MICROCOSM: GILTS > DMO Releases May-July Supply Calendar - RV Thoughts...

- Very interesting announcement from the DMO this am (see their PDF HERE) which will shape curve activity until July.

- While we won’t know where the BoE stands regarding and extension of QE beyond their current £190bn (for gilts) until May 7th or perhaps as late as June 18th, we can get a good idea from this am on where the risk is concentrated. As you’ll see from the rundown, the initial indication of a shorts/ mediums heavy load has been smoothed out with more longs supply, especially the inclusion of a new 30yr syndication on top of the 10yr and 40yr we knew about.

- Here are some points:

- NEW 7yr > Jan 2028 issue on June 11th

- NEW 5yr benchmark June 23rd 1/2026 maturity

- NEW 2050 VIA SYNDICATION in first half of JUNE...

- Tap of the 4Q32s and 4H34s (!)

- NO SIGNS of a NEW 15yr benchmark yet...

- The rest is a smattering of old and new with taps of the 0F25s, 1Q27s, 1Q41s, 1T57s, 1F54s, 1H26s, 4T30s, etc.

- They've left the specific issues blank for the second half of July...

- So, the DMO has corrected some of the short/medium vs longs imbalance due to feedback from the market:

"...the short conventional auction proposed on Thursday 28 May has been replaced with a long conventional

auction and the ordering of the auctions has changed, with the medium auction now at 10:00am and the long auction at 11:30am; and (iv) the medium conventional auction proposed on Tuesday 7 July has been replaced with a long conventional auction."

- 4Q32s... Tap would make them eligible again for QE which, in theory, should be bullish for the issue.

The tap is on May 21st and would likely be £2bn, maybe a bit more... So, given the QE guidelines, they're really not eligible until late May and only £2bn or so. Either way, it's still positive for the issue rv-wise and is probably why they didn't bring a new 15yr. I think it's probably a bit early to start buying them although this will certainly get the 4Q32 shorts a bit antsy....

- > It'll take the rest of this am for the new calendar to sink in but here are some more RV-salient points:

1) May 19 we've got the 2061 syndication (mkt assuming £4bn or so) then May 21 4Q32s tap. Following Wed 1T57s tap and Thurs 1T49s tap. That's a lot of long risk crammed into 2 weeks.

2) No 0S29s! Mkt figured that one out pretty sharply and they rocketed richer on the curve on the open. At £35.3bn they're not exactly 'rare' but with 1F28s losing their lustre with a new 1/28 7yr coming, 29s will remain popular.

3) Concentration risk?

Let's tally this up:

1F28s tap

1Q27s tap

new 7yr benchmark 1/28s

new 10/30s synd/taps

4T30s tap

4Q32s tap

4H34s tap

Suddenly the 4-6yr sector doesn't seem so crowded (and explains why the 1H26s have done so well this am). Nor, does the 36s-39s area with 3 taps of the 1Q41s on the way which makes them ineligible for QE for 6 weeks of this May-July period.

4) Ghost town or promised land?

We've got at least 3 taps of the 1Q41s and LOTS of paper 29yrs and longer. That leaves a gaping hole in the 2042-2047s sector. No, C&R isn't great and convexity is better in ultras but with a new 30yr syndication announced on top of the 54s, 57s and new 2061s, this 22-27yr sector looks interesting, especially since it’s all still eligible for QE…

Charts:

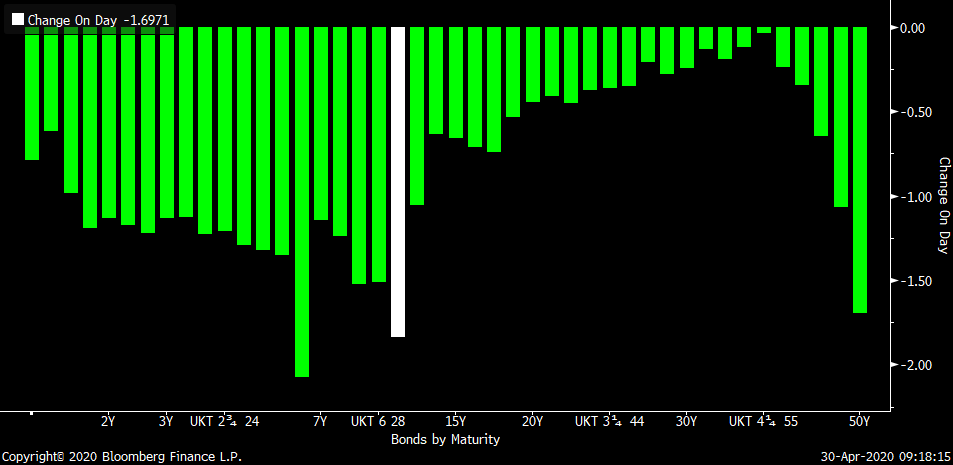

GILTS – Change on Day with 0S29s highlighted. The 1H26s have shot out of the gates too with the new 1/26 5yr not until June 2nd.

RV ideas on the way…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

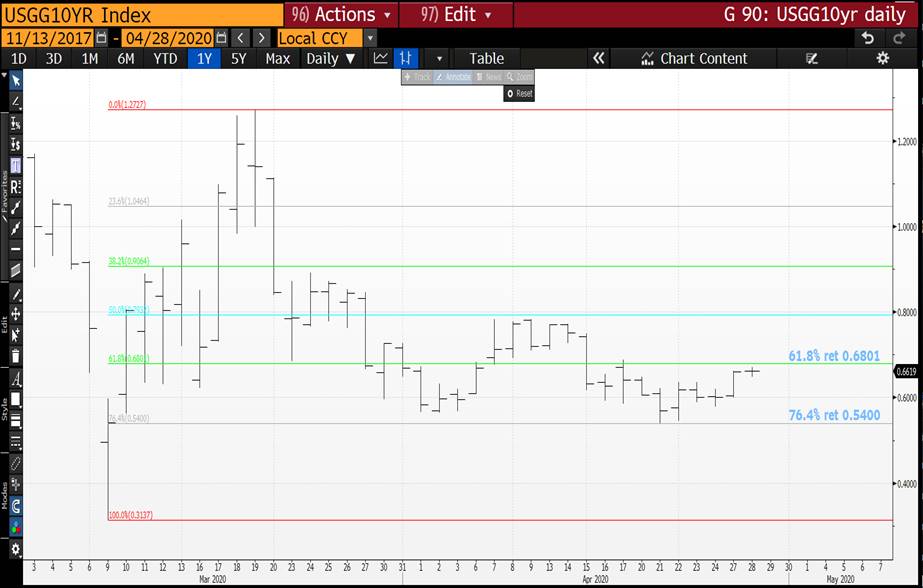

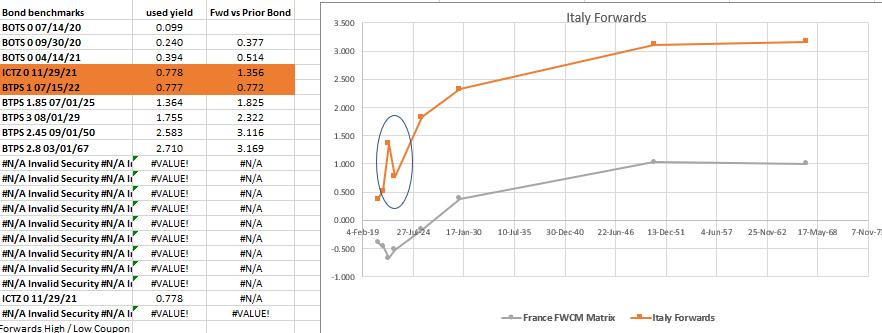

BONDS YIELDS SHOULD HEAD HIGHER GIVEN ALL SUPPORT LEVELS HAVE HELD, WE JUST NEED MOVEMENT! KEEP AN EYE ON US 10YR YIELDS, WILL BE THE FIRST CONFIRMATION YIELD WILL HEAD HIGHER.

BONDS YIELDS SHOULD HEAD HIGHER GIVEN ALL SUPPORT LEVELS HAVE HELD, WE JUST NEED MOVEMENT!

KEEP AN EYE ON US 10YR YIELDS ESPECIALLY IF THE 61.8% RET 0.6801 IS BREACHED, IT WILL BE THE FIRST CONFIRMATION YIELD WILL HEAD HIGHER.

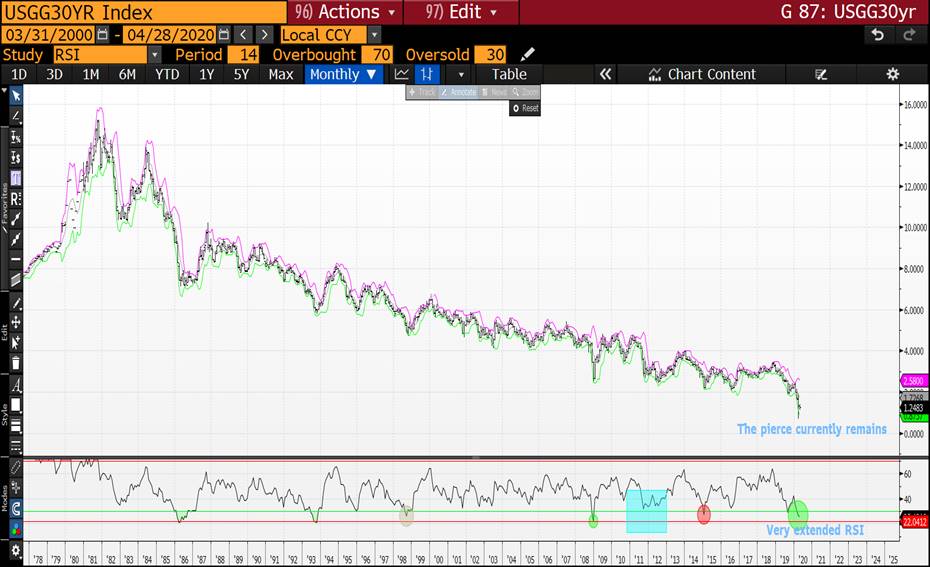

**THE US LONGEND HAS FOR SOME TIME CALLED FOR HIGHER YIELDS GOING FORWARD, THAT YIELD RALLY SHOULD START.**

THE BONUS IS THAT MOST MONTHLY BOND YIELD RSI’S HAVE ALREADY SEEN THEIR 2008-09 EXTENSIONS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

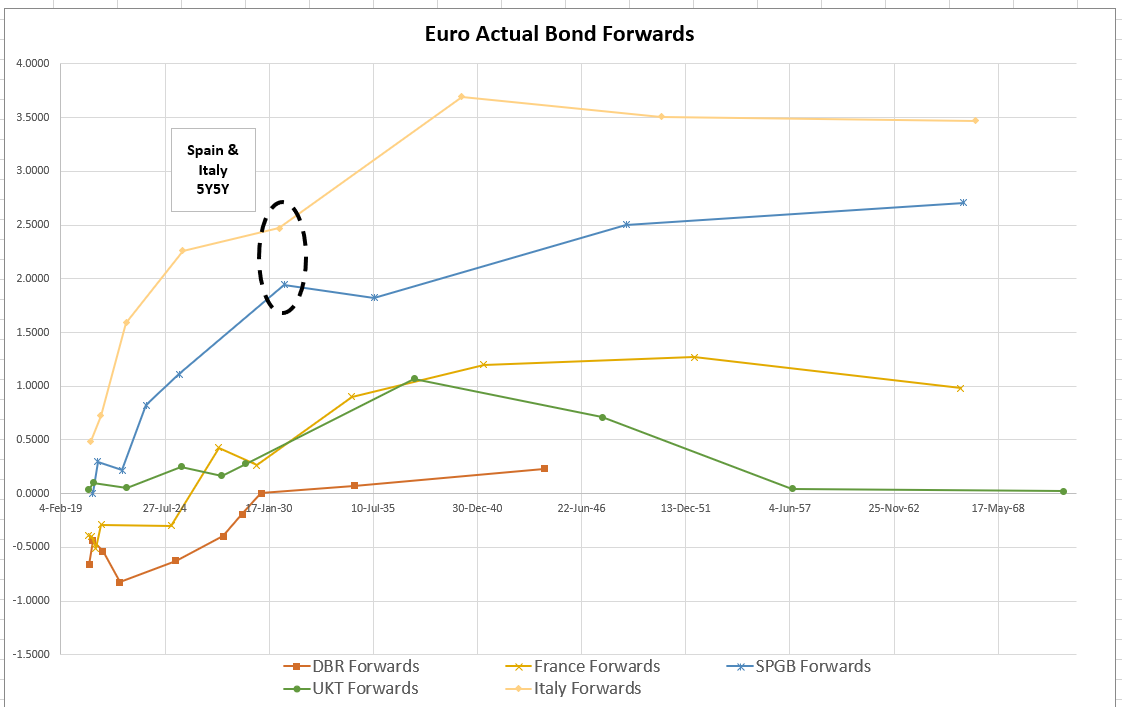

Euro RV update and Shadow portfolio - James Rice @Astor Ridge

Euro RV and Shadow portfolio over the next few days

I thought I’d add a portfolio of trades to my comments. If nothing other than for a sense of integrity in owning one’s winners and losers

It’s all too easy for people to draw circles around where their arrows land!

If you have any thoughts about what you need to see on the shadow portfolio – Sharp Ratio, Mean reversion, Balance sheet usage, friction – pls let me know

I think there’ll be some great opportunities over the next few years – to paraphrase Harold Macmillan - ‘you never had it so good’

But with that comes a downside. We have to understand value and not simply observe changes. We have to scale and we have to be diverse. If I were running risk, I’d try to be ever more conscious of those things.

Issuance to pay for Corona & increased QE are forcing trades to extreme boundary conditions. While I’m truly respectful of those forces, I still live by the Mantra that ‘Value Will Out’

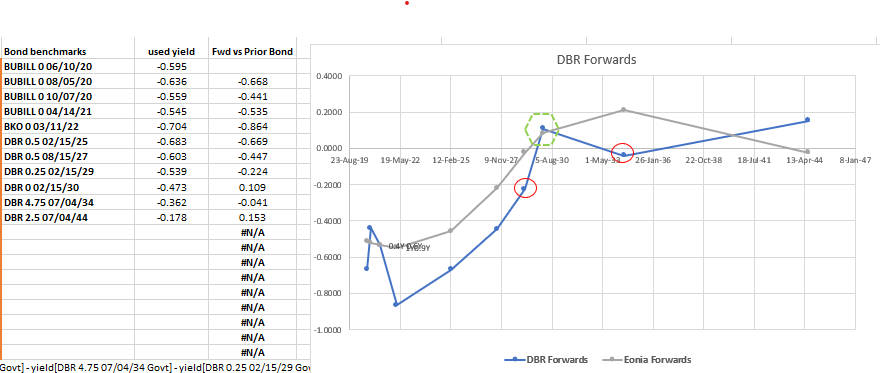

In Germany on Wednesday we have a tap in the 10y Dbr 0% 2030

We're still looking for decent forward rate steepeners and this one might bear fruit. The ten yr is also scheduled to be tapped again on the 20th May

The issuance point vs the liquid future (29s30s) is pretty steep so much so that the Fwd is up bouncing against the Eonia ceiling. Yet we have a syndicated 15y for Germany in May - and of late syndications have come at almost grotesque discounts to current so that 10s15s should steepen out too

{GE} -rxa +feb30 -old15y

weights: -.8 / +1 / -.2

current: rcv +6.1bp, 25% risk on here

add: rcv +7.5bp 75% risk on there

Fwds look solid and expect the May syndication to steepen out that king from on the run 10y to 15y

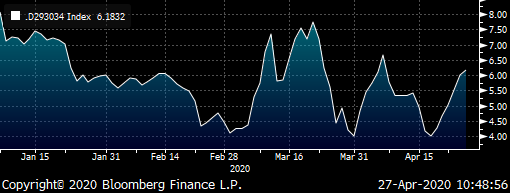

cix:

200 * (YIELD[DBR 0 02/15/30 Corp] - 0.8 * YIELD[DBR 0.25 02/15/29 Corp] - 0.2 * YIELD[DBR 4.75 07/04/34 Corp])

Forwards

Last week in Italy we had a new 5y (Jul25) and a tap of CTZ 0% nov21

Both the Nov21 and the Jul25 are cheap –the market has rallied on the 2y on generally positive news. And the supplied issues have been left behind

Here we can see quite a disproportionate jump in forwards to accommodate for the yield difference

ICTZ nov/21 0.767%

BTS CTD 1% jul22 0.777%

I like

{IT} +nov21 -BTSA +5y

+.8 / -1 / +.2

here I've used old 5y (feb25) for some history, but the new guy (jul25) looks pretty good too

BTS CTD is Btps 1% jul22

Levels

Enter: pay sprd @-20.5 bp

Add: @ -22.5 bp

Target: -13 bp

C&R:

Carry: just checking as it seem strongly positive carry !

Guessing cos it's a nett add of cash, 18%

cix: pay this spread…

2 * (yield[BTPS 1 07/15/22 Govt]-0.8*yield[ICTZ 0 11/29/21 Govt]-0.2*yield[BTPS 0.35 02/01/25 Govt])*100

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303 –

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Mon Apr 27th

The following are today's top stories from Bloomberg on your My News Page categories:

Business Briefing

1) Oil Slides Back Near $15 on Glut While Producers Start Cuts

(Bloomberg) -- Oil resumed its decline to trade near $15 a barrel as swelling global crude stockpiles made it more difficult for leading producers to balance the market by curbing output. Futures in New York slid as much as 11.8%, snapping a four-day gain. While U.S. drilling is sliding and Saudi Arabia has started reducing output ahead of the start date for OPEC+ supply ...

2) Deutsche Bank Reports Surprise Profit Amid Uncertain Outlook (1)

(Bloomberg) -- Deutsche Bank AG joined other investment banks in beating first quarter earnings expectations while putting a question mark over its outlook. Revenue amounted to about 6.4 billion euros ($6.9 billion), exceeding estimates, and net income of 66 million euros defied analyst predictions for a loss. At the same time, provisions for soured credit hit the highest ...

3) Citigroup Sees Asset Sales Boosting $47 Billion Gulf Debt Binge

(Bloomberg) -- Oil-rich Gulf nations may turn to asset sales to complement an almost $50 billion debt spree to support economies rocked by the coronavirus pandemic and the collapse in crude prices, according to Citigroup Inc. Countries including Saudi Arabia and the United Arab Emirates have “really attractive” government-owned assets, which could be sold to the public or ...

World News Briefing

4) Regions Move Toward Reopening; BOJ Takes Action: Virus Update

(Bloomberg) -- Global coronavirus cases approached the 3 million mark, though Spain and France reported the fewest deaths in more than a month and the rise in U.S. infections trailed the one-week average. Italy will ease its lockdown in just over a week, a key test in efforts across Europe to broadly restart public life. New York, the center of the U.S. outbreak, outlined reopening plans ...

5) Johnson Returns to Work as Business Demands Lockdown Clarity

(Bloomberg) -- Boris Johnson returns to work for the first time in a fortnight with one key item at the top of his in-tray: when will he let Britain do so? The prime minister will chair the government’s Monday morning meeting to coordinate efforts to tackle the virus. He spent the last two weeks recuperating at Chequers, his grace-and-favor countryside house, after ...

6) Singapore Becomes Asia’s Most Infected Nation After China, India

(Bloomberg) -- Singapore -- which has one of Asia’s smallest populations -- is emerging with the region’s highest number of coronavirus cases after the world’s two most populous countries. The island-nation reported 931 new cases on Sunday, with the total number of infections exceeding 13,000, overtaking Japan. Only China and India have more cases in Asia. ...

7) Kim Jong Un Mystery Grows on Reports of Train, Medical Team

(Bloomberg) -- Speculation about Kim Jong Un’s health intensified over the weekend after tantalizing -- yet unverified -- reports about a visit by a Chinese medical team and movements of the North Korean leader’s armored train. China sent a team including doctors and senior diplomats to advise its neighbor and longtime ally, Reuters reported on Saturday, citing three people ...

8) Cuomo Announces Phased Plan to Reopen New York; Deaths Drop

(Bloomberg) -- New York’s coronavirus deaths dropped to 367 Sunday, the lowest in almost a month, as Governor Andrew Cuomo sketched out a phased-in reopening that begins with construction and manufacturing. That could start as soon as May 15, he said, probably upstate before the New York City area. The governor’s briefing -- filled with technicalities and conditions for restarting the ...

Bonds

9) Philippines Offers Dollar Bonds as Deficit Set To Worsen

(Bloomberg) -- The Philippines is marketing sovereign bonds denominated in dollars, joining a host of borrowers raising cash buffers to weather the coronavirus pandemic. The country, whose projected deficit ratio would be the worst in two decades, is offering 10-year and 25-year tranches, people familiar with the matter said. Just last week, central bank Governor Benjamin ...

10) Contagion Risks Build in India’s Credit Market After Fund Freeze

(Bloomberg) -- India’s credit markets were jolted late last week when a major money manager halted withdrawals from mutual funds, adding to a worrying string of superlatives that have been piling up since well before the coronavirus pandemic. Franklin Templeton’s decision to wind up $4.1 billion of Indian debt funds was the biggest-ever forced closure of funds in the ...

11) Rich Asians Feel Pain on $10 Billion Bond Bets After Crash

(Bloomberg) -- Risky bond investments that wealthy Asians often made with borrowed money are coming back to haunt them after the credit market’s crash. Before the coronavirus pandemic roiled global financial markets this year, those investors piled into so-called fixed maturity funds in a hunt for stable yields. Barclays estimated last month that there’s more than $10 ...

12) Won Leads Rise in Currencies on Virus Stabilization: Inside Asia

(Bloomberg) -- Most emerging Asian currencies gain, led by South Korea’s won, as the dollar weakens and traders take comfort in moves by some countries to ease restrictions imposed to curb the virus pandemic. A gauge of regional equities rallies.

- Spain and France reported the fewest virus deaths in more than a month and the rise in U.S. infections trailed the one-week ...

13) JAPAN PREVIEW: BOJ Set to Enhance Corporate Finance Support

(Bloomberg Economics) -- The Bank of Japan is likely to roll out further support for companies at its meeting on Monday, in the latest -- and probably not the last -- initiative to help the economy get through the pandemic. The main objective now is to head off systemic risks that could snowball in the event of a surge in bankruptcies and unemployment, while keeping rates low to support the government’s stepped-up fiscal ...

Central Banks

14) U.S. Stock Futures Rise After BOJ Stimulus Boosts Asian Equites

(Bloomberg) -- U.S. stock index futures gained for a second day after the Bank of Japan expanded stimulus and investors looked out for further signs of progress in the global fight against the coronavirus. Contracts on the S&P 500 rose 1% as of 6:42 a.m. in London, while futures climbed 1.2% on the Nasdaq 100 Index and 1.1% on the Dow Jones Industrial Average. The BOJ ...

15) Global Stocks Rise; Yen Ticks Up on BOJ Support: Markets Wrap

(Bloomberg) -- Global stocks started the week with gains amid signs of positive developments in the fight against the coronavirus and a boost to stimulus measures from the Bank of Japan. The dollar retreated. Asian shares climbed, U.S. futures reversed earlier losses to trade higher and European contracts pushed up. Trading volumes remained subdued amid the risk-on move. In ...

16) India Stocks Extend Gains on RBI Support to Mutual Funds

(Bloomberg) -- India’s benchmark equity index extended gains after the central bank announced measures to help asset managers tackle any run on mutual funds in case of mounting redemption pressure from investors after Franklin Templeton said it would wind up Indian debt funds. The S&P BSE Sensex climbed 2.4% to 32,066.16 as of 10:25 a.m. in Mumbai. The benchmark index ...

Economic News

17) BOJ Vows to Buy as Many Bonds as Needed in Stimulus Move

(Bloomberg) -- The Bank of Japan scrapped a limitation on buying government bonds and ramped up its purchases of corporate debt, joining global counterparts in their unprecedented expansion of monetary stimulus as the coronavirus hammers the world economy. The bank had come under increasing pressure to take more action as the declaration of a nationwide state of emergency ...

18) PBOC’s Yi Pledges Support to Virus-Weakened Economy

(Bloomberg) -- China should maintain liquidity at a reasonably ample level and offer targeted support to companies hit by the coronavirus epidemic, China’s central bank Governor Yi Gang said. The impact from the virus on China’s economy will be short-lived, and the fundamentals won’t change, according to the article by Yi published by the Economic Research Journal in its ...

19) World’s Battered Supply Chains Shift to Recover-and-Survive Mode

(Bloomberg) -- When the timeline of the pandemic of 2020 is complete, March 24 will stand out as a day to remember for everyone from sports fans to anthropologists to cola drinkers. Japan postponed the Summer Olympics that day. India put 1.3 billion people under lockdown. Inhabitants of the U.K. awoke to their first day in home ...

20) BOJ’s Focus Shifts to Keeping Japan Inc. Afloat: Economics

(Bloomberg Economics) -- OUR TAKE: The Bank of Japan is pulling out the stops to shore up the nose-diving economy. The measures will allow the central bank to do more to prop up Japan Inc. and support fiscal stimulus. The primary objective appears to be to provide sufficient assistance to head off any surge in bankruptcies that could cripple longer-term prospects. The reflation effort is now on hold. ...

21) Tale of Two Economies Will Determine Post-Lockdown Growth

(Bloomberg) -- The restart of the world economy risks going ahead without a key ingredient: the consumer. Getting companies to resume operations and factories to reopen is one thing. Persuading consumers to brave catching the coronavirus and go out to shop, eat, travel or watch sports is another. “Nothing about reopening the economy will be easy, but restarting businesses will be more ...

European Central Bank

22) FT Markets: ECB set to beef up asset purchases with shift into ‘junk’ bonds https://t.co/nindYwX7wJ

FT Markets

@FTMarkets

ECB set to beef up asset purchases with shift into ‘junk’ bonds on.ft.com/3cPDMut

Sent via SocialFlow. View original tweet.

23) Letter: Those challenging the ECB’s rescue measures are not mad

Preview text not available for this story.

24) ? ECB expected to start [...]

Preview text not available for this story.

25) Those challenging the ECB's rescue measures are not mad

Preview text not available for this story.

26) ECB expected to start buying riskier fallen angel bonds

Preview text not available for this story.

First Word FX News Foreign Exchange

27) *THAILAND PLANS TO EXTEND ITS STATE OF EMERGENCY TO MAY 31

28) Bolsonaro Seen Tapping Ally to Head Justice Ministry Amid Crisis

(Bloomberg) -- President Jair Bolsonaro is expected to nominate a close ally to head Brazil’s justice ministry, replacing a previous cabinet member who accused him of trying to meddle in police investigations, according to Folha de S.Paulo newspaper. The move would do little to dismiss allegations of political interference leveled against the president by Sergio Moro, a ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

GILTS Revision Note - Corrected DMO PDF link

Sorry about that!

This shld work well:

https://www.dmo.gov.uk/media/16478/sa230420.pdf

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MICROCOSM: UK's Revised Funding Remit and Impact on GILTS > Quick Rundown

- The UK DMO has announced their funding plans for the May-Jul period (click HERE for the PDF)

- Here’s summary of the salient points for RV-driven gilts investors:

- £180bn issuance from May to July which will be mostly conventional gilts. Next funding remit announced Jun 29th .

- The current 2 auctions per day for 2 days schedule will continue.

- There will be 5 linker auctions.

- The new Oct 2030 benchmark syndication confirmed for Tues May 12th and the 30yr+ syndication for Tues May 19th.

- Additional syndications could be announced for Jun/Jul.

- The usual market consultations process will continue in devising an appropriate auctions schedule.

- DMO announced possible new 7yr and 15yr benchmarks.

- The £60bn per month schedule is £53bn MORE issuance than is left under the current £190bn BoE QE program.

- BoE will review their QE plans on May 7th, followed by another meeting on June 18th. Given the weight of the supply the DMO is asking the market to take down, the BoE might want to err on the side of caution and extend the program, at least by enough to cover July’s supply.

- Current QE buckets of 23-26s, 27s-39s and 40s and longer remains in place but could be adjusted to reflect changes to the auction calendar.

- Market Reaction and Comment:

- This remit is larger than the market was expecting, all told. The Treasury/DMO have left the door wide open by not committing to a budget beyond July, which, under these extraordinary circumstances, seems rational. That said, this May-July supply barrage suggests Johnson’s government won’t be shy about their dependence upon the market to help finance the UK economy’s recovery. Bottom line is, we still don’t know what the TOTAL funding remit for 2020/21 will be.

- Market reaction was initially bearish but we’ve clawed back early losses and G M0 is just 8 ticks weaker on the day. Doesn’t hurt that there’s no supply today and another APF operation waiting in the wings.

- A potential new 7yr and 15yr benchmark were a surprise and suggests the focal point of issuance will remain in the 3-20yr sector given we could have a 3yr, 5yr, 7yr, 10yr, 15yr and 20yr.

- Initial dealer reaction was ‘cautious’ regarding the outlook for the 15-20yr sector given the potential for a new 15yr benchmark. While we share the view that ‘exclusivity’ that the lack of issuance and great carry and roll that the 2034s to 2038s have enjoyed of late could be jeopardized by more supply, we would also anticipate that there will be substantial real money demand for that sector given the changing landscape Brexit has created and the continued wave of buy-ins that drive the long-end.

- The 1F28s have gone from zero to hero and back to zero in the last 3-4 days. The 1Q27-1F28-0S29 fly that we’ve been in and out of is now -4.2bps mid, almost 3bps cheaper in the last 24hrs. After yesterday’s APF buying, the 1F28s have just £6.3bn left under the BoE’s 70% per-issue limit. Add to that now, the solid odds of a new early 2028 issue to compete with these 1F28s and the market sees little reason to hold into them.

- For us, the bottom line here is the UK GILTS market will continue to be very fertile ground for the RV community for the foreseeable future!

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** PLEASE READ ** BONDS YIELDS TO HEAD HIGHER FROM HERE, DEFINITELY FOR SOME TIME TO COME!

CHARTWISE I HAVE BEEN WAITING FOR CONFIRMATION OF THE IMPENDING LONGEND YIELD BASE-BOUNCE, WELL TODAY LOOKS LIKE THE DAY. YIELDS HIGHER FROM HERE AND FOR SOME TIME, THE STOP IS CHEAP!

BONDS YIELDS TO HEAD HIGHER FROM HERE, DEFINITELY FOR SOME TIME TO COME! CHEAP STOP FOR THE DIRECTIONAL PLAY.

THE BONUS IS THAT MOST MONTHLY BOND YIELD RSI’S HAVE ALREADY SEEN THEIR 2008-09 EXTENSIONS.

**THE US LONGEND HAS FOR SOME TIME CALLED FOR HIGHER YIELDS GOING FORWARD, THAT YIELD RALLY SHOULD START TODAY.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

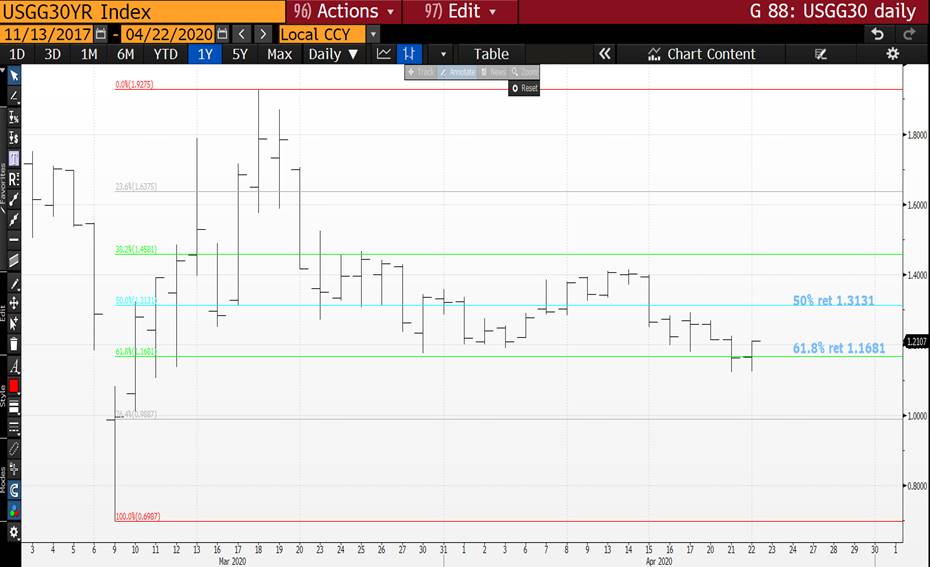

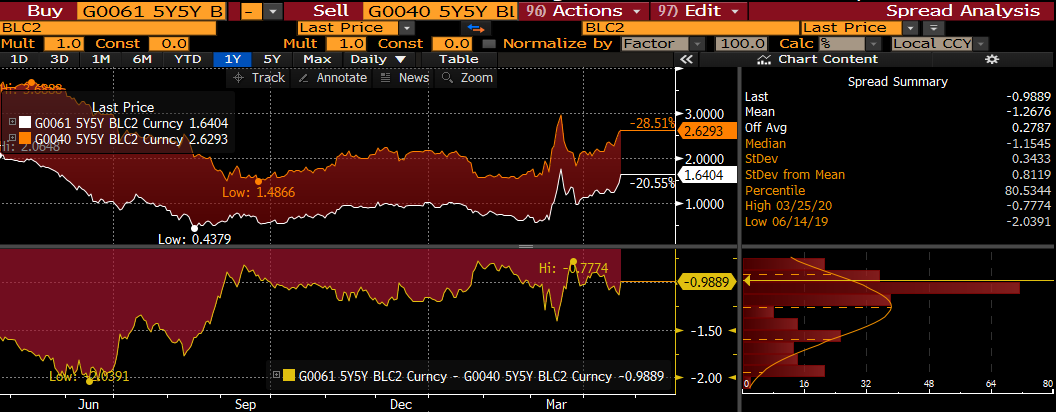

Trade checking numbers for pricing tmrw - Spain vs Italy 5s10s

Am I missing something here ?– this trade looks out of whack and

Spain Flattener 5s10s vs Italy Steepener 5s10s

Waiting on firm pricing after the syndicate…

Rationale

- recent new issues have come with significant new issue discounts to clear

- 5y Italy & 10y Spain have forced the 5y5y forwards to be out of line

Graph of Forwards (using new issues)

History of 5s10s Spain vs Italy using old benchmarks…

Spain

100 * (YIELD[SPGB 0.5 04/30/30 Corp] - YIELD[SPGB 0 01/31/25 Corp])

Italy

100 * (YIELD[BTPS 1.35 4/30 Corp] - YIELD[BTPS 0.35 2/25 Corp])

Levels using new issues – subject to syndicate pricing…

Spain

SPGB 1.6 04/30/25 vs

Estimated .SPGB 1.2 10/31/30 – should be secondary market tomorrow

+66bp

Italy

BTPS 1.85 07/01/25 vs

BTPS 0.95 08/01/30

+33bp

so an additional 33bp vs old benchmarks!!!

On forwards…

Using Generics – I get -99bp but using my calculations including the new bonds I see the forward spread much closer to -59bp

Something seems wrong here – do you see these numbers?

Apols

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MARKET UPDATE : **EQUITIES CONTINUE TO STALL AND THIS WEEK LOOK READY TO FAIL.**

MARKET UPDATE : **EQUITIES CONTINUE TO STALL AND THIS WEEK LOOK READY TO FAIL.**

OIL CHART INCLUDED AT THE END OF THIS PRESENTATION.

SADLY LITTLE FURTHER TECHNICAL DEFINITION, THAT SAID IF STOCKS FAIL HERE, IT IS FOR A WHILE. BONDS REMAIN A BIT OF A PUZZLE, US 30YR YIELDS STILL POINT HIGHER GIVEN THE MARCH 9TH PIERCES REMAIN, WHILST 2YR YIELDS HAVE ROOM TO EDGE SLIGHTLY LOWER.

LONGTERM BACK END US YIELD CHARTS STILL POINT TO A LONG-TERM LOW IN PLACE, YET THE FRONT END STILL LOOKS LIKE THEY HAVE ONE MORE NUDGE LOWER. LONG END YIELDS NEED AN EVENT RISK-FUNDAMENTAL STORY TO HEAD HIGHER.

STOCKS REMAIN A PAIN GIVEN SO MANY MONTHLY CHARTS HAVE FAILED TO EXTEND THEIR RSI’S TO 2008-09 LEVELS, YET ARE NOW RECOVERNG WELL. THIS RALLY DOES NOT FEEL SUSTAINABLE BUT WE SHALL SEE.

SINGLE STOCKS HAVE REALLY RECOVERED WELL BUT EXPECT HEADWINDS SOON AS RESISTANCE APPROCHES.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: BUSY Week in the UK! Quick Rundown >

- Today’s the proverbial ‘calm before the storm’ – the only day this week without a significant market event in the UK. Let’s run through the highlights:

- Auctions:

- Tomorrow: £3.25bn UKT 0F25s; £1.5bn UKT 1F54s

- Wednesday: £3.0bn UKT 1Q27s; £3.25bn UKT 124s

- 25% PAOF still applies. This is significantly less DV01 than last week’s supply given concentration of 3 of the 4 taps in the 4-7yr range. (RV colour on this shortly)

- QE Operations:

- Size of daily operations unchanged at £4.5bn per day, £1.5bn per bucket.

- Tomorrow: 1T37s, 1H26, 124, 0F25, 1Q27, 0S29, 1T49, 1F54 ineligible

- Wednesday: 1H26, 124, 2T24, 0F25, 1Q27, 0S29, 1T49, 1F54 ineligible (Just 3 issues in 3-7yr bucket)

- Thursday: 1H26, 124, 2T24, 0F25, 1Q27, 0S29, 1T49, 1F54 ineligible

- Data:

- Tomorrow: Jobs data

- Wednesday: Inflation and House Price data

- Thursday: PMI and CBI trends data

- Friday: Retail Sales data

- UK Treasury Announcement on Apr 23rd:

- Chancellor announces revised funding targets for FT 2020/21, accounting for Covid-19 related spending programs.

- The tone of the OBR’s estimates and the nebulous impact their guidelines have on the UK Treasury’s decision making process have sparked a rather broad array of estimates for the total 20/21 funding package. Some are well above £300bn while others are a more conservative ~£260bn range.

- As noted in our recent notes, the pace of QE buying (in both DV01 and WAM terms) has largely mopped up the DMO’s additional April supply, keeping a lid on gilts yields across the curve. With about £150bn QE buying left in the £190bn announced at the end of March, the market will be keeping a very close eye on the size and timing of any negative net funding over the next 6 months+.

- We should also get some information on the timing of the May syndications of a new 10yr benchmark and perhaps the maturity of the ultras conventionals issue.

- We’ll be back with more soon… Buckle up!

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796