Trade Radar, Nov 16th – Nov 20th: Will & James @Astor Ridge

A few trades on our minds coming into the week Nov 16th – Nov 20th

Main supply next week:

- Germany to tap 10y – Wednesday

- French supply 23s, 26s and 27s – Thursday 19th

- Spain to sell 26 & 27s – Thursday 19th

- Belgium supply TBA (5y & 10y), - Monday 23rd, positive news out on reduced supply

- Nether 7y - Tuesday 24th

Trades & Fades:

- Italian 20y too cheap? - Sell 15yr, Buy 20y, Sell 30y

- Buy Spanish longs on Blend vs Italy and France

- Sell Ireland 30y, Buy Belgium 30y

- Time to fade the tightening – Sell France vs Finland as a soft widener into year end

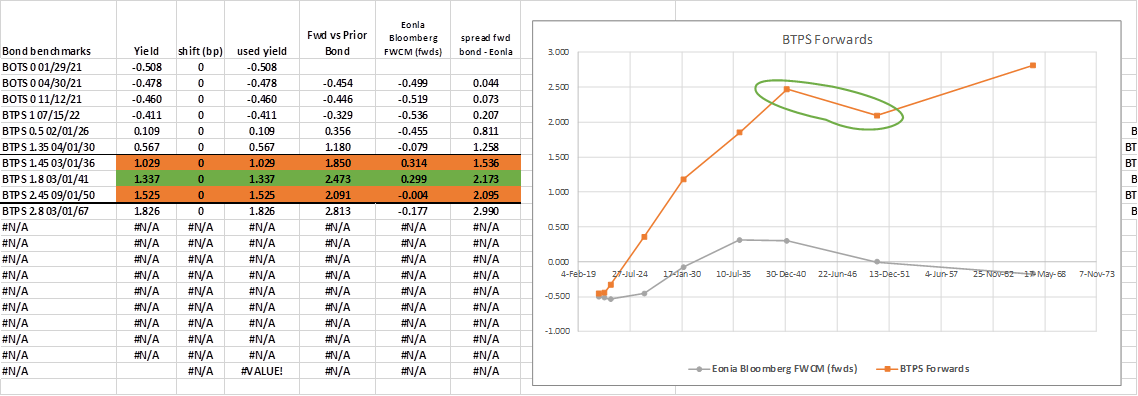

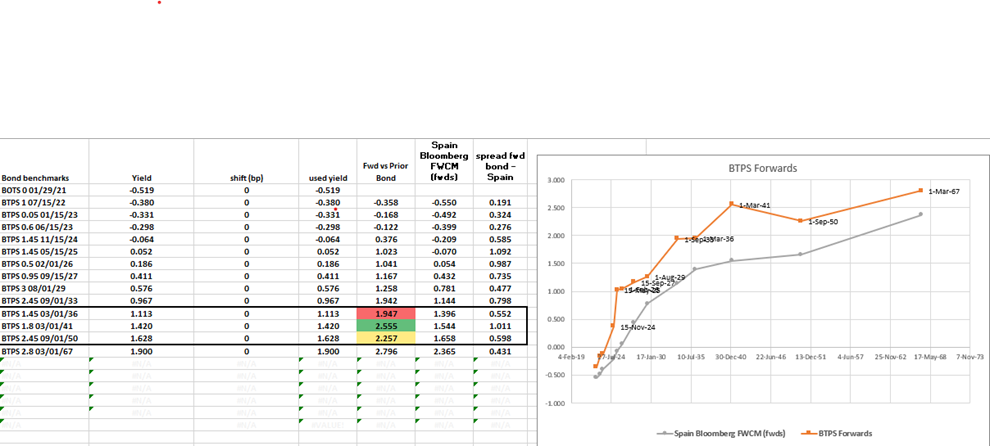

On our Trade Radar coming into what could have been the last piece of long end supply this year in Italy…

Italy

Sell 15yr, Buy 20y, Sell 30y

Rationale

- 20y trades cheap

- the 15y5y forward is actually higher than the 20y10y, which is unusual for a weaker credit such as Italy (BBB, Baa3, Outlook Stable)

- we had supply in the 15y this Thursday and this could be the last long tap before yr end

- For forwards to look like a continuous, smooth, upward sloping path – the fly could perform by 7bp in the belly (=14 on double counting) , so the structure has a lot of intrinsic value – the whole 20y sector is cheap

- The 36s are losing their historical premium arising from Low coupon/Low price status as there are more recent 10yrs, 20yrs and 50yrs with similar or lower coupons

The fly is an approximation of the expression of long 15y5y fwd vs short 20y10y

Cix:

(2 * YIELD[BTPS 1.8 03/01/41 Corp] - YIELD[BTPS 2.45 09/01/50 Corp] - YIELD[BTPS 1.45 03/01/36 Corp]) * 100

3mo Carry / Roll

Flat / Flat

Using -10bp repo spread

CIX of 1y older vs same bonds with more history

(2 * YIELD[BTPS 3.1 03/01/40 Corp] - YIELD[BTPS 3.85 09/01/49 Corp] - YIELD[BTPS 3.35 03/01/35 Corp]) * 100

So we see our current structure as at least 5bp to the rolled one – but more importantly in both circumstances the 20y point is cheap looking at forwards and we see more upside in the long term

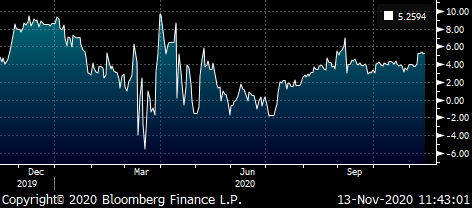

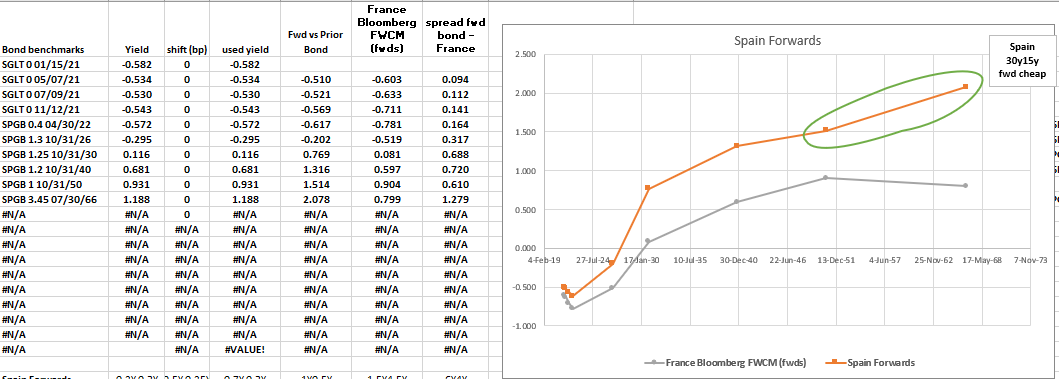

Spain 20y and 50y versus blend of Italy and France 30y

Here’s how we see Spanish 30 years versus on credit anomaly vs other Euro 30yrs….

We can buy Spain cheap to Italy but use a short in France as a bit of balance to the credit hedge

But here’s how we see Spanish 30y on forwards rates versus the 20y and 50y…

*This also adds some colour as to why some operators in the 10s30s curve in Italy are confounded by its refusal to flatten further – essentially the Italian credit is now looking rich vs Spain and the forward rate spread of 10y20y it/ge is as tight as the forward rate spread 5y5y it/ge

So concatenating the two trades we get

Long Spain 20y and 50y vs

Short 60% France 30y

Short 40% Italy 30y

Cix:

100 * ((0.5 * YIELD[SPGB 3.45 07/30/66 Corp] + 0.5 * YIELD[SPGB 1.2 10/31/40 Corp]) – 0.6 * YIELD[FRTR 1.5 05/25/50 Corp] – 0.4 * YIELD[BTPS 2.45 09/01/50 Corp])

So this structure @ +14bp executable makes sense as a first entry

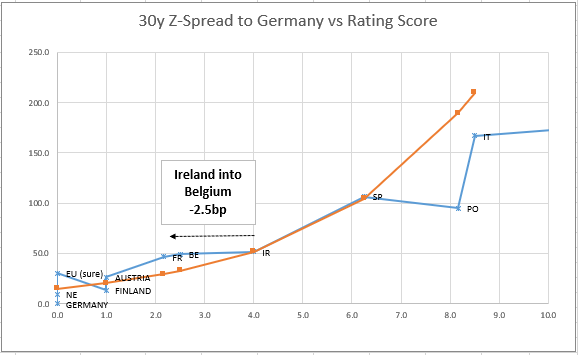

Sell Ireland 30y, Buy Belgium 30y

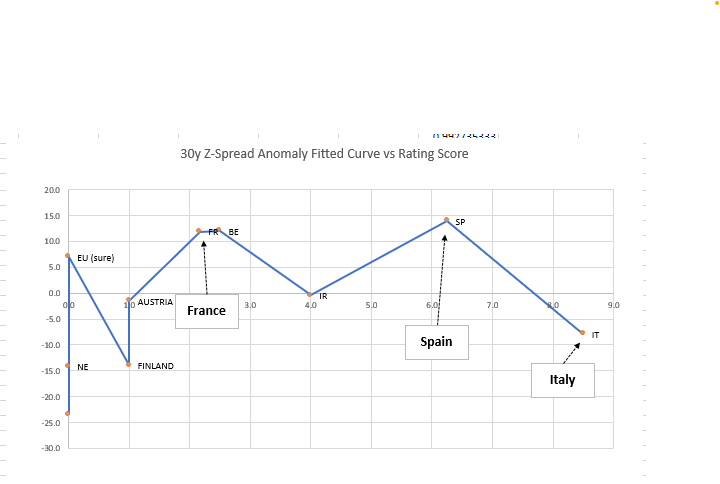

Here’s how we see Euro Credits on Spread to Germany with a fitted curve….

As a loose boundary condition we want to try and shorten up the credit curve for a minimal give in times when credit has tightened to core

Ireland into Belgium is -2.5bp on z spread

Ratings (S&P, Moody’s), Fitch has Belgium on neg outlook, other agencies have stable

Ireland: AA-, A2

Belgium: AA, Aa3

In yield space…

YIELD[IRISH 1.5 05/15/50 Corp] - YIELD[BGB 1.7 06/22/50 Corp]

Today’s Belgium funding headline was a modest cut… (Bloomberg)

Debt Agency cuts target for bond sales this year to EU44.5 billion from revised EU46.5 billion in June

· Debt Agency sees amount of outstanding treasury bills rising by only EU3.0 billion this year, saw EU10 billion increase in June

· In addition, Belgian Debt Agency expects to obtain EU2.0 billion from the European Union’s SURE bond issuance proceeds

· NOTE: Belgium has raised EU42.5 billion from bond sales so far this year

Supply expected in Belgium, Monday 23rd November – this may offer an opportunity to add to this trade

Lvls

Current: -2.6bp

Add: Flat

Target: -14bp, although that’s the extreme of the range that’s where I see credit flat vs Rating notch value – assuming generally other credits are unchanged

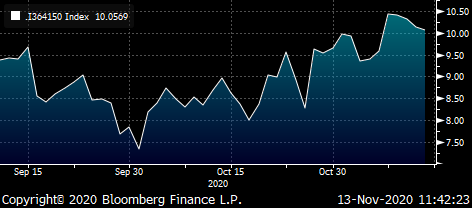

If we hedge the credit risk with Italy we get a sense of how this moves in sympathy with the Italian credit moves….

-Irish30y

+90% Belgium 30y

+10% Italy 30y

Cix:

100 * (YIELD[IRISH 1.5 05/15/50 Corp] - 0.9 * YIELD[BGB 1.7 06/22/50 Corp] - 0.1 * YIELD[BTPS 2.45 09/01/50 Corp])

Arguably on a fully credit hedged basis the Irish bond is in the middle of the distribution, given where Italy is – so the tailwinds for this trade may not be so strong, or similarly our first piece is in very social size and we use the fully hedged fly as an aide to add further should credit tighten

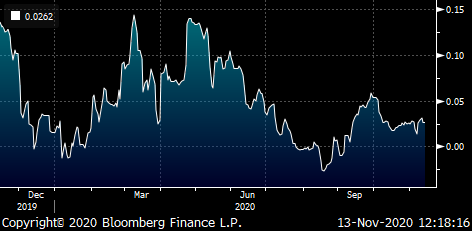

Is the spread tightening running out of steam? – looks towards opportunistic semi-core wideners to fade the move

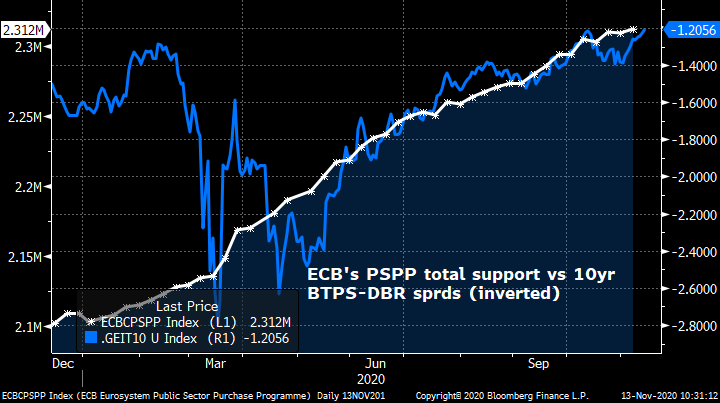

Trade Idea: Buy RFGB 0% Sep-2030 vs. FRTR 0% Nov-30

Rationale:

- BTP/Bund, OAT/RX & Global equities all moving inexorably tighter and higher and importantly all in tandem, providing a good degree of validation to the move

- That said we have seen the market reject these spread levels again and again when a new risk event comes round the corner

- Whilst the Covid outlook has brightened considerably on the back of the vaccine news, the timing seems less clear, which could leave us spending more time back in the “new normal”

- Whilst we don’t necessarily see a reversal in spreads in the context of lower issuance into year end and cash on the sidelines, we do think that the market is more vulnerable to a negative shock than it has been for a while (extended lockdowns, vaccine issues, who knows?? – this is 2020!)

- As a result we like scaling into short France vs long Finland as a soft widener

- Move out of AA -> AA+ (Fitch)

- Supportive supply dynamic (Finland finished tapping for 2020)

- Finland cheap vs other core issuers

- Entry level 7 bpts (50%), 5 bpts (50%)

- Exit level 9 bpts (50%), run remaining 50% into January new issuance, which should favour spread widening

Spreads at historically key levels:

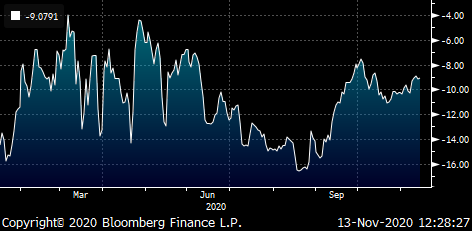

Finland spread to France trading very tight

Specific cheapness of Finland highlighted by the RFGB vs RAGB & FRTR (10y, 1:2:1 weighting)

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

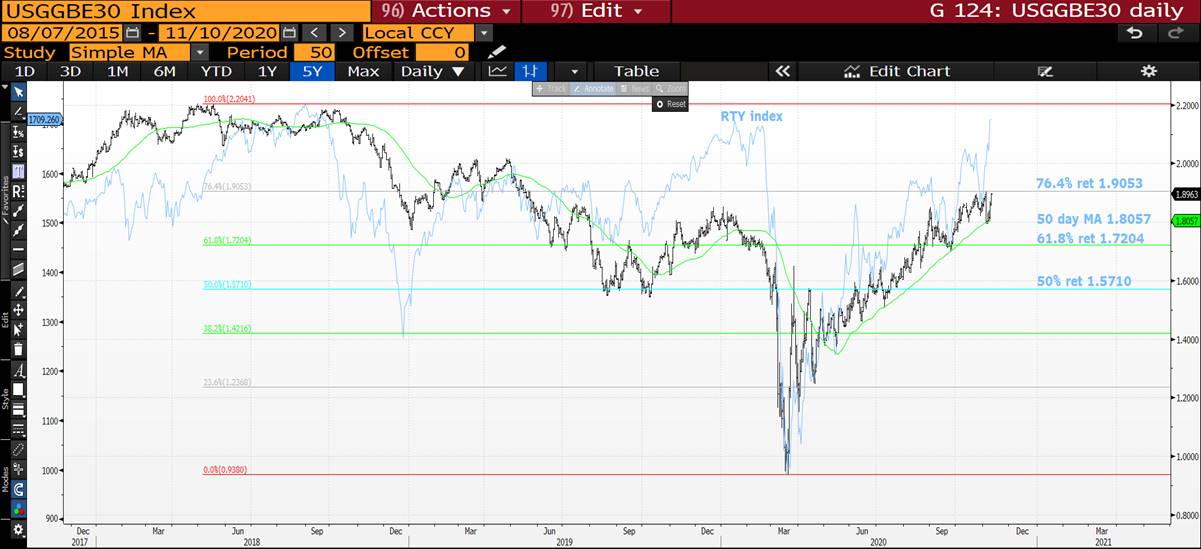

US BREAKEVENS AND USGGT : BREAKEVENS POPPED BUT CONTINUE TO STRUGGLE AGAINST MOVING AVERAGE RESISTANCE.

US BREAKEVENS AND USGGT : BREAKEVENS POPPED BUT CONTINUE TO STRUGGLE AGAINST MOVING AVERAGE RESISTANCE.

30YR BREAKEVENS POST A VERY TECHNICAL FAILURE STALLING AT THEIR 76.4% RET 1.9053, A PERFECT HIT! ADDITIONALLY MONTHLY 50 PERIOD MOVING AVERAGE IS OFFERING LONGTERM REISTSANCE.

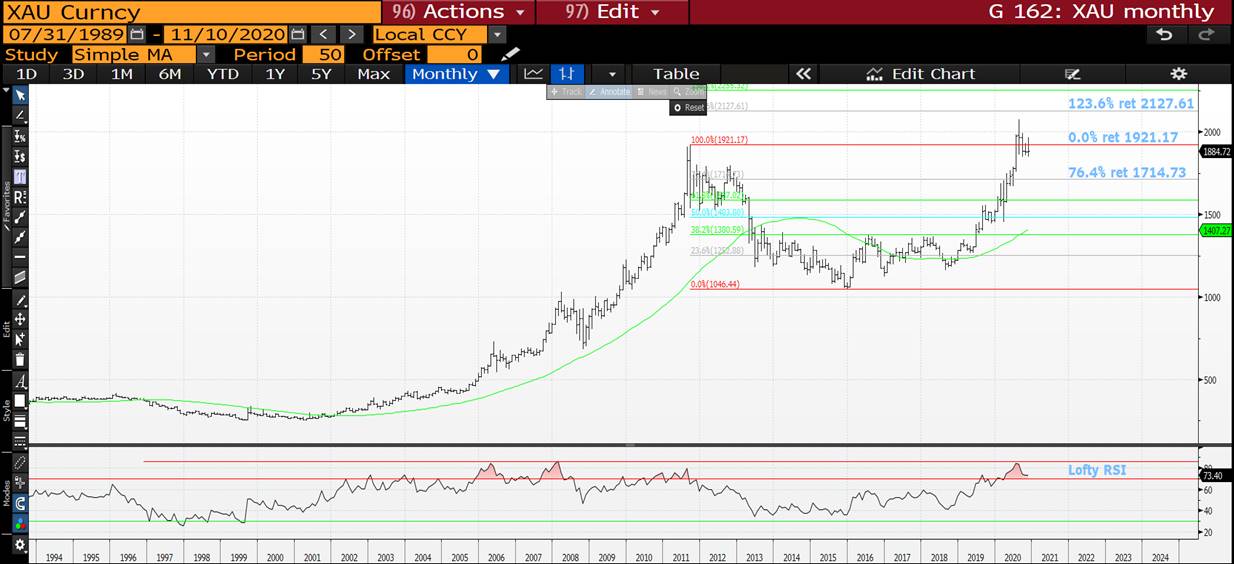

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI'S LOOK HISTORICALLY LOFTY AND ADDITIONALLY MOVING AVERAGE RESISTANCE.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

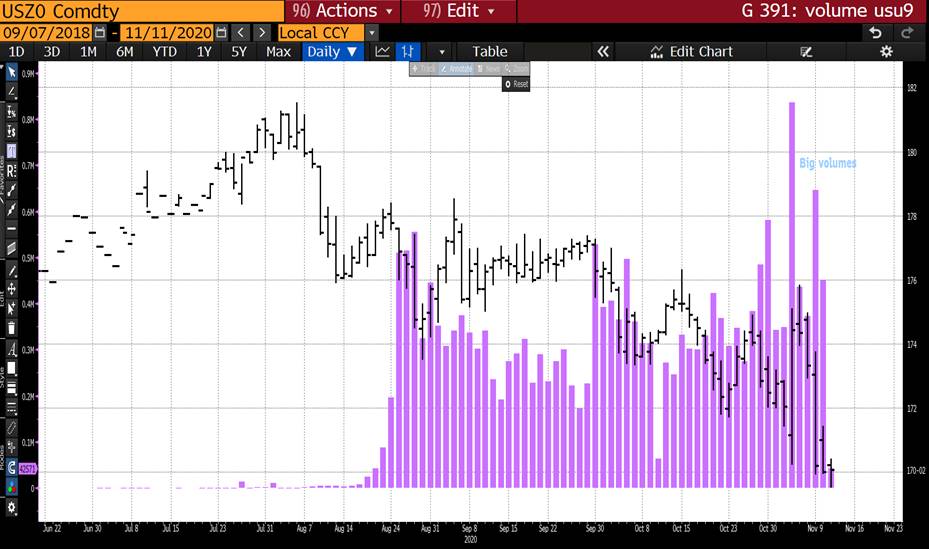

BONDS YIELDS : AS MENTIONED PREVIOUSLY WE HAVE PRODUCED A MONTHS RANGE IN 2 WEEKS THUS DO EXPECT SOME CONSOLIDATION BEFORE THE NEXT YIELD MOVE HIGHER.

BONDS YIELDS : AS MENTIONED PREVIOUSLY WE HAVE PRODUCED A MONTHS RANGE IN 2 WEEKS THUS DO EXPECT SOME CONSOLIDATION BEFORE THE NEXT YIELD MOVE HIGHER.

WE SHOULD SEE YIELDS CLOSE THE MONTH A LOT HIGHER, THAT SAID IT NEEDS TO BE A STEADY GRIND.

**WE HAVE PLENTY OF PROMINENT LEVELS TO WATCH FOR.**

US 30YR IS TESTING A LONGSTANDING 38.2% RET 1.7533, SO VERY KEY AS IT HAS HELD SINCE MARCH THIS YEAR.

US 10YR YIELD ARE POISED TO BREACH THE TOP OF A SIGNIFICANT UPTREND CHANNEL 0.9734.

US 5YR YIELD IS POISED TO JOIN THE 30YR AND 10YR BY BREACHING ITS LONG STANDING 200 DAY MOVING AVERAGE 0.4573.

REMEMBER THIS HAS ALSO BEEN ONE OF THE BIGGEST VOLUME MONTHS FOR SOME TIME.

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS, ESPECIALLY IN THE FRONT END.

GERMAN MONTHLY YIELDS CONTINUE TO TEASE THE LONGTERM DOWNTREND CHANNEL.

GERMAN DBR 46 IS FLIRTING WITH ITS 200 DAY MOVING AVERAGE 169.087.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: Rates Markets Yin and Yang > Comment Into Year-End

Happy Friday the 13th - may it bring us luck.

First, a quick definition for those not familiar with 'Yin and Yang': two complementary principles of Chinese philosophy: Yin is negative, dark, and feminine, Yang positive, bright, and masculine. Their interaction is thought to maintain the harmony of the universe and to influence everything within it.

Most friends and colleagues agree that 2020 has been the year we'd all like to forget, 'It can't end fast enough!' is a common refrain. With just over 6 weeks left in 2020 we are still faced with a considerably larger number of 'Yin vs Yang' forces than usual, each driving the markets on a daily, weekly and even monthly basis. While the adage 'Time heals all wounds" is likely to apply to all of the Y v Y events below, it's not merely how long a resolution takes but whether it's an outcome the market expects or not.

Our Yins vs Yangs:

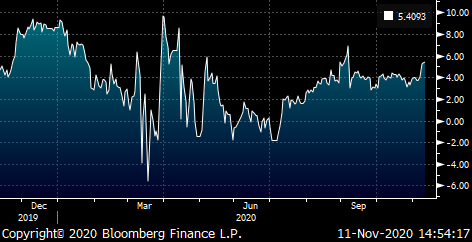

- Covid-19 vs the Vaccine

- Pfizer's announcement of a vaccine breakthrough on Monday sparked the biggest developed rates market selloff in months, a euphoric response to news we've all been waiting for. As the reality of the vaccine's cost and its delivery limitations sank in, the air leaked out of the balloon and as of this morning's open, US bond futures have clawed back ~3 of the 4 point sell-off (173-24 > 169-16 > 172-12).

- Cases across Europe and the US continue to rise with California passing 1 million infections and France at 1000 cases per 100k. Restrictions are becoming more stringent despite much of Europe already in lockdown. Trump remains silent on the surge in US cases.

- "We do see the economy continuing on a solid path of recovery, but the main risk we see to that is clearly the further spread of the disease here in the United States," Federal Reserve Chair Jerome Powell said during a panel discussion at a virtual conference hosted by the European Central Bank. "With the virus now spreading, the next few months could be challenging."

- Will there be a vaccine successful in turning this tide? Yes. When? Who knows? Handicapping the timing of the vaccine against the eventual economic impact is perilous at best.

- Biden vs Trump

- The outcome of the Nov 4 Presidential election remains contested as Trump claims voting irregularities that jeopardize the authenticity of Biden's apparent victory. While the federal, state and local election commission continues to assert that the 2020 election "was the most secure in American history" and that "there is no evidence" any voting systems were compromised, Trump is littering the country with lawsuits and demands for recounts. To add insult to injury, Biden was declared the winner in Arizona last night, the first time a Democrat has won since 1996.

- While the presidential melee carries on, Georgia will hold a runoff for its two senate seats on Jan 5, 2021. The Republicans are expected to take one or both of these seats, maintaining control of the Senate. However, if the Democrats win, the split will be 50-50, leaving the vice president to cast the deciding vote. A 'blue wave' has implications for everything from taxes and infrastructure spending to US trade and defense policies.

- While it seems remote now, there are wild cards here, laid out very clearly by Van Jones in this TED TALK. What if Trump doesn't concede? What if there's a special election that nullifies the first one? Scary stuff indeed.

- The by-product of this stalemate is far-reaching. It will delay the signing of a much-needed covid-19 stimulus bill that Pelosi and Mnuchin tried in vain to pass, slowing the US economic recovery. It will also detract from vital coordination needed to battle the surge in coronavirus hitting much of the country. Lastly, a long, drawn-out battle in the courts dents the US's reputation globally, potentially driving USD weakness.

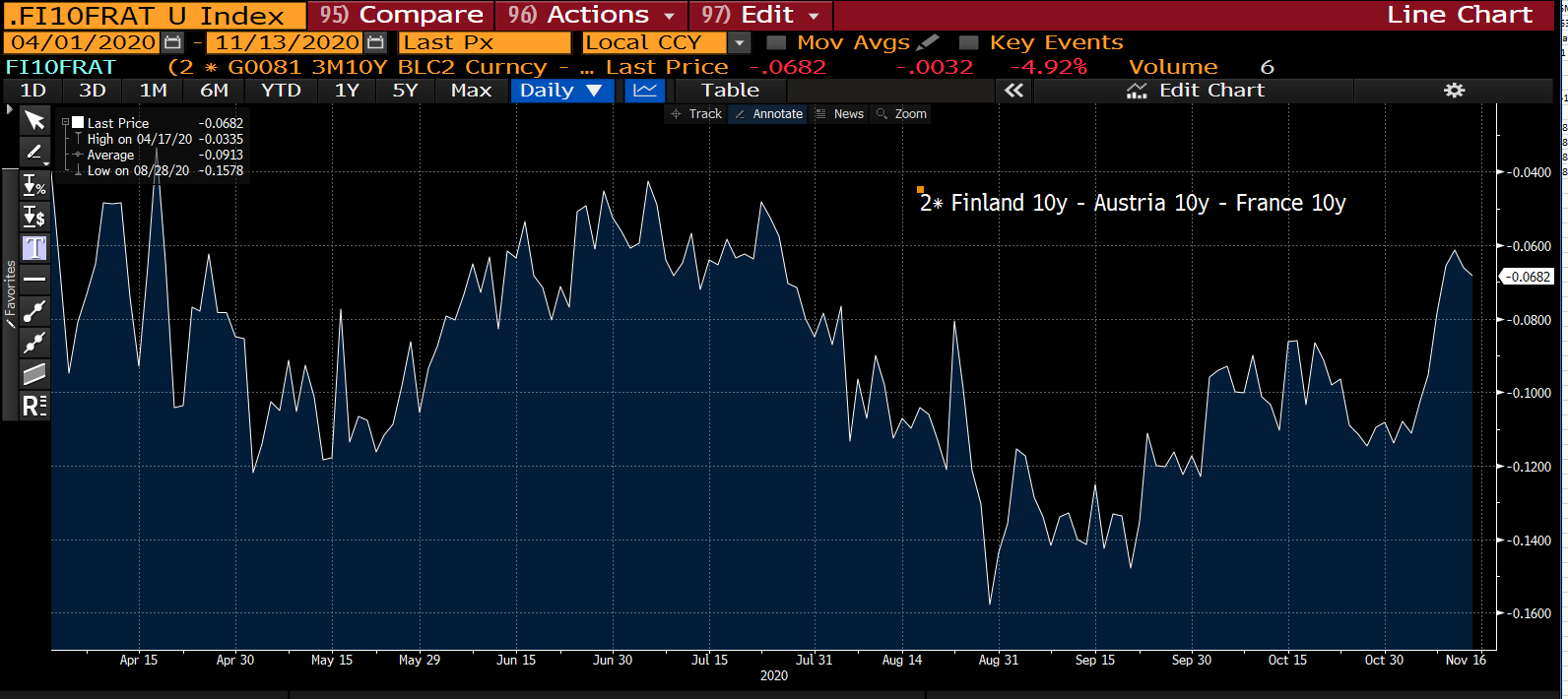

- Sovereign Supply vs Quantitative Easing

- FED, ECB and BoE officials have been very vocal about the need for fiscal spending to drive support for pandemic-driven economic challenges after their base rates were cut to record lows. While most argue more needs to be done (neg rates still in play in the UK?), the year-to-date fiscal spending on a myriad number of programs (especially in the UK) has been at a record pace, driving a surge in UST, UKT and EGB issuance, including the ponderous new EU program expected to dominate the EUR SSA market in 2021.

- We can see below that anchoring base rates at/through zero while cranking up bond issuance has helped drive a steepening of the UST curve and, to a lesser extent, the gilts curve.

- The FED's QE support hasn't been as forceful or effective as the BoE and ECB's has been in 2020 which is reflected in their curve. The BoE has already announced another £150bn for all of 2021 and the ECB has promised to 'wow' the markets with another dramatic dovish move at their Dec 10th meeting. QE will likely remain a key cog in the ECB's covid-19 response, especially given where base rates are.

- The question, across the board is, 'Will the FED follow suit with a more 'complete' QE effort once the next stimulus package is passed? Will the ECB roll-out a more formalized yield-curve control approach? Will the BoE adjust the APF buckets to reflect available liquidity across their curve? Time is of the essence but with year-end approaching, we're probably talking mid-Q1 at best.

- Boris Johnson vs Europe

- For those living in the UK since the Brexit vote in 2016, you probably share the same extraordinary sense of exasperation, frustration and impatience that I do. It's beyond comprehension that after almost 3 ½ years of negotiations, the same issues are preventing a deal. Without going into the minutiae, the bottom line is the clock is ticking towards the BIG Dec 31st deadline where the UK leaves the EU, deal or no deal. From this am's BBG article: "Another week of negotiations -- one that was supposed to be decisive -- will end Friday with little progress made in the main areas of disagreement, according to three EU officials familiar with the situation. While both sides can see what a final agreement would look like, Brussels officials insist that reaching one will require the U.K. prime minister to move first, a stance their British counterparts reject." Good grief.

- In the last week we've had a frosty call with Biden (Don't screw with the Good Friday Agreement Boris!) , Johnson's right hand man, the controversial Dominic Cummings is gone by year-end and the Europeans are sending their usual messages of both despair and hope.

- While the UK government has done its very best to make the outcome as baffling as possible (with little help from Barnier to be fair), most Brits expect there will be a deal. As always, the devil's in the details, but at this point the rally in Cable and the modest re-steepening of the curve suggest a deal will be done, one that gets them over the line and can be amended during the transition period.

- The mechanics of signing the deal aside, there isn't a soul from here to Hong Kong who expects the transition to go smoothly regardless of the deal's complexion. Johnson's administration has been taken to account by his own party for its shambolic handling of the pandemic and his own ratings have taken a severe hit. Fumbling the Brexit deal, the one he himself campaigned so actively for, would be a monumental failure and would likely cost him his job as PM. With his 'Joe Biden Problem' and time wasting, one would think the onus is now on Boris to blink first – and Europe knows this.

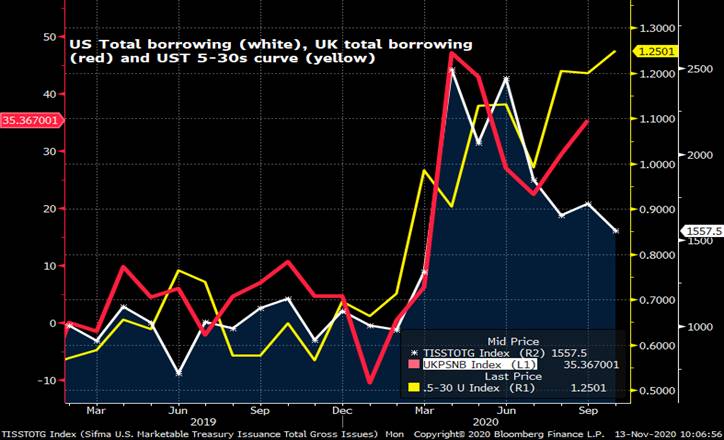

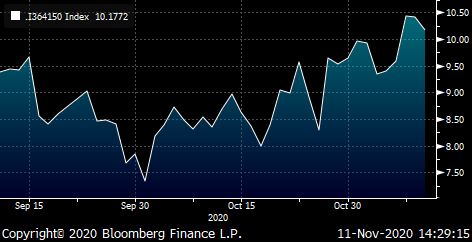

- The ECB vs Credit Risk

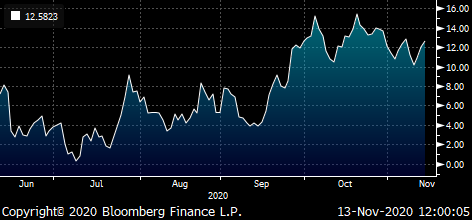

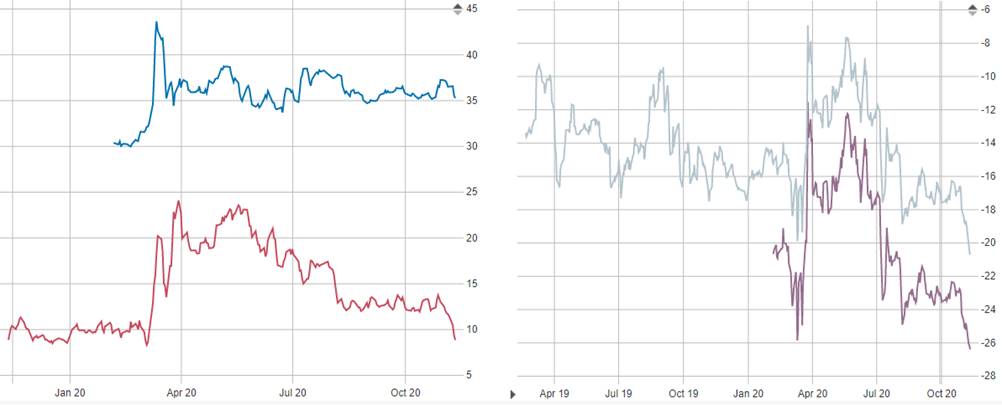

- The ECB's PSPP, ABB and PEPP programs have been at the heart of their response to the pandemic. Like them or loathe them, these programs have helped to not only lower overall yield levels across all EGB issuers but they've driven a tightening of peripheral vs core spreads to record tight levels. The chart below illustrates the high correlation since mid-May this year until now.

- While Europeans (especially Italians!) are grateful for this rates support at their time of need, this move to such tight levels not only ignores the sovereign credit ratings of countries like Italy, Spain and Portugal who have borne the brunt of the pandemic, it also creates an implied ECB-driven backstop that Lagarde and company may not be able to support once the pandemic's effects have waned.

- Euro swaption vols are back near the lows seen in 2019 as a reflection of this spread compression and richening of yield levels. Is the market supposed to believe that there is no market-event on the horizon that could prompt a spike higher in rates or a widening of EGB credit spreads like DBR-BTPS?

- The short answer is 'No', we're not supposed to believe yields can't go up because we saw that up close and personal this week when RXZ0 sold off almost 3 points in 3 days. We had a little blip wider in BTPS spreads but that proved short lived and while RXZ0 hasn't recovered like USZ0 has, we're still 1.1 points off the lows.

- The ECB's 'bazooka' is meant to prevent an economic calamity. However, the collateral damage to the European pensions industry will be palpable if they persist with QE, etc longer than is necessary.

- And what about the EU program? Mutualization of debt among EGB issuers takes the load off investors at spreads deemed 'reasonable'. This is a plan that's been long in coming and a product that will be warmly received by end-users, provided there is ample access to the bonds in both the primary and secondary markets.

- Does the existence of this EU program make BTPS less interesting? While it all depends on the spreads they come at, the pool of money chasing European rates is finite, suggesting something's got to give.

- Conclusion

- Rates markets are facing a lopsided risk-reward profile that is ostensibly short volatility. The question is, are the options a 1 month expiry or 6 months? It we're long, we're prone to a vaccine headline, a Trump concession speech, a decline in Covid-cases or even a less dovish ECB than hoped. Get short and we're at risk if Trump takes this debacle to it's extremes, the pandemic gets really nasty or the wheels completely fall off the Brexit wagon. To say this is an extraordinary market in an extraordinary year is an understatement indeed.

- These are the approaches we're taking with positions into year-end:

- Stay in positive carry trades as we could remain range bound into year-end.

- Trade the ranges.

- Tactical supply-driven relative value continues to work albeit for modest gains.

- Net-neutral exposure across the curve with both flatteners and steepeners as RV affords.

- Vol is still relatively cheap (MOVE index back to 44 after pop to 65) – get long puts for those vaccine headlines.

More to come soon. Your feedback is welcome!

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FRTR 39s are rich on the 10s30s curve

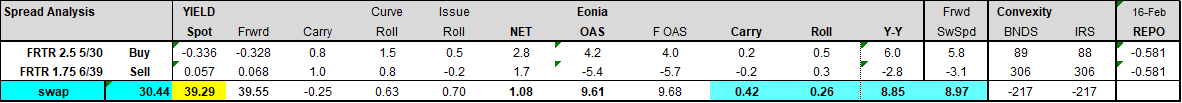

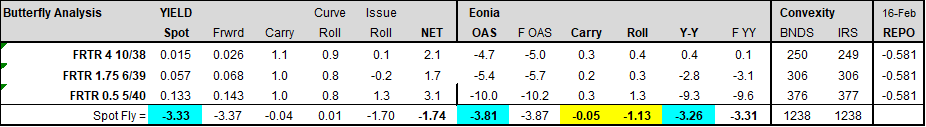

Trade 1): Buy FRTR 2.5 5/30 vs 1.75 6/39 on MM Eonia at 9 bps:

3mo carry/roll = 0.7 bps

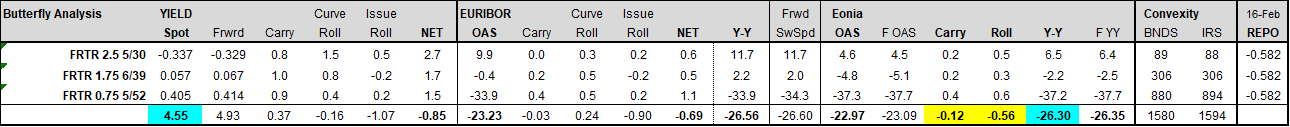

RATIONALE: FRTR 30s39s cash curve (red/lt axis) and MM Eonia curve (blue/rt axis) are moving in opposite directions – due to risk-on driven steepening of Eonia 10s20s:

However, the swap curve could re-flatten as initial euphoria fades, given the recent Covid spike and lag times in vaccine distribution.

The 39s (green bond) are also locally rich on the FRTR curve:

TRADE 2) Sell belly of FRTR 5/30-6/39-5/52 MM Eonia bfly @ -25 bps:

Short the belly ~ + 0.7bps carry/roll over 3mos

RATIONALE - FRTR 39s remain rich on the 10s30s curve:

30s39s52s bfly:

The richness is magnified when compared to the Eonia curve, where 10s20s30s = +30bps:

FRTR 39s52s (blue) vs 30s39s (red) MM Eonia spread Purple – FRTR 30s39s52s MM Eonia bfly

Grey – FRTR 30s39s50s MM Eonia bfly (for more history)

At some point in the QE cycle, the 35 bps pickup in FRTR 20s30s curve vs the Eonia curve should encourage RM to extend.

Moreover, the FRTR 0.75 5/52 roll steeply to the 1.5 5/50 (+5.6 bps on MM Eonia for a 2yr gap), AND will be eligible for QE (PSPP/PEPP) in 6 months when they fall below 31yrs.

Regards,

Jim

Jim Lockard

Founder / Managing Partner

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade radar - Italy Fly -15y +20y -30y, James & Will @ Astor Ridge

On our Trade Radar coming into what could be the last piece of long end supply this year in Italy…

Italy

Sell 15yr, Buy 20y, Sell 30y

Rationale

- 20y trades cheap

- the 15y5y forward is actually higher than the 20y10y, which is unusual for a weaker credit such as Italy (BBB, Baa3, Outlook Stable)

- we have supply in the 15y on Thursday and this could be the last tap before yr end

- For forwards to look like a continuous, smooth, upward sloping path – the fly could perform by 7bp in the belly (=14 on double counting) , so the structure has a lot of intrinsic value – the whole d20y sector is cheap

- The 36s are losing their historical premium arising from Low coupon/Low price status as there are more recent 10yrs, 20yrs and 50yrs with similar or lower coupons

The fly is an approximation of the expression of long 15y5y fwd vs short 20y10y

Cix:

(2 * YIELD[BTPS 1.8 03/01/41 Corp] - YIELD[BTPS 2.45 09/01/50 Corp] - YIELD[BTPS 1.45 03/01/36 Corp]) * 100

3mo Carry / Roll

Flat / Flat

Using -10bp repo spread

CIX of 1y older vs same bonds with more history

(2 * YIELD[BTPS 3.1 03/01/40 Corp] - YIELD[BTPS 3.85 09/01/49 Corp] - YIELD[BTPS 3.35 03/01/35 Corp]) * 100

So we see our current structure as at least 5bp to the rolled one – but more importantly in both circumstances the 20y point is cheap looking at forwards and we see more upside in the long term

Will & James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Live From The Field

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BONDS YIELDS : YIELDS HAVE COME ALONG WAY ON SUBSTANTIAL VOLUME AND ITS ONLY THE 11TH DAY OF THE MONTH! **PLEASE READ SOME SIGNIFICANT LEVELS TO WATCH FOR**

BONDS YIELDS : YIELDS HAVE COME ALONG WAY ON SUBSTANTIAL VOLUME AND ITS ONLY THE 11TH DAY OF THE MONTH! WE SHOULD SEE YIELDS CLOSE THE MONTH A LOT HIGHER, THAT SAID IT NEEDS TO BE A STEADY GRIND.

**WE HAVE PLENTY OF PROMINENT LEVELS TO WATCH FOR THIS WEEK.**

US 30YR IS TESTING A LONGSTANDING 38.2% RET 1.7533, SO VERY KEY AS IT HAS HELD SINCE MARCH THIS YEAR.

US 10YR YIELD ARE POISED TO BREACH THE TOP OF A SIGNIFICANT UPTREND CHANNEL 0.9692.

US 5YR YIELD IS POISED TO JOIN THE 30YR AND 10YR BY BREACHING ITS LONG STANDING 200 DAY MOVING AVERAGE 0.4677.

REMEMBER THIS HAS ALSO BEEN ONE OF THE BIGGEST VOLUME MONTHS FOR SOME TIME.

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS, ESPECIALLY IN THE FRONT END.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

GERMAN MONTHLY YIELDS CONTINUE TO TEASE THE LONGTERM DOWNTREND CHANNEL.

GERMAN DBR 46 HAS BREACHED ITS 200 DAY MOVING AVERAGE 169.010.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

US BREAKEVENS AND USGGT : BREAKEVENS POPPED WITH EQUITES YESTERDAY BUT YET AGAIN HAVE RUN INTO MAJOR MOVING AVERAGE RESISTANCE.

US BREAKEVENS AND USGGT : BREAKEVENS POPPED WITH EQUITES YESTERDAY BUT YET AGAIN HAVE RUN INTO MAJOR MOVING AVERAGE RESISTANCE.

30YR BREAKEVENS POST A VERY TECHNICAL FAILURE STALLING AT THEIR 76.4% RET 1.9053, A PERFECT HIT! ADDITIONALLY MONTHLY 50 PERIOD MOVING AVERAGE IS OFFERING LONGTERM REISTSANCE.

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI'S LOOK HISTORICALLY LOFTY AND ADDITIONALLY MOVING AVERAGE RESISTANCE.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

STOCKS : A MASSIVE BOUNCE IN EQUITIES BUT THE US MARKET HAS LEFT SOME VERY EXPOSED REVERSAL RANGES FROM YESTERDAY.

STOCKS : A MASSIVE BOUNCE IN EQUITIES BUT THE US MARKET HAS LEFT SOME VERY EXPOSED REVERSAL RANGES FROM YESTERDAY. WE MAY END UP FORMING MAJOR TOPS ESPECIALLY IN SINGLE STOCKS.

THE MARKETS NEED TO CONTINUE HIGHER OR WE STALL AND STALL IN STYLE, ESPECIALLY NOW THE US MARKET IS ROLLING OVER VERSUS EUROPE FOR THE FIRST TIME IN A WHILE.

DOUBT AFTER THESE BUSY VOLUME FILLED 10 DAYS OF NOVEMBER NO ONE WOULD LIKE TO HAZARD A GUESS WHERE EQUITIES CLOSE THE MONTH?

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris