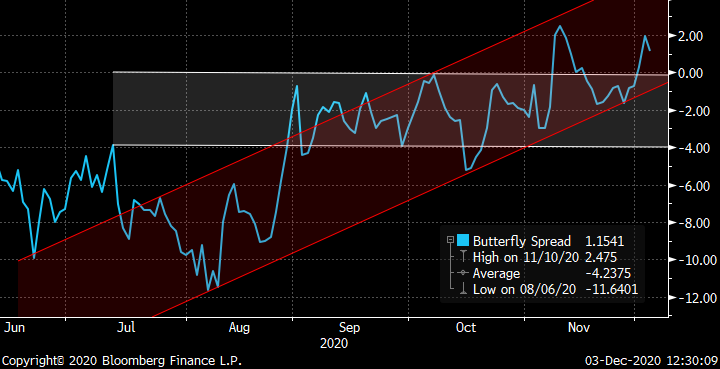

US BREAKEVENS AND USGGT : BREAKEVENS TO “TOP OUT” AGAIN GIVEN THE RSI ON ALL DURATIONS IS OVERBOUGHT!

US BREAKEVENS AND USGGT : BREAKEVENS TO “TOP OUT” AGAIN GIVEN THE RSI ON ALL DURATIONS IS OVERBOUGHT!

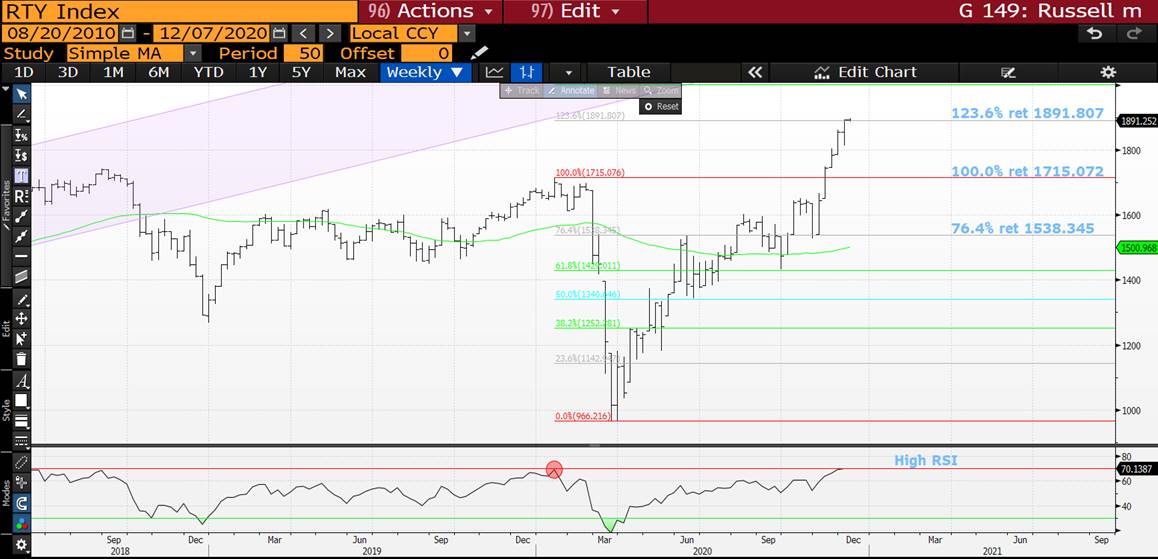

THE RUSSELL WEEKLY AND NOW DAILY RSI IS AS HIGH AS JANUARY 2020 PRE A CONSIDERABLE DROP!

US 5YR BREAKEVENS COULD BE THE ONE TO WATCH GIVEN THEY ARE TESTING A MULTI YEAR RETRACEMENT 76.4% RET 1.8761.

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI’S LOOK HISTORICALLY LOFTY AND ADDITIONALLY MOVING AVERAGE RESISTANCE.

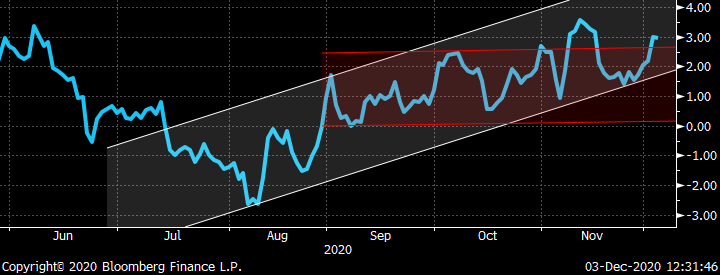

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

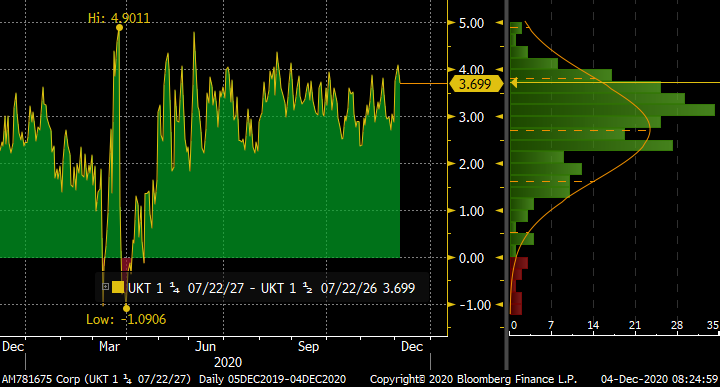

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BONDS YIELDS : THE USD WEAKNESS CONTINUES TO ADD VALUE TO THE LONGTERM CALL FOR HIGHER BOND YIELDS.

BONDS YIELDS : THE USD WEAKNESS CONTINUES TO ADD VALUE TO THE LONGTERM CALL FOR HIGHER BOND YIELDS. IDEALLY WE SEE SOME NEW YIELD HIGHS INTO THE WEEKEND AIDED BY ALL BAR THE 2YR ABOVE THEIR 200 DAY MOVING AVERAGES.

**DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.** JUST NEED THIS YIELD UP MOVE TO CONTINUE ALL MONTH!

**WE HAVE PLENTY OF PROMINENT LEVELS TO WATCH FOR.**

US 10-30 CURVE HAS AN RSI LOW NOT SEEN SINCE NOVEMBER 2019 AND IS NOW STEEPENING!

US 30YR YIELD AS WE CONTINUE TO REMAIN ABOVE THE 1.4478 2OO DAY MOVING AVERAGE THE NEXT BIG LEVEL TO BREACH LOOMS I.E. THE MULTI YEAR 38.2% RET 1.7533, SHOULD THIS BE BREACHED WE "FLY".

US 10YR YIELD HAS HELD ABOVE ITS 0.7521 2OO DAY MOVING AVERAGE AND POISED TO BREACH ITS 38.2% RET 0.9469.

US 5YR YIELD HAS JOINED THE 30YR - 10YR BY BREACHING ITS LONG STANDING 200 DAY MOVING AVERAGE 0.3959.

ADDITIONALLY ITS QUARTERLY CHART (PAGE 9) HIGHLIGHTS HOW MUCH FURTHER WE HAVE TO GO GIVEN THE RSI EXTENSION SIMILAR TO 1998, 2003 AND 2008!

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS, ESPECIALLY IN THE FRONT END.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

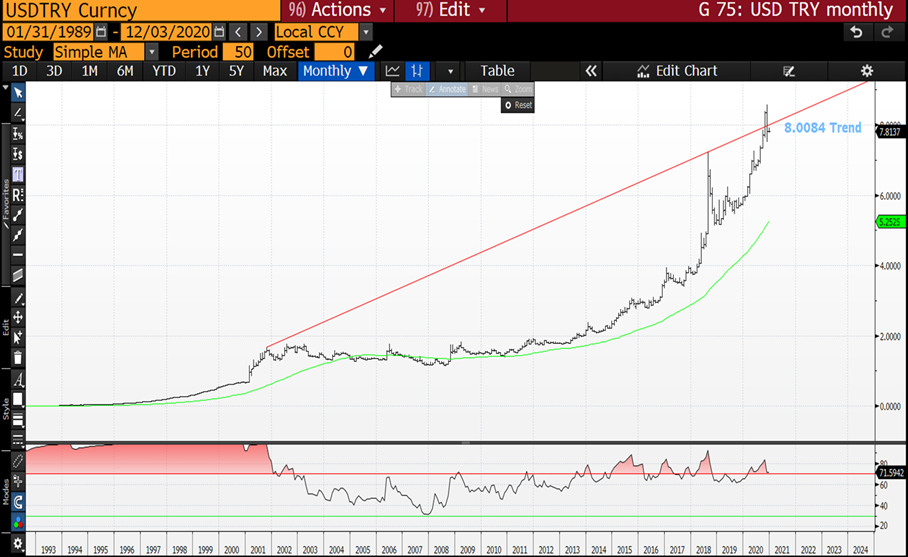

FX UPDATE : IS A LOWER USD TELLING US YIELDS WILL HEAD HIGHER POST NON-FARM? THE USD IS BREACHING MANY KEY LEVELS.

FX UPDATE : IS A LOWER USD TELLING US YIELDS WILL HEAD HIGHER POST NON-FARM? THE USD IS BREACHING MANY KEY LEVELS.

THE AUD IS THE ONE TO WATCH AS IT IS NOW ON ITS WAY HIGHER GIVEN THE "FREE AIR" SPACE IT IS IN NOW!

USD CAD HAS BREACHED LAST MONTH LOW AND HEADING TOWARD A KEY 50% RET 1.2625.

USD MXN IS ONE TO WATCH GIVEN WE ARE POISED TO BREACH THE 50 PERIOD MOVING AVERAGE-38.2% RET 19.7005.

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

USDTRY REMAINS BELOW ITS MAJOR 2001 TRENDLINE 8.0084.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

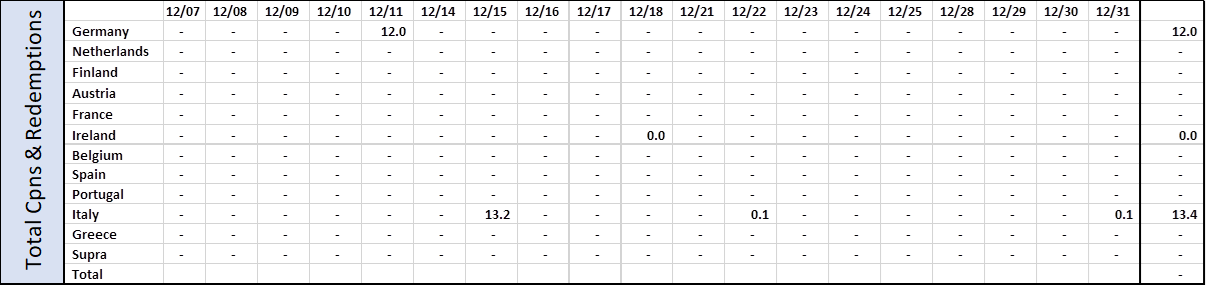

Trades and Fades - Week of 7th to 11th December, James & Will at Astor Ridge

The week ahead:

- Coupons and redemptions supportive for Germany and Italy for the rest of the month. Note Italian redemption is a CCT. CCTs currently at fair levels, but liquidity issues may mean this gets recycled short term into BTPS

- Supply schedule running on fumes, but Spain to announce bonds this afternoon and more clarity from Italy post close on whether they will cancel their mid-month supply (scheduled for 10th December). Not that they normally do but hey, this is 2020

- All eyes clearly on ECB next Thursday. Rhetoric somewhat tough to interpret, but any upside surprises to PEPP extension size likely to impact Italy and Spain, particularly in long ends

Trades of the week below (click on links)

- Buy 50y Spain on either 30/50 Box or 10/50 Box vs France

- Sell 10y Italy vs 7y and 15y Wings

- Buy France 30y vs Germany and Italian wings (as recommended last week)

- Sell Ireland vs France as January auction setup trade

- Sell Portugal 28 vs Spain 28

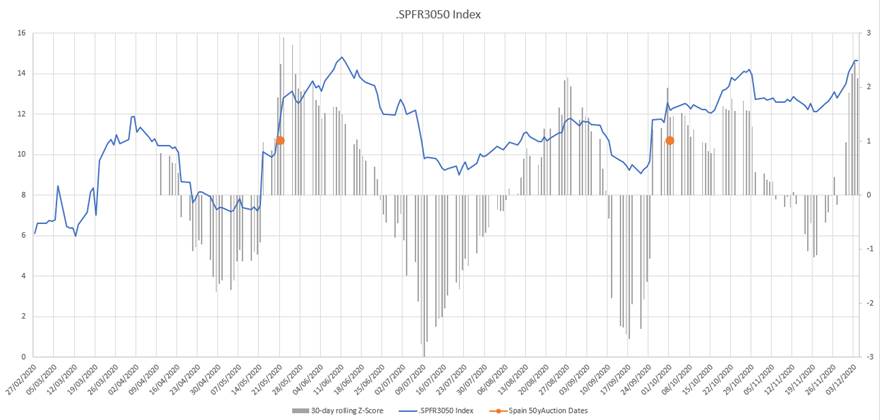

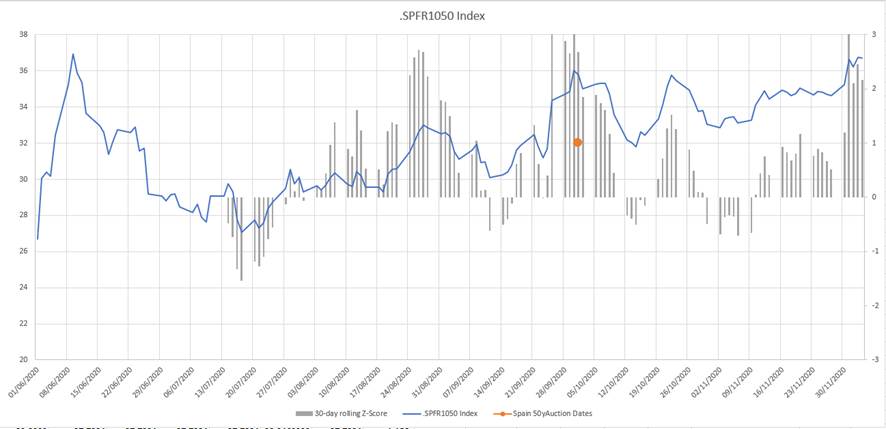

Buy 50y Spain on either 30/50 Box or 10/50 Box vs France

- 50y Spain looking cheap to us now and worth taking a look

- Positioning in Spanish 50y has weighted on Spain 30/50, steepening it up to 27 basis points

- Conversely supply in 30y France has flattened French 10/30 to 12.3 basis points

- The combination of the two has pushed the box to recent highs

- Given the relative illiquidity of this spread we think that both 30/50 and 10/50 iterations give us the best chance of execution, so choose to look at both possibilities

- What is clear from looking at the charts is that 1) Auction events see a substantial cheapening in 50y Spain and 2) It is value (as in a cheap z-score) that provides the catalyst for a reversion in the spread, rather than anything more cyclical. We think we are at this inflection point

- Current level: 14.4 basis points

- Entry level: 14 basis points

- Profit take: 11 basis points

- Any meaningful upsizing of the PEPP should help both Italian and Spanish long ends to flatten

- 30/50 CIX 100 * ((YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1 10/31/50 Corp]) - 1 * (YIELD[FRTR 1.75 05/25/66 Corp] - YIELD[FRTR 1.5 05/25/50 Corp]))

- 10/50 CIX 100 * ((YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1.95 07/30/30 Corp]) - 1 * (YIELD[FRTR 1.75 05/25/66 Corp] - YIELD[FRTR 0 11/25/30 Corp]))

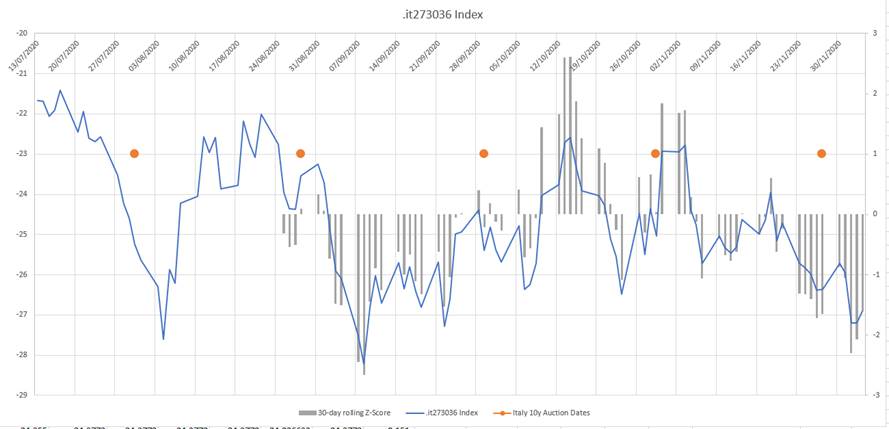

History of Spain/France 30y50y box (auction dates in orange)

History of Spain/France 10y50y box (auction dates in orange)

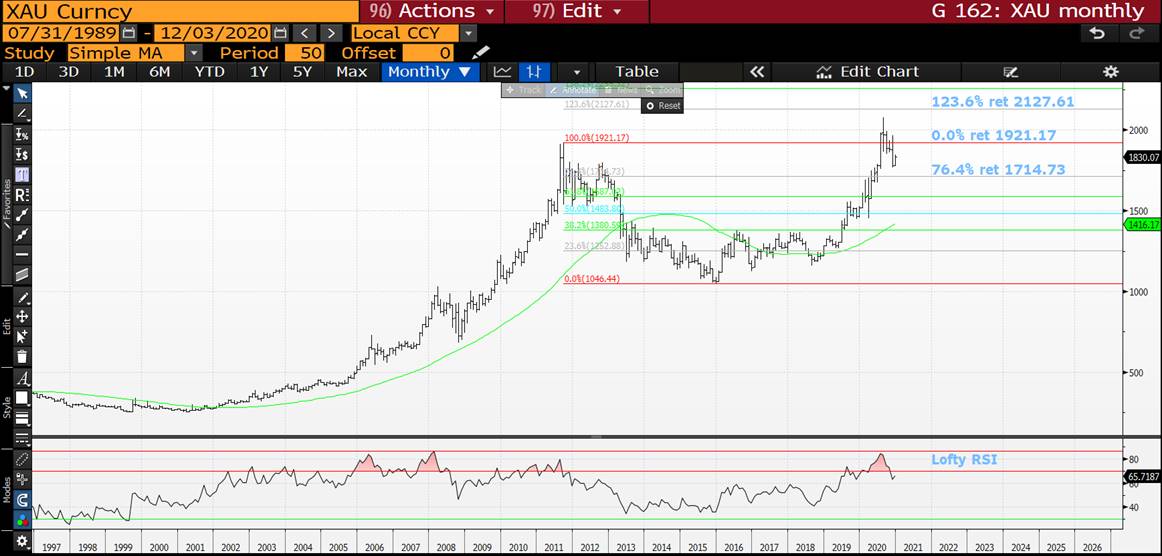

Sell 10y Italy vs 7y and 15y Wings

- IK rally in recent days, coupled with general long end weakness in EGBs and selling of the Italian belly vs the long end has left this fly at attractive levels

- Looking at 10y auction dates there in a noticeable cyclicality to this fly, so we feel this this offers a stable auction concession trade into year end supply

- Longs should benefit on an upsized PEPP, whereas a more benign outcome should nevertheless see supply weigh on the belly

- Current level -26.9

- Entry level -26.9

- Target -24.0

- CIX: (2 * YIELD[BTPS 3.5 03/01/30 Corp] - YIELD[BTPS 0.95 09/15/27 Corp] - YIELD[BTPS 1.45 03/01/36 Corp]) * 100

History of Italy 7/10/15 fly (10y auction dates highlighted)

Buy France 30y vs Germany and Italian wings (as recommended last week)

Right here we feel the opportunity is in the cheapening in 30y France rather than in the individual issues

Good timing to put on 52s QE drop in trade

- French May52 are a cheap 30y

- They will go into QE buying next May

- French long end supply yesterday gave us an entry

- Spectre of increased issuance in Germany means its premium could be diluted

Trade Structure

Buy 30y France – 100%

Sell 30y Germany (UBH1 Futures) – 70%

Sell 30y Italy – 30%

Levels

Current: +8bp

Enter: +8bp

Add: +11bp

Target +2.5bp

Cix

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp])

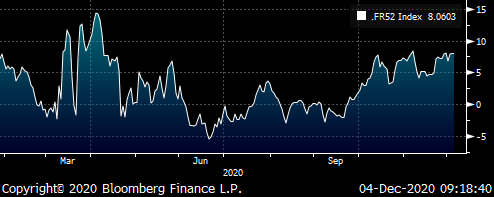

History

Rationale

- The Natural hedge for long supply is French 30y – we still see this as cheap on the curve and France has cheapened as a credit

- The gap between France and Germany is still wide despite other semi-core and core spreads tightening

Sell Ireland vs France as January auction setup trade

- As we head into January's supply season, we like edging into supply hedges

- Given that Ireland tends to be a first mover in terms of syndication we like making use of current levels to get short the issuer in anticipation of a supply concession

Current level: 5.4

Enter: 5.4

Add: 4.0

Target: 9.0

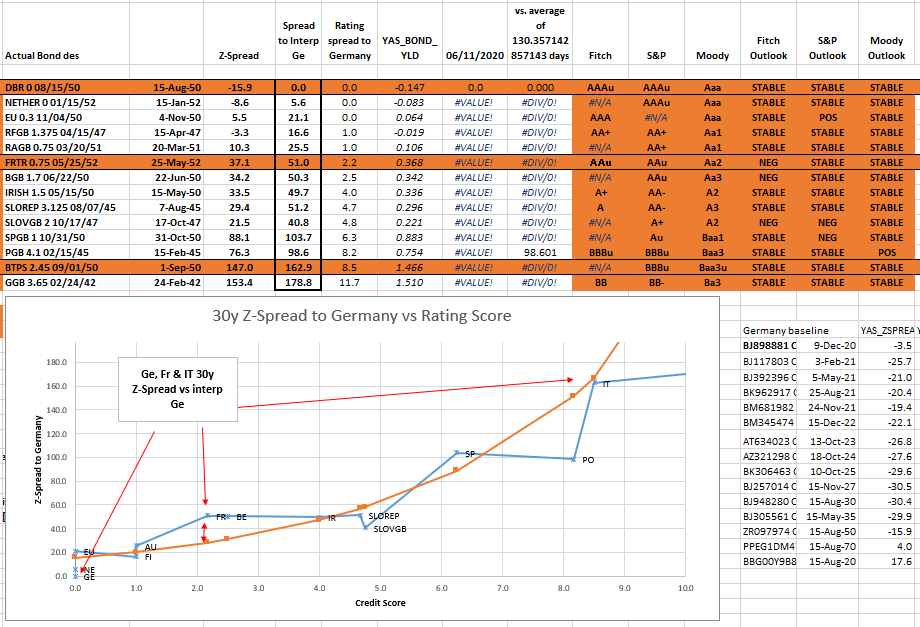

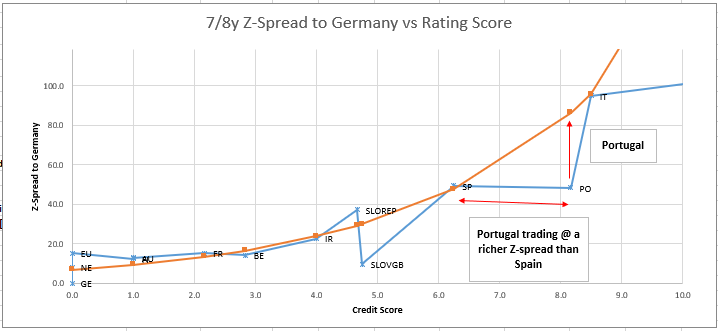

Sell Portugal 28 vs Spain 28

Portugal has been a huge beneficiary of QE flows – has moved beyond simple spread compression

Structure: Sell Portugal 28 to buy Spain 28

Lvl: -0.43bp

Enter: -1bp (25% risk)

Add: +3bp (50% risk)

Target: -6bp

Cix:

100 * (YIELD[SPGB 1.4 04/30/28 Corp] - YIELD[PGB 2.125 10/17/28 Corp])

BBG History

7y & 8y Euro Credit RV –

(interpolated Z-Spread vs Germany)

Rationale

In the rising tide of spread compression Portugal as a major beneficiary of the capital key allocation of QE look distorted

Any ease in QE over December or a generic credit widening leaves the Portugal Spain spread as looking most vulnerable to widen

Happy to get on the phone and discuss as always,

Will and James

![]()

Will Scott

O: +44 (0) 203 - 143 - 4800

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Will Scott. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS > Jan-Mar Supply Calendar Announced - Quick Recap/Thoughts

GILTS > Jan-Mar Supply

Please click HERE for the DMO's press release

> DMO Announcement at 7:30 this am has a couple surprises and taps of the usual suspects:

1F71s tap on Feb 2

1T57s tap on Feb 16 (!?) Why do they keep tapping these…?

NEW 10/26 5yr on Mar 2

0H61s tap Mar 2

NEW linker 31s Mar 10

Tap of 1T49s (!?)

Only ONE short gilts auction in January!

Sizes will be:

1-5yr £2.75bn-£3.5bn

5-7yr £2.5-3.25bn

7-15yr £2.25-3.0bn

15-30yr £1.75-2.5bn

30+yr £1.5-2.25bn

Linkers £750mm-1.5bn

SYNDICATIONS!

Tues Jan 19 (TBC) a NEW Jan 31 2046 Maturity

Feb 9th a NEW LONG Linker

Linker tender also announced for Dec 9th, a tap of the linker 48s.

So! No new 30yr but lots of other longs to keep us busy. Not sure why they're tapping 57s and 49s again (although 49s will be back in play for APF for a bit).

The 46s syndication was called for but not a slam dunk - new 51s will have to wait for the new year.

Quick GILTS RV... New 0ct 26

> In yesterday am's note (in our chats) we talked about the potential for a new UKT 1/27 issue that could weigh heavily on the 1Q27s, hampering their performance on the curve as we head into Jan-Mar.

> This 10/26 maturity is closest to the 1H26s - an issue whose days as the richest issue in the sector were numbered in our view. This announcement is the 'nail in the coffin' for the issue, the only saving grace for them is the new 26s don't arrive until March 2 and front-end supply is very light in Jan-Feb.

> We expect the 0E26-1H26-1Q27 fly to cheapen, all else equal. Now that the DMO has confirmed there is only 1 more tap of the 0E26s coming (Feb 2), any remaining new issue premium they have left will be drained from the issue. It'll also be available for more APF ops too which will likely mean they'll richen to the 0F25s too.

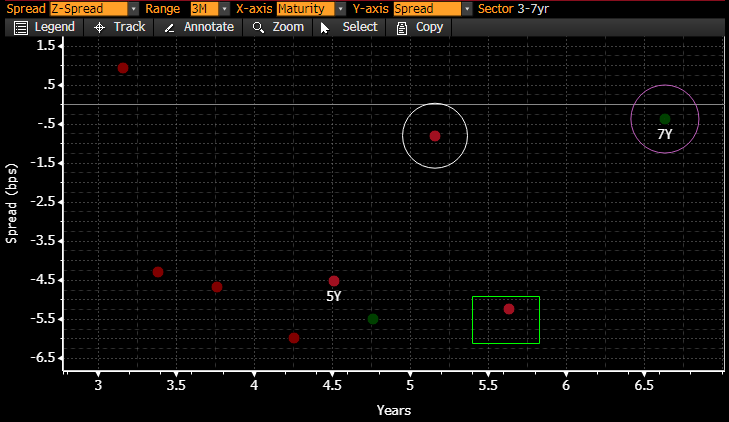

UKT 3-7yr sector Z-sprd scatter plot… The 0E26 and 1Q27s are circled and 1H26s in the green box. The 5yr is the 0F25s which, all else equal, should see spread compression, especially with the 1H21 redemption in January and the only short end auction in January is the 0E24s.

UKT 1H26-1Q27 Z-sprd… This spread will remain sensitive to moves in SONIA, however, the 1H26s should lose their premium on the curve.

More soon…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US BREAKEVENS AND USGGT : BREAKEVENS, HOPEFULLY TOMORROWS NON-FARM WILL CAUSE THE OVERBOUGHT RSI’S TO “KICK IN” AND WEEKLY RUSSELL RSI TURN LOWER!

US BREAKEVENS AND USGGT : BREAKEVENS, HOPEFULLY TOMORROWS NON-FARM WILL CAUSE THE OVERBOUGHT RSI’S TO “KICK IN” AND WEEKLY RUSSELL RSI TURN LOWER!

THE RUSSELL WEEKLY RSI IS AS HIGH AS JANUARY 2020 PRE A CONSIDERABLE DROP!

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI’S LOOK HISTORICALLY LOFTY AND ADDITIONALLY MOVING AVERAGE RESISTANCE.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

STOCKS : EUROPEAN STOCKS ARE TRADING SIDEWAYS BUT THE US CONTINUES TO GRIND HIGHER, PUSHING SOME RSI’S TO A DISLOCATED POINT.

STOCKS : EUROPEAN STOCKS ARE TRADING SIDEWAYS BUT THE US CONTINUES TO GRIND HIGHER, PUSHING SOME RSI’S TO A DISLOCATED POINT. THEY STILL REMAIN ANYONES GUESS?!

THE DAILY RSI’S ARE ALL NOW VERY OVER BOUGHT.

THE RUSSELL WEEKLY CHART HAS A VERY DISLOACTED RSI SIMILAR TO EARLY 2020.

I DO BELIEVE WE WILL ONLY SEE THE REAL ECONOMIC IMPACT NEXT YEAR.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: GILTS > An RV Focus on the 10yr Sector (Chart package)

GILTS... 10yr sector

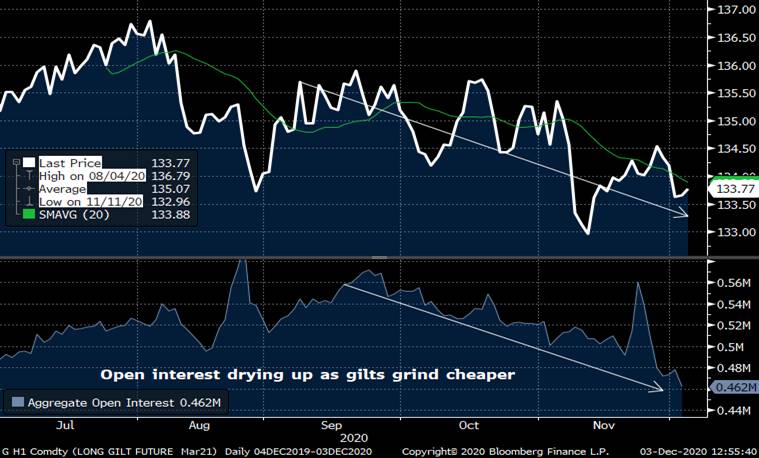

> As the 'bus driver' for the whole gilts curve, the performance of the G A contract and its CTD/surrounding issues is extraordinarily important to the performance of the whole gilts market.

> We keep an eye on a handful of gauges that reflect positioning and performance of the benchmark.

5-10-15 (0F25-4T30-4Q36) – back to its cheapest levels…

1F28-4T30-4Q32 – cheapening…

Invoice spreads vs SONIA (modest cheapening) – still range bound…

Cross market vs UST and DBRS… (US-UK-GE 10yr blend with GBP/USD overlaid). Correlation remains solid with some oscillations.

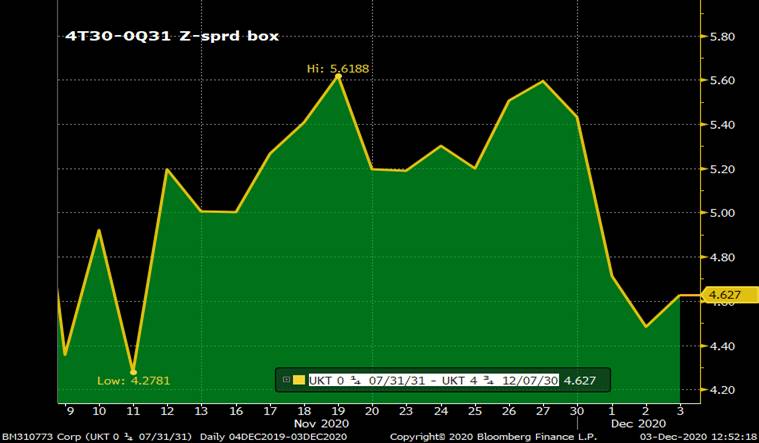

4T30-0Q31 Z-sprd box… Yield spread was new lows into 31s tap, now 9.6 mid. Reports of 1-2 large buyers vs swaps.

G A contract on a bearish trajectory with open interest steadily declining as we head into Brexit and the market begins to price in the vaccine boost…

Here's a chart of US 10yrs vs Fed Funds target vs the UKT 10yr vs UK base rate… On a relative basis, the UK trades a lot richer than the UST curve and that's with the USD under pressure. The combination of Covid, Brexit and APF has kept gilts contained…

So, what can we glean from this exercise?

- Risk appetites are dwindling in the UK. Could be year-end driven but the unwind began in September. With gilts supply declining into the end of the fiscal year this probably won't present a problem for the BoE/DMO.

- Will be interesting to see how the supply dynamics affect the front-end. If a Brexit deal is announced and it's more than just a stop-gap measure to avoid a disaster, we could see central banks pile back into GBP which will be bullish for 0-3/5yr gilts.

- Relative to base rates, gilts still look rich with 4T30s just ~24bps cheap. Plenty of room to cheapen if vaccine accelerates a rebound in the economy.

- Momentum has been bearish but a slow grind rather than a vol spike. Steepeners aren't quite as toxic in gilts as they are in EGBs given the ECB's bias.

- The BoE's commitment to £150bn APF is a moveable feast but assuming it happens, it'll be a good deal easier to be short the UK via swaps than gilts.

Ideas to follow… Comments/feedback always welcome.

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FX UPDATE : THE USD IS POISED FOR A “FREE FALL” DROP, THUS GIVEN THE CORRELATION IMPLY BOND YIELDS SHOULD HEAD A LOT HIGHER.

FX UPDATE : THE USD IS POISED FOR A “FREE FALL” DROP, THUS GIVEN THE CORRELATION IMPLY BOND YIELDS SHOULD HEAD A LOT HIGHER.

THE AUD IS THE ONE TO WATCH AS IT IS NOW ON ITS WAY HIGHER GIVEN THE “FREE AIR” SPACE IT IS IN NOW!

USD CAD HAS BREACHED LAST MONTH LOW AND HEADING TOWARD A KEY 50% RET 1.2625.

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

USDTRY REMAINS BELOW ITS MAJOR 2001 TRENDLINE 8.0084.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BONDS YIELDS : THIS WEEKS NON-FARM COULD BE A KEY DRIVER IN SEEING YIELDS “FLY”.

BONDS YIELDS : THIS WEEKS NON-FARM COULD BE A KEY DRIVER IN SEEING YIELDS “FLY”. DO PONDER THE QUARTERLY CHARTS TO UNDERSTAND THE RECENT YIELD RALLY IS ONLY JUST THE START.

**WE HAVE PLENTY OF PROMINENT LEVELS TO WATCH FOR.**

US 10-30 CURVE HAS AN RSI LOW NOT SEEN SINCE NOVEMBER 2019 AND IS NOW STEEPENING!

US 30YR YIELD AS WE CONTINUE TO REMAIN ABOVE THE 1.4478 2OO DAY MOVING AVERAGE THE NEXT BIG LEVEL TO BREACH LOOMS I.E. THE MULTI YEAR 38.2% RET 1.7533, SHOULD THIS BE BREACHED WE “FLY”.

US 10YR YIELD HAS HELD ABOVE ITS 0.7521 2OO DAY MOVING AVERAGE AND POISED TO BREACH ITS 38.2% RET 0.9469.

US 5YR YIELD HAS JOINED THE 30YR - 10YR BY BREACHING ITS LONG STANDING 200 DAY MOVING AVERAGE 0.3959. ADDITIONALLY ITS QUARTERLY CHART (PAGE 9) HIGHLIGHTS HOW MUCH FURTHER WE HAVE TO GO GIVEN THE RSI EXTENSION SIMILAR TO 1998, 2003 AND 2008!

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS, ESPECIALLY IN THE FRONT END.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris