FX UPDATE : USD WEAKNESS IS BACK ON TRACK AS MANY CROSSES PUSHING NEW USD WEAKNESS LOWS.

FX UPDATE : USD WEAKNESS IS BACK ON TRACK AS MANY CROSSES PUSHING NEW USD WEAKNESS LOWS.

THE AUD IS THE MAIN CROSS TO WATCH AS HOPEFULLY IT CAN POP BACK ABOVE ITS MULTI YEAR MOVING AVERAGE 0.7250.

USD CAD IS TESTING ITS MAJOR 50 PERIOD MOVING AVERAGE 1.3179!

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONS IN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOMNE TIME.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

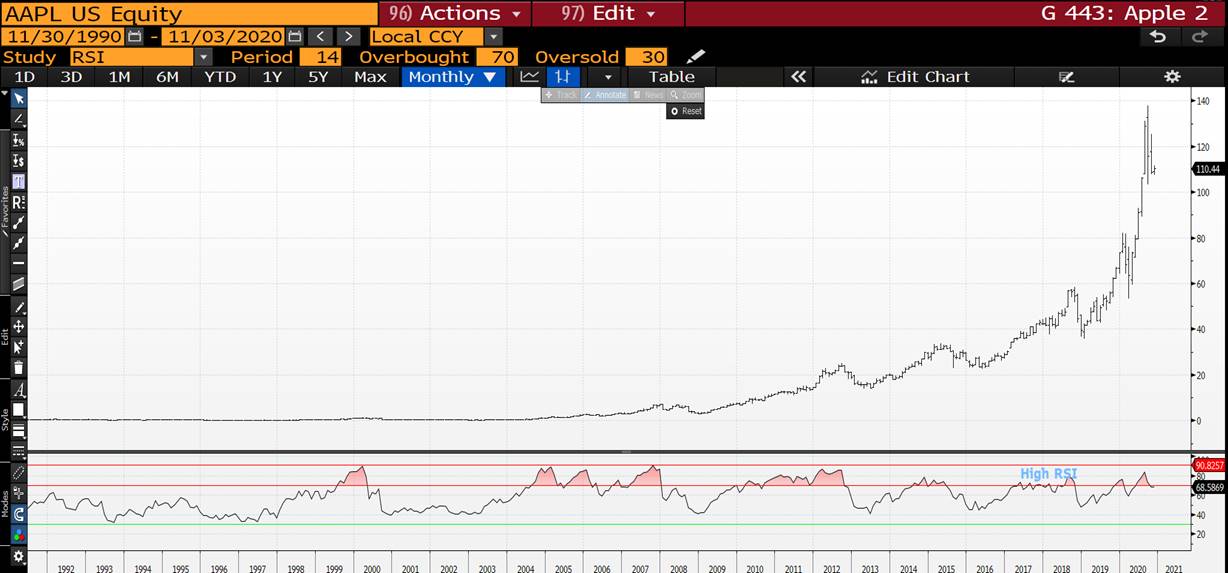

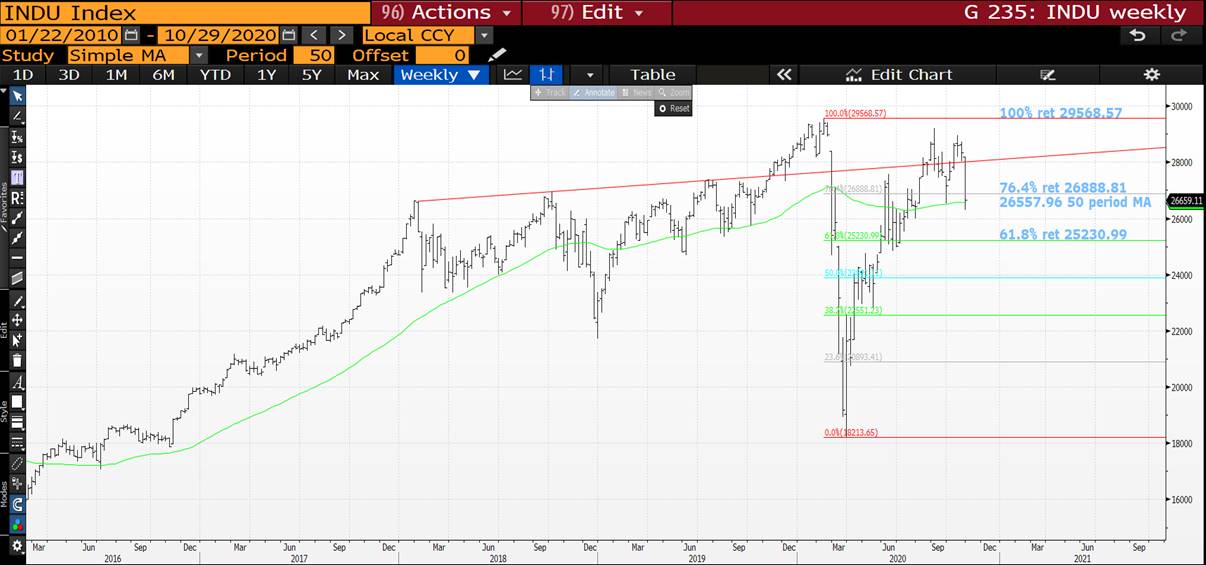

STOCKS : EQUITIES HAVE BOUNCED BUT SIMILAR TO BONDS IT IS STRAIGHT INTO SIZEABLE RESISTANCE.

STOCKS : EQUITIES HAVE BOUNCED BUT SIMILAR TO BONDS IT IS STRAIGHT INTO SIZEABLE RESISTANCE.

SINGLE STOCKS ALSO LOOK LIKE SOME LONG-TERM TOPS ARE IN PLAY.

EUROPEAN EQUITIES HAVE LOW RSI'S BUT NOT AS DRAMATIC AS THE MARCH DISLOCATION.

THE NASDAQ IS BACK BELOW ITS 50 DAY MOVING AVERAGE.

I DO BELIEVE WE WILL ONLY SEE THE REAL ECONOMIC IMPACT NEXT YEAR.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

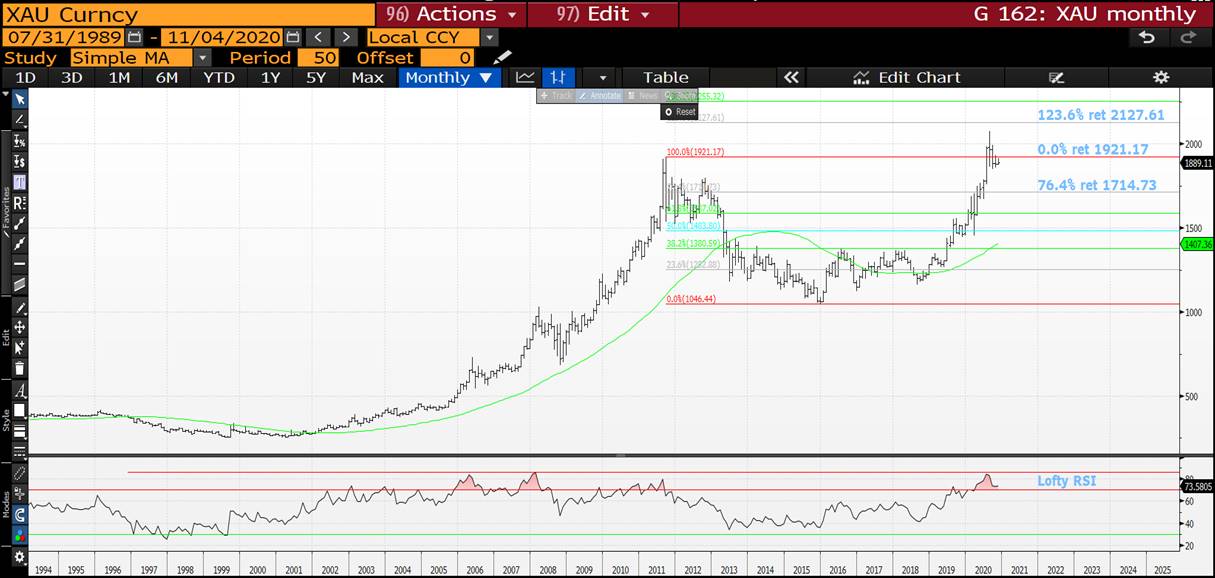

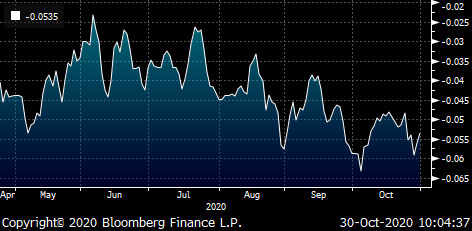

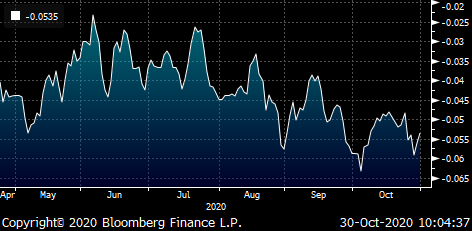

US BREAKEVENS AND USGGT : BREAKEVENS HAVE AN EXTENDED RANGE WHICH HAS NEATLY SERVED TO ENDORSE THE CALL FOR A LONGTERM “TOP”.

US BREAKEVENS AND USGGT : BREAKEVENS HAVE AN EXTENDED RANGE WHICH HAS NEATLY SERVED TO ENDORSE THE CALL FOR A LONGTERM “TOP”.

30YR BREAKEVENS WEEKLY AND DAILY RSI’S ARE NOW HEADING LOWER, POST HITTING THEIR 76.4% RET 1.9053.

10YR BREAKEVENS ARE TESTING THEIR 50 DAY MOVING AVERAGE 1.6947.

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI’S LOOK HISTORICALLY LOFTY.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

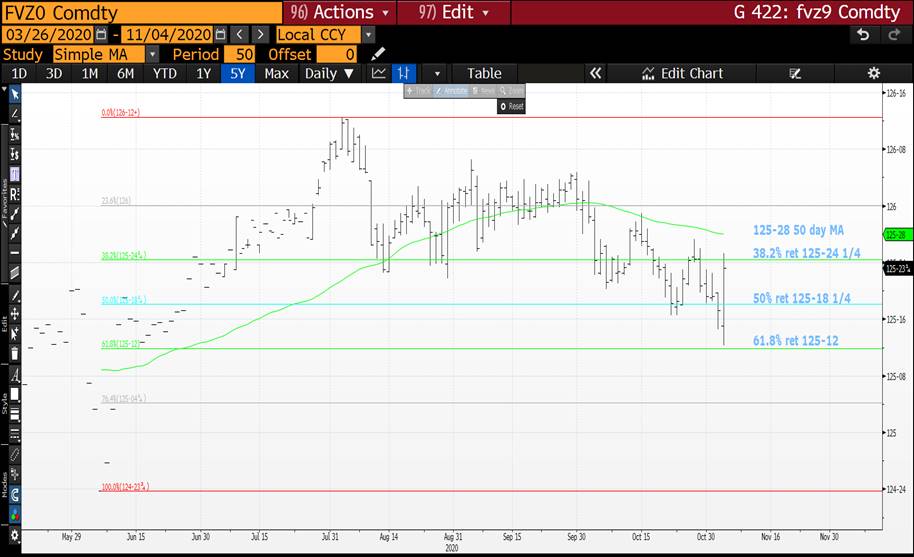

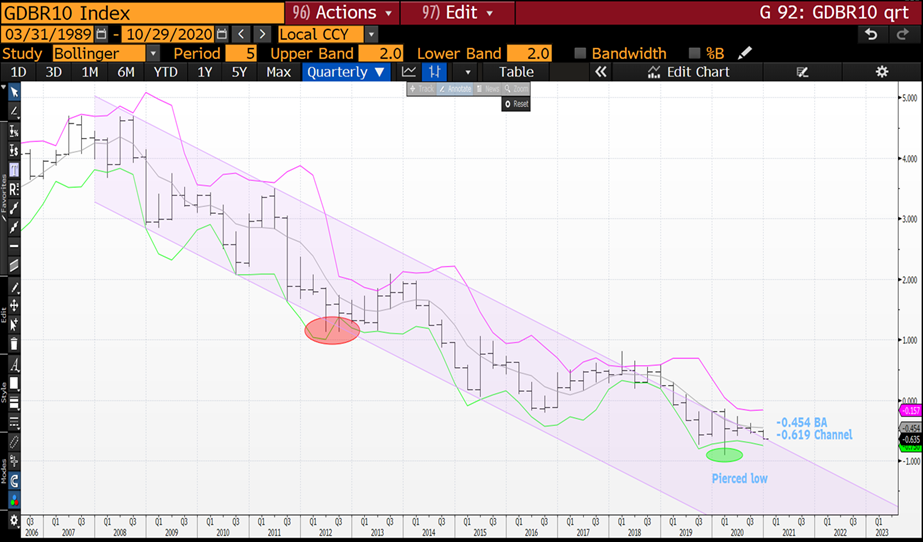

BONDS YIELDS : THE ELECTION UNCERTAINTY HAS PRODUCED SOME VERY EXTENDED RANGES FOR WEEK 1 OF NOVEMBER, PROMPTING A SHORT COVERING RALLY.

BONDS YIELDS : THE ELECTION UNCERTAINTY HAS PRODUCED SOME VERY EXTENDED RANGES FOR WEEK 1 OF NOVEMBER, PROMPTING A SHORT COVERING RALLY.

THESE ONE DAY RANGES WILL BE A PROBLEM TO WORK AROUND HOWEVER MOST FUTURES CURRENTLY REMAIN SUB THEIR ALL IMPORTANT 50 DAY MOVING AVERAGES.

US 30YRS REMAIN ABOVE THEIR 200 DAY MOVING AVERAGE 1.4899, SO YIELDS SHOULD HEAD HIGHER AGAIN.

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

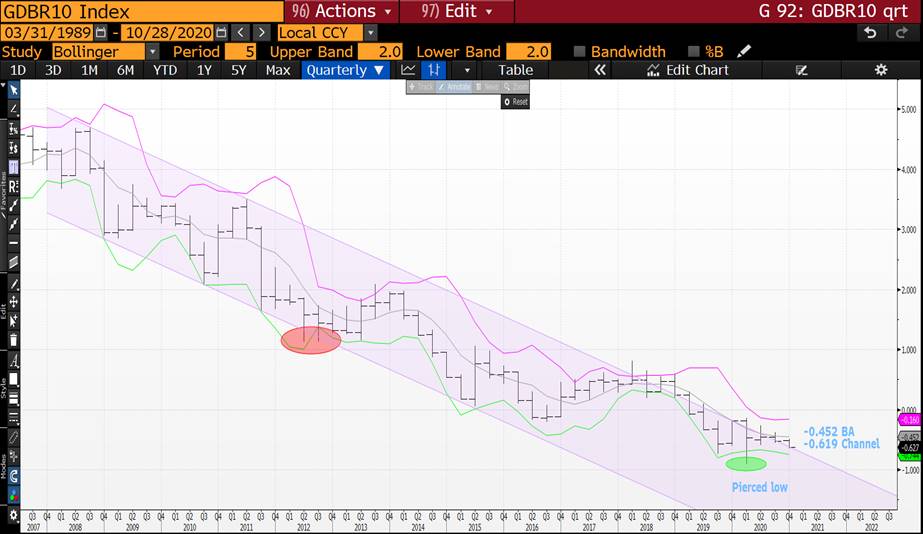

GERMAN MONTHLY YIELDS CONTINUE TO TEASE THE LONGTERM DOWNTREND CHANNEL.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trade Radar - week of 2nd - 6th November, James & Will @ Astor Ridge

As of this morning…

Here's a few things that we're looking at currently

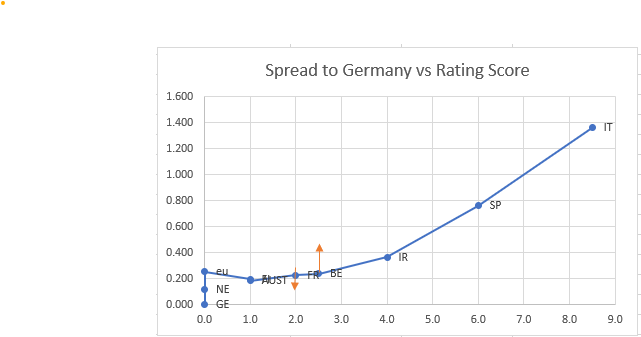

Generally tough time for RV – not a lot leaping out at us and seems a bit of de-risking going on in positioning. Btps and credit in general on the extreme tight vs core but the ECB sending more signals in the vein of 'do whatever it takes'

Fades & Trades

Our fades revolve around the structural components of each market that tend to persist but have the good fortune to be close to extremes – that said, trades are mostly 'on our radar' rather than at executable levels at this point but we wanted to let you know what we were thinking of

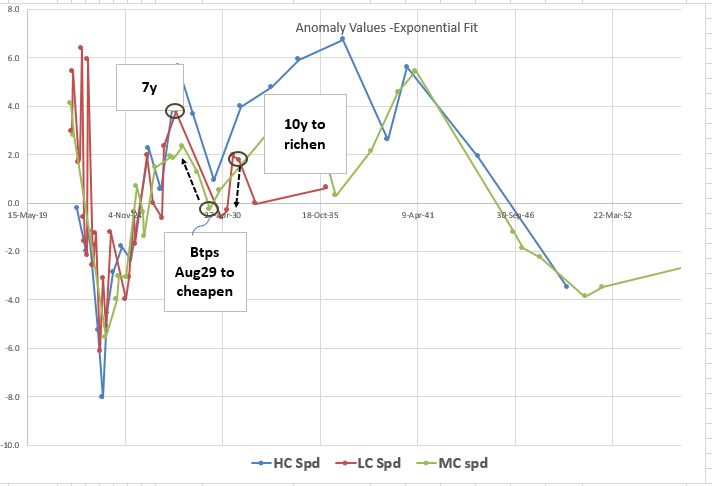

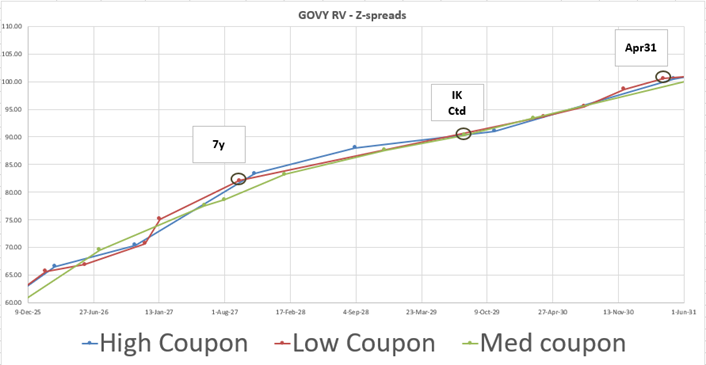

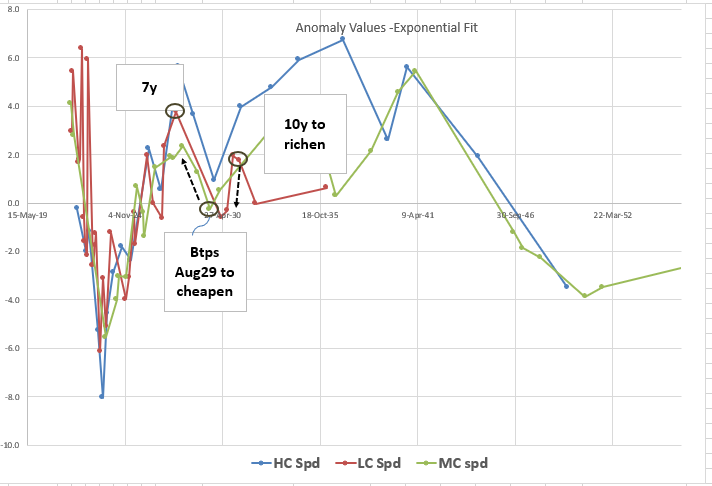

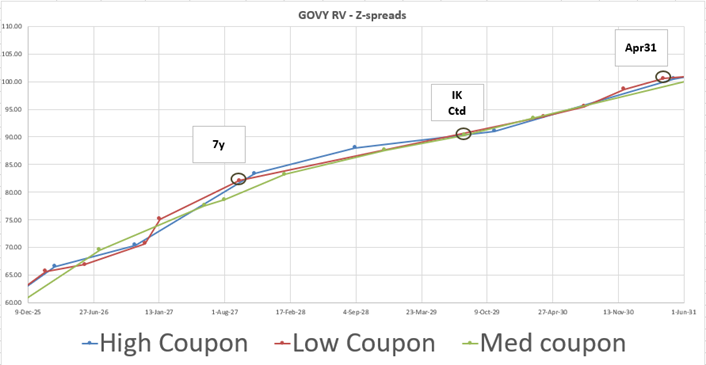

Italy: +7y -ik +10y

- The CTD, Btps Aug29 drops out of the basket in early December and surfs into the cheap 8y zone. The 10y has a low coupon that could fare well in a flattening sell-off

Levels

Curr: -1.4bp

Range: -5.5bp / -1bp

Target: +5bp

Graph of anomalies..

Graph of Z-Spreads

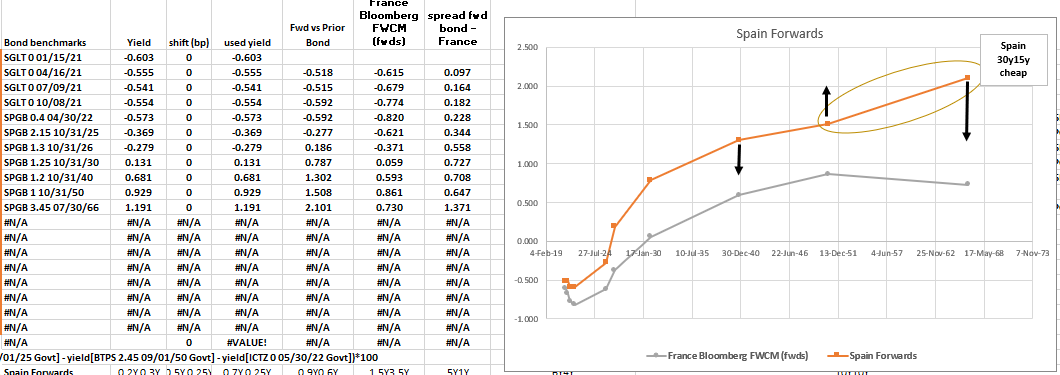

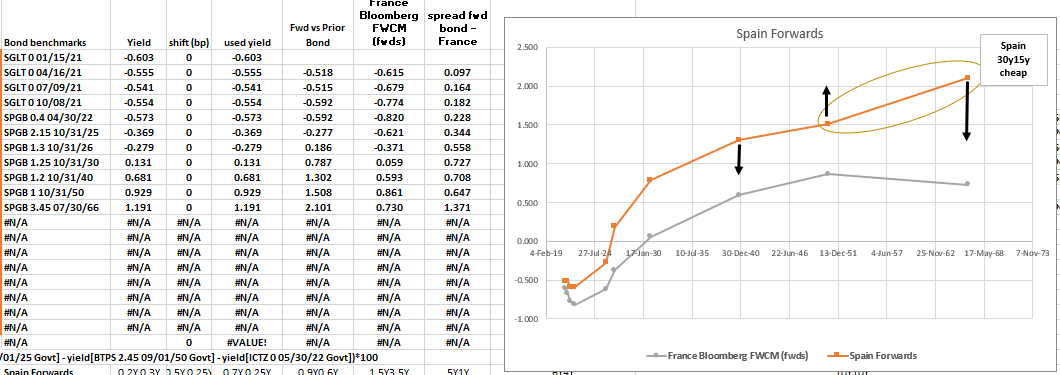

Spain: +20y -30y +50

- The on the run 20y in Spain remain cheap to the curve fit and too flat vs the 30y, recently the 30s x 50s curve has steepened as Spain 50y has cheapened after supply

Graph of Forwards

Cix: (2 * YIELD[SPGB 1 10/31/50 Corp] - YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1.2 10/31/40 Corp]) * 100

Levels:

Curr: -1.3bp

Enter: -1bp

Add: -3bp

Target: +3bp short term, Long term +6bp

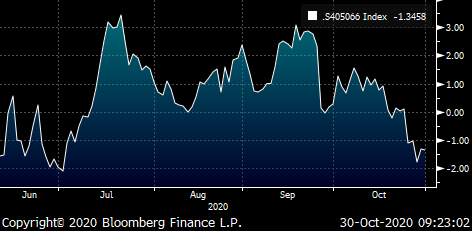

Graph of Cix

- The market has struggled to absorb supply in the recently tapped 50y and we see a similar disconnect, but less pointed in Italy too. Although long term value suggests the fly should be > +5bp a move back to the top end of the range makes sense after the street clears its overhang in 66s

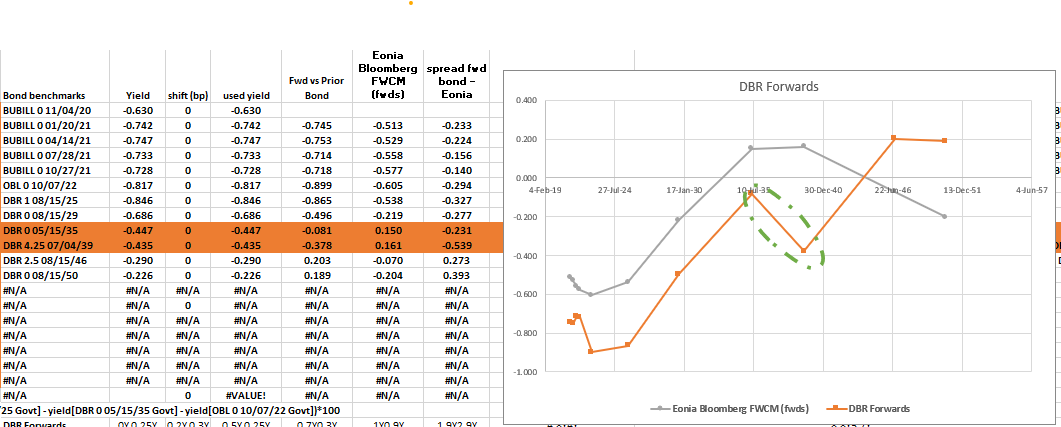

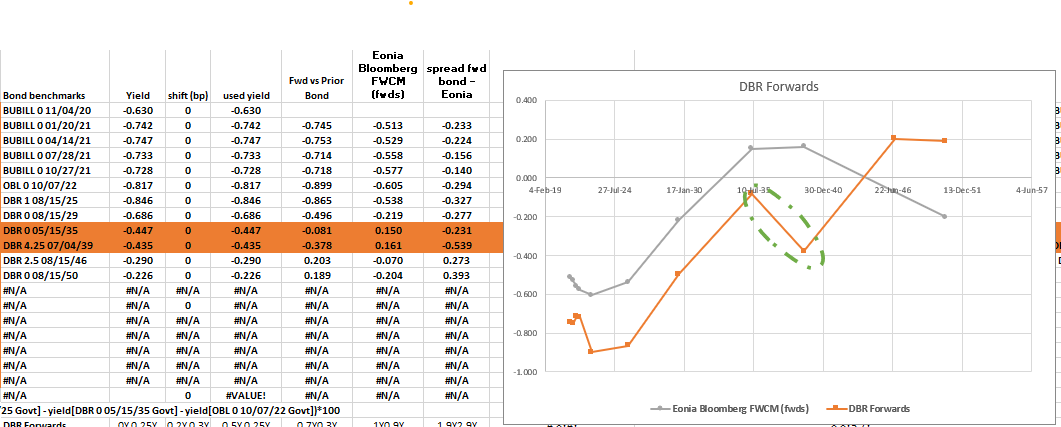

Germany : Steepener +35s -39s

Vs 15% -rx / +ub

Amazingly, with lower yields the High coupon 20yrs are no longer positive carry to low coupons – that's a function of the simple yield vs the repo rate being inverted

We're through the prices at which QE has bought the 39s and I struggle to see how they can continue to buy that segment

No more scheduled supply in 35s this year and a tap in the 30y (which gives us sympathy with the hedge) on November 11th

CIX: 100*((yield[DBR 4.25 07/04/39 Govt]-yield[DBR 0 05/15/35 Govt])-0.15*(yield[DBR 2.5 08/15/46 Govt]-yield[DBR 0 08/15/29 Govt]))

Levels

Curr: -4.8bp

Enter: -4.75bp, -6.5bp

Range: -5.5bp, -0.4bp

Target: -0.5bp

Forwards…

BBG history

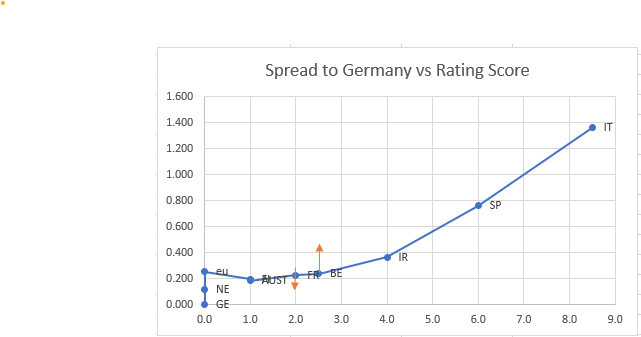

Short Belgium / Long France & Spain on Credit Spread

Moodys now rates Belgium Aa3 but France Aa2

As such, the rising tide of credit contraction has lifted all boats and Belgium and Ireland look tight to France

Using our proprietary Credit Score (amalgamating Ratings) this is how we see the Euro Issuers Spread vs Germany

Belgium looks tight to France in the context of rising spreads for diminishing credit quality

|

Actual Bond des |

Yield |

Yield spread to Germany |

Rating spread to Germany |

|

YLD_CNV_MID |

YLD_CNV_MID |

||

|

DBR 0 08/15/30 |

-0.630 |

0.000 |

0.0 |

|

NETHER 0 07/15/30 |

-0.515 |

0.114 |

0.0 |

|

EU000A283859 Govt |

-0.375 |

0.254 |

0.0 |

|

RFGB 0 09/15/30 |

-0.435 |

0.195 |

1.0 |

|

RAGB 0 02/20/30 |

-0.445 |

0.184 |

1.0 |

|

FRTR 2.5 05/25/30 |

-0.404 |

0.226 |

2.0 |

|

BGB 0.1 06/22/30 |

-0.391 |

0.239 |

2.5 |

|

IRISH 0.2 10/18/30 |

-0.266 |

0.364 |

4.0 |

|

SPGB 1.25 10/31/30 |

0.133 |

0.762 |

6.0 |

|

BTPS 1.65 12/01/30 |

0.706 |

1.336 |

8.5 |

Short Belgium, Long 87.5% France, Long 12.5% Spain

Levels

Curr: -5.4bp

Enter: -6.5bp

Looking for 1bp richer in Belgium…

Credit Notch Weighted

Cix: yield[BGB 0.1 06/22/30 Govt]-0.875*yield[FRTR 2.5 05/25/30 Govt]-0.125*yield[SPGB 1.25 10/31/30 Govt]

Graph..

Any thought or feedback please let us know

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

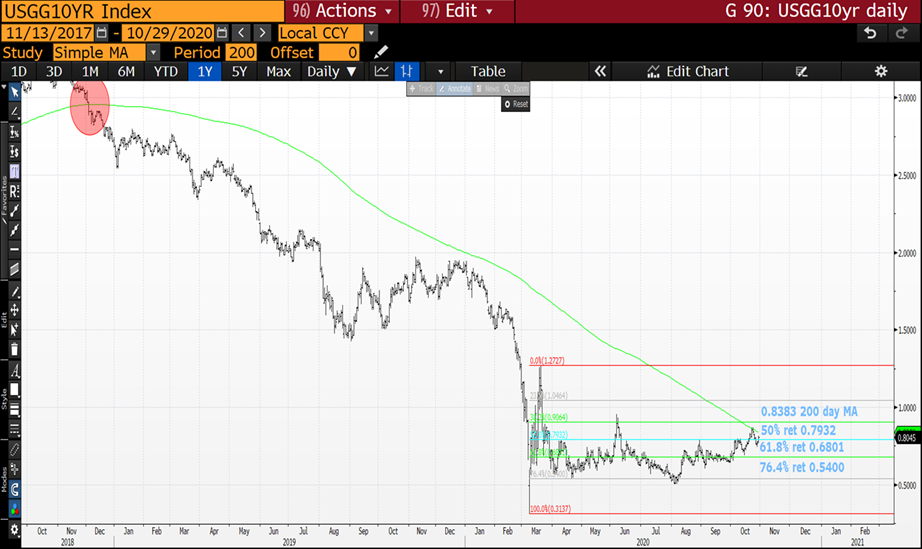

BONDS YIELDS : US YIELDS COULD PUSH HIGHER INTO MONTH END ESPECIALLY IF THE 10YR BREACHES ITS 200 DAY MOVING AVERAGE 0.8336!

BONDS YIELDS : US YIELDS COULD PUSH HIGHER INTO MONTH END ESPECIALLY IF THE 10YR BREACHES ITS 200 DAY MOVING AVERAGE 0.8336!

IF SO THIS WILL BE A STRONG YIELD PERFORMANCE CHARTWISE AND A FUTHER CONFIRMATION OF MUCH HIGHER YIELDS.

US 30YRS REMAIN ABOVE THEIR 200 DAY MOVING AVERAGE 1.4992.

ALL US MONTHLY AND QUARTERLY RSI DISLOCATIONS CONTINUE TO FORECAST MUCH HIGHER YIELDS.

OPEN INTEREST AND VOLUME HAS SEEN A MAJOR DROP IN LONG HOLDINGS FROM MARCH, THE RESULT IS YIELDS COULD RALLY HARD OVER THE NEXT FEW MONTHS, CONFIRMING THE LONGSTANDING QUARERTLY-MONTHLY CALL.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

GERMAN MONTHLY YIELDS CONTINUE TO HOLD THE LONGTERM DOWNTREND CHANNEL.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

STOCKS : A CRUCIAL JUNCTURE HERE GIVEN WE HAVE SOME OVERSOLD DAILY RSI’S AND THE DOW IS TESTING ITS 200 DAY MOVING AVERAGE 26214.48.

STOCKS : A CRUCIAL JUNCTURE HERE GIVEN WE HAVE SOME OVERSOLD DAILY RSI’S AND THE DOW IS TESTING ITS 200 DAY MOVING AVERAGE 26214.48.

EUROPEAN EQUITIES HAVE LOW RSI’S BUT NOT AS DRAMATIC AS THE MARCH DISLOCATION.

THE NASDAQ AND RUSSELL ARE BOTH NOW BELOW THEIR RESPECTIVE 50 DAY MOVING AVERAGES.

I DO BELIEVE WE WILL ONLY SEE THE REAL ECONOMIC IMPACT NEXT YEAR.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trade Radar - week of 2nd - 6th November, James & Will @ Astor Ridge

Here's a few things that we're looking at currently

Generally tough time for RV – not a lot leaping out at us and seems a bit of de-risking going on in positioning. Btps and credit in general on the extreme tight vs core but the ECB sending more signals in the vein of 'do whatever it takes'

Fades & Trades

Our fades revolve around the structural components of each market that tend to persist but have the good fortune to be close to extremes – that said, trades are mostly 'on our radar' rather than at executable levels at this point but we wanted to let you know what we were thinking of

Italy: +7y -ik +10y

- The CTD, Btps Aug29 drops out of the basket in early December and surfs into the cheap 8y zone. The 10y has a low coupon that could fare well in a flattening sell-off

Levels

Curr: -1.4bp

Range: -5.5bp / -1bp

Target: +5bp

Graph of anomalies..

Graph of Z-Spreads

Spain: +20y -30y +50

- The on the run 20y in Spain remain cheap to the curve fit and too flat vs the 30y, recently the 30s x 50s curve has steepened as Spain 50y has cheapened after supply

Graph of Forwards

Cix: (2 * YIELD[SPGB 1 10/31/50 Corp] - YIELD[SPGB 3.45 07/30/66 Corp] - YIELD[SPGB 1.2 10/31/40 Corp]) * 100

Levels:

Curr: -1.3bp

Enter: -1bp

Add: -3bp

Target: +3bp short term, Long term +6bp

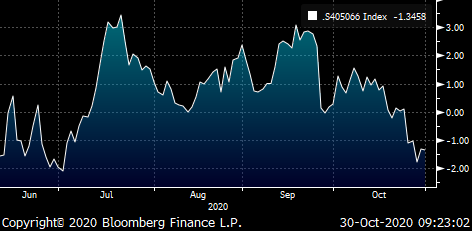

Graph of Cix

- The market has struggled to absorb supply in the recently tapped 50y and we see a similar disconnect, but less pointed in Italy too. Although long term value suggests the fly should be > +5bp a move back to the top end of the range makes sense after the street clears its overhang in 66s

Germany : Steepener +35s -39s

Vs 15% -rx / +ub

Amazingly, with lower yields the High coupon 20yrs are no longer positive carry to low coupons – that's a function of the simple yield vs the repo rate being inverted

We're through the prices at which QE has bought the 39s and I struggle to see how they can continue to buy that segment

No more scheduled supply in 35s this year and a tap in the 30y (which gives us sympathy with the hedge) on November 11th

CIX: 100*((yield[DBR 4.25 07/04/39 Govt]-yield[DBR 0 05/15/35 Govt])-0.15*(yield[DBR 2.5 08/15/46 Govt]-yield[DBR 0 08/15/29 Govt]))

Levels

Curr: -4.8bp

Enter: -4.75bp, -6.5bp

Range: -5.5bp, -0.4bp

Target: -0.5bp

Forwards…

BBG history

Short Belgium / Long France & Spain on Credit Spread

Moodys now rates Belgium Aa3 but France Aa2

As such, the rising tide of credit contraction has lifted all boats and Belgium and Ireland look tight to France

Using our proprietary Credit Score (amalgamating Ratings) this is how we see the Euro Issuers Spread vs Germany

Belgium looks tight to France in the context of rising spreads for diminishing credit quality

|

Actual Bond des |

Yield |

Yield spread to Germany |

Rating spread to Germany |

|

YLD_CNV_MID |

YLD_CNV_MID |

||

|

DBR 0 08/15/30 |

-0.630 |

0.000 |

0.0 |

|

NETHER 0 07/15/30 |

-0.515 |

0.114 |

0.0 |

|

EU000A283859 Govt |

-0.375 |

0.254 |

0.0 |

|

RFGB 0 09/15/30 |

-0.435 |

0.195 |

1.0 |

|

RAGB 0 02/20/30 |

-0.445 |

0.184 |

1.0 |

|

FRTR 2.5 05/25/30 |

-0.404 |

0.226 |

2.0 |

|

BGB 0.1 06/22/30 |

-0.391 |

0.239 |

2.5 |

|

IRISH 0.2 10/18/30 |

-0.266 |

0.364 |

4.0 |

|

SPGB 1.25 10/31/30 |

0.133 |

0.762 |

6.0 |

|

BTPS 1.65 12/01/30 |

0.706 |

1.336 |

8.5 |

Short Belgium, Long 87.5% France, Long 12.5% Spain

Levels

Curr: -5.4bp

Enter: -6.5bp

Looking for 1bp richer in Belgium…

Credit Notch Weighted

Cix: yield[BGB 0.1 06/22/30 Govt]-0.875*yield[FRTR 2.5 05/25/30 Govt]-0.125*yield[SPGB 1.25 10/31/30 Govt]

Graph..

Any thought or feedback please let us know

James & Will

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 60 Rumson rd, rumson, nj 07760

Office: +44 (0) 203 -143 - 4178

Mobile: +44 (0) 7540-117705

Email: james.rice@astorridge.com

Website: www.astorridge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BONDS YIELDS : HOPEFULLY YIELDS MOVE HIGHER INTO MONTH END GIVEN 30YRS ARE ABOVE THEIR 200 DAY MOVING AVERAGE AND 10YRS ABOUT TO JOIN THEM.

BONDS YIELDS : HOPEFULLY YIELDS MOVE HIGHER INTO MONTH END GIVEN 30YRS ARE ABOVE THEIR 200 DAY MOVING AVERAGE AND 10YRS ABOUT TO JOIN THEM. IF SO THIS WILL BE A STRONG YIELD PERFORMANCE CHARTWISE AND A FUTHER CONFIRMATION OF MUCH HIGHER YIELDS.

US 10YR YIELDS FAILED TO BREACH ITS 200 DAY MOVING AVERAGE 0.8383 FIRST TIME UP BUT SHOULD ON THE SECOND ATTEMPT.

OPEN INTEREST AND VOLUME HAS SEEN A MAJOR DROP IN LONG HOLDINGS FROM MARCH, THE RESULT IS YIELDS COULD RALLY HARD OVER THE NEXT FEW MONTHS, CONFIRMING THE LONGSTANDING QUARERTLY-MONTHLY CALL.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

GERMAN MONTHLY YIELDS CONTINUE TO HOLD THE LONGTERM DOWNTREND CHANNEL.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BONDS YIELDS : YILEDS SHOULD START TO HEAD HIGHER AGAIN GIVEN THE 30YR IS POISED TO HIT ITS 200 DAY MOVING AVERAGE SUPPORT AT 1.5057.

BONDS YIELDS : YILEDS SHOULD START TO HEAD HIGHER AGAIN GIVEN THE 30YR IS POISED TO HIT ITS 200 DAY MOVING AVERAGE SUPPORT AT 1.5057.

US 10YR YIELDS FAILED TO BREACH ITS 200 DAY MOVING AVERAGE 0.8433 FIRST TIME UP BUT SHOULD ON THE SECOND ATTEMPT.

OPEN INTEREST AND VOLUME HAS SEEN A MAJOR DROP IN LONG HOLDINGS FROM MARCH, THE RESULT IS YIELDS COULD RALLY HARD OVER THE NEXT FEW MONTHS, CONFIRMING THE LONGSTANDING QUARERTLY-MONTHLY CALL.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

GERMAN MONTHLY YIELDS CONTINUE TO HOLD THE LONGTERM DOWNTREND CHANNEL.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris