Macro trade for a GFC re-run: Receive CAD 5y5y vs EUR

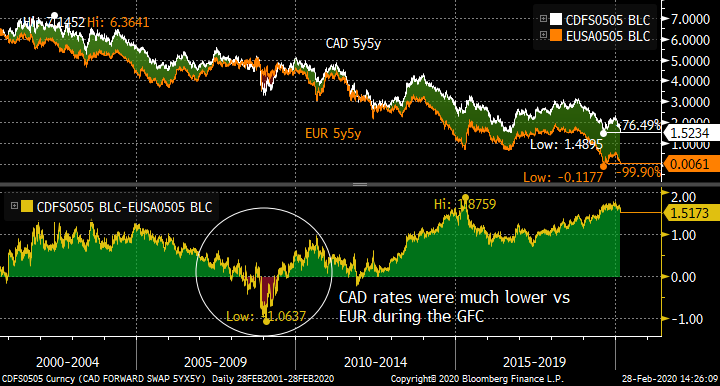

Bottom Line: In the event of a sustained global slowdown, Canadian rates have further to fall than EUR (not least since the Bank of Canada has more bullets left than the ECB), but currently the spread is at the wides. Hence this is a decent cross-market swap trade on its own merits, but puts you long the tail risk of a major correction due to a viral pandemic. Other cross-market spreads have already moved sharply towards their historical GFC extremes of 2008/09, but CAD-EUR 5y5y has yet to see a similar move.

Trade:

Recv CAD 300mm 5y5y swap

Pay EUR 225mm 5y5y swap

Target entry 155bp on the 1:1.28 weight

(Equivalent to USD 100k/bp of CAD 5y5y. DV01 weight 1:1.28)

Rolldown of approx. negative 5bp over the first year.

Rationale: The evolution of the coronavirus epidemic and its impact on the global economy is close to impossible to forecast. While cases at the epicentre of the outbreak appear at least to be plateau’ing, reported infection numbers further afield seem to be on an upward trajectory, as is the concern in both public and financial life. The fragile state of some developed economies is not a good starting place for a shock to supply or activity. In the rates space, it is common to look at 5y5y rates to assess dislocations between currencies, and the CAD 5y5y rate has been pulsing on cross-market heat maps.

I’ve run a PCA analysis of 5y5y rates for the last 20 years of data, and the two currencies’ 5y5y rates that stand out are EUR to the low side, and CAD to the high side (see table)

Residual vs PCA 1 for G10 5y5y rates:

|

EUR |

GBP |

USD |

JPY |

SEK |

NOK |

CHF |

AUD |

NZD |

CAD |

|

|

Residual bp |

-61.1 |

-22.3 |

53.8 |

-50.0 |

-37.1 |

30.2 |

5.1 |

-15.8 |

24.1 |

105.2 |

|

T-stat |

-1.46 |

-0.89 |

1.29 |

-1.28 |

-1.01 |

0.94 |

0.26 |

-0.32 |

0.43 |

2.26 |

So, even prior to the virus newsflow, my model was flagging up a receive CAD / pay EUR trade.

Using the PCA 1 weights (with an exponential beta) gives a relative weight of CAD:EUR 1:1.28. This is the past year’s relationship on that basis:

The spread has already started to move (though the volatility in the market makes exact levels unclear), but is still very much at the high end of the past year’s range. So this is not an unreasonable local RV trade, but the history during the global financial crisis suggests that if the coronavirus outbreak becomes pandemic and we re-approach the conditions of the global financial crisis of 08/09 this spread could collapse. Canada is an oil producer, Europe is a consumer so the effect of lower oil prices (on reduced Chinese/global demand) will have the opposite impact in each economy. In addition, Canada has room below to deliver accommodation in a way that Europe does not, having used up most if not all of its monetary ammunition.

Would love to have your feedback,

Best wishes,

David

David Sansom

![]()

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MARKET UPDATE : I WOULD STILL BE INCLINED TO TAKE PROFITS ON TODAYS OPENINGS GIVEN THE RSI DISCLOCATIONS REMAIN WRONG! (JUST DAILY CHARTS).

MARKET UPDATE : I WOULD STILL BE INCLINED TO TAKE PROFITS ON TODAYS OPENINGS GIVEN THE RSI DISCLOCATIONS REMAIN WRONG! (JUST DAILY CHARTS).

THE ROLL CAN SOMETIMES BE A CATALYST FOR CHANGE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MARKET UPDATE : WE MIGHT NEED A BREATHER AS SO MANY STOCK AND BOND DAILY CHARTS HAVE RSI DISCLOCATIONS THAT ARE WRONG!

MARKET UPDATE : WE MIGHT NEED A BREATHER AS SO MANY STOCK AND BOND DAILY CHARTS HAVE RSI DISCLOCATIONS THAT ARE WRONG! TAKE SOME POSITIONING OFF TODAY IF LONG BONDS AND SHORT STOCKS.

BOND YIELDS MIGHT HAVE GOTTEN TOO CARRIED AWAY GIVEN THE EXTENDED DAILY RSI’S.

STOCKS TOO ARE IN THE SAME CAMP OF OVER EXTENDED DAILY RSI’S.

- STOCKS WILL GO LOWER BUT DO NEED A BREATHER ESPECIALLY GIVEN TODAYS CAPITULATION.

2. BONDS : THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, BUT WE NEED A PAUSE BEFORE THE NEXT MOVE LOWER.

US BREAKEVENS AND USGGT :

BREAKEVENS HEADING LOWER.

COMMODITIES : GOLD AND SILVER SHOULD MOVE A LOT HIGHER.

EQUITIES : STOCKS NOW LOOK VERY VULNERABLE, THE WORST IS YET TO COME.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

SHORT-TERM EUROPEAN EQUITY UPDATE.. DIP BUYERS SHOULD BE IN TODAY BUT REMEMBER TO

EQUITIES : TIME TO GIVE THE DIP BUYERS A CHANCE. NOW WE KNOW SOME MAJOR TOPS ARE IN TODAY FEELS LIKE A BOUNCE DAY.

MANY DAILY RSI’S ARE OVERSOLD WHILST THE LONGTERM CHARTS POINT TO MARKETS MUCH LOWER.

EUROSTOX AND DOW HAVE HELD IMPORTANT LEVELS SO LETS SEE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

EQUITIES SPECIAL : EQUITIES NOW IS THE TIME FOR THEM TO FAIL.

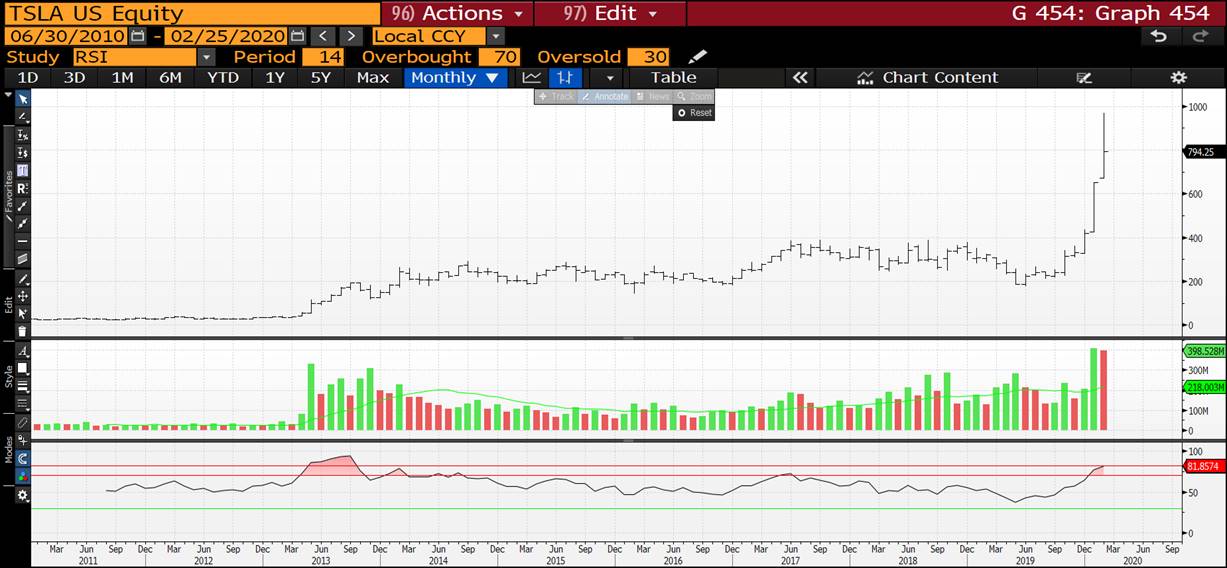

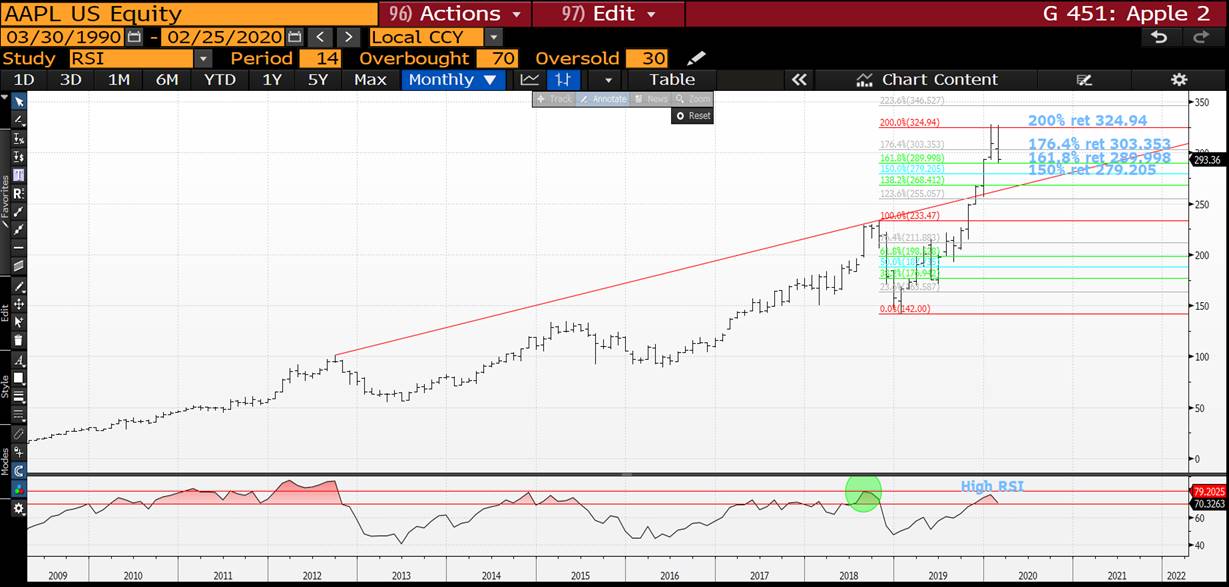

EQUITIES : IT HAVE MENTIONED NUMEROUS TIMES THAT MANY WEEKLY US STOCKS HAVE BEEN OVER BOUGHT, NOW WE ARE SEEING THOSE STOCKS FORM MAJOR AND SIGNIFICANT TOP.

THIS WONT BE A SHORT-TERM THING.

SOME PRIME EXAMPLES BELOW :

- TESLA IS A GOOD EXAMPLE GIVEN ITS “ONE OFF” VOLUME IN EARLY FEBRUARY PLUS SIGNIFICANT OVER BOUGHT RSI ACROSS ALL DURATIONS.

-

- APPLE A SOLID STOCK NOW LOOKS EXTREMLY OVERBOUGHT THUS COULD BE TIME IT TOPS IS IN. I THINK IT WILL BE HIT BY THE CHINA SHUT DOWN ALONG WITH OTHERS.

-

THIS ARTICLE FROM 2018 TALKS OF HIGH RELIANCE OF CHINESE SUPPLIERS. THIS SUPPLY-DEFAULT IS GOING TO HURT ALL.

https://asia.nikkei.com/Asia300/Apples-Chinese-suppliers-grows-to-the-highest-level-numbers-quadrupled-from-2012

www.ccn.com/why-tesla-stock-should-panic-about-chinas-auto-sales-implosion/

blinks.bloomberg.com/news/stories/Q63L6LMB2SJQ

SOME MONTH END CLOSES MIGHT PRESENT MAJOR PROBLEMS.

EUROSTOX AND FTSE DAILY CHARTS ARE THE FIRST TO TEST ITS 200 DAY MOVING AVERAGE.

FTSE IS NOW OFFICIALLY FAILING.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

_PLEASE READ ........MARKET UPDATE : EQUITIES HAVE A BIG PROBLEM AND ONGOING ONE AT THAT.

MARKET UPDATE : EQUITIES HAVE A BIG PROBLEM AND ONGOING ONE AT THAT. WE ARE ON THE MOVE AND THIS IS JUST THE START IF US STOCKS HAVE TOPPED, SO MANY REMAIN HISTORICALLY OVER BOUGHT. THE GLOBAL SLOW DOWN IS LOOMING AND CREDIT WILL BE IN SHORT SUPPLY.

BOND YIELDS HAVE HAD A REPRIEVE BUT SHOULD CONTINUE TO REPLICATE 2011-2012 HISTORICAL MOVE.

STOCKS ARE FINALLY ON THE MOVE AND THE EFFECTS OF THE CHINA SLOW DOWN WILL BE FELT SOON. NOTHING IS LEAVING CHINA INCLUSIVE OF MUCH NEEDED COMPNENT. BOND YIELDS WILL FALL FAST AND A LOT FURTHER.

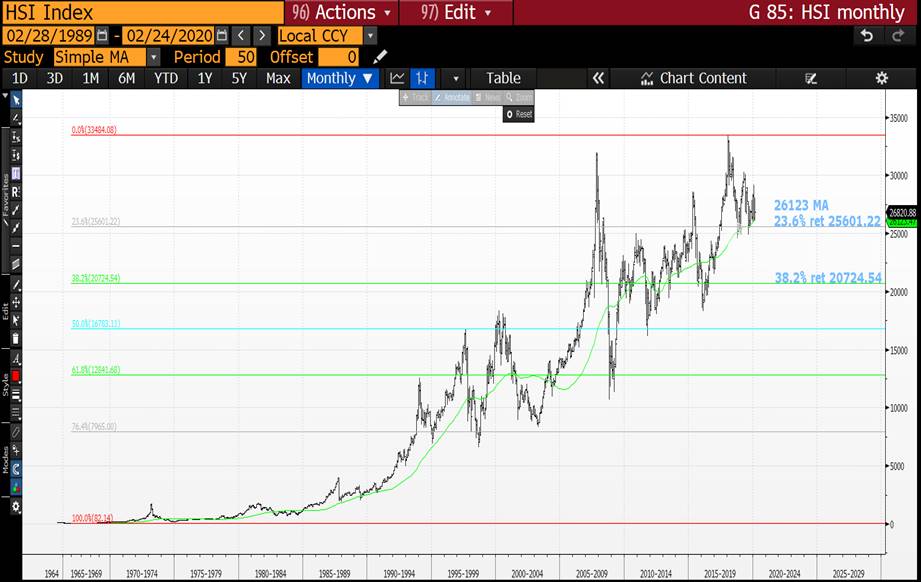

STOCKS : LOWER WITH THE HANG SENG CLOSE TO A VERY KEY MULTI YEAR RETRACEMENT. THE CORONAVIRUS DOES NOT SEEM TO BE ABAITING.

BONDS : THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, WHILST GERMANY BREACHED BACK INTO THE LONGTERM DOWNTREND YIELD CHANNEL. ADDITIONALLY THE DBR 46’S HAVE BREACHED THEIR SIGNIFICANT MOVING AVERAGE

US BREAKEVENS AND USGGT :

BREAKEVENS HEADING LOWER.

COMMODITIES : GOLD AND SILVER SHOULD MOVE A LOT HIGHER.

EQUITIES : STOCKS NOW LOOK VERY VULNERABLE, THE WORST IS YET TO COME.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

GBP Macro trade: Buy 5-30 Floors, funding by OTM receivers on 2y.

Bottom Line: Commentators see the UK government smashing the chains off the austerity coffers as they attempt to fulfil their generous election spending plans. This shift to Keynesian infrastructure, research and other stimulative spending should push the MPC off centre-stage and into the wings. Our view is that increased Gilt supply will drive yields higher in the belly (5y to 10y) than at the short or long ends, and that this could send the 5-30 curve back towards the inverted pre-crisis levels. At the same time, an equivocal MPC will find it hard to cut rates. I’ve proposed two trades to set 5-30 flatteners, funded by selling the risk of a sharp repricing of the short end to lower rates. Both versions have positive roll-down, which is helpful if the UK situation remains muddled between domestic and global pressures.

Trade:

Buy GBP 1bn Floor on CMS 30-5 ATMF (k=0.16%)

Sell GBP 500mm 1y2y Receiver k=0.50% (around 18bp OTM)

for 3bp running

or

Buy GBP 1bn Floor on CMS 30-5 ATMF (k=0.16%)

Sell GBP 750mm 1y2y Receiver k=0.50% (around 18bp OTM)

for 0.5bp premium take out

Spot 2y at 0.71%

Spot 5y-30y at 0.12%

Rationale: With the change of government, and Chancellor, the so-called “Fiscal Rules” in the UK look vulnerable. The bounteous spending promises, if carried through, will likely increase Gilt supply, and historically this has impacted the belly of the curve (eg 5y-10y) more than the short or long ends. At the same time, and for the first time since its inception, the MPC will be heading for the backseat as fiscal expansion takes the wheel. So this gives two themes: flattening in 5-30 and selling volatility on short rates.

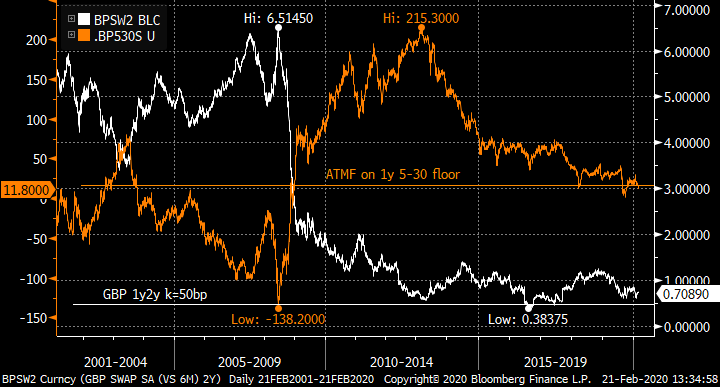

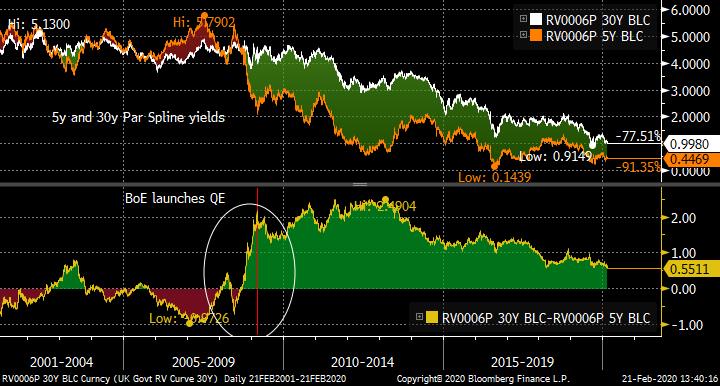

The chart shows the 5y-30y curve (in orange) and 2y spot swaps in white. The curve is sitting is firmly at the bottom of the range since the global financial crisis, but has been much flatter (indeed strongly inverted) in the sunnier times before that.

The combination of sharply reduced MPC rates and the onset of the QE programme drove a sharp steepening in the Gilt 5-30 curve in 2008/2009, as the 5y point led the way lower. It is not unreasonable to suggest that in the reverse move, where supply pushes the belly higher and the MPC moves eventually to wind down QE (it has said that the APF reinvestment would be reviewed when rates hit 1.25%, so 50bp from now) that 5y-30y would move back into the pre-GFC range.

The risk to the trade is clearly that the MPC turns dovish and/or the government does not follow through with its spending plans. The trade loses money if the 2y rate expires below 0.50% (as it seems likely that the 5-30 curve will be steeper).

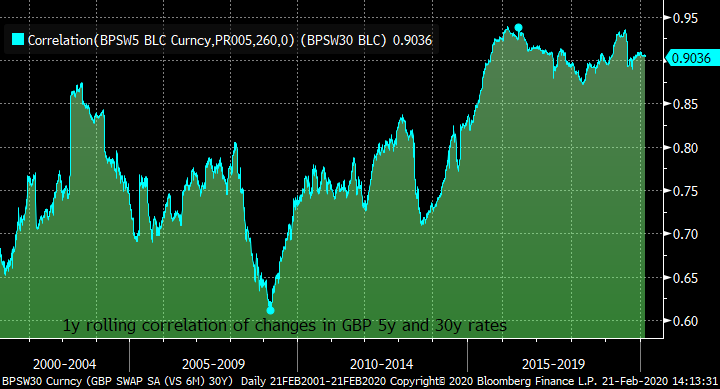

Looking at the implied curve volatility, GBP 5-30 curve vol is close to its lows of the past 3y, as the realized correlation between 5y and 30y rates is above 90% (chart). Historically, correlations have been significant weaker, and the scenario in which this trade works is precisely one where correlations should break lower.

Carry roll-down.

1bn x 500mm version: Given the convexity adjustment for the CMS floor, the trade has positive roll-down of 2.3bp over the first 6 months.

NPV P&L

Inception 3.3bp 0

After 3m 4.5bp 1.2bp

After 6m 5.6bp 2.3bp

After 9m 6.1bp 2.8bp

1bn x 750mm version: This has better rolldown characteristics as the 2y has a higher weight, and so the value of the roll further out of the money is higher

NPV P&L

Inception -0.4bp 0

After 3m 1.8bp 2.2bp

After 6m 4.0bp 4.4bp

After 9m 5.6bp 6bp

This trade is a macro call on the shift from monetarist to Keynesian polices, and the possible move by the UK towards “New Deal” infrastructure and other spending. The “BoE sitting on its hands” view is relatively consensus given the opposing forces on the UK economy, but the flattening is predicated on increased supply and higher yields.

Would love to hear your thoughts!

Best wishes

David

David Sansom

![]()

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Bloomberg Bond News Summary > Fri Feb 21st

Business Briefing

1) Stocks Drop With Treasury Yields on Virus Jitters: Markets Wrap

(Bloomberg) -- Asian stocks, U.S. and European futures retreated Friday amid renewed concern about the impact of the coronavirus as cases outside of China increased. Treasuries and gold advanced. Shares in Korea and Hong Kong saw the steepest losses, with more modest declines in Australia. Japanese stocks closed little changed while those in China edged higher. The yield on ...

2) Dollar Has No Equal for Investors Sheltering From Outbreak (1)

(Bloomberg) -- Currency traders seeking shelter as the spreading coronavirus roils financial markets just can’t get enough of the teflon dollar. The greenback has gained versus some 30 major world currencies in the past month, coinciding with mounting concern over the outbreak’s economic impact. The yen and the Swiss franc, two traditional haven currencies, have proven no ...

3) China Rotation Time for Bonds to Run Past Stocks: Markets Live

4) Global Shipping’s ‘Perfect Storm’ to Pass, Veteran CEO Says (1)

(Bloomberg) -- The global shipping industry has run into very rough waters in 2020 as the virus crisis that’s engulfed China and roiled commodity markets added to headwinds from a seasonal slowdown and poor weather. One chief executive who oversees a fleet of 55 vessels says there’ll be a comeback. “This is certainly temporary,” said John Wobensmith of Genco Shipping & Trading Ltd. ...

5) Virus Epidemic Enters New Phase as Cases Outside China Multiply

(Bloomberg) -- South Korea has more than 150 cases. Those for Singapore and Japan have topped 85. And then there are the 600-plus from a quarantined cruise ship in Japan. As the cases of coronavirus infections mount, worries are growing that the outbreak is entering a concerning next phase. Where China had the vast majority of cases and deaths before, there are now signs ...

World News Briefing

6) Korean Infections Jump; Hubei Revises Up New Cases: Virus Update

(Bloomberg) -- The number of coronavirus cases in China topped 75,000, while concerns grew over the pace of infections in other Asian countries. China’s death toll rose to 2,236 with 115 new fatalities in Hubei province. The province at the center of the outbreak revised up its number of new cases to 631 from 411 reported earlier. China has been continually changing the ...

7) Trump Ads Will Take Over YouTube’s Homepage on Election Day

(Bloomberg) -- In the immediate run up to the U.S. presidential election and on Election Day, the homepage of YouTube is set to advertise just one candidate: Donald Trump. The president’s re-election campaign purchased the coveted advertising space atop the country’s most-visited video website for early November, said two people with knowledge of the transaction. The deal ...

8) Merkel’s Succession Has Descended Into Chaos and She Knows It

(Bloomberg) -- While Angela Merkel maintains her characteristically unflappable demeanor in public, behind the scenes the German chancellor realizes she’s all but lost the ability to influence the power struggle raging within her party. In the chancellery, there’s growing concern about how her chosen heir -- Annegret Kramp-Karrenbauer, who resigned last week after failing ...

9) Russia Backs Trump in 2020, and He Rages Over Alert to Congress

(New York Times) -- A classified briefing to House members is said to have angered the president, who complained that Democrats would “weaponize” the disclosure. WASHINGTON — Intelligence officials warned House lawmakers last week that Russia was interfering in the 2020 campaign to try to get President Trump re-elected, five people familiar with the matter ...

10) Overwhelmed Chinese Hospitals Turn Away Patients Without Virus

(Bloomberg) -- Liu Zi’ao was awaiting surgery in a Wuhan hospital to treat the tumor pressing on his spinal cord when, suddenly, he was told to leave. The novel coronavirus had plunged the central Chinese city’s health-care system into crisis, and all resources were being diverted to contain it. In the month since, the 25-year-old former acupuncturist has been turned away from ...

Bonds

11) Bond Traders Double Down on Fed Cut Bets in Rate Markets Rally

(Bloomberg) -- U.S. government bond markets saw a rush of buying Thursday that piled up bets on interest-rate cuts amid concern that the coronavirus will damage global growth. Increasing anxiety over the toll and spread of the virus appears to have contributed to the momentum in trades that took the 10-year yield just shy of 1.50%, to the lowest since Jan. 31. Expectations ...

12) Treasury 10-Year Drops Below 1.50%, Aussie Slips on Virus Spread

(Bloomberg) -- U.S. 10-year bond yields dip below 1.50% for first time since September, with cash yields lower by 1-2bps across the curve. Broad risk-off moves are weighing on markets in Asia as Aussie slips and the yen ekes out a modest gain.

- Volumes in Treasuries are robust with gentle bull flattening move intact, typical of risk-off price action

- Early gains were kick started after another jump in South Korean virus cases, with markets ...

13) HNA Bond Euphoria Cools as Market Weighs State Takeover Talk

(Bloomberg) -- A remarkable rally in dollar bonds of Chinese conglomerate HNA Group Co. eased slightly Friday, as investors awaited confirmation of reported plans of a government seizure of the embattled firm. Once the poster child for China’s debt-fueled overseas acquisition spree, HNA could now find itself a takeover target of Beijing, a plan that may involve the sale of its lucrative airline assets in an ...

14) Aussie Drops, Yen Gains With Widening Virus Spread: Inside G-10

(Bloomberg) -- The yen halted a two-day loss and the Australian dollar fell to a fresh 11-year low as the rising number of coronavirus infections outside of China kept traders on the edge.

- Treasuries advanced as investors sought refuge in havens after South Korea reported 52 more cases while two people evacuated to Australia from a cruise ship in Japan also tested positive ...

15) Investors Come Back for More After 34% Bond Returns in Russia

(Bloomberg) -- Investors who took home 34% returns on Russian local-currency bonds last year are increasing their bullish bets after Central Bank Governor Elvira Nabiullina signaled more rate cuts. Ten-year yields fell below 6% for the first time in at least a decade as money managers topped up the $16 billion they poured into the market last year. High demand at weekly ...

16) Won Leads Drop in EM FX Amid Virus Case Surge: Inside Asia

(Bloomberg) -- South Korea’s won drops, leading a decline in emerging market currencies in Asia, as investors dump risk assets following a wider coronavirus spread in the region.

- South Korea reported 52 more cases, bringing the total to 156, while two people evacuated to Australia from a cruise ship in Japan also tested positive for the virus

- Asia’s biggest economies are already feeling the brunt of the coronavirus shock. Key ...

Central Banks

17) Buffett, JPMorgan, HKEX, Bank of Korea: Week Ahead in Functions

(Bloomberg) -- Berkshire Hathaway Inc. releases results on Saturday, Tuesday is JPMorgan Chase & Co.’s investor day, Hong Kong Exchange & Clearing Ltd. reports Wednesday, Bank of Korea sets rates on Thursday and U.S. consumer sentiment is due Friday. Use Bloomberg functions to prepare for the week’s events and act when news breaks. ...

18) Australia Banks to Face Climate Stress Tests, Regulator Says (1)

(Bloomberg) -- Get serious on climate change risks. That’s the message from Australia’s prudential regulator as it joined counterparts in the U.K., the Netherlands and Singapore in ramping up its surveillance of how ready financial institutions are to deal with climate change. Banks will have to undertake stress tests to measure their resilience to a broad range of ...

19) EUROPE PREVIEW: PMIs to Lay Economic Weakness Bare in 1Q (1)

(Bloomberg Economics) -- Today is important for the European economy -- the flash PMIs are among the most reliable gauges of economic momentum and they’ll be closely monitored by policy makers and investors alike. Here’s what to expect:

- The euro area’s business surveys for January suggested the outlook was steadily improving. We don’t think that trend has been sustained in February ...

20) JAPAN REACT: Hotel Stays, Durable Goods, and Virus Impact on CPI

(Bloomberg Economics) -- OUR TAKE: Japan’s core inflation (excluding fresh food and energy) slowed in January, pulled down by lower accommodation and durable goods prices. It’s hard to be certain but that may partly reflect hotel reservation cancellations by Chinese tourists affected by measures to contain the coronavirus. The hit to sales from the sales-tax hike explains the weakness in durable goods prices. ...

21) Japan Price Gains Buoyed by Energy Offer BOJ Little Comfort (2)

(Bloomberg) -- Japan’s core inflation accelerated for a fourth month in January, but with the gain boosted by gasoline costs the data does little to bolster a case that consumer-led price momentum is picking up as the Bank of Japan hopes. Consumer prices excluding fresh food rose 0.8% from a year earlier, picking up speed from a 0.7% gain in December, the ministry of ...

Economic News

22) Asia’s Economies Flash Early Signs of Virus Hit as G20 Meets

(Bloomberg) -- Asia’s biggest economies are already feeling the brunt of the coronavirus shock. Key gauges for manufacturing in Australia and Japan fell while early export orders for South Korea showed a slump in Chinese demand. Data from China showed car sales sank 92% in the first half of February while its Commerce Ministry said trade and inbound investment would take an ...

23) The World’s Biggest Economies Get a Jolt of Government Spending

(Bloomberg) -- Governments across the world are starting to use more fiscal firepower to boost economies, though the shift may not be happening fast enough to appease central bankers who say they’re sick of carrying the burden of stimulus alone. In more than half of the world’s 20 biggest economies, analysts now expect looser budgets ...

24) Big Economic Reads: Beijing Steps Up Response to Virus Outbreak

(Bloomberg) -- The coronavirus continues to ripple through the world economy, prompting mounting fears over the outlook for the Chinese economy and beyond. With Group of 20 finance minsters and central bankers convening for talks in Saudi Arabia on Friday, here’s a run down of this week’s best stories, enterprise and analysis from Bloomberg Economics. ...

25) G-20 Chiefs to Meet as China, Japan, Europe Stall: Economics

(Bloomberg Economics) -- Group-of-20 finance chiefs, meeting Saturday, will confront a dreary and deteriorating picture on global growth. A combination of the China virus, Japan sales-tax hike, and Europe factory slump mean six of the world’s eight biggest economies have stalled. That raises two questions: first, could isolated short-term shocks compound into something bigger and longer lasting; second, if that happens, ...

26) SNB Isn’t Panicking About the Franc And Here’s One Reason Why

(Bloomberg) -- The Swiss National Bank appears to be content for now to allow the franc to drift higher, with little evidence that it’s getting into a dogfight with markets. While reluctance to aggressively sell the franc may be partly driven by fear of being labeled a currency manipulator by the U.S., SNB data also suggest the valuation may not be so extreme as it appears. ...

European Central Bank

27) ECB REACT: Policymakers' Optimism Yet to Find `Firmer Grounds'

(Bloomberg Economics) -- Minutes from the January monetary policy meeting of the European Central Bank confirm the cautiously optimistic tone adopted by President Christine Lagarde at the press conference. But this nascent hopefulness is unlikely to survive the blows taken by the economy since policy makers met in January.

- The Governing Council slightly tweaked its assessment of risks facing the euro area. It ...

28) ECB Warned of Caution on Economy Even Before Coronavirus Hit (1)

(Bloomberg) -- European Central Bank policy makers warned against signaling too much economic optimism at their January rate-setting meeting, a view that proved prescient now that the coronavirus outbreak is dashing hopes for an upturn any time soon. The Jan 22-23 Governing Council meeting was held as trade tensions appeared to be easing -- with a first phase of a ...

29) ECB PREVIEW: Minutes May Reveal Policy Makers Views on Review

(Bloomberg) -- The European Central Bank launched a review of its monetary policy strategy on Jan. 23. The review, expected to take a year to complete, will focus mainly on the ECB’s price stability objective. But will also cover financial stability, employment and environmental sustainability.

- The ECB’s self-appraisal will probably be the main point of interest in the minutes of its ...

30) ECB tone upbeat on eurozone growth before coronavirus struck

Preview text not available for this story.

31) Christine Lagarde Has a Troubling Ambition: Ferdinando Giugliano

(Bloomberg Opinion) -- Christine Lagarde is eager to make her mark at the European Central Bank. At the moment, we know precious little about her views on the future course of monetary policy. But one thing is clear, the new president wants the ECB to take on a bigger role in the fight against climate change. Lagarde thinks it’s possible to reconcile this ambition with the ECB’s mandate, which ...

First Word FX News Foreign Exchange

32) Japan Lawmaker Says Digital Yen Isn’t Coming Anytime Soon

(Bloomberg) -- Anyone expecting the Japanese government or its central bank to issue a digital currency in the near future is likely to be disappointed, according to the head of a ruling party group that’s studying the idea. Hideki Murai, a lawmaker who heads the digital money team of Prime Minister Shinzo Abe’s party, says creating a new state-issued digital currency ...

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Idea 5/10 France Steeper vs 75% hedge OE/RX Flattener

Trade: Buy FRTR 0.75% 3/25 vs Selling FRTR 0.75 11/28(CTD OATH0) 100k Risk

Sell DBR 0.5% 2/25(OEM0) vs Buying DBR 0.25% 2/29(RXH0 or M0) 75K Risk

Entry: -10.5bps, add -9.0, Target -16bps

Carry and Roll – Net 0.5bps Positive – 3mos

Rational:

- Level of German rates has been a strong driver for compression of spreads – Not looking for us to revisit of the August 2019 low in yields

- 10yrs currently expensive on the French Curve (5/10/30y) – Bottom Chart

- Next up supply point will be 10y and longer – France will shift to sharply negative NET Funding in March(approx. 14bl)

- Both 5y and 10y Spreads vs core at muli-qtr lows( and only several bps from multi-year lows) – looking for either stabilization of spreads with 10yrs cheapening(supply trade or directional trade)

or risk-off trade where 10yrs widening faster than 5yrs while investors attempt to shorten credit term risk premium profile while maintaining exposure to France.

- 75% Hedge with OE/RX produces less volatility – mitigates to some degree further downside should yields come lower & spreads tighten further.

- Relative ease of executing the trade given ¾ of the trade is done through futures

- Carry + Roll is marginally positive assuming 13bps differential in funding

- RV – taking advantage of Cheap 5yrs in France, and marginally expensive current French CTD falling out of the basket in a couple of weeks time

|

|

Butterfly Analysis |

|

YIELD |

|

|

Curve |

Issue |

|

EURIBOR |

Frwd |

|

Curve |

Issue |

|

|

Eonia |

|

|

|

|

25-May |

Rich Cheap |

R-C |

LIBOR |

|

EONIA |

|

|

|

|

|

Spot |

Frwrd |

Carry |

Roll |

Roll |

NET |

OAS |

AsSwp |

Carry |

Roll |

Roll |

NET |

Y-Y |

OAS |

F OAS |

Carry |

|

Y-Y |

REPO |

Analysis |

NET |

OAS |

Yld |

OAS |

DUR |

|

-1 |

FRTR 0.75 11/28 |

Sell |

-0.296 |

-.29 |

0.5 |

1.6 |

0.0 |

2.1 |

12.6 |

12.6 |

-0.2 |

0.5 |

-0.2 |

0.1 |

13.0 |

-3.1 |

-3.2 |

0.1 |

|

-2.3 |

-0.455 |

FRTR 0.75 11/28 |

0.7 |

0.6 |

0.1 |

0.6 |

2.7 |

|

1 |

FRTR 0 3/25 |

Buy |

-0.509 |

-.51 |

-0.2 |

1.4 |

0.5 |

1.6 |

18.8 |

19.1 |

-0.3 |

0.6 |

0.5 |

0.7 |

18.8 |

3.5 |

3.6 |

-0.1 |

|

4.2 |

-0.455 |

FRTR 0 3/25 |

(1.3) |

(1.4) |

(1.3) |

(1.6) |

(0.6) |

|

0.75 |

DBR - 0.25 2/29 |

Buy |

-0.508 |

-.506 |

0.2 |

1.1 |

0.1 |

1.4 |

34.7 |

35.0 |

-0.2 |

0.0 |

0.0 |

-0.2 |

35.4 |

19.0 |

19.1 |

-0.2 |

|

20.0 |

-0.585 |

DBR - 0.25 2/29 |

0.3 |

0.3 |

(0.0) |

0.3 |

1.2 |

|

-0.75 |

DBR - 0.5 2/25 |

Sell |

-0.653 |

-.656 |

-0.3 |

0.5 |

0.0 |

0.2 |

32.6 |

33.1 |

-0.2 |

-0.3 |

0.0 |

-0.4 |

33.1 |

17.3 |

17.6 |

-0.2 |

|

18.4 |

-0.585 |

DBR - 0.5 2/25 |

0.1 |

0.1 |

0.2 |

0.1 |

(0.3) |

|

|

Spot Fly = |

|

-10.3 |

-10.6 |

-0.3 |

0.2 |

0.5 |

0.5 |

-7.8 |

-8.0 |

-0.1 |

0.3 |

0.6 |

0.8 |

-7.6 |

-7.8 |

-8.0 |

-0.2 |

|

-7.7 |

|

|

1.9 |

1.8 |

1.7 |

2.0 |

2.1 |

Chart Below:(Inverted for ease of graph– Long Term 5/10 Box France vs Germany (Purple Line) – Since 2019 – Lower Rates(10y Bunds – Green Line)

means tighter spread and flatter Credit Term Premium . Bottom Panel – both 5y and 10y French Spreads vs Germany

Chart Below: 5/10/30 Fly 50/50 wtd – Using Generic Rates – CMT Spline curves.

![]()

Stephen Creaturo

O: +44 (0) 203 - 143 – 4175

M: +44 (0) 7 809 575 890

E: stephen.creaturo@AstorRidge.com

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This marketing was prepared by Stephen Creaturo, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MARKET UPDATE : CONSOLIDATION OVER TIME NOW FOR BOND YIELDS TO FALL, STOCKS CONTINUE TO DEFY ALL LOGIC.

MARKET UPDATE : CONSOLIDATION OVER TIME NOW FOR BOND YIELDS TO FALL, STOCKS CONTINUE TO DEFY ALL LOGIC.

BOND YIELDS HAVE HAD A REPRIEVE BUT SHOULD CONTINUE TO REPLICATE 2011-2012 HISTORICAL MOVE.

STOCKS REMAIN VERY OVER BOUGHT AND MANY NOW LOOK LIKE PUTTING IN LONGTERM TOPS, BUT THAT SAID NEED TO FAIL THIS WEEK!

- WE NEED SOME NEW BOND YIELD LOWS SOON. YIELDS CONTINUE TO GRIND LOWER WITH GERMANY AND US 5YR FOCUS CHARTS, TIME TO REPLICATE THE 2011-2012 SCENARIO.

- STOCKS LOWER INTO THE WEEKEND, IDEALLY THEY HEAD LOWER FROM TODAY AS MANY HAVE ONLY JUST REVISITED THEIR RECENT HIGHS. THE CORONAVIRUS DOES NOT SEEM TO BE ABAITING.

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, WHILST GERMANY BREACHED BACK INTO THE LONGTERM DOWNTREND YIELD CHANNEL. ADDITIONALLY THE DBR 46’S HAVE BREACHED THEIR SIGNIFICANT MOVING AVERAGE.

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

EQUITIES : STOCKS NOW LOOK VERY VULNERABLE, THE WORST IS YET TO COME.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris