MICROCOSM: BTPS Supply This AM... Is it Safe? RV Colour/Ideas

BTPS Supply This AM... RV Colour

- So, we've got another Eurogroup meeting at 5pm, well after this am's BTPS auction and before a 4 day holiday weekend (depending where you live). German officials swear up and down a deal is imminent and the ECB's QE efforts have done a pretty good job of limiting any damage caused to BTPS of late. (Case in point, 10yr DBR-BTPS sprds opened at +16bps yesterday on fears of no Eurogroup deal and by lunchtime they were just +5bps - an 11bps correction on no new info)...

- That said, it seems unless something looks really out of whack, RV interest in this am's auctions is likely to be tepid at best. Let's see whether there’s a trade here.

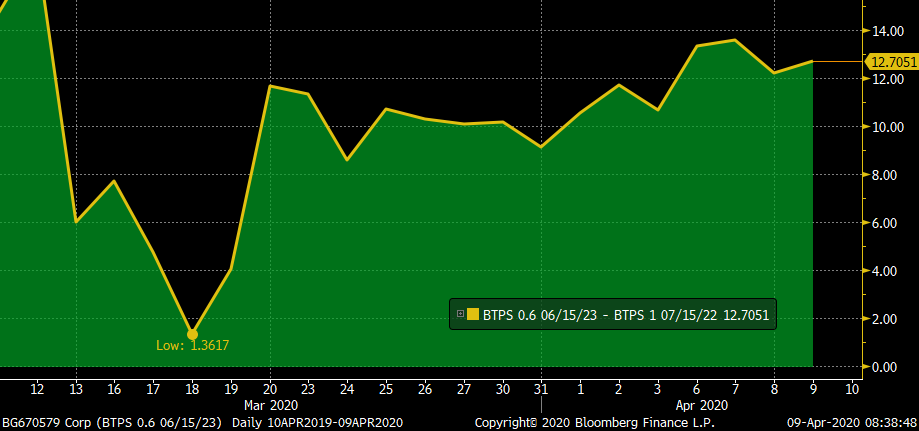

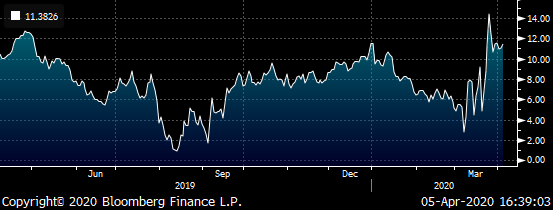

- BTPS .6 6/23 - cheapened 30 basis points in yield since Monday (!), 6/23-10/23 yield sprd is just 3bps, they've got ~16bps of C&R over 3 mos and on fly vs 3/15/23 and 10/23s they're at their cheapest since Mar 24 at +2.8bps mid. The pick-up from BTS contracts (7.22) into these BTPS 6/23s is +14bps mid this am. These should fly off the shelf.

BTPS 7/22-BTPS 6/23 Z-sprd box

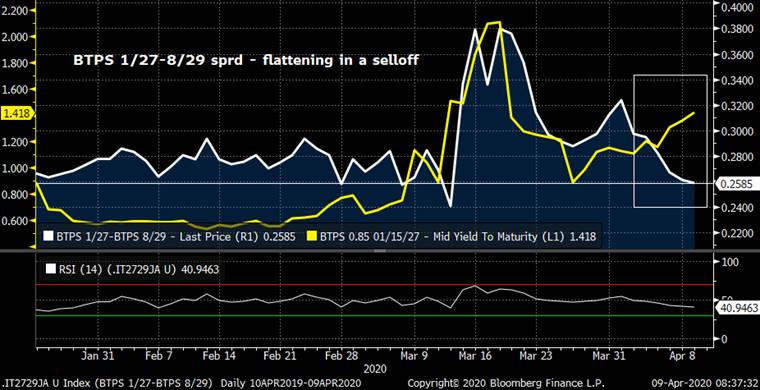

- BTPS 0.85 1/27 - Yet MORE 7yr supply, on the heels of deals from Spain, Belgium and Ireland. Interestingly, those deals have done well with their deal concessions attracting ample demand and the market's faith has been rewarded as 7-9/10s has steepened in each of them. The .85 1/27-3 8/29 (IKM0) yield sprd has flattened 8bps back to the lows since Apr 1 and the steepener has 6bps+ of positive C&R. They've cheapened almost 25bps in yield this week and the 7/26-1/27-8/27 fly is at its cheapest since Mar 12th. Not a slam dunk but these 1/27s look pretty damn cheap to me.

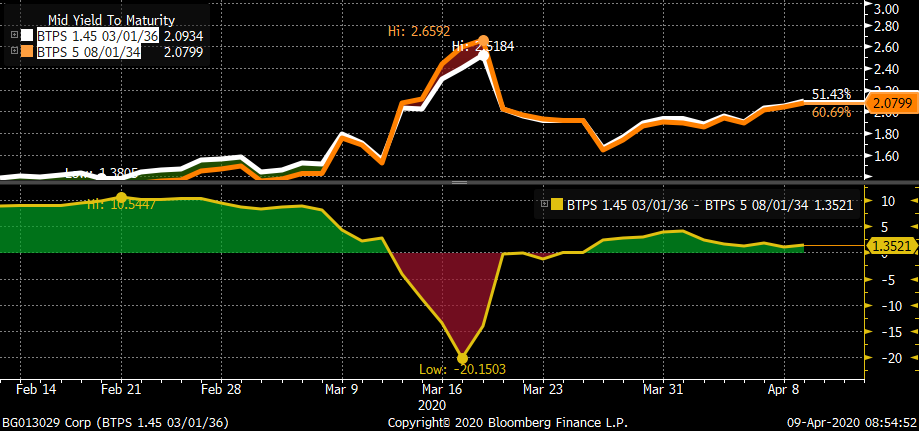

- BTPS 1.45% 3/36 - First tap of the 9bn syndicated deal brought on Feb 11th. The issue has held its own on the curve so far but there was a 2 week window into the end of March where the 15-25yr sector of the BTPS curve became VERY difficult to trade. Volatility was high, balance sheet scarce and risk appetites very low. Having the lowest coupon beyond the BTPS 0.95 8/30s helps them somewhat, not just from a convexity standpoint but also from a credit point of view as we’d expect them to outperform their higher coupon neighbours if things got ugly in BTPS. This helps explain why these BTPS 3/36s trade .7bps THRU the BTPs 3.35 3/35s. As with the 23s and 27s, we’ve seen a nice cheapening on an outright basis, currently 2.09% having started the week at 1.90%. As we can see from the chart below, the BTPS 3/36s trade at a small pick-up over the BTPS 5 34s and slightly through the BTPs 3/35s. We can also see from the chart that when the wheels fell off in mid-March, the 3/36s outperformed the 34s by 20bps at one point. With the ECB backstopping BTPS this kind of mayhem seems less likely, however, it does suggest that the relative safety of these low-coupon BTPS 3/36s is worth owning and should provide support at today’s tap. No, not a slam dunk but supportive nonetheless.

- BTPS 4.75 9/44 > High coupon issue with few redeeming features other than a dealer who really needs them as this has ‘reverse inquiry’ all over it. That said, the issue has cheapened a bit on the curve into this am’s tap. The tap is capped at 750mm so not a massive amount of risk. Unless you really need them, we’re steering clear of this illiquid issue.

We’ll be in touch!

Thanks

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

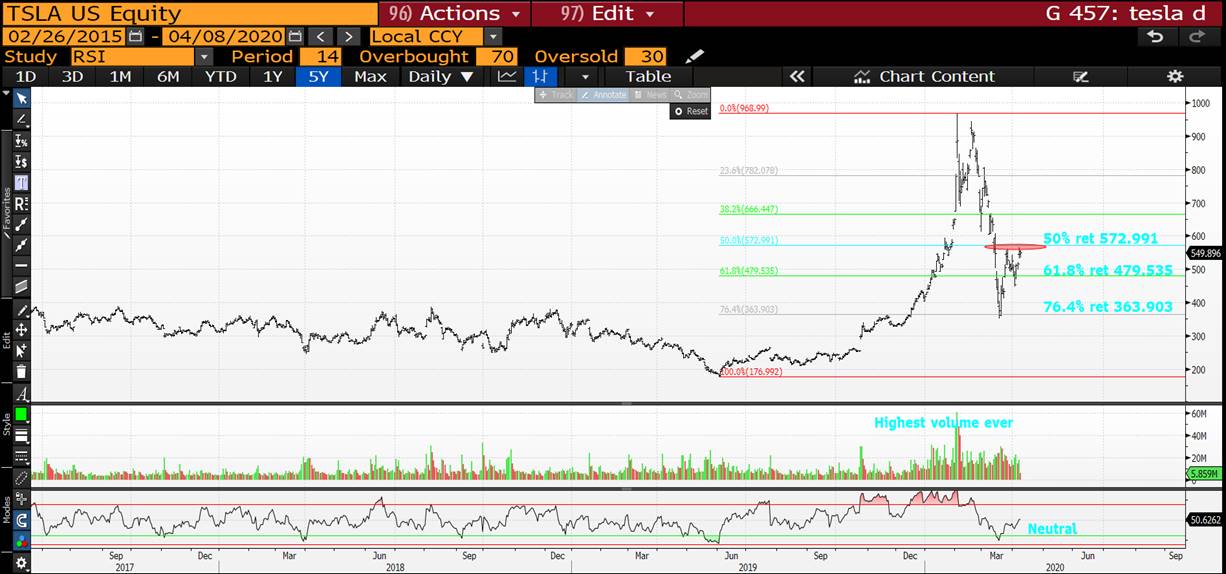

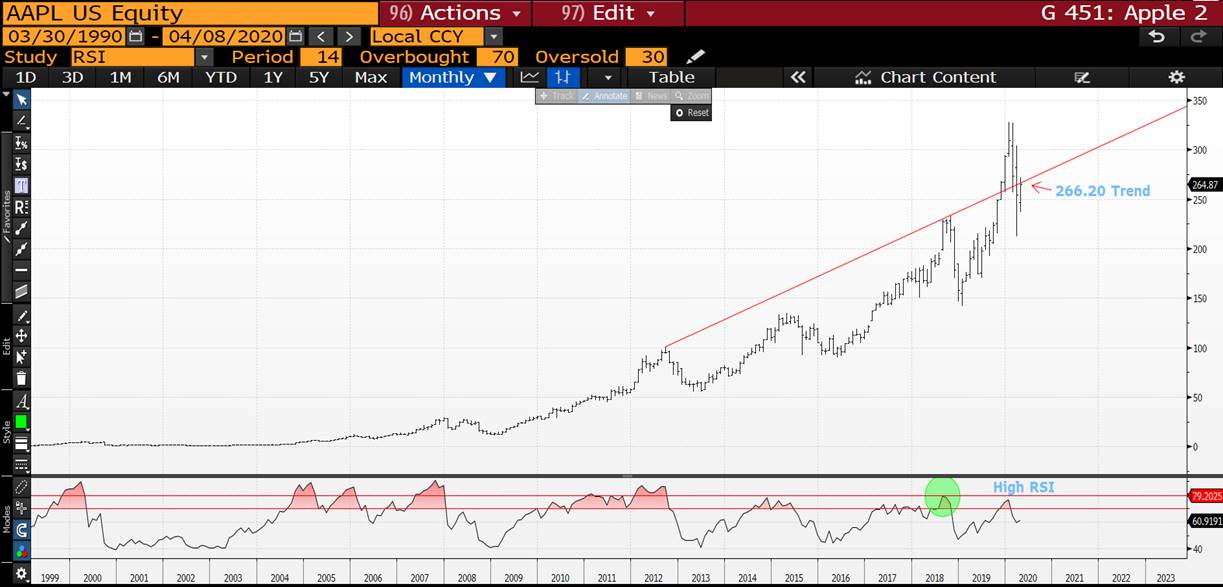

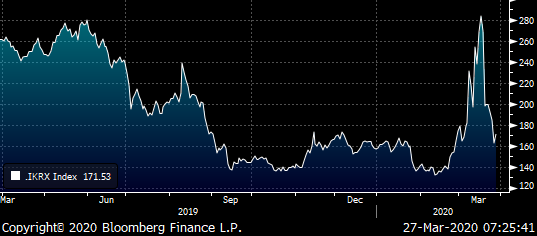

STOCKS COULD JUST HAVE A “WOBBLE” HERE ESPECIALLY IF APPLE AND TESLA FAIL TODAY.

STOCKS COULD JUST HAVE A “WOBBLE” HERE ESPECIALLY IF APPLE AND TESLA FAIL TODAY.

**SINGLE STOCKS COULD BE THE ONES TO WATCH, TESLA (AGAINST A MONTHLY BOLLINGER) AND APPLE (AGAINST A MULTI YEAR TREND LINE).**

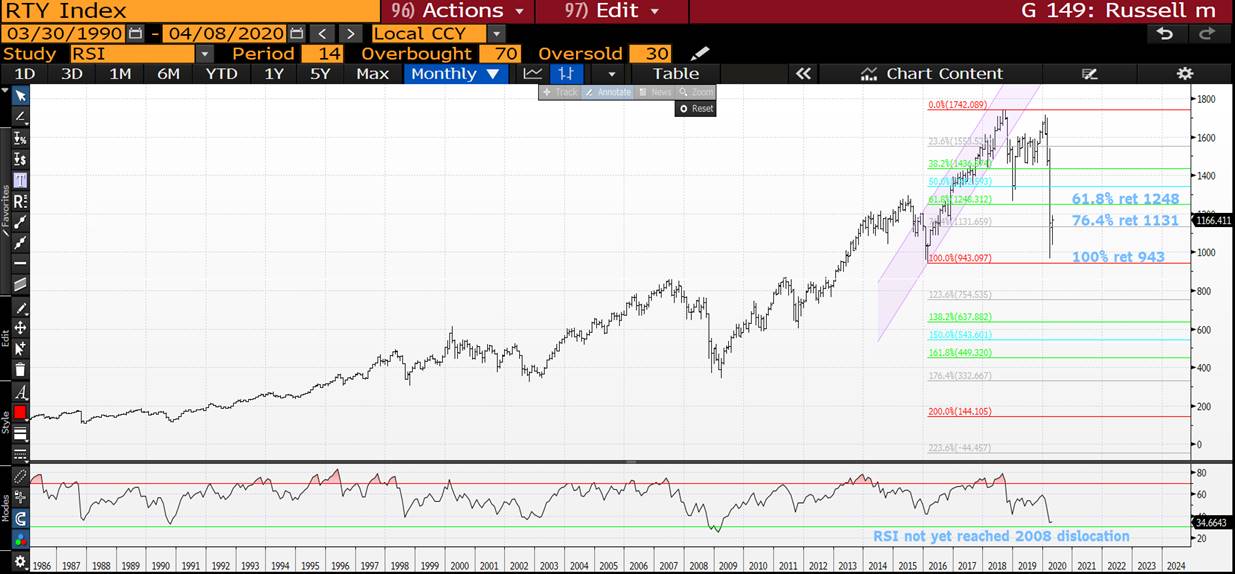

EQUITIES FOR ME CONTINUE TO BE ON WATCH ESPECIALLY SINCE THE INITIAL DROP FAILED TO REACH 2008-09 DISLOCATION, THE RESULT IS WE MAY STALL AT ANY MOMENT. THE RESULT IS I AM “TWITCHY” AT ANY PAUSE, TODAY MIGHT BE ONE.

THAT SAID MANY WEEKLY RSI’S REMAIN 2008 LOW WHILST THE DAILY RSI’S ARE NOW NEUTRAL POST THE LATEST RECOVERY.

**A TOUGH CALL BUT LOWER LOOKS THE PATH OF LEAST RESISTANCE, UNTIL WE GAIN A 2008 DISLOCATION-SHAKE DOWN.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MARKET UPDATE : THE TAIL OFF IN VOLATILITY IS KILLING MANY RSI OPPORTUNITIES, THAT SAID IT STILL LOOKS LIKE BOND YILEDS WILL HEAD LOWER AIDED BY MARCH 9TH BOLLINGER PIERCES.

MARKET UPDATE : THE TAIL OFF IN VOLATILITY IS KILLING MANY RSI OPPORTUNITIES, THAT SAID IT STILL LOOKS LIKE BOND YILEDS WILL HEAD LOWER AIDED BY MARCH 9TH BOLLINGER PIERCES. MAINTAINING THESE PIERCES IS KEY!

STOCKS REMAIN A PAIN GIVEN SO MANY MONTHLY CHARTS HAVE FAILED TO EXTEND THEIR RSI’S TO 2008-09 LEVELS, YET ARE HOLDING. WE HAVE A BASE JUST NEED MORE CONVICTION, THIS WITH SO MANY DAILY RSI’S NEUTRAL. IT MAY COME IF BOND YIELDS HEAD HIGHER.

SINGLE STOCKS REMAIN IN A VERY NEGATIVE TERMINAL STATE BUT ARE FINDING A SUPPORT.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Macro RV, April 6th - James Rice @Astor Ridge

“Two Bonds Good, One Bond Better”

Taking a lead from Animal Farm, by George Orwell

“Four legs good, two legs better! All Animals Are Equal. But Some Animals Are More Equal Than Others.”

Animal Farm, George Orwell

Thoughts

Liquidity has been and will continue to be a major challenge

Many relationships in the RV world hit new extremes in the second half of March. Until that rolls out of recent memory, Bid / Offer friction and Var will remain high

How do we combat this?

- Sparse Curve Builds – looking to build forward curves from a very sparse set of points

- Using Futures – maximising liquid futures and benchmarks in trade expression

- Waiting for trades to be at value extremes using much ‘wider’ (disparate tenors) constructs

- Allowing for Friction – we need to not only expect friction on entry – working with the dealer community, but need to expect that on exit too

- Scaling – as var of relationships increases, it seems that a portfolio approach of with trades coming and going makes sense. Just a handful of trades will get to the extreme levels where they start to become a very strong conviction trade. That doesn’t mean that we don’t make money with the others – we express and take off without getting deep into adding territory

- Comparison – when the vol of value trades increases , we need to be conscious of how big the opportunities are elsewhere to maximise relative Sharpe Ratio

- Leaving orders – if you leave a mess outside someone’s door and tell him to clear it up you’ll get short shrift. If you ask someone to work with you to tidy up a mess you, might get somewhere. So it is with trading. It’s not that dealers lack appetite. They are economic agents. The system is strained with many working from home. So we have to sacrifice some probability of getting done in return for getting an acceptable level at which we may get done – leaving an order

What remains the same?

- Value – the boundary conditions dictated by forward rates still determine the entry points

- ‘fair’ – we’re still seeing a mean reversion to value

- Themes – two major these are in play; QE and issuance. QE is undoubtedly sub-optimal but can be large. John W puts out an excellent piece on the UK when it is ‘full’ on certain issues. that seems to be the nadir in value terms. Issuance means steeper curve. So we buy forwards at flat to longer ones, where it’s out of context to the curve.

- Polarisation – Hedging instruments still to reflect extremes – witness the rich / cheap in the Italian IK and BTS futures at either side of the credit cycle. But for every futures buyer, there’s a seller. These distortions come out in the wash eventually

- Balance Sheet – using futures for as many legs as possible we can get more liquid and lower balance sheet structures – our sacrifice is to accept that we will trade less often

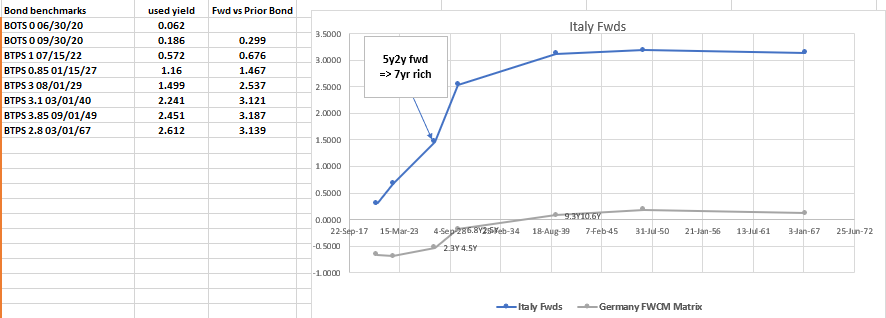

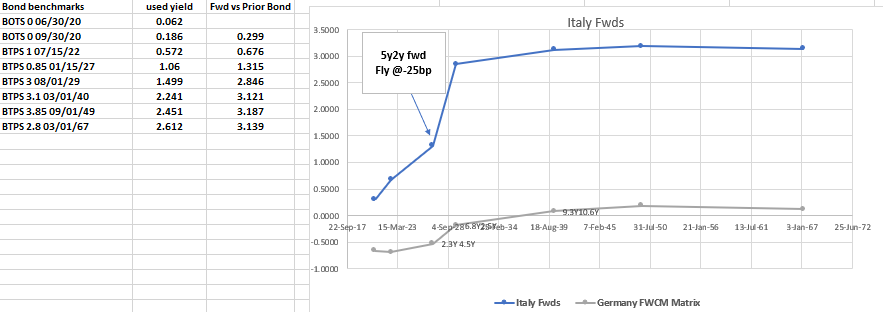

Italy – One Bond, Two Futures

+2yFut, -7y, +10yFut

Pay the belly

Weights: +0.3 / -1 / +0.7 (*as per the shape of the fitted curve)

Cix:

2 * (YIELD[BTPS 0.85 01/15/27 Corp] - 0.3 * YIELD[BTPS 1 07/15/22 Corp] - 0.7 * YIELD[BTPS 3 08/01/29 Corp]) * 100

Levels

Current: -3.3bp

Entry: -7.5bp (20%)

Add: -25bp (80%)

Target: +18bp

In forward space this is how the curve looks…

Rationale

- Tuesday will see the announcement of Italian supply for Thursday April 9th

Regular 3y, 7y & longer tenor possible

- Generally the forward curve should be steeper but looks out of line at the 7y point

- As a very wide fly this can move around and recent extremes dictate our small entry amount and a desire to see the trade either mean revert next week or achieve the distortions of mid-March

- The Market seems to struggle with the absorption of new risk – witness Spanish and Belgian 7y syndications. With dealers running at reduced staffing, it is my sense that the market will demand a discount for all new risk

Carry & Roll

- Carry: +2.6bp /3mo (@10bp repo spread)

- Roll: Flat

Risks

- As a wide expression of tenor risk this fly has large Var and large range. Extreme value is around -25bp

- A very strong flattening of the forward curve – heading towards default, could cause the bullet to outperform wings

- The low coupon nature of the 7y causes it to stay bid vs the higher coupon ik ctd – 3% Aug 29

At the Extremes, how does it look to add?

How do forwards look at the extremes… - shifting the 7y by 10bp richer, all other things being equal…

At this point the gradient would be so steep from 7s to 10s ,that the 9y5y would be almost flat to 10y10y. That would seem an exceptionally unlikely or ‘over-informed’ scenario for the path of rates

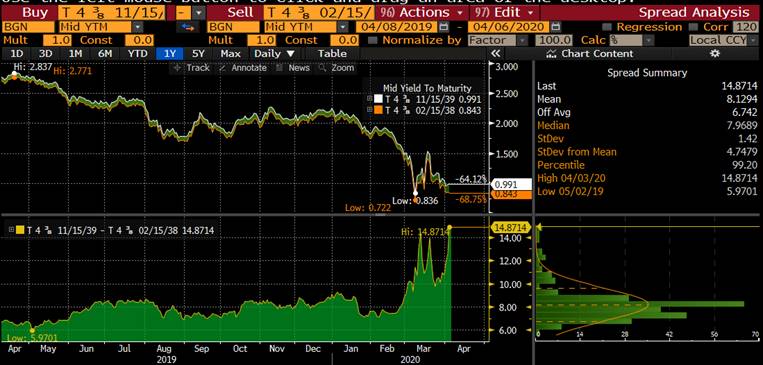

US

Sell T 4.375% Feb38, Buy 4.375% Nov39

Steep US curve at maturities longer than USA contract CTD (Feb36) implies forwards > 3.00%

Cix:

(YIELD[T 4.375 11/15/39 Govt] - YIELD[T 4.375 02/15/38 Govt]) * 100

Levels

Current: +14.9bp

Entry: +14.9bp (33% of risk)

Add: +20bp (67% risk), at which point the nov39 could be so cheap as to force the forwards from 2039 to 2045 to be back sub 2%

Target: +5bp,

Forwards

Rationale

- This is a fade of the steeply sloped UST curve, from the 2036 to 2045: from the USA contract to the WNA contract.

- It does not have quite the same risk of being short a CTD (UST Feb36), yet expresses that dislocation

- Feb38 -> Nov39 is one of the steepest parts of the US curve and implies a high forward: 3.19%

- This is one of the few relationships that is still on a high relative to mid-March, whereas many others have retraced some of those moves. See -USA +WNA in yield spread (T Feb36 into T Nov45) off the Mid-March highs…

Graph UST Feb36 into USTT Nov45

Carry & Roll

- Carry -0.1bp /3mo (@15bp repo spread)

- Roll -0.1bp /3mo

Risks

- The spread steepens due to

USA future outperforming WNA in further dislocations

The specific issues becoming more idiosyncratic

Generic steepening of the yield curve

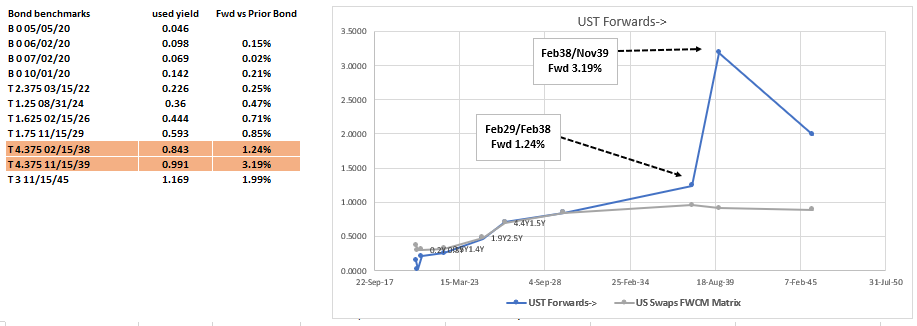

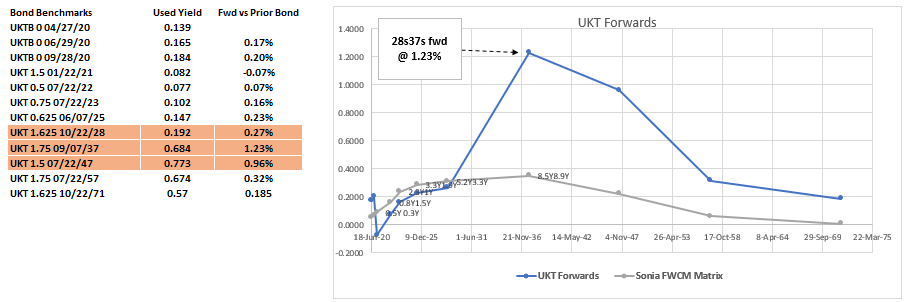

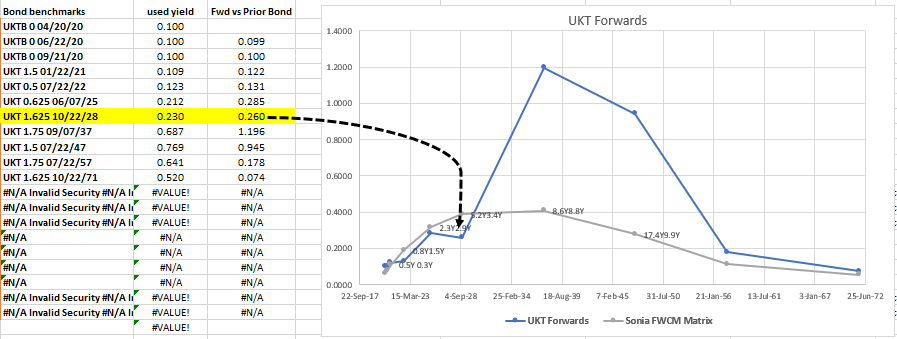

UK

-28s +37s -47s

Systemic cheapness in 20yrs, highlighted by last Tuesday’s £2Bln tap of 2041

Cix:

(2*yield[UKT 1.75 09/07/37 Govt] - yield[UKT 1.5 07/22/47 Govt] - yield[UKT 1.625 10/22/28 Govt])*100

Graph

Levels

Current: +40.4bp

Entry: +40bp

Add: +45bp, (compensates for any cheapness in the back leg)

Target: <30bp, long term target <10bp – stellar roll, but difficult bucket

Forwards

Rationale

- Systemic cheapness of the 20y sector – the Sonia curve predicts a much more benign pricing set for 20+ yrs

- 37s is shorter than the 20y point, next tap Wednesday 15th April

- Roll down is very strong – 37s roll at 5.5bp /yr

Consider the fly approx 3 yrs shorter: -26s +34s -44, trades at +17.3bp

- The 37s got pushed cheaper by the recent tap in UKT 1.35% 41s

- The long belly, short wings is an approximation of the long forward rate steepener trade, which we prefer in a higher supply environment

Mis-weighted Fly – as per curve ‘shape’ – similar to vol weighted…

100 * (YIELD[UKT 1.75 09/07/37 Corp] - 0.25 * YIELD[UKT 1.625 10/22/28 Corp] - 0.75 * YIELD[UKT 1.5 07/22/47 Corp])

Carry & Roll

Carry: +0.6bp /3mo (a10gp repo spread)

Roll: +0.1bp /3mo (fitted curve)

Risks

- Further Taps of the 37s cause it to remain cheap – next tap Wednesday April 15th,

- APF (asset Purchase Facility) – QE causes the shorts to stay bid, UKT28s have benefited from buying in QE from March 24th to day more so than 37s and 47s, which is one of the reasons the RV is so distorted

In general, my sense is market could still shake a lot of people out here. We have to scale accordingly and trust that Value will out. We need to pay attention to fresh issuance as the market is wounded in its ability to absorb. Liquidity is poor , but the counter is that the opportunity set is good.

Have an excellent week and let me know if there’s anything I can help with. Working from home ain’t so bad !

Ricey

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: Busy Holiday-Shortened Week on Tap > EGB and UKT Supply

- Morning… This is the first week of the DMO’s new 2 auctions a day for 2 days (Double-Double-Trouble?) which will be met with £4.5bn a day of QE from Tues-Thurs (unchanged from last week). We’ll also have a pretty busy calendar in Europe although it won’t be as heavy as last week. With the markets closed in Europe and the UK on Friday and Monday, we should have an action packed 4 days.

- As noted in my recent notes on the UK, relative-value players have been doing a good job of cheapening new issues into their auctions and QE ineligibility, especially for those that have been trading rich to the curve. With balance sheets and risk appetites taxed amid heightened volatility, we don’t see this pattern changing any time soon, especially now with supply doubling versus last week. Corporates will be bought as well for the first time this QE cycle.

This week’s UK auctions are:

10am tomorrow> £3.25bn NEW UKT 0.875% 2023s (quoted at +6.4bps to the 0T23s on Friday in gray mkt)

11:30am “ > £1.25bn tap of the UKT 1T57s (~40.4k G M0 equivalents). Grinding richer after a sharp cheapening.

10am Wednesday> £2.00bn tap of the UKT 4T30s (CTD). 4T30s have richened ~15bps vs swaps of late.

11:30am “ > £2.75bn “ “ “ UKT 2 25s. Sprd vs 0F25s has cheapened 5bps since peaking at -11.4bps.

As usual, the QE operations will follow this schedule:

3-7yr 12:15-12:45

7yr-20yr 13:15-13:45

20yr+ 14:15-14:45

It’s easier to tell you which issues are excluded and when rather than copy the whole list.

From the DMO’s rundown:

UKT 1.625% 2028 will be excluded from the 07/04/20 operation because it will

have been auctioned by the DMO within one week of the purchase operation.

UKT 1.25% 2041 will be excluded from the 07/04/20, 08/04/20 operation because

it will have been auctioned by the DMO within one week of the purchase

operation.

UKT 1.75% 2057, 2% 2025, 4.75% 2030 will be excluded from the 07/04/20,

08/04/20, 09/04/20 operation because it will have been auctioned by the DMO

within one week of the purchase operation.

UKT 0.875% 2029, 1.75% 2037 will be excluded from the 08/04/20, 09/04/20

operation because it will be auctioned by the DMO within one week of the

purchase operation.

UKT 1.5% 2026, 1.75% 2049 will be excluded from the 09/04/20 operation because

it will be auctioned by the DMO within one week of the purchase operation.

We’ll update our RV ideas later this am.

- Europe’s redemptions in April are substantial which will turbo-charge the ECB’s QE buying. April bunds mature on the 17th, OATs on the 25th, BTPS on the 15th, Bonos on the 30th and Ireland on the 18th, totalling 30.4bn led by Germany and France’s 8.7bn and 8bn respectively. Add to that 13bln+ of QE (depending how aggressive the ECB wants to be) and we’re talking at least 44bn worth of buying from now until the end of the month. Tough to be too short EGBs with that factored in.

- Conventionals Calendar:

Tue 8th

Austria 0% 30s (est 500mm)

“ 0% 24s (est 700mm)

Wed 9th

Germany 4bn DBR 0% 30s

Italy 3yr, 7yr & 30yr (TBC today)

Ireland is expected to syndicate a new issue this month.

- More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** PLEASE READ ** EQUITIES STALLING AND AT VERY POOR “BOUNCE” RETRACEMENTS I.E. HIGHLIGHTING THEIR INHERENT WEAKNESS.

EQUITIES STALLING AND AT VERY POOR “BOUNCE” RETRACEMENTS I.E. HIGHLIGHTING THEIR INHERENT WEAKNESS.

ONE PERSISTANT BUG BEAR IS THAT SO MANY MONTHLY RSI’S FAILED TO ACHIEVE A 2008 DISLOCATION, MAYBE TIME TO REMEDY THAT!

THAT SAID MANY WEEKLY RSI’S REMAIN 2008 LOW WHILST THE DAILY RSI’S ARE NOW NEUTRAL POST THE LATEST RECOVERY.

**A TOUGH CALL BUT LOWER LOOKS THE PATH OF LEAST RESISTANCE, UNTIL WE GAIN A 2008 DISLOCATION-SHAKE DOWN.**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: DMO Fills in the Blanks for April's Calendar - Colour/RV IDEAS

> The DMO has completed the calendar for April's auctions - u can find the PDF HERE.

> Nice cross-section of off the run issues. The auctions on top of those we knew yesterday will be 1 24, 2t 24, 1h 26, 1q 27, 0s 29, 1t 37, 1t 49 and 1f 54.

> As noted in our GILTS note yesterday (attached), we'll do our best to take advantage of any cyclicality the auction/QE concessions bring us while focusing on the broader picture. Some initial ideas driven by today’s mini-tender below.

> In the meantime, we’ll have a £3bn mini-tender of the 1F28s this morning. Auction format is largely the same, although there are no non-comps and the Post Auction Option Facility is closed.

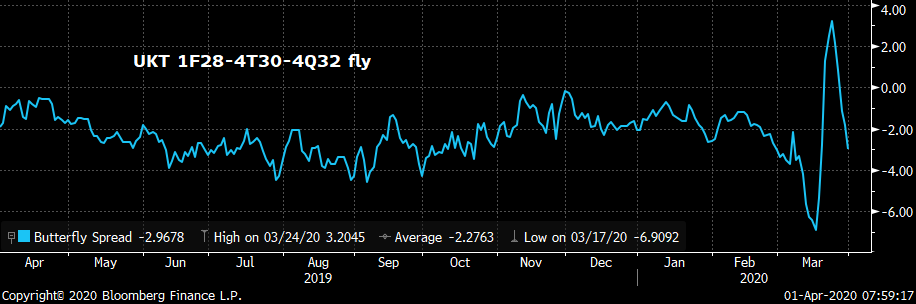

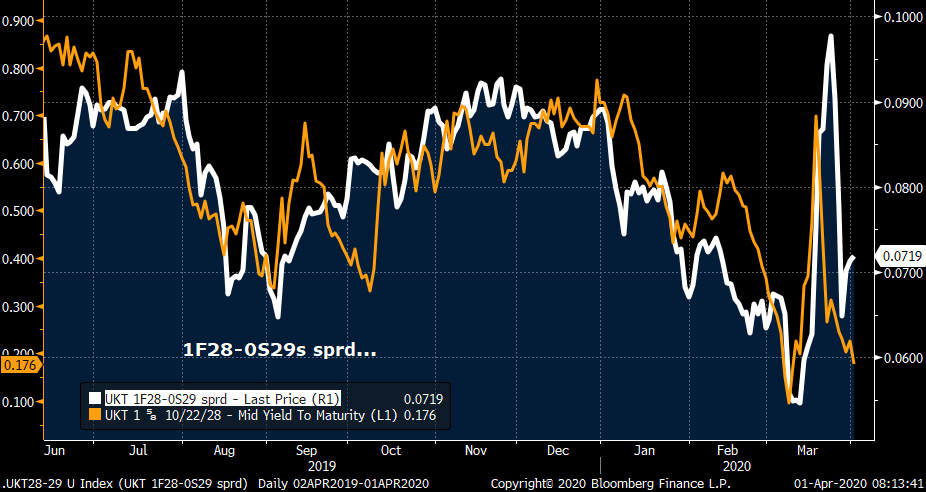

> The 1F28s were one of the richest issues in the belly of the curve before the announcement of this mini-tender, featuring highly in the first couple weeks of the 4T20 APF and QE operations. We wouldn’t call these 1F28s cheap by any means, but we can see from the chart below that the 1Q27-1F28-0S29 fly has cheapened from -4.25bps to -.6bps (having briefly reached +.5bps) and are now closer to ‘fair’ vs their low cpn neighbours. Next week’s 10yr supply will be a tap of the 4T30s on Wednesday which makes them ineligible for QE. We’ve seen a nice reversal of the recent cheapening of the 4T30s over the last several sessions on fly vs 28s and 32s. While the 4Q32s remain ineligible for QE – and trade cheap to the curve – there remains a sharp divergence between yield level and the steepness of the 30-32s sprd. We think the odds are high that this 4T30s cheapening will resume into next week as the weight of 4 auctions a week neutralizes some of the bullish impact of the QE buying.

Also… 1Q27-1F28-0S29 fly

And lastly, the 1F28-0S29 steepener has a nice little bearish bias which could come in handy into next week’s cranking up of supply. Plus, the 0S29s are tapped again on Apr 15th…

AUCTION DATE & CLOSING TIME GILT DETAILS ANNOUNCED (3:30pm)

Thur 2 Apr 10:30am GBP 2,000 MN 1 1/4% Treasury Gilt 2041 Tues 24 Mar

Tues 7 Apr 10:00am GBP 3,250 MN 0 1/8% Treasury Gilt 2023 Tues 31 Mar

Tues 7 Apr 11:30am GBP 1,250 MN 1 3/4% Treasury Gilt 2057 Tues 31 Mar

Weds 8 Apr 10:00am 4 3/4% Treasury Gilt 2030 Weds 1 Apr

Weds 8 Apr 11:30am 2% Treasury Gilt 2025 Weds 1 Apr

Weds 15 Apr 10:00am 0 7/8% Treasury Gilt 2029 Weds 8 Apr

Weds 15 Apr 11:30am 1 3/4% Treasury Gilt 2037* Weds 8 Apr

Thur 16 Apr 10:00am 1 1/2% Treasury Gilt 2026* Thur 9 Apr

Thur 16 Apr 11:30am 1 3/4% Treasury Gilt 2049 Thur 9 Apr

Tues 21 Apr 10:00am 0 5/8% Treasury Gilt 2025 Tues 14 Apr

Tues 21 Apr 11:30am 1 5/8% Treasury Gilt 2054* Tues 14 Apr

Weds 22 Apr 10:00am 1 1/4% Treasury Gilt 2027* Weds 15 Apr

Weds 22 Apr 11:30am 1% Treasury Gilt 2024* Weds 15 Apr

Tues 28 Apr 10:00am 0 7/8% Treasury Gilt 2029* Tues 21 Apr

Tues 28 Apr 11:30am 0 1/8% Index-linked Treasury Gilt 2028 Tues 21 Apr

Weds 29 Apr 10:00am 2 3/4% Treasury Gilt 2024* Weds 22 Apr

Weds 29 Apr 11:30am 1 3/4% Treasury Gilt 2049* Weds 22 Apr

As previously announced, the DMO will also hold a gilt tender for up to GBP

3,000 million (nominal) of 1 5/8% Treasury Gilt 2028 on Wednesday 1 April.

Following publication by the Office for National Statistics of the outturn

for the 2019-20 CGNCR (ex NRAM, B&B and NR), which is due to be published on 23

April 2020, the DMO will publish an announcement setting out a comprehensive

revision to the 2020-21 financing remit. The revision will, as normal, reflect

any impact on the 2020-21 financing remit from the outturn 2019-20 CGNCR (ex

NRAM, B&B and NR) but will also take into account implications for the

Government's borrowing requirement of all measures announced by government up to

that date, to support the economy through the period of disruption caused by

COVID-19.

More to come!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

PLEASE READ : MARKET UPDATE : A FEW POINTS TO NOTE PRIOR TO MONTH END.

MARKET UPDATE : A FEW POINTS TO NOTE PRIOR TO MONTH END.

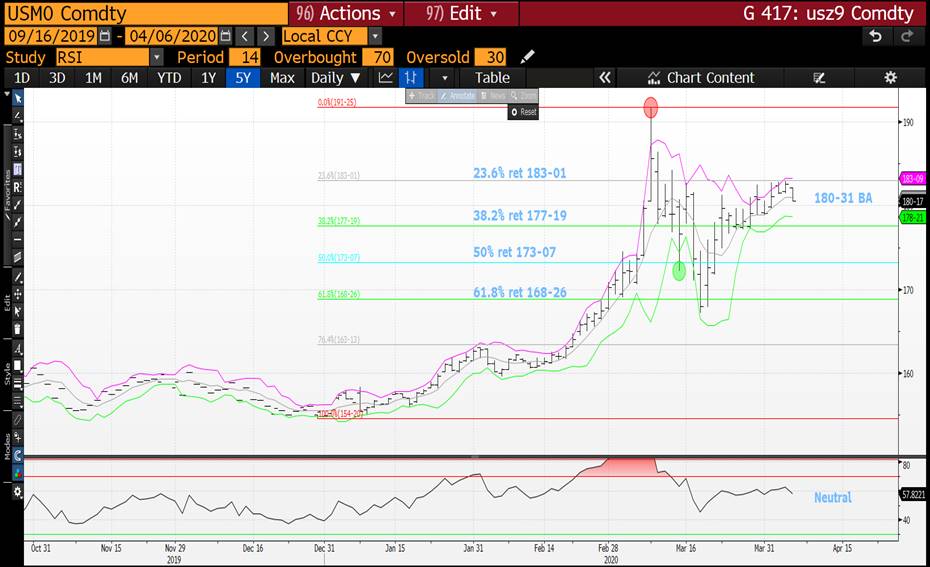

BOND YEILDS IN GENERAL LOOK LIKE PRESERVING THE LOWS ESTABLISHED ON THE 9TH OF MARCH, THUS YIELDS SHOULD CONTINUE ON HIGHER.

GERMANY ALSO HAS A PUNCTUATED YIELD LOW AND CLOSE TO A MOVE OUTSIDE THE RELIABLE CHANNEL.

STOCKS ARE A TENUOUS HOLD BUT WHILST MAKING ALL THE RIGHT NOISES, WE COULD HAVE A BASE. WE JUST NEED SOME STRONGER CLOSES INTO MONTH END.

SHORTDATED SINGLE STOCKS HAVE A DECENT REJECTION OF THE RECENT LOWS IN PLACE.

*  **BONDS SHOULD FAIL HERE, IDEALLY FAIL CARRYING ON THE TREND INITIATED WITH THE MARCH 9TH UPSIDE PIERCE. THE US 30YR IS THE BEST MARKET TO VIEW THIS SITUATION AND ONE TO FOCUS ON. IT IS HIGHLIGHTING A COMPLETE HALT TO THE YIELD SELL OFF, BUT THIS WONT BE WITHOUT EMOTION. THE PRICE SWINGS WILL BE VOLATILE TILL THE MONTHLY CLOSE IS IN.

**BONDS SHOULD FAIL HERE, IDEALLY FAIL CARRYING ON THE TREND INITIATED WITH THE MARCH 9TH UPSIDE PIERCE. THE US 30YR IS THE BEST MARKET TO VIEW THIS SITUATION AND ONE TO FOCUS ON. IT IS HIGHLIGHTING A COMPLETE HALT TO THE YIELD SELL OFF, BUT THIS WONT BE WITHOUT EMOTION. THE PRICE SWINGS WILL BE VOLATILE TILL THE MONTHLY CLOSE IS IN.

STOCKS CONTINUE TO PUT IN BASE AIDED BY SIZEABLE VOLUMES, WE JUST NEED THAT RECOVERY INTO MONTH END.***

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

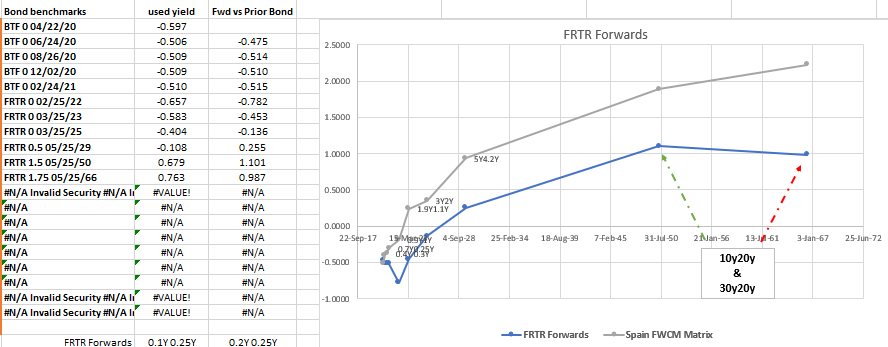

The EU & US opportunity Set

The Macro / RV opportunity set…

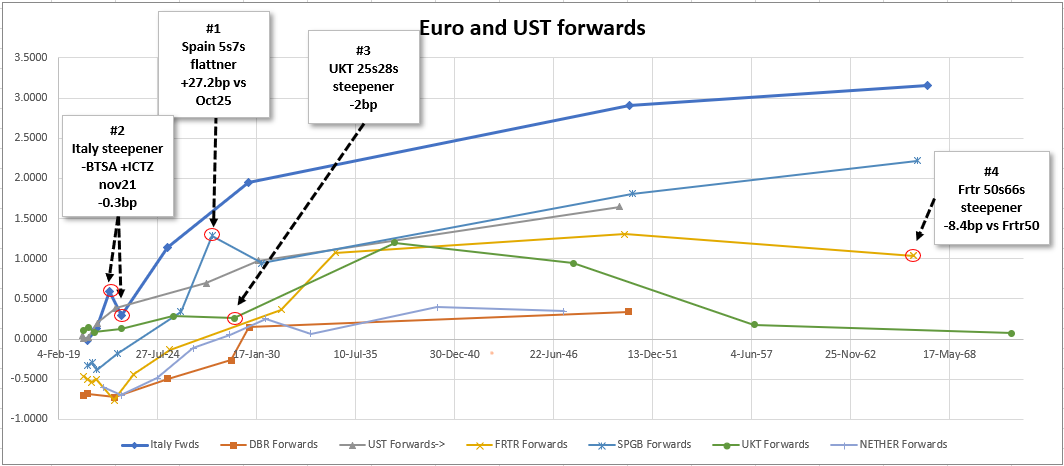

Consider the context of bond specific Forwards in Europe

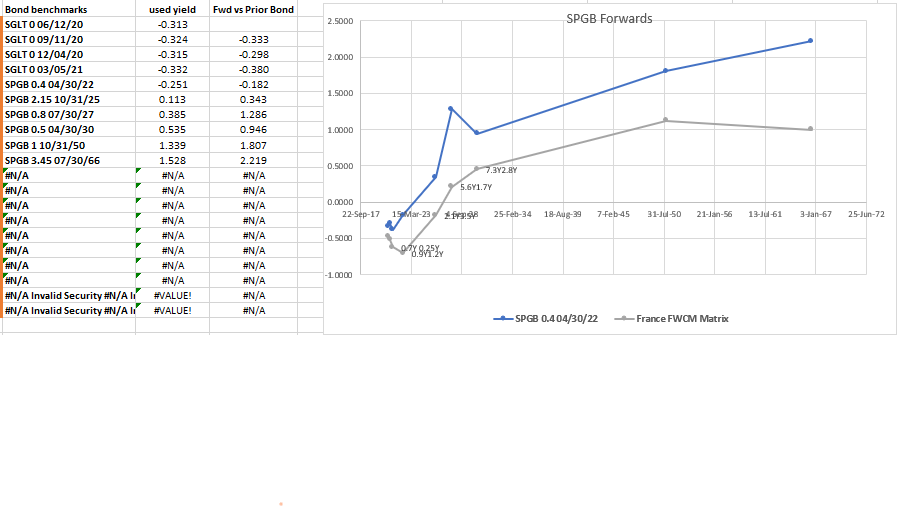

#1 New 7y Spain Spgb 0.8% Jul27, +27.2bp vs Spgb 2.15% Oct25

- Last Tuesday’s new Spanish 7 yr came cheap, as they issued €10Bln

- Flatteners and Steepeners both look good – the 5yr point is also rich, so going with the flattener

- The Bond Forward 5y2y is pushed way over the fitted curve, towards Italian levels

- This is a good 12bp away from fair

Bloomberg History of 5y vs old 7y…

Spanish Forwards

- Risks: The Spgb Jul27 as a new bond stays cheap. A wholesale curve steepening erodes the RV. The Oct25 gets rich on repo.

- Carry: -0.4bp /3mo using 10bp repo spread

- Roll: -0.3bp /3mo

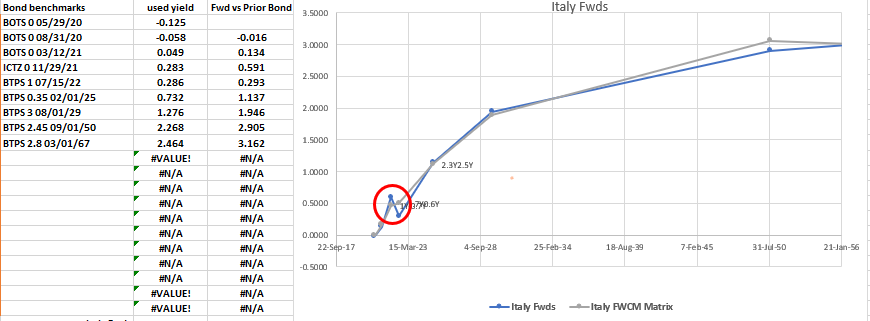

#2 Italy: Sell BTSA contract (Ctd = Btps 1% Jul22) +ICTZ 0% Nov21

Nov21 CTZ left cheap by 2y rally

Target +1bp & +4bp (33% and 67% risk respectively)

Bloomberg

- The CTZ 0% Nov21 have been left behind in the recent rally, but with a softer Italian market on Friday, we expect the bond to outperform the 2y Futures contract (CTD Btps 1% Jul22)

- In terms of forwards a flat or inverted curve makes no sense. Here we see the forwards curve with a spread of -0.3bp

- Risks: a significant rally in the 2y futures could lead to a flattening in 1s2s spread and the RV is eroded in the context of the wider curve

- Carry +1.8bp /3mo @-15bp spread

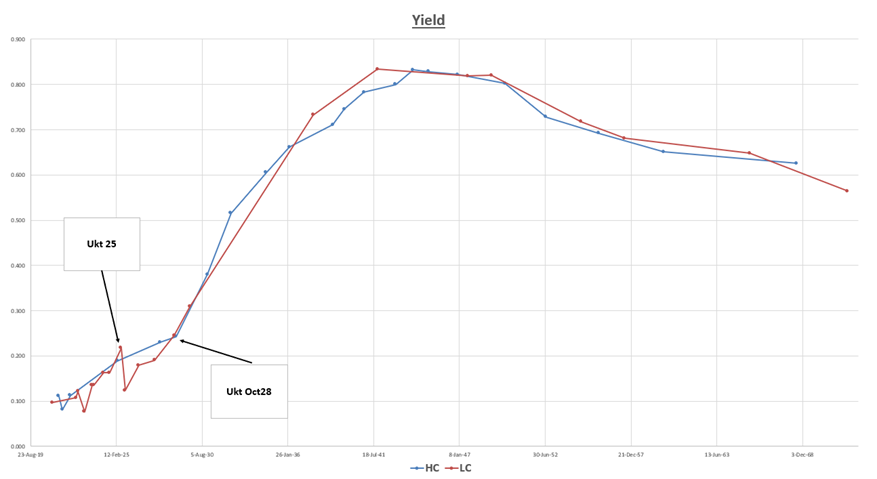

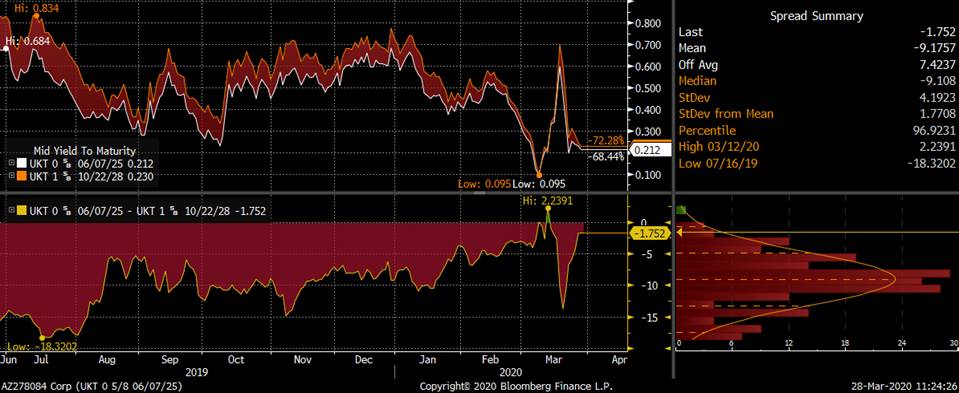

#3 UKT flattener: -Ukt 1.625% Oct28, +Ukt 0.625 6/25

The Flows in the UK are idiosyncratic at the moment – the APF is engaged in Buybacks yet issuance is set to increase and the Recent Fitch downgrade to AA- from AA could cause a steepening of the curve.

Levels

Current: -1.8bp

Entry (33%): -2bp

Add (66%): Flat

Target: -7.5bp

Graph – UK Yield Curve

As with most yield curves am looking for steepeners either in yield or forwards rate space – I chose this one as it accentuates the anomalies vs the fitted curve but maintains some width as to not be wiped out by dealing costs

Furthermore the very high forwards caused by the persistent cheapness of the 20y and 30y should put some constraint on how flat 25s 28s can go

BBG Spread history..

In terms of forward rates the steep curve 10s20s and 20s30s implies high forwards. This is at odds with the 8y – 10y segment.

Graph of Ukt Forward rates

Risks: Whole curve collapses / flattens to Sonia

Ukt Oct28 stay bid from APF buying of the sector

Repo goes tight on Oct28 (*BoE maintains repo facility on Ukt issues to constrain excessive squeezes)

#4 France – Butterfly

-OATA (Ctd Frtr 0.5% May29

+Frtr 0.5% May50

-Frtr 1.75% May60

The long end, 30y tenor of France cheapened from the extreme flat levels of mid-March

France 10s30s

We are also anticipating heavier supply in long ends in general as deficits blossom. Yet PEPP plans so far have not announced buying intentions beyond the 31y maturity limit

We are looking for forward rate structures where we can receive the 10y20y at a rate higher than the 30y20y – fwd rate steepeners

An approximation of the fwd rate steepener would be the butterfly:

-10y +30y -50y

-0.15 / +1 / -0.85

CIX: 200 * (YIELD[FRTR 1.5 05/25/50 Corp] - 0.15 * YIELD[FRTR 0.5 05/25/29 Corp] - 0.85 * YIELD[FRTR 1.75 05/25/66 Corp])

*Weighted as per the gradient of the fitted curve

Using the OATA Futures (Ctd May29) for the short bond

Levels:

Current: +9.3bp

Entry: +8.5bp

Add: +10.5bp

Target: +1bp

Target where the forward curve is mildly upward sloping as per Spain & Italy – (arguably as weaker credits they could be flatter)

Graph of Butterfly

Carry: +0.2bp /3mo @repo spread od 10bp

Roll: -0.1bp /3mo

Forwards (with Spanish Bonds as a reference)

Correlations / Regressions

the 30y20y has a string correlation to the 10y20y

BBG stats on CMB (1y Data)

Beta: 104%

R2: 0.965

Graph of residual

Graph of Regression

Risks:

- as an ongoing supply point, the 2050 stays offered (next long supply is Thursday 2nd April: Nov28, Nov29 and Jun39)

- Oat contracts & 66s get richer on the curve

If you’d like to see the US stuff or more on these themes drop me a line

James

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

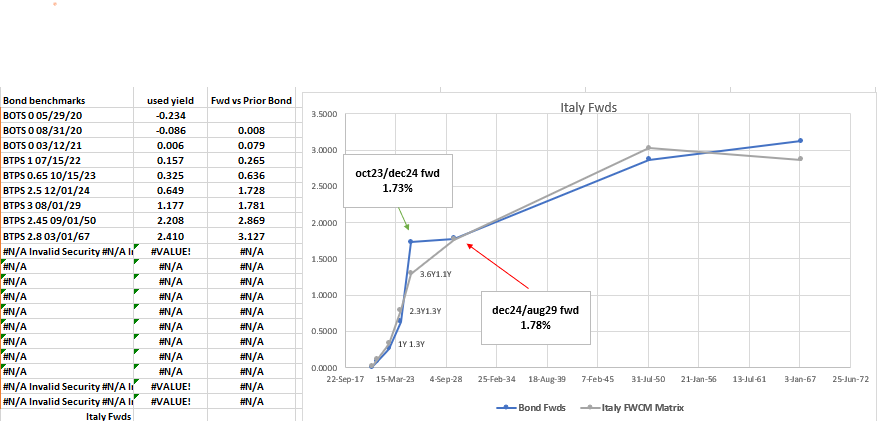

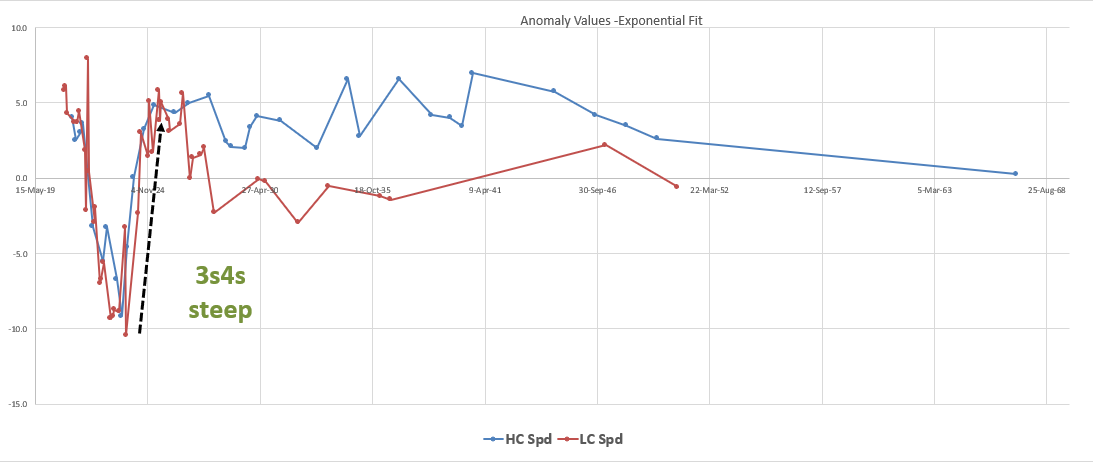

Trade Radar #1

Trade #1 on my Radar

Italy 3s4s gets stretched, 3y1y forward cheap to IK futures

Structure

- Sell LC Btps 0.65% Oct23, Buy Btps 2.5% Dec24, Sell IK futs

- Weights: -0.75 / +1 / -0.25

- CIX: 200 * (YIELD[BTPS 2.5 12/01/24 Corp] - 0.75 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.25 * YIELD[BTPS 3 08/01/29 Corp])

- Current: +22bp

- Target: +8bp

Rationale

- In the recent rally curve longs have left the 5y segment offered

- Similarly the rally has been led by the 2y & 3y (BTSA Ctd => jul22) as the BOI fought to sustain the level of the 2y - *Bank of Italy exchange transaction issued Oct23, May24, and Nov24 vs Buying Jul22 on 20th March

- The credit environment is now one of ‘whatever it takes’ – so we wish to buy shorter forwards at levels as cheap as or close to longer ones – 3y1y is almost as high as the 5y5y (using IK). This flatness to the curve is redolent of an ik/rx spread > +250bp not the current +168bp

Graph of Forward rates (including smooth fwds from FWCM on BBG)

Graph IK/RX spread – Italy vs Germany 10y tenor

- Anomalies vs a fitted curve show 3s4s to be the greatest anomaly

Trade Properties

- Weightings: based on the shape of the fitted curve – 3x the weighting in the front leg vs the back

- Carry: -0.3bp /3mo using 15bp spread

- Roll: Flat

Risks

- Oct23 as a low coupon preserve an anomaly bid

- The Dec24 stay offered, (feb25 5y supply on Tuesday 31st March)

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796