FT Opinion: Loneliness during the American epidemic

I like this thought provoking piece in today’s FT… M

|

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MACROCOSM: UK Rates and Equities > Sentiment Counts - Charts/Comment

GILTS... 'Sentiment Counts'

> Very interesting charts comparing bonds and stocks performance of late.

> Chart below of G M0 (gilts) vs the FTSE over the last 20 days shows unusual shifts in their correlation that has confounded much of the rates community (ourselves included!).

> At the start of March we had a typical inverse relationship - stocks down, bonds up as FTQ flows emerged.

> As stocks began to really sell-off around Mar 9th, however, the relationship became positively correlated as equities sellers had to dump in the money bonds holdings to raise money for margin calls.

> NOW, we've got another positive correlation as BOTH bonds and stocks rally in response to the recovery/ stimulus measures put in place, not the least of which are the BoE's acceleration of the APF buying along with a massive £200bn QE package that has mopped up ~£19bn+ gilts in the last 5 sessions..

> So, what happens NOW? Well, we have NO QE buying from the BoE until Tuesday (qtr-end) AND the stock market is on a tear, not only due to anticipated $2trln bailout package from the US but also in expectation of the mother of all index rebalancing moves into Mar 31st.

> With a mini-tender coming Apr 1, no QE and stocks trading well, we're inclined to take a more bearish view of the rates market over the next couple sessions. Trades like the UKT 25-30-36 fly have stormed back mightily over the past few sessions and issues like the 1F28s, 0S29s and 1T37s have had impressive runs... Time to fade that.

UKT 49s-71s is still very inverted, even after a modest retracement. Here’s 71s into 49s…

More to come…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar #1

Trade #1 on my Radar

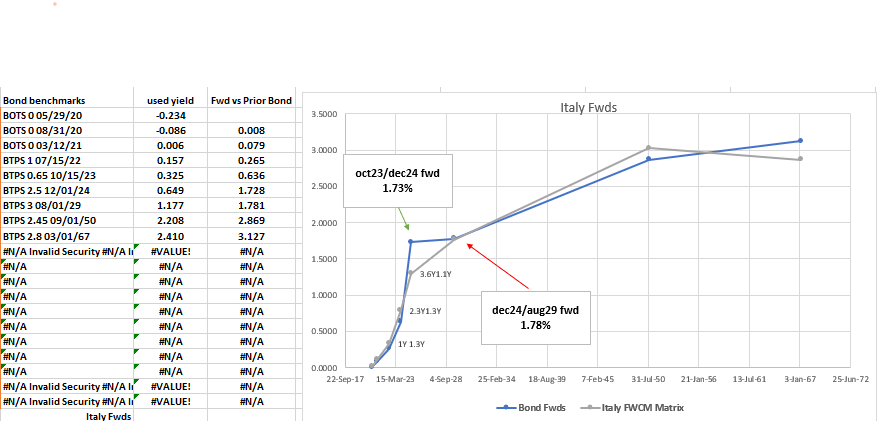

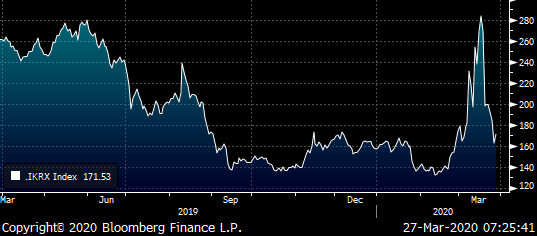

Italy 3s4s gets stretched, 3y1y forward cheap to IK futures

Structure

- Sell LC Btps 0.65% Oct23, Buy Btps 2.5% Dec24, Sell IK futs

- Weights: -0.75 / +1 / -0.25

- CIX: 200 * (YIELD[BTPS 2.5 12/01/24 Corp] - 0.75 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.25 * YIELD[BTPS 3 08/01/29 Corp])

- Current: +22bp

- Target: +8bp

Rationale

- In the recent rally curve longs have left the 5y segment offered

- Similarly the rally has been led by the 2y & 3y (BTSA Ctd => jul22) as the BOI fought to sustain the level of the 2y - *Bank of Italy exchange transaction issued Oct23, May24, and Nov24 vs Buying Jul22 on 20th March

- The credit environment is now one of ‘whatever it takes’ – so we wish to buy shorter forwards at levels as cheap as or close to longer ones – 3y1y is almost as high as the 5y5y (using IK). This flatness to the curve is redolent of an ik/rx spread > +250bp not the current +168bp

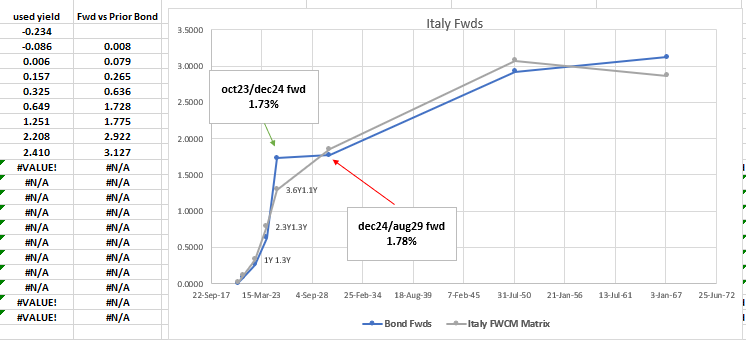

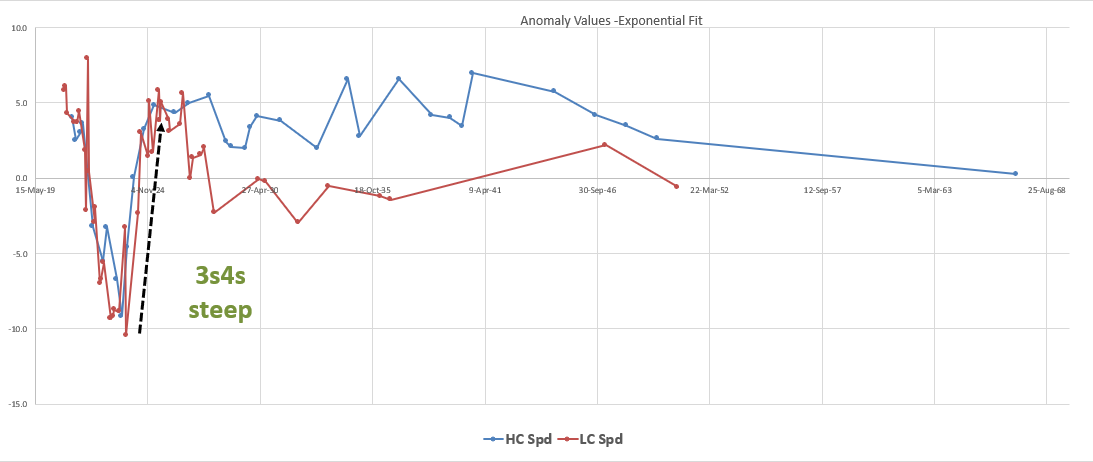

Graph of Forward rates (including smooth fwds from FWCM on BBG)

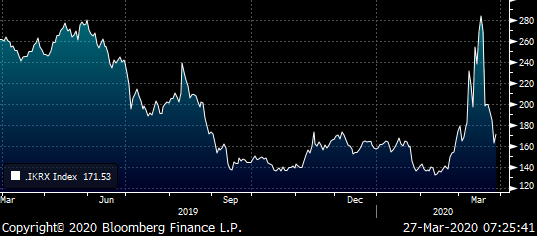

Graph IK/RX spread – Italy vs Germany 10y tenor

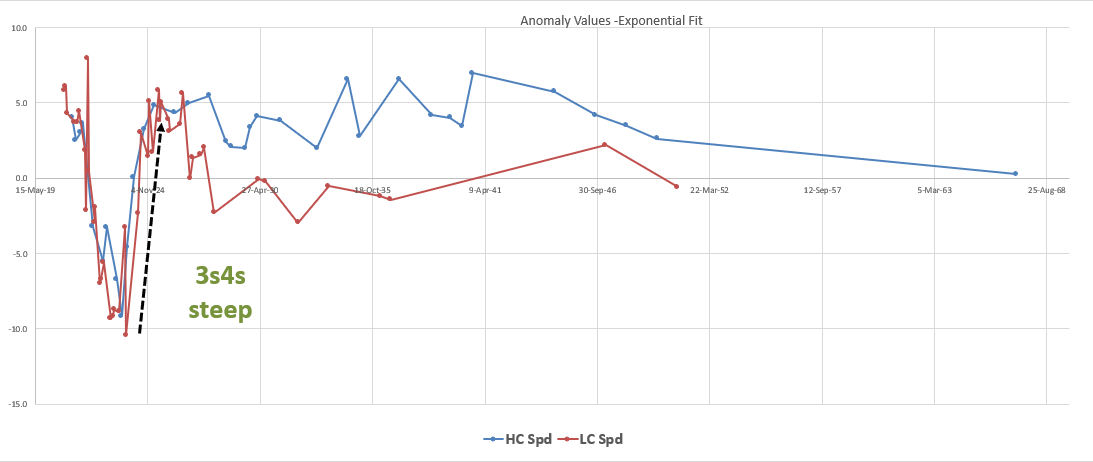

- Anomalies vs a fitted curve show 3s4s to be the greatest anomaly

Trade Properties

- Weightings: based on the shape of the fitted curve – 3x the weighting in the front leg vs the back

- Carry: -0.3bp /3mo using 15bp spread

- Roll: Flat

Risks

- Oct23 as a low coupon preserve an anomaly bid

- The Dec24 stay offered, (feb25 5y supply on Tuesday 31st March)

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Recall: Trade Radar, James Rice @Astor Ridge

James Rice would like to recall the message, "Trade Radar, James Rice @Astor Ridge".

Bloomberg Bond News Summary > Fri Mar 27th

Business Briefing

1) Stocks Should Be Afraid If Dollar Was Their Crutch: Markets Live

2) U.S. Equity Futures Slip; Treasuries Push Higher: Markets Wrap

(Bloomberg) -- U.S. equity futures dropped after the first three-day rally in American stocks since mid-February, while Treasuries advanced as investors take stock of strengthening stimulus efforts across the globe. S&P 500 futures retreated after the index surged over 6% Thursday. European contracts fluctuated. The dollar headed for its biggest weekly fall since 2009, ...

World News Briefing

3) India Cuts Rates; U.S. Cases Surpass China: Virus Update

(Bloomberg) -- The U.S. overtook China for the most coronavirus cases worldwide, fueled by a large jump in infections in New York, while global deaths from the pandemic surpassed 24,000. The Reserve Bank of India cut interest rates, joining central banks around the world in boosting stimulus to counter the economic impact of the coronavirus outbreak. U.S. President Donald ...

4) Sunak’s U.K. Virus Aid Package Beats Financial Crisis Stimulus

(Bloomberg) -- Chancellor of the Exchequer Rishi Sunak said he’d do “whatever it takes” to prop up U.K. businesses and jobs as the country grapples with the coronavirus pandemic, and he’s putting the country’s money where his mouth is. Sunak’s fourth emergency package of measures announced Thursday -- 9 billion pounds ($11 billion) of support for the self-employed -- brings ...

5) Second Virus Shockwave Is Hitting China’s Factories Already

(Bloomberg) -- Since last week, emails from foreign clients have been flooding into export manager Grace Gao’s in-box, asking to delay orders already made, putting goods ready to be shipped on hold until further notice, or asking for payment grace periods of up to two months. Gao’s firm, Shandong Pangu Industrial Co., makes tools like hammers and axes, 60% of which go to ...

6) Trump Touts ‘Very Good’ Talk With Xi as U.S. Cases Surpass China

(Bloomberg) -- U.S. President Donald Trump said he and Chinese leader Xi Jinping had a “very good conversation” about the coronavirus pandemic and that the two nations were working closely together to defeat it. “Just finished a very good conversation with President Xi of China. Discussed in great detail the CoronaVirus that is ravaging large parts of our Planet,” Trump ...

7) Stacks of Urns in Wuhan Prompt New Questions of Virus’s Toll

(Bloomberg) -- The long lines and stacks of ash urns greeting family members of the dead at funeral homes in Wuhan are spurring questions about the true scale of coronavirus casualties at the epicenter of the outbreak, renewing pressure on a Chinese government struggling to control its containment narrative. The families of those who succumbed to the virus in the central Chinese city, where the ...

Bonds

8) Credit Markets Are Set For The Sharpest Weekly Rebound In Years

(Bloomberg) -- Credit markets rebounded sharply this week after unprecedented steps by central banks and governments in response to the coronavirus pandemic. The price of insuring bonds against default in Asia is set for the biggest weekly drop in more than a decade. Spreads on investment-grade dollar notes in the region tightened by a record. It’s a stark contrast to last ...

9) Rupee, Bonds Jump on India Rate Cut, $50 Billion Liquidity Boost

(Bloomberg) -- The rupee and bonds rallied after the Reserve Bank of India slashed interest rates and announced a liquidity infusion of as much as $50 billion, joining global central banks in easing policy to limit the impact of the coronavirus pandemic. Stocks fell after rising initially. The benchmark repurchase rate was cut by 75 basis points to 4.40% on Friday following an ...

10) Pimco Says for Asia Dollar Bonds, It’s ‘Trading by Appointment’

(Bloomberg) -- The coronavirus pandemic has upended financial markets around the world, and few have been altered so drastically as the Asian dollar bond market. After a record stint of activity late last year, issuance and trading has gone eerily quiet in a region that was the first to experience widespread lockdowns and working from home. ...

11) Echoes of Asia Financial Crisis Haunt Region’s Debt Market

(Bloomberg) -- As the coronavirus outbreak roils credit markets around the world, Asia is under particular threat. The region has led the world in economic growth for years as debt helped fuel frenetic construction of airports, bridges and apartment towers for millions of people moving into cities. That model is now running up against an unprecedented spike in borrowing ...

12) Asia Firms Await More Stability to End Lull in Dollar Bond Sales

(Bloomberg) -- A slew of rescue measures from global central banks and nations amid the global Covid-19 crisis might have revitalized U.S. and Europe primary bond sales. In Asia though, dollar issuance remains in freeze. Issuers in the region are waiting for the wild swings in the financial markets to end, with an eye also on whether the premium to borrow dollars in Asia ...

13) Fed Heeds Repo Crisis of 2019 in Tackling Quarter-End Strain

(Bloomberg) -- The Federal Reserve’s massive moves to unclog the financial system’s plumbing are starting to unfreeze short-term funding markets -- just in the nick of time. Pressures from the coronavirus crisis are coinciding with the last days of a quarter, when the market for repurchase agreements can get hairy even during the best of times. The Fed discovered this to ...

Central Banks

14) Australia QE Program Shows ‘Signs of Success’ in First Week (2)

(Bloomberg) -- Australia’s central bank is one week into buying government bonds in order to lower interest rates across the economy and the early verdict: so far so good. The Reserve Bank of Australia has bought A$21 billion of securities ($12.8 billion) since last Friday, after setting an objective for three-year government bond yields of 0.25%, the same as the cash rate. ...

15) Singapore Central Bank Preps Aggressive Move: Decision Guide (1)

(Bloomberg) -- Singapore’s central bankers are poised to take unprecedented action Monday to bolster financial markets and support an economy facing a severe recession. The Monetary Authority of Singapore, which uses the currency as its main policy tool rather than interest rates, will probably take unusually aggressive action of two moves, according to economists surveyed ...

Economic News

16) India’s RBI Unleashes $50 Billion of Liquidity, Slashes Rate

(Bloomberg) -- The Reserve Bank of India cut interest rates and announced steps to boost liquidity in a stimulus worth 3.2% of gross domestic product to counter the economic impact of the coronavirus outbreak. The benchmark repurchase rate was slashed by 75 basis points to 4.40% from 5.15%, Governor Shaktikanta Das said Friday after an emergency meeting of the rate-setting ...

17) From Spain to Germany, Farmers Warn of Fresh Food Shortages

(Bloomberg) -- In his three decades growing strawberries and blueberries, Cristobal Picon has learned how to grapple with problems ranging from droughts and driving winds to floods and freezes. But this year, the coronavirus outbreak has proven too much. Every spring, Picon’s fields in Huelva, on the Atlantic coast of Spain tucked between Seville and the border with ...

18) Federal Reserve’s Balance Sheet Tops $5 Trillion for First Time

(Bloomberg) -- The Federal Reserve’s balance sheet topped $5 trillion for the first time amid the U.S. central bank’s aggressive efforts to cushion debt markets against the coronavirus outbreak through large-scale bond-buying programs. Total assets held by the Fed rose by $586 billion to $5.25 trillion in the week through March 25, according to data published Thursday on ...

19) Vietnam’s GDP Growth Slows in First Quarter as Virus Hits (1)

(Bloomberg) -- Vietnam’s economic growth slowed in the first quarter as the coronavirus outbreak hurt key industries from tourism to manufacturing. Gross domestic product rose 3.82% from a year earlier, the General Statistics Office in Hanoi said Friday, down from 6.97% previously reported for the last quarter of 2019. That would be the slowest growth since at least 2013, ...

European Central Bank

20) ECB Biggest User of Fed Swap Line; BOJ, BOE, SNB Also Used It

(Bloomberg) -- Global central banks tapped the Federal Reserve’s FX swap lines for a total of $206.051b, in the week ended March 25, according to New York Fed data published Thursday.

- The European Central Bank tapped the line for $116.22b across various 7-day and 84-day facilities

- The Bank of Japan tapped the line for $67.175b across various 7-day and 84-day facilities

- The Bank of England tapped the line for $19.015b across various 7-day and 84-day ...

21) Volkswagen Calls on ECB to Speed up Emergency Lending: FT

(Bloomberg) -- Volkswagen has urged the European Central Bank to speed up emergency lending plans to support companies amid the coronavirus outbreak, the Financial Times reports, citing an interview with the company’s CFO Frank Witter.

- ECB should purchase short-term debt, which matures in as little as six or nine months, co. said

- NOTE: Volkswagen is one of Europe’s most ...

22) ECB’s Lagarde Isolated Herself Temporarily After Virus Contact

(Bloomberg) -- European Central Bank President Christine Lagarde isolated herself last week following exposure to a person with the coronavirus, according to two people familiar with the matter. An ECB spokesman declined to comment, but said the president has been working in her office this week. The precautionary measures haven’t prevented Lagarde from leading policy discussions. Last ...

23) After Bailing Out Euro Area, Lagarde Tackles Merkel on Debt (1)

(Bloomberg) -- Just over a week after Christine Lagarde stepped in to shield European Union governments from a market rout, they rejected her appeal to show more solidarity in the face of the coronavirus pandemic. The European Central Bank president reiterated her appeal for joint debt issuance on a video conference with EU leaders on Thursday, saying the bloc is facing a ...

24) ECB, Banks in Talks on Dividend Options Including Delays (2)

(Bloomberg) -- The European Central Bank is in talks with the continent’s lenders on dividends as banks across the region grapple with shareholder payouts amid one of the worst economic crises in recent years. One option under discussion between the euro area’s main financial supervisors and the banks is to delay paying out profits to shareholders until at least the third ...

Federal Reserve

25) Recession Busting Buffers May Rise Faster When Good Times Return

(Bloomberg Intelligence) -- The coronavirus crisis's unexpected and severe onset may prompt the Fed and other central banks to increase countercyclical capital buffers (CCyB) faster in good times as countries using them, like the U.K., are now releasing the buffers to stoke lending. We expect governments that haven't raised CCyB above zero may opt to in the next expansion.

First Word FX News Foreign Exchange

26) Dollar Slides on Rising U.S. Virus Cases, Poor Data: Inside G-10

(Bloomberg) -- The dollar slipped versus all its Group-of-10 currency peers after the U.S. overtook China for the most coronavirus cases globally and jobless claims surged to all-time highs. Treasuries rose.

- The Bloomberg Dollar Spot Index fell 0.3%, taking its loss this week to 3.7%, set to be a record in data going back to 2005. A total of 3.28 million Americans filed for ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar, James Rice @Astor Ridge

Trade #1 on my Radar

Italy 3s4s gets stretched, 3y1y forward cheap to IK futures

Structure

- Sell LC Btps 0.65% Oct23, Buy Btps 2.5% Dec24, Sell IK futs

- Weights: -0.75 / +1 / -0.25

- CIX: 200 * (YIELD[BTPS 2.5 12/01/24 Corp] - 0.75 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.25 * YIELD[BTPS 3 08/01/29 Corp])

- Current: +22bp

- Target: +8bp

Rationale

- In the recent rally curve longs have left the 5y segment offered

- Similarly the rally has been led by the 2y & 3y (BTSA Ctd => jul22) as the BOI fought to sustain the level of the 2y - *Bank of Italy exchange transaction issued Oct23, May24, and Nov24 vs Buying Jul22 on 20th March

- The credit environment is now one of ‘whatever it takes’ – so we wish to buy shorter forwards at levels as cheap as or close to longer ones – 3y1y is almost as high as the 5y5y (using IK). This flatness to the curve is redolent of an ik/rx spread > +250bp not the current +168bp

Graph of Forward rates (including smooth fwds from FWCM on BBG)

Graph IK/RX spread – Italy vs Germany 10y tenor

- Anomalies vs a fitted curve show 3s4s to be the greatest anomaly

Trade Properties

- Weightings: based on the shape of the fitted curve – 3x the weighting in the front leg vs the back

- Carry: -0.3bp /3mo using 15bp spread

- Roll: Flat

Risks

- Oct23 as a low coupon preserve an anomaly bid

- The Dec24 stay offered, (feb25 5y supply on Tuesday 31st March)

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Euro Spain Trade, James Rice @Astor Ridge

Trade Radar

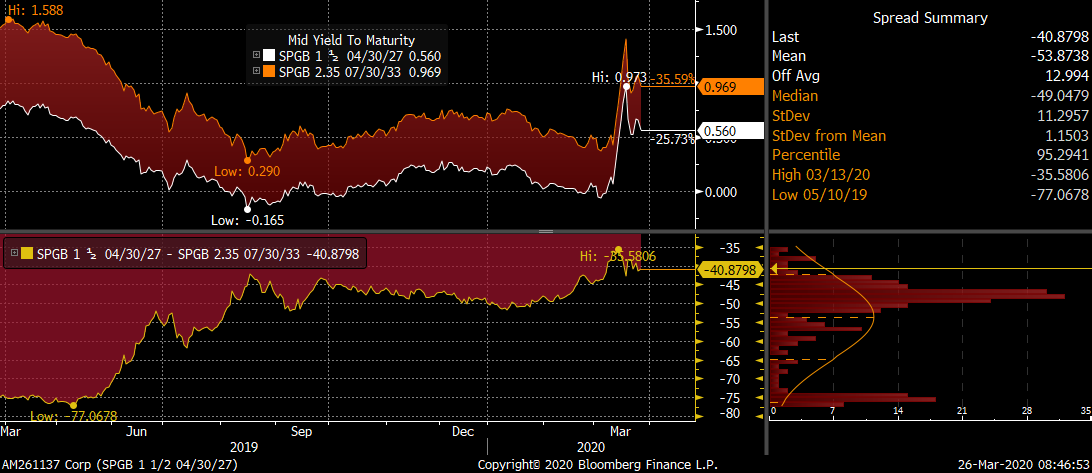

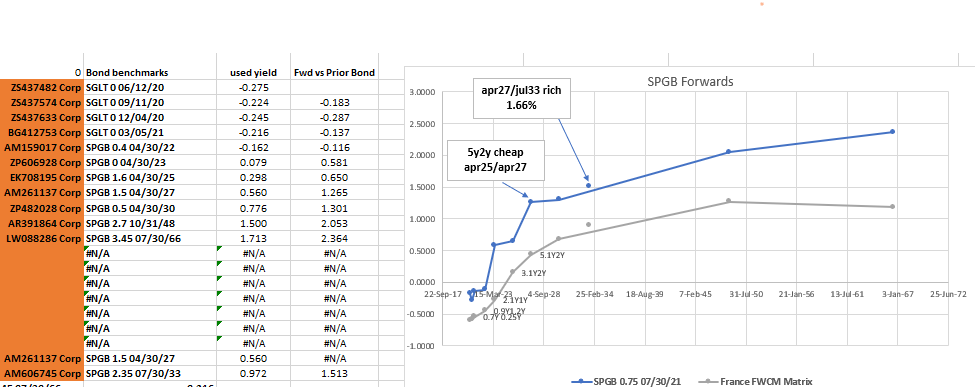

Spain +7y -13y, looks ok at -41bp, best location @-36bp

+Spgb Apr27, -Spgb Jul33

I’d, have a little here, but to make the forward flat vs 5y2y, I would need the 27ss to be only -36bp vs the 27s, which explains the recent narrow in the yield spread…

Forwards…

And essentially that’s why I really like the -Apr30 +Apr27 steepener….

Best – keep firing requests, here to get whatever you need done

James Rice

![]()

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

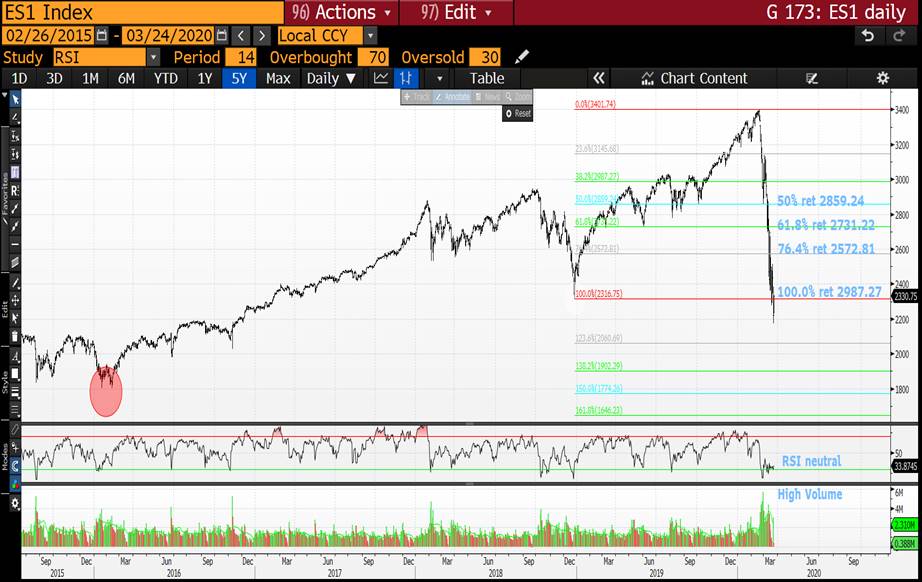

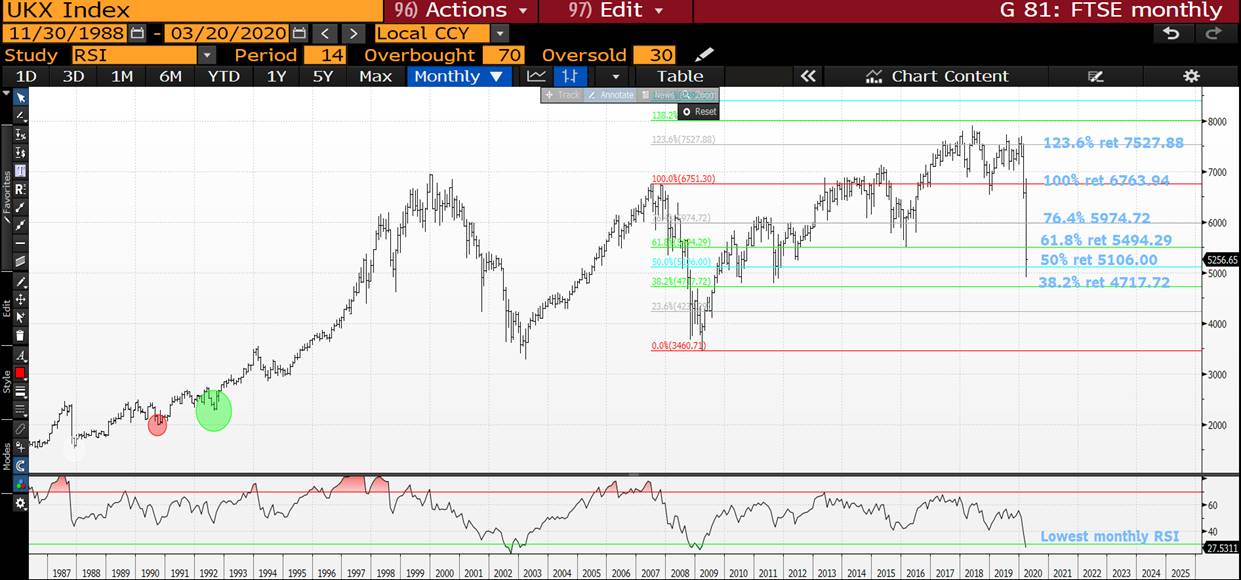

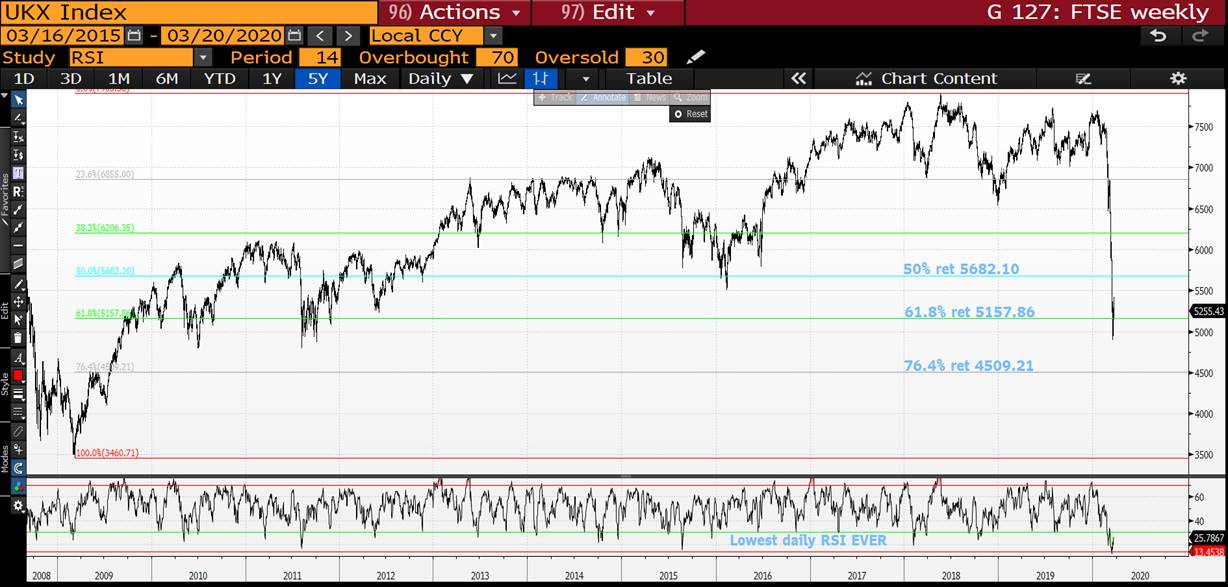

EQUITIES BASING BUT WILL ONLY TRULY SHOW THEIR ABILITY TO CONFIRM A REAL HOLD ONCE THE MONTHLY CLOSES ARE IN.

EQUITIES BASING BUT WILL ONLY TRULY SHOW THEIR ABILITY TO CONFIRM A REAL HOLD ONCE THE MONTHLY CLOSES ARE IN. IT IS VERY SIMILAR SITUATION TO THE MONTHLY US BOND YIELDS.

THAT SAID SO MANY SINGLE STOCK OUTLOOKS LOOK POOR.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

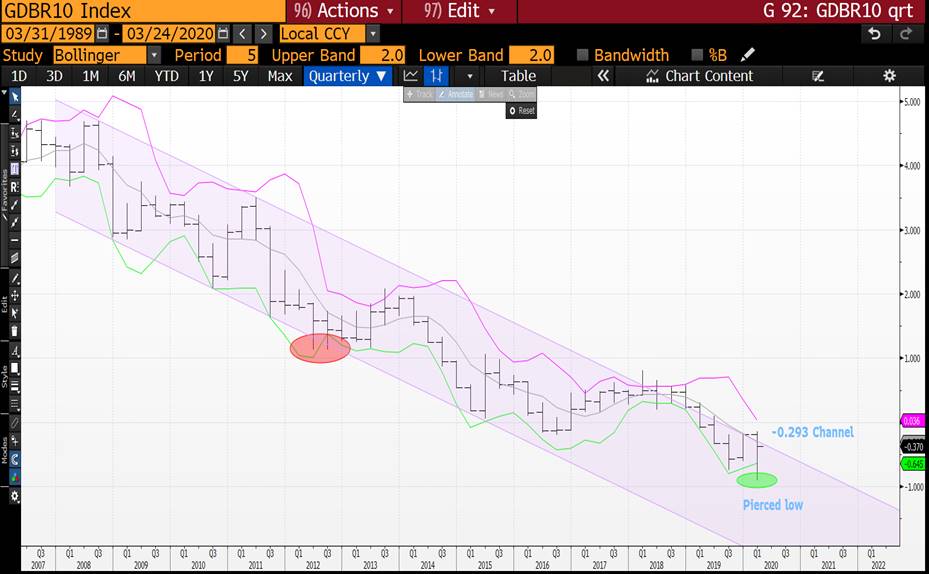

MARKET UPDATE : WE ARE EDGING TOWARD MONTH END AND IF THINGS REMAIN AS THEY ARE, THEN BOND YIELDS WILL HAVE SEEN THEIR LOW!

MARKET UPDATE : WE ARE EDGING TOWARD MONTH END AND IF THINGS REMAIN AS THEY ARE, THEN BOND YIELDS WILL HAVE SEEN THEIR LOW!

GERMANY ALSO HAS A PUNCTUATED YIELD LOW AND CLOSE TO A MOVE OUTSIDE THE RELIABLE CHANNEL.

STOCKS ARE A TENUOUS HOLD BUT WHILST MAKING ALL THE RIGHT NOISES, WE COULD HAVE A BASE.

SINGLE STOCKS REMAIN IN A VERY NEGATIVE TERMINAL STATE BUT ARE FINDING A SUPPORT.

***BONDS NEED TO MAKE A DECISION HERE, IDEALLY FAIL CARRYING ON THE TREND INITIATED WITH THE MARCH 9TH UPSIDE PIERCE. THE US 30YR IS THE BEST MARKET TO VIEW THIS SITUATION AND ONE TO FOCUS ON.

IT IS HIGHLIGHTING A COMPLETE HALT TO THE YIELD SELL OFF, BUT THIS WONT BE WITHOUT EMOTION. THE PRICE SWINGS WILL BE VOLATILE TILL THE MONTHLY CLOSE IS IN.

GERMAN YIELD CHART A SPECIAL CASE. **A slightly cloudy picture given we have 2 opposing pierces. Normally in this situation the original downside pierce takes prescience providing we hold the bollinger average -0.510. A breach of the 38.2% ret -0.151 will help a lot.**

STOCKS CONTINUE TO PUT IN BASE AIDED BY SIZEABLE VOLUMES, WE JUST NEED THAT RECOVERY AND SINGLE COULD FINALLY HELP.***

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EQUITIES TO FINALLY HOLD : EQUITIES FINALLY LOOK LIKE PUTTTING A BASE IN, NOT BEFORE TIME GIVEN THE RSI DISLOCATIONS AND DROP.

SEE PDF FOR MORE DETAIL.

EQUITIES FINALLY LOOK LIKE PUTTTING A BASE IN, NOT BEFORE TIME GIVEN THE RSI DISLOCATIONS AND DROP.

THAT SAID SO MANY SINGLE STOCK OUTLOOKS LOOK POOR.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris