and bars are shut (again), mingling with friends and family is limited and the Christmas hiatus we were all looking forward to is in doubt. Aside from the dispiriting affect this is having on sentiment, it's also going to whack economic activity in the UK in December, the most important month of the year for the economy.

- Reports on the state of the Brexit negotiations out of London/Brussels continue to taunt the markets as they veer from utter dismay to hopeful enthusiasm. Yesterday's bear steepening (in very thin volumes) unwound some of last week's bull flattening but risk appetites are waning as the market loses patience with the stagnation.

- With a 20Y+ APF today and a 7-20yr operation tomorrow, the bulls still have the upper hand from a gilts risk perspective. We've given a bit of it back but SONIA for the June meeting is still slightly negative at -1.3bps mid this am so we're still pricing in a dovish BoE.

- This am's Oct UK jobs data was soft at -143k and with Nov and Dec seeing tighter restrictions than October, we can surely expect a worsening of the data.

- Thursday's MPC Meeting

- The MPC's decision to extend QE by another £150bn in 2021 was driven largely by the lingering economic effects of the Covid-19 pandemic and a broader view that, deal or no deal, the impact of Brexit will be a significant drag on the economy in the next 1-2yrs. That said, the consensus among our strategist friends is that a no-deal Brexit outcome is still unlikely, even with the gloomy mood of the talks, so unless a no-deal outcome is announced in the next two days, the MPC is unlikely to announce any changes to the levels of accommodation already in place.

- If a no-deal IS announced, however, the consensus is for an immediate move to zero base rates and an additional £100bn QE, taking the remaining total to £250bn AND a likely increase in the frequency and size of each operation, akin to what we saw in March-May this year. Talk of negative rates – both among MPC members and the market – will accelerate and the market will likely price in a cut to -10bps by the Feb/Mar meetings.

- Where there is a bit less agreement, however, is with the details of the QE operations. Assuming Johnson & Barnier sign a deal, do the APF operations remain at the same pace or are they reduced somewhat to ensure the £150bn extends further into 2021? Do they make the much-debated move to realign the APF buckets to better match gilts liquidity/risk with their buying needs.

- Market Snapshot

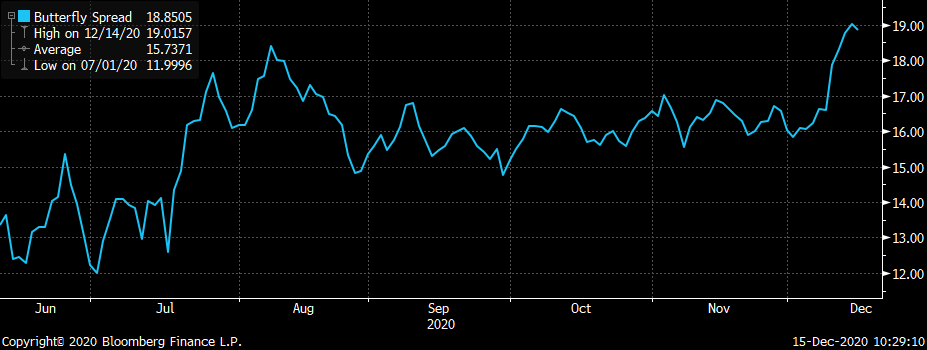

UKT 40-50-60 fly – 30yr point cheapening sharply on the curve

The 0F35s remain cheap on the curve…

But they've done well since their last tap…

0E24-0F25-0E26 fly has richened sharply in line with 4y1y SONIA… 0E24s coming under pressure as balance sheets are reduced into year-end. The 24-24 sprd is now at it's cheapest, the 0E24s +5.6bps mid…

UKT 1Q27-0E28-1F28 fly has come a long way since September. The 26-28s sector becomes very interesting in early 2021. By the end of January, the 0E28s slide into the 3-7yr bucket, adding some much-needed liquidity to the short bucket. Then on March 2nd we get the new UKT 10/26s which will likely impact 1H26s most, along with the 1Q27s. The 0E24s slide sub 3yrs so fall out of the basket too (which explains why they're cheap). The 1Q27s trade cheap to the curve and while they've have competition within the sector, they still have £7.9bn in APF eligibility into 2021 and should, in theory, outperform issues like 2T24, 225s, 1H26, 4Q27s and 1F28s going fwd. The 1H26-1Q27 sprd still looks steep to us although the recent flattening is in line with the move in Sonia.

UKT 27-28-28 fly – until mid-October the richening of the 0E28s was part of the new issue normalization to the curve. Since then their performance has been more directional, dictated by the level of rates. While the 0E28s still look on the cheap side to us they're more prone to selling pressure now.

Will be in touch…

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FX UPDATE : THE USD CONTINUES TO WEAKEN AND IS APPROACHING SOME VERY KEY LEVELS, THIS SHOULD AID A BOND YIELD RALLY!

FX UPDATE : THE USD CONTINUES TO WEAKEN AND IS APPROACHING SOME VERY KEY LEVELS, THIS SHOULD AID A BOND YIELD RALLY!

THE AUD IS WELL ON ITS WAY HIGHER GIVEN THE "FREE AIR" SPACE ABOVE!

USD CAD HAS BREACHED LAST MONTH LOW AND HEADING TOWARD A KEY 50% RET 1.2625.

USD MXN IS ONE TO WATCH GIVEN WE ARE POISED TO BREACH THE 50 PERIOD MOVING AVERAGE-38.2% RET 19.7005.

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

USDTRY HAS A PERFECT FAILURE AT ITS MAJOR 2001 TRENDLINE 8.0084.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BONDS YIELDS : YIELDS TO CONTINUE HEADING HIGHER GIVEN NEARLY ALL FUTURES HAVE FAILED THEIR 50 DAY MOVING AVERAGE.

BONDS YIELDS : YIELDS TO CONTINUE HEADING HIGHER GIVEN NEARLY ALL FUTURES HAVE FAILED THEIR 50 DAY MOVING AVERAGE.

**DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.** JUST NEED THIS YIELD UP MOVE TO CONTINUE ALL MONTH!

**WE HAVE PLENTY OF PROMINENT LEVELS TO WATCH FOR.**

US 10-30 CURVE HAS BEEN A GREAT HELP ESPECIALLY AS WE HAVE JUST HELD THE

23.6% RET 71.396.

US 30YR YIELD AS WE CONTINUE TO REMAIN ABOVE THE 1.4387 2OO DAY MOVING AVERAGE THE NEXT BIG LEVEL TO BREACH LOOMS I.E. THE MULTI YEAR 38.2% RET 1.7533, SHOULD THIS BE BREACHED WE "FLY".

US 10YR YIELD HAS HELD ABOVE ITS 0.7318 2OO DAY MOVING AVERAGE AND POISED TO BREACH ITS 38.2% RET 0.9469.

US 5YR YIELD HAS JOINED THE 30YR - 10YR BY BREACHING ITS LONG STANDING 200 DAY MOVING AVERAGE 0.3644. ADDITIONALLY ITS QUARTERLY CHART (PAGE 9) HIGHLIGHTS HOW MUCH FURTHER WE HAVE TO GO GIVEN THE RSI EXTENSION SIMILAR TO 1998, 2003 AND 2008!

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS, ESPECIALLY IN THE FRONT END.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trades and Fades - Week of 14th to 18th December, James & Will at Astor Ridge

Trades and Fades for next week Euro RV plus our thoughts on January syndications

Best Will & James

The week ahead:

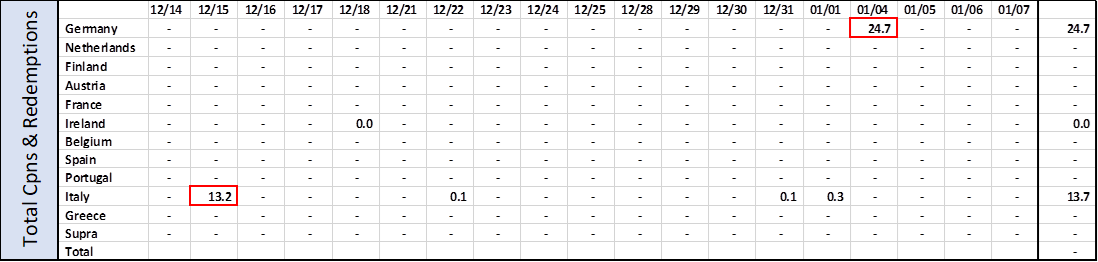

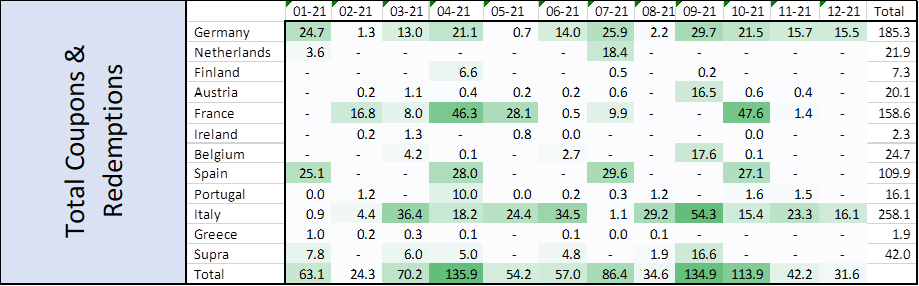

· Coupons and redemptions supportive for Italy for the rest of the month. Note Italian redemption is a CCT. Germany to see further support in January with 24.7 bn in C&R

· Looking further ahead January sees support for Germany and Spain in terms of C&R flows. Full year schedule below:

· Yesterday's ECB meeting and the general lack of supply likely clearly supportive for bonds, but it is not unreasonable to question how much further we can rally in outright Bund yields.

· Similarly, we have been struggling to break to new lows in spreads

· What seems fair is to assume that in the wake of supply in Q1 and what could be a disconnect between issuance and PEPP buying, that we can sell against short term strength in spreads, whilst looking for micro opportunities to capture supply concessions

Trades of the week below:

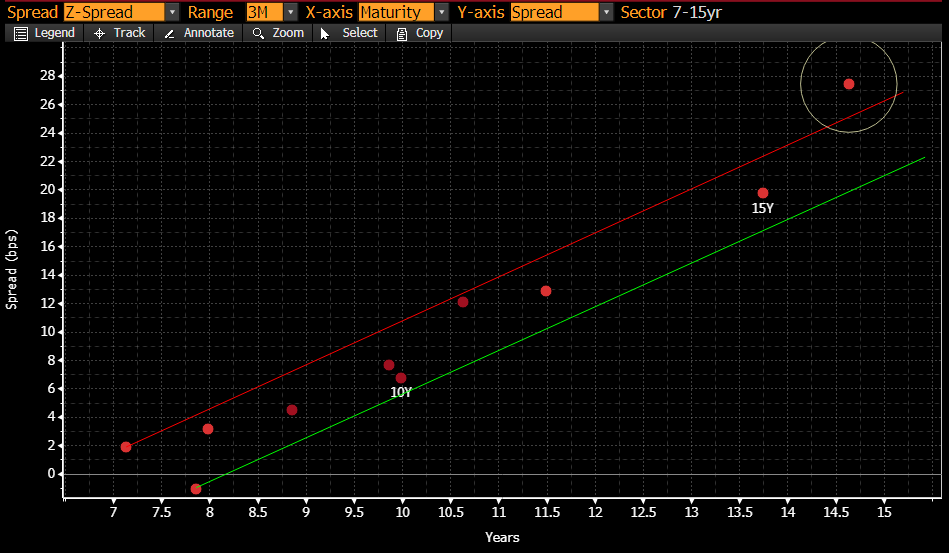

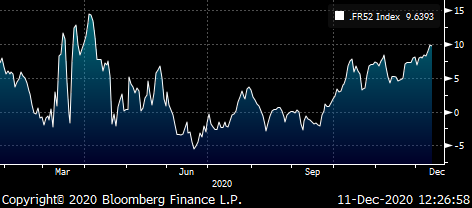

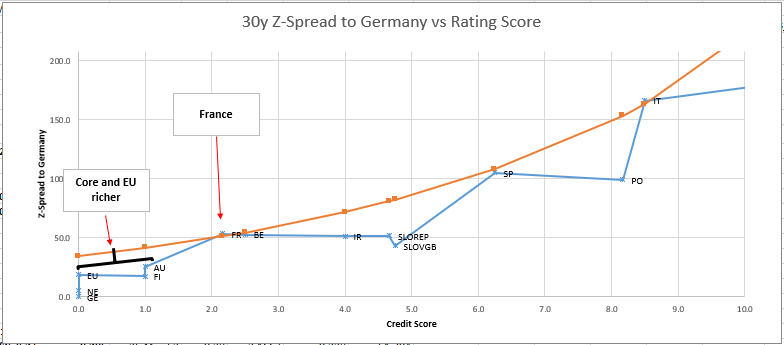

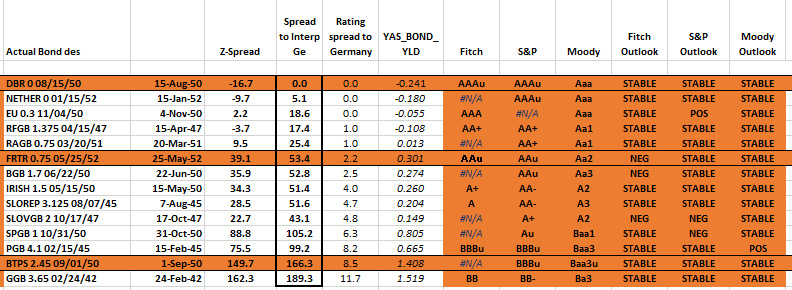

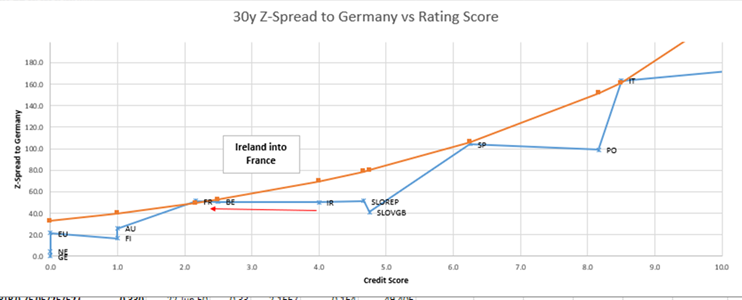

Buy France vs Germany and Italy on Credit Weighted Fly

- French Longs 30y cheapened as a credit after French supply announcement

Structure

Long France 52

Short 30% Italy, 70% Germany 46s (UB contract)Cix:

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp]) -

BBG graph

Levels:

Enter: +9.6bp

Add: +12.5bp

Target: +2.5bp

Rationale

France has cheapened over last long supply and on the prospect of 50y syndic in Jan

Frtr 52 goes into QE next May

Longs in Core countries trade much richer, hence the pick up using our credit model ratios rather than simple PCA

Graph: 30y Z-Spreads vs interpolated Germany

Table 1 – Data on Relative 30y Z-Spreads

Roll / Carry (bp per 3mo)

Germany: -0.3 / -1.2 (-0.68% repo)

France: +0.4 / +0.9 (-0.55% repo)

Italy: -0.5 / -2.5 (-0.58% repo)

Weighted Sum: flat / -0.7 bp /3mo

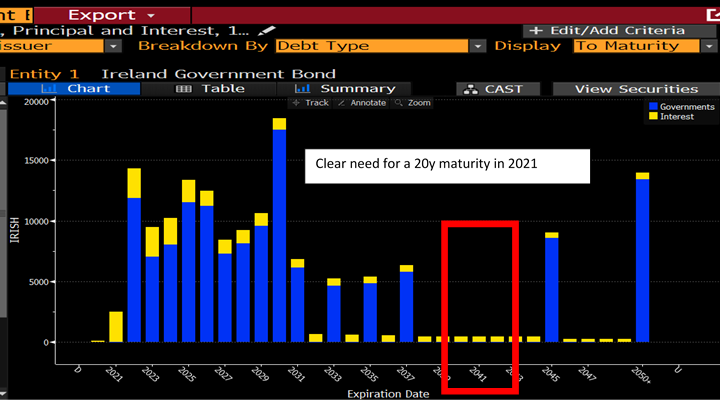

Sell Irish 5/37 vs FRTR 5/40 with a view to close out into syndicated supply

- Ireland structurally a rich credit vs France on our interpolated curves.

- This is even more exaggerated in longer tenors

- Ireland has limited funding needs this year, but tends to syndicate early January

- With no redemptions this year pressuring their issuance shedule we think they will opt for a 20y in January

- We think there will be QE demand for on the run bonds with a larger free float, so new issues should perform well in 2021

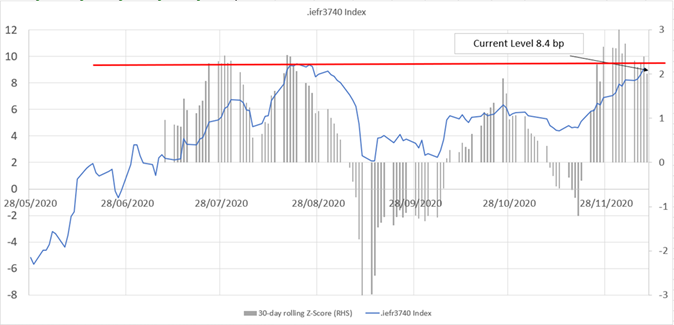

Graph 1: Irish 37 vs FRTR 5/40 at top end of the recent range

Graph 2: Distribution of Irish redemptions

Graph3: Ireland trades rich, especially in the long end, when compared to a ratings based curve

Sell BTPS 3/30 vs BTPS 1/27 & BTPS 4/31

- 4/31 has underperformed over the past week, despite the end of month tap having been cancelled

- Conversely, with little confidence of exactly what is being syndicated by Italy in Q1, we would like to run 7/10 steepeners into supply. Our only issue is that the levels are a little ambivalent in 7/10

- The cheapness of 4/31, however, makes the fly much more compelling, whilst retaining a steepening bias

- We have weighted the fly 60:40 in favour of 10y to take out a small amount of the directionality

- CIX 2 * (YIELD[BTPS 3.5 03/01/30 Corp] - 0.4 * YIELD[BTPS 0.85 01/15/27 Corp] - 0.6 * YIELD[BTPS 0.9 04/01/31 Corp]) * 100

James Rice & Will Scott

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice & Will Scott, consultants with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

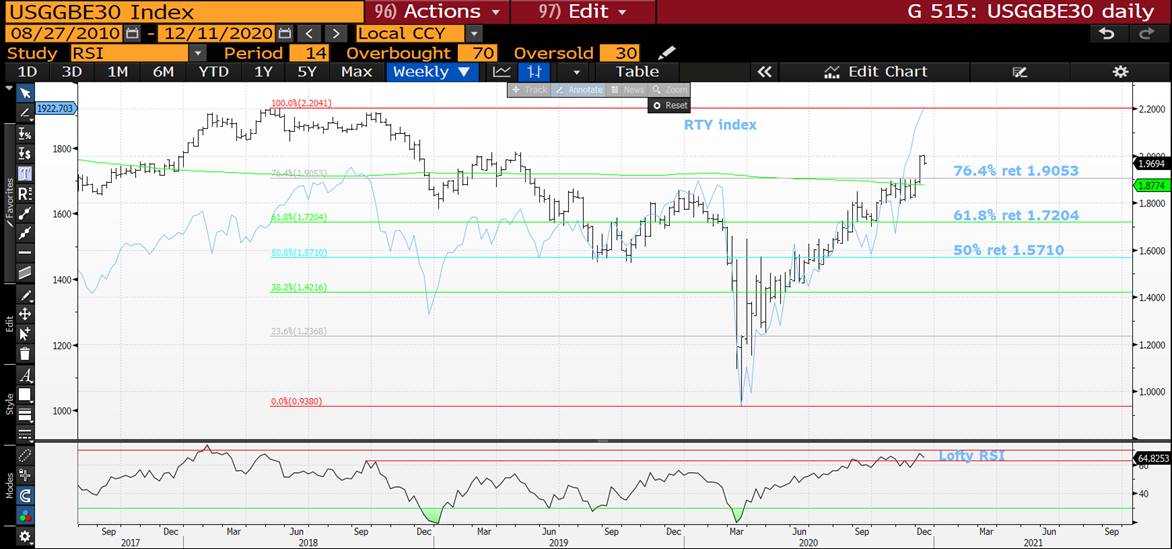

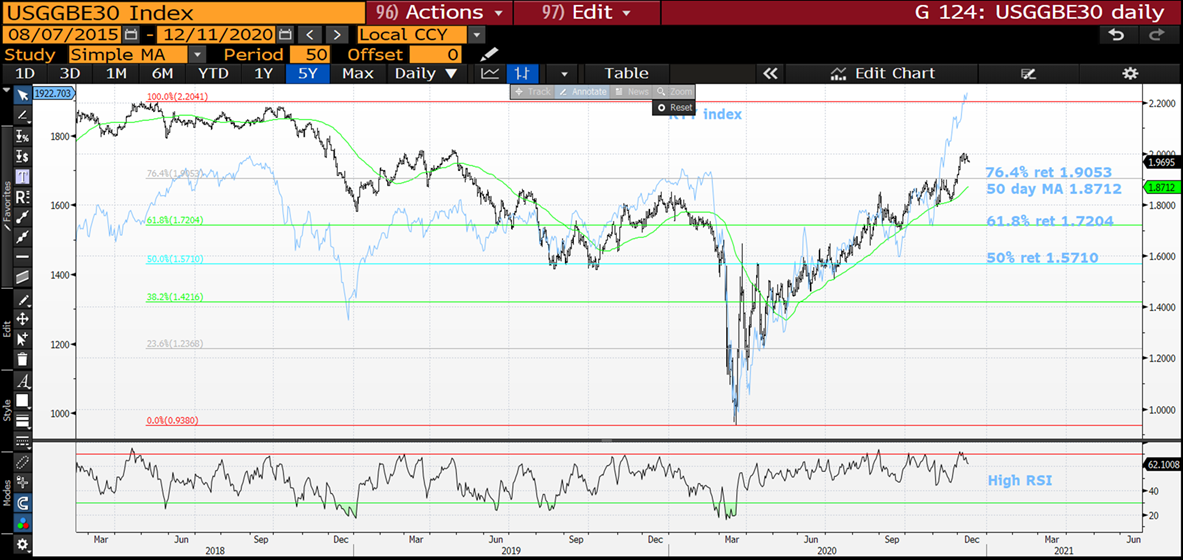

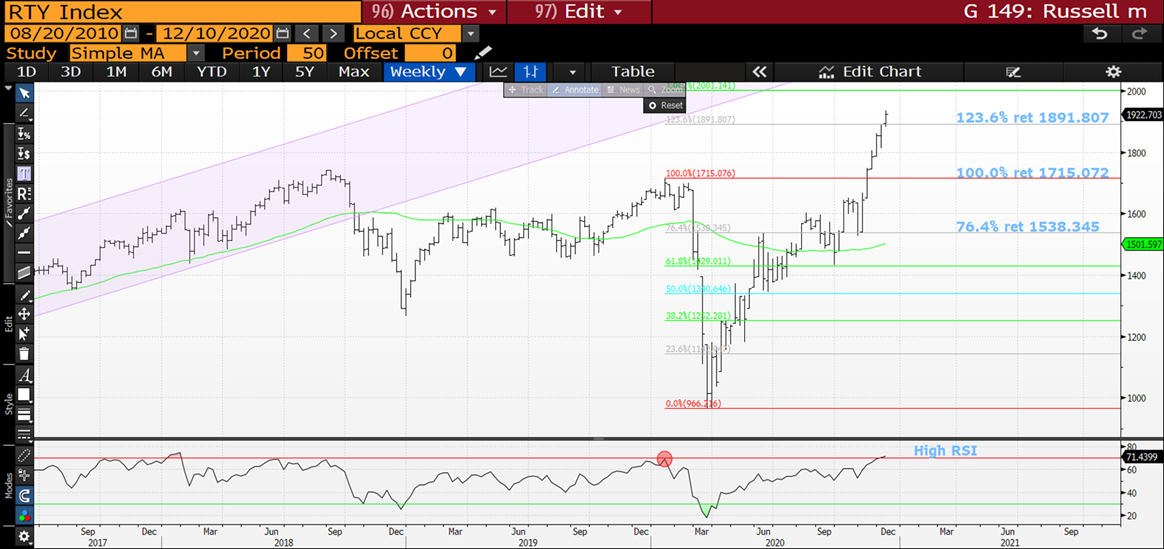

US BREAKEVENS AND USGGT : BREAKEVENS, THE CLOSE NEEDS TO BE A LOT LOWER BUT WE COULD BE CREATING A NASTY TOP GIVEN THE NUMEROUS RSI EXTENSIONS.

US BREAKEVENS AND USGGT : BREAKEVENS, THE CLOSE NEEDS TO BE A LOT LOWER BUT WE COULD BE CREATING A NASTY TOP GIVEN THE NUMEROUS RSI EXTENSIONS.

THE RUSSELL WEEKLY AND NOW DAILY RSI IS AS HIGH AS JANUARY 2020 PRE A CONSIDERABLE DROP!

US 5YR BREAKEVENS COULD BE THE ONE TO WATCH GIVEN THEY ARE STALLING AT A

MULTI YEAR RETRACEMENT 76.4% RET 1.8761.

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI'S LOOK HISTORICALLY LOFTY AND ADDITIONALLY MOVING AVERAGE RESISTANCE.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

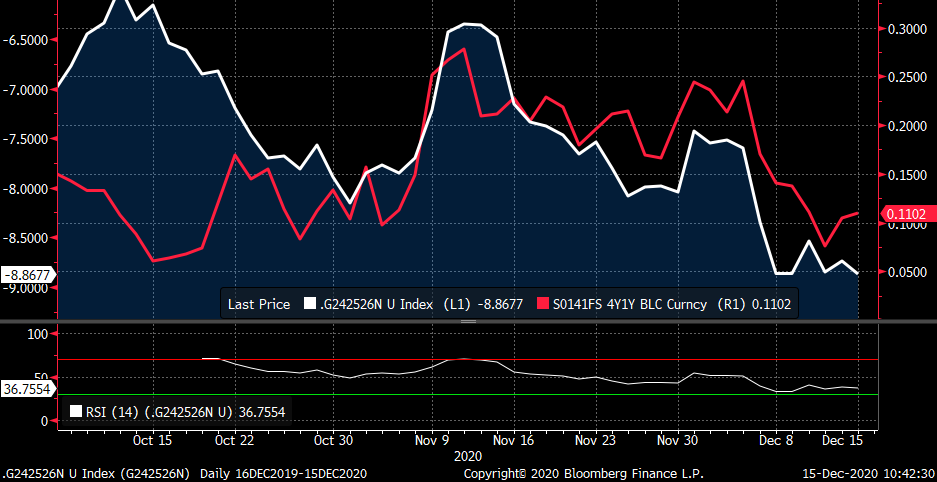

MICROCOSM: Quick AM Note on UK/Gilts... Brexit and the BoE

Good note from my colleague Marc (with a couple embellishments of my own):

Good morning {GB}. Last night the BoE confirmed the APFs for next week, schedule as usual 3-7y Mon, >20y Tues, 7-20y Wed. Long gilts continue to squeeze vs bund led by the ultra long-end, I see several reasons for this:

1) Brexit negotiations struggling

2) RM/ LDI buying ultra gilts

3) No supply + APFs next week means net bullish bias

4) ECB less dovish than expected yesterday.

I still think the dynamics are for gilts to outperform in the new year, but would look to reduce at these levels given the speed and magnitude of the move.

** Chart below of 10yr UK vs US and DBRs shows the UK at the richest levels on a momentum basis all year - quite an achievement given the Covid emergency in both the US and Europe right now. The gilts market is clearly positioned for the worst which leaves little room to manoeuvre if Bojo comes up with a 'Christmas Miracle'.

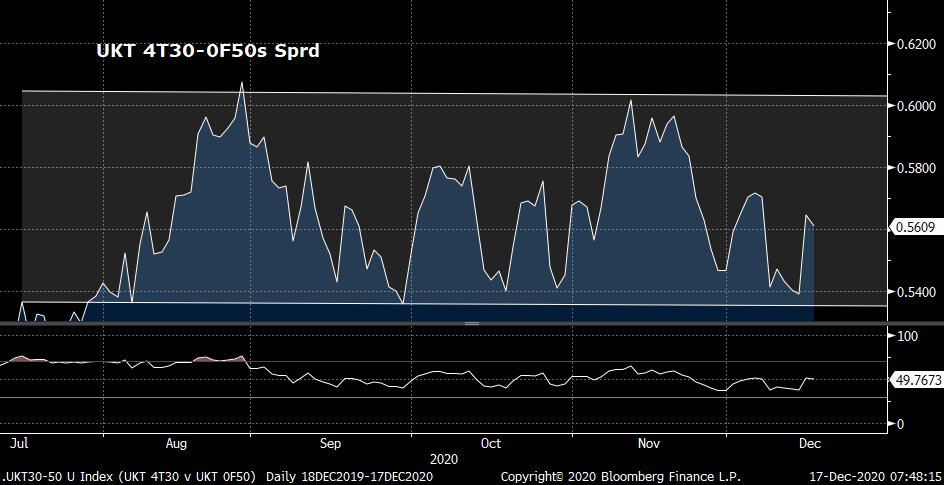

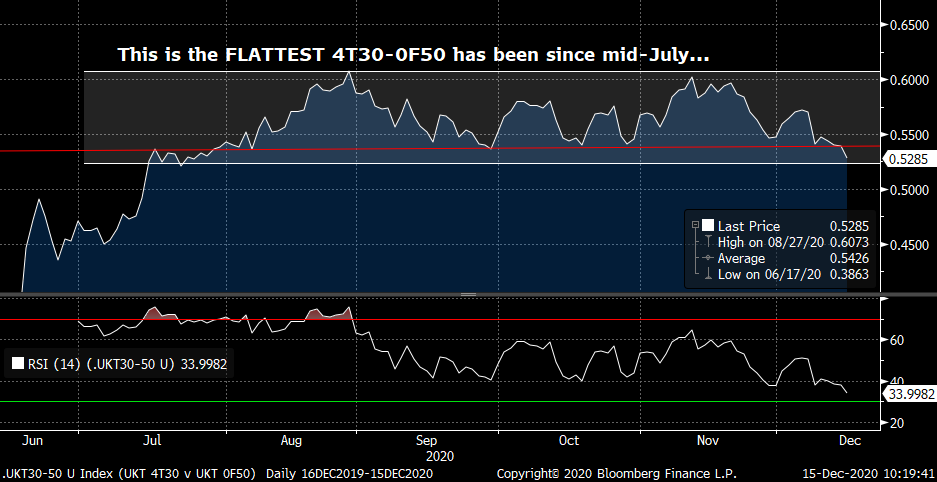

Chart below of 4T30-0F50 yield sprd (10-30s) shows we're about to take out the key support that has held since August but, perhaps more telling, the divergence of Cable vs the curve is correcting with GBP selling emerging. The resumption of this correlation gives a green light to the market to take the curve flatter.

And what about the MPC meeting next Thursday? If the deadline this Sunday is to be believed (what CAN we believe about Brexit these days?!) then the MPC will have a clear(er) understanding of where the UK stands going into January 1st.

MPC members like Saunders have been very vocal about the BoE's willingness to provide further monetary policy support via a cut of the base rate to zero and yet another extension of QE beyond the current package. While not a substantial move, a 10bps cut to zero means the next move is negative rates and would force 1y1y SONIA to new cycle lows. This could help mitigate some of the flattening bias although it'll certainly mean further UK outperformance vs US and Germany.

These comments just hit the tapes:

*BAILEY: BOE DOING QUITE EXTENSIVE WORK ON IMPACT OF NEG RATES

*BAILEY: BOE HAS A LOT IN ARMORY IN CASE OF BREXIT DISRUPTION

On the other side of the coin, a Brexit-Breakthrough, however paltry, would remove a huge source of stress and angst for the UK economy AND the MPC. It means the only game in town is Covid and while that also remains a monumental challenge, there are reasons for optimism given the vaccines are now being administered. From a policy perspective, it's unlikely to mean the MPC pulls the plug on QE, at least until June (in our view), HOWEVER, they could slow the pace of buying from the current ~£1.4bn per op which will shift the net gilts supply for Jan-Mar to a net cash need that would likely steepen the curve and drive a correction in the sharp inversion of the long-end this week.

We're hopeful, like the rest of the market, that cooler heads prevail and a deal can be struck in time. However, they've given us little reason to think a deal is imminent.

We'll be in touch.

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FX UPDATE : USD WEAKNESS CONTINUES AIDED BY A MAJOR BREAK ON THE AUD, PLENTY MORE ROOM ACROSS MANY OTHER CROSSES.

FX UPDATE : USD WEAKNESS CONTINUES AIDED BY A MAJOR BREAK ON THE AUD, PLENTY MORE ROOM ACROSS MANY OTHER CROSSES.

THE AUD IS WELL ON ITS WAY HIGHER GIVEN THE "FREE AIR" SPACE ABOVE!

USD CAD HAS BREACHED LAST MONTH LOW AND HEADING TOWARD A KEY 50% RET 1.2625.

USD MXN IS ONE TO WATCH GIVEN WE ARE POISED TO BREACH THE 50 PERIOD MOVING AVERAGE-38.2% RET 19.7005.

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

USDTRY REMAINS BELOW ITS MAJOR 2001 TRENDLINE 8.0084.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris