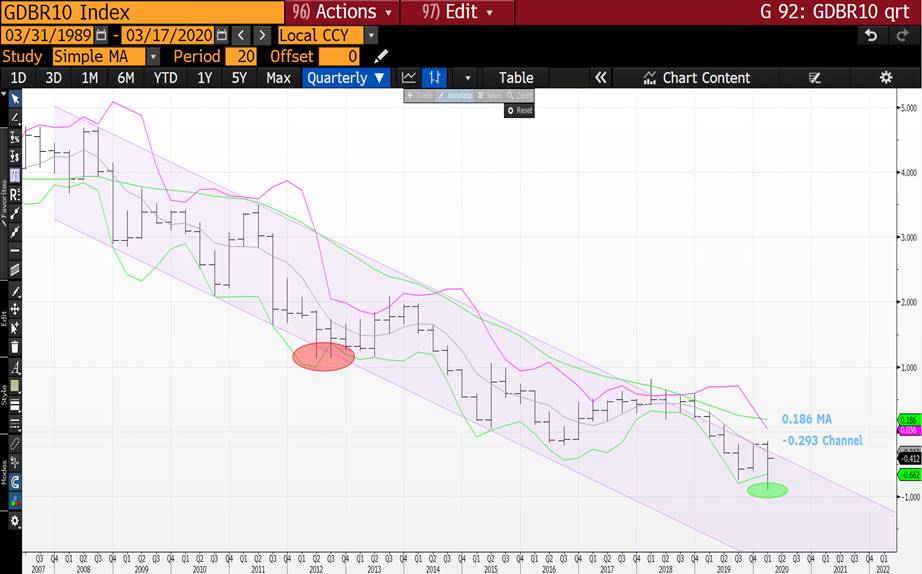

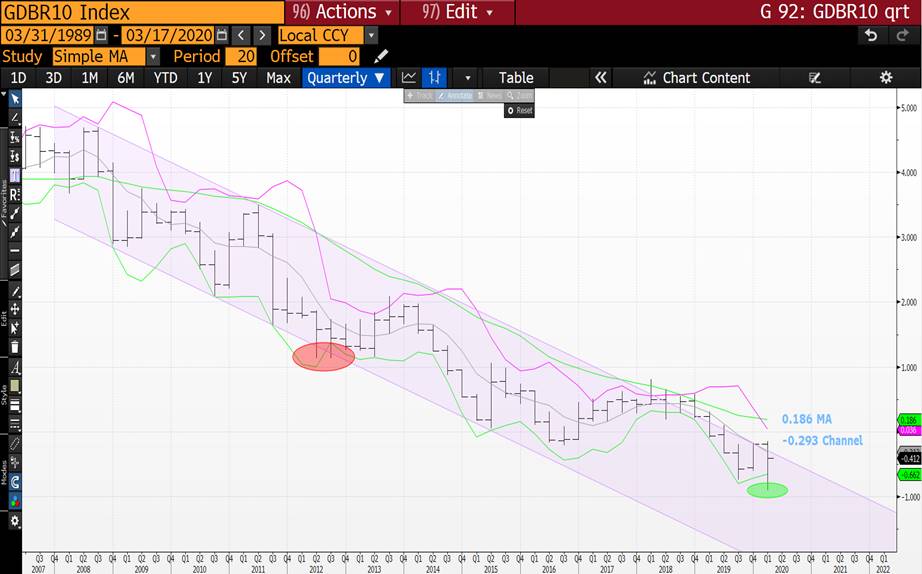

MARKET UPDATE : IF US YIELDS MAINTAIN THIS LOW INTO MONTH END THEN YIELDS WILL HEAD HIGHER FOR THE NEXT FEW YEARS.

MARKET UPDATE : IF US YIELDS MAINTAIN THIS LOW INTO MONTH END THEN YIELDS WILL HEAD HIGHER FOR THE NEXT FEW YEARS.

GERMANY ALSO HAS A PUNCTUATED YIELD LOW AND CLOSE TO A MOVE OUTSIDE THE RELIABLE CHANNEL.

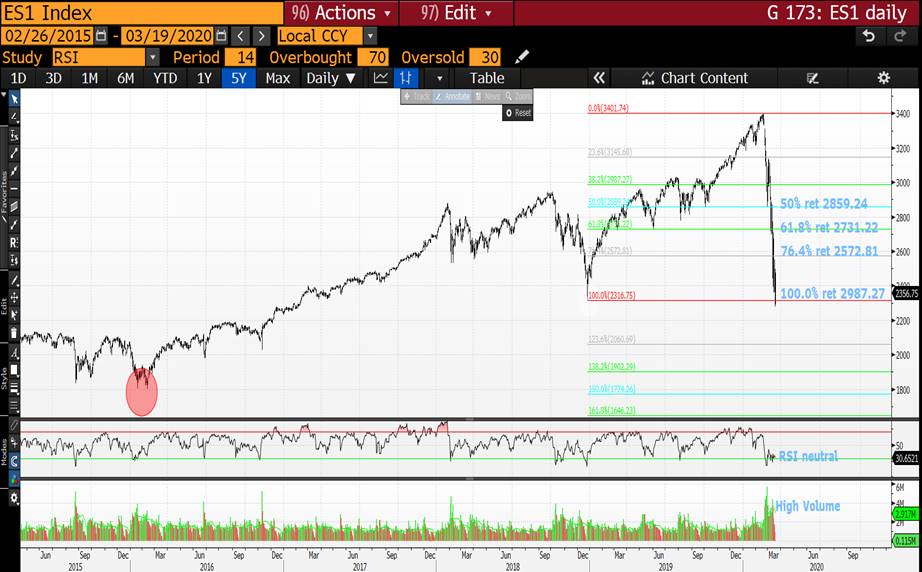

STOCKS HAVE ALL THE TECHNICAL REASONS TO BOUNCE STILL BUT THE FUNDAMENTAL PICTURE LOOKS HORRIFIC. SINGLE STOCKS REMAIN THE BIGGEST OBSTACLE TO A RALLY.

EQUITIES REMAIN WEAK IN EUROPE AND LETS SEE THE KNOCK ON EFFECT IN THE US.

IT WILL BE A CHOPPY RIDE TILL MONTH END BUT THE CLOSE COULD BE EXTREMLY CONCLUSIVE.

SINGLE STOCKS REMAIN IN A VERY NEGATIVE TERMINAL STATE! BUT A TESTING SET OF LONGTERM CLOSES OVER THE NEXT FEW MONTHS.

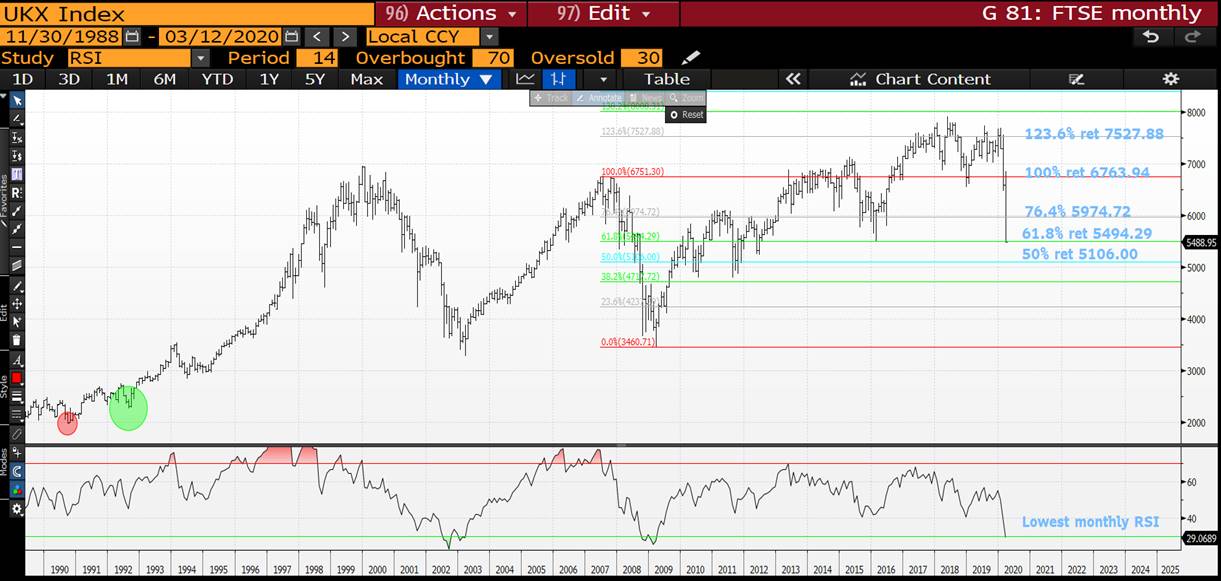

EQUITIES SEEM TO BE BASING NOW ESPECIALLY EUROPE WHICH HAS THROWN UP SOME 2008 RSI DISLOCATIONS.

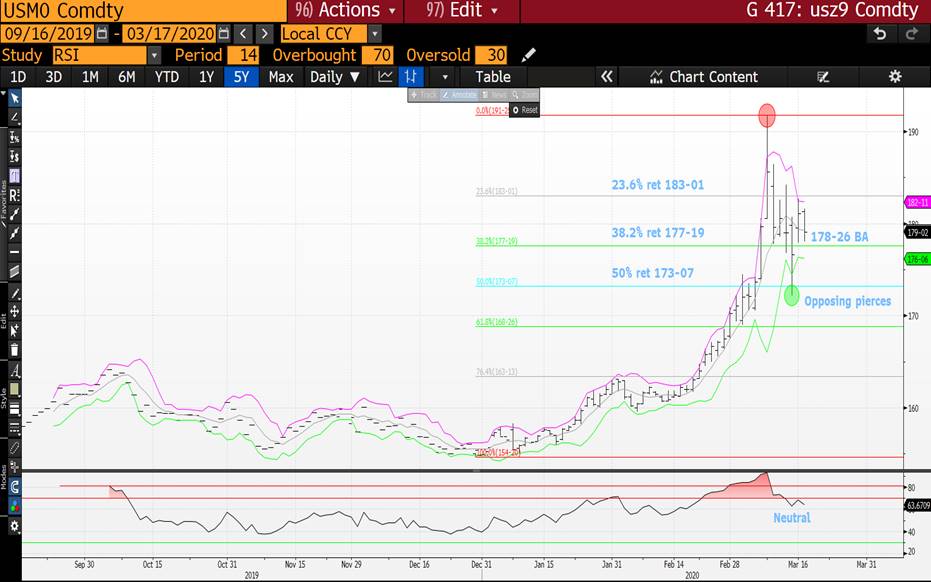

***THE FED DID LITTLE TO THE EXISTING TRENDS IN PLAY. BONDS SEEM TO BE RESPONDING TO THEIR EXTENDED RSI’S ACROSS ALL DURATIONS SO FOR THE TIME BEING YIELDS WILL BOUNCE. THE BIG QUESTION IS COULD THIS BE THE YIELD LOW GIVEN THE SEVERITY OF THE BACK END DOWNSIDE YIELD CHART PIERCE.

IT IS HIGHLIGHTING A COMPLETE HALT TO THE YIELD SELL OFF, BUT THIIS DECISION ISNT GOING TO BE WITHOUT EMOTION GIVEN THE PRICE SWINGS NOR CONFIRMED TILL THE MONTHLY CLOSE IS IN. ***

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Bloomberg Bond News Summary > Wed Mar 18th

Business Briefing

1) U.S. Stock Futures Slide After Rally; Yen Gains: Markets Wrap

(Bloomberg) -- U.S. and European stock futures slumped and the yen advanced, retracing some of the previous day’s moves as traders continue to test where fundamental valuations lie amid rapidly changing news flow. Rallies fizzled throughout Asia, with Japanese shares ending barely up after rising over 4% at one point. Sydney stocks plunged more than 6%, while shares in Hong ...

2) Sorry European Stocks It All Turned Ugly in Asia: Markets Live

3) U.S. Index Futures Hit Limit Down as Volatility Grips Market

(Bloomberg) -- U.S. stock futures slid, hitting exchange-enforced bands that prevent further losses, as investors assess the Trump administration’s beefed up policy response to the coronavirus. Contracts on the S&P 500, Nasdaq 100 and Dow Jones Industrial Average all reached the so-called limit down level established each day by the Chicago Mercantile Exchange. Futures ...

World News Briefing

4) Federal U.S. Government Shifts to Work-From-Home: Virus Update

(Bloomberg) -- The White House ordered the federal U.S. government to maximize the use of teleworking and minimize face-to-face interactions, emulating moves by major employers across the globe. Travel curbs continue to expand. European countries agreed to shut their borders to foreigners, Taiwan made a similar move and Hong Kong is considering the step. Australia told its ...

5) Trump Told Mnuchin to Go Big, and a $1 Trillion Stimulus Emerged

(Bloomberg) -- Steven Mnuchin had an ominous message for Senate Republicans gathered Tuesday in a marble-clad meeting room in the Russell office building: we need to pass a virus stimulus bill, or the U.S. could be looking at a 20 percent unemployment rate. The message was a far cry from little more than a week ago, when Trump and his aides had declared the economy was ...

6) Putin Shocked Aides Caught Out by His Presidential Power Play

(Bloomberg) -- Vladimir Putin’s surprise move to allow himself to remain as president until 2036 caught even many Kremlin insiders off guard, leaving some feeling deceived by his motivation for changing the constitution. His sudden reversal -- approving a plan that he’d long publicly resisted -- was a blow to some senior officials’ hopes that he would find a more elegant ...

7) Biden Sweeps Tuesday Votes, Taking Command of Democratic Race

(Bloomberg) -- Joe Biden swept the Democratic presidential primaries being held Tuesday, winning in Arizona, Florida and Illinois giving him a commanding lead over his rival Bernie Sanders in the battle to secure the party’s nomination. Biden’s domination of the race since the South Carolina primary has put him on a glide path to the party’s nomination to take on President ...

8) China Further Erodes Hong Kong’s Autonomy With Journalist Cull

(Bloomberg) -- In ousting a group of American reporters in Beijing, China also dealt a severe blow to Hong Kong’s autonomy that could have lasting repercussions for media freedom in the city. China on Wednesday said that U.S. journalists set to be expelled from Beijing wouldn’t be allowed to work in the special administrative regions of Hong Kong or Macau, either. That’s ...

Bonds

9) Fallout From Turmoil in Global Credit Markets Is Spreading

(Bloomberg) -- The fallout from the worst rout in credit markets since the global financial crisis is spreading, threatening everything from mortgage debt in Australia to short-term money markets in the U.S. As the deadly coronavirus pandemic brought more grim headlines Wednesday, spreads on Asian dollar bonds and credit-default swaps pushed out further in another volatile ...

10) Yardeni Says Bond Vigilantes May Return After Virus Crisis Fades

(Bloomberg) -- The market veteran credited with coining the term “bond vigilantes” says there’s a chance they could make a return in the aftermath of the coronavirus, after being largely absent for decades. Government debt in most developed nations has seen a powerful rally the past two months as the deadly epidemic throttled economic growth. But once the outbreak finally ...

11) How a Little Known Trade Upended the U.S. Treasury Market

(Bloomberg) -- It is said that liquidity is a coward, it disappears at the first sign of trouble. What happened in Treasuries last week was one example of this, as problems in one small corner of the bond market helped spark a liquidity crisis in another that lead to a $5 trillion Federal Reserve promise to calm markets. As coronavirus cases spiked around the world and unprecedented travel restrictions ...

12) Credit Turmoil Is Closing In on Japan’s $650 Billion Market

(Bloomberg) -- Japan’s corporate bond market had been an oasis of calm in recent weeks, with deals staying steady even as the coronavirus pandemic caused the worst sell-offs elsewhere since the global financial crisis. That’s now changing. The cost to insure company debt against default in Japan has surged 77 basis points so far in March, the sharpest monthly increase since ...

13) Australia’s Mortgage-Backed Security Market ‘Effectively Closed’

(Bloomberg) -- Australia’s mortgage-backed security market, a crucial source of finance for consumer loans, has gummed up. With credit markets everywhere reeling as investors wake up to the severity of the coronavirus crisis, local fund managers say they expect to see new issuance pulled. “The market is effectively closed for new residential mortgage-backed security issuance. ...

14) Oaktree Planning New Distressed Fund to Catch Bad Debt Surge

(Bloomberg) -- Oaktree Capital Management LLC is planning a new distressed debt fund as recent credit market turmoil throws up investment opportunities. “High-yield bonds, loans and CLO tranches, for example, offer markedly better opportunities than they did in the very recent past,” co-founder Howard Marks said in a March 16 client note titled ‘A Different World’. ...

Central Banks

15) Pound Snaps Six-Day Loss as U.K. Announces Stimulus: Inside G-10

(Bloomberg) -- The pound halted a six-day losing streak against the dollar after some investors judged its recent losses as excessive and as the U.K. government announced a stimulus package.

- GBP/USD jumped as much as 0.6% after touching 1.2003 on Tuesday, its lowest since Sept. 3. Boris Johnson’s administration announced a massive rescue package of loans and grants for ...

16) BOJ’s $112 Billion ETF Target Boosts Topix Index Over Nikkei 225

(Bloomberg) -- The Bank of Japan’s record purchase of exchange-traded funds is clearly having an impact on at least one thing: the Topix index’s outperformance versus the Nikkei 225 Stock Average. The benchmark Topix gained 2.8% over the past two sessions, compared with a loss of 1.6% for the Nikkei 225. The divergence “makes sense,” given the BOJ’s plan to double its ...

17) Fed Unleashes Emergency Loan Facilities as U.S. Braces for Virus

(Bloomberg) -- The Federal Reserve unleashed two emergency lending programs on Tuesday to help keep credit flowing to the U.S. economy amid strain in financial markets that it blamed on the coronavirus pandemic. The central bank is using emergency authorities to establish a Commercial Paper Funding Facility with the approval of the Treasury secretary, according to a Fed statement ...

18) Turkey’s Emergency Steps Push Real Rate Near World’s Lowest (2)

(Bloomberg) -- Turkey’s central bank cut borrowing costs by a full percentage point and announced a series of measures to boost liquidity amid the coronavirus outbreak, pushing its interest rates adjusted for inflation near the world’s lowest. The benchmark rate was cut to 9.75% from 10.75% at an emergency meeting, the central bank said on Tuesday. The Monetary Policy ...

19) The Only Question on South African Rate Cut Is ‘How Much?’ (1)

(Bloomberg) -- The debate around South African interest rates has now moved from whether the central bank will cut on Thursday to how much it will cut. Of 21 economists in a Bloomberg survey, 11 predict a 50 basis-point reduction, while the balance expect the rate to be lowered by 25 basis points. Forward-rate agreements show traders have switched from pricing in a less ...

Economic News

20) Surging U.S. Dollar Is Next Big Headache for the World Economy

(Bloomberg) -- King Dollar is creating a new headache for virus-battered economies globally, with emerging markets especially vulnerable as they try to cope with collapsing currencies and plunging demand. Investors are fleeing emerging markets in record numbers and piling into the safe-haven greenback, with two emergency interest-rate cuts this month by the Federal Reserve ...

21) Those $1,000 Checks Can’t Stop the Now-Inevitable U.S. Recession

(Bloomberg) -- President Donald Trump’s plan to send $1,000 to every American, part of emergency stimulus of as much as $1.2 trillion to contain the economic hit from the coronavirus, is unlikely to stop a U.S. recession. The administration announced plans Tuesday to send the direct payments in coming days following several weeks of pressure from investors, economists, ...

22) SNB’s Virus Fallout Sees Franc Pushed to a Five-Year High

(Bloomberg) -- Pressure is intensifying on the Swiss National Bank to join policy makers around the world who’ve cut interest rates and increased stimulus in response to the coronavirus outbreak. The central bank hasn’t dropped a bombshell so far this year, despite the franc being at a five-year high against the euro. Instead, data ...

23) Cutting China 2020 GDP Forecast to 1.4% as Virus Drags: Econmics

(Bloomberg Economics) -- Bloomberg Economics is downgrading its forecast for China’s 2020 growth. Our previous estimate for the year was 5.2%. Our new forecast is 1.4%. That drastic reduction reflects a number of factors:

- Growth in the first two months of the year was significantly worse than expected. Plugging the record contraction in industrial output, retail sales, and fixed ...

24) Trump Pushes $1.2 Trillion Stimulus, $1,000 Checks in Two Weeks

(Bloomberg) -- The Trump administration is discussing a plan that could amount to as much as $1.2 trillion in spending -- including direct payments of $1,000 or more to Americans within two weeks -- to blunt some of the economic impact of the widening coronavirus outbreak. Treasury Secretary Steven Mnuchin pitched $250 billion in checks to be sent at the end of April with a ...

European Central Bank

25) ECB’s Holzmann Says Monetary Policy Has Reached Its Limits

(Bloomberg) -- ECB Governing Council was unanimous in its analysis that monetary policy has reached its limits and fiscal policy is needed to address coronavirus crisis, council member Robert Holzmann tells Der Standard in interview.

- “It’s the job of the state to provide guarantees and social support, monetary policy can’t paper over the problem,” Holzmann quoted as saying

- About market reaction to ECB President Christine Lagarde’s press conference last week: ...

26) ECB Provides Banks With 109 Billion Euros to Prevent Squeeze

(Bloomberg) -- Banks took 109.1 billion euros ($120 billion) from the European Central Bank in the first installment of interim financing designed to prevent money markets from seizing up during the coronavirus pandemic. The cash is part of a package of measures the ECB unveiled last week that also included an increase in bond-buying and more favorable terms for its ...

27) SocGen Sees Capital Requirement Falling 1% Point on ECB Relief

(Bloomberg) -- SocGen said measures announced by the ECB last week will cut its minimum requirement for common equity Tier 1 capital to 8.98% from 10.03%.

- The decline was prompted by an allowance to use subordinated bonds to help fill its overall capital requirements as well as the elimination of the so-called countercyclical capital buffer

- The company’s CET1 ratio stood at 12.7% at the end of December, SocGen said in a statement ...

28) Kuroda Remains Wary Over Deeper Negative Rates Like Lagarde

(Bloomberg) -- Bank of Japan Governor Haruhiko Kuroda’s actions once again showed his wariness over taking interest rates further below zero, despite yet another wave of hefty cuts from global central banks in response to the coronavirus pandemic. Like European Central Bank chief Christine Lagarde last Thursday, Kuroda opted for more asset purchases rather than rely on the ...

29) ECB’s Company Bond-Buying Dash Fails to Halt Credit Market Slump

(Bloomberg) -- A busy week of corporate purchases for the European Central Bank failed to prevent the biggest jump in risk premiums of euro high-grade bonds in more than a decade.

- Central bank bought ~EU1.9b of corporate bonds in the week to Mar. 16

- Added 14 new securities to its portfolio of almost 1,330 corporate bonds

- Weekly pace is the third-largest since the ECB restarted net asset purchases in Nov.

- ECB ...

First Word FX News Foreign Exchange

30) Funding Markets Pause for Breath Ahead of Key Swap Auctions

(Bloomberg) -- Broad U.S. dollar funding markets showed a modest easing Wednesday, as investors paused to reflect on the recent slew of Federal Reserve policy measures, the impact of which will be mostly felt in coming days. The Bank of England and European Central Bank are set to conduct enhanced swap auctions announced as part of Sunday’s policy package, following a $32 ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MARKET UPDATE : POST THE FED A MIXED PICTURE IN THE US BOND YIELDS BUT EUROPE IS KEEN TO CONTINUE THE YIELD HIGHER CALL.

MARKET UPDATE : POST THE FED A MIXED PICTURE IN THE US BOND YIELDS BUT EUROPE IS KEEN TO CONTINUE THE YIELD HIGHER CALL.

STOCKS HAVE ALL THE TECHNICAL REASONS TO BOUNCE BUT THE FUNDAMENTAL PICTURE LOOKS HORRIFIC. SINGLE STOCKS REMAIN THE BIGGEST OBSTACLE TO A RALLY.

EQUITIES REMAIN WEAK IN EUROPE AND LETS SEE THE KNOCK ON EFFECT IN THE US.

IT WILL BE A CHOPPY RIDE TILL MONTH END BUT THE CLOSE COULD BE EXTREMLY CONCLUSIVE.

SINGLE STOCKS REMAIN IN A VERY NEGATIVE TERMINAL STATE! BUT A TESTING SET OF LONGTERM CLOSES OVER THE NEXT FEW MONTHS.

EQUITIES SEEM TO BE BASING NOW ESPECIALLY EUROPE WHICH HAS THROWN UP SOME 2008 RSI DISLOCATIONS.

***THE FED DID LITTLE TO THE EXISTING TRENDS IN PLAY. BONDS SEEM TO BE RESPONDING TO THEIR EXTENDED RSI’S ACROSS ALL DURATIONS SO FOR THE TIME BEING YIELDS WILL BOUNCE. THE BIG QUESTION IS COULD THIS BE THE YIELD LOW GIVEN THE SEVERITY OF THE BACK END DOWNSIDE YIELD CHART PIERCE.

IT IS HIGHLIGHTING A COMPLETE HALT TO THE YIELD SELL OFF, BUT THIIS DECISION ISNT GOING TO BE WITHOUT EMOTION GIVEN THE PRICE SWINGS NOR CONFIRMED TILL THE MONTHLY CLOSE IS IN. ***

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MACROCOSM: Charts Rundown > Making Sense of the Nonsense

When things get really ugly in the markets, I like to delve into charts to help make sense of the nonsense. We’ll see below that while we’re not in uncharted territory, it’s the speed and ferocity of this massive risk dump that has alarmed the markets most.

Rates

Bunds have plumbed new depths in yields in response to Covid-19’s expect impact on the German/European economy. We can see, however, that the correlation with Mftg PMIs has been solid and this decay has been going on since early 2018. We’ve spent most of the last 18 months with 10yr DBRs rich to the 200 day MA level and we’re sitting on it right now.

Bund futures chart shows a very well established down trend in the level of open interest since mid-2018. This has accelerated lower as the ECB returned to QE and would help explain why liquidity feels rather impaired over the last few months.

DBR-BTPS 10yr spread vs FTSE’s MIB equity index (inverted) – correlation has been high enough – especially in times of stress – to suggest this EGB spread is a good way to express a view on equities – especially Italy’s. This chart goes back to 2017 and the 30 day RSI is flashing overdone, as one might expect.

USTs 2-10s with inverted FDTR Index (fed funds target - inverted). The correlation of the 2-10s curve to rising fed funds was largely as expected until the last couple weeks where the wheels fell off. The unprecedented 100bps rate cut, combined with the announcement of QE has combined to keep the curve in bull-flattening mode although we’ve begun to leak steeper…

UKT 10-30s vs Cable (inverted)…

Equities

S&Ps have had a couple other monumental sell-offs in the last 25-30yrs but they happened over the course of months, not days. Back then, the amount of credit/cash sloshing around the system was a lot smaller than it is now (which is how stocks rallied so much to begin with) and the pullbacks were associated with recessions. Remains to be seen whether this move in equities signals a recession.

SPX 500 Dividend yield… Widest spread to UST 30yrs at +114bps seen in a long time…

Credit

Just about every measure of corporate credit we have access too is flashing ‘Oh No!’. The ITRX XOVER index, HY spreads, VIX, you name it. The worrying thing is, there’s been little sign of a reversal even after the Fed’s move this weekend.

OIL

Conventional wisdom is cheaper oil is good for economic growth. We get that – but the bulk of the meaningful declines in GDP over the last 30yrs saw a demand—driven decline in oil prices that was associated with the start of the recession. It wasn’t until later in the cycle that those cheap trips to the pumps really mattered.

WTI vs US GDP YOY

CURRENCIES

The US dollar remains the ‘port in the storm’ although the link to short rates levels has broken down…

Cable’s getting spanked here – which seems a reflection not just of the impact of Covid-19 on the UK economy but the realization that there’s more fiscal spending needed AND there’s still Brexit to deal with. This 1.20 level is HUGE.

More to come…!

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Joe Rogan Experience #1439 - Michael Osterholm (Coronavirus Update)

Michael Osterholm is an internationally recognized expert in infectious disease epidemiology. He is Regents Professor, McKnight Presidential Endowed Chair in Public Health, the director of the Center for Infectious Disease Research and Policy (CIDRAP), Distinguished Teaching Professor in the Division of Environmental Health Sciences, School of Public Health, a professor in the Technological Leadership Institute, College of Science and Engineering, and an adjunct professor in the Medical School, all at the University of Minnesota. Look for his book "Deadliest Enemy: Our War Against Deadly Germs" for more info

You’ll get the gist of his message in the first 10-15 mins… It’s very interesting – and a little alarming…

https://www.youtube.com/watch?v=E3URhJx0NSw&feature=youtu.be

Best,

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Mon Mar 16th

Business Briefing

1) Treasuries Soar After Fed Move; Stocks Decline: Markets Wrap

(Bloomberg) -- Treasuries surged and U.S. equity futures tumbled at the start of another volatile week as investors responded to a rapidly escalating economic hit from the coronavirus and a massive emergency move by the Federal Reserve to ease policy. Benchmark Treasury yields declined more than 30 basis points at one point. Futures on the S&P 500 Index hit trading ...

2) Aramco Keeps $75 Billion Dividend Promise Even With Oil’s Plunge

(Bloomberg) -- Even with oil prices having slumped, Saudi Aramco said it still intends to give at least $75 billion to shareholders this year. The world’s biggest company by market value, which listed in the Saudi Arabian capital of Riyadh in December, will pay the dividends on a quarterly basis, it said in its 2019 financial results released on Sunday. ...

3) Welcome to a World Where Yields Are Lower Forever: Markets Live

World News Briefing

4) Airlines Cut Flights; BOJ Strengthens Stimulus: Virus Update

(Bloomberg) -- The Federal Reserve slashed rates to near zero as central banks took sweeping action to blunt the financial impact of the coronavirus outbreak. U.S. stock futures tumbled and Treasuries jumped as investors worried that central bank actions aren’t enough. The Bank of Japan strengthened stimulus but stopped short of cutting its negative interest rate. ...

5) Biden, Sanders Use Coronavirus Response to Define Their Visions

(Bloomberg) -- In their first one-on-one debate, Joe Biden and Bernie Sanders framed their responses to the coronavirus outbreak they way they’ve crafted their campaigns from the beginning -- one the steady hand of experience, the other a revolutionary wanting to reshape the country. They sparred on ideological lines over how the government should contain the outbreak. ...

6) From Schools to Bars, Closures Mark America’s Big Shutdown

(Bloomberg) -- The biggest school system in the U.S. is closing. California is confining the elderly to their homes. Bars, restaurants, resorts and several retail chains are closing shop. Welcome to the Great Shutdown, as wide swaths of the American economy enter suspended animation to combat the spread of the coronavirus. On Sunday, New York City Mayor Bill de Blasio said the city’s public schools -- ...

7) NYC, LA Ramping Up Virus-Fighting With Reasturant Closures

(Bloomberg) -- New York City and Los Angeles are taking major steps to curb social interaction to fight the spread of the coronavirus. The two biggest U.S. cities will limit restaurants to take out and delivery orders. New York City will also shut down nightclubs, movie theaters, small theater houses, concert venues and allow bars to only offer take out and deliveries -- ...

8) CDC Says Mass Gatherings in U.S. Should be Scrapped for Now

(Bloomberg) -- In the most extreme effort yet to slow the march of coronavirus in the U.S., the Centers for Disease Control and Prevention recommended that events of 50 people or more not be held for about two months. For the next eight weeks, organizers should cancel or postpone in-person events of that size throughout the U.S., the agency said on its website Sunday. When ...

Bonds

9) Treasuries Lead Rally With Fed, BOJ Raining Cash Across Markets

(Bloomberg) -- Treasuries surged after the Federal Reserve slashed interest rates to near zero, leading an effort by global central banks to provide liquidity for stressed markets. Global bonds rallied. Just hours after the Fed’s second emergency rate-cut this month, the Bank of Japan announced plans to buy more corporate bonds and commercial paper, while the Reserve Bank ...

10) Historic Sell-Off Leaves Credit Markets Unimpressed by Fed Move

(Bloomberg) -- Credit markets reeling from their worst week since the global financial crisis weren’t impressed by the Federal Reserve’s dramatic moves, as investors including Pacific Investment Management Co. called for governments to also do more to avert a meltdown. The Fed cut its benchmark interest rate by a full percentage point to near zero Sunday and promised to ...

11) Pimco Says Policy Makers Need to Do More to Prevent Meltdown

(Bloomberg) -- Pacific Investment Management Co. joined a growing group of big investors warning that a global recession looks increasingly inevitable in the face of the coronavirus pandemic and more needs to be done to stem a crisis. “Fiscal and monetary policy makers around the world will have to pull out all the stops to prevent what currently looks like an inevitable ...

12) Fed’s Unexpected Cut to Induce More Volatility: PineBridge’s Lau

(Bloomberg) -- The Federal Reserve’s unexpected move highlights the liquidity squeeze in the financial system in terms of dollar shortage and illiquid repo market, which will undoubtedly induce more volatility in the system and cause market sentiment to be more defensive, said Arthur Lau, head of Asian ex-Japan fixed income at PineBridge Investments.

- That said, it also suggests central banks will not hesitate to carry out radical measures ...

13) Shell-Shocked Markets Wake to Fed at Zero Amid Dollar Volatility

(Bloomberg) -- If traders hoped Friday’s turnaround would prove more than a moment of relief for the world’s shell-shocked markets, an emergency interest-rate cut by the Federal Reserve and coordinated steps by other central banks failed to bring any lasting sense of stability. The dollar fell across the board as the U.S. central bank lowered rates to 0%-0.25%, a level last ...

14) Morgan Stanley Says Markets Are Bottoming So Sell U.S. Dollar

(Bloomberg) -- Global financial markets are now in a bottoming phase, and investors should start to add risk and sell the U.S. dollar, according to Morgan Stanley. The tightening of financial conditions has been fast and furious, caused by a slump in stock markets and a widening of credit spreads, strategists including Matthew Hornbach in New York wrote in a report ...

Central Banks

15) Funding Market Stress Worsens Despite Emergency Fed Action

(Bloomberg) -- The howitzer from the Federal Reserve on Sunday is blowing up one corner of the very funding market it was supposed to save. That’s a sign they have only addressed the symptoms and not the cause. The three-month cross-currency basis for dollar-yen -- a proxy for how expensive it is to get the greenback -- spiked to its widest on record, according to data ...

16) BOJ Ramps Up Asset Buying, Holds Rates Steady After Fed Cut (2)

(Bloomberg) -- The Bank of Japan strengthened its stimulus but stopped short of cutting its negative interest rate at an early meeting Monday after the Federal Reserve slashed its own rates to address the rapidly mounting economic shock of the coronavirus pandemic. The BOJ said it would buy more assets including exchange-traded funds and corporate bonds, and offer a new ...

17) U.S. Stock Futures Tumble to Limit Down After Fed Rate Reduction

(Bloomberg) -- U.S. stock futures tumbled, wiping out most of the rally that swept Wall Street in Friday’s last hour and tripping exchange trading curbs, as investors worried that emergency measures by the Federal Reserve will fall short of cushioning the coronavirus’s blows to the economy. Contracts on the S&P 500, whose violent swings have triggered limits in five of the ...

Economic News

18) China’s Economy Suffers Historic Slump Due to Virus Shutdown

(Bloomberg) -- China suffered an even deeper slump than analysts feared at the start of the year as the coronavirus shuttered factories, shops and restaurants across the nation, underscoring the fallout now facing the global economy as the virus spreads around the world. Industrial output plunged 13.5% in January and February from a year earlier, retail sales fell 20.5%, ...

19) BOJ Ramps Up Asset Buying, Holds Rates Steady After Fed Cut

(Bloomberg) -- The Bank of Japan strengthened stimulus but stopped short of cutting its negative interest rate at an early meeting Monday after the Federal Reserve slashed its own rates to address rapidly mounting shocks from the coronavirus. The BOJ doubled its target for net purchases of exchange-traded funds to 12 trillion yen ($112 billion). Even before the Fed took ...

20) The Fed’s Future Is Already Here as U.S. Joins Zero-Rate World

(Bloomberg) -- America’s central bankers thought they had plenty of time to prep for their next encounter with the zero-rate world they escaped with such difficulty after 2008. On Sunday night, the coronavirus plunged them back into it well ahead of schedule. In the second emergency interest-rate cut in two weeks, the Fed slashed its benchmark back ...

21) Europe’s Recession Inevitable as Last Line of Defense Crumbles

(Bloomberg) -- There’s 1,000 miles and a body of water between Mark McGowan and the Italian epicenter of Europe’s coronavirus outbreak. He may as well be next door. His 16-room hotel, the Scholars Townhouse in Drogheda, north of Dublin, has seen a 60% drop in room revenue. The business market “just melted away overnight,” he said. “We have three people at reception and what struck me is the silence. You don’t hear the ...

22) Fed Slashes Rates to Near Zero as U.S. Economy Braces for Virus

(Bloomberg) -- The Federal Reserve swept into action on Sunday to save the U.S. economy from the fallout of the coronavirus, slashing its benchmark interest rate by a full percentage point to near zero and promising to boost its bond holdings by at least $700 billion. In remarks underlining the sense of urgency, Fed Chairman Jerome Powell told a hastily assembled press ...

European Central Bank

23) ECB leader apologises for remarks that hit Italy bonds

Preview text not available for this story.

24) Lagarde Apologised to ECB’s Governing Council, FT Reports

(Bloomberg) -- European Central Bank President Christine Lagarde apologized to colleagues on the Governing Council for communicating poorly after last week’s policy decision, the Financial Times reported. She told policy makers at the start of a conference call on Friday that she was sorry for saying that it’s not the institution’s role to close bond spreads, according to ...

25) Christine Lagarde apologises for botched communication of ECB strategy

Preview text not available for this story.

Financial Times

@FinancialTimes

FT Exclusive: Christine Lagarde apologised to the European Central Bank’s governing council for her botched communication about its new monetary policy strategy which triggered a bond market sell-off last week on.ft.com/2x3VquH

Sent via SocialFlow. View original tweet.

First Word FX News Foreign Exchange

27) *BANK OF KOREA TO HOLD EMERGENCY MEETING AT 4:30PM LOCAL TIME

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

**PLEASE READ AS LONGTERM IMPLICATIONS IF RIGHT ** MARKET UPDATE : CHART WISE WE NOW HAVE A MASSIVE LONGTERM DILEMA, COULD THAT BE THE LOW FOR BOND YIELDS!

MARKET UPDATE : CHART WISE WE NOW HAVE A MASSIVE LONGTERM DILEMA, COULD THAT BE THE LOW FOR BOND YIELDS!

IT WILL BE A CHOPPY RIDE TILL MONTH END BUT THE CLOSE COULD BE EXTREMLY CONCLUSIVE.

SINGLE STOCKS WILL ARGUE NO! BUT A TESTING SET OF LONGTERM CLOSES OVER THE NEXT FEW MONTHS.

EQUITIES SEEM TO BE BASING NOW ESPECIALLY EUROPE WHICH HAS THROWN UP SOME 2008 RSI DISLOCATIONS.

***BONDS SEEM TO BE RESPONDING TO THEIR EXTENDED RSI’S ACROSS ALL DURATIONS SO FOR THE TIME BEING YIELDS WILL BOUNCE. THE BIG QUESTION IS COULD THIS BE THE YIELD LOW GIVEN THE SEVERITY OF THE BACK END DOWNSIDE YIELD CHART PIERCE.

IT IS HIGHLIGHTING A COMPLETE HALT TO THE YIELD SELL OFF, BUT THIIS DECISION ISNT GOING TO BE WITHOUT EMOTION GIVEN THE PRICE SWINGS NOR CONFIRMED TILL THE MONTHLY CLOSE IS IN. ***

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Bloomberg Bond News Summary > Fri 13th of March

Business Briefing

1) Global Stock Rout Eases as U.S. Futures Climb: Markets Wrap

(Bloomberg) -- Asian stocks pared losses following the worst Wall Street session since 1987, as U.S. futures pushed higher. Still, most benchmarks remained in the red, with investors spooked that emergency fiscal and monetary packages won’t be enough to stave off a recession. S&P 500 contracts reversed losses of as much as 3% and climbed, while futures in the U.K. saw ...

2) Asia Stocks Go Wild After Trading Halts Set Off in Morning (1)

(Bloomberg) -- A terrible week for Asian stocks started to look a bit better as Friday evolved. As Asia woke up to the worst Wall Street sell-off since 1987, benchmark indexes sank across the region, triggering trading halts from Seoul to Bangkok, Manila, Jakarta and Mumbai. But by 1:40 p.m. in Hong Kong, Australian stocks had staged a record intraday swing to trade up ...

3) Roche Gets Clearance for Coronavirus Test That’s 10 Times Faster

(Bloomberg) -- Roche Holding AG said it won emergency approval from the U.S. government for a highly automated coronavirus test, potentially speeding up the ability to test patients by a factor of 10. The U.S. Food and Drug Administration granted “Emergency Use Authorization” to the test, which runs on Roche’s cobas 6800/8800 systems. The tool also is available in Europe ...

4) Bear Market Rallies Can Be Most Powerful of All: Markets Live

World News Briefing

5) More Regions Lock Down; Sports Leagues Halt Play: Virus Update

(Bloomberg) -- French President Emmanuel Macron called the coronavirus the epidemic of the century as the death toll from the coronavirus approached 5,000. New York City declared a state of emergency, bringing the financial and cultural capital of the U.S. to a standstill, while the Philippines locked down Manila. Sports organizations from Major League Baseball to the PGA ...

6) Europe Grinds to Halt as ECB Is Criticized for Too Little Action

(Bloomberg) -- France and Italy took a rare swipe at the European Central Bank after efforts to contain the fallout from the coronavirus pandemic failed to calm jittery markets and only deepened the rout. President Emmanuel Macron was joined by Italian officials in saying that an ECB stimulus package announced earlier in the day falls short of tackling the unfolding crisis. ...

7) New York Adopts War Footing to Ready Hospitals for Virus Surge

(Bloomberg) -- Officials in New York rushed to prepare hospitals for a surge in coronavirus cases that could put unprecedented pressure on the medical system in the country’s largest population center, an acknowledgment that attempts to contain the virus’s spread are largely giving way to efforts to mitigate the damage. New York Mayor Bill de Blasio declared a state of emergency. Hospitals in the area asked ...

8) Inside the Oval Office, a Fierce Fight Over Trump’s Virus Speech

(Bloomberg) -- Donald Trump sat in the Oval Office Wednesday before the biggest speech of his presidency, listening to his aides argue about whether barring Europeans from traveling to the U.S. would trigger a global depression. The medical experts on his team were adamant: The best way to slow the spread of the novel coronavirus was to buy time by keeping Europeans out, ...

9) The City That Never Sleeps Is Brought to Standstill by Virus

(Bloomberg) -- New York, the financial and cultural capital of the U.S., folded in on itself Thursday amid the coronavirus pandemic. Mayor Bill de Blasio declared an emergency in the nation’s largest city. Offices and trading floors were half-empty, those workers still present surrounded by vacant desks and the smell of hand sanitizer. Broadway theaters went dark and ...

Bonds

10) Asian Central Banks Inject Funds to Soothe Virus-Rattled Markets

(Bloomberg) -- Asian central banks moved aggressively to counter the market carnage Friday, pumping liquidity into the financial system and discussing emergency action to fight the global economy’s biggest threat since the financial crisis. The Bank of Korea is considering a special meeting to tackle wild swings in the foreign-exchange market, and Japan offered to provide ...

11) Worst Week For Credit in Decade Fuels Fear of Defaults Surging

(Bloomberg) -- The worst week for credit since the global financial crisis is raising the risk of a chain reaction of defaults and testing the capacity of policy makers around the world to ensure access to cash for businesses devastated by the coronavirus pandemic. Companies from Boeing Co. to Hilton Worldwide Holdings Inc. have been drawing down on available loans and ...

12) Japan Corporates Join Cash Rush With Paper Issuances at Record

(Bloomberg) -- The global dash for cash has hit Japan where the outstanding amount of commercial paper is at record levels, surpassing the peak set before the collapse of Lehman Brothers. Outstanding issuance at the end of February was 22.8 trillion yen ($217 billion), a monthly record, according to data going back to April 2007 from Japan Securities Depository Center Inc. ...

13) China Conglomerate Suffers Weak Demand for Dollar Bond Swap Plan

(Bloomberg) -- Xinjiang Guanghui Industry Investment (Group) Co., a Chinese private conglomerate with businesses in car dealership and energy, received weak response from investors to an offer to swap a soon-to-mature dollar bond for a new one. Based in the western region of Xinjiang, Xinjiang Guanghui said holders representing around $58 million, or 19.36% of the aggregate ...

14) Global Bond Yield Tumble Means Cash Piling Up for Japan Insurer

(Bloomberg) -- For Japan’s Taiju Life Insurance Co., the global bond rally is a good time for it to pare its foreign holdings. It has been cutting back on overseas debt, and is looking to buy super-long Japanese sovereign bonds, according to Hiroshi Nakamura, a senior manager in the investment planning department. “We aren’t panicking in this crisis,” Nakamura said in an interview last week. “We are a ...

15) Dollar Advances on Liquidity Worries, Stock Rout: Inside G-10

(Bloomberg) -- A gauge of the dollar traded near a three-year high as a global sell-off in stocks and worries about a liquidity crunch spooked investors. The yen fell after an unscheduled repo operation by the Bank of Japan.

- Investors sold bonds from Australian to South Korean debt, while bidding up Treasuries in a rush for dollar assets. Concerns are growing among ...

Central Banks

16) Fed Pressed to Be Hero With Zero Interest Rates as Trump Stalls

(Bloomberg) -- All of Wall Street’s eyes are on Washington again, but only Federal Reserve Chairman Jerome Powell is catching its gaze. With few encouraging signs of a comprehensive fiscal policy response from the U.S. government to the coronavirus, investors are looking to the central bank to fill the vacuum. It unleashed a trillion dollars but failed to halt the stock ...

17) Gold Joins Global Market Slump as Investors Cash in on Rally

(Bloomberg) -- Not even the safe haven of gold has been spared from this week’s global market rout. Bullion is heading for its biggest weekly loss since 2013, despite climbing to the highest in more than seven years earlier this week, as investors sell the metal to meet liquidity needs. Equities have been in freefall on concerns emergency fiscal and monetary packages won’t ...

18) Central Banks Join Fed in Pumping Liquidity Into Markets (2)

(Bloomberg) -- Central banks from Japan to Australia joined the Federal Reserve in pumping cash into stressed markets, seeking to calm panicking companies and stem a surge in short-term financing rates. The Bank of Japan offered to buy 200 billion yen ($1.9 billion) of bonds in an unscheduled operation, adding to an earlier injection of short-term funds. The Reserve Bank of ...

19) Japan’s Top Brass Look to Calm Markets as BOJ, MOF Meet (2)

(Bloomberg) -- Japan’s top policy makers tried to calm jittery investors Friday by injecting funds into markets and underlining their close cooperation with other Group of Seven nations as markets continued to slide across Asia over concerns of the coronavirus pandemic. “Because recent market moves have been nervous, we wanted to emphasize that we are cooperating, and that ...

20) Manila Lockdown to Hit Philippine Growth, Boost Rate-Cut Bet (1)

(Bloomberg) -- A monthlong lockdown in the Philippine capital to contain the spread of coronavirus is set to curb economic growth and make an interest-rate cut next week more likely. Growth could weaken to below 6% in the first quarter of the year, according to Nicholas Mapa, an economist at ING Bank in Manila. With more than 12 million people, the Manila region accounts ...

Economic News

21) Global Recession Risk Spikes as World Powers Down, Markets Slump

(Bloomberg) -- A pandemic-driven global recession is becoming more likely by the day as the flow of goods, services and people face ever-increasing restrictions and financial markets slump. In just the past day or so, President Donald Trump curbed travel to the U.S. from Europe, Italy’s government ordered almost every shop to close, India suspended ...

22) We’re All Japan Now as Virus Drives Low-Rates World Toward Zero

(Bloomberg) -- There aren’t many precedents for the trauma that financial markets have suffered this week, as the coronavirus crisis drove U.S. stocks into a bear market and briefly sent yields on every Treasury bond crashing below 1%. But there may be a precedent for the hole that policy makers find themselves in when the dust has settled. Just not an American one. The ...

23) Calls Rise for Emergency Dollar Funding, With Strains Escalating

(Bloomberg) -- Emerging signs of a rush for dollars in the global financial system have spurred calls for the world’s central banks to use a key tool deployed during the credit crisis more than a decade ago: currency swap lines. The Bloomberg Dollar Spot Index climbed more than 1% for the second time this week on Thursday, reaching a three-year high. The Japanese yen, so ...

24) China’s Activity Slump From Virus Hit Likely a Bottom: Economics

(Bloomberg Economics) -- China’s activity data for the first two months of the year -- to be released on Monday -- could show the economy slid into uncharted waters as the coronavirus outbreak hamstrung businesses. Yet, we expect that to be the nadir of this virus-induced downturn, with activity picking up pace in coming months. Chinese data at the beginning of the year have typically been affected by seasonality, hence ...

25) Australia Advises Against Gatherings of More Than 500 People (2)

(Bloomberg) -- Australia is advising against non-essential, organized gatherings of 500 people or more from Monday, in an escalation of the nation’s response to the coronavirus outbreak. Prime Minister Scott Morrison told reporters in Sydney on Friday the move wouldn’t impact schools, universities or public transport. He also urged Australians to reconsider their need to ...

European Central Bank

26) Villeroy: ECB Will Use Flexibility to Combat Fragmentation

(Bloomberg) -- Bank of France Governor Francois Villeroy de Galhau says the European Central Bank will use all the flexibility it has to combat fragmentation in the euro area if necessary.

- Villeroy speaks on France’s Radio Classique

- Says ECB package of measures announced Thursday is “powerful,” and “coherent” with the economic situation

- “The ECB is careful that our monetary policy is well transmitted to all the countries in ...

27) GERMANY DAYBOOK: ECB Criticism, EU Leaders Under Pressure

(Bloomberg) -- For more company events and economic data in Germany, see EVTS and ECO GER. Also see Bloomberg Daybreak for a customizable global view of what will shape today’s news. WHAT TO WATCH:

- Top News:

- Europe Grinds to Halt as ECB Is Criticized for Too Little Action

- EU Leaders Under Pressure After ECB Salvo Fails to Calm Markets

- Here’s What’s in the EU Arsenal as Another Crisis Batters Growth ...

28) Investors On War Footing for Europe Crisis After Market Crash

(Bloomberg) -- European Central Bank President Mario Draghi’s pledge in 2011 to do “whatever it takes” to save the continent in the midst of the crisis helped bring bond markets back from the brink. Now, Christine Lagarde may be pushing them back there. Italian bonds endured their worst day ever -- trumping other momentous times in history, including the euro-area debt ...

29) We’re All Japan Now, Trump Sentiment Risk, Surgical ECB: Eco Day

(Bloomberg) -- Welcome to Friday, Asia. Here’s the latest news and analysis from Bloomberg Economics to help take you through to the weekend:

- There aren’t many precedents for the trauma that financial markets have suffered this week, as the coronavirus crisis drove U.S. stocks into a bear market and briefly sent yields on every Treasury bond below 1%. Larry Summers said the ...

First Word FX News Foreign Exchange

30) Here’s What Market Watchers Are Saying About the Wild Turnaround

(Bloomberg) -- The word “whipsaw” -- that old favorite of financial pundits in volatile times -- hardly does it justice. After opening to one of the most brutal waves of selling in years on Friday, Asian stock markets bounced suddenly off their lows in a move that left investors grasping for explanations. The rally was most extreme in Australia, where the benchmark index ...

31) Dollar Is King After Liquidity Fears Fuel Stampede From Risk (1)

(Bloomberg) -- As fears of a global liquidity crunch grow, investors say there’s only one safe place: the dollar. Funds are piling into the greenback while dumping almost everything else from stocks to bonds and other currencies. Trading in Indian and Indonesian equities was halted after steep declines while bonds in Australia, Japan and South Korea seized up and dollar ...

32) Indian Stocks Pare Losses, Rupee Recovers as Global Rout Eases

(Bloomberg) -- Indian equities pared losses as trading resumed after declines of 10% triggered a circuit breaker, and the rupee recovered from a new low, as U.S. futures rebounded from the day’s lows. The S&P BSE Sensex was down 0.5% to 32,627.86 at 10:42 a.m. in Mumbai. The gauge tumbled at the start of the session along with the NSE Nifty 50 Index to trigger a ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

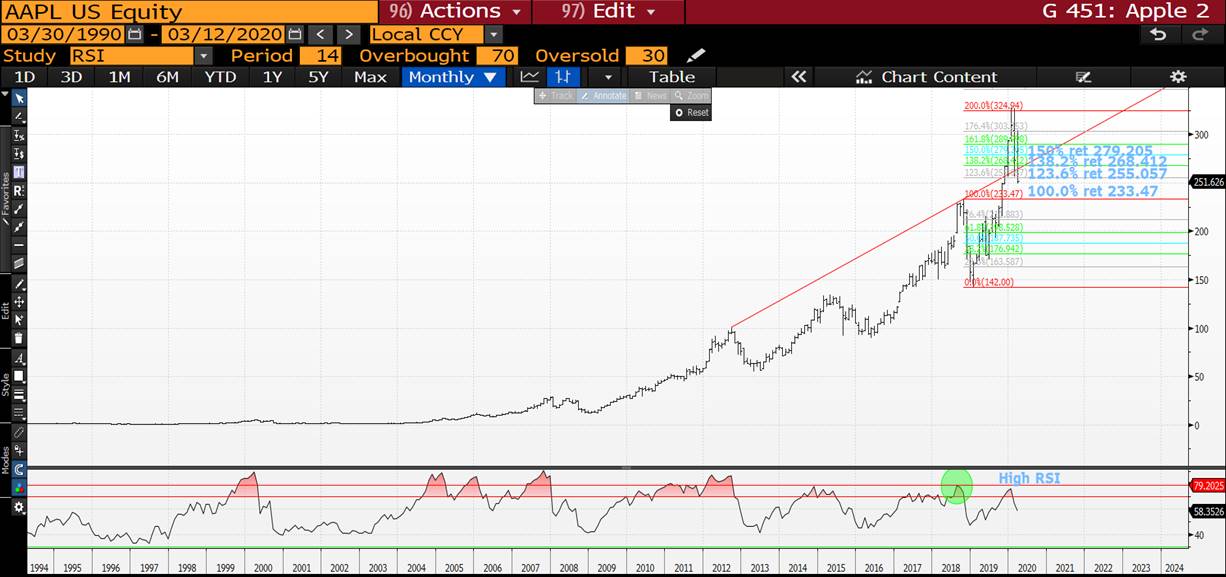

US EQUITY UPDATE : US EQUITIES ARE A DIFFERENT STORY TO EUROPE GIVEN SO MANY MAJOR SINGLE STOCKS HAVE ONLY JUST TOPPED.

US EQUITIES ARE A DIFFERENT STORY TO EUROPE GIVEN SO MANY MAJOR SINGLE STOCKS HAVE ONLY JUST TOPPED.

IN EUROPE THE CALL FOR A BOUNCE IS A LOT EASIER GIVEN THE RSI DISLOCATIONS BUT THIS IS NOT THE CASE FOR THE US INDICES, ESPECIALLY SOME MAJOR NAMES IN THE SINGLE STOCK MARKET.

TESLA, APPLE, INTEL ALL HAVE MONTHLY CHARTS EMBARKING ON A SIZEABLE BEAR MARKET.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •