Trade update: CAD 5y5y vs EUR + idea for SEK 1y2y vs EUR

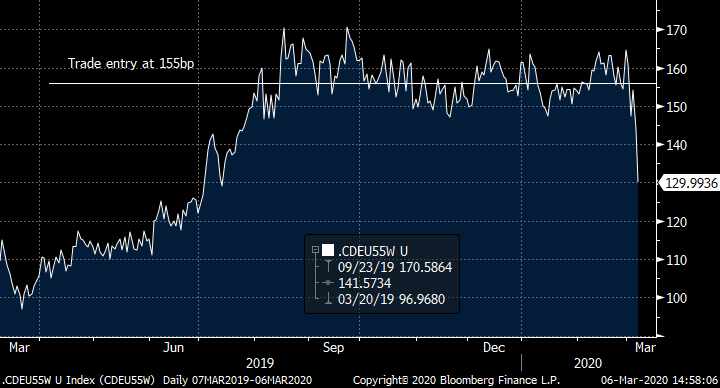

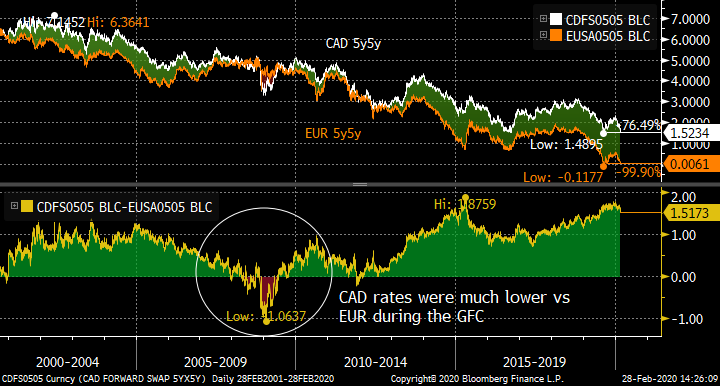

A week ago, I suggested CAD 5y5y vs EUR spread tighteners (on a PCA-weighted basis). The weighted spread at the time was 155bp, and has narrowed 25bp to 130bp today (chart). The markets are highly volatile, and the momentum is for this trade to narrow further, so I’d lighten up the position here but not close completely.

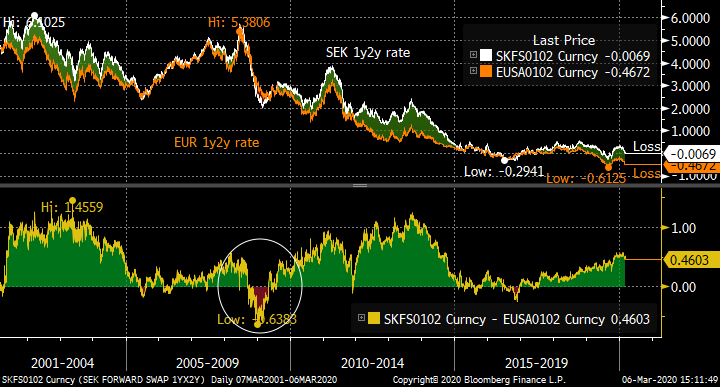

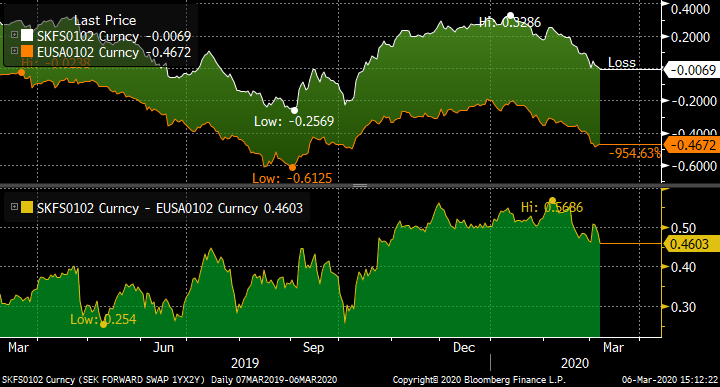

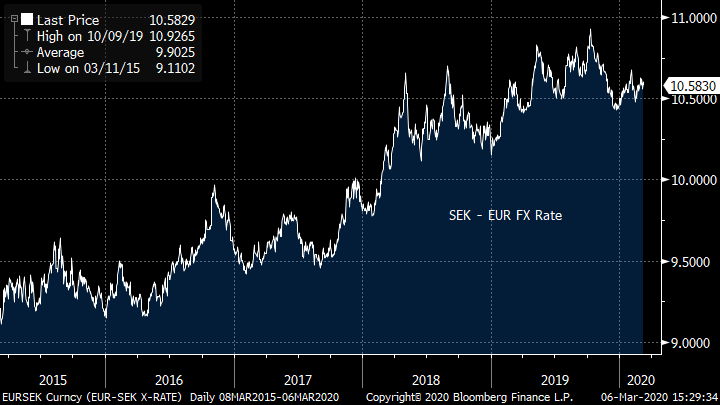

A home for the VaR released might be a similar idea in SEK vs EUR short rates. Receive SEK 1y2y rate (2y rate, 1y fwd) and pay EUR. The spread is currently at the top end of the range, and was much tighter during the global financial crisis of 2008/09.

The recent history shows this spread has started to compress, but has plenty of room to move further.

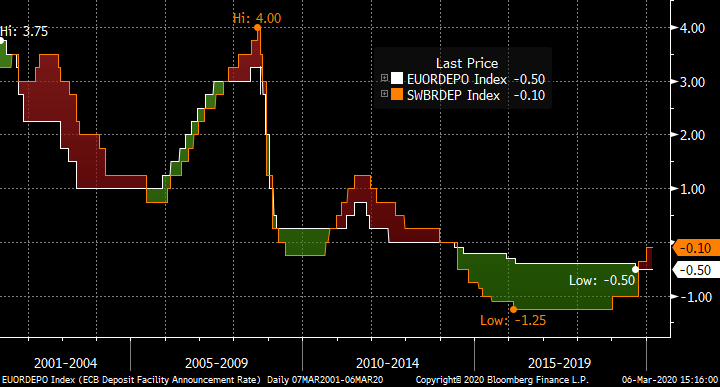

Riksbank vs ECB policy rates for the past 20 years. The Riksbank has, on paper at least, considerably more space to ease back to their previous level of accommodation.

The SEK-EUR FX rate has been a concern of the Riksbank in past, which suggests that any ECB easing would be matched (if not exceeded) by the Swedes.

I realize it’s a volatile time, and liquidity can be a problem, but I’d be interested on your thoughts on this!

Best wishes

David

As a reminder, this is the recommendation from last Friday:

Bottom Line: In the event of a sustained global slowdown, Canadian rates have further to fall than EUR (not least since the Bank of Canada has more bullets left than the ECB), but currently the spread is at the wides. Hence this is a decent cross-market swap trade on its own merits, but puts you long the tail risk of a major correction due to a viral pandemic. Other cross-market spreads have already moved sharply towards their historical GFC extremes of 2008/09, but CAD-EUR 5y5y has yet to see a similar move.

Trade:

Recv CAD 300mm 5y5y swap

Pay EUR 225mm 5y5y swap

Target entry 155bp on the 1:1.28 weight

(Equivalent to USD 100k/bp of CAD 5y5y. DV01 weight 1:1.28)

Rolldown of approx. negative 5bp over the first year.

Rationale: The evolution of the coronavirus epidemic and its impact on the global economy is close to impossible to forecast. While cases at the epicentre of the outbreak appear at least to be plateau’ing, reported infection numbers further afield seem to be on an upward trajectory, as is the concern in both public and financial life. The fragile state of some developed economies is not a good starting place for a shock to supply or activity. In the rates space, it is common to look at 5y5y rates to assess dislocations between currencies, and the CAD 5y5y rate has been pulsing on cross-market heat maps.

I’ve run a PCA analysis of 5y5y rates for the last 20 years of data, and the two currencies’ 5y5y rates that stand out are EUR to the low side, and CAD to the high side (see table)

Residual vs PCA 1 for G10 5y5y rates:

|

EUR |

GBP |

USD |

JPY |

SEK |

NOK |

CHF |

AUD |

NZD |

CAD |

|

|

Residual bp |

-61.1 |

-22.3 |

53.8 |

-50.0 |

-37.1 |

30.2 |

5.1 |

-15.8 |

24.1 |

105.2 |

|

T-stat |

-1.46 |

-0.89 |

1.29 |

-1.28 |

-1.01 |

0.94 |

0.26 |

-0.32 |

0.43 |

2.26 |

So, even prior to the virus newsflow, my model was flagging up a receive CAD / pay EUR trade.

Using the PCA 1 weights (with an exponential beta) gives a relative weight of CAD:EUR 1:1.28. This is the past year’s relationship on that basis:

The spread has already started to move (though the volatility in the market makes exact levels unclear), but is still very much at the high end of the past year’s range. So this is not an unreasonable local RV trade, but the history during the global financial crisis suggests that if the coronavirus outbreak becomes pandemic and we re-approach the conditions of the global financial crisis of 08/09 this spread could collapse. Canada is an oil producer, Europe is a consumer so the effect of lower oil prices (on reduced Chinese/global demand) will have the opposite impact in each economy. In addition, Canada has room below to deliver accommodation in a way that Europe does not, having used up most if not all of its monetary ammunition.

Would love to have your feedback,

Best wishes,

David

David Sansom

![]()

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

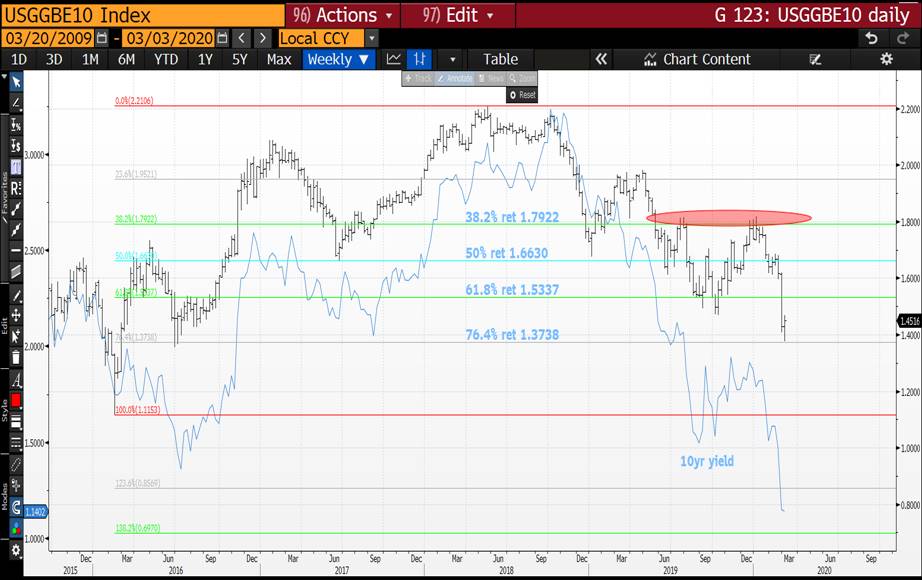

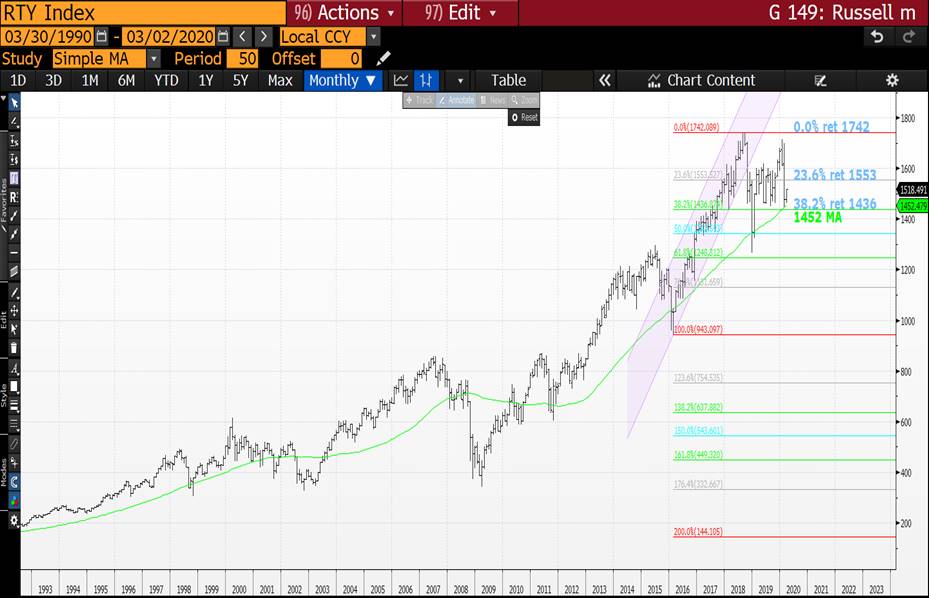

QUICK UPDATE EQUITIES : THE CURRENT LOWS REMAIN PIVOTAL ESPECIALLY AS MANY ARE MADE UP OF 61.8% RETRACEMENTS AND THE EXCEPTION VOLUME AT THE LOWS.

QUICK UPDATE EQUITIES : THE CURRENT LOWS REMAIN PIVOTAL ESPECIALLY AS MANY ARE MADE UP OF 61.8% RETRACEMENTS AND THE EXCEPTION VOLUME AT THE LOWS.

THE VOLUME WILL EITHER FORM SUPPORT OR BECOME A VIABLE CAP TO A BIGGER NEGATIVE SENTIMENT.

CHARTWISE IT LOOKS LIKE TOMORROWS POST NON FARM CLOSE WILL BE THE DECIDING FACTOR AND NOT BEFORE, I.E. DON’T OVER TRADE DOWN HERE UNLESS WE HAVE A DEFINED BREAK GIVEN THE VOLUMES INVOLVED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Bloomberg Bond News Summary > Thurs March 5th

Business Briefing

1) Europe Wants Taste of China's Best Week Since 2015: Markets Live

2) Global Stocks Gain on Stimulus; U.S. Futures Slip: Markets Wrap

(Bloomberg) -- Asian stocks extended a global equity rally after an emergency U.S. spending bill to combat the impact of the coronavirus added to signs of support from policy makers around the world. Treasuries edged higher and U.S. stock futures gave back some of Wednesday’s gains. Equities gained across the region with the Asian benchmark set to advance for a fourth day. ...

World News Briefing

3) Travel Curbs Tighten; California Calls Emergency: Virus Update

(Bloomberg) -- Japan will quarantine all people arriving from China and South Korea, the Yomiuri newspaper reported, Australia added Korea to its banned list and HSBC Holdings Plc joined companies curbing employee travel. California, the most populous U.S. state, called a state of emergency after its outbreak worsened. The U.S. House of Representatives passed a $7.8 billion ...

4) Coronavirus Spread in China Slows Sharply But Doubt Remains

(Bloomberg) -- While infections in the rest of the world accelerate, the coronavirus epidemic is showing signs of easing at its center -- China -- with new cases slowing dramatically and recoveries gathering pace. Still, doubt remains over whether the government’s statistics show the full picture. China reported 139 new confirmed cases of the coronavirus on Wednesday. That was a slight ...

5) Virus Testing Blitz Appears to Keep Korea Death Rate Low

(Bloomberg) -- Highly contagious and manifesting in some with little or no symptoms, the coronavirus has the world struggling to keep up. But when it comes to containing the epidemic, one country may be cracking the code -- by doubling down on testing. South Korea is experiencing the largest virus epidemic outside of China, where the pneumonia-causing pathogen first took ...

6) What Doctors Treating Covid-19 in Wuhan Say About The Virus

(Bloomberg) -- As the new coronavirus epidemic spreads across the globe, experts are turning to findings from China, where it originated, to better understand the disease. Since January, doctors at the outbreak’s epicenter in Wuhan have been studying the virus whose effects are mostly mild but can occasionally turn deadly. Medical professionals who have been treating and studying Covid-19 patients in Wuhan ...

7) Putin and Erdogan are Feuding and There’s Big Money at Stake

(Bloomberg) -- A fresh standoff between Vladimir Putin and Recep Tayyip Erdogan is testing the fragile alliance that has allowed Russia and Turkey to work together in the Middle East. But there’s another major reason why things may not get too far out of hand: the countries have deeply entrenched economic ties. The potential for economic upheaval was tested in 2016 when Moscow imposed sweeping ...

Bonds

8) Japan Bond Carry Trade Lives On Even as Dollar Premiums Slide

(Bloomberg) -- The Federal Reserve’s emergency interest-rate cut and expectations of further easing have slashed dollar premiums in funding markets. While that would typically make investing in overseas bonds such as Japan’s a lot less attractive, a sharp decline in U.S. yields is seen offsetting the impact of this key carry-trade metric, keeping buyers interested. ...

9) Bajaj Group Monitors Virus Impact as It Mulls Bond Plan From May

(Bloomberg) -- Lalitpur Power Generation Co., a unit of an Indian conglomerate Bajaj Group, will “look at” a possible offering of dollar-denominated bonds from May or June, as it continues to monitor the effects of the coronavirus, according to Prabal Banerjee, group finance director at Bajaj Group.

- Lalitpur Power is a special purpose vehicle of Bajaj Group to develop a thermal power ...

10) Virus Drags Mining Giant Vedanta to Record Lows for Bonds

(Bloomberg) -- One of the world’s largest metals and mining giants has tumbled to record lows in the bond market, adding to a growing list of commodity companies that are selling off as the coronavirus epidemic hits demand for raw materials. Vedanta Resources Ltd.’s dollar bonds due in 2024 slid 4.5 cents to an all-time low of 79.1 cents on Wednesday after Moody’s Investors ...

11) Yen Rises With Treasuries on Growing Virus Spread: Inside G-10

(Bloomberg) -- The yen climbed along with Treasuries as the continued global spread of the coronavirus fueled haven bids.

- Japan’s currency traded near a five-month high after infections in Germany rose by more than a fifth to 240 on Wednesday and Poland registered its first case. California declared a state of emergency and the U.S. House of Representatives passed a $7.8 ...

12) Carry-Trade Rally Called Into Question as Virus Keeps Spreading

(Bloomberg) -- Emerging-market carry trades have rallied this week as the Federal Reserve unexpectedly cut interest rates to counter the coronavirus, but some investors still doubt the gains will last. An index that measures returns from borrowing in dollars and putting the funds into eight high-yielding currencies such as the Brazilian real and Indonesian rupiah jumped ...

13) Some EM Investors Are So Nervous They’re Piling Into Treasuries

(Bloomberg) -- U.S. Treasuries are the polar opposite of what emerging-market investors should be buying. But for some money managers who typically only focus on high-risk developing nations, they’ve become the asset of choice as they try to preserve capital. With markets across the world reeling from the spread of the coronavirus, traders are ...

Central Banks

14) Virus Leaves Iceland’s Post-Crisis Tourism Hopes in Tatters (1)

(Bloomberg) -- After 2008, Iceland swore never again to build an economy only on banks. But its latest big export -- tourism -- might have left it exposed to a whole new world of trouble. Currency traders recently started dumping the Icelandic krona in anticipation of bad news. The trigger was Icelandair Group hf, which lost almost a third of its market value last week amid ...

15) Fed Cut Delivers Timely Boost With Inflation Spooking EU’s East

(Bloomberg) -- The U.S. Federal Reserve’s emergency rate cut just took some of the sting out of the inflation wave sweeping eastern Europe, helping the region’s currencies beat peers. The Hungarian forint, the Polish zloty and the Czech koruna are among the best emerging-market performers against the euro and the dollar in the last five days. The reason: a wider gap between ...

16) Sri Lanka Central Bank Holds Key Rate as Inflation Spikes (1)

(Bloomberg) -- Sri Lanka kept its benchmark interest rate unchanged after easing in January, even as policy makers across the Asia-Pacific signaled readiness to support their economies in the face of the coronavirus outbreak. The Central Bank of Sri Lanka left the standing lending facility rate at 7.5% on Thursday, and the deposit rate at 6.5%. The decision was predicted by ...

17) BOE Will Cut Rate By 50Bps at March Meeting, Goldman Predicts

(Bloomberg) -- Goldman Sachs sees Bank of England policy makers lowering key rate to 0.25% on March 26.

- Sees “significant easing” because virus “expected to push the U.K. economy to the edge of recession,” and MPC has sufficient policy space.

- Adds that a smaller move than 50 basis points is possible

- Note: New BOE Governor Andrew Bailey starts on March 16. Has said he’s waiting for “more ...

18) S.Africa’s Kganyago Says No Need for Emergency Rates Meeting (1)

(Bloomberg) -- South Africa’s central bank sees no need for an emergency meeting on interest rates and will wait for its regular gathering on March 19 to announce a policy decision, Governor Lesetja Kganyago said. Calls for the central bank to cut rates have increased this week after data on March 3 showing the economy slumped into a recession in the fourth quarter. The ...

Economic News

19) Global Economy Is Gripped by Rare Twin Supply-Demand Shock

(Bloomberg) -- The coronavirus is delivering a one-two punch to the world economy, laying it low for months to come and forcing investors to reprice equities and bonds to account for lower company earnings. From one side, the epidemic is hammering the capacity to produce goods as swathes of Chinese factories remain shuttered and workers housebound. That’s stopping ...

20) A Tortuous Journey From London Exposes a Hard Economic Truth

(Bloomberg) -- Tom Mathew travels most weeks from his home in London to the industrial park on the edge of the northern English town of Bury from where the family business distributes sandwiches and snacks to schools and hospitals. It takes just over two hours by train to go the first 160 miles (259 kilometers) to the nearby city of Manchester. Usually, there’s even wifi so ...

21) Australia Economy Set to Shrink Based on Treasury, RBA Estimates

(Bloomberg) -- Australia’s economy is likely to suffer a quarterly contraction for the first time in nine years, based on an initial estimate of the coronavirus’s impact from the nation’s Treasury and Reserve Bank. Both told a parliamentary panel in separate hearings that they expect half a percentage point cut from gross domestic product in the first three months of the ...

22) House Passes $7.8 Billion for Emergency Virus Spending

(Bloomberg) -- The House passed a $7.8 billion emergency spending bill Wednesday to fund the U.S. government’s response to the coronavirus outbreak. The Senate is expected to vote on the measure later this week and send it to President Donald Trump for his signature. The bipartisan bill, passed 415-2, is more than triple the amount Trump last week proposed spending to deal ...

23) Fed Says U.S. Economy Held Up Amid First Signs of Virus Impact

(Bloomberg) -- The U.S. economy expanded at a modest to moderate rate in the first weeks of the year, according to a Federal Reserve survey taken just as the virus outbreak was beginning to impact some businesses and unnerve financial markets. “There were indications that the coronavirus was negatively impacting travel and tourism,” according to the report released ...

European Central Bank

24) Bund Yields’ Move Near Record Lows Stokes Japanification Fears

(Bloomberg) -- German bond yields may be just days away from falling to all-time lows as investors pile into Europe’s safest debt to dodge the global growth shock from the coronavirus. Investors expect the current record low of -0.74% to be tested even if the European Central Bank holds off from loosening its monetary policy in response to the Federal Reserve’s emergency ...

25) ECB, UBS Restrict Travel; Traders Price in BOE Cut: Virus Update

(Bloomberg) -- Total coronavirus cases globally topped 93,000 and infections rose in Europe, including an official in Brussels. China reported 38 more deaths and fatalities rose to nine in the U.S. Cases also surged in South Korea, Iran, Malaysia and India. Traders are speculating that the Bank of England will cut rates this month, following the Federal Reserve’s surprise ...

26) ECB Restricts Travel; Delayed Olympics Possible: Virus Update

(Bloomberg) -- The European Central Bank said it would restrict all non-essential travel until April 20, Japan’s Olympics minister said it would be possible to delay the summer games to later in the year and car sales in China plunged. Total coronavirus cases topped 93,000. China reported 38 more deaths and fatalities rose to nine in the U.S. South Korea reported more ...

27) Traders Betting on ECB Cut Spur Biggest Euro Drop in Five Months

(Bloomberg) -- Money markets are in no doubt the European Central Bank will cut interest rates next week, fueling the biggest decline for the euro since September. Traders see a 100% chance of a 10 basis-point cut by the ECB, up from 80% on Tuesday. The prospects of more easing sent the euro tumbling as much as 0.7%, ending the currency’s best four-day winning streak in ...

28) ECB Researchers Say European Fiscal Rules Need Reality Check

(Bloomberg) -- The European Union should adapt its fiscal rules to a world where growth and interest rates are low and more government spending is needed, according to European Central Bank researchers. The EU’s framework that asks governments to limit debt to 60% of economic output, has often been criticized as a corset forcing high-debt member states into ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

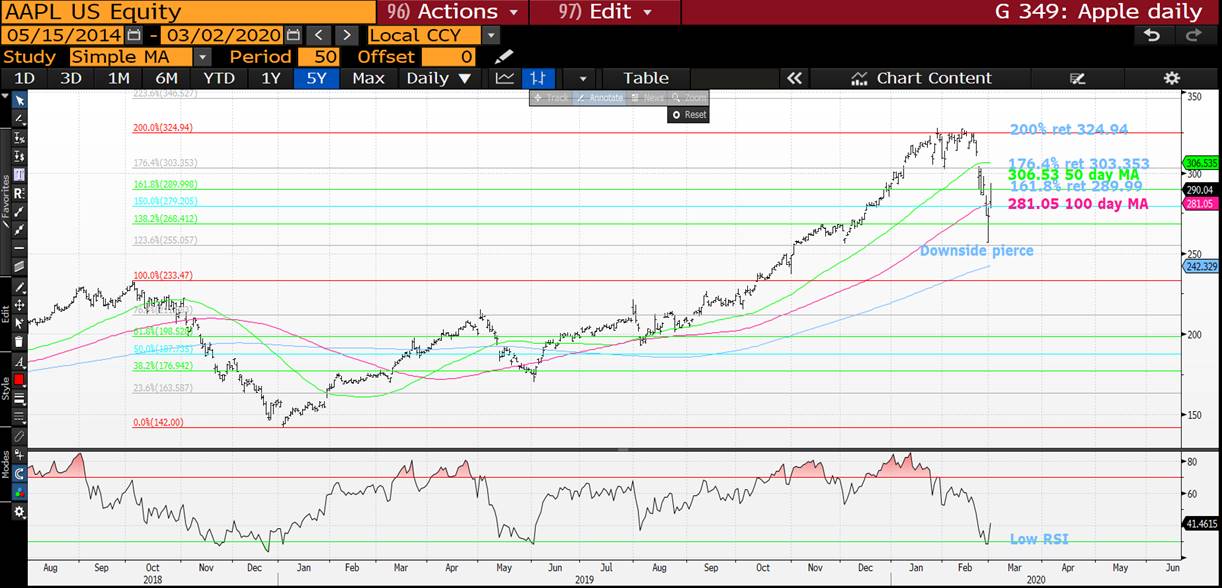

SHORT-TERM MARKET UPDATE : THE DAILY RSI CHART PREDICTIONS SEEM TO REMAIN THE SAME DESPITE THE FEDS ACTIONS.

SHORT-TERM MARKET UPDATE : THE DAILY RSI CHART PREDICTIONS SEEM TO REMAIN THE SAME DESPITE THE FEDS ACTIONS.

** STOCKS ARE KEY TODAY THEY MINIMALLY NEED TO BREACH YESTERDAYS HIGHS AND CLOSE STRONG.**

FED ACTION HAS CREATED A POTENTIAL POINT OF VOLUME AND ROTATION.

ALL DAILY CHARTS CONTINUE TO SHOW VERY DISLOCATED RSI’S, CALLING FOR HIGHER STOCKS AND LOWER BONDS IN THE SHORT-TERM.

BOND YIELDS HAVE BASED GIVEN THE EXTENDED DAILY RSI’S, LETS SEE HOW HIGH THEY RECOVER.

STOCKS TOO ARE IN THE SAME CAMP OF OVER EXTENDED DAILY RSI’S AND ARE ALREADY RECOVERING. MANY DAILY RSI’S ARE AS LOW AS DECEMBER 2018’S LOW.

- STOCKS WILL GO LOWER BUT DO NEED A BREATHER FROM THE RECENT CAPITULATION.

- BONDS : THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, BUT WE NEED A PAUSE BEFORE THE NEXT MOVE LOWER. ALSO THE FUTURES CHARTS HIGHLIGHT AN OLD FAVOURITE UPSIDE BOLLINGER PIERCE, A NEGATIVE SIGNAL.

EQUITIES : STOCKS NOW LOOK VERY VULNERABLE BUT A BOUNCE IS DUE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Bloomberg Bond News Summary > Wed Mar 4th

Business Briefing

1) Biden’s Big Night: Five Keys to His Super Tuesday Turnaround

(Bloomberg) -- Joe Biden’s Super Tuesday success seemed improbable just a week ago, when Bernie Sanders was flying high atop national polls and the former vice president was bogged down in a fight for the centrist mantle. But then Biden won South Carolina, forced three of those rivals out of the race, and picked up more than 100 endorsements — all on the way to the 14-state ...

2) U.S. Stock Futures Rise on Primaries; Yen Slips: Markets Wrap

(Bloomberg) -- U.S. stock futures rebounded after Tuesday’s sharp decline, and the yen dipped, as investors took in Super Tuesday election results alongside the Federal Reserve’s emergency interest-rate cut. Treasuries pared gains. Joe Biden’s surprise comeback in the race blunted the chance of the Bernie Sanders nomination that had unsettled some investors. Futures on the ...

3) India’s Top Court Strikes Down Curbs on Cryptocurrency Trade (2)

(Bloomberg) -- India’s Supreme Court struck down a central bank directive that effectively outlawed virtual currencies in Asia’s third-largest economy. A three-judge bench headed by Justice Rohinton F. Nariman agreed with petitions by cryptocurrency exchanges, start ups and industry bodies that had challenged the Reserve Bank of India’s April 2018 decision to ban banks from ...

World News Briefing

4) Global Fatality Rate 3.4%; Olympics Delay Possible: Virus Update

(Bloomberg) -- The head of the World Health Organization said the novel coronavirus doesn’t transmit as efficiently as influenza but the fatality rate is higher at 3.4%, based on reported cases. Japan’s Olympics minister said it would be possible to delay the summer games to later in the year. Total infections rose above 93,000, with China reporting 38 more deaths and fatalities ...

5) Biden Surges on Super Tuesday, Blunted by Sanders in California

(Bloomberg) -- Bernie Sanders won the biggest prize of the Super Tuesday primaries with a victory in California, but Joe Biden staged a surprise comeback in the race for the Democratic presidential nomination with victories in eight states. Biden scored wins in Virginia, North Carolina, Arkansas, Oklahoma, Tennessee, Alabama and Minnesota. And in one of the biggest upsets ...

6) Iran Uranium Stockpile Is Enough to Build Bomb If It’s Enriched

(New York Times) -- So far, the evidence suggests that Iran’s recent actions are calculated to pressure the Trump administration and Europe rather than rushing for a bomb. WASHINGTON — Iran’s growing stockpile of nuclear fuel recently crossed a critical threshold, according to a report issued Tuesday by international inspectors: For the first time since ...

7) Japan Olympics Minister Floats Prospect of Postponement on Virus

(Bloomberg) -- Japan’s Olympics minister said it would theoretically be possible to delay this summer’s Tokyo Olympics to a later date in 2020 amid worries the coronavirus could cause the Games to be canceled for the first time since World War Two. Seiko Hashimoto told a parliamentary committee the delay within the calendar year was possible under the terms under which ...

8) Biden Widens Lead Over Sanders in Delegate-Rich Texas: TOPLive

Bonds

9) Credit Suisse Sees Funding-Strain Risk Without Fed Liquidity

(Bloomberg) -- Disruptions to the global supply chain from the coronavirus have sparked the danger of funding strains that could be made worse by steep Federal Reserve interest-rate cuts, according to analysts at Credit Suisse Group AG. “The supply chain is a payment chain in reverse,” Zoltan Pozsar, an investment strategist at the bank in New York, and economist James Sweeney ...

10) Powell’s Misfire Fuels Rally in Asian Bonds, Led by Indonesia

(Bloomberg) -- Indonesian bonds led a rally in Asian debt markets after the Federal Reserve’s emergency interest rate cut failed to restore confidence among investors in the world’s biggest economy. While Asia is just as exposed to the financial fallout of the coronavirus, the focus on Wednesday turned to the higher returns that come with the region’s riskier bonds. ...

11) No Bottom in Sight for Yields After Fed ‘Bazooka’ Misfires

(Bloomberg) -- There’s no bottom in sight for Treasury yields after the Federal Reserve’s aggressive rate cut failed to quell fears that the coronavirus is wrecking the global economy. Before Tuesday, the 10-year note had never yielded less than 1%. Once that historic level was breached, less than 30 minutes later the rate was threatening 0.90% -- or half the amount it ...

12) Fed Raises Bets for Cuts in Japan and New Zealand, QE Down Under

(Bloomberg) -- The Federal Reserve’s first emergency interest-rate cut in over a decade is intensifying bets for monetary easing across major bond markets in the Asia-Pacific region. Expectations for rate cuts have climbed in Japan and New Zealand, while in Australia -- where markets were already pricing for a reduction in the benchmark to a perceived floor -- there are now ...

13) Lebanese Banks Asked to Swap Eurobonds; Foreigners May Get Paid

(Bloomberg) -- Lebanon is reviving an offer for a debt swap with local banks as the government enters crunch time before a $1.2 billion Eurobond comes due next week. At a meeting with bankers Tuesday, the finance minister proposed that local banks swap their entire Eurobond holdings for new debt at a lower coupon, a person familiar with the talks said. ...

14) Hobbled by Virus, China’s Wanda Has $5.7 Billion Bonds Due

(Bloomberg) -- Dalian Wanda Group Co., the Chinese conglomerate that borrowed billions of dollars to fund an acquisition binge, is facing a double whammy this year: a wall of maturing debt and a deadly virus that has hampered its operations. The empire founded by billionaire Wang Jianlin, who once aspired to beat Walt Disney Co. in entertainment, needs to refinance or pay ...

Central Banks

15) Gold Handed Big Win With Powell’s Cut Hammering Treasury Yields

(Bloomberg) -- Gold just got a powerful boost from the Federal Reserve, with bullion extending gains in Asia after the U.S. central bank’s emergency, virus-driven rate cut set off a collapse in 10-year Treasury yields to an all-time low. Bullion prospers from low rates, and more easing is expected from the Fed and other central banks as policy makers seek to blunt the ...

16) A Hedge Fund Pioneer Bets on Higher Rates, Recovery In Stocks

(Bloomberg) -- A top hedge fund manager in Canada says the coronavirus sell-off is a temporary setback that will soon give way to an economic rebound, sending stocks and interest rates higher. “While there will certainly be an economic hit from the virus, when you go back through these ‘pandemic’ periods of time, there’s really, without exception, a fairly significant ...

17) India’s Central Bank Head Says Uncommon Measures are Working (1)

(Bloomberg) -- India’s central bank governor said the unconventional policy steps the authority has undertaken to boost lending to the real economy are starting to work. The gap between the main repurchase rate and the benchmark 10-year bond yield has begun to narrow as a result of its measures aimed at pulling down corporate borrowing costs, Reserve Bank of India Governor ...

Economic News

18) Fed Rate Cut Strains Central Bank Peers With Less Room to Follow

(Bloomberg) -- The Federal Reserve’s decision to slash U.S. interest rates to contain the economic damage from the coronavirus leaves policy makers in Europe and Japan under more pressure from investors to follow suit even though they have less scope to do so. The emergency cut, delivered shortly after Group of Seven finance chiefs jointly vowed to take action where ...

19) Coronavirus Alone Won’t Trigger Italian Debt Crisis: Economics

(Bloomberg Economics) -- Italy has more coronavirus infections than any other country outside Asia, raising the risk of a bigger outbreak and a blow to growth in 2Q. With debt elevated, whenever a crisis hits Italy, the question is: Will bond yields blow out? The answer, we think, is no. The European Central Bank stands ready to contain the financial fallout from the virus and even a ...

20) Virus Scare to Keep Polish Rates on Pause: Decision Day Guide

(Bloomberg) -- The scare to supply chains and economic growth caused by the outbreak of the coronavirus is set to trump Poland’s inflation concerns and help the central bank keep official borrowing costs on hold for longer. All 27 economists in a Bloomberg survey said Poland’s Monetary Policy Council will leave its benchmark interest rate at a record-low of 1.5% at ...

21) Johnson Urged to Look Beyond Big Ticket Spending in Budget

(Bloomberg) -- U.K. Prime Minister Boris Johnson should look beyond large transport projects to ensure the billions of pounds of planned extra spending boosts the whole U.K. economy, according to the Resolution Foundation. Johnson’s budget next week is expected to raise capital spending by 20 billion pounds ($26 billion) a year, taking investment to levels last sustained in ...

22) The G-7 Held a Call on the Virus and Only the Fed Did Anything

(Bloomberg) -- Finance ministers from the richest nations and their central bankers held a rare conference call early Tuesday. They pledged to do whatever it takes to support a global economy under acute threat from the coronavirus. When they hung up the phone, only a single institution sprang into action. The U.S. Federal Reserve cut ...

European Central Bank

23) ECB to Cut Following Fed’s ‘Decisive’ Action, Commerzbank Says

(Bloomberg) -- The European Central Bank will respond to the Federal Reserve’s “decisive” interest rate cut with easing of its own, according to Commerzbank AG. With the outlook deteriorating, officials in Frankfurt are likely to cut the deposit rate by 10 basis points and boost monthly bond buys by 20 billion euros ($22.3 billion) at their meeting next week, Joerg Kraemer, ...

24) Europe’s Bond Rally Signals Bets on More ECB Quantitative Easing

(Bloomberg) -- Mediterranean debt surged to lead a rally in the region, showing traders expect central bank stimulus may come in the form of more bond buying. Money markets have lifted bets on global interest-rate cuts this month after the Federal Reserve’s emergency 50-basis-point move Tuesday, including at the European Central Bank. Yet with doubts over the value of ...

25) ECB’s Villeroy Says Monetary Policy Is ‘Already Very Expansive’

(Bloomberg) -- Governments should “do their bit” cushioning the economy from the coronavirus hit, while the European Central Bank’s monetary policy is already “very expansive,” Bank of France Governor Francois Villeroy de Galhau says.

- “Our current monetary policy is already very expansive and acts as an economic stabilizer,” Villeroy says in an interview with Dutch ...

26) ECB’s Knot: Virus Could Cause Great Damage to Dutch Economy

(Bloomberg) -- Although the impact from the coronavirus on Dutch economy is “very uncertain, it can potentially cause great damage if the spread of the virus isn’t stopped quickly,” Dutch central bank president Klaas Knot said in a speech in Amsterdam.

- Dutch economy is doing “good” unless you count the potential impact of the virus, according to Knot, who sits on the ECB’s ...

27) ECB INSIGHT: Lagarde’s Policy Options as Fed Drops Rates (1)

(Bloomberg Economics) -- If the coronavirus continues to spread in Europe, the euro-area economy will shrink -- there’s nothing the European Central Bank can do to prevent that. What President Christine Lagarde can do is minimize the extent to which the shock to demand might linger. At the March meeting the Governing Council ought to provide liquidity and cut interest rates, but it may not go that far. The Fed’s emergency half-percentage point cut today ...

First Word FX News Foreign Exchange

28) JPMorgan Asset Says Investors Likely to Pile Into U.S. Bonds

(Bloomberg) -- The Federal Reserve was smart to cut rates now rather than waiting for things to escalate, and its action should boost flows into U.S. bonds, according to JPMorgan Asset Management. Investors should consider longer-dated government bonds in safe markets, Bob Michele, global head of fixed income at the asset manager, said in an email. ...

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

**PLEASE UPDATE ** MARKET UPDATE : BONDS ARE TOPPING WHILST STOCKS HAVE BASED, QUESTION IS HOW LONG DOES THIS LAST.

MARKET UPDATE : BONDS ARE TOPPING WHILST STOCKS HAVE BASED, QUESTION IS HOW LONG DOES THIS LAST. THIS VIRUS WONT GO AWAY FAST NOR BE CONTAINED.

EVEN MR TRUMP WAS TOLD IT WOULD BE A YEAR BEFORE A VACCINE IS AVAILABLE.

THAT SAID WE HAVE CREATED MANY TECHNICAL EXTREMES TO INDUCE PROFIT TAKING OR SHORT TERM POSITIONING.

**POSSIBLE TRADE IDEAS, FADING THE US 5-30 OR 2-30 ( Page 15 & 17).**

BOND YIELDS HAVE BASED GIVEN THE EXTENDED DAILY RSI’S, LETS SEE HOW HIGH THEY RECOVER.

STOCKS TOO ARE IN THE SAME CAMP OF OVER EXTENDED DAILY RSI’S AND ARE ALREADY RECOVERING. MANY DAILY RSI’S ARE AS LOW AS DECEMBER 2018’S LOW.

STOCKS WILL GO LOWER BUT DO NEED A BREATHER FROM THE RECENT CAPITULATION.

BONDS : THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, BUT WE NEED A PAUSE BEFORE THE NEXT MOVE LOWER.

US BREAKEVENS AND USGGT :

TAKE POSITIONING OFF IF SHORT THIS SECTOR.

EQUITIES : STOCKS NOW LOOK VERY VULNERABLE BUT A BOUNCE IS DUE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Bloomberg Bond News Summary > Tues Mar 3rd

Business Briefing

1) U.S. Futures, Japan Stocks Slide; Yen Advances: Markets Wrap

(Bloomberg) -- U.S. equity futures surrendered gains, Japanese stocks tumbled and bond yields fell Tuesday as enthusiasm about a shift by global policy makers to aid growth faded. Australia’s dollar rose even after the central bank cut its benchmark rate by a quarter point, underscoring how traders’ expectations have rapidly shifted in recent days. A Reuters report saying ...

2) Global Assets Want G-7 Full Shock and Awe Display: Markets Live

3) Oil Extends Rally as G-7 and OPEC+ Step Up Response to Virus

(Bloomberg) -- Oil extended its rebound from last week’s slump as global policy makers pledged to safeguard markets from the coronavirus, while OPEC and its allies are expected to deepen production cuts. Futures in New York have now recouped more than a third of last week’s 16% plunge in a reversal that’s come amid a broad move upward in financial markets driven by signs ...

4) Gold Investors Savor Cascade of Monetary Easing as Virus Bites

(Bloomberg) -- Gold investors are contemplating prospects for a global wave of monetary policy easing as authorities move to confront the challenges thrown up by the coronavirus crisis, including expectations for lower interest rates from the Federal Reserve that could weigh on the dollar. “As we are likely to head into another easing cycle, the gold price will be supported in ...

World News Briefing

5) Emergency Measures Go Global as Cases Top 90,000: Virus Update

(Bloomberg) -- Governments from Japan to the U.K. prepared emergency measures or economic packages to fight the spread of the coronavirus. Australia’s central bank cut interest rates as the health threat grows and President Donald Trump said the U.S. Federal Reserve should follow suit. Indonesia said it’s working on a second financial stimulus and might block more flights ...

6) Netanyahu Nears Chance to Form Government, Israeli Polls Show

(Bloomberg) -- Prime Minister Benjamin Netanyahu is within striking distance of forming Israel’s next government, exit polls showed, an outcome that bodes well for his efforts to stay out of court but less so for the prospects of Israeli-Palestinian peace. Recently indicted in three graft cases, Netanyahu had gambled on repeat elections to win a majority in parliament and ...

7) Biden Gets Boost From Klobuchar, Buttigieg Before Super Tuesday

(Bloomberg) -- Joe Biden welcomed former rivals Pete Buttigieg, Amy Klobuchar and Beto O’Rourke into the fold Monday in a show of force by the Democratic Party’s establishment against front-runner Bernie Sanders the night before Super Tuesday. Buttigieg and Klobuchar dropped out of the race in the last 24 hours and threw their support behind Biden, whose decisive win in ...

8) U.S. Hits Back at China, Orders Media Outlets to Slash Staff

(Bloomberg) -- The Trump administration ordered four Chinese state-owned news outlets to slash the number of staff they have working in the U.S., part of a broader response to Beijing’s restrictions on American journalists including its expulsion of three Wall Street Journal reporters last month. The move risks further tit-for-tat measures from Beijing as the world’s biggest economies ...

9) Israel Early Vote Count Sees Likud’s Lead Narrowing: TOPLive

Bonds

10) BOJ Displays Resolve on Calming Markets With Another Repo Move

(Bloomberg) -- The Bank of Japan conducted an unscheduled debt buying operation for a second day amid growing expectations of a coordinated effort by global central bankers and finance ministers to mitigate the economic impact of the coronavirus. The BOJ offered to buy 500 billion yen ($4.6 billion) of Japanese government debt with repurchase agreements, the central bank ...

11) Debt-Bloated Firms That Coronavirus Threatens to Drag Down

(Bloomberg) -- From Richard Branson’s Australian airline to U.S.-based cinema chains and casino operators, the companies most vulnerable to the coronavirus outbreak are facing mounting pressure in global credit markets. An escalating outbreak that drives off customers and revenue could lead to ratings downgrades, hinder refinancing efforts, and in some cases trigger ...

12) Kotak Finally Bets on an India Stressed Asset in Boon to Cleanup

(Bloomberg) -- An asset manager backed by Asia’s richest banker has finally invested in a stressed Indian asset, in a positive sign for the broader push to clean up the nation’s massive pile of bad debt. Kotak Special Situations Fund invested 5 billion rupees ($69 million) in beleaguered Jindal Stainless Ltd., India’s largest stainless steel producer, according to a ...

13) BlackRock Says Virus Panic Can Turn Aussie Yields Negative

(Bloomberg) -- Australia may be the next market to see negative yields as the fallout from the coronavirus drives an unstoppable bond frenzy, according to BlackRock Inc. Prolonged equity losses and monetary easing by the Reserve Bank of Australia can send the nation’s 10-year bond yield into negative terrain for the first time, according to Craig Vardy, head of fixed income ...

14) Yen Rises on Report G-7 Silent on Coordinated Cuts: Inside G-10

(Bloomberg) -- The yen advanced after a report that Group-of-Seven nations have not agreed to new fiscal spending or coordinated interest rate cuts to cushion the economic impact of the coronavirus. Treasuries rose.

- Yen climbed as much as 0.6% while the Nikkei-225 Stock Average reversed an initial gain as the news sapped some of the optimism that had swept through markets ...

15) Treasuries Dip, Pivotal RBA Rate Decision, Japan 10-Year Auction

(Bloomberg) -- Treasury futures dip from the open, after being knocked lower into New York close as verbal intervention from central banks keeps risk sentiment supported. RBA rate decision ahead is expected to set the tone after global repricing of rate cuts. Markets fully pricing a cut.

- Japan due to sell 10-year bond for 2.1t yen at 11:35am HKT. This may be challenging given ...

Central Banks

16) RBA Cuts, Signals Ready to Do More in Fiscal-Monetary Shot (1)

(Bloomberg) -- Australia kicked off an expected worldwide policy response to China’s slowdown and fallout from the coronavirus with an interest-rate cut that’s set to operate in tandem with fiscal measures to cushion the economic blow. Reserve Bank chief Philip Lowe reduced the cash rate by a quarter percentage point to 0.5%, a new record low, as expected by traders and ...

17) Australian Stocks Pare Gains After RBA Cuts Benchmark Rate (2)

(Bloomberg) -- Stocks pared gains after the Reserve Bank of Australia cut the benchmark rate by 25 basis points to support the economy amid the coronavirus outbreak. The S&P/ASX 200 index trimmed gains to 0.7% and closed at 6,435.7 after the central bank’s decision. The gauge surged as much as 2.1% earlier in the session after traders bet the RBA would lower rates and ...

Economic News

18) Coronavirus Seen as Yet Another Damaging Blow to Globalization

(Bloomberg) -- The upheaval from the coronavirus outbreak may be the final jolt that the world’s biggest companies need to reevaluate how they operate in a globalized economy, the OECD’s chief economist Laurence Boone said. The sprawling, continent-crossing supply chains of corporations have already come under pressure from trade tensions and climate concerns, and may face ...

19) Emergency Fiscal Action Debated to Cushion World Virus Shock

(Bloomberg) -- Governments struggling to contain the global economic fallout from the coronavirus outbreak face mounting calls to unleash a major fiscal stimulus that could help cushion the blow. While some investors are already betting that the epidemic will warrant the first joint emergency monetary easing since 2008, a gathering throng of analysts is asking if budget aid ...

20) Bailey Faces First BOE Test as Coronavirus Rewrites Outlook

(Bloomberg) -- Andrew Bailey is being thrown in at the deep end. The man who becomes Bank of England governor in less than two weeks is set to make the first public appearance connected to his new role on Wednesday. His tenure starts when concerns about the coronavirus have sparked a flurry of speculation that central banks around the world will start emergency policy ...

21) BOJ Flexes Muscles Within Framework to Calm Markets: Economics

(Bloomberg Economics) -- OUR TAKE: The Bank of Japan’s framework gives it plenty of room to ramp up stimulus -- and it’s making more use of it to shield the economy from the coronavirus. Tuesday’s unscheduled offer to buy 500 billion yen of JGBs -- following a similar operation on Monday when it also made a record one-day purchase of ETFs -- shows it’s ready and willing to use its balance sheet to calm markets. ...

22) Central Bankers Intensify Response to Virus Amid Recession Fears

(Bloomberg) -- Global policy makers sought to reassure markets that they’re ready to respond to the coronavirus outbreak, as fears mount that its spread could push the world economy toward recession. Australia’s central bank reduced the cash rate Tuesday by a quarter percentage point to 0.5%, a record low. That marked a stunning reversal in recent days, with money markets ...

European Central Bank

23) ECB Joins Central Banks Pledging Coronavirus Action If Needed

(Bloomberg) -- European Central Bank President Christine Lagarde belatedly joined the crowd of leading central bankers pledging to take action if needed against the economic damage from the coronavirus outbreak. In a statement late Monday, Lagarde said the outbreak is a “fast-developing situation, which creates risks for the economic outlook and the functioning of financial ...

24) GERMANY DAYBOOK: ECB Ready for Action, Qiagen Takeover Talks

(Bloomberg) -- European Central Bank President Christine Lagarde has pledged to take action if needed against the economic damage from the coronavirus outbreak. Thermo Fisher Scientific is in advanced talks to acquire Qiagen after discussions broke off late last year. For more company events and economic data in Germany, see EVTS and ECO GER. Also see Bloomberg Daybreak for ...

25) ECB’s Lagarde Says ‘We Stand Ready’ to Take Appropriate Steps

(Bloomberg) -- European Central Bank says in a statement that it’s closely monitoring coronavirus developments.

- Story to follow.

26) ECB Says Ready to Take Appropriate, Targeted Steps Amid Virus

(Bloomberg) -- Christine Lagarde, president of the European Central Bank, said the central bank is ready to act to support the economy amid the spreading coronavirus. “The ECB is closely monitoring developments and their implications for the economy, medium-term inflation and the transmission of our monetary policy,” Lagarde said in a statement Monday posted on the ECB’s ...

27) ECB Board Majority Is Opposed to Enria’s Push to Spur Bank Deals

(Bloomberg) -- European Central Bank supervisory board chair Andrea Enria is meeting early resistance to proposals for boosting mergers and acquisitions in the continent’s banking industry, people with knowledge of the matter said. A majority of the ECB’s supervisory board signaled at a meeting last week that they were skeptical of or outright opposed to allowing banks to ...

First Word FX News Foreign Exchange

28) *SWISS ECONOMY GREW 0.3% Q/Q IN FOURTH QUARTER; ESTIMATE 0.2%

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITIES TIME FOR THEM TO HOLD, BIGGEST QUESTION IS HOW HIGH DO THEY BOUNCE.

EQUITIES TIME FOR THEM TO HOLD, BIGGEST QUESTION IS HOW HIGH DO THEY BOUNCE.

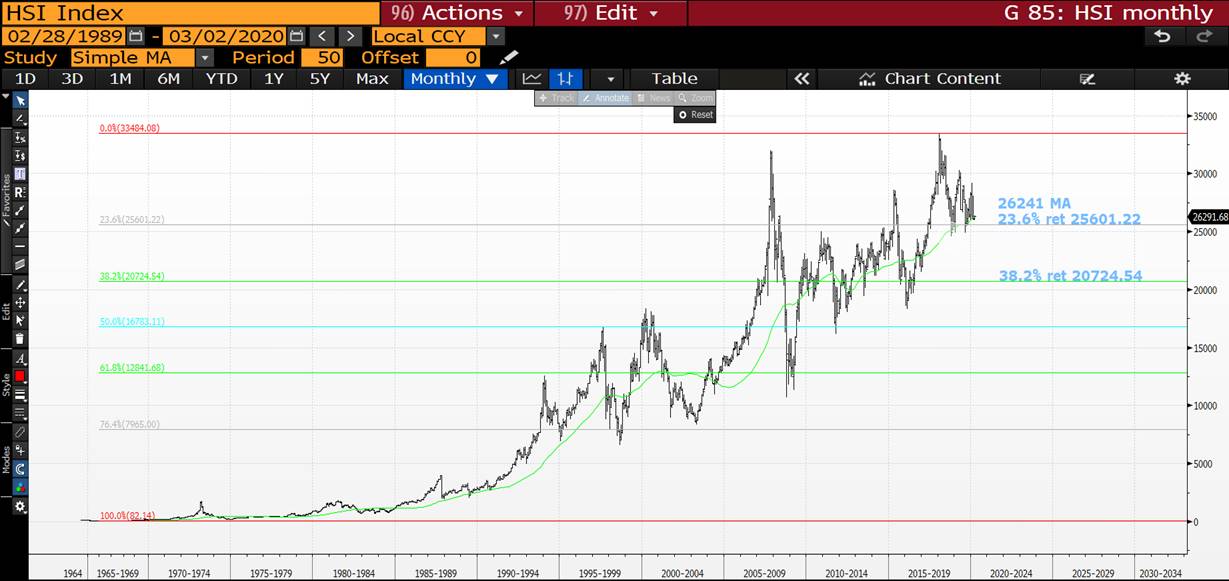

EQUITIES : WE HAVE HELD SOME MAJOR RETRACEMENTS, MOVING AVERAGES AND FORMULATED RSI’S SIMILAR TO DECEMBER 2018. KEY QUESTION IS HOW HIGH WE BOUNCE GIVEN THE GLOBAL SPREAD OF THE CONORAVIRUS. IT’S A TOUGH CALL!

SOME PRIME EXAMPLES BELOW :

- TESLA IS A GOOD EXAMPLE GIVEN ITS “ONE OFF” VOLUME IN EARLY FEBRUARY PLUS SIGNIFICANT OVER BOUGHT RSI ACROSS ALL DURATIONS. IT IS NOT OVERSOLD DESPITE THE LATEST DROP.

2. APPLE HAS CREATED A LONGTERM TOP BUT LIKE MANY ITS DAILY HAS PRODUCED A VERY OVERSOLD RSI, SIMILAR TO DECEMBER 2018.

- INTEL HAS CREATED A SIMILAR FORMATION TO APPLE BUT ADDITIONALLY HIT ITS 200 DAY MOVING AVERAGE 5362.

HANG SENG IS ONE TO WATCH GIVEN IT IS CLOSE TO THE ALL IMPORTANT MULTI YEAR 23.6% RET 25601.22.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: BIG Month on Tap in UK GILTS Market > Quick Rundown

GILTS... Coordinated Move?

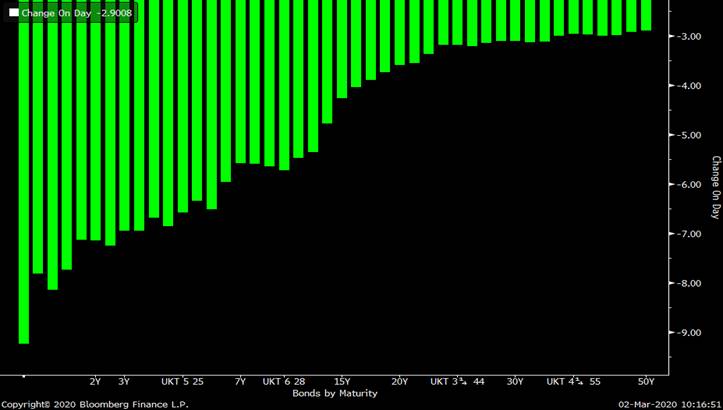

> Dovish chatter from the Fed, BoJ and BoE over the weekend has not only helped to stabilize stocks but, as we can see from the nosedive in 2yr note yields (.76%?!), it's driven heightened expectations of coordinated rate cuts from the major CBs.

> We can debate the efficacy of rate cuts all day long (25bps off UK base rates? ZZZzzzz) but the steepening impact on the curve is undeniable (see below).

UKT Yields – Change on Day Today

UST 2-10s – massive moves

> The GILTs market is a VERY busy place in the next month. Aside from 4 more conventionals auctions (2 X 0F25s, 4T30s and 1T49s) we've got the £17.5bn APF next Monday, the FY 20/21 budget Mar 11th (Gilts issuance ests range from £145bn to £180bn!) yet more Brexit talks and that's not even factoring in Covid-19.

> Heading into March, our views are:

1) Last big APF for the next 16 months will be a backstop but Covid-19 driven longs far outweigh the BoE's demand.

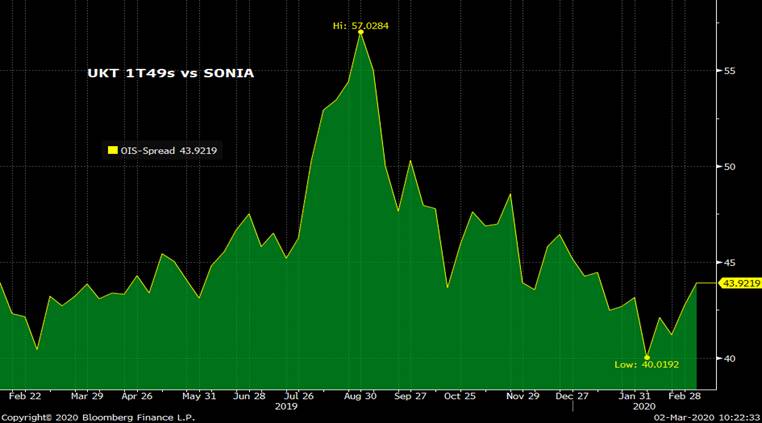

2) Whether Sunak announces £145bn or £180bn, the bottom line is we’ll be getting a lot more NET gilts issuance in FY 20/21. We can see from the chart below that the 1T49s are still just a few bps off their richest levels vs SONIA in the last year.

3) As noted in our attached rundown of a couple weeks ago, the 10-20yr sector will be well trodden ground over the next month given the supply calendar, the steepness of the curve and the location of the 4H34s and 4Q36s and the longest/shortest issues in their APF buckets.

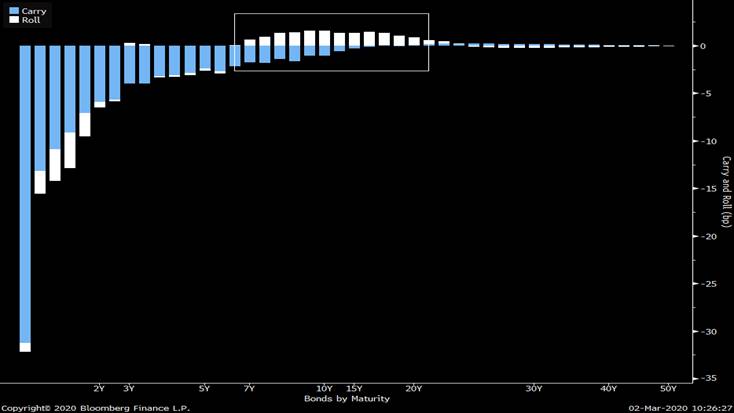

GILTS Carry and Roll

- Base rates in the UK are 75bps which has GC hovering in the low 70s. UKT 1T22s are currently yielding .231% and the 225s are an eye watering .193%. The MPC would have to cut base rates 50bps to get these issues remotely close to positive carry. This ‘Nike Swoosh’ Z-sprd curve out to 25yrs will force the market longer unless the BoE really gets aggressive.

Swoooosh!

- The 4T30s are in a ‘prove it’ phase for us. They don’t trade with any repo value and have struggled to richen much to the sector, despite being the CTD into one of the biggest rallies we’ve seen in gilts in a long time. Their tap next Tuesday makes them eligible for the APF which could prompt a bit of RV interest but thus far, we’ve seen little evidence of it and would be better sellers of the issue on balance in favour of the 0S29s or 4H34s a bit longer…

- ULTRAs – DMO is unlikely to issue them for the foreseeable future after last Thursday’s forgettable tap of the 1T57s. They still look rich to us on many metrics but if the budget comes at the higher end of the range then the 30yr point is likely to come under fire again – erasing recent richening vs 40s and 57s (for ex).

More soon…

Mark

![]()

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167