US BREAKEVENS AND USGGT : BREAKEVENS ARE FINALLY ON THE MOVE AND BY THE END OF THE WEEK SHOULD CONFIRM THEIR LONGTERM TOP.

US BREAKEVENS AND USGGT : BREAKEVENS ARE FINALLY ON THE MOVE AND BY THE END OF THE WEEK SHOULD CONFIRM THEIR LONGTERM TOP.

30YR BREAKEVENS WEEKLY AND DAILY RSI'S ARE NOW HEADING LOWER.

10YR BREAKEVENS ARE TESTING THEIR 50 DAY MOVING AVERAGE 1.6894.

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI'S LOOK HISTORICALLY LOFTY.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

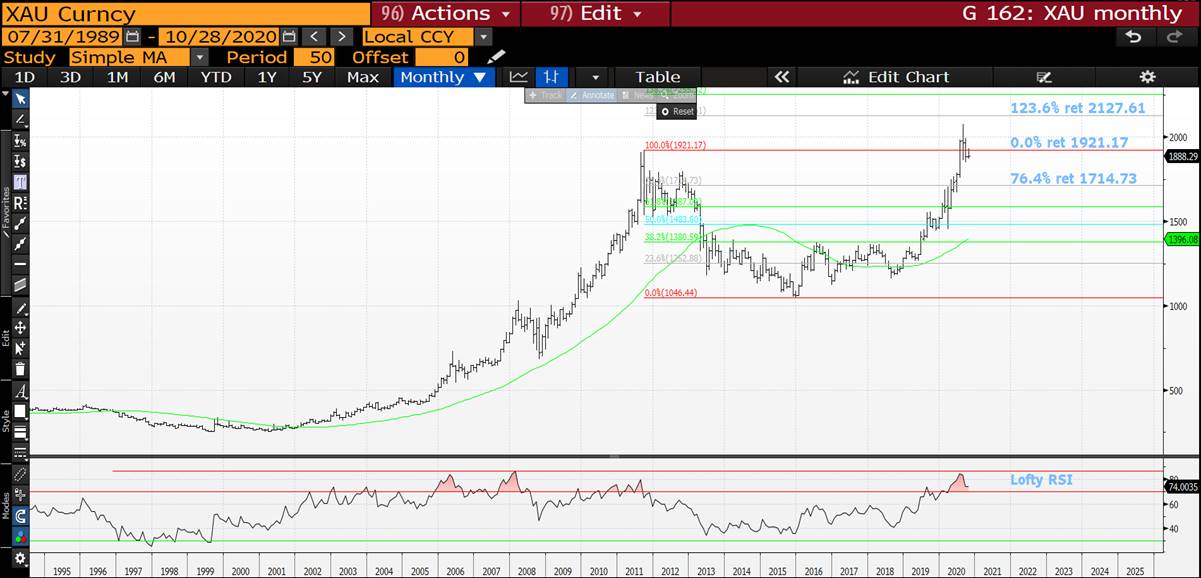

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: GILTS > ADIOS 0R30s! Auction Preview...

GILTS > Adios 0R30s!

