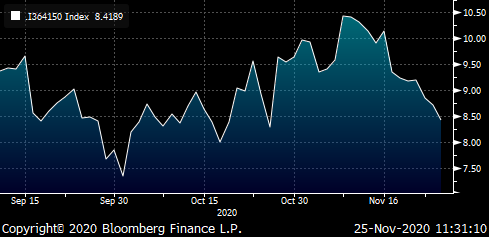

forwards / roll and carry in Italy in the 2y-7y

Thinking about the Italian curve 2 – 7yrs and how that all looks to me – as per our convo

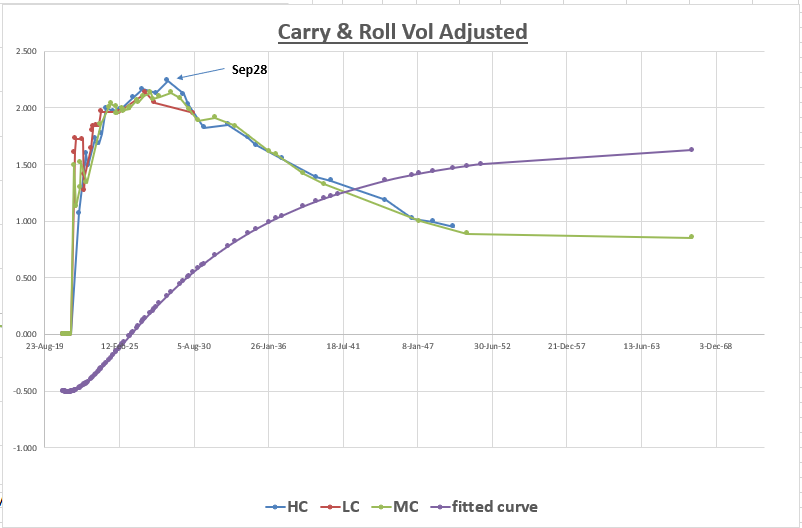

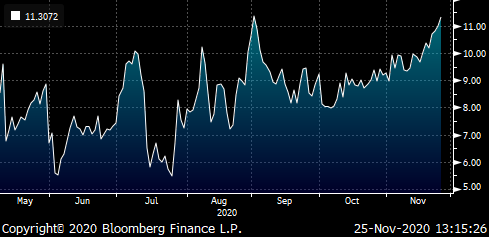

Carry and roll 90 day vol adjusted

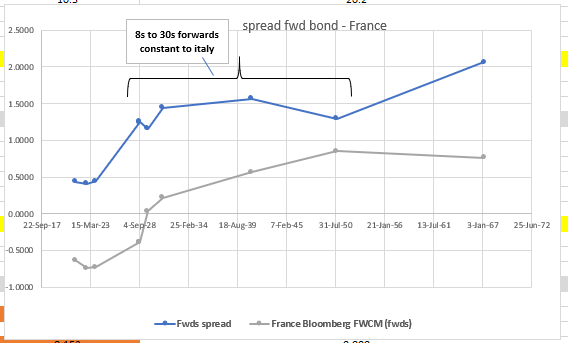

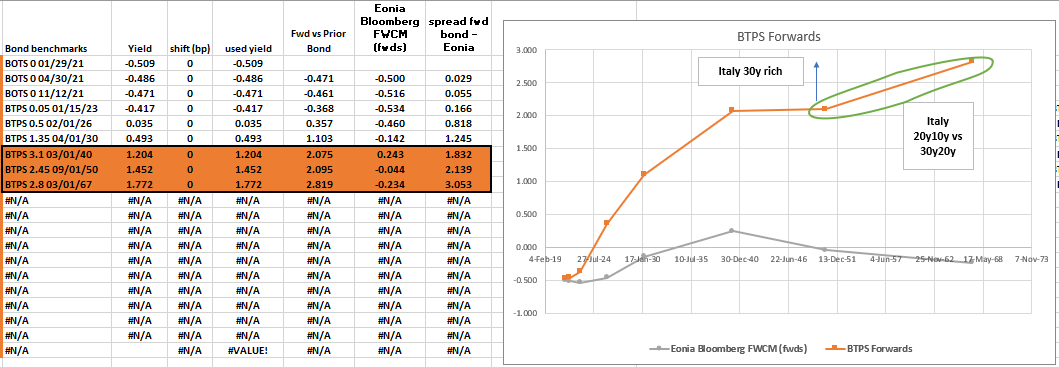

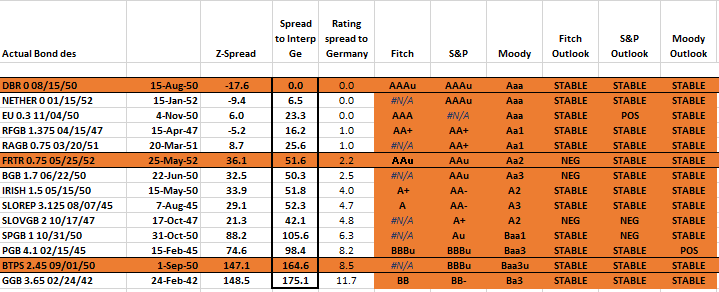

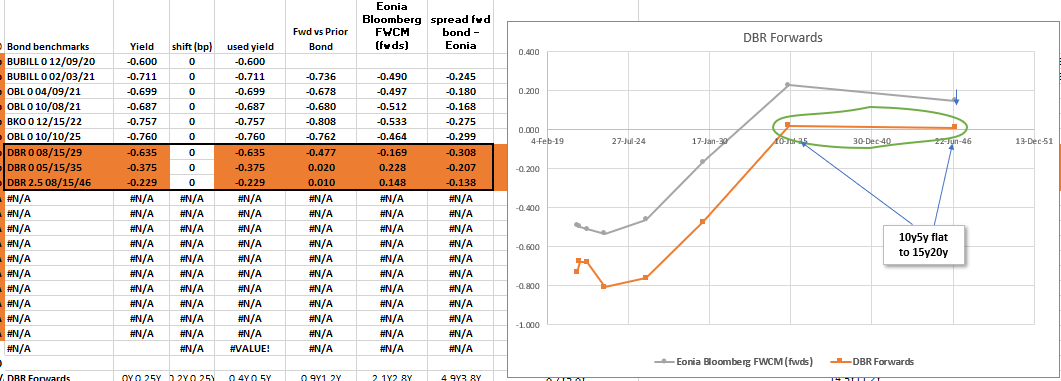

I see 8yr to 30yr on forwards constant spread to France – which am using as a more 'bond type' benchmark than the swap curve

Spread of Italian bond forwards vs same dates on French curve….

To me there can be two things that can happen crudely – Italy narrows or widens!

- In a narrowing I cannot see how the longer forwards from 10y to 30y can narrow more than things like 3y2y or 5y2y. This would more likely happen in a credit event scenario at much more stretched spread levels – which implies to 5y and 7y should do better in narrowing

So to me 10s30s steepener here is actually a widening trade because the short end is benign and because of forward spread levels – unlike previous widenings we have witnessed where 10s30s flattens

- In a narrowing the forwards that can narrow the most are 3y2y and 5y2y as they have much better roll into the richer segments - so yeah, I like long 5years and long 7yrs in the absence of any shock negative event / news

