MARKET UPDATE : **THIS WEEK WE HAVE LACKED MANY CONFIRMATION MOVES.**

MARKET UPDATE : **THIS WEEK WE HAVE LACKED MANY CONFIRMATION MOVES.**

SADLY LITTLE FURTHER TECHNICAL DEFINITION, THAT SAID IF STOCKS FAIL HERE, IT IS FOR A WHILE. BONDS REMAIN A BIT OF A PUZZLE, US 30YR YIELDS STILL POINT HIGHER GIVEN THE MARCH 9TH PIERCES REMAIN, WHILST 2YR YIELDS HAVE ROOM TO EDGE SLIGHTLY LOWER.

LONGTERM BACK END US YIELD CHARTS STILL POINT TO A LONG-TERM LOW IN PLACE, YET THE FRONT END STILL LOOKS LIKE THEY HAVE ONE MORE NUDGE LOWER.

STOCKS REMAIN A PAIN GIVEN SO MANY MONTHLY CHARTS HAVE FAILED TO EXTEND THEIR RSI’S TO 2008-09 LEVELS, YET ARE NOW RECOVERNG WELL. THIS RALLY DOES NOT FEEL SUSTAINABLE BUT WE SHALL SEE.

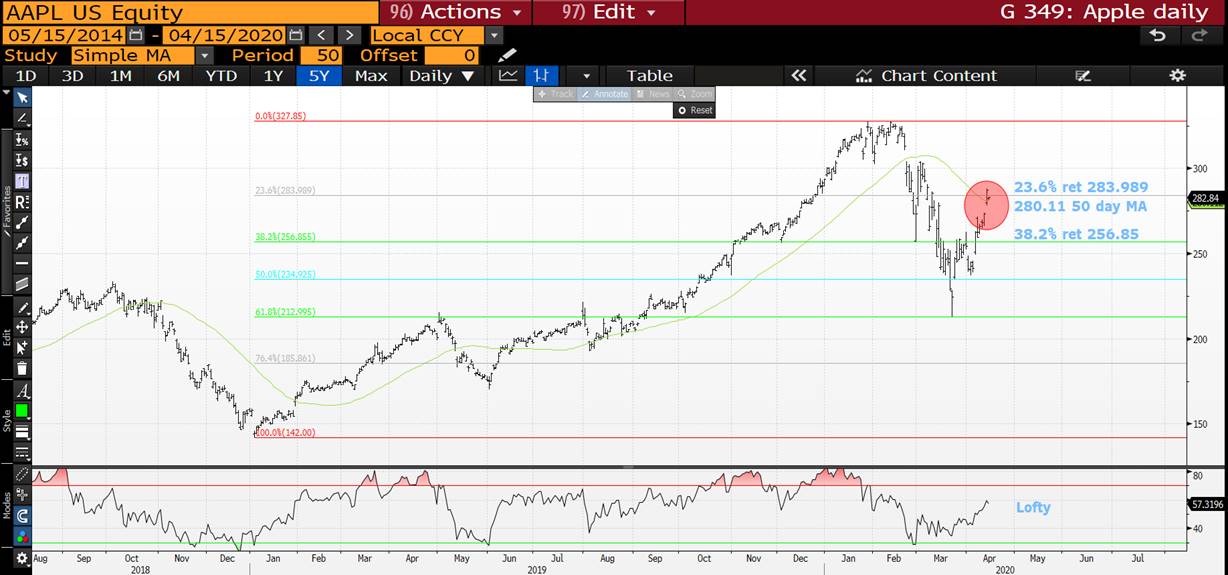

SINGLE STOCKS HAVE REALLY RECOVERED WELL BUT EXPECT HEADWINDS SOON AS RESISTANCE APPROCHES.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: GILTS > Impact of Issuance/QE Expansion on Curve Thus Far

- The Gilts market has had a remarkable 5 weeks. The impact of Covid-19 on the markets has been extraordinary, as has been the UK government’s response to the economic pressures a virtual lockdown of the UK has created. Sunak’s announcement of an additional borrowing need of £45bn in April, in advance of a revision to the 2020/21 issuance need on April 23rd that has steadily climbed over the last month (estimates now well north of £300bn gross issuance) was met with expanded QE operations that, thus far, have helped to prevent a bearish backlash in gilts.

- Those who’ve been following our Gilts RV recommendations since mid-March will know that the interplay between the DMO’s auction cycle and the BoE’s QE eligibility guidelines can create fertile ground for profitable trade ideas. While most of the RV ideas have been of the 3-5bps ‘curve dislocation’ variety – which is bread and butter for most of our clients – we think there is a big enough volume of data now that should allow us to detect broader trends and patterns along the curve in response to the auction/QE operations. As with all of these ‘forensic’ investigations, the inputs we use to analyse the impact are very important. For the sake of brevity, we’ll do our best to keep this from becoming a term paper.

- The basics:

The APF reinvestment of the 4T20s began on March 9th in the usual format of one sector per day, ~£1.45bn each which was expected to run until the start of April. Due to Covid-19, the whole operation was summarily concluded with two rather enormous operations on Mar 20th and 23rd.

The new QE operation began on Mar 24th and was a turbo-charged APF with £3bn per day, £1bn per bucket and scheduled for Tues, Wed and Thurs. At this point, the Chancellor still hadn’t announced the new April auction calendar. Importantly, for RV players, the buckets were adjusted, the mediums extended to 4Q39s from 4Q36s with 4Q40s now the shortest issue in the new 20yr+ bucket.

On March 31st, the BoE’s QE operations were expanded to £4.5bn PER DAY in response to the Treasury’s announcement of additional borrowing needs of £45bn in April. The new 2 auctions per day for 2 straight days was unprecedented for the UK. Not only is this more supply than we’ve ever seen but it has played havoc with the eligibility calendar for QE buying.

As we’ll see from the charts below, the relief trade on Thursdays where there’s QE without supply has started to have a significant impact on the curve. We’ll also approximate the DV01 per APF/QE operation too which could help reveal a pattern…

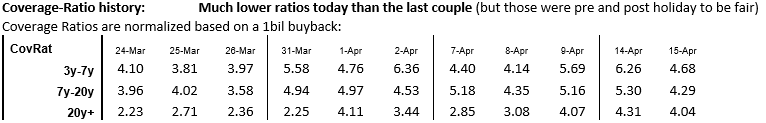

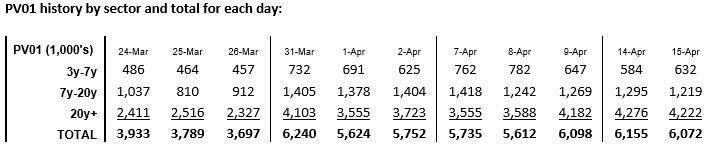

- Some excellent tables provided by my colleague John Wentzell that we’ll borrow for this exercise. The data begins at the start of the QE operations.

- Here’s the auction calendar since Mar 10th, with the PV01s for both issuance and QE since start of April:

Date Issue Size PV01 PV01 of QE Difference

3/10 4T30 £2.587bn £3.4mm

3/17 1T49 £2.3bn £6.33mm

3/19 0F25 £3.25bn £1.66mm

3/20-3/31 NO SUPPLY – APF/QE ONLY

4/1 1F28 £3.3bn £2.975mm £5.624mm +£2.324mm

4/2 1Q41 £2.0bn £4.16mm £5.752mm +£1.592mm

4/7 0E23 £4.06bn £1.14mm

4/7 1T57 £1.562bn £6.05mm £5.735mm -£1.455mm

4/8 4T30 £2.092bn £2.71mm

4/8 225 £2.750bn £1.565mm £5.612mm +£1.337mm

4/9 NO SUPPLY £6.098mm +£4.070mm

4/14 NO SUPPLY £6.155mm +£6.155mm

4/15 0S29 £3.676bn £3.555mm

4/15 1T37 £2.313bn £4.182mm £6.072mm -£1.665mm

We can see that there have only been two days thus far where the PV01 of the auctions was higher than the net PV01 of all the QE bonds bought by the BOE that day.

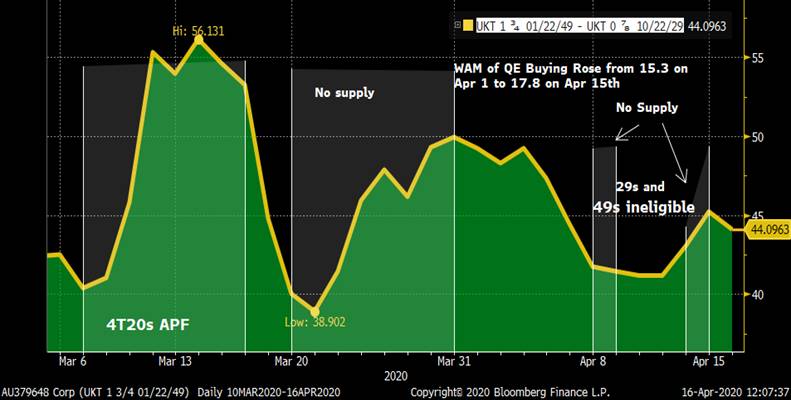

- Charts > Z-sprd curves

0F25-0S29

Clear bull flattening move when supply ended on Mar 20th – then steepened back when supply resumed. The 0S29s were ineligible for QE last week which contributed to the steepening bias.

0S29-1T49

0F25-1T37s

1T37s-1T49s

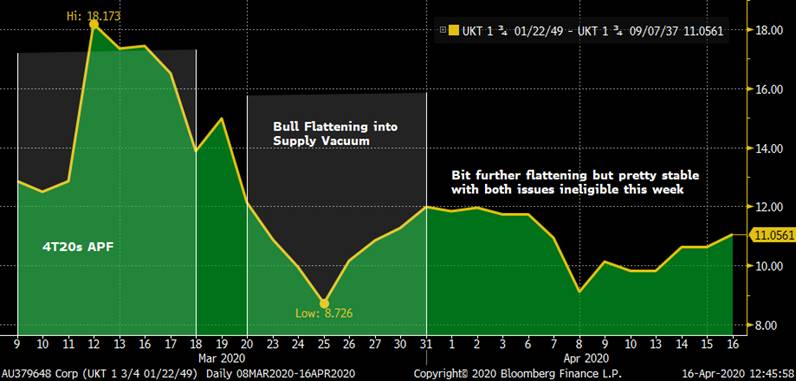

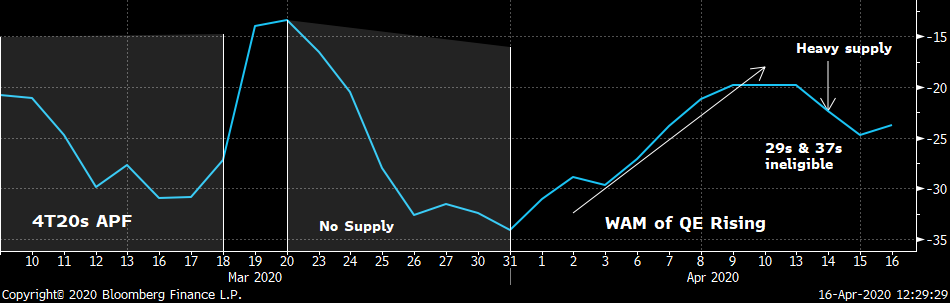

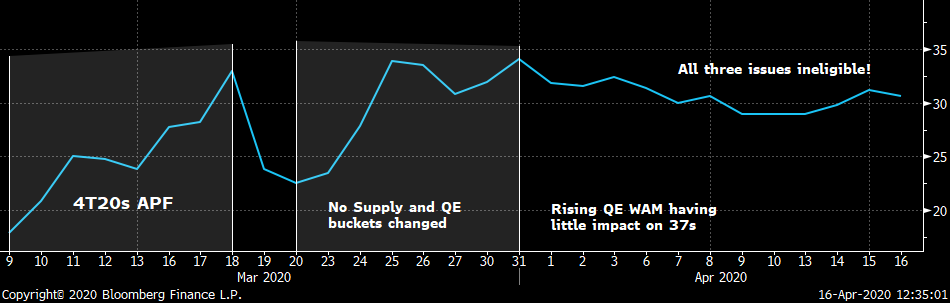

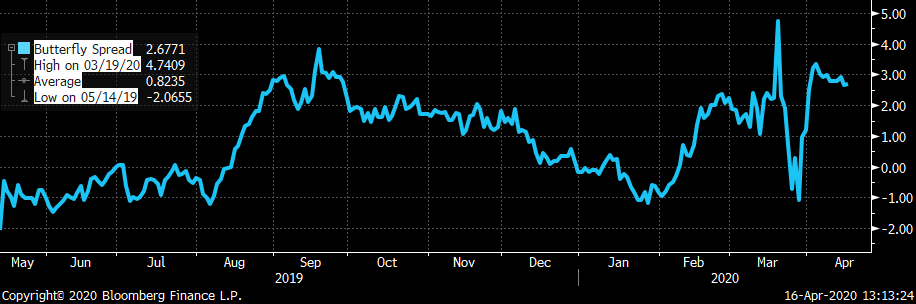

Yield Butterflies

0F25-0S29-1T37

Big richening of 29s when supply dried up in late March. But 29s gave much of that back when QE WAM began to rise.

0S29-1T37-1T49

The 15-20yr sector really hasn’t done much all things considered. The shifting of the 20yr+ bucket to the 4Q40s and their ineligibility weighed. They seem cheap here given the overall flattening bias.

1T37-1T49-1F71

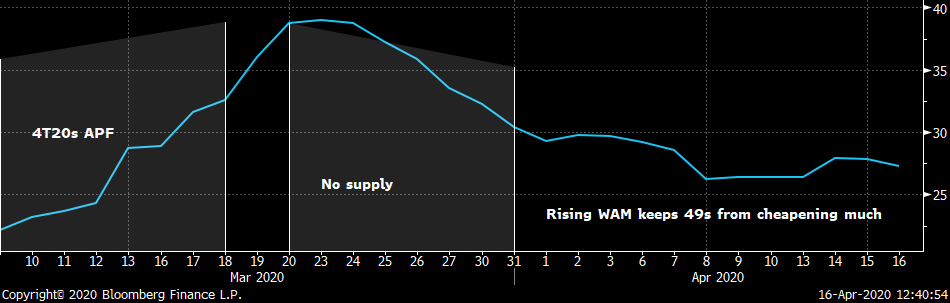

The 49s got clobbered into the end of the APF but rallied nicely when QE kicked into gear. We’ve chopped sideways for most of April though as the market awaits more info on 20/21 issuance.

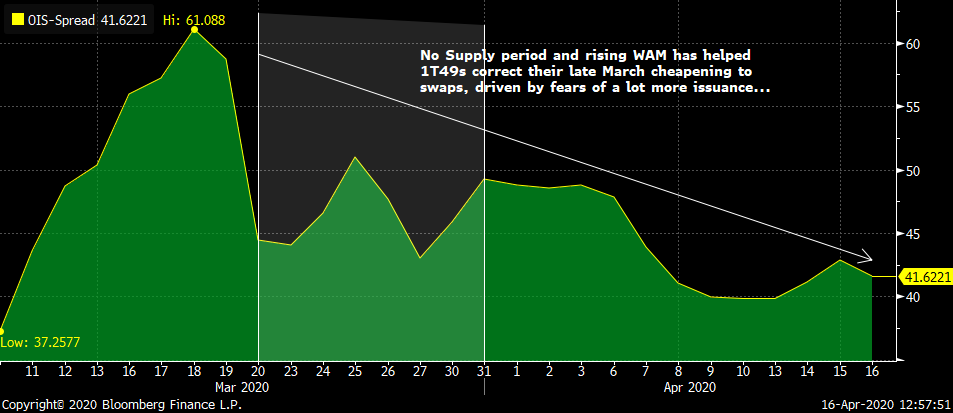

1T49s vs SONIA

There seems little reason to think that this can’t richen some more if QE continues at this pace…

- Other considerations:

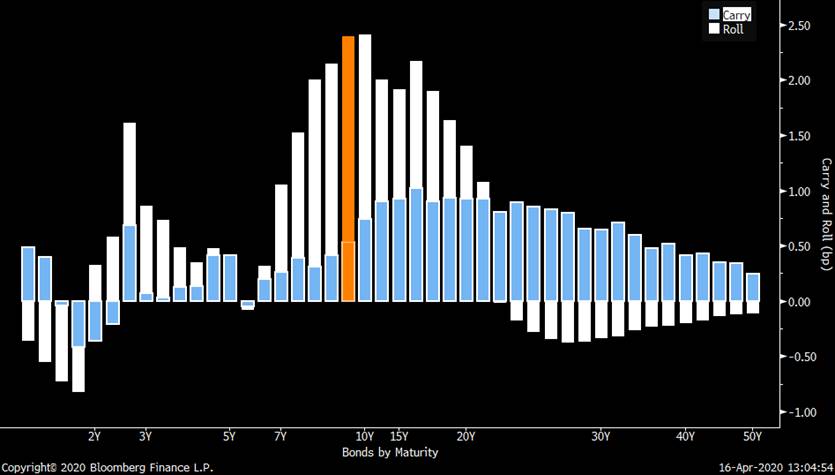

The chart below of carry and roll of the gilts curve is interesting. We can see the ‘sweet spot’ on the curve remains the 10yr sector with the 0S29s the most attractive issue at this point. That said, the 15-20y sector has ample C&R to attract demand and with the 29-37s sprd (for ex) still +36bps and both issues soon to be eligible for QE again, we think this flattener makes sense all things considered.

- Summary… While the charts above don’t reveal any ‘slam dunk’ trade ideas per se, they confirm that the gilts curve is in the midst of an overall long-end driven flattening bias, thanks to the rising WAM of QE purchases. This argues for a continuation of the extension bias we’ve advocated, especially into issues that have lagged due to the QE/auction dynamics. Time to keep an eye on the 1T54s, the next long issue to be tapped and the last ultras until May’s syndication.

UKT 1H47-1F54-3H68 fly

Comments always welcome…

Thanks,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

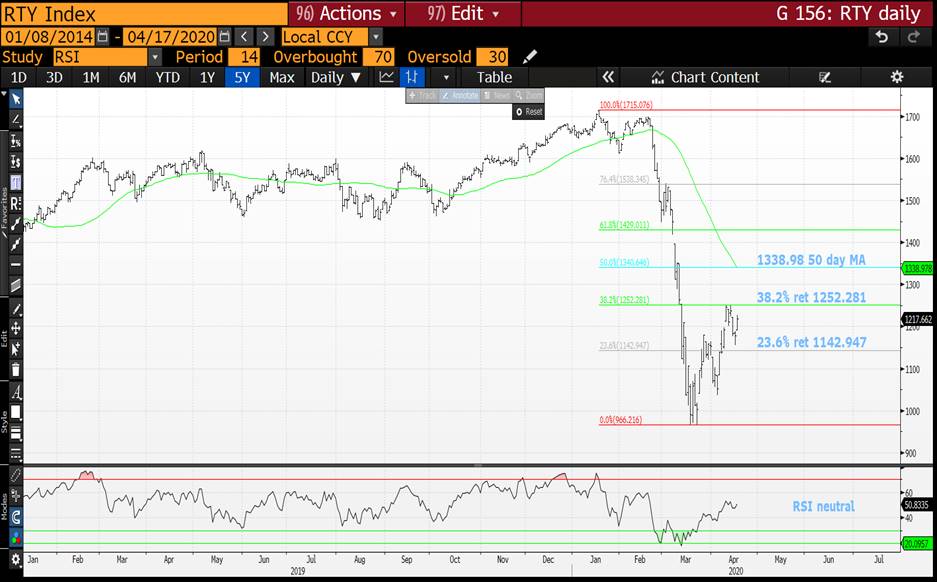

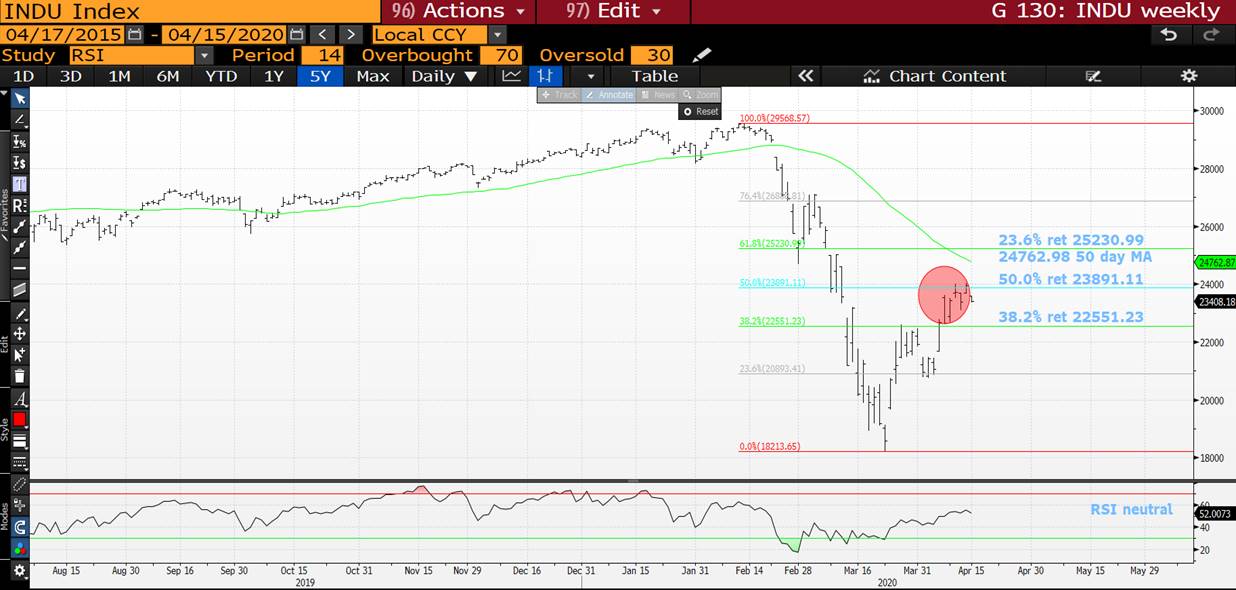

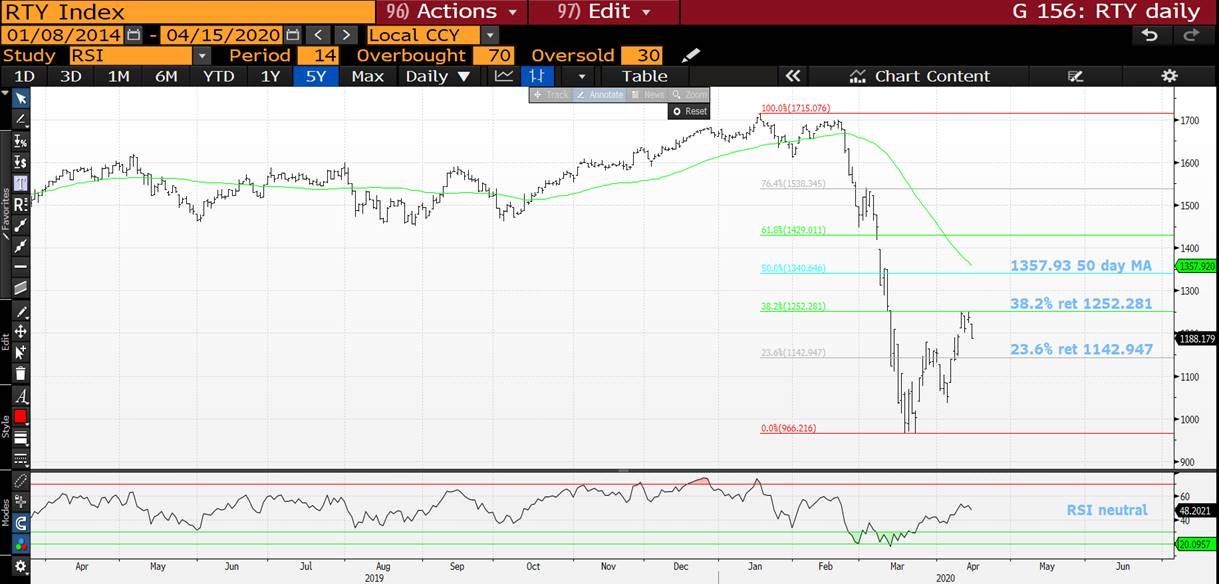

US EQUITIES : TODAY COULD BE THE DAY FOR THE “NEXT LEG LOWER”!

US EQUITIES : TODAY COULD BE THE DAY FOR THE “NEXT LEG LOWER”!

THE US STOCKS ARE NOW IN A SIMILAR POSITION TO THE PRREVIOUS EUROPEAN EQUITY PIECE.

**THERE MUST BE GENUINE CONCERN WE SEE THE RECENT LOWS, SO MANY FAILURE LEVELS ARE AT MEASLY 38.2% RETRCEMENTS.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

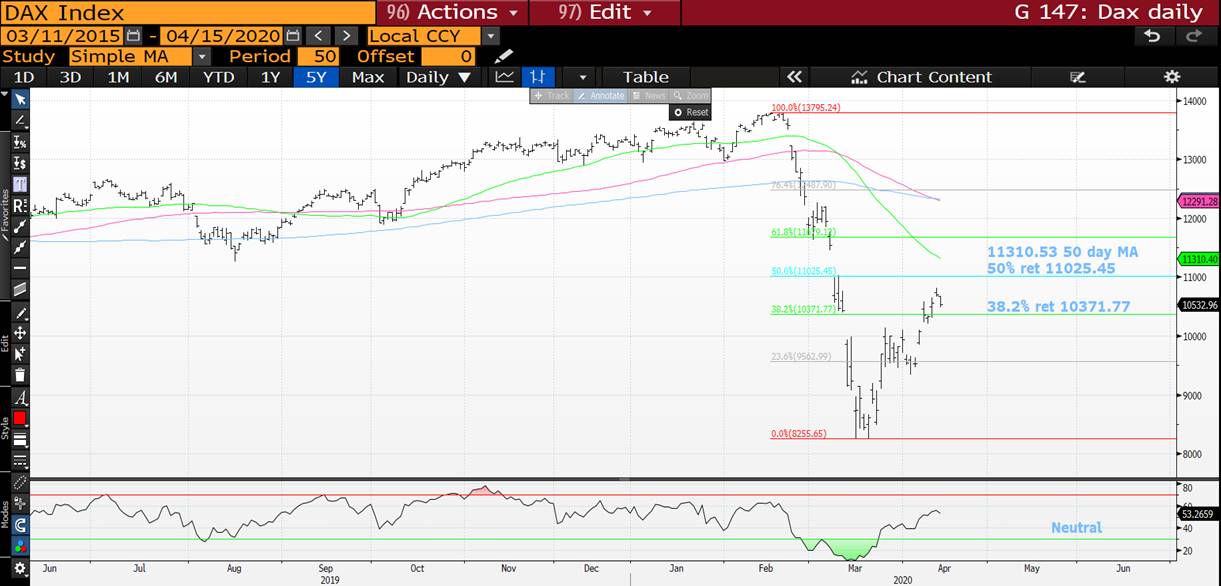

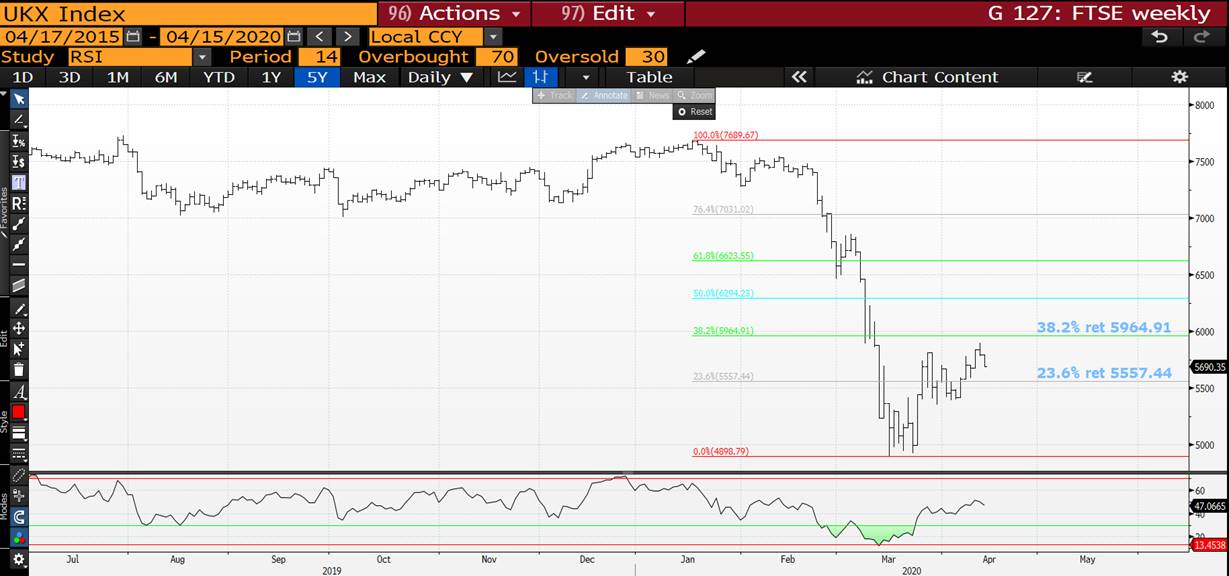

EUROPEAN EQUITIES : ARE THEY ABOUT TO ASSIST THE EQUITY CALL LOWER GIVEN MANY ARE NOW STALLING!

EUROPEAN EQUITIES : ARE THEY ABOUT TO ASSIST THE EQUITY CALL LOWER GIVEN MANY ARE NOW STALLING! LETS SEE IF THEY IMPACT THE LATEST US BOUNCE?

WE HAVE WITNESSED SOME HEALTHY RECOVERIES MOSTLY IN US STOCKS BUT THE LATEST REJECTION IN EUROPE IS PITIFUL, 38.2% RETRACEMENTS IS NOT A GOOD REJECTION POINT.

WE COULD EASILY AND QUICKLY SEE THE LOWS AGAIN. WE STILL HAVE A LOT OF UNFINISHED BUSINESS GIVEN WE FAILED TO ACHIEVE 2008-09 RSI LOWS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MARKET UPDATE : THE CURRENT RATE OF PROGRESS IS CRUSHING THE EFFECTIVENESS OF SO MANY RSI’S.

MARKET UPDATE : THE CURRENT RATE OF PROGRESS IS CRUSHING THE EFFECTIVENESS OF SO MANY RSI’S.

LONGTERM BACK END US YIELD CHARTS STILL POINT TO A LONG-TERM LOW IN PLACE, YET THE FRONT END STILL LOOKS LIKE THEY HAVE ONE MORE NUDGE LOWER.

STOCKS REMAIN A PAIN GIVEN SO MANY MONTHLY CHARTS HAVE FAILED TO EXTEND THEIR RSI’S TO 2008-09 LEVELS, YET ARE NOW RECOVERNG WELL. THIS RALLY DOES NOT FEEL SUSTAINABLE BUT WE SHALL SEE.

SINGLE STOCKS HAVE REALLY RECOVERED WELL BUT EXPECT HEADWINDS SOON AS RESISTANCE APPROCHES.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Euro RV - April 14, James Rice, Astor Ridge

The Shape of things to come…

Bond curves and swaps curves have started to reflect very different expectations in the long end

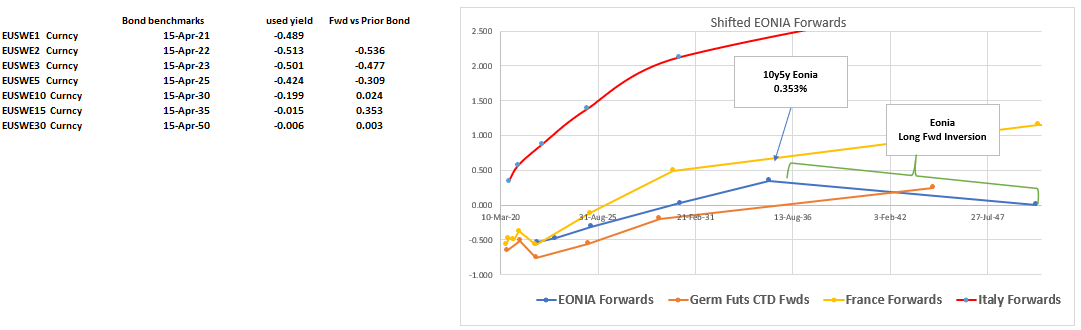

Consider the Forward curves For:

German Futures (CTDs), French Benchmarks, Italian Benchmarks and Eonia Swaps…

Observations

- The Swap curve has a forward rate inversion that could be attributed to convexity, ALM receiving or credit quality

- The bond curves all have upward sloping forward rate curves – not only an expectation of economic recovery and Inflation but also the weight of long end supply from the issuers arising from COVD-19 stimulus packages

- With swaps now collateralised on a mark to market basis – we could view swaps as a very different credit prospect in longer tenors.

Dislocations and Themes

- The theme in ‘Bond-land’ would be to find Fwd rate steepeners at flat or close to 0 – using the discounts from Syndications and other large flows to give us edge

- My fade in Swaps is to find the reverse – to find points on the swap curve where the forward rates rise at a constant or excessive rate and then suddenly invert – for example the 10y5y vs the 15y15y

- And our best edge will be at the confluence of these two themes

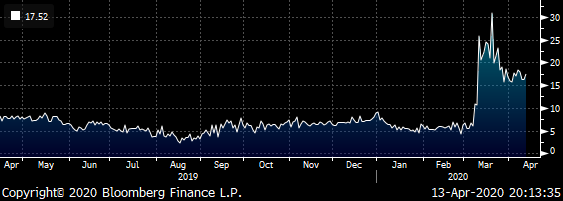

Trade #1 -Eonia Swaps

Receive the top of the fwd rate Curve

Receive 15y vs Pay 10y and 30y

Cix:

(2 * EUSWE15 Curncy - EUSWE10 Curncy - EUSWE30 Curncy) * 100

Levels:

Current: +17.5 bp

Entry: +17 bp (25% risk)

Add: +24 bp (75% risk)

Target: +5.5 bp

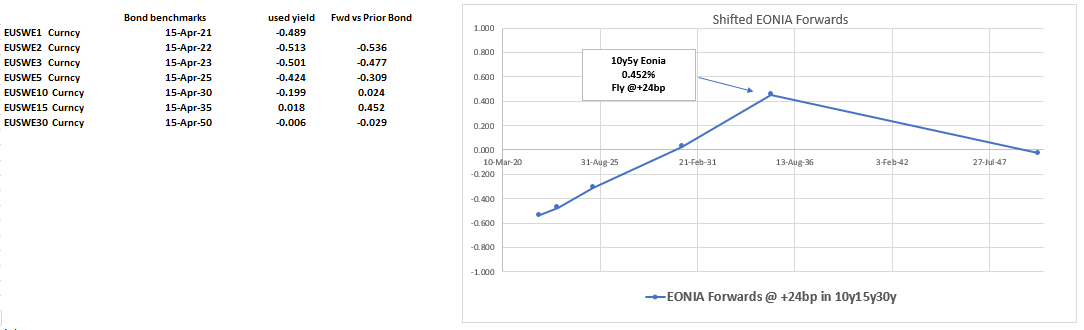

How does the Value look at the major Add level of +24bp?

- If we get to the Major add level- we have set is at a point where the slope of the forward curve from 5y5y to 10y5y would be greater than prior points on the curve.

- Also the inversion in forwards from 10y5y to 15y15y would be even more inverted – that would seem an ‘overly-informed’ is dislocated shape of the curve

- So for Risk management we put some on here and add at the extremes in the knowledge of the value rather than pure history

Graph of forwards but with 10y shifted such that the 10y15y30y fly is @ +24bp

Risks

- These tenors remain disconnected for protracted periods of time

- The 15y cheapens relatively

More to follow

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Tues Apr 14th

Business Briefing

1) Commodity Currencies Rally on China Data Beat: Inside G-10

(Bloomberg) -- Commodity currencies advanced as risk sentiment received a boost after China’s exports data beat estimates.

- Norway’s krone was the biggest gainer among Group-of-10 currencies, helped by a rise in crude prices. Australia’s dollar climbed for a seventh session as the China trade report allayed concerns about global demand for commodities

- China’s exports in yuan terms declined 3.5% from a year earlier in March compared with ...

2) North Korea Fires Several Short-Range Missiles, South Korea Says

(Bloomberg) -- North Korea fired multiple projectiles that appeared to be short-range missiles toward waters off its eastern coast on Tuesday, South Korea’s Defense Ministry said. Multiple air-to-surface missiles were fired from fighters jets, with the missiles flying about 150 kilometers (90 miles), the Yonhap News Agency said, citing the South Korea’s Joint Chiefs of ...

3) Stocks Climb Ahead of Earnings; Dollar Slips: Markets Wrap

(Bloomberg) -- Global stocks pushed higher Tuesday ahead of one of the most uncertain earnings seasons on record as the coronavirus pandemic rattles the world economy. The dollar retreated. Stocks climbed across Asia with benchmarks in South Korea and Japan pacing gains. U.S. futures rose after the S&P 500 Index retreated overnight and European contracts pointed higher. ...

4) Renault Scales Back China Presence by Exiting Dongfeng Venture

(Bloomberg) -- Renault SA is scaling back its already limited presence in China, with the French carmaker agreeing to transfer its 50% stake in a local venture to partner Dongfeng Motor Corp. as the coronavirus outbreak weighs on car demand. The manufacturers entered a preliminary agreement over the stock transfer, Renault said in an emailed statement Tuesday, without ...

World News Briefing

5) Trump Declares He Has ‘Total’ Authority to Reopen After Virus

(Bloomberg) -- President Donald Trump declared he has “total” authority to order states to relax social distancing to combat the coronavirus outbreak and reopen their economies, and warned that governors who refuse would face political consequences. Asked what provision gives the president the power to open or close state economies, Trump said: “Numerous provisions. We’ll ...

6) India Extends Lockdown; Countries Weigh Reopenings: Virus Update

(Bloomberg) -- Countries across the globe weighed the timing for easing restrictions, as hot spots showed slower rates of infections. India extended its lockdown, following a similar move by France. In the U.S., governors formed coalitions for the reopening of their economies, setting up a potential clash with President Donald Trump, who insisted he alone has that ...

7) China Says Hong Kong Lawmakers’ Stall Tactics Could Breach Oaths

(Bloomberg) -- China’s top agency overseeing Hong Kong said lawmakers blocking action by the local legislature were potentially violating their oaths, in a signal that Beijing was losing patience with the months-long legislative logjam. The Hong Kong and Macau Affairs Office urged the city’s Legislative Council in a statement released Monday to end the stalemate and resume ...

8) Crisis Gives Germany Sense of Vindication for ‘Black Zero’ Years

(Bloomberg) -- Now Germany is deploying its financial firepower to fight the coronavirus crisis, convincing the country that it was wrong to shun budget deficits for many years just got even harder. The government of Europe’s biggest economy has long faced calls by officials from the International Monetary Fund and the European Central Bank, to the U.S. administration of Donald Trump ...

9) Trump Defends His Coronavirus Record With Anger, and a Video

(Bloomberg) -- President Donald Trump declared “everything we did was right” and angrily denounced media reports suggesting his administration had failed to adequately ramp up coronavirus testing or the production of medical supplies in a testy press conference Monday at the White House. Trump, who said he was frustrated by the reports questioning his administration’s response ...

Bonds

10) Credit Markets in Asia Catch Up to Fed Rally With China Bullish

(Bloomberg) -- Credit markets in Asia returned Tuesday from a public holiday playing catch-up to the improvement in sentiment in the U.S., prompted by the Federal Reserve expanding its bond-buying program to include some high-yield securities. Spreads on top-rated Asian dollar bonds declined while the cost of credit-default swaps retreated, according to traders. China ...

11) Malaysia’s Oil Giant Markets Jumbo Bond as Asian Credit Rallies

(Bloomberg) -- Malaysia’s Petroliam Nasional Bhd. has started marketing a jumbo dollar bond offering Tuesday, in another sign of the easing strain in the region’s credit markets. The offering by the energy company known as Petronas comes only a few days after Indonesia sold its biggest-ever dollar note for funds to help fight the coronavirus crisis, following a lull in the ...

12) Japan’s Fukoku Mutual Prefers Equities Over Debt as Yields Slide

(Bloomberg) -- Equities continue to generate superior stable income over debt, Yusuke Onodera, general manager at Fukoku Mutual Life Insurance Co. in Tokyo, says in an interview.

- Co. can invest in foreign stocks via funds to get both income and capital, Onodera said. His comments come as Fukoku on Tuesday announced its allocation plan for the fiscal year that began April 1

- Co. plans to boost domestic equities holdings by 20b yen and plans to increase foreign ...

13) How the BOJ’s Massive Market Operations Make and Break Investors

(Bloomberg) -- Just when it seemed impossible to do more, along came the coronavirus, spurring the Bank of Japan to double-down on its already massive market operations. The BOJ’s presence is now felt in virtually every corner of Japan’s financial markets and its actions continue to shape global money flows. The first quarter of 2020 saw the central bank add a staggering 30 ...

14) Intelsat Seeks Bankruptcy Loan to Stay Afloat Until C-Band Sale

(Bloomberg) -- Intelsat SA is seeking backers for a bankruptcy loan that would keep the satellite service in business under Chapter 11 court protection while it’s waiting for billions of dollars in proceeds from a government spectrum auction. JPMorgan Chase & Co. is shopping the debtor-in-possession loan to institutional investors, many of whom specialize in financial ...

15) FX/RATES DAYBOOK EUROPE: AUD Extends Winning Run, NOK Jumps

(Bloomberg) -- The Australian dollar climbed for a seventh day as commodity currencies rallied, with its gains aided by better-than-expected Chinese trade data. That’s even as Australian business confidence plummeted to the lowest on record. The Norwegian krone led gains in Group-of-10 currencies against the greenback as oil prices rose. TODAY ...

Central Banks

16) Indonesia Seen Cutting Rate Amid Pandemic: Decision Guide (1)

(Bloomberg) -- Indonesia’s central bank is expected to lower borrowing costs for a third straight month as policy makers take unprecedented steps to bolster the economy amid the coronavirus pandemic. Bank Indonesia will cut its benchmark rate by 25 basis points Tuesday to 4.25%, according to 18 of 28 economists surveyed by Bloomberg. One economist predicted a 50 basis-point ...

17) Commodity Currencies Rally Fueled by China Data: Inside G-10

(Bloomberg) -- Commodity currencies advanced as risk sentiment received a boost after China’s exports data beat estimates.

- Norway’s krone rose 1% against the dollar to become the biggest gainer among its Group-of-10 peers, followed by the Australian dollar

- China’s exports in yuan terms declined 3.5% from a year earlier in March compared with forecast for a 12.8% fall

- “The China data beat definitely plays a part in fueling the risk-currencies’ rally -- it’s ...

18) EM Day Ahead: Indonesia Rates, Poland Trade, Brazil Activity

(Bloomberg) -- Focus will be on Indonesia’s central bank, which is expected to cut the key rate for a third time this year to limit the hit to growth from the Covid-19 pandemic. Helping to convince Bank Indonesia to act looks to be the Federal Reserve’s $60 billion lifeline to provide developing nations with dollars, which helped trim losses for Asia’s worst emerging currency. ...

19) Capitec Withholds Dividend on Central Bank’s Virus Guidance

(Bloomberg) -- Capitec Bank Holdings Ltd. decided against paying a final dividend after South Africa’s central bank urged lenders to withhold shareholder payouts to conserve cash amid the coronavirus pandemic. The Stellenbosch-based lender typically pays out 40% of earnings before one-time items in dividends, Capitec said in an earnings release on Tuesday. Adjusted earnings ...

20) China Agriculture Imports From U.S. Rose 110% in 1Q (1)

(Bloomberg) -- China 1Q exports to U.S. fell 23.6% y/y in yuan terms, China’s customs spokesman Li Kuiwen speaks at press conference in Beijing.

- China 1Q imports from U.S. was down 1.3% y/y in yuan terms

- China imports of pork, soybean, cotton from U.S. rose in 1Q

- China’s trade is facing bigger difficulties: Customs ...

Economic News

21) Italy’s Crisis Funds May Come Too Late for Desperate Businesses

(Bloomberg) -- Italy’s companies and small businesses desperately need the 740 billion euros ($807 billion) the government pledged to keep the economy afloat through the pandemic recession. By the time the money arrives, it might be too late. Banks, which have to channel most of the aid to recipients, “have to follow standard procedures because part of the financing risk ...

22) China’s Trade Fell Less Than Expected Even as Virus Spread

(Bloomberg) -- China’s trade performed better than expected in March, with both exports and imports declining less than expected even as the coronavirus prompted business shutdowns around the world.

- Exports declined 6.6% in dollar terms in March from a year earlier, while imports fell 0.9%, the customs administration said Tuesday. Economists had forecast that exports would ...

23) Goldman Sees Advanced Economies Shrinking 35% Amid Pandemic

(Bloomberg) -- Advanced economies will shrink about 35% this quarter from the prior three months, four times as much as the previous record set in 2008 during the financial crisis, according to annualized figures from Goldman Sachs Group Inc. How fast economies will rebound is an open question because nobody knows how quickly people can get back to work, New York-based ...

24) Australia Treasury Sees Unemployment Soaring to 10% This Quarter

(Bloomberg) -- Australia’s jobless rate will almost double this quarter, the nation’s Treasury estimated, as the shutdown of large swathes of the services industry upends the labor market. Unemployment will soar to 10% in the three months through June, from 5.1% in February, Treasurer Josh Frydenberg said Tuesday, citing department forecasts. Without the government’s ...

25) U.K. Likely to Announce Lockdown Extension This Week, Raab Says

(Bloomberg) -- British ministers will decide in the next three days on extending the country’s lockdown, with Foreign Secretary Dominic Raab telling reporters it was likely to carry on and the government’s chief scientific adviser saying he expects the daily rate of deaths to continue to rise. Under the law passed last month to tackle the spread of coronavirus throughout the ...

European Central Bank

26) ECB’s Guindos Says Genuine Recovery Might Not Show Until 2021

(Bloomberg) -- Europe is likely to experience a more severe recession than the rest of the world and might not show proper signs of recovery until next year, according to European Central Bank Vice President Luis de Guindos. Economic prospects are worsening as governments across the 19-nation euro area extend lockdowns to rein in the spread of the coronavirus. The French ...

27) BIS: Luis de Guindos: Interview in La Vanguardia

What is your assessment of the global economic situation in the midst of this coronavirus crisis? The global economy will enter recession and so will the European economy, albeit an even more severe one. The ultimate fall in GDP will depend on how long the lockdown lasts. International bodies have calculated that the economy will shrink by 2% to 3% for each month of lockdown. So one and a half months ...

28) BIS: Christine Lagarde: Interview in Le Parisien 14 Apr 2020

29) BIS: Christine Lagarde: Interview in Le Parisien

From Emmanuel Macron's repeated references to "war" to Queen Elizabeth II invoking the spirit of the Blitz, memories of the darkest hours in our history are resurfacing. Are we in effect facing a war? There are probably points of comparison. What is certain is that an invisible enemy is severely testing our healthcare systems and our extraordinary healthcare workers. And that same enemy is putting ...

30) Daily Bitcoin: ECB Expects Worse Recession in Europe Than Global Economy

The European Central Bank (ECB) expects the European economy to suffer a more severe recession than the global economy. Countries across the euro area will experience “a deep recession,” which entails unprecedented funding needs of more than €1 trillion ($1.1 trillion), explained ECB Vice President Luis de Guindos. Also read: IMF Declares Global Recession, 80 Countries Request Help, Trillions ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

FW: fwd steepeners

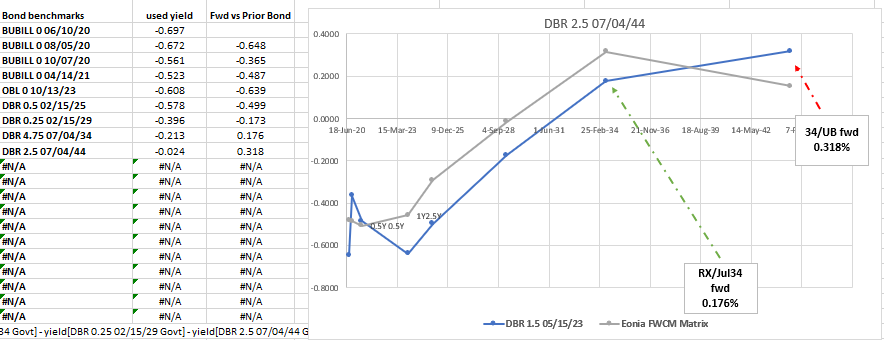

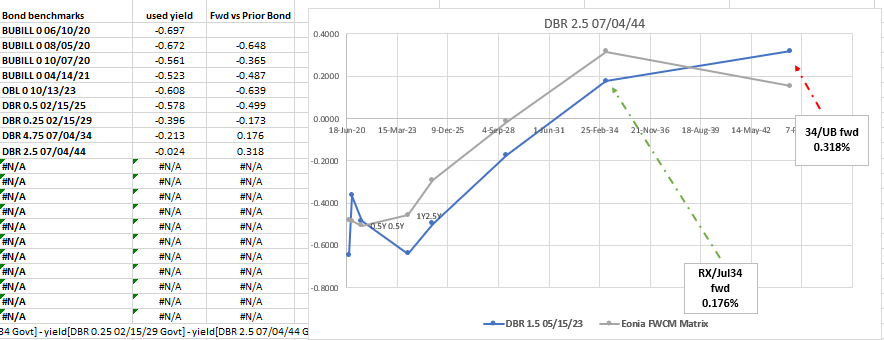

Apols – I missed the may addition of 2035 (15yr) Germany as pointed out by David Sansom

New maturity segments for Bunds

The Federal government intends to introduce two new maturity segments for the Federal bond instrument in the second quarter of 2020.

In May 2020, a 15-year Federal bond maturing in May 2035 (ISIN DE0001102515) will be issued. A reopening of € 2.5 billion in size is planned Number 2 on 7 April 2020 Page 3 of 9

in June. The new issue in May is intended to be carried out via syndicate, while the reopening in June is to take place by auction as usual.

explains the cheapness – still like it but on hold for the best level

From: James Rice

Sent: 09 April 2020 11:46

Subject: fwd steepeners

- I like this trade

{GE} -rx +2034s -ub

weights: -.5 / +1 / -.5

cix:

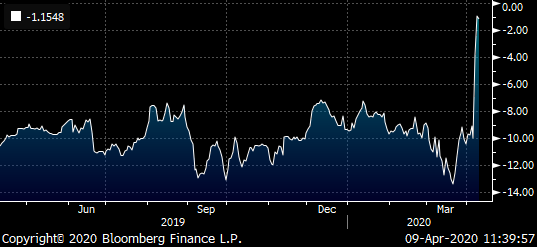

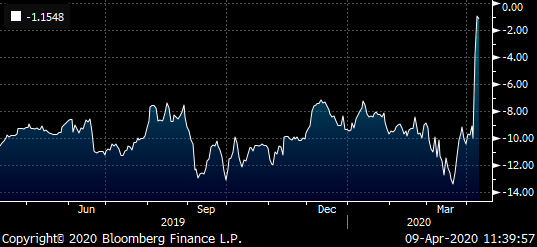

(2*yield[DBR 4.75 07/04/34 Govt] - yield[DBR 0.25 02/15/29 Govt] - yield[DBR 2.5 07/04/44 Govt])*100

so a proxy for a fwd rate steepener and relatively liquid too (futures on the wings)

there's been talk of tapping the old high coupons but nothing shown in quarterly planning

We're at a level I would have 15-20% on

current: -1.1bp

entry : here (20%)

add : +3bp (80%)

Target: -7bp

forwards look decent

Forwards:

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

fwd steepeners

- I like this trade

{GE} -rx +2034s -ub

weights: -.5 / +1 / -.5

cix:

(2*yield[DBR 4.75 07/04/34 Govt] - yield[DBR 0.25 02/15/29 Govt] - yield[DBR 2.5 07/04/44 Govt])*100

so a proxy for a fwd rate steepener and relatively liquid too (futures on the wings)

there's been talk of tapping the old high coupons but nothing shown in quarterly planning

We're at a level I would have 15-20% on

current: -1.1bp

entry : here (20%)

add : +3bp (80%)

Target: -7bp

forwards look decent

Forwards:

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796