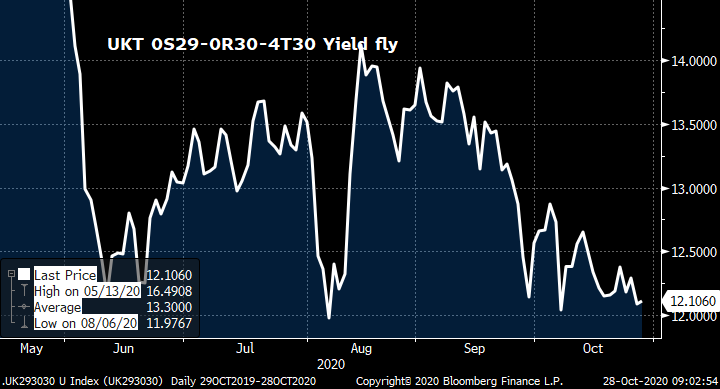

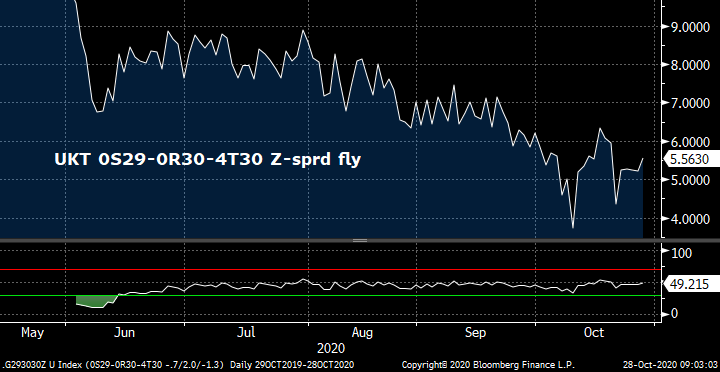

> LAST TAP of the 0R30s before the new UKT 7/31s arrive on Nov 12th.

> As noted earlier this week, this issue is well on its way to normalizing on the curve.

Take a look at the charts below of UKT 29-30-30 yield and Z-sprd flies. The yield fly has been capped at the +12bps level since the syndication (with 0S29-0R30 yield sprd about the same at the 1F28-0S29 sprd). The Z-sprd fly has stalled in the +5bps zone after a solid performance.

> Dealers report that this 0R30s issue is the second most widely held gilts issue by private investors. Not sure where they get those #s but it's not surprising. It does, however, suggest to me that there's going to be a big coterie of investors who will be keen to see where the UKT 7/31s open on the curve with an eye on rolling longer, especially if the tone of the mkt remains bullish.

> In the meantime, we expect this 10am tap to go fine, especially given the stats of each previous tap. That said, we're not buying into the 'they're done tapping it, let's get long' narrative here.

UKT 1H26-0R30-4H34 Fly vs 0R30 yields

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

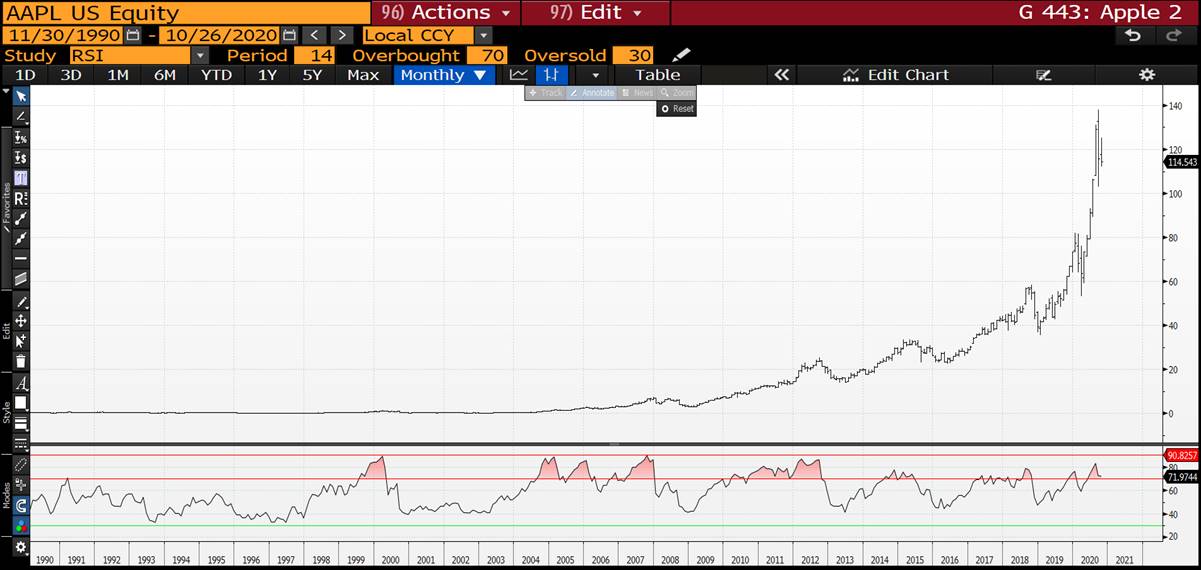

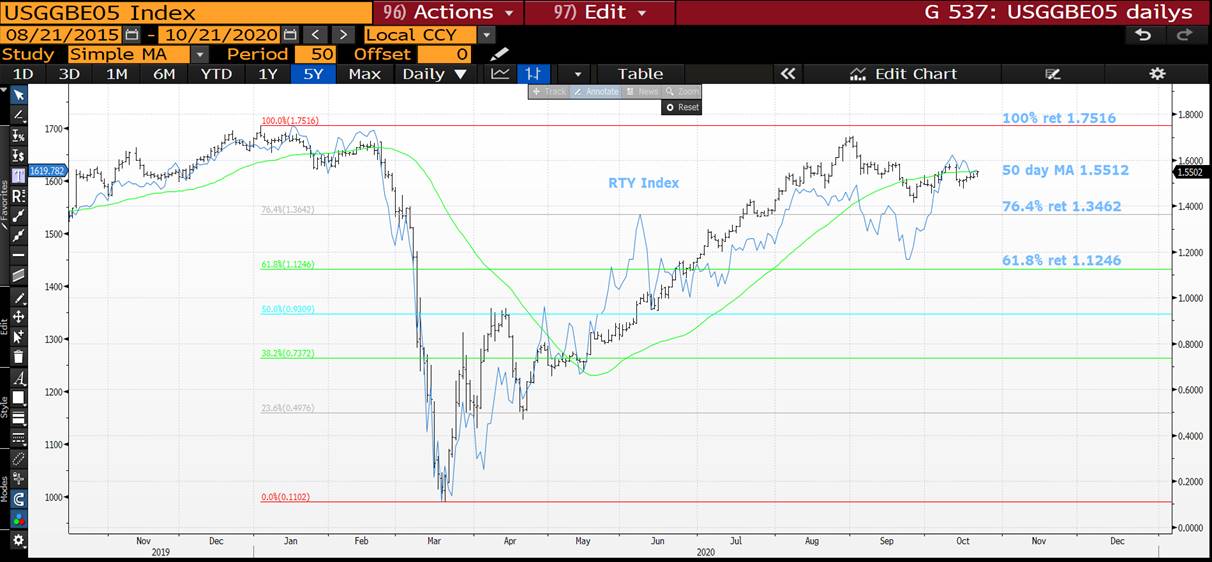

**PLEASE READ ** STOCKS : ARE STOCKS ABOUT TO MAKE A MAJOR STATEMENT-TOP, ITS LOOKING VERY LIKELY!

STOCKS : ARE STOCKS ABOUT TO MAKE A MAJOR STATEMENT-TOP, ITS LOOKING VERY LIKELY! WE HAVE FAILED TO BREACH LAST MONTHS HIGH ON MANY COUNTS WITH RSI'S AT HISTORICAL DISLOCATIONS.

THE DOW WEEKLY HAS TOPPED OUT, FAILING TO BREACH THE EARLY SEPTEMBER HIGH OF 29199.35.

THE EUROPEAN RECOVERY HAS BEEN NOTHING LIKE THE USA, MAYBE TIME FOR THE USA TO FOLLOW EUROPE LOWER.

IF STOCKS FAIL THEN THIS WILL SUPPORT THE LONGTERM OF US BREAKEVENS HEADING LOWER.

MANY US SINGLE STOCKS HAVE AN INCOMPREHENSIBLE INCLINE THAT NEEDS SOME SORT OF RETRACEMENT.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

US BREAKEVENS AND USGGT : BREAKEVENS MAY JUST BE STALLING GIVEN WE ARE HITTING MAJOR RETRACEMENT RESISTANCE AND THE RSI’S ARE STRETCHED.

US BREAKEVENS AND USGGT : BREAKEVENS MAY JUST BE STALLING GIVEN WE ARE HITTING MAJOR RETRACEMENT RESISTANCE AND THE RSI’S ARE STRETCHED.

30YR BREAKEVENS WEEKLY AND DAILY RSI’S ARE VERY DISLOCATED NOW.

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI’S LOOK HISTORICALLY LOFTY.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: GILTS > Quick Rundown - Today's APF and this Week's Supply

GILTS... Quick Kickstart

> Bull flattening in line with the rest of the G-7 this am has taken back some of the bear-steepening into the end of last week. G Z0's range remains well entrenched, reinforcing the RV bias to play these extremes.

> 3-7yr APF... 0E26s return today which adds to the 124s, 0F25s and 1Q27s. This will be the only op before the 0E26s drop out again for 2 weeks so expect them to feature prominently, especially given how well they've performed.

> £3.25bn UKT 0E24 tap @ 10am tomorrow will take them above the £4bn APF threshold but they won't be on the list until Nov 9th. We're still seeing interest to sell 124s into 0E24s around the +5bps area...

> £1bn tap of the mercurial 1F71s tomorrow at 11:30am is seen as smaller than expected and a far cry from replenishing the float the APF now owns. As such, there's been little concession on the curve with 2H65-1F71 still -9bps. The issue has cheapened almost 10bps in the last few sessions in yield and has been stable vs SONIA so drumming up demand shouldn't be a problem.

> Wednesday's final tap of the 0R30s in £2.5bn takes them to ~£37bn-ish post PAOF. The 0R30-4T30 yield sprd has hovered around 3.75-4.0bps in Oct but the 0R30s have outperformed on Z-sprd, now 1.5bps. As noted last Friday, the market's long these 0R30s and could get impatient, especially since the new 31s are coming on Nov 12th and will be cheap...

More to come...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BONDS YIELDS : A VERY BIG WEEK FOR THE YIELD HIGHER CALL, ENDORSED BY A BREACH OF 200 DAY MOVING AVERAGES.

BONDS YIELDS : A VERY BIG WEEK FOR THE YIELD HIGHER CALL, ENDORSED BY A BREACH OF 200 DAY MOVING AVERAGES.

US 10YR YIELDS HAVE BREACHED THEIR 200 DAY MOVING AVERAGE FOR THE FIRST TIME SINCE DECEMBER 2018.

OPEN INTEREST AND VOLUME HAS SEEN A MAJOR DROP IN LONG HOLDINGS FROM MARCH, THE RESULT IS YIELDS COULD RALLY HARD OVER THE NEXT FEW MONTHS, CONFIRMING THE LONGSTANDING QUARERTLY-MONTHLY CALL.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

GERMAN MONTHLY YIELDS CONTINUE TO HOLD THE LONGTERM DOWNTREND CHANNEL AND BOUNCE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: CHARTS > Bearish Momentum Building in Rates - Techs at Key Levels

- "Nobody said it would be easy".

- This oft-used quote applies to the markets these days, especially in G-10 rates.

- To the dismay of health officials the world over, Covid-19 has had a nasty resurgence that has many countries poised for more restrictions and lockdowns which is already creeping back into economic data across much of Europe. Fiscal and monetary support has been pledged but we're seeing its limitations.

- So, if things are still bleak, why have yields been rising and curves steepening of late, especially in the US and UK? Lets take a look:

- Little happened at last night's final Biden-Trump debate to make a dent in Biden's considerable lead in the polls. Barring a pre-vote shock, a Biden/Democrats victory should be unassailable, leaving little room for Trump's post-election theatrics. This would remove a major source of market stress and 'flight to quality' demand for USTs. A Biden victory is widely expected to result in more borrowing, bigger deficits and yet more USTs issuance.

- Brexit still isn't a done-deal but noises out of London/Brussels are positive. Cable has surged higher in response.

- Gilead's Remdesivir has been granted FDA approval as a C-19 treatment and vaccine trials are gathering pace with some calling for a Q1 2021 breakthrough.

- Credit ratings agencies are active, reviewing both sovereign and corporate issuers ratings in light of the impact of C-19 on debt levels and economic growth prospects. S&P is expected to cut Italy to BBB- (in line with Moody's and DBRS) while Greece and Netherlands will also be updated. With credit spreads within EGBs still at record levels, strategists are now saying risks are asymmetric towards widening vs Germany.

- With ample fodder for both a bullish and bearish outlook, technical analysis becomes a vital cog in our strategy wheel, especially in light of the 'crossroads' we've arrived at below.

UST 10yr yields – 2yr history – daily. We can see that we are back to levels in the 14 day RSIs that have proven to be a buy-zone on tactical, short-term moves. The 2yr grind richer in the 200 day MA has finally crossed with current market levels which provides a key 'cross road' for the market. A bounce off this level keeps the broader bullish tone alive, a clean break above it will make the bulls antsy.

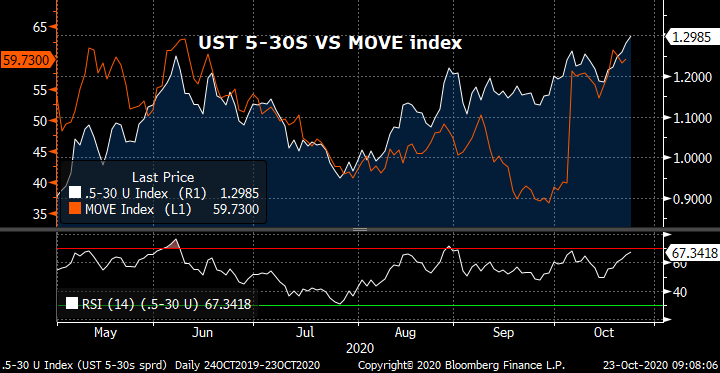

With the FED promising to keep the funds rate target unched until the US economy is back to normal, rising rates must mean a steeper curve. It also means higher implied vol levels (as per chart below).

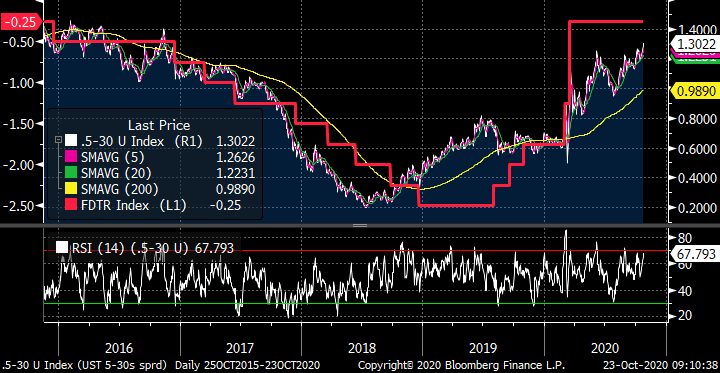

UST 5-30s vs inverted Fed funds target (upper bound) suggests this move could continue before it's 'mispriced' vs historical correlations. That said, momentum indicators above show that on a short-medium term basis the curve is very steep and due for a pause.

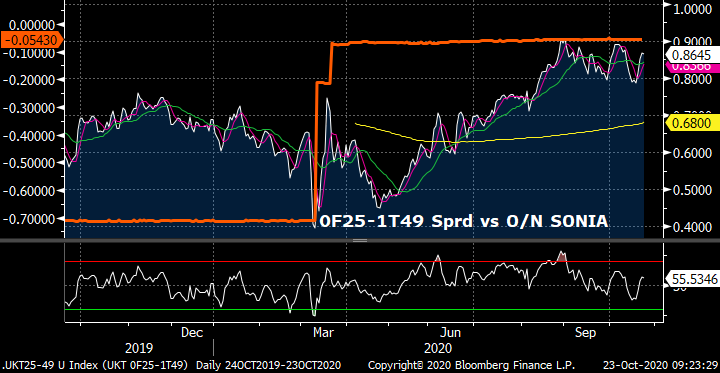

UKT 0F25-1T49 curve is also within a few basis points of it's post-lockdown peak of +90bps. We can see that the curve is showing a similar inverse correlation this year. The current 90bps ceiling has held since mid-August amidst gyrations in Cable (mostly Brexit-driven), economic data and UK borrowing needs/gilts supply. An extension of QE without a commensurate move to negative base rates would likely solidify this 90bps level further. It also suggests to us that on a medium-term basis we'll need a Brexit solution to drive a further steepening, likely reflecting higher long yields.

UKT 4T30 Yields (G Z0) vs Cable… For the second-half of 2019 and the start of 2020 GBP/USD and 4T30s yields were simpatico, tracking each other pretty well. The BoE's cut of the base rate and accelerated pace of QE put an abrupt end to that, leaving G Z0 to chop around in a very narrow 5bps range for most of the Mar-Oct period. With Covid still active, QE likely to be extended (consensus now seems +£75bn for Jan-Mar) and the BoE likely to keep rates unched (at worst), this 5bps range is only in jeopardy if a Brexit deal happens and/or a vaccine is announced. We've been trading this range actively in various directional flies and curve trades.

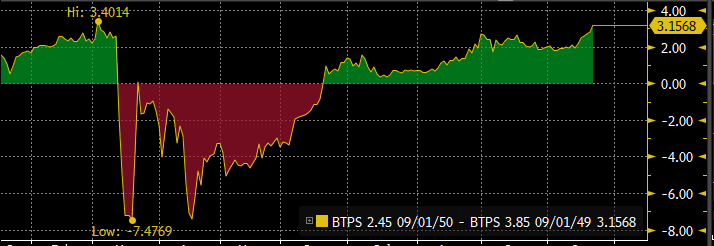

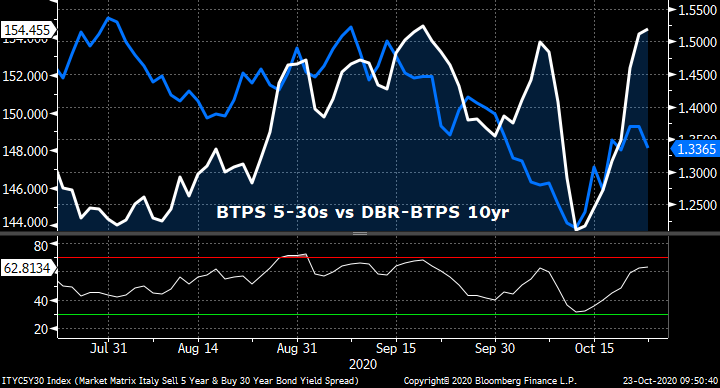

BTPS have been on a mission since spreads exploded wider in April. The correlation with credit indexes was strong until mid-July when 10yr DBR yields bottomed-out and BTPS kept richening. We are seeing some faint signs that BTPS are leaking cheaper, grinding back in line with ITRX. The path of Covid, the size of the expected ECB PEPP extension in Dec (consensus currently Eur 500bn) and Italy's credit outlook will each play a part here. Broader market influences like implied vol levels and sister markets like stocks also weigh-in. Either way, consensus is becoming broader that the BTPS-DBRs spread outlook is asymmetric from here.

The BTPS curve slammed flatter with the snap tighter vs DBRs. This came unglued with the announcement of the new 30yr deal ahead of today's S&P review- steepening 5-30s back to the wides. One of these is going to be right – either the curve is too steep or spreads are too tight.

More to come soon… Feedback ALWAYS welcome…

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

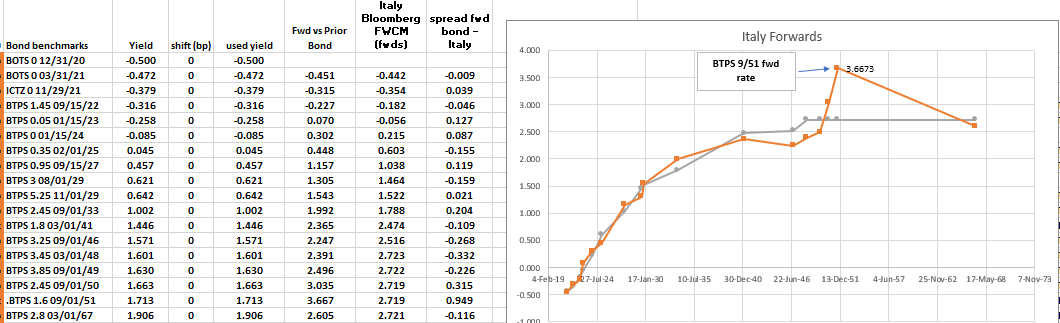

New Italy 30y

Italy announces new 30y

Syndication Btp Sep/51

Initial Price Talk BTP 09/50 +10bps area ***

Buy Btps 51s vs Btps 50 and/or Btps 49

Levels:

IPT: Btps Sep50 +10bp

Enter: +5bp (50% risk)

Add: +7.5bp, +10bp (25% risk)

Target: +3bp

Carry

Estimated -0.2bp /3mo @ repo spread of -10bp, estimated 1.75% coupon on the new issue

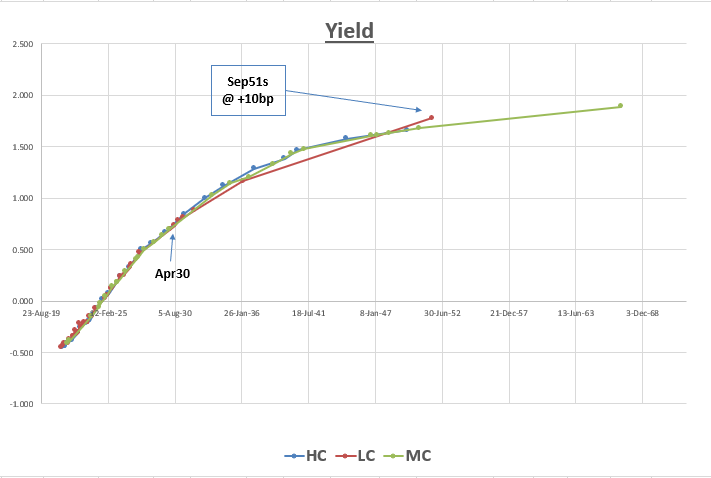

Graph 1 - Yield Curve plus sep51s…

The bond looks set to have a LOW COUPON AS WE'RE ARE AT THE LOW END OF THE RANGE OF Btp yields..

As such as a low coupon, coming at 'fair' or 'cheap' to the curve – this has tremendous scope to richen

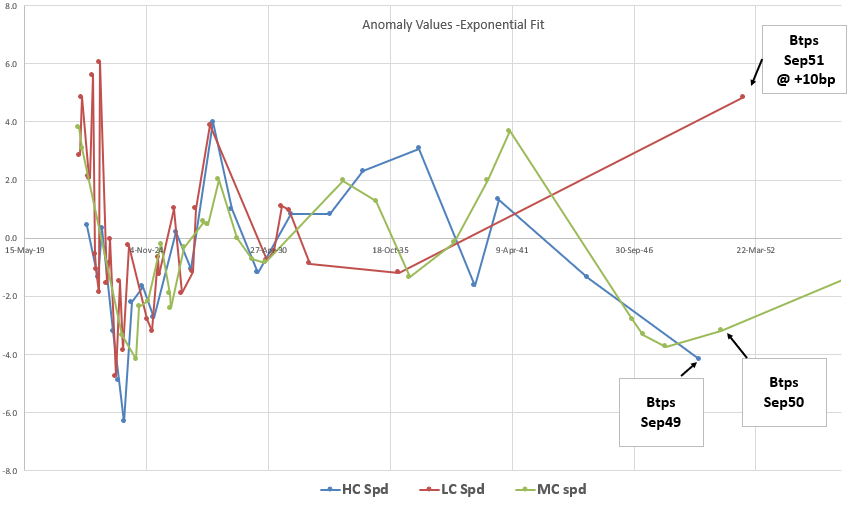

Graph 2 - Anomaly Values for High, Low and Medium Coupons

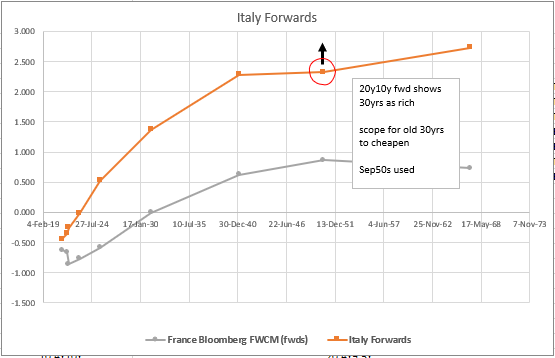

If we look at 30ys on the forward curve in the context of 20y and 50y – the 30y is a rich point – so we want to sell local issues that should underperform

Rationale

- If we look at Italian bonds with low coupons , with the exception of 7yrs, they trade much closer to the 'zero' anomaly value to the fitted curve

- The time value of the credit risk option in Italy is at its greatest for long bonds – hence the premium for low coupons vs High should be at its greatest there

- 30yrs are rich on forwards vs 20y and 50y, hence we want to own this new bond vs local higher coupon 30yrs (see Graph3)

- Italy ratings due on Friday – consolidation into Low Coupons makes sense at fair value on a cash flow valuation

Graph 3 – Italy Forwards

Risks

- The tap bond Sep51 stays offered – during further issuance

- The two outstanding long bonds (49s and 50s) hold their value

- The carry doesn't not allow the trade to be held – carry estimates coming tomorrow with final coupon

Any thoughts or feedback let me know

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

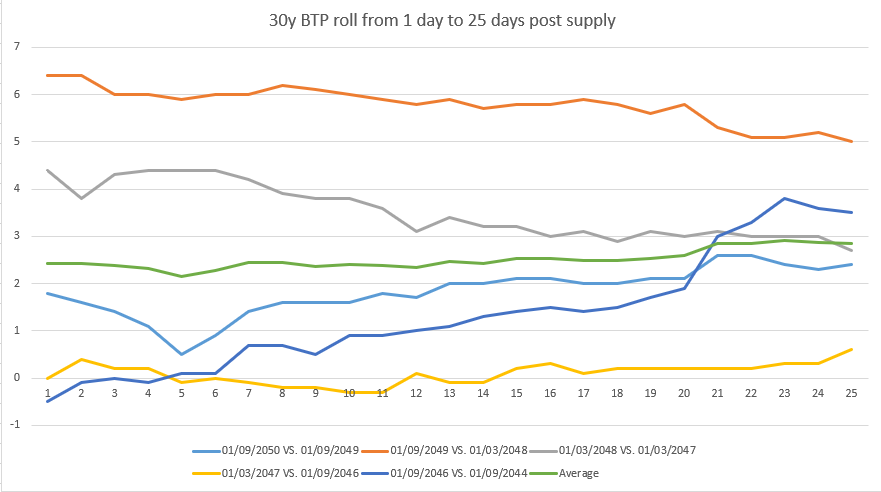

FW: New Italy 30y Sep-51 - Food for thought

- Italy to launch new Sep-2051 via outright and also via debt swaps. Sizes for the switch and outright are as yet TBD.

- Bonds to be bought back are:

- BTP 3.75% - 08/01/2021 (ISIN code IT0004009673)

- BTP 4.0% - 05/01/2023 (ISIN code IT0004898034)

- BTP 4.75% - 08/01/2023 (ISIN code IT0004356843)

- BTP 2.45% - 10/01/2023 (ISIN code IT0005344335)

- CCTeu - 01/15/2025 (ISIN code IT0005359846)

- Note the prevalence of high coupon issues here

- 10/30 has been steepening all week which had been attributed to an overhang to an overhang of long end supply from last week, perhaps also exacerbated by yesterday's headlines out of the treasury:

*ITALY TO DO DEBT SWAPS, BUYBACKS TO INCREASE AVG MATURITY

Nevertheless the swiftness of the issuance seems to have come as a surprise to most.

- In absence of a further grab to yield or indeed a sustained risk off move it seems difficult to quantify how much value there is in the new bond as a 10/30 flattening trade unless we see a further backup in the curve, given the relative cheapness of the 20y sector

- Instead we see the micro forwards and therefore the rolls as offering the greatest value:

- Current 30y roll has cheapened from 1.9 -> 3.1 bpts, leaving the roll and the 1y gap at the steepest levels for some time:

- Assuming (and it is merely an assumption) that the new Sep-2051 prices at 5 bpts over the 2050 (i.e. 5 bpts on the new 30y roll) then we end up with a 1y fwd of 3.6%

- Whilst this is highly leveraged, it implies a reflattening of the current roll to 2 bpts and a fair value of the new roll of ~ 2 bpts

Implied forwards based on current roll at 3 bpts and new roll at 5 bpts:

Historical Performance post supply:

Tough to draw many conclusions here, but worth looking at. I think all we can say is that cheap issues rally and expensive issues have a habit of mean reverting back to average levels!

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US BREAKEVENS AND USGGT : BREAKEVENS CONTINUE TO GRIND HIGHER BUT BOTH WEEKLY AND DAILY RSI’S ARE LOFTY. WE SHOULD STALL SOON.

US BREAKEVENS AND USGGT : BREAKEVENS CONTINUE TO GRIND HIGHER BUT BOTH WEEKLY AND DAILY RSI’S ARE LOFTY. WE SHOULD STALL SOON.

5YR BREAKEVENS ARE TEASING THEIR ALL IMPORTANT 50 DAY MOVING AVERAGE.

I HAVE ADDED MONTHLY BREAKEVEN CHARTS GIVEN THEIR RSI’S LOOK HISTORICALLY LOFTY.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. A BIG STEP AS THE USGGT 10YR IS TEASING ITS

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

PREVIOUS LOW -0.9494. FINALLY WE ARE GRINDING HIGHER.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

GOLD HAS FAILED SOLID RESISTANCE, I.E. ITS PREVIOUS HIGH.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris