Spanish long end Fly - Trade Radar, James Rice @Astor Ridge

Sell Spanish 30y

Buy Spanish 20y and Spanish 50y

Trade Structure

Sell Spgb 1% Oct 50

Buy Spgb 1.2% Oct 40 & Buy Spgb 3.45% Jul 66

Weightings:

20y / 30y / 50y

+0.33 / -1 / +.67

Levels:

Current: -14.7 bp

Entry: -14 bp (50% risk)

Add: -2bp (50% risk)

Target: +1 bp (15bp expected profit)

Cix:

200 * (yield[SPGB 1 10/31/50 Govt]-0.35*yield[SPGB 1.2 10/31/40 Govt]-0.65*yield[SPGB 3.45 07/30/66 Govt])

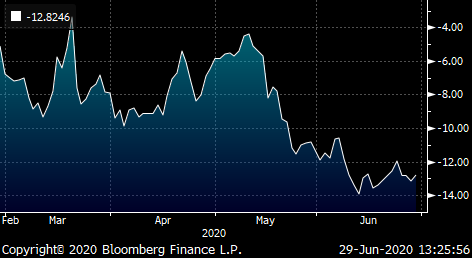

History

using older High Coupon 20y Issue

200 * (yield[SPGB 1 10/31/50 Govt]-0.35*yield[SPGB 4.7 07/30/41 Govt]-0.65*yield[SPGB 3.45 07/30/66 Govt])

Graph of History (using old HC 20y)

Carry: +0.4bp / 3mo (using -10bp repo spread)

Roll: +0.1bp / 3mo

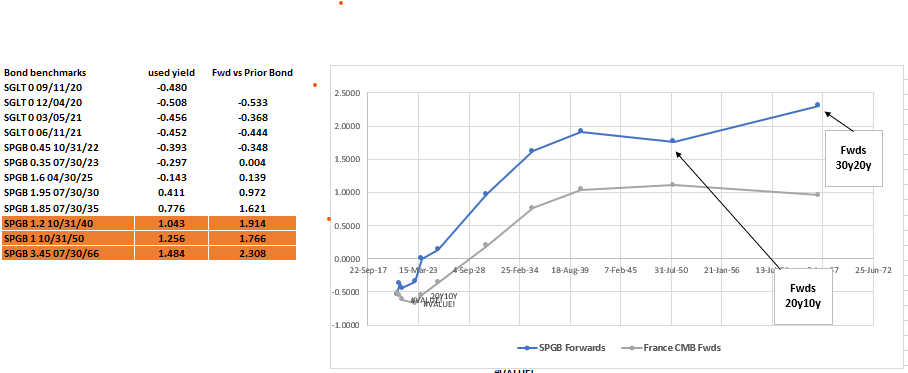

Forwards

Rationale

- The new syndicated LC 20y has come cheap to the Curve

- The 20s30s is very flat - in Spain 20s30s is +21.3bp (+21.7bp in France, +28.7bp in Italy)

- The 30s50s is steep – Spain +22.8bp (+10.9bp France, +16.7bp Italy)

- As an ongoing tap point the 30y could cheapen – 1st issued Feb20, Tapped: Mar20 and Apr20 – total issue size €8,7bln, prior 30yr Spgb 2.7% 48 is €14,5bln

2048s were tapped 6 times during 2019

Risks

- The 30y remains rich or richens further

- Additional taps to the 20y and 50y cause them to cheapen

- The repo on the 30y goes tight

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: Quick GILTS RV Into Qtr-End & Supply > Keep an eye on FLATTENERS

GILTS > Quick RV Update

- DMO consultations back in March are what brought about taps of the 4T30s, 4Q32s and 4H34s in the Apr-Jul calendar released in late March. So, while we didn't get the rumoured 2035 syndication (maybe Sep-Nov?), an easier solution, given feedback, would be additional taps of the 34s, 36s, 37s, et al. This would be in line with the Solvency II reviews and the expectation of more liability matching further down the curve. Combine this with a tap of the 4H34s on Thursday and we're happy to fade any re-richening of this sector, at least between now and Thurs.

- The 0E28s have traded well on balance since they were first auctioned, holding in nicely on the curve vs 1Q27s and 1F28s. That said, the 1Q27-0E28 sprd has grinded a bit steeper in both yield and z-sprd terms since the MPC's APF adjustment on Jun 18th bear-steepened the curve. Medium-term, we remain buyers of the 0E28s given the accelerated pace of issuance of new benchmarks means less time in the cheap 'gestation' stage and a quicker normalization process on the curve. We're keeping an eye on these 0E28s into Wednesday AM's tap for a chance to either add to our long 0E28 vs 1Q27 and 1F28 fly OR, our short 0S29s vs 0E28/0R30s fly given recent re-richening of the 29s and their proximity to the BoE's 70% eligibility threshold.

- Broadly speaking – as highlighted in my attached note – we're heading into a month/qtr-end where equities into bonds AND fairly sizeable rates index extensions provide ample fodder for curve flattening trades. This am's DMO announcement didn't include any supply landmines, opening the door for a continuation of the flattening moves we saw into the end of last week. Wednesday's tap of the new 0F50s suggests a bit of caution makes sense but as we can see from today's action, you don't have to extend that far to make money in the flattener today. We're not getting married to these flatteners, however, as they are clearly event-driven so be mindful of location and timing.

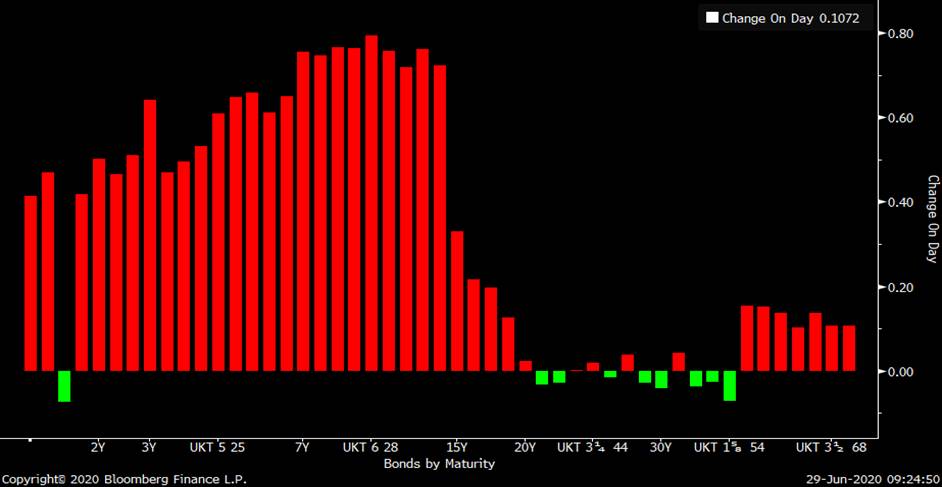

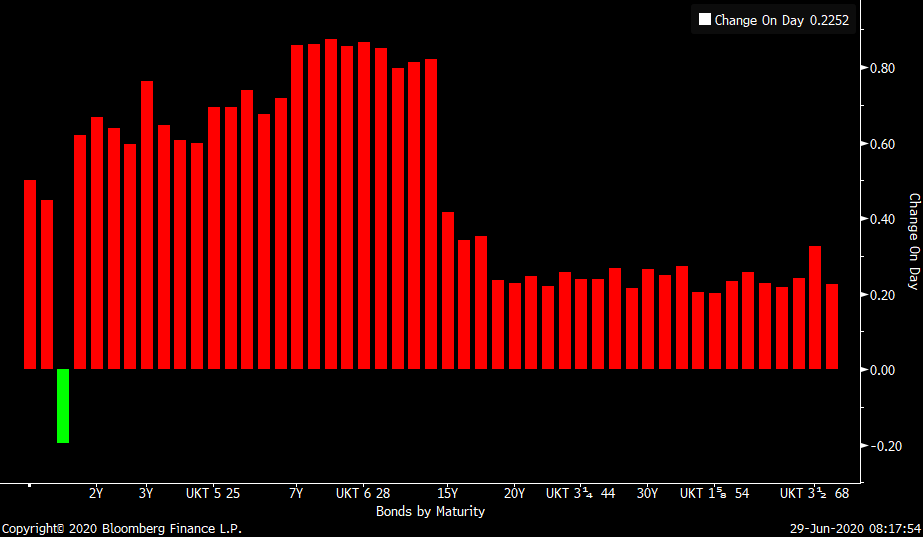

Today's yields – change on day:

UKT 29-49s sprd vs FTSE 100 index

G U0 is sitting on Key Short/Med term trendline support as the pennant formation shows we're running out of room against previous resistance. If we surrender this support we're looking at a quick 60 cent pullback…

More soon…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: UK DMO's July-August Supply Announcement > Slowly, Slowly

- The UK Debt Management Office has given us an outline of their auction plans for the back end of July and a loose framework for August. Here are some bullet points:

- April-August will raise a 'minimum of £275bn' via 33 auctions from July to August (sticking with the 2 auctions a day, twice a week calendar). Given the turbulent nature of the UK's fiscal outlook, it's prudent for the DMO to be taking a cautious approach here, especially with stories in the press of new highs in Covid-19 cases in the US.

- As of last Friday, the DMO raised £181.25bn via gilts sales which leaves £93.75bn for Jul-Aug. The schedule was for £238.5bn from Apr-Jul so the extension to £275bn by end of Aug means £36.5bn expected in Aug alone which is roughly in line with estimates. If we take into account the UKT 2 7/20 redemption (~£32.5bn), net supply dips to £61.25bn which matches up remarkably well with Jul-Aug QE of £62.1bn.

- NO Syndications announced for the Jul-Aug period although the DMO has asked for feedback on mini-tenders... There was a lot of chatter last week about a new syndicated 2035 issue which is off the table for now.

- The completed Jul-Aug calendar will be announced this Friday, Jul 3rd, at 7:30am after consultations held with the market today and tomorrow. There will be one, universal (GEMMs and investors) call at 15:30 BST TODAY. The Sep-Nov calendar will be released at the end of July.

- From a trading standpoint, the announcement that there will be NO syndications in Jul-Aug (perhaps a couple mini-tenders) is generally bullish for gilts as one could argue there won't be any big duration events to deal with, especially in the summer months when volumes/flows often slow. It also suggests less pressure on long-rates AND a better WAM match of supply and APF.

- From DMO1:

"In order to provide market participants with an opportunity to raise questions about today's announcement and the financing remit more generally, the DMO is also inviting all GEMMs and investors to participate in a conference call at 3:30pm today (Monday 29 June 2020) at which the DMO will outline its proposed financing plans for July and August. If you would like to participate in the conference call, please contact <PA.Mail@dmo.gov.uk>; by midday on Monday 29 June

2020. Dial-in details will be emailed to attendees in advance of the call. "

- Modest BEAR flattening of the curve thus far in reaction to the announcement:

More to come.

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

THE USD HAS FOUND SUPPORT BUT STILL LOOKS TO BE “DAMAGED GOODS”, TO MAINTAIN THE OEVRALL BIAS LOWER WE NEED WEAKER CLOSES FOR MONTH END.

THE USD HAS FOUND SUPPORT BUT STILL LOOKS TO BE “DAMAGED GOODS”, TO MAINTAIN THE OEVRALL BIAS LOWER WE NEED WEAKER CLOSES FOR MONTH END.

THE USD LOOKS TO BE GOING ONE WAY FROM HERE.

**WORTH A READ**

HERE ARE A SELECTION OF USD CROSSES THAT MUST SURELY SEE THE USD FADE OVER TIME. SIMILAR TO THE BOND MARKET REJECTION OF ITS MARCH EXTREMES!

I HAVE USED NON-CORE CROSSES AS THEY ACHIEVED SOME MAJOR DISLOCATIONSIN MARCH SIMILAR TO US BONDS. I HAVE MARRIED THE USD WITH BRL,MXN,RUB AND CLP. THEY HIGHLIGHT BOTH USD AND US BONDS ARE HEADING LOWER FOR SOME TIME.

SOME CROSSES ARE AT MULTI YEAR EXTREMES AND REPRESENT A SIZEABLE LONGTERM TRADE OPPORTUNITY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: QTR/Month-End Should Keep Long Rates Well Bid

Bonds, Equities and Index Flows into M/E

- There's a LOT of talk out there of balanced funds selling equities to move back into bonds at month/qtr-end given the sharp rally in stocks we've seen this month/qtr. GS estimates the flow could be worth $45bn in the US alone.

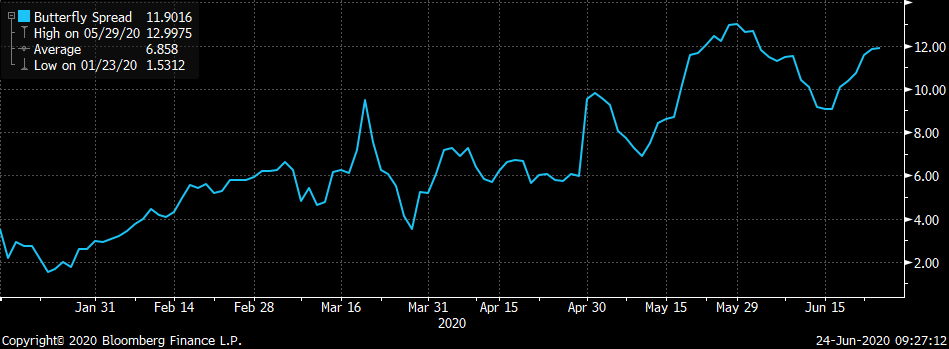

- The stocks into bonds estimates are supportive for UK & Eur rates too, which should provide further bull-flattening to curves into Tuesday. With little rates supply scheduled from now until Tuesday pm (DBR 7yrs and intermediate BTPS on Tues) and more APF/PEPP flows on tap, it's tough to be short the mkt outright with any confidence right now. The 109bps level in UST 5-30s appears to be a key medium/term support which could take an uncharacteristic flattening turn even if stocks stabilize between now and Tuesday (chart). DBR 10-30s is closing out the week with a nice flattening move back to s/term supports around the 42.5bps level. And finally, the remarkable post-MPC meeting steepening we saw last Thursday to Monday merely provided the market with a nice opportunity to re-load flatteners at the top of the long-term bull flattening channel. (Chart)

- For the UK, there are substantial month-end index extensions (for those who don't follow FTSE index guidelines). However, the wild-card is the DMO's remit which will be published at 7:30am Monday. We'll get the supply calendar for the 2nd half of July and the Aug-Oct period (expected). Frankly, the UK government knows as much as we do about how much more fiscal support the UK economy will need as we head into the autumn and Brexit plans gather steam. So, the DMO's remit is likely to be in a similar vein as the Apr-Jul one we got in March, covering as much detail as they feel confident providing.

- Estimates vary on the size and duration of UK supply although the one consensus is that there will be a deceleration from the torrid Apr-Jul issuance we've seen. The unprecedented 3-month supply deluge has already brought us a new 3yr, 5yr, 7yr, 10yr (syndication), 30yr (syndication) and 40yr (syndication), not to mention a myriad of taps of existing conventionals. So, it seems that we're unlikely to get another syndication (aside from a rumoured new 15yr) and the pace of gross/net issuance will moderate. This will likely keep align the supply calendar better to the revised APF purchases schedule announced last week. At this point, we're all watching the OBR's estimates of growth and funding needs which will fluctuate with the success (or failure) of lockdown-unwind efforts – hence the uncertainty. Again, estimates vary but the consensus is for around £120bn gross issuance from Jul-Sep or £90bn Aug-Oct. Anything much higher or lower than that will generate a curve response, complicated somewhat by month/qtr-end scenarios.

- How to play it? Well, if you've been enjoying the bull-flattening move this week and have profits in the trade, it's worth considering lightening up a bit into today's close, purely because the DMO announcement is at 7:30am and by the time the market opens, G U0 and/or UKT 29-49s will have already repriced. We'll be back with more as the day progresses…

Charts:

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

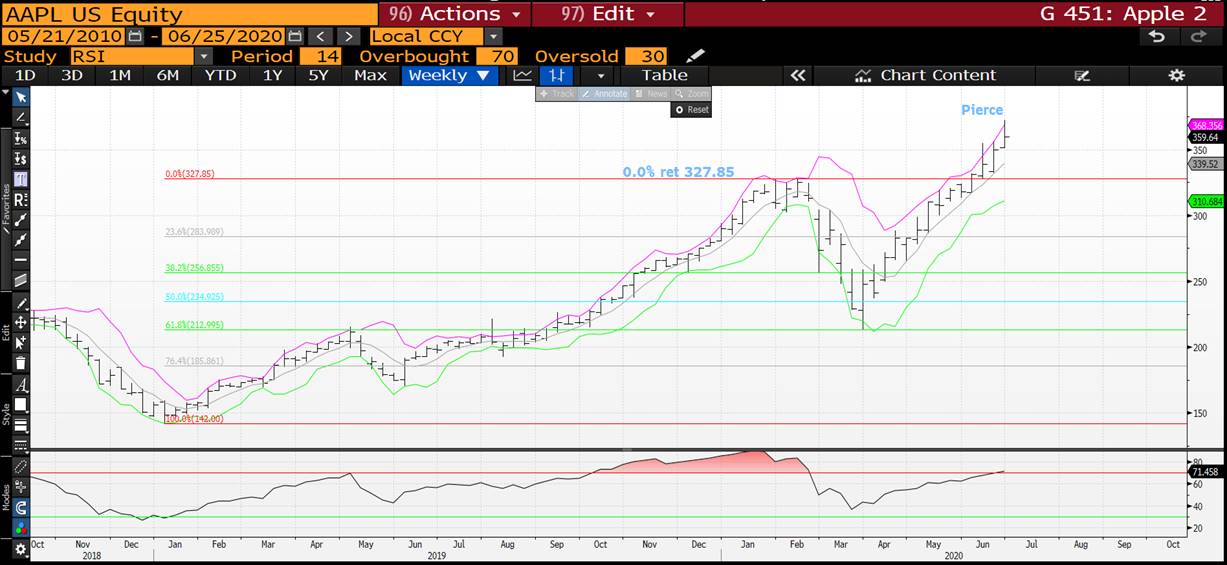

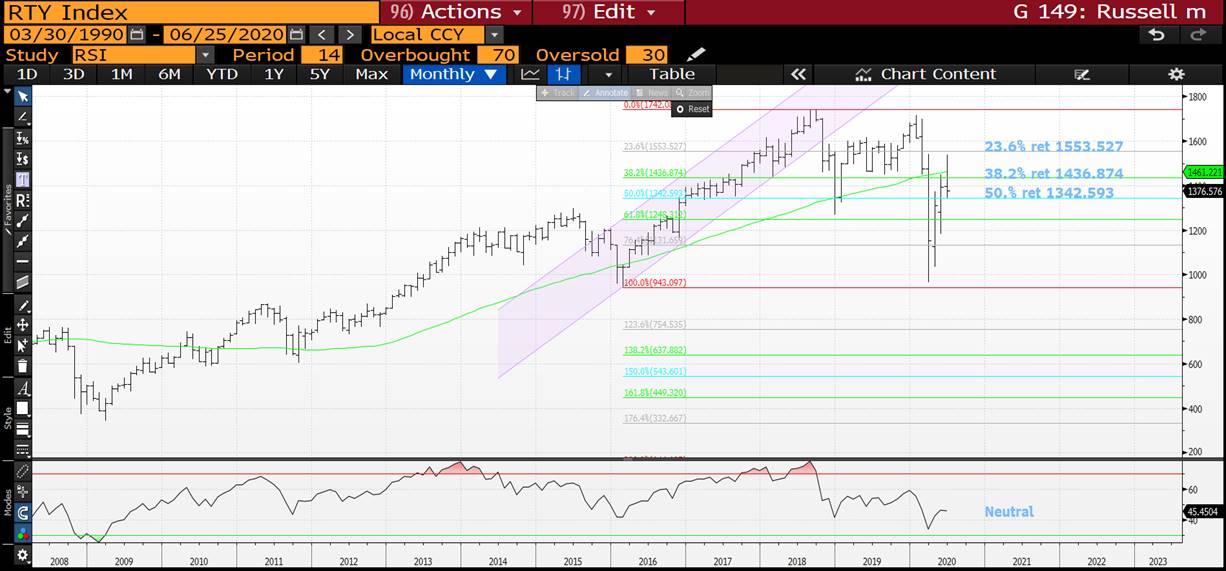

STOCKS : AS WITH BONDS ITS ALL ABOUT THE MONTHLY CLOSES.

STOCKS : AS WITH BONDS ITS ALL ABOUT THE MONTHLY CLOSES. STOCKS HAVE HAD A MAJOR REVERSAL ON THE MONTH SO THE NEXT STEP IS TO SEE IF THE CLOSE REPRESENTS THAT.

IF WE FAIL THEN SOME SINGLE STOCKS WILL RECREATE A TERMINAL FORMATION.

THE MONTH ISNT EVEN HALF WAY THROUGH BUT WE HAVE HAD SOME PULL BACKS FROM THE HIGHS HINTING AT POTENTIAL MONTHLY FAILURE.

I DO BELIEVE WE WILL ONLY SEE THE REAL ECONOMIC OUTLOOK ONCE PEOPLE RETURN TO WORK OR NOT AS THE CASE MAYBE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

BONDS YIELDS : **QUICK UPDATE** YIELDS REVERSED YESTERDAY AND HEADED LOWER THE OPPOSITE TO THEIR PLANNED ROUTE HIGHER.

BONDS YIELDS : **QUICK UPDATE** YIELDS REVERSED YESTERDAY AND HEADED LOWER THE OPPOSITE TO THEIR PLANNED ROUTE HIGHER. GIVEN THE LOW VOLUMES KEEP AN OPEN MIND AND AWAIT THE MONTHLY CLOSES.

GIVEN YESTERDAYS OPEN INTEREST AND VOLUME PIECE REMEMBER THERE HAS BEEN A MAJOR DROP IN LONG HOLDINGS FROM MARCH, THE RESULT IS YIELDS COULD RALLY HARD INTO MONTH END, CONFIRMING THE LONGSTANDING MONTHLY CALL.

PREFERENCE STILL REMAINS FOR A BOND YIELD BOUNCE AND STOCK SELL OFF.

** STILL CONFIDENT WE HAVE SEEN THE LOWS IN LONGEND YIELDS!**

GERMAN MONTHLY YIELDS HAVE SEEN THEIR LOWS BUT ARE NOW FLIRTING WITH THE LONGTERM DOWNTREND CHANNEL.

DBR 46's THE CHART TO WATCH TODAY AS IT IS CLOSEST TO THE 200 DAY MA 166.051.

DID HEAR FROM VARIOUS SOURCES THAT CTA'S ARE NOW SHORT FUTURES BASED ON THIS WEEKS PRICE ACTION.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: GILTS > Pulling Apart the Front-End of the Curve

GILTs... FRONT-END Charts

- "In the land of the blind, a one eyed-man is king". Or perhaps, better yet, "Beggars can't be choosers." With yields at/through zero a bit of ingenuity is key.

- The front-end of the SONIA curve remains at its richest ever levels, a reflection of the MPC's declaration that short rates are staying short for a LONG time. That's left most of the gilts from 22s to 28s at or sub-zero yields, even with the MPC still only 'considering' negative base rates.

- With supply in the front-end larger in notional terms than the rest of the curve (as of last week shorts saw £61.2bn issuance, mediums £50.6bn and longs £46.9bn with syndications), GEMMS are very sensitive about balance sheet usage during the auction process, especially if they are left wearing short paper trading at sub-zero yields and, in many cases, with repo bids at GC levels.

- Today's £3.25bn 2T24s tap is a good example. At the 111.32 average price they yield -.04% but their repo bid is likely to be 10bps cheap to that level and with no APF until tomorrow, they'll need to manage a position that the 2.01 b/c suggests there was little demand for. This helps explain why the 0E26s struggled yesterday and are cheaper this morning. They are a relatively new issue that will find support – because they're one of few issues at a positive yield – but until the GEMMs are rid of their auction longs the issue will languish. Despite the fact that the 225s, 1H26s and 1F28s repo is at best 10-15bps through GC, it's enough to help mitigate the costs of a long which helps explain why the 225-0E26-1H26 fly has cheapened back to =14.8bps. We're still not back to the cheapest levels in these 0E26s – and the rally in SONIA says we're not supposed to – but the post-auction 'cleansing' process of the GEMMs books is going to take longer than it did over the last 6 weeks.

Charts:

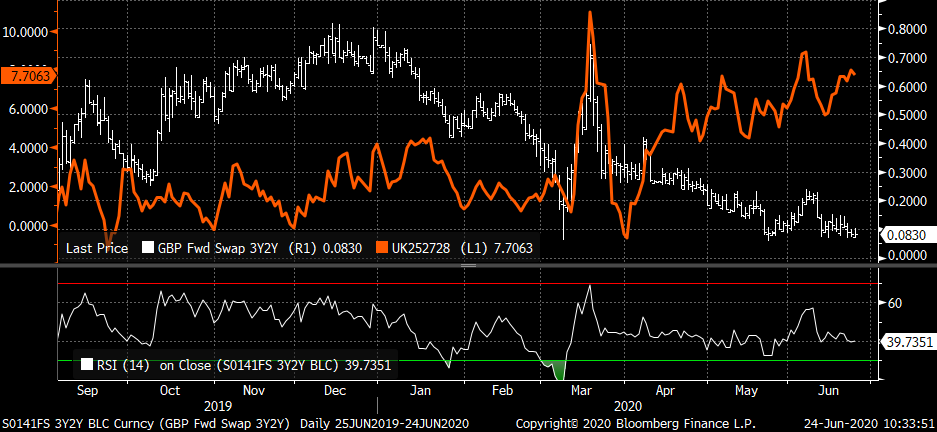

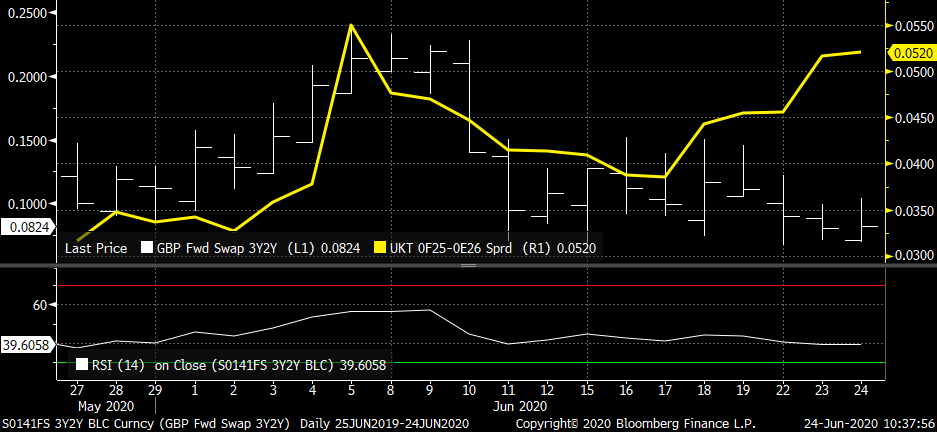

UKT 225-1Q27-1F28 fly vs 3y2y SONIA

OF25-0E26 sprd is about 2bps too steep if we use the 3y2y SONIA level as a guide. Some of that is the new issue concession which will remain for a month+ but the cheapening from +3.75bps since last Wednesday is also a reflection of the post-MPC meeting's shift in APF expectations. We think the 0E26s are cheap here but the market's still trying to get used to the new QE dynamics and they could stay that way for a while.

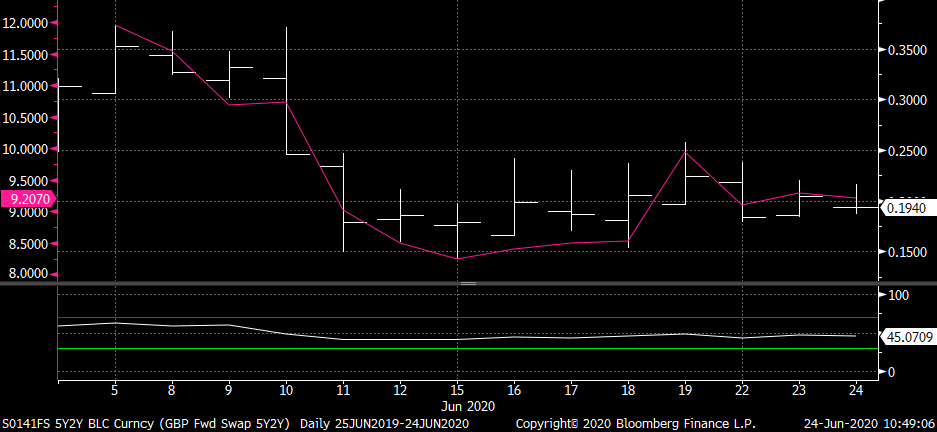

The SONIA 5y2y chart looks very similar to the 3y2y above – pinned to the bottom of it's range. Interestingly, the recent cheapening of the 1Q27s on the curve has not been matched by the new 0E28s yet. The chart below is of the 1Q27-0E28-1F28 fly vs 5y2y SONIA. The fly has a modest flattening bias given its 6.4 vs 2.8 wings which could leave the 0E28s vulnerable in a sell-off, however, they've held in well thus far. With a tap of the 0E28s scheduled for next Wednesday Jul 1st, we could see the 0E28s cheapen up a bit on the curve unless the Jun 29th DMO supply announcement comes with a reduction in auction sizes for July and beyond.

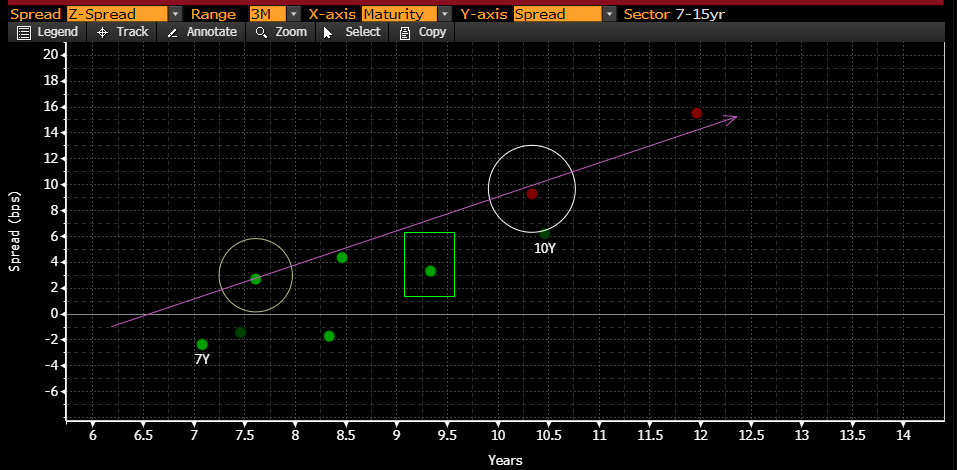

Lastly, 0E28 – 0S29 – 0R30 fly remains rich but over the next month should cheapen as both wings become larger and the 0S29s run out of room under the 70% APF limit. As of last night's operation there were just £4.06bn left vs £10.1bn (and climbing) of the 0R30s.

0S29s in the box with 0E28s and 0R30s circled.

More to come….

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: GILTS Supply Today > You're On Your Own! Quick Rundown

GILTS Supply Review/Preview…

- If yesterday's taps of the UKT 0E26s and UKT 0R30s were a sign of things to come in the gilts market then we're in for a more challenged environment going forward.

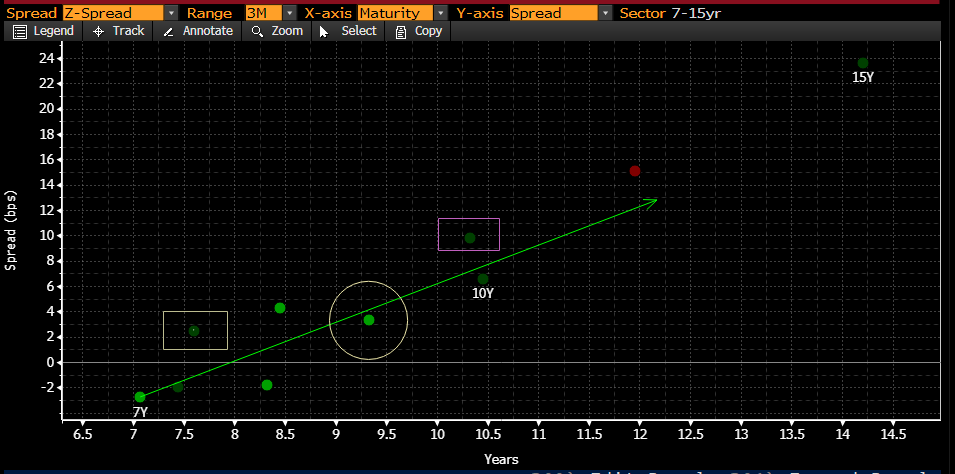

- Both issues cheapened into the bidding, the 0R30s back to +12.7bps on fly vs 0S29s and 4T30s and the 0E26s had given back .5bps vs 225s and 1H26s. By day's end both flies cheapened further and are opening weaker this morning too, the 30s fly +12.9bps and the 26s fly +14.9bps. While this back pedalling on the curve is by no means a catastrophe, it is a bit worrying that two of cheapest issues on the curve didn't attract enough demand to erase their pre-auction concessions – even with the 0R30s attracting £628mm of PAOF demand. It was also a reminder that the paltry yield levels in the UKT (at least out to 10yrs) are not enough to attract real money demand, especially given the divergence we're seeing vs stocks (chart below).

- The 'elephant in the room' here is the impact of the deceleration of the APF purchases this week relative to last week. John Wentzell's post-APF rundown (attached) highlights the results of the APF (14.9yr WAM, £4.488mm DV01) were ok on balance, albeit at a decelerated pace. On a positive note for gilts, the widening of UKT 29s vs FRTR 29s reversed a couple bps and the recent curve steepening has reversed course, UKT 29-49s now 2bps from the recent wides at +52.8bps. That flattening has as much to do with soft demand at the 10yr auction, however, as it does about a lopsided APF WAM vs supply.

- Today's supply is a bigger test for the market. The APF auction resumes tomorrow so no support for today's auctions and the net DV01 of £6.8mm+, given the 2T24s and 1F54s taps, will be longer than yesterday, especially if the PAOFs are taken up.

The Z-sprd chart of the 3-7yr sector shows the 2T24s remain one of the richer issues in the sector, despite cheapening vs both libor and Sonia swaps in the last couple weeks. Another tap likely dominated by GEMMs with little PAOF support unless we rally sharply post-auction.

- Those of us who've dipped into the treacherous waters of the ultras-sector lately won't be surprised to learn that the UKT 1F54s are trading cheap to the curve. This will be the issue's FOURTH tap since April 14th which will take the issue up to around ~15.6bn+ (depending on PAOF). The good news for holders of this issue is there are no more scheduled taps on the calendar (at least until the DMO updates it on Jun 29th) and the new 2050s, 2061s and 1F71s are all smaller and will be a bigger priority for the DMO going fwd.

UKT 1T49-1F54 Z-sprd box remains at cheap end of its range:

UKT 1Q41-1F54-1F71 fly – back close to its wides at +11.6bps

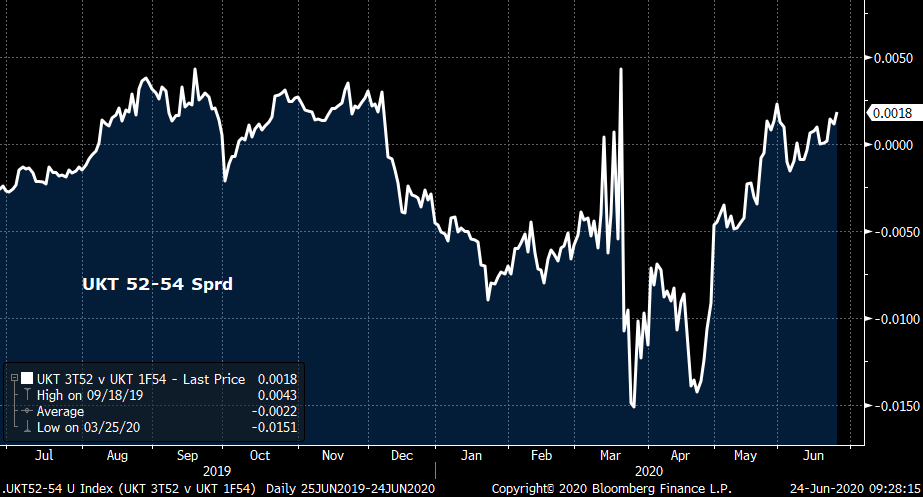

Micro-flattener UKT 3T52-1F54 also back near its cheapest…

- Bottom-line – This is a day where we're supposed to 'let the mkt come to us', buying the auction issues (including yesterday's 26s and 30s) when they look VERY cheap, as opposed to just 'cheap'.

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission's Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: NETHERLAND > July's a Big Month - Stay/Get Long

HOLLAND in JULY...

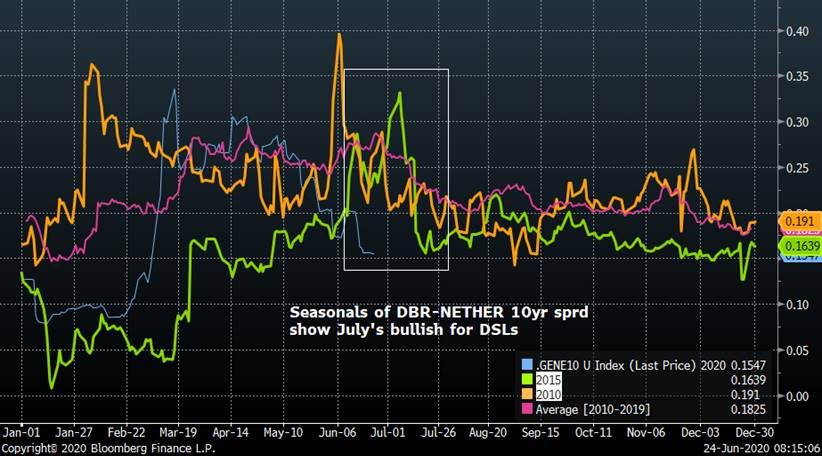

> There are 2 months a year that 'matter' for Dutch State Loans - January and July.

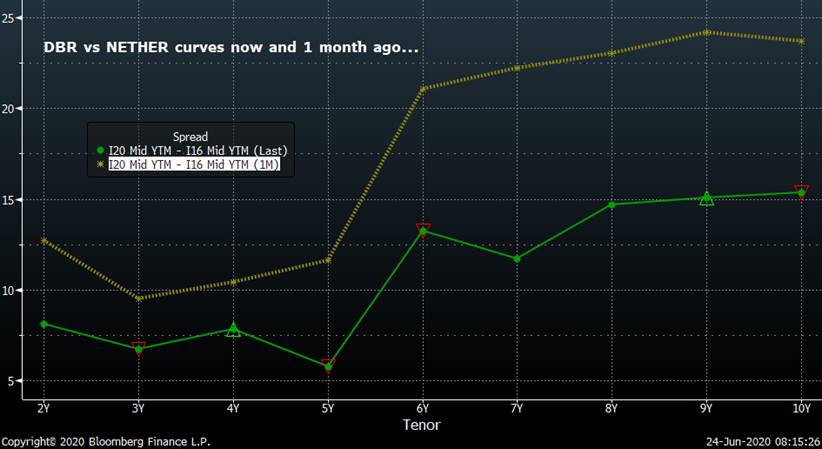

> This July we'll have €2.4bn in cpns and €14.4bn in redemptions that will support DSLs. While that figure is diluted by the sharp increase in DSTA issuance in 2020 due to the Coronavirus (2020 funding is €135.8bn now vs €42.7bn on Jan 8th), there is still a tailwind in July that should provide some support, especially in the 28/29s maturities given the 8.5yr duration of most NETHER indexes.

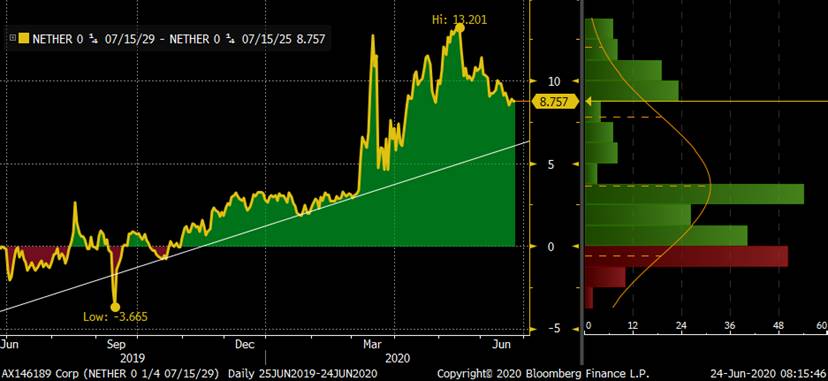

> We've seen a solid narrowing of NETHER-DBR spreads from the wides which, all told, should continue. The same grind flatter of FRTR 26-29s noted yesterday should be replicated in Holland too barring a bearish shock to the mkt. NETHER 7/25-7/29 Z-sprd is still +8.7bps, 5.5bps steeper than in February - we like this as a flattener both yield and Z-sprd and still see room for further spread compression vs DBRs in the 28s-30s sector.

> Happy to discuss other permutations...

DSL 7/25-7/29 Z-sprd box

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796