Bloomberg Bond News Summary > Tues Feb 18th

Business Briefing

1) HSBC Targets Revamp with 15% Staff Cuts, $7.3 Billion Charge

(Bloomberg) -- HSBC Holdings Plc is set to slash about 15% of its workforce, and is taking $7.3 billion of charges in its latest attempt to revive its fortunes since the global financial crisis. The London-based lender is also targeting cost cuts by $4.5 billion as it faces challenges including Hong Kong protests and the coronavirus. HSBC, which earns the bulk of its ...

2) Stocks, Bond Yields Decline After Apple Warning: Markets Wrap

(Bloomberg) -- U.S. futures fell with Asian stocks and bond yields after Apple Inc. said quarterly sales would miss forecasts, illustrating the blow to corporate earnings and economic growth from the deadly coronavirus. Equity benchmarks in Tokyo, Seoul and Hong Kong saw declines of over 1%. Sydney and Shanghai saw more modest drops. Apple suppliers including TDK Corp. and ...

3) TOPLive Starts: Follow Glencore Full-Year Earnings in Real Time

World News Briefing

4) Canadians Aboard Cruise Liner Reportedly Infected: Virus Update

(Bloomberg) -- Canada said 32 of its citizens aboard the stricken Diamond Princess have tested positive for the coronavirus, according to a tweet from the Toronto Star. Japan said earlier Tuesday that it expected to remove all passengers from the cruise liner by Friday, and South Korea said it would evacuate its citizens and fly them back to Seoul. The ship remains docked ...

5) Rare Release of Xi’s Speech on Virus Puzzles Top China Watchers

(Bloomberg) -- China’s elite politics are a black box and the country’s leaders like to keep it that way. That’s what makes the events of this weekend so perplexing even to seasoned China watchers. On Saturday, the ruling Communist Party’s top theoretical publication, Qiushi Journal, released a speech showing that President Xi Jinping was directing efforts to contain the ...

6) A Single Cruise Guest Sparks a Global Rush to Contain Virus

(Bloomberg) -- As passengers from the shunned cruise liner Westerdam head home following two weeks in limbo at sea, health authorities around the world are having to mobilize to prevent further spread of the coronavirus after an American guest from the ship was found to be infected. Cruise operator Holland America Line -- which gave assurances that the pathogen that’s killed ...

7) Lung Biopsy of Deceased China Patient Shows SARS-Like Damage

(Bloomberg) -- Doctors studying a 50-year-old man who died in China last month from the new coronavirus found that the disease caused lung damage reminiscent of two prior coronavirus-related outbreaks, SARS and MERS. The patient died on Jan. 27 after a two-week illness that left him increasingly breathless. His heart stopped following damage to his alveoli, tiny grape-like ...

8) I Flew to See My Parents and Ended Up in Coronavirus Quarantine

(Bloomberg) -- I felt hundreds of eyes staring as my heart pounded, blood rushed to my face and sweat dripped down the back of my neck. I had just stepped off the plane at Seoul’s Incheon International Airport, and this wasn’t what I’d expected. For weeks I’d been covering the coronavirus outbreak for Bloomberg News in Hong Kong -- tracking the case counts, the travel ...

Bonds

9) World’s Biggest Glovemaker Raises Money as Virus Fuels Demand

(Bloomberg) -- The world’s biggest glovemaker is turning to the credit market to raise funds as the coronavirus outbreak tests the Malaysian company’s capacity to churn out the rubber products. Top Glove Corp. plans to raise 1 billion ringgit ($241 million) from perpetual Islamic notes as demand soars for gloves to help protect against the deadly virus, which has infected ...

10) Sex Abuse Claims Drive Boy Scouts of America to Seek Bankruptcy

(Bloomberg) -- The Boy Scouts of America filed for bankruptcy to protect itself from a rising tide of claims tied to sexual abuse of children in its ranks. The group filed under Chapter 11 of the bankruptcy code, which allows the organization to keep operating while it works out a plan to pay its debts and design a recovery plan. Court papers filed in Delaware listed liabilities of up to $1 billion and assets as much ...

11) Default Fear Pushes India Funds to Ring-Fence Vodafone Idea Debt

(Bloomberg) -- Indian mutual funds are carving out their investments in troubled Vodafone Idea Ltd.’s debt into separate portfolios as they seek to limit any fallout from a possible default by the telecom carrier. UTI Mutual Fund and Nippon Life India Asset Management have moved to ring-fence their holdings in Vodafone Idea’s debt on Monday after credit assessor Care Ratings Ltd. ...

12) Commodity Currencies Slide on Global Growth Worries: Inside G-10

(Bloomberg) -- Commodity currencies dropped after Apple Inc. flagged that Chinese factories are resuming production at a slower pace than anticipated, renewing concerns over the economic impact of the coronavirus outbreak.

- The currencies of New Zealand, Australia and Norway fell at least 0.4% to lead losses among Group-of-10 peers. Treasuries rallied across the curve as ...

13) China Dollar Bonds Worth $20.9 Billion Are Yielding Above 15%

(Bloomberg) -- The yield on these securities from Chinese companies was above 15% this week, bringing the total face value of Chinese dollar bonds in that category to $20.9 billion.

- 26 out of 67 bonds on the list are from the real estate industry

- Majority of issuers on the list are Beijing-based and represent $12.3b of bonds

- Note: Items in white have payments due within a month ...

14) Traders in ‘Complacency’ as Shorts Wither: Volatility Monitor

(Bloomberg) -- Short interest on the SPDR S&P 500 ETF Trust has begun this year at levels not seen since 2007, according to the latest exchange-reported data compiled by Bloomberg. Btig LLC strategist Julian Emanuel said in a note Sunday that “a quiet sort of complacency seems to have descended over investors, weary of the last several weeks’ gyrations,” partially because “the bears have capitulated -- with ...

Central Banks

15) Search for Big G-10 FX Movers Points to Yen, Aussie: Macro View

(Bloomberg) -- Japan, Australia and Canada are among the Group of 10 countries whose currencies have the greatest room to strengthen this year, according to a model based on factors such as real-effective exchange rates and rate differentials.

- The currencies stand to gain anywhere from 4% to 6% against the dollar in 2020, based on the model, which factors in REER, real ...

16) French MiFID II Research Revamp May Ease Asset-Manager Pressure

(Bloomberg Intelligence) -- French asset managers from Amundi to AXA to Lyxor may win easier access to more and better-quality investment research, supporting fund performance and easing revenue-margin pressure, with the Authorite des Marches Financiers' plan to overhaul its MiFID II regime. The changes could give the country's managers a competitive edge over EU and U.K. peers, in our view.

17) Philippines Offers to Sell More 2029 Bonds as Yield Falls (1)

(Bloomberg) -- The Bureau of the Treasury sold all 30b pesos of 2029 treasury bonds it offered at an auction Tuesday as bids were twice more than what it offered.

- Average yield fell to 4.409% from 4.617% at previous auction on Nov. 12, according to data at auction covered live in Manila

- Bids reached 83.6b pesos vs 30b pesos offer

- Treasury opened a tap facility, offering to sell 15b pesos more of the re-issued bonds ...

18) TRANSLATION: Yonhap Infomax: BOK launches 'Blockchain Bond' Treasury Trading Test

19) RBA Reviewed Case for Further Rate Cut, Worried About Borrowing

(Bloomberg) -- Australia’s central bank reviewed the case for a further interest-rate cut, but decided against it in order to avoid encouraging additional borrowing as house prices climb, minutes of its Feb. 4 meeting in Sydney showed. The Reserve Bank also expects the coronavirus outbreak to “subtract from growth in exports over the first half of 2020,” the minutes ...

20) N.Z. Economists Agree With RBNZ on Limit to House-Price Gains

(Bloomberg) -- New Zealand economists agree with the RBNZ that there will be a pick up in house-price inflation in early 2020, but this will be short-lived amid increased supply, slowing population growth and credit constraints. according to emailed notes.

- ANZ Bank sees house price inflation lifting to 8% by mid-2020 with a “fairly sharp moderation” to ~3% thereafter

- Westpac raises its house-price inflation projection to 10% by mid-2020 but sees a slowdown ...

Economic News

21) How Fast Can China’s Economy Bounce Back from Virus Lockdown

(Bloomberg) -- The biggest question for the global economy right now is how quickly China can get back to anything like normal operations while it’s battling the coronavirus outbreak that has killed almost 1,900 people and sickened tens of thousands. Government controls and people’s fears to go outside have decimated spending for businesses from local noodle joints and ...

22) Boris Johnson’s 570 Billion Reasons for Wanting an EU Trade Deal

(Bloomberg) -- Brexit shattered 50 years of trade policy in Britain, divorcing the country from its single largest market. Prime Minister Boris Johnson is now trying to glue the pieces back together. Since Britain left the European Union on Jan. 31, Johnson has dispatched his foreign secretary on a tour of Australia and Japan to show that Britain is open for business, while ...

23) U.S. Is Considering New Wave of China Tech Restrictions

(Bloomberg) -- The Trump administration is considering new restrictions on exports of cutting-edge technology to China in a push aimed at limiting Chinese progress in developing its own passenger jets and clamping down further on tech giant Huawei’s access to vital semiconductors, according to four people familiar with the discussions. Senior officials are expected to decide by the end of this month whether to block exports ...

24) Most Economists See Virus Pushing Japan Into Recession: Survey

(Bloomberg) -- Japan is falling into recession as the coronavirus pummels an economy already weakened by a sales tax hike, according to a Bloomberg survey. Nine out of 14 polled economists see the economy shrinking again in the three months to the end of March, following the sharpest contraction in more than five years last quarter. The median forecast of analysts shows ...

25) Korean President Calls for ‘Extraordinary Steps’ to Combat Virus

(Bloomberg) -- President Moon Jae-in said the spreading coronavirus is an emergency for South Korea’s economy and called for “extraordinary” steps to minimize its impact. “An emergency situation warrants an emergency prescription,” Moon told his Cabinet on Tuesday, warning that the virus’s impact could be bigger and longer-lasting than a 2015 epidemic that killed 38 people ...

European Central Bank

26) ECB Added LVMH’s New Euro-Denominated Bonds to CSPP Last Week

(Bloomberg) -- The ECB added 10 new securities to its CSPP program during the week ended Feb. 14, according to central bank data analyzed by Bloomberg.

- Two securities matured and the value of the CSPP portfolio increased by EU1.997b at amortized cost

- Size of CSPP now at EU192.556b

- NOTE: Central bank reinstated net asset purchases on Nov. 1

27) Lagarde Confronts Political Cost of ECB’s Subzero Rate Policy

(Bloomberg) -- “Nobody trusts you,” lawmaker Joerg Meuthen told European Central Bank chief Christine Lagarde, switching briefly to English during a tirade in his native German. “You should be aware of that.” The far-right Alternative for Germany representative was railing about negative interest rates -- and while enduring bluster is par for the course for ECB presidents, ...

28) Euro Options Turn More Bearish in Repeat of 2019 ECB Easing Bets

(Bloomberg) -- Options traders are turning increasingly negative on the euro in a move that resembles the pricing adjustment seen in July when the currency market positioned for potential easing by the European Central Bank.

- Risk reversals are now trading in favor of puts in the short- to medium-term as concerns over the coronavirus outbreak and the health of the euro ...

29) Global Policy, Lagarde’s Challenge, China Rate Cut: Eco Day

(Bloomberg) -- Welcome to Monday, Europe. Here’s the latest news and analysis from Bloomberg Economics to help get your week started:

- The broad policy direction for many of the world’s central banks and governments now hinges on one question: how will the Chinese government respond to the economic shock?

- Finance leaders from across the world will gather in Saudi Arabia this week to discuss a global economy ...

30) After Fed and ECB, India May Turn Next to BOE for Inspiration

(Bloomberg) -- First it was the Federal Reserve. Then the European Central Bank. Now, India’s monetary authority may look to the Bank of England for ideas to revive growth, economists say. The Reserve Bank of India could possibly draw inspiration from BOE’s Funding for Lending Scheme to jump start loan growth in the economy that’s set for its weakest expansion in 11 years, ...

First Word FX News Foreign Exchange

31) Cyprus Warns Allies They’re Giving Erdogan Free Rein in Region

(Bloomberg) -- Turkey is taking advantage of worsening relations between Russia and the North Atlantic Treaty Organization to push for more influence in the eastern Mediterranean and most other countries have failed to react, Cyprus’s president said. “Turkey feels unrestrained given U.S. efforts to keep the country in the western alliance,” President Nicos Anastasiades said ...

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

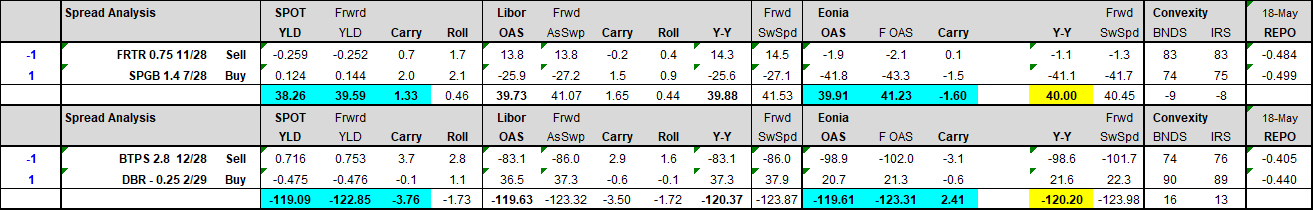

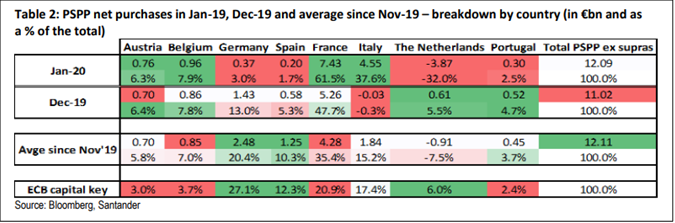

Buy 10yr SPGB-FRTR spread hedged with IK-RX

TRADE:

Buy SGPB 1.4 7/28 vs FRTR 0.75 11/28 (CTD) in $20k/01

Sell BTPS 2.8 12/28 (CTD) vs DBR 0.25 2/29 (CTD) in $6.7k/01 (33% credit delta hedge)

è> Long the FRTR-SPGB ’28 spread hedged with 33% BTPS-DBR CTD spread @ -2 bps:

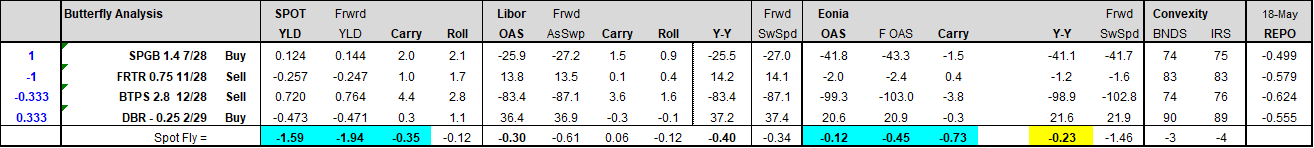

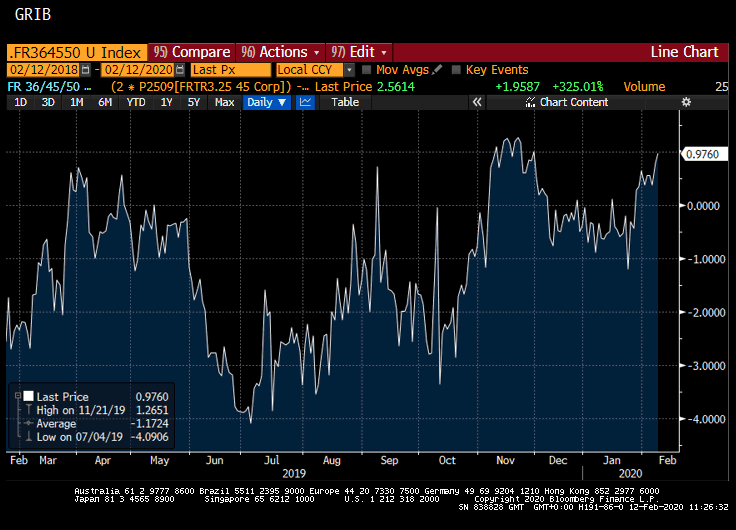

Chart below is SGPB 1.4 7/28 – FRTR 0.75 11/28 (CTD) spread minus 33% of BTPS 2.8 12/28 – DBR 0.25 2/29 spread – this spread has cheapened 15 bps since Jan and 43 bps since June.

100 * ((YIELD[SPGB1.4 7/28 Corp] - YIELD[FRTR0.75 11/28 Corp]) – 0.333*(YIELD[BTPS2.8 12/28 Corp] - YIELD[DBR0.25 2/29 Corp])):

1st Target: -10 (+8 bps)

2nd Target: -15 (+13 bps)

Stop: +2 (-4 bps)

RATIONALE:

===========

SPGB-FRTR spread has heavily lagged the tightening in the BTP-DBR spread:

White – SPGB 1.4 7/28 – FRTR 0.75 11/28 (CTD) spread

Yellow – BTPS 2.8 12/28 (CTD) vs DBR 0.25 2/29 (CTD) spread

From the chart above, the SPGB-FRTR spread looks 8-9 bps cheap.

The SPGB-FRTR spread hedged with 33% BTP-DBR has cheapened 15 bps since January, due to the following:

- Italian election results shifted power away from Eurosceptic factions (Norda/5 Star), tightening BTP-DBR hedge

- PSPP bought a disproportionate amount (7.4bn) of FRTRs in January, deviating from the Capital Key to bolster heavy French supply

PSPP bought 61.5% FRTRs in Jan = 3x the Capital Key (20.9%):

- PSPP also bought 37.6% BTPS in Jan > 2x the Capital Key (17.4%)

- Conversely, SPGBs were underbought (only 0.2bn or 1.7% of purchases, vs 12.3% of Capital Key)

Why the SPGB-FRTR spread hedged with BTP-DBR should work:

- ECB will need to smooth out future purchases, e.g. buy more SPGB and DBR, and less FRTR and BTPs to realign with the capital key

- Spain’s YTD issuance is ~ 23.3% completed compared to France’s ~ 13.5%

- France has twice the amount of remaining net issuance (net of C&R flows/PSPP buying) than Spain (70.2bln vs 35.1bn).

- BTP-DBR spread has narrowed to new lows on global reach for yield and corona virus fears; however Fitch, while affirming Italy’s BBB view with negative outlook, gave a dire long term assessment:

“Based on our macroeconomic and fiscal forecast gross general government debt (GGGD) will increase to 137.0% of GDP in 2021 from 134.8% in 2018, driven by subdued nominal GDP growth, and a 1.1pp weakening in the primary balance from 2018 to 2021. This compares with the current 'BBB' median public debt of 36% of GDP and would leave Italy as one of the most highly indebted sovereigns rated by Fitch. Italy's 'BBB' rating and Negative Outlook reflect the extremely high level of general government debt, very low trend GDP growth, economic policy uncertainty and associated downside risks to our public debt projections. The relatively high net external debt and improving, but still weak, banking sector asset quality, also weigh on the rating.”

NB: This spread has tended to trade risk off (e.g. performs better on peripheral widening) in the short term.

Regards

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

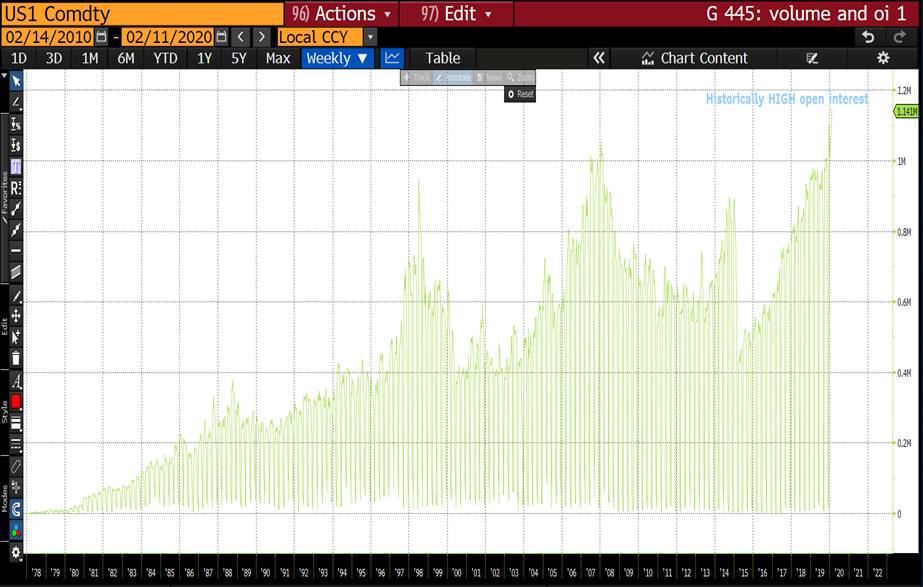

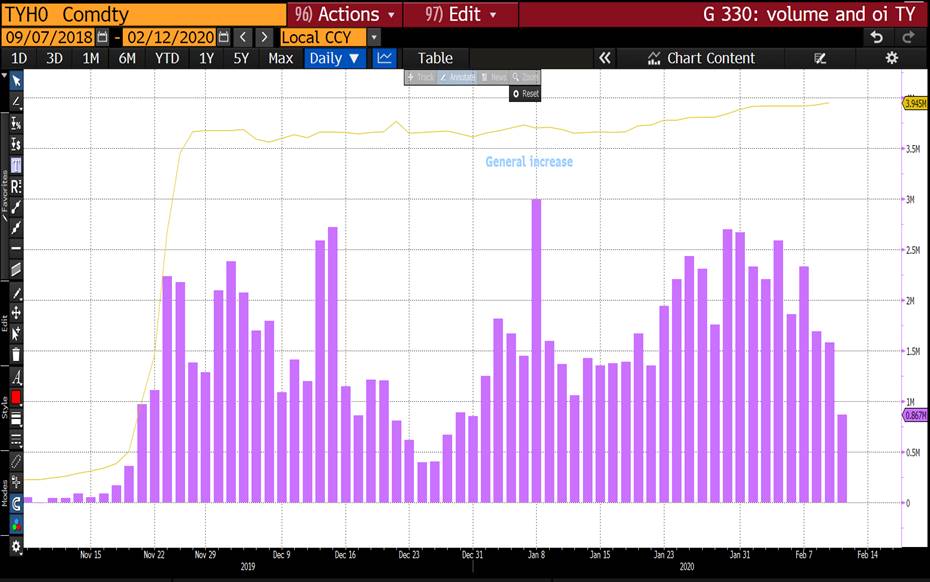

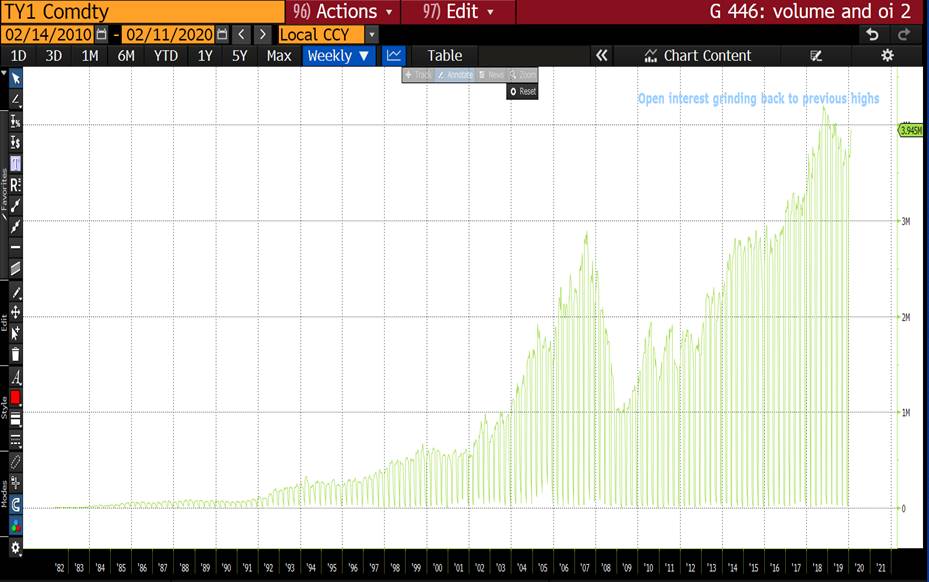

VOLUME AND OPEN INTEREST SPECIAL : US OPEN INTEREST CONTINUES TO PORTRAY LONGS ADDING ALL THE WAY ESPECIALLY IN THE US 30YR CONTRACT (SEE PAGE 11).

VOLUME AND OPEN INTEREST SPECIAL : US OPEN INTEREST CONTINUES TO PORTRAY LONGS ADDING ALL THE WAY ESPECIALLY IN THE US 30YR CONTRACT (SEE PAGE 11).

THAT SHOULD BE THE MAIN FOCUS FOR ANY LONGS, I.E. ROLL EARLIER THAN NORMAL.

EUROPE HAS A LOT LESS POSITIONING, THUS LITTLE BIAS.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

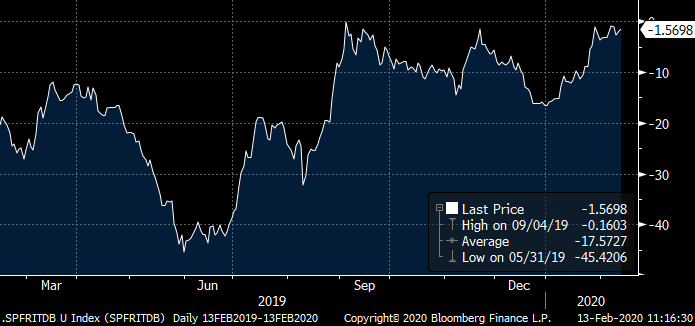

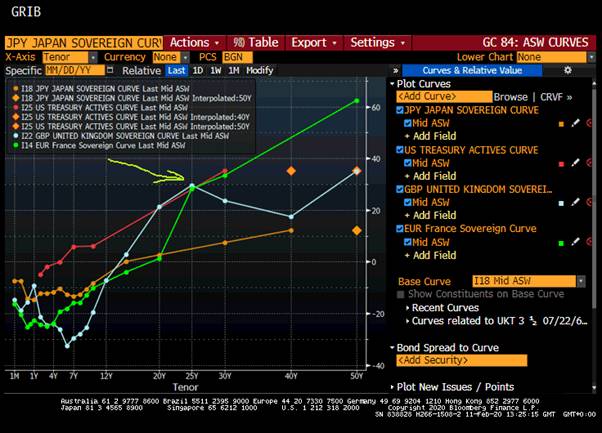

Trade idea: France 36s45s50s eonia YY asw fly, French 45s v cheap

CIX =

(2 * P2509[FRTR3.25 45 Corp]) - P2509[FRTR 1.25 36 Corp] - P2509[FRTR 1.5 50 Corp]

Trade idea: buy belly of 36s45s50s eonia YY asw fly @ 0.8bps or better

I started this exploration by comparing the different asw curves in rates. My thesis is that we’re now already Japan or soon to be Japan.

What stands out is the cheapness of the French (green line) 25yr asw.

1 month z scores at extremes.

ASW Fly Levels are at range extremes:

3m carry and roll = +0.1bps

Buy 45s on the asw fly around here + 0.8bps or better and look to exit around -1.5bps.

The reason I prefer the asw fly is that for me, it’s the best way to capture and isolate the anomaly value.

Please feel free to share any thoughts or feedback. It would be greatly appreciated.

Warm regards,

Mike

![]() image003.jpg@01D57AD2.CB892020">

image003.jpg@01D57AD2.CB892020">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7989-854-611

Email: mike.ohr @astorridge.com

Website: www.astorridge.com

This commentary was prepared by Mike Ohr at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

MARKET UPDATE : CONSOLIDATION TIME UNLESS STOCKS FAIL OR YIELDS DROP FURTHER TODAY.

MARKET UPDATE : CONSOLIDATION TIME UNLESS STOCKS FAIL OR YIELDS DROP FURTHER TODAY. STOCKS CONTINUE TO PERFORM DESPITE ALL CONORAVIRUS NEWS PREVENTING YIELDS FROM PRINTING NEW LOWS. WE NEED A DECISION HERE OR WE CONSLIDATE.

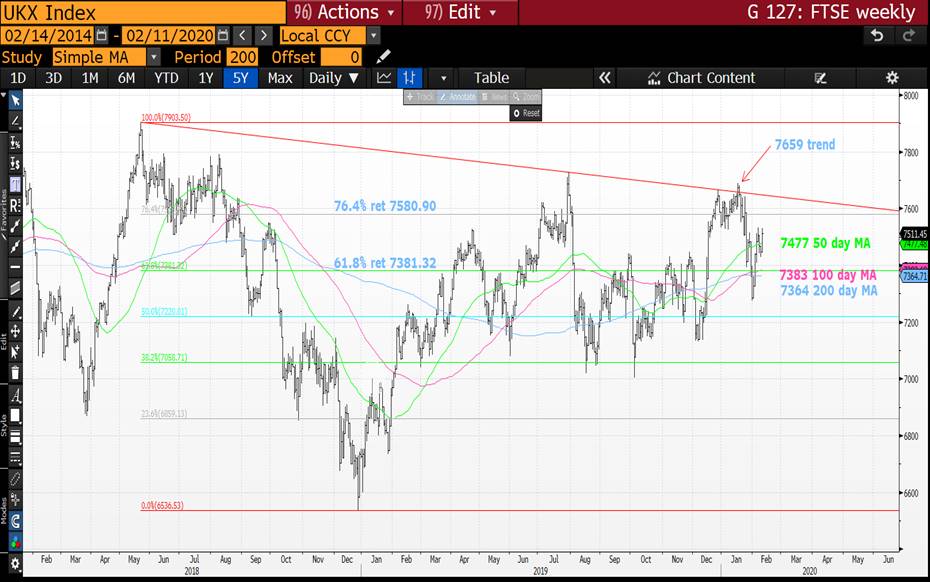

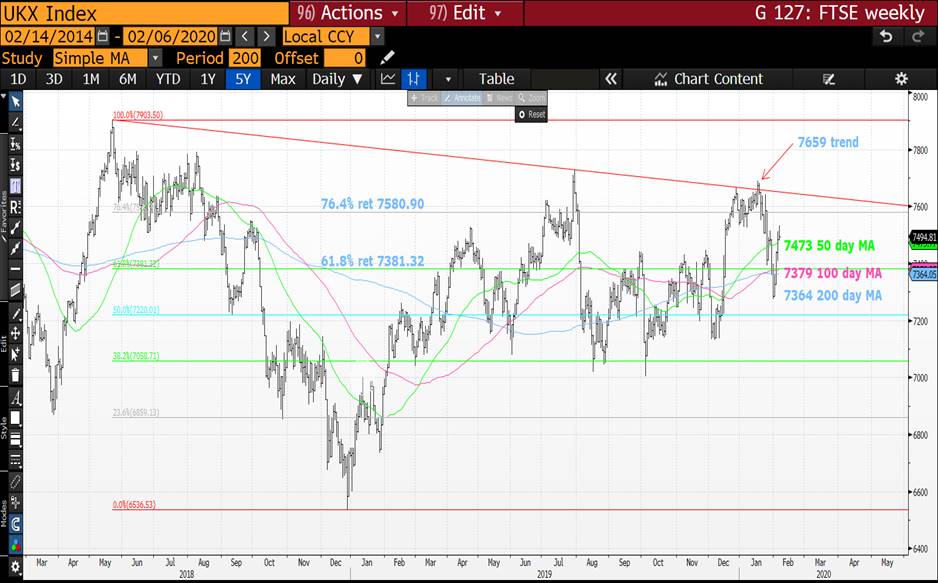

BOND YIELDS HAVE HAD A REPRIEVE BUT SHOULD CONTINUE TO REPLICATE 2011-2012 HISTORICAL MOVE. WATCH GILTS, THEY LED THE RALLY AND COULD DO IT AGAIN TODAY.

STOCKS REMAIN VERY OVER BOUGHT AND MANY NOW LOOK LIKE PUTTING IN LONGTERM TOPS, BUT THAT SAID NEED TO FAIL THIS WEEK!

- BOND YIELDS LOWER FROM TODAY? YIELDS CONTINUE TO GRIND LOWER WITH GERMANY AND US 5YR FOCUS CHARTS, TIME TO REPLICATE THE 2011-2012 SCENARIO.

- STOCKS LOWER TODAY, IDEALLY THEY HEAD LOWER FROM TODAY AS MANY HAVE ONLY JUST REVISITED THEIR RECENT HIGHS. THE CORONAVIRUS DOES NOT SEEM TO BE ABAITING.

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, WHILST GERMANY BREACHED BACK INTO THE LONGTERM DOWNTREND YIELD CHANNEL. ADDITIONALLY THE DBR 46’S HAVE BREACHED THEIR SIGNIFICANT MOVING AVERAGE.

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

EQUITIES : STOCKS NOW LOOK VERY VULNERABLE, THE WORST IS YET TO COME.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

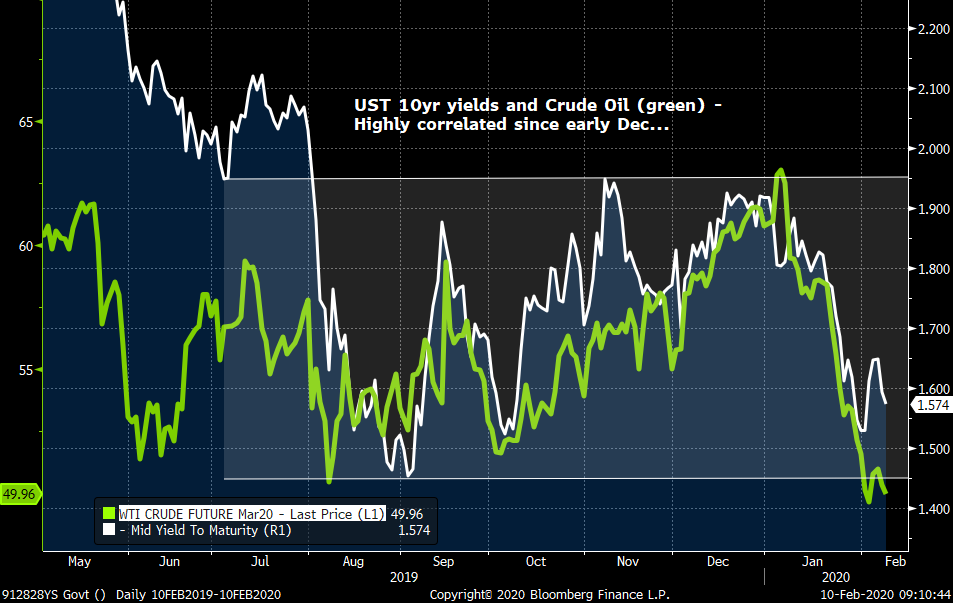

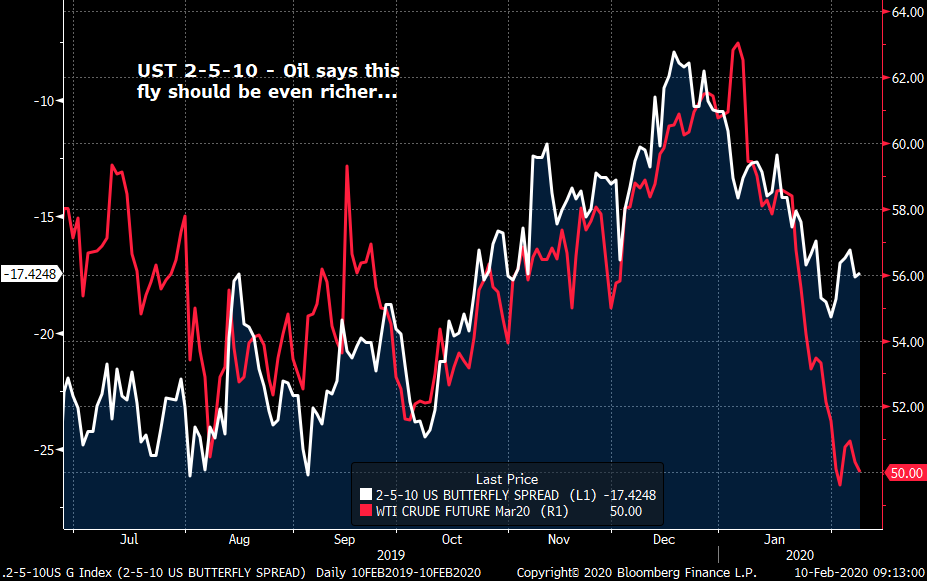

MICROCOSM: US Treasuries - Quick Color... All about oil

US Treasuries > Quick Colour

> Friday's US NFP # came in firmer than estimates, in line with Wednesday’s ADP data yet 10yr notes closed the session 1/2 point higher at 101-16/32.

> This week's US data is consumer driven - retail sales, CPI and U of Michigan consumer sentiment - with most economists expecting solid numbers, in line with the tone of last week's data.

> So, with all this strong data, why aren't USTs selling off?

> The Coronavirus is the short answer. While some suggest it's expansion has slowed, it's impact will still be substantial, even if it's largely limited to China's Q1 growth. Oil continues to hover around the $50/bbl level which most see as dampening inflationary pressures for most of the G-10 which will keep the FED on hold but leaning dovish, even with the firmer recent data. In addition, equities have been very volatile of late which accounts for USTs support.

> This week's $84bn quarterly refunding kicks off tomorrow. The 10yr has been in a 50bps range between 1.45% and 1.95% since mid-August ‘19 with its correlation to the level of crude very high since early Dec. Until we see signs of oil's bullish reversal from this $50/bbl level, we'll likely remain at the rich end of the range in 10yr notes.

More to come…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** PLEASE READ ** MARKET UPDATE : BONDS HAVE HAD A SIZEABLE YIELD BOUNCE ENOUGH TO ERADICATE MOST OF THEIR OVER EXTENDED RSI’S.

MARKET UPDATE : BONDS HAVE HAD A SIZEABLE YIELD BOUNCE ENOUGH TO ERADICATE MOST OF THEIR OVER EXTENDED RSI’S. IT STILL FEELS WRONG FOR STOCKS TO BE SO BULLISH, AM HOPING TODAY IS THE LAST “TOP”.

BOND YIELDS HAVE HAD A REPRIEVE BUT SHOULD CONTINUE TO REPLICATE 2011-2012 HISTORICAL MOVE. WATCH GILTS, THEY LED THE RALLY AND COULD DO IT AGAIN TODAY.

STOCKS REMAIN VERY OVER BOUGHT AND MANY NOW LOOK LIKE PUTTING IN LONGTERM TOPS, ONES FOR SEVERAL MONTHS TO COME. WE CANNOT

- BOND YIELDS LOWER FROM TODAY? YIELDS CONTINUE TO GRIND LOWER WITH GERMANY AND US 5YR FOCUS CHARTS, TIME TO REPLICATE THE 2011-2012 SCENARIO.

- STOCKS LOWER TODAY, IDEALLY THEY HEAD LOWER FROM TODAY AS MANY HAVE ONLY JUST REVISITED THEIR RECENT HIGHS. THE CORONAVIRUS DOES NOT SEEM TO BE ABAITING.

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, WHILST GERMANY BREACHED BACK INTO THE LONGTERM DOWNTREND YIELD CHANNEL. ADDITIONALLY THE DBR 46’S HAVE BREACHED THEIR SIGNIFICANT MOVING AVERAGE.

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

EQUITIES : STOCKS NOW LOOK VERY VULNERABLE, THE WORST IS YET TO COME.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

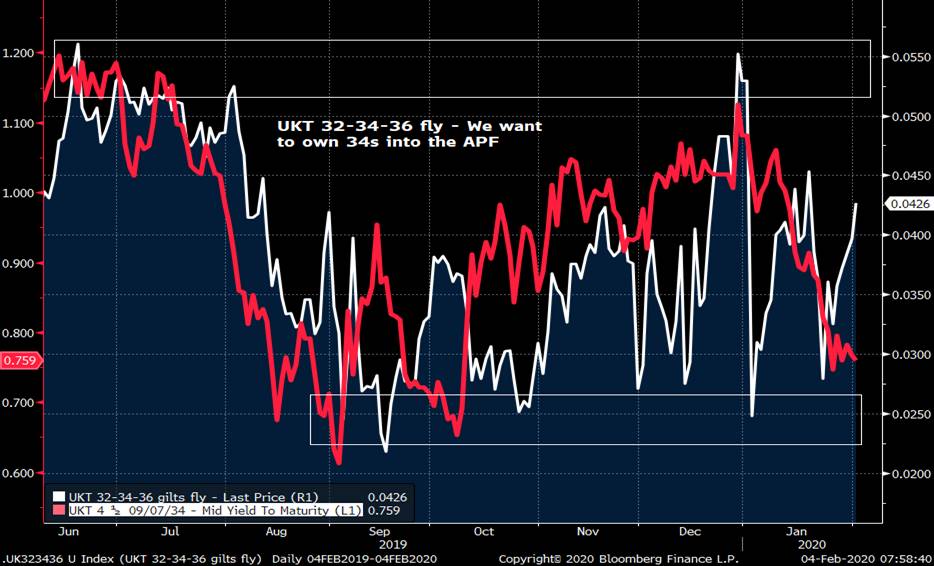

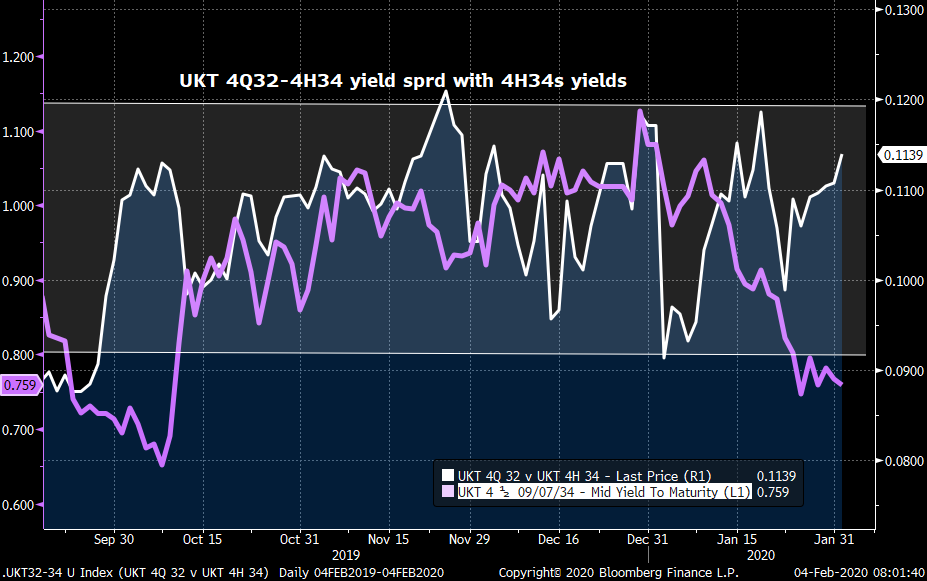

MICROCOSM: GILTs > UKT 32-34-36 Fly... Micro-RV

Early GILTS...

- Last week we highlighted how the 4H34s have traded well into the last few APF operations as their status as the longest issue in the mediums basket made them popular sale with both GEMMS and real money.

- We also pointed out that at the 4T20s’ March APF reinvestment (~£17.5bn over 4 weeks of ops) the mediums basket will be more abundant than at the last few APFs since the 0S29s will be at full strength and the 4T30s Mar 11th tap makes them available for the last 3 ops, giving us £50bn+ total liquidity for ~5.8bn in BoE demand.

- This relative supply glut changes our mindset from an RV perspective. Rather than trying to handicap an issue’s scarcity-value and the potential repo bid that demand might generate at the APF, we’re now more inclined to simply look to buy issues that are at the cheap end of their recent range on the curve (especially if they’re diverging from their usual directional bias) and sell issues that may struggle to maintain their richness all the way from now until the start of the APF on March 10th.

- The UKT 4Q32-4H34-4Q36 fly is a popular trade among gilts players as it generally trades in a well defined ~3bps range between +2.5 and +5.5bps but its also in a steep part of the curve that’s popular for its roll and carry. Given the 4Q32s proximity to the 4T30s (CTD into G H0), they tend to have a slightly higher sensitivity to directional moves than both the 4H34s and 4Q36s. We can see from the chart below of the fly vs the 4H34s yields that the fly is cheapening as the market rallies which isn’t always the case. The 4Q32-4H34 leg has steepened 1.5bps since Jan 23rd while 4H34-4Q36s is unchanged. We don’t think this will last long since the 4Q32s are ineligible for the APF and while the 4Q36s may find some demand at the APF as the shortest issue in the longs basket, the last few APFs have shown 4H34s were more popular.

- We like owning 4H34s on this fly and think it’s worth having on your radar for the next couple weeks. We’ll begin buying them on the fly if it climbs north of +4.5bps and add on the way up to +5.0 or higher. Same goes for the UKT 4Q32-4H34 sprd – a move north of +11.5bps (it’s +11.4bps now) is a good flattener in our view given the 1yr range has been +12.1 to +9.25bps.

More to come…

Best,

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

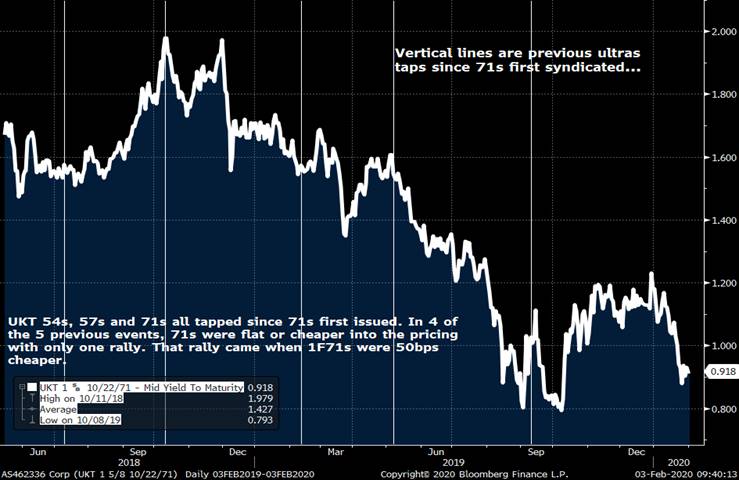

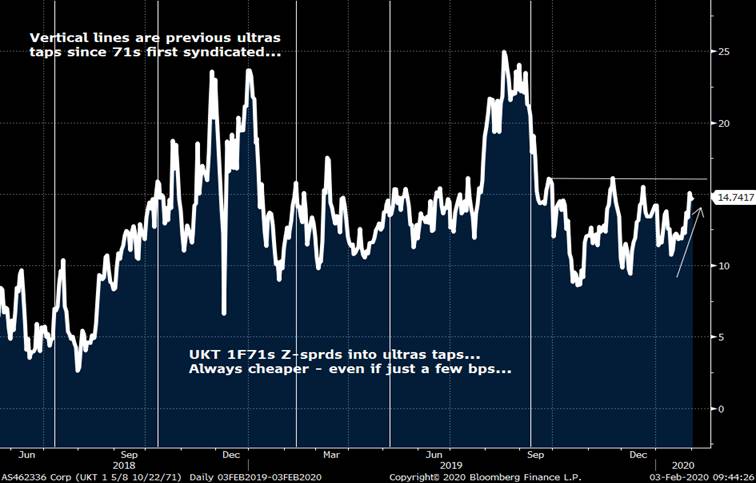

MICROCOSM: GILTS > UKT 1F71s 8 Days Away... Fully Priced In Yet? RV Analysis...

- There’s a 23 day gap in the DMO’s issuance calendar for conventional gilts between the Jan 28th tap of the 0S29s and the Feb 20th tap of the UKT 1H26s. Sandwiched in the middle of that gap is the only conventionals syndication this quarter, the tap of the UKT 1F71s which is expected on Feb 11th.

- Aside from the wide assortment of economic and political influences that drove the gilts market in January (not to mention most of 2019), we’ve also had considerable corp and SSA issuance in GBP and continued pension fund interest to divest a growing portion of their long obligations via buy-ins and longevity swaps. While the market’s pretty good at handicapping the impact of the economic and political events and even predicting supply flows, the timing of these pension moves has proven a challenge. We saw this first hand a couple weeks ago when long ultras were bid-only, right about the time the RV community began setting shorts in them in anticipation of the 1F71s tap. While they/we might have been a touch early, there’s still a lively debate in the market about where issues like the 1F71s should trade.

- So, with 8 days before the 1F71s tap, are they cheap enough, still too rich or just right? Well, the answer depends how you look at things.

- UKT 1F71s Yields

- 1F71s Z-sprds – Always cheaper either on trend or right before pricing…

- UKT 1T57-1F71 Z-sprd box with 54s, 57s and 71s taps noted. This is a key chart for much of the RV community who take one look at the cheapening of the 71s vs the 57s since September and suggest that the 71s are already cheap enough on the curve, especially given where the spread was in September. What gives this view a bit more ‘teeth’ is this dis-inversion of the 57s-71s box has occurred during a ~30bps rally in 1F71s yields. Simply put, the last time 71s traded at a yield of 91bps, the 1T57-1F71 Z-sprd box was -2.6bps, not +4bps where it is now.

- Lastly, here’s an interesting macro-chart for you of the level of GBP/USD (cable) and 1F71 yields. From early February 2019 the correlation of GBP with 1F71 yields was solid – Cable sold off and ultras rallied. In October, the wheels fell off that correlation as GBP rallied well off the lows and, after a modest bearish correction, 1F71s came roaring back and are currently at the widest divergence during this span. Dealers like BNP are saying GBP longs are at extremes and due for a correction if/when the realities of the Brexit situation sink in. Others opine that GBP levels are accurate and reflect a pace of investment in the UK that will continue to surge. Either way, this divergence is notable, especially with Sajid Javid expected to present a rather profligate UK budget on March 11th.

- While a case can be made that the 1F71s are already cheap enough and the tap on Feb 11th baked in the cake, we remain cautious and prefer disinversion trades in the sector. We remain short 1F54s vs 1T49s for example, hoping for a break of the +5bps trendline (see below). We also like owning 1T49s vs 1T37s and 1T57s which remains within a bp of the 2019/20 wides.

- UKT 1T48s vs 1F54s

We’ll be in touch… Comments and questions always welcome.

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

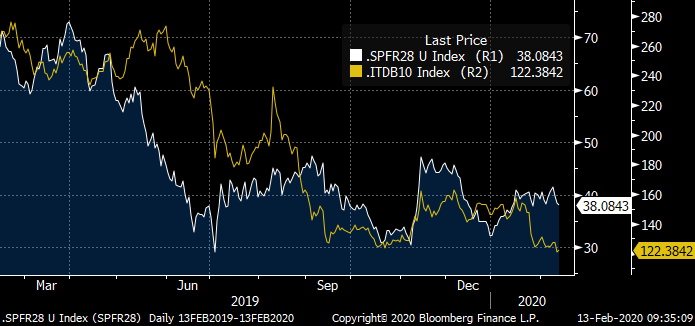

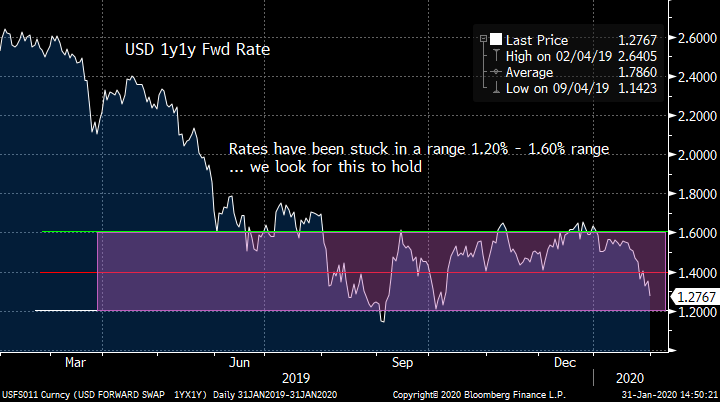

Trade: USD short-rates range-bound as Fed continues liquidity operations

Bottom line: The Fed appears unlikely to change course in the next few months, so here is a trade to play the range in USD short rates without excessive exposure to tail risk. Buying a payer fly caps the loss at the premium paid, while setting the low strike in-the-money gives a positive carry position.

Trade:

Buy USD 1bn 6m1y1y mid-curve payer 1x2x1 payer fly k=1.20% / 1.40% / 1.60%

For 3.3 bp running (mid indicative).

Spot 1y1y 1.28%. 6m ATMF 1.25%

Rationale: The Fed has announced it will continue Bill purchases of $60bn / month until April, and expects to taper to $30bn in May and June. At the same time, the Fed is extending their repo operations until at least the end of April to ensure excess supply of reserves beyond their stated $1.5trn floor. To us, this pegs the short end of the USD curve for at least the next 3 months (end April) and arguably significantly longer than that. In this environment, it is interesting to look at low-risk ways of positioning for the status quo to hold. The global rally has pushed short rates lower in sympathy, towards the bottom of the past 6 months’ range.

The chart shows the USD 1y1y forward rate.

Because the low strike is in-the-money, the trade has positive roll as more of the intrinsic value it captured (and hence positive theta). In essence this makes it a short volatility position, but the downside is capped at the premium paid (unlike selling strangles).

Technically, the 1y1y rate is flirting with over-sold territory, making the mildly bearish stance of this trade an interesting proposition. Daily RSI in chart:

Rolling the trade down the rate and volatility surface:

Date NPV ($) P&L

Inception 330k 0k

After 1m 350k +20k

After 2m 375k +45k

After 3m 410k +80k

After 4m 470k +140k

After 5m 590k +240k

Expiry 720k +390k

As we are currently towards the bottom of the strike range, this is essentially a bearish trade. The maximum payoff is 16.6 bp for a maximum downside of 3.4bp. A more aggressive structure would be to forego buying the high strike and converting to a 1x2 payer spread with unlimited downside if the Fed turns hawkish.

The main risk is that the Fed moves out of its wait-and-see mode. If 1y1y expires below 1.20%, or above 1.60%, the initial premium is lost.

As ever, we’d love to hear your thoughts.

Best wishes,

David

David Sansom

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

Office: +44 (0) 203 143 4180

Mobile: +44 (0) 7976 204490

Email: david.sansom@astorridge.com

Web: www.AstorRidge.com

This marketing was prepared by David Sansom, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796