- Conclusion - In terms of value both 20s30s steepening and 18month / yr flattening are solid roll and carry trades – and are borne out by the vol adjusted roll and carry chart – which really likes Btps 4.75 sep28 – the old ctd (HC nov 27 actually had a great run as they fell into the 7y area so I don't mind sep28 as a decent purchase here)

- What's interesting is that although the Ctz May22 and sep22 are locally cheap – even they still look a sell when you look longer in the curve – if we issue select I'd go for selling something like HC 2.45% oct 23 vs buying sep28

In short, I like

Duration matched oct23 -> sep28

(YIELD[BTPS 4.75 09/01/28 Corp] - YIELD[BTPS 2.45 10/01/23 Corp]) * 100

Forward weighted it would look more like short 40% of the oct23 vs 100% of sep28

Gotta say timing/location doesn't look epic – so I'd be of a mind to wait for more of a sell-off

So, taking the average of duration and forward weighted gives 70% short in oct23 – net delta of 30% - pretty much where your mind is at

but tbh I would hedge the delta in another issuer as they are all, as we agreed becoming like rates markets – maybe a cheeky short in the Portugal 28s which are just plain rich?

Apols if there's nothing hugely concrete still looking

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US BREAKEVENS AND USGGT : BREAKEVENS HAVE GROUND HIGHER BUT AS PREVIOUSLY REMAIN VERY OVERBOUGHT ACROSS ALL DURATIONS.

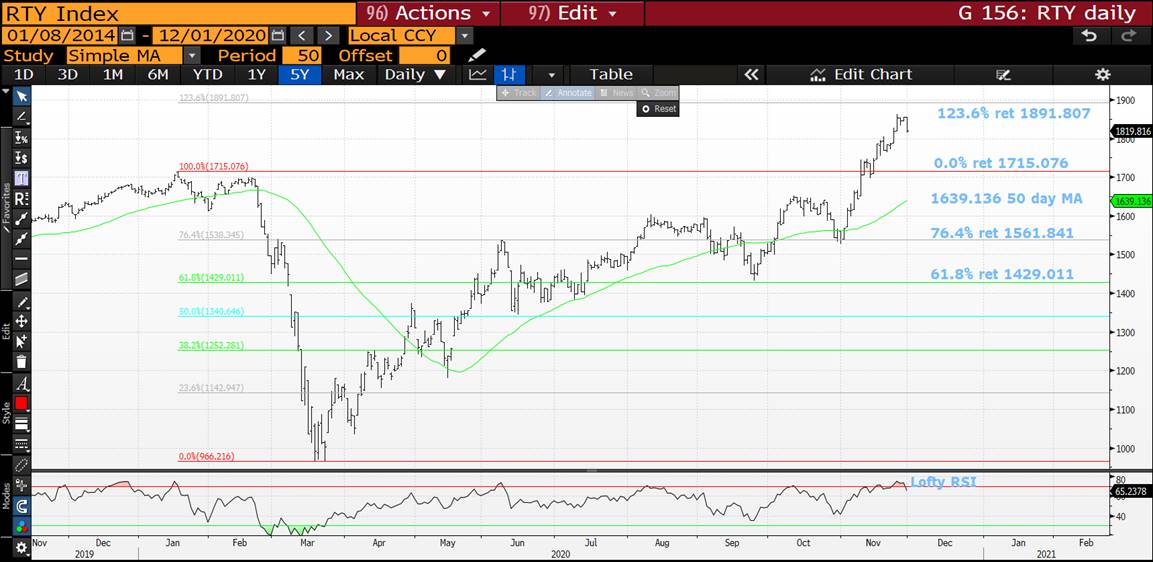

US BREAKEVENS AND USGGT : BREAKEVENS HAVE GROUND HIGHER BUT AS PREVIOUSLY REMAIN VERY OVERBOUGHT ACROSS ALL DURATIONS. ADDITIONALLY THE RUSSELL FINALLY LOOKS LIKE TOPPING.

30YR BREAKEVENS CONTINUE TO PERFORM BUT ALL DURATIONS OF RSI ARE HEADING TO LOFTY LEVELS.

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI'S LOOK HISTORICALLY LOFTY AND ADDITIONALLY MOVING AVERAGE RESISTANCE.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

FX UPDATE : USD WEAKNESS PERSISTS WITH NEW LOWS VERY LIKELY. THIS CONTINUES TO AID THE CALL FOR HIGHER BOND YIELDS.

FX UPDATE : USD WEAKNESS PERSISTS WITH NEW LOWS VERY LIKELY. THIS CONTINUES TO AID THE CALL FOR HIGHER BOND YIELDS.

THE AUD IS THE ONE TO WATCH, IT IS POISED FOR A MAJOR RALLY IF WE BREACH THE RECENT HIGH 0.7414.

USD CAD HAS BREACHED ITS MAJOR 50 PERIOD MOVING AVERAGE 1.3167 AND HEADED LOWER!

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

USDTRY REMAINS BELOW ITS MAJOR 2001 TRENDLINE 8.0084.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

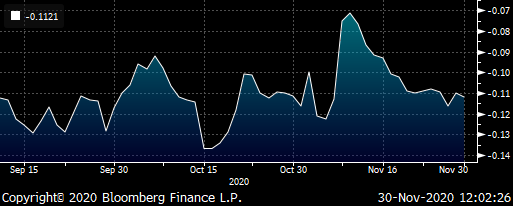

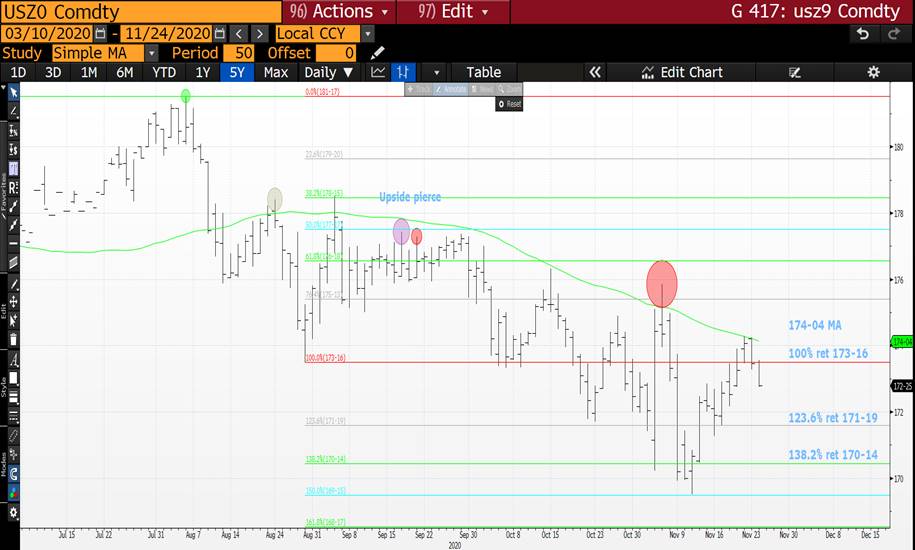

BONDS YIELDS : A DISAPPOINTING CLOSE LAST MONTH HAS DIFFUSED SOME OF THE DECEMBER “VOLATILITY” EXPECTATION.

BONDS YIELDS : A DISAPPOINTING CLOSE LAST MONTH HAS DIFFUSED SOME OF THE DECEMBER “VOLATILITY” EXPECTATION.

TO MAINTAIN THE LONGTERM YIELD HIGHER CALL WE NEED TO CLOSE BACK AT THE MONTHS HIGHS.

**WE HAVE PLENTY OF PROMINENT LEVELS TO WATCH FOR.**

US 10-30 CURVE HAS AN RSI LOW NOT SEEN SINCE NOVEMBER 2019 AND IS NOW STEEPENING!

US 30YR YIELD IS HAPPILY HOLDING ABOVE ITS 1.4492 2OO DAY MOVING AVERAGE AND THE FUTURES FAILED ITS 50 DAY MOVING AVERAGE 175-08, A TEXT BOOK SCENARIO.

US 10YR YIELD HAS HELD ABOVE ITS 0.7550 2OO DAY MOVING AVERAGE.

US 5YR YIELD IS POISED TO JOIN THE 30YR AND 10YR BY BREACHING ITS LONG STANDING 200 DAY MOVING AVERAGE 0.4007.

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS, ESPECIALLY IN THE FRONT END.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

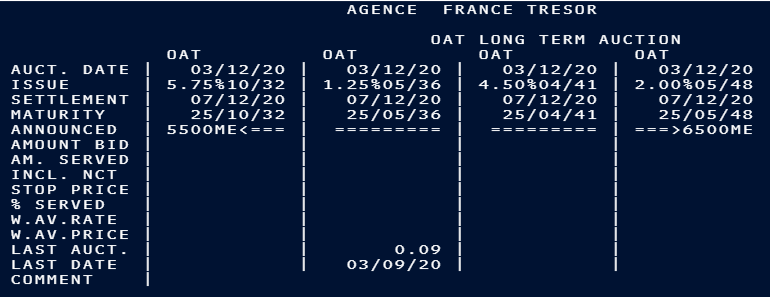

Trades & Fades - week of 30th Nov - 4th Dec

Trades and Fades

looking for clever ways to get short the 10y -15y sector – looks cheap so the search is real!

30y hedge bond looking cheap and goes into QE next May

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp])

- Futures – Calendar Rolls, more on that later

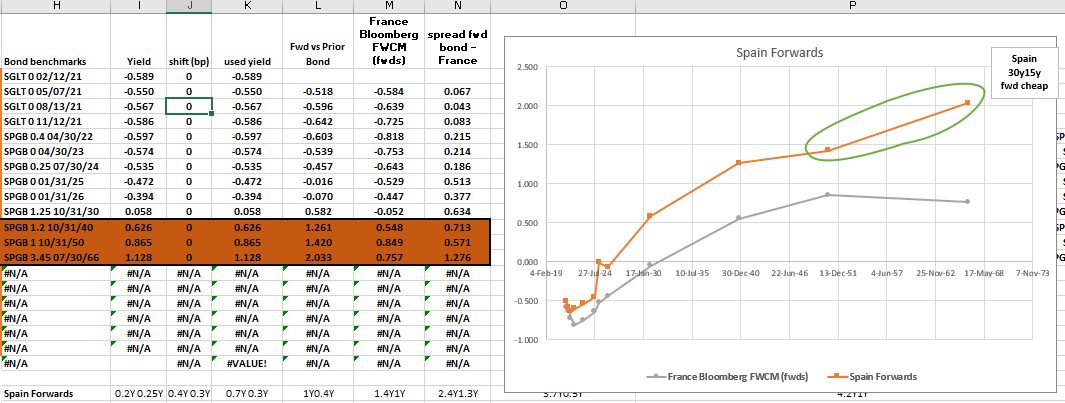

{SP} / {IT}: 20s 30s 50s

30y looking rich on Fly in both issuers

Could the ECB take off the 30y cap at the December meeting?

- Germany: 5y Wednesday

- {IT} Italy: Friday 4th Dec – announcement for Dec 10th supply – expecting cancellation

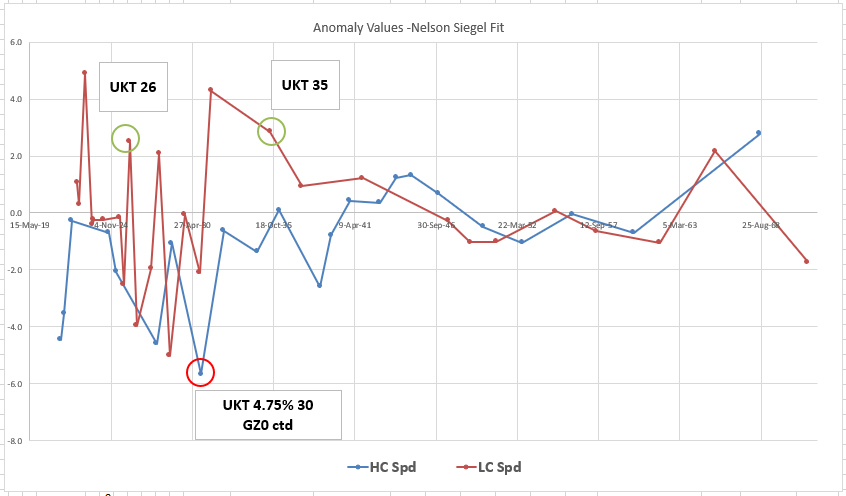

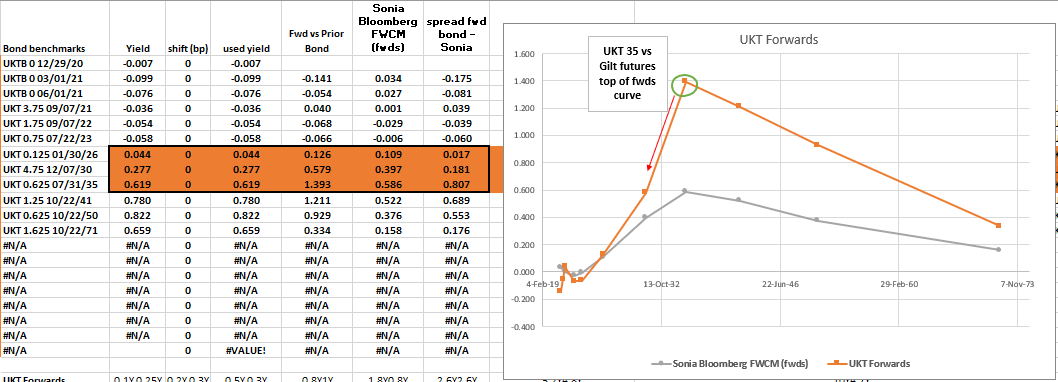

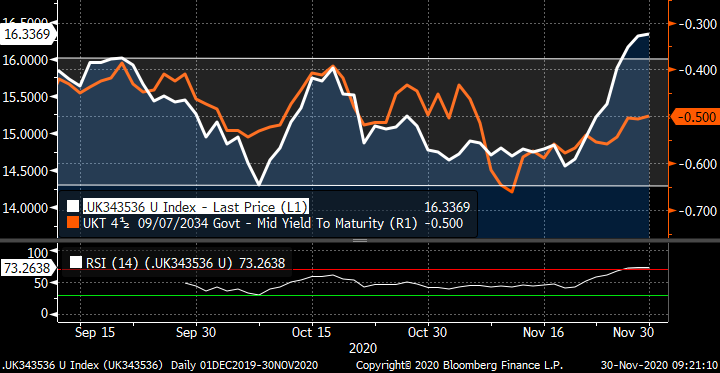

UK – the UKT sees two taps this week – both are cheap in forwards

Tough to find a structure ahead of supply – after the event we want to come out with something that looks like

+ UKT26 / -GZ0 / +UKT35

Cix

(2 * YIELD[UKT 4.75 12/07/30 Corp] - YIELD[UKT 0.625 07/31/35 Corp] - YIELD[UKT 0.125 01/30/26 Corp])

Trade History

Rationale

– GZ0 fully prices its anomaly and should see pressure from the cheaper 31s being tapped

- UKT 35 represents the top of the forwards curve vs shorter bonds

- Butterfly of long 26s short gilt futures and long 35s is an approximation of the extreme slope of forwards from 2026 thru' 2030 to 2035

UKT Anomalies vs Fitted curve (coupon adjusted* by => plus 'Z' spread minus Swap spread)

Forwards

Levels

Current: -11.2bp

Enter: -11bp (25% risk)

Add: -14bp (50% risk)

These levels are derived not from history – we choose not to let the market define value for us – but take it the shape of forward rates

@ -14bp and below the trade looks really appealing in terms of slope of the fwd rate curve.

Given that we're going for a social 25% risk @ -11bp means it's a tactical trade to absorb supply. We don't want to miss the trade – but want to be involved more deeply at -14bp and below and need to hold some fire back for that

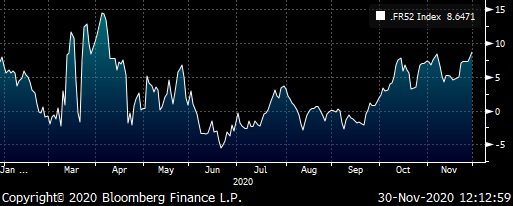

France supply in long end this Thursday

- Right here we feel the opportunity is in the cheapening in 30y France rather than in the individual issues

Good timing to put on 52s QE drop in trade

- French May52 are a cheap 30y

- They will go into QE buying next May

- French long end supply next week gives us an entry

- Spectre of increased issuance in Germany means its premium could be diluted

Trade Structure

Buy 30y France – 100%

Sell 30y Germany (UB Futures) – 70%

Sell 30y Italy – 30%

Cix

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp])

History

Levels

Current: +8.8bp

Enter: +8.25bp

Add: +11bp

Target +2.5bp

Rationale

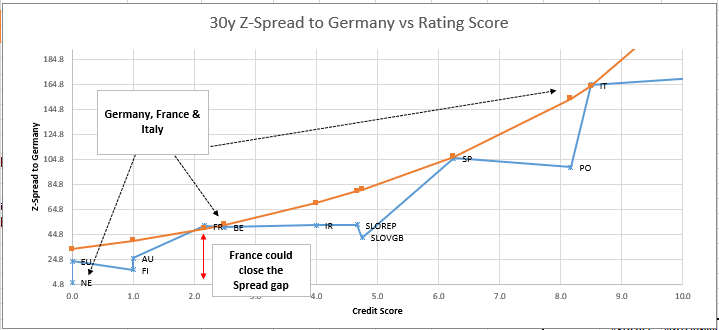

- The Natural hedge for long supply is French 30y – we still see this as cheap on the curve and France has cheapened as a credit

- The gap between France and Germany is still wide despite other semi-core and core spreads tightening

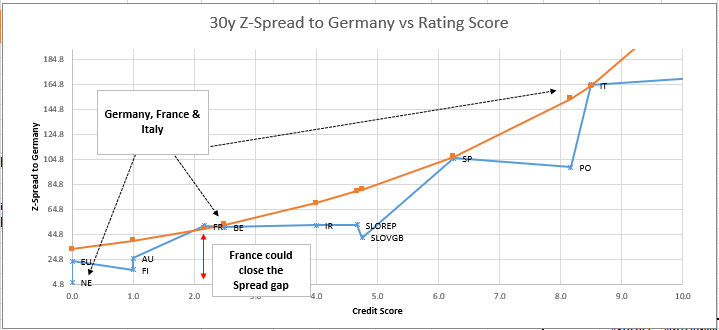

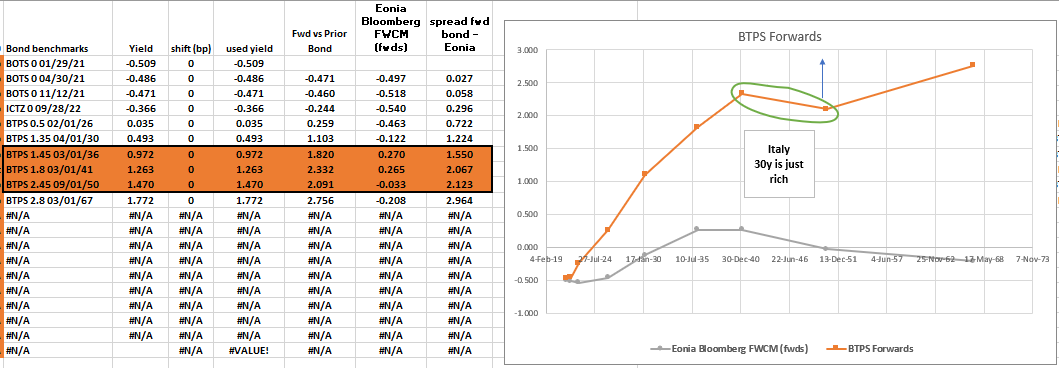

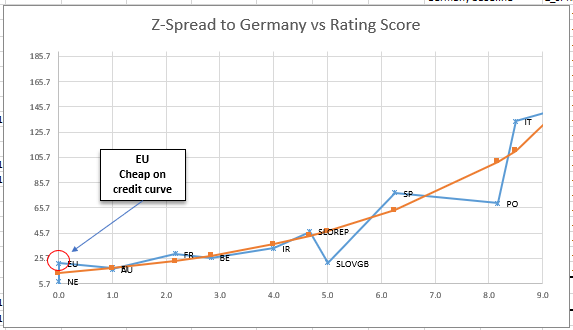

30yr Euro Credits – Graph

Z-spread to Germany plotted against Credit Score*

*Credit score is a proprietary amalgam of Fitch, S&P and Moody's rating and outlook

Worth taking a better look at 50y as we head into the ECB meeting.

- Market consensus seems to be overwhelmingly that the 30y buying limit for APP will remain intact

- Whilst we neither agree, nor disagree, the fact is that the market didn't expect 30y either when QE started, and look what happened there

- ECB meeting aside, 50y does offer some value in both the Spanish and Italian curves, so now is as good a time as any to take a further look:

- Spain and Italy +20y / -30y / +50y

30y looking rich on Fly in both issuers

Italy

+Mar40, -Sep50 +Mar67

Cix:

(2 * YIELD[BTPS 2.45 09/01/50 Corp] - YIELD[BTPS 2.8 03/01/67 Corp] - YIELD[BTPS 3.1 03/01/40 Corp]) * 100

History

Forwards

Rationale

- QE has reached along the curve and left 50yrs behind

- Any further rally could see a flattening of 30s50s

- A sell off similarly would hopefully steepen the 20y 30y spread

Spain

-10/50, +10/40, +7/66

Cix

(2 * YIELD[SPGB 1 10/31/50 Corp] - YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1.2 10/31/40 Corp]) * 100

History

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EGB Spreads ... using a RX-IK hedge to reduce credit exposure, with 3 trade examples

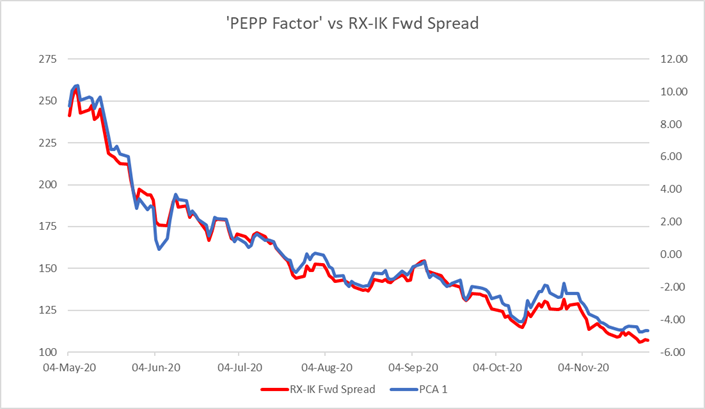

Bottom Line: The ECB's PEPP has been and continues to be the primary factor driving inter-country EGB spreads tighter. So I have set out to find a single market factor that can be used to hedge the effects of the programme on sovereign credit spreads in the Eurozone. My conclusion is that a large part of the variation in spreads can be hedged by a simple RX-IK contract hedge.

Trades:

Buy OAT 0% Feb-26

Sell Bonos 1.3% Oct-26

with a hedge of 0.21% DV01 in RX-IK contracts (Buy IK)

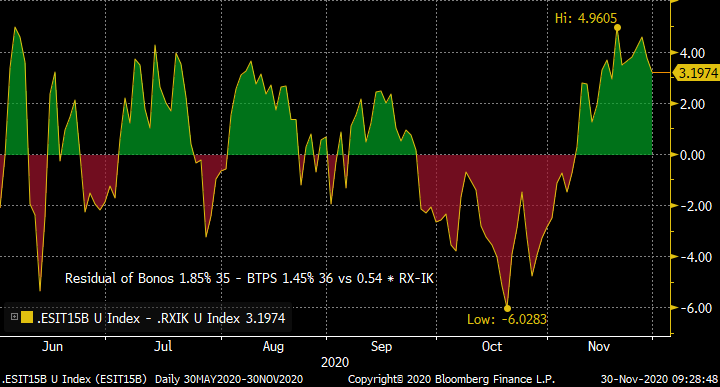

Buy Bonos 1.85% 35

Sell BTPS 1.45% 36

with a hedge of 0.45% DV01 in RX-IK contracts (Buy IK)

Sell Bund 0% Aug-50

Buy OAT 0.75% May-52

with a hedge of 0.17% DV01 in RX-IK contracts (Sell IK)

Rationale: It is apparent to even the most casual observer that inter-country EGB spreads have been well-correlated through the Covid crisis. This is not surprising as all countries are suffering economically, and the introduction of the PEPP has been a game-changer for spreads. Credit spreads have narrower relentlessly as the EU has embraced the concept of burden-sharing (not least through the massive expansion of EU issuance).

But which spreads, and at what tenors have tightened too much, and which not enough?

To attempt to answer this question, I have taken a reduced grid of 15 non-overlapping spreads (Germany-France, France-Spain and Spain-Italy) and tenors (5y,10,15y,20y & 30y) to extract a "PEPP factor" using PCA for the past seven months (ie after the PEPP initiative was introduced). As a starting point, the rate inputs are taken from the par-spline CMT rates for each country: this will give us a guide to the narrow/wide sectors without benchmark roll discontinuities.

Once I have extracted the PCA1 factor, I have scanned a wider set of over-lapping spreads (still using CMT rates). The spread with the highest correlation to the PCA1 factor over the analysis period is Germany-Italy 10y (R2 of 99% on level regression). This is perhaps not a shock, but the analysis does provide a statistical validation for our intuition. The happy by-product is that this is a spread which is easily reproducible in the futures market through the forward yield spread of the RX and IK contracts. This is how the PCA1 / PEPP Factor compares to the RX-IK forward spread.

It is also straightforward to scan this universe for the spreads that are the most dislocated from the prediction from the RX-IK spread:

|

5Y |

France |

Spain |

Italy |

|

Germany |

0.8 |

-1.2 |

-0.4 |

|

France |

|

-1.7 |

-0.7 |

|

Spain |

|

|

0.8 |

|

10Y |

France |

Spain |

Italy |

|

Germany |

0.3 |

-0.7 |

0.8 |

|

France |

|

-1.0 |

0.4 |

|

Spain |

|

|

1.1 |

|

15Y |

France |

Spain |

Italy |

|

Germany |

0.4 |

-0.5 |

1.1 |

|

France |

|

-0.9 |

0.7 |

|

Spain |

|

|

1.4 |

|

20Y |

France |

Spain |

Italy |

|

Germany |

0.6 |

0.0 |

0.4 |

|

France |

|

-0.5 |

-0.1 |

|

Spain |

|

|

0.3 |

|

30Y |

France |

Spain |

Italy |

|

Germany |

1.1 |

0.1 |

0.5 |

|

France |

|

-0.7 |

-0.3 |

|

Spain |

|

|

0.3 |

The colour-coding allows us identify some likely areas to look deeper:

- France-Spain 5y too narrow

- Spain-Italy 15y too wide

- Germany-France 30y too wide

So, let's look at a few examples of spreads that have been identified as out of line.

France-Spain 5y vs RX-IK

Here I'm using a slightly longer Bonos than the more recent SPGB 0% Jan-26 to get more history for the spread. The residual shows that Spain has richened over the past month to now look around 5bp too narrow when hedged with the RX-IK spread.

Spain-Italy 15 y vs RX-IK

15y Italy has been performing well vs France and Spain recently, but now makes 15y Spain look relatively cheap:

Germany-France 30y vs RX-IK

With a DV01 beta-weighting of 1:0.165 DBR-OAT: RX-IK, this is the residual of Germany-France 30y for the past 6 months, showing the spread to be around 2.5bp too wide currently. Long-end supply is coming in France next week, so we might look for the 4bp residual extreme to be reached. As my colleagues have noted, in May next year the OAT becomes eligible for PEPP and PSPP buying, which could give it a transitional boost.

Taking things a stage further, we can simply scan the universe of spreads for box trades with have a high absolute T-stat while maintaining a decent correlation between the spreads. The pattern is that France-Italy spreads are too narrow when compared to Spain-Italy, on a weighted basis.

|

Spread A |

Spread B |

R^2 |

Resid |

T-stat |

|

Spain-Italy 5Y |

France-Italy 5Y |

97% |

-6.0 |

-1.9 |

|

Spain-Italy 10Y |

France-Italy 5Y |

96% |

-6.6 |

-1.8 |

|

Spain-Italy 15Y |

France-Italy 5Y |

95% |

-8.4 |

-2.0 |

|

Spain-Italy 15Y |

France-Italy 10Y |

97% |

-5.4 |

-1.8 |

|

Spain-Italy 15Y |

France-Italy 20Y |

97% |

-5.8 |

-1.8 |

|

Spain-Italy 15Y |

France-Italy 30Y |

95% |

-6.4 |

-1.7 |

The point here is that while a four-bond cross-issuer trade can be tricky to execute, the RX-IK hedge can be used to leg the position. In principle you can construct a portfolio of such two-bond spreads with a net RX-IK hedge for the position.

I hope this is a starting point for discussing which spreads can offer value.

Any thoughts? Please let me know!

Best wishes

David

David Sansom

![]()

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Another Busy Week in the UK... Quick Rundown w/RV Colour

GILTS... Busy Start to Dec as Nov comes to an end…

> Yet another 'Crucial Week for Brexit Talks' lined up as you can see from the headlines this am. The EU remains 'hooked' on the fishing rights dilemma which could be a deal breaker.

U.K. Urges EU to Move on Fish, With Brexit Deal Possible in Days

London 'Thrown to the Lions' as Brexit Finance Deal Unlikely

Worse Than Covid? Risks to U.K. Economy as Brexit Deadline Nears

England Lockdown Cuts Virus Cases 30%, Study Shows

BOE Splits Between Insiders and Outsiders Over Subzero Rates

> The story above 'Worse than Covid?...' is at the heart of the divergence of UKT 10-30s and Cable (as we've been pointing our ad nauseum over the last week. We had a good call on the curve flattening bias as we've flattened sharply from +60bps to +54.5bps, the bottom of the range since August. This has happened with GBP stuck at key resistance, implying that the FX market expects a Brexit deal. The obvious question now becomes, do we have the momentum to continue this divergence?

> SUPPLY This week is 0E26s & 1Q41s tomorrow and UKTi 28s and 1Q31s Wed - nothing in the long-end at all. With the usual APF calendar Mon-Wed, the obvious assumption is there's ample BoE demand to mop up the DV01 and all else equal, the odds of a flattening through the 54.0bps support in 10-30s are solid. So, supply won't be the culprit if the gilts flattening stalls.

> Relatively speaking, the 15-20yr sector has lagged much of this flattening bias which we've been using as an oppty to add to longs. The last auction of this year is the 0F35s next Wed but we have 0F50s before then... Keep an eye on 10-15-30s

flies...

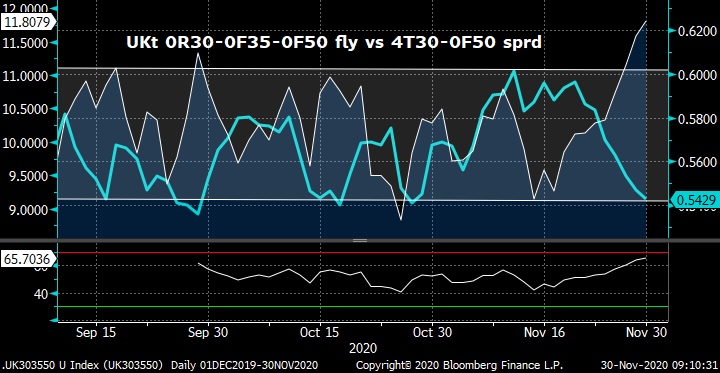

UKT 0R30-0F35-0F50 – Making new wides this am ahead of next week's 35s and 50s taps

UKT 4H34-1Q41-0F50 fly – grinding richer into tomorrow's 41s tap but lagging 10-30s

UKT 34-35-36 fly back to its cheapest ever levels as the high cpn wings outperform in the rally. Inversely correlated to yield levels…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

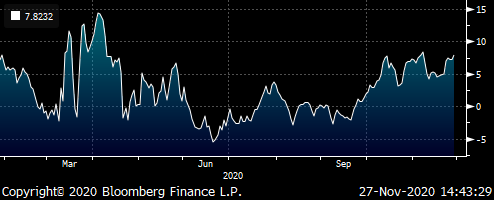

Trade Radar - Friday 27th November James & Will @ Astor Ridge

French Supply – Good timing to put on 52s QE drop in trade

- French May52 are a cheap 30y

- They will go into QE buying next May

- French long end supply next week gives us an entry

- Spectre of increased issuance in Germany means its premium could be diluted

Trade Structure

Buy 30y France – 100%

Sell 30y Germany (UB Futures) – 70%

Sell 30y Italy – 30%

Cix

100 * (YIELD[FRTR 0.75 05/25/52 Corp] - 0.7 * YIELD[DBR 2.5 08/15/46 Corp] - 0.3 * YIELD[BTPS 2.45 09/01/50 Corp])

Graph

Levels

Current: +7.8bp

Enter: +8bp

Add: +11bp

Target +2.5bp

Next week (Thursday) brings supply in France

The Natural hedge for long supply is French 30y – we still see this as cheap on the curve and France has cheapened as a credit

Generally the credit curve is too 'shallow' at semi and core levels

–France / Germany is too wide given France / Italy

The Italian credit gives context to the credit curve and provides a credit hedge

Here's how credits look in 30yr Euro

Z-spread to Germany plotted against Credit Score*

*Credit score is a proprietary amalgam of Fitch, S&P and Moody's rating and outlook

Data…

This is borne out in the credit butterfly trade as shown in the graph above

Trade Mechanics

Please give us a call for details

Best

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - James & Will @ Astor Ridge

Click the links below to take you to the idea..

This fly one of the last decent PV kinks in the forwards curve…

Working nicely….

Structure

-Sell Btps Mar36

+Buy Btps Mar41

-Buy Btps Sep50

Lvl:

Incepted +10.25bp

Current: +8.3bp

Target Short term: +7.5

Target Long Term: +3bp

Cix:

(yield[FRTR 2 05/25/48 Govt]-yield[RFGB 1.375 04/15/47 Govt])-0.1*(yield[SPGB 2.9 10/31/46 Govt]-yield[EU 3.75 04/04/42 Govt])

Graph

20y supply out of the way

Don’t be fooled by history – this has intrinsic value all the way +2.5bp

First stop is to take some off at +7.5 and run the rest

Forwards

New Eu 15yr priced cheap as a credit and 15yrs cheap on in core curves

Structure

€50MM 15y EU 0% Jul35 (€75.75k /01)

Sell 243 RXZ0 contracts

Sell 78 UBZ0 contracts

Lvl: +55.4bp mid

Cix of Trade:

(2 * YIELD[EU 0 07/04/35 Corp] - YIELD[DBR 2.5 08/15/46 Corp] - YIELD[DBR 0 08/15/29 Corp]) * 100

Looking at just the German curve…

Here’s the history of 15y Ge vs RX and UB…

The 15y German point is cheap

Cix:

(2 * YIELD[DBR 0 05/15/35 Corp] - YIELD[DBR 2.5 08/15/46 Corp] - YIELD[DBR 0 08/15/29 Corp]) * 100

The German 15y is cheap in real value terms on forward rates – the 10y5y, 0.02% (RX vs 15y) forward from the bond curve is flat to the 15y10y, 0.01% (15y vs UB)

So what about the credit? - EU vs Germany

Major Rating Agencies (Fitch, S&P, Moody’s)

EU: n/a, AAA, Aaa

Germany: AAA, AAA, Aaa

Here’s how the 15y Tenors in Europe trade in Z-Spread over interpolated Germany

Z-Spread vs Rating Score*

*Rating Score is a proprietary culmination of current Agency Ratings and Outlooks

Blue – Actual Z-Spread

Orange – Fitted Credit Curve

So for this new issue we see EU as a cheap way of shortening into a triple A name from other core and semi-core credits

Putting the two together we like sell RX and UB to buy the EU 15y

More to follow

Let us know

James Rice, William Scott

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BONDS YIELDS : YIELDS GRINDING HIGHER AS ANTICIPATED, IDEALLY NEW HIGHS BY MONTHEND.

BONDS YIELDS : YIELDS GRINDING HIGHER AS ANTICIPATED, IDEALLY NEW HIGHS BY MONTHEND.

TO MAINTAIN THE LONGTERM YIELD HIGHER CALL WE NEED TO CLOSE BACK AT THE MONTHS HIGHS.

**WE HAVE PLENTY OF PROMINENT LEVELS TO WATCH FOR.**

US 10-30 CURVE HAS AN RSI LOW NOT SEEN SINCE NOVEMBER 2019 AND IS NOW STEEPENING!

US 30YR YIELD IS HAPPILY HOLDING ABOVE ITS 1.4587 2OO DAY MOVING AVERAGE AND THE FUTURES FAILED ITS 50 DAY MOVING AVERAGE 174-04, A TEXT BOOK SCENARIO.

US 10YR YIELD HAS HELD ABOVE ITS 0.7701 2OO DAY MOVING AVERAGE.

US 5YR YIELD IS POISED TO JOIN THE 30YR AND 10YR BY BREACHING ITS LONG STANDING 200 DAY MOVING AVERAGE 0.4218.

REMEMBER THIS HAS ALSO BEEN ONE OF THE BIGGEST VOLUME MONTHS FOR SOME TIME.

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS, ESPECIALLY IN THE FRONT END.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris