BONDS YIELDS : YIELDS HAVE PULLED BACK FROM LAST WEEKS OVER BOUGHT DAILY RSI, THE US 30YR IS TESTING 1.3729 BOLLINGER AVERAGE SUPPORT.

BONDS YIELDS : YIELDS HAVE PULLED BACK FROM LAST WEEKS OVER BOUGHT DAILY RSI, THE US 30YR IS TESTING 1.3729 BOLLINGER AVERAGE SUPPORT.

HOPEFULLY TOMORROWS NON-FARM WILL SET US BACK ON THE TREND FOR HIGHER YIELDS.

**I HAVE LEFT OUT THE VOLUME AND OPEN INTEREST CHARTS GIVEN THE ROLL PERIOD, THUS LESS CHARTS. **

DO TAKE A LOOK AT ALL MONTHLY CHARTS ENCLOSED TO UNDERSTAND THE YIELD LOWS ARE IN AND HOW MUCH HIGHER THEY COULD GO!

DBR 46 HAS POPPED BACK ABOVE ITS KEY 38.2% RET 165.087.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: GILTS Yields/Spreads - Which Economic #s Matter Most?

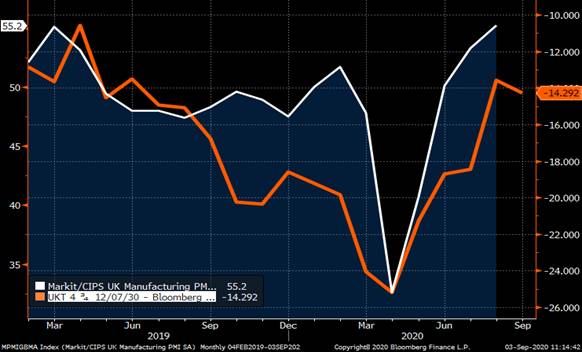

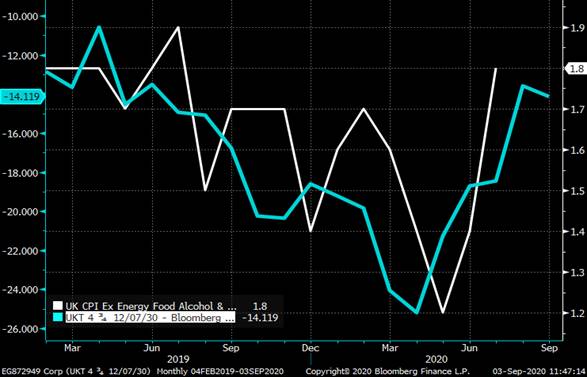

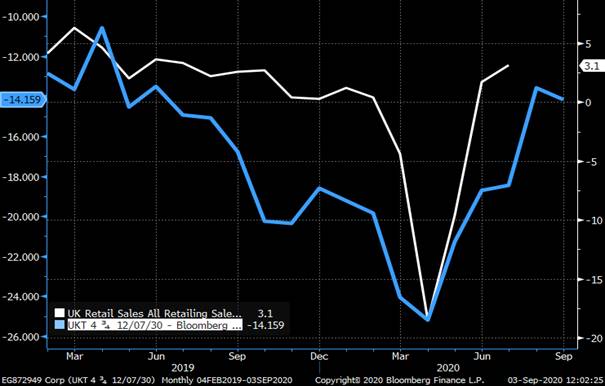

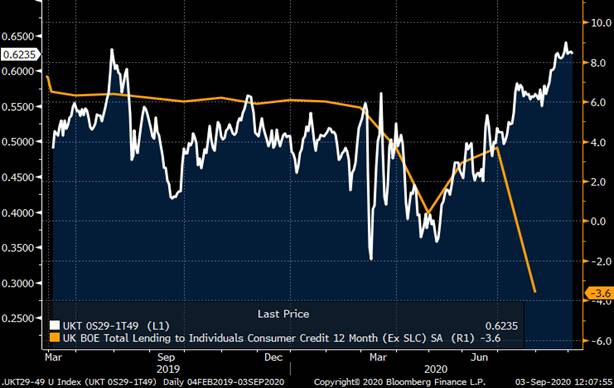

- Back from summer holidays and time to roll up our sleeves and devise a game plan. With Covid-19 still very much in the news (sadly) and countries across the globe dealing with varying levels of infections, we thought it would be useful to nail down which economic indicators have been most useful in helping to forecast the path of rates and/or the curve. With a dizzying number of indicators to choose from across the G-7 from and markets to apply them to, we thought we'd keep it simple and focus on the UK. We've chosen the UKT 0S29-UKT 1T49 yield curve and the UKT 4T30 Z-sprd and then set out on our wild goose chase to find good matches back to Feb 2019. The charts below are the indicators that matched best.

- While there are indicators that matched reasonably well, some of them had a two month lag (only back to June this am for ex) which eliminated them from consideration.

Markit Mftg PMI

Remarkably tight correlation considering the volatility we've seen this year.

Correlation to Z-sprd levels is ok but not as high.

UK CPI MOM is a monthly indicator that's had a solid correlation to both the curve and Z-sprds, especially since the start of the lockdown in March.

Even better for Z-sprd levels…

Core CPI also good, despite the 1 month lag…

Correlation of the curve to consumer confidence USED to be solid UNTIL Covid.

What it's better at is helping to validate YIELD levels as the correlation's improved the worse things got. The rally in 4T30s foretold the erosion in confidence in this case.

Core retail sales YOY has also been a solid predictor, despite the 1 month lag. In this case, the correlation to the curve and Z-sprd has been very good since March – but not with outright yield levels.

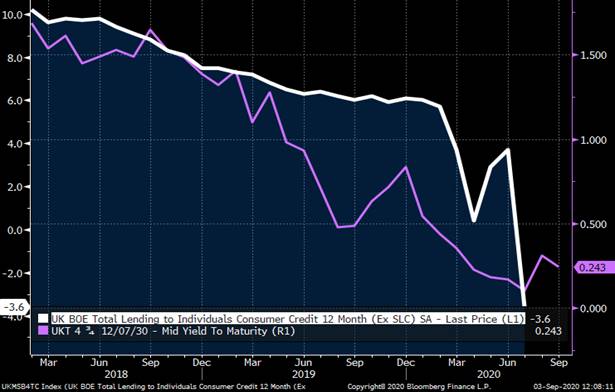

Consumer Credit levels are very interesting as a barometer for gilts/curve. Chart below shows a solid tracking vs the curve but there's been a complete divergence since June – the curve steepening despite a nose-dive in credit. Second chart makes more sense intuitively, yields falling as credit demand evaporates.

Nationwide House Prices have had a solid correlation (inverse) with 4T30 Z-sprds which broke down when the govt rolled out their stamp duty cut and house prices rallied. Yield levels have been detached from house prices since late last year.

But overall yield levels don't seem to care much about housing these days.

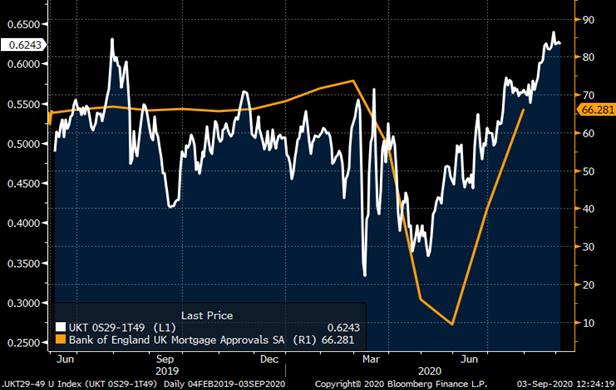

Mortgage approvals seem to matter more to the curve…

New Car Registrations is a monthly series with a 1month lag that's a good barometer of retail demand. Correlation to the curve and Z-sprds is solid.

- To sum up:

- Market UK Mftg PMIs and CPI (agg and core) are both well correlated and released frequently enough to be used as strong indicators when devising a gameplan for the curve and Z-sprd levels.

- Consumer confidence levels are worth monitoring for their correlation to outright yield levels.

- Core retail sales are also solid for curve/Z-sprd and offer a good barometer of demand.

- Consumer credit demand, is an interesting one which is best combined with new car registrations and mortgage approvals for a more complete picture of big ticket spending.

- While the market's focus on the weight of gilts supply on yields/spreads/curve is justified given the size of the UK's borrowing and the QE dynamics at work, these charts help to confirm that fundamental macro indicators are driving a great deal of these moves and ignoring their influence can prove very costly.

More ideas and colour to follow…

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

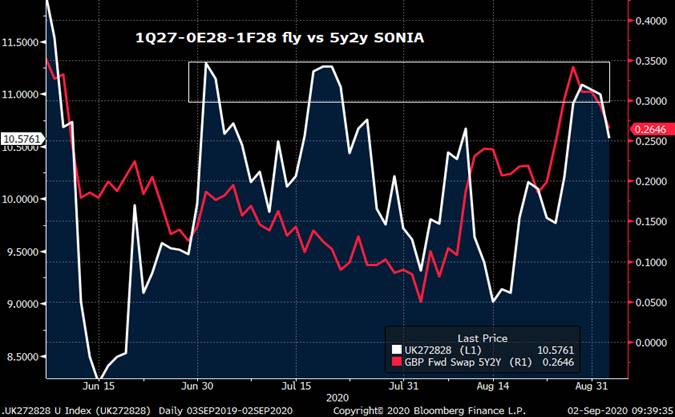

MICROCOSM: GILTS - 0E28s Tap Tomorrow - RV Thoughts/IDEAS

GILTs... 0E28s Into Tomorrow

> We've grown accustomed to seeing a nice cheapening of this issue into its taps, attracting good RV demand on the concession that has largely paid off for buyers.

> In my recent note I highlighted how the landscape is changing on this issue - and some of the other low cpn issues. They've become more sensitive to directional forces and positioning due to less overall APF support and a very busy auction calendar.

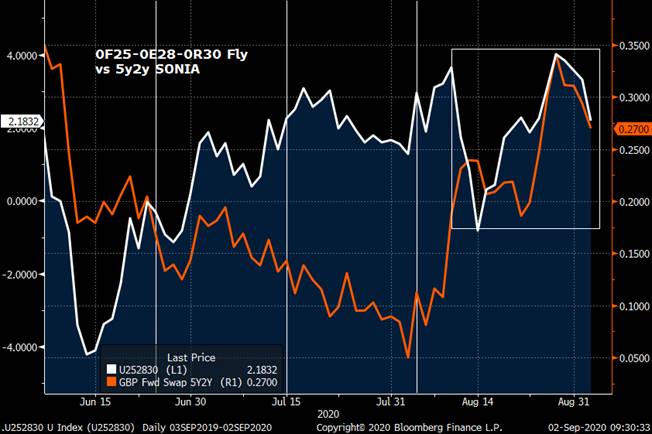

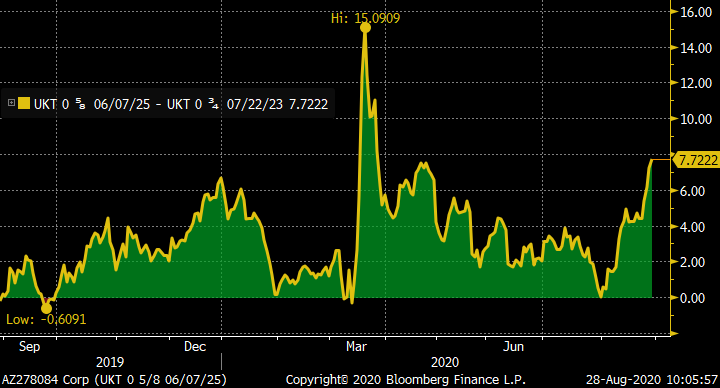

> The chart below of the 0F25-0E28-0R30 fly (one of a handful of popular expressions) shows that since the BoE dialed-down APF ops to the current £4.41bn per week, GBP yields (both SONIA and gilts) have risen but, more importantly for RV, the correlation of this fly to SONIA levels has risen markedly. So, while this yield fly has richened from +4 to +2.2 in the last couple days, it's been driven by a 6bps rally in 5y2y SONIA.

> The second chart of the same fly using Z-sprds also shows a richening of 28s but only 1.1bps, suggesting these 0E28s remain cheap.

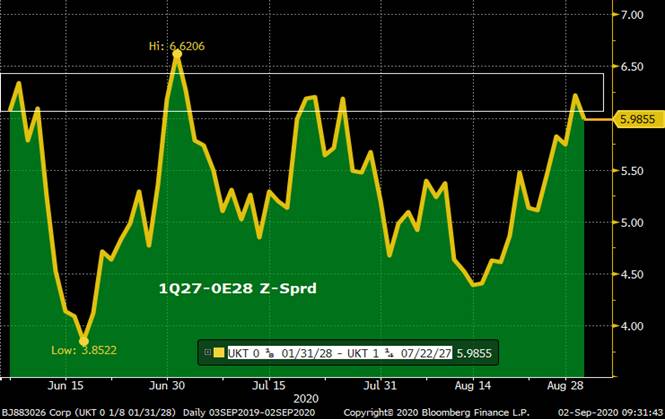

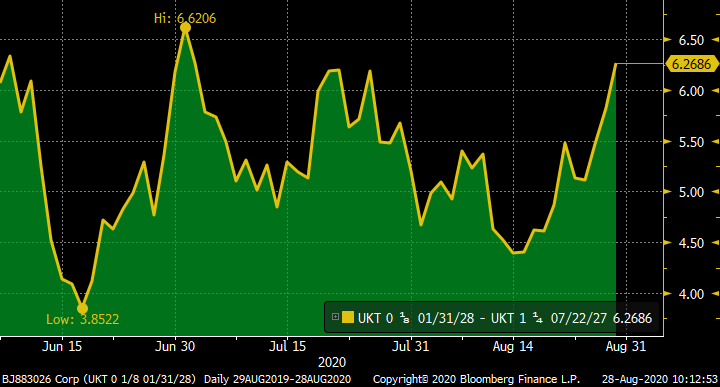

> With the bear steepening bias less prevalent now and a tap of the 1Q27s coming on Sep 15th, I like selling 1Q27s into 0E28s on yield sprd or Z-sprd as we remain close to the Jun-Sep wides (chart below).

- With no 5yr supply until Sep 24th (0E26s) we prefer selling the 1Q27s as the short leg of our fly (as above). The simple 1Q27-0E28-1F28 fly has only richened .5bp from its recent wides and, while also sensitive to the levels of SONIA, there's more 'juice' in this fly than the one above in our view, despite being tighter maturities-wise.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

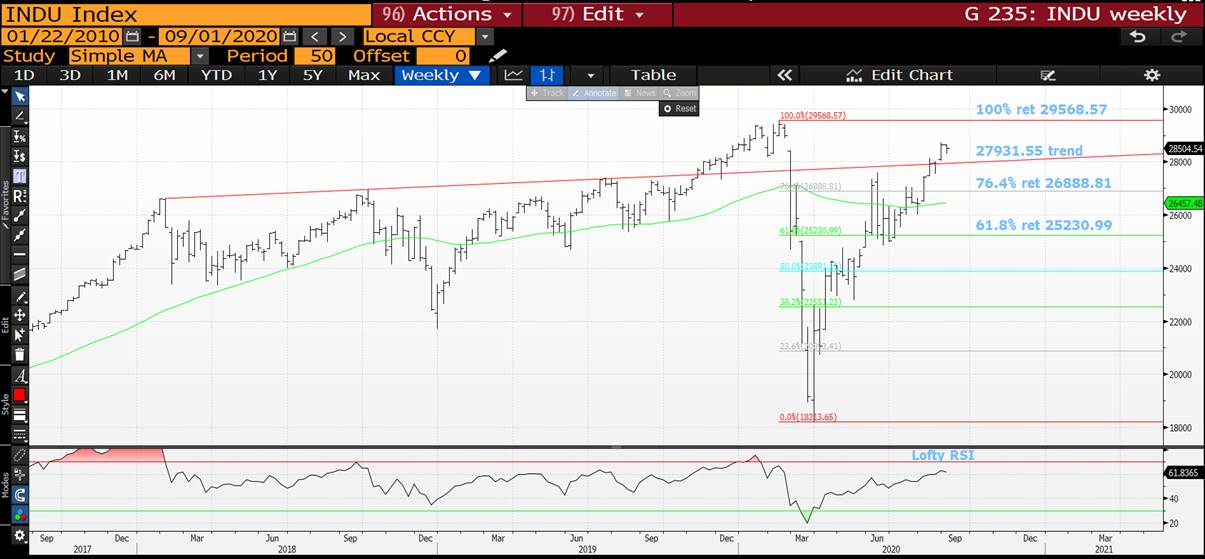

STOCKS : STOCKS CONTINUE TO BE A TOUGH CALL BUT IN EUROPE SEEM VERY HEAVY AND STRUGGLING, THE USA IS A DIFFERENT MATTER.

STOCKS : STOCKS CONTINUE TO BE A TOUGH CALL BUT IN EUROPE SEEM VERY HEAVY AND STRUGGLING, THE USA IS A DIFFERENT MATTER.

THE DOW WEEKLY HAS POPPED ITS LONTERM TRENDLINE BUT THE RSI IS NOW VERY LOFTY.

THE EUROPEAN RECOVERY HAS BEEN NOTHING LIKE THE USA.

I DO BELIEVE WE WILL ONLY SEE THE REAL ECONOMIC OUTLOOK ONCE PEOPLE RETURN TO WORK OR NOT AS THE CASE MAYBE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

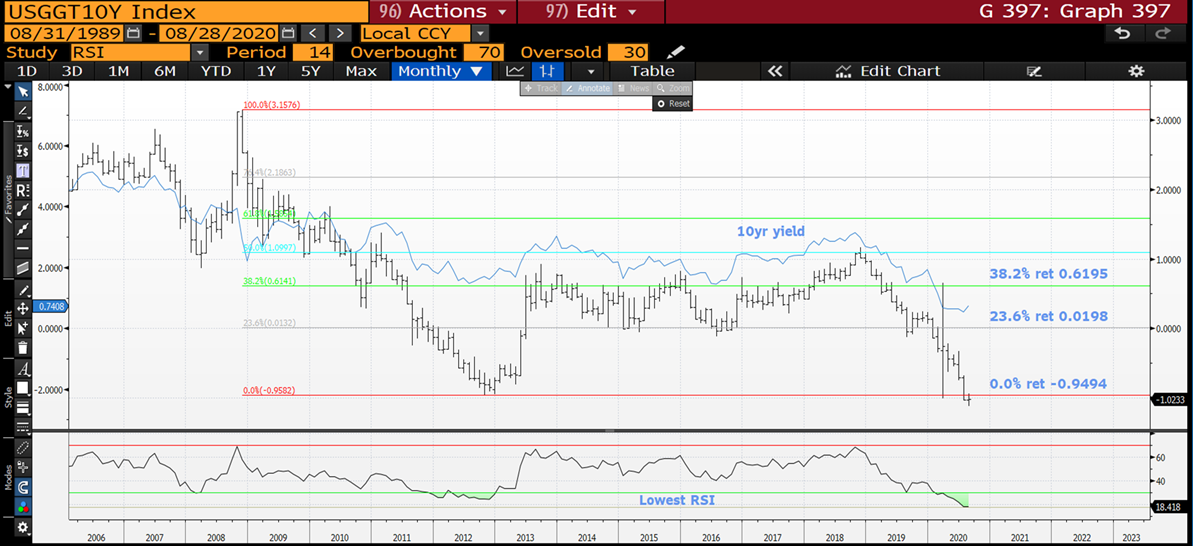

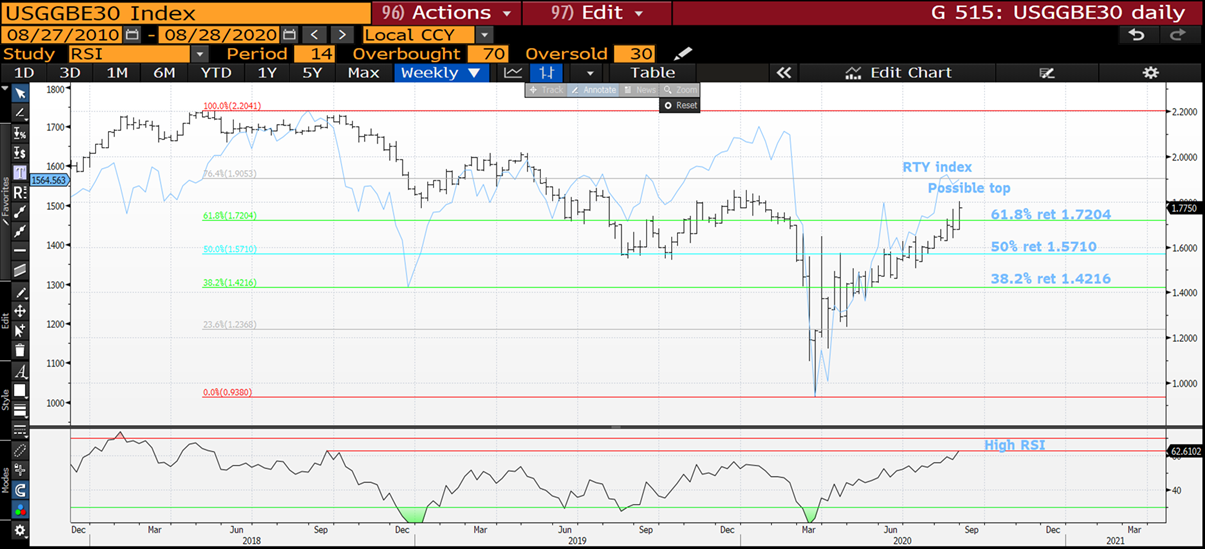

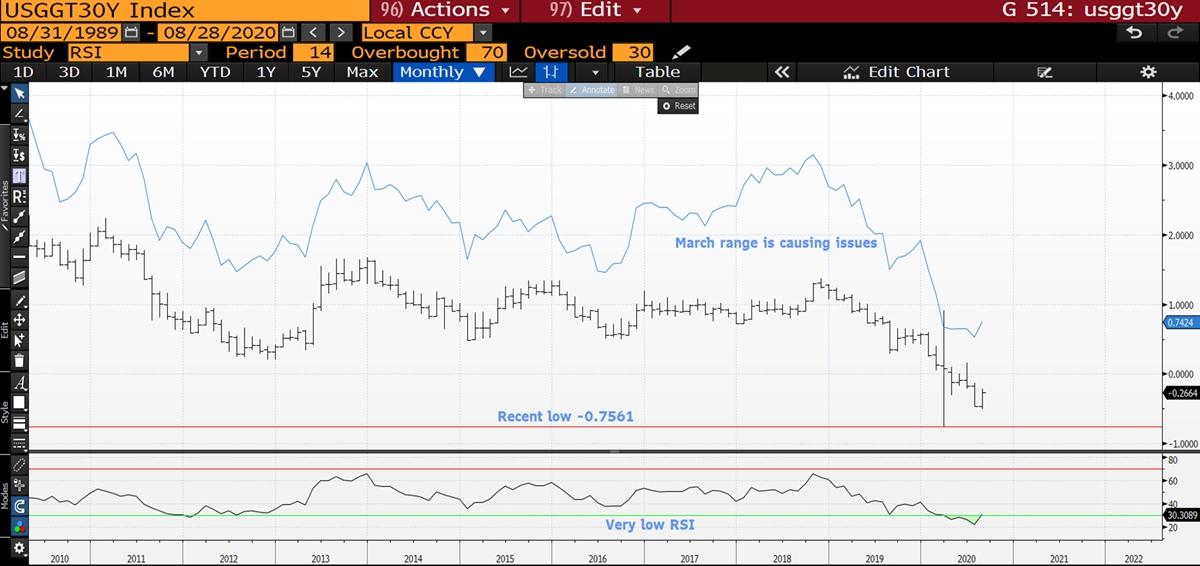

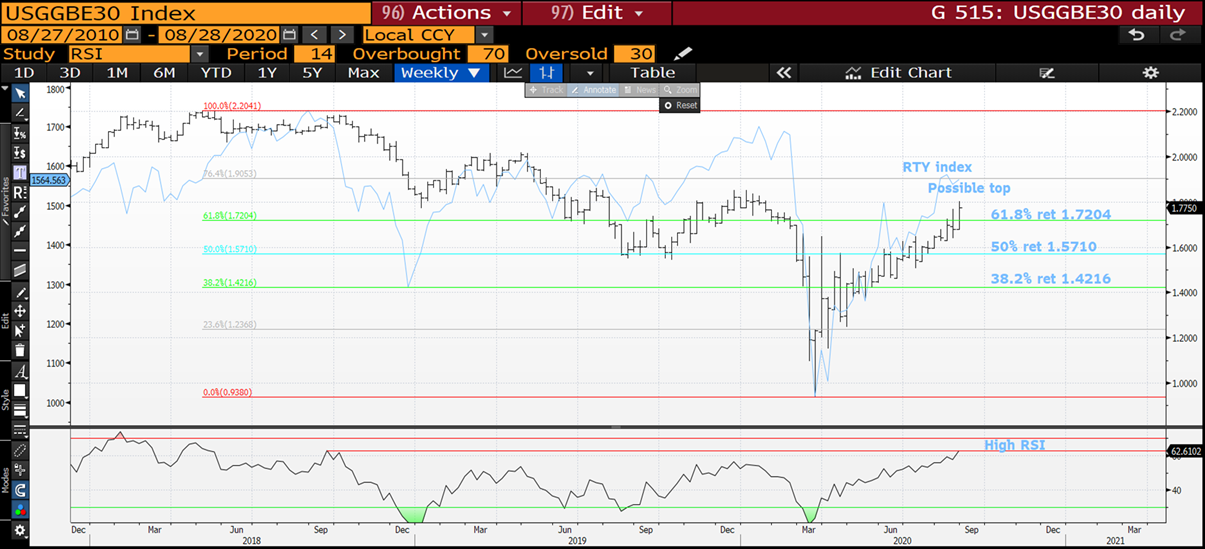

US BREAKEVENS AND USGGT : LONGTERM CHARTS AGAIN PREDICT USGGT BASING WHILST BREAKEVENS ALTHOUGH PUSHING HIGHER HAVE SOME EXTREMLY DISLOCATED RSI’S.

US BREAKEVENS AND USGGT : LONGTERM CHARTS AGAIN PREDICT USGGT BASING WHILST BREAKEVENS ALTHOUGH PUSHING HIGHER HAVE SOME EXTREMLY DISLOCATED RSI’S.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. POST YESTERDAYS PRICE ACTION WE ARE ABOUT TO EMBARK ON A MAJOR REVERSAL.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

BREAKEVENS PERSIST IN GRINDING HIGHER BUT THEY ARE PUSHING THE RSI’S TO MAJOR HISTORICAL MONTHLY DISLOCATION LEVELS. USGGBE10Y COULD BE THE ONE TO WATCH AS WE FLIRT WITH ITS 76.4% RET 1.7982.

ADDITIONAL CHARTS ARE GOLD AND THE EURO BOTH OF WHICH ARE POISED FOR A MAJOR CORRECTION LOWER.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BONDS YIELDS : LITTLE TO ADD GIVEN THE LONGTERM CHARTS CONTINUE TO CALL FOR HIGHER YIELDS.

BONDS YIELDS : LITTLE TO ADD GIVEN THE LONGTERM CHARTS CONTINUE TO CALL FOR HIGHER YIELDS.

LETS SEE WHAT NON FARM CAN BRING TO THE NEXT MOVE, GIVEN WE ARE ALREADY WORKING OFF THE DAILY RSI DISLOCATIONS.

**I HAVE LEFT OUT THE VOLUME AND OPEN INTEREST CHARTS GIVEN THE ROLL PERIOD, THUS LESS CHARTS. **

DO TAKE A LOOK AT ALL MONTHLY CHARTS ENCLOSED TO UNDERSTAND THE YIELD LOWS ARE IN AND HOW MUCH HIGHER THEY COULD GO!

DBR 46 HAS BREACHED ITS KEY 38.2% RET 165.087.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

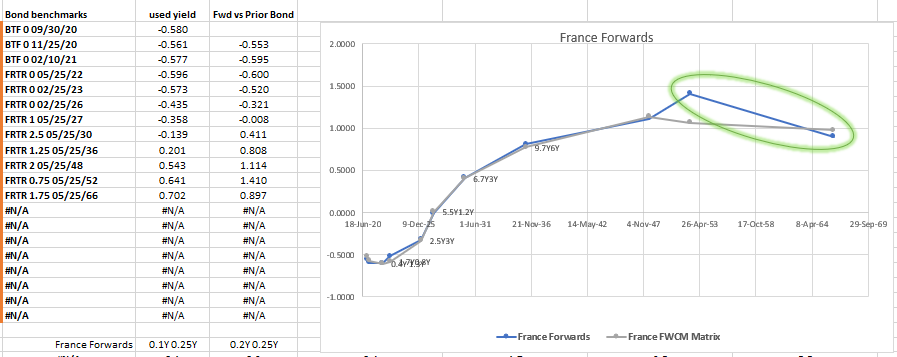

France 20y / 30y / 50y fwd steepener

With US long rates edging higher and the Powell’s comments about average inflation leave me looking for steepeners throughout the back end of Euro Curves – indeed we saw WNA (25y) vs 30y steepen 1.5bp over the last few days in the US

To me the best expression is to be long bullets vs wings as an approximation of a forwards steepener.

In France on Thursday we have supply in Frtr – there’s a couple expressions I like – but chiefly

Buy Frtr May52

Sell Frtr May48 & Sell Frtr May66

Cix:

2 * (yield[FRTR 0.75 05/25/52 Govt ]-0.5*yield[FRTR 1.75 05/25/66 Govt ]-0.5*yield[FRTR 2 05/25/48 Govt ])*100

Levels

Curr: +3.75bp

Enter: work +4bp (50% of risk, up to end of day before supply)

Add: +6.25b (50% risk, it’s not been there, but at this point the Stand Deviation times by the r2 of the wings is almost +2, which would be my aggressive target

Target: 0bp (Long Term Target, -2bp)

Graph (BBG)

Forwards

Rationale

- Although 52’s are a tap bond, they are at cheap level

- It suite my view that I’m looking for forward rate steepener – approximated by long bullet short wings

- Forwards are out of line to the fitted curve

- The forwards suggest positive roll. The prior fly 45s/50s/66s is at +0.5bp

- The penultimate day coming into supply (Wednesday) is often the nadir for these structures as Dealers make room

Carry & Roll

Carry: -0.1bp /3mo @-10bp spread

Roll: Flat

VAR & optimisation

using 155 days of data

We used 50/50 weightings

FYI..

Correlation (Beta) based wing weightings: 40/60

r2 of wings: 0.51

minimised VAR weightings: 45/55

Risks

Issue size could increase by an additional 15bln including Thursday’s tap, prior issue is €28Bln

The two wings could richen further

Any feedback or thoughts – love to hear it

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

US BREAKEVENS AND USGGT : USGGT LOOK LIKE BASING WHILST BREAKEVENS ALTHOUGH PUSHING HIGHER HAVE SOME EXTREMLY DISLOCATED RSI’S.

US BREAKEVENS AND USGGT : USGGT LOOK LIKE BASING WHILST BREAKEVENS ALTHOUGH PUSHING HIGHER HAVE SOME EXTREMLY DISLOCATED RSI’S.

USGGT ALL DURATIONS ARE AT HISTORICAL MONTHLY RSI LOWS, ONE OF 2008 PROPORTIONS. POST YESTERDAYS PRICE ACTION WE ARE ABOUT TO EMBARK ON A MAJOR REVERSAL.

**** A ONCE IN A LIFETIME SITUATION REGARDING USGGT10Y!****

BREAKEVENS PERSIST IN GRINDING HIGHER BUT THEY ARE PUSHING THE RSI’S TO MAJOR HISTORICAL MONTHLY DISLOCATION LEVELS.

ADDITIONAL CHARTS ARE GOLD AND THE EURO BOTH OF WHICH ARE POISED FOR A MAJOR CORRECTION LOWER.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BONDS YIELDS : IT HAS BEEN A GOOD WEEK FOR THE YIELD HIGHER CALL BUT SOME DAILY RSI’S ARE LOOKING LOFTY.

BONDS YIELDS : IT HAS BEEN A GOOD WEEK FOR THE YIELD HIGHER CALL BUT SOME DAILY RSI’S ARE LOOKING LOFTY. THE LONGTERM VIEW REMAINS AND IS CLOSE TO A FULL ON CONFIRMATION RALLY!

**I HAVE LEFT OUT THE VOLUME AND OPEN INTEREST CHARTS GIVEN THE ROLL PERIOD, THUS LESS CHARTS. **

DO TAKE A LOOK AT ALL MONTHLY CHARTS ENCLOSED TO UNDERSTAND THE YIELD LOWS ARE IN AND HOW MUCH HIGHER THEY COULD GO!

DBR 46 HAS BREACHED ITS KEY 38.2% RET 165.087 AND ON ITS OWN MISSION LOWER.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: Big US/UK/EUR Steepening Moves But How Much Further?

Trade ideas at the bottom…

- US/UK/EUR Curves - My 2c

Article on BBG this am: Bond Traders See 'Green Light' to Keep Driving the Curve Steeper

Time for a reality check I think.

- We've been looking for the US/UK/EUR curves to steepen further all week (as per our emails/ chat posts) in anticipation of the FED's shift on inflation yesterday and in recognition of a resumption of a busy EGB issuance cycle next week, adding to a mountain of outstanding debt across most of the G-7.

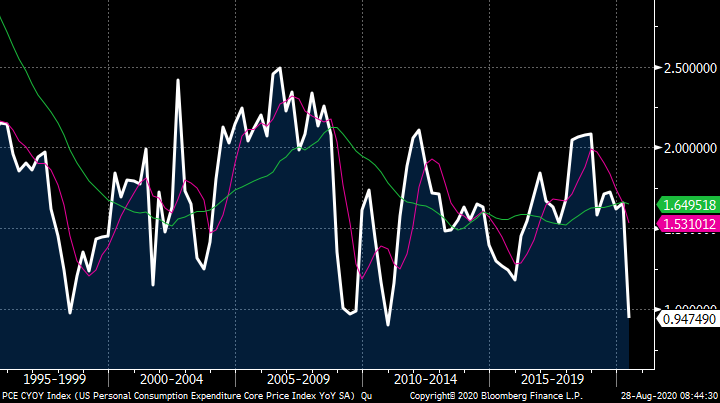

- The Fed's assumed tolerance for a 2%+ inflation rate in an effort to arrive at an average 2% rate is a logical, pragmatic approach to what has become a very thorny issue for central bankers all over the world, a by-product of the virtually free money approach to monetary policy since the financial crisis in 2007/08. While the market's bear-steepening response was warranted yesterday, exacerbated by thin summertime liquidity and a market still net long duration, we think it's important to bear in mind that just because Powell said the FED would tolerate above target inflation for a while when warranted (like now, for ex), IT DOESN'T MEAN THAT SPIKE IN INFLATION IS IMMINENT! Powell went to great lengths to explain this shift, admitting that this process is 'more art than science' and that inflation should be in the same category as employment in terms of the manageability of the level of both indicators. However, at no point did he provide a roadmap as to how the FED would help to revive inflationary pressures.

- With the YOY core PCE deflator release later today expected to come in at 1.2% after an extraordinary nosedive last qtr, it seems a move north of 2% is not only unlikely until next year at the earliest but foolhardy to expect it without a massive surge in commodities and rising base rates. The chart below of YOY Core PCE shows the 20 month moving avg since 1995 has been 1.65% - nowhere near 2%, let alone 2.5%+.

- As noted yesterday, we think the Fed's move raises the odds that the BoE (via Bailey at 14:05) will lean on the hawkish side of neutral too, putting further bear steepening pressure on the GILTS curve. While the UK economy has had an impressive bounce in Q3 as the Covid lockdown was largely lifted, it is indeed premature to suggest there's plain sailing ahead, especially as the government begins to wean the economy off the furlough scheme and other support mechanisms. For example, August preliminary services PMI came in at 60.1, the highest level in over 5yrs and in reality, one that will be difficult to sustain on a medium term basis.

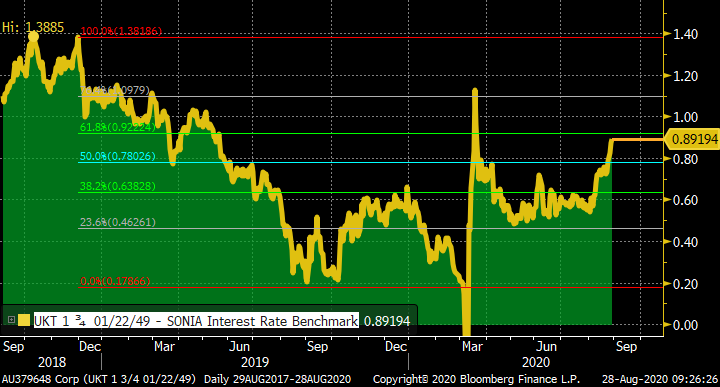

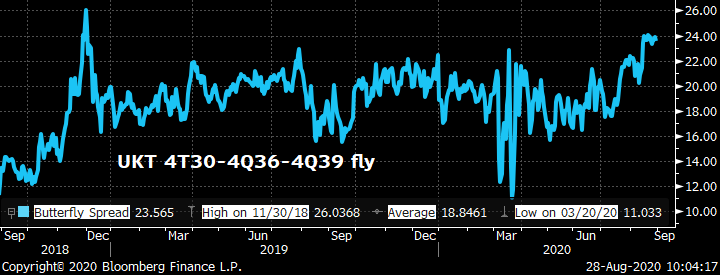

- From a markets perspective, we've seen a huge bearish move in gilts. The combination of a massive accumulation of public debt (now well north of £2trln), an unexpected bounce in core CPI in July to 1.8% and the BoE's reduction in QE support from Apr-Jul levels have driven much of the bear steepening. As we can see from the chart below of the UKT 10-30s, the curve has only been this steep 3 times in the past two years and 30yr gilts now trade ~89bps cheap to O/N SONIA, the cheapest they've been since May 2019 (not including the 2 day spike in March).

- A monstrous issuance calendar, by UK standards, will continue to challenge the DMO well into next year. All told, we think the DMO has done a masterful job of managing the government's funding while remaining sensitive to the needs of their client base. As noted yesterday, the DMO is slightly ahead of schedule for their Apr-Nov funding total of £385bn with about £105bn left from Sep-Nov. On a short-medium term basis, here's what we've got:

- Wed Sep 2 – Linker 56s tap & 20y+ 20y+ APF

- Thu Sep 3 – 10am £2.75bn 0E28s tap, 11:30am £2bn 1Q41s tap & 7-20y APF (Smallest week for conventionals in a while)

- Mon Sep 7 – 3-7y APF & Cpn date for Mar/Sep gilts. BIG index moves across the curve, especially in front-end.

- Tues Sep 8 – Day – UKT 7/35s syndication & 20y+ APF

- Wed Sep 9 – 7-20y APF

- Thu Sep 10 – 10am £3.5bn 0E23 tap, 11:30am £2.25bn 0F50s tap (est)

- Mon Sep 14 – 3-7y APF

- Tues Sep 15 – 10am £3bn 1Q27s tap (est), 11:30am £2bn 1T37s tap (est), 20y+ APF

- Wed Sep 16 – 10am £2.75bn 0R30s Tap and 7-20y APF.

We can see above that the pace of auctions has slowed somewhat, especially in conventionals – due largely to the 35s and 61s syndications. That said, the sizes of the taps have been reduced from the pace of last qtr too, lining them up a bit better with the APF support. Issuance in the 15-20yr sector is the largest in the next two weeks by far with 41s, the syndication then 37s the week after. There is also a noticeable dearth of issuance in the 5yr sector with the next tap not until Sep 24th's 0E26s auction. A big index extension in the 1-5yr bucket as the 3T20s mature and 3T21s slip below 1yr will help anchor 0F25s and even 225s on the curve.

- Despite what seems like a massive amount of risk, we think the recent bear steepening has provided ample concession for the market to support this 15yr deal and the 0F50s tap that follows. We will be using any further steepening into today's close/Tuesday's open to unwind steepeners and begin accumulating longs in the 15yr sector via bflies like the 4T30-1Q36-4H42, et al. We'll also look to

UKT 0T23-0F25 Sprd – Could flatten into Sep index moves.

UKT 1Q27 into 0E28 – 28s will be tapped next Thursday and the 27s on Sep 15th. Z-sprd box back close to the wides and yield sprd new wides. GEMMs have been loathe to part with their 0E28s this week, however, given the last post-auction richening.

Will call to discuss..

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796