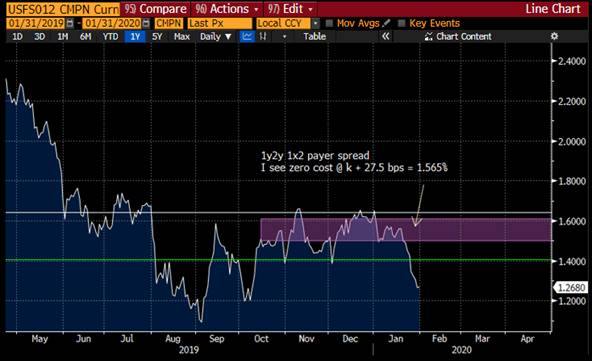

USD Front end: buy 6m2y 1 x 2 payer spread @ zero cost

Here it is again including breakeven rates and vol stats (z-scores)

__________________________________________________________________

So I’ve been racking my brain looking for the best way to make money near term on the back of the Fed’s continuing liquidity operations.

For me, this is the best expression:

- We now know that Fed will continue bill purchases $60bn per month until April, and expect them to taper to $30bn in May and June.

- Fed also announced that they will extend their repo operations (Term OMOs) at least through April to ensure excess supply of reserves beyond their stated $1.5trn floor.

My view is that the Front end is pegged at least til April (3 months) and I would argue for a lot longer than that.

After much consideration, I think that 1x2s payer spreads are the best way to take advantage of this.

I looked at many expiries but 6m2y and 1y2y came out best. (1y2y gives a little extra cushion (higher otm strike) but sacrifices optimal 3m decay)

6m2y 1x2 payer spread

Atm = 1.343%

Otm + 18 bps for zero cost = 1.523%

Trade makes money as long as 2y rate is below 1.703% at expiry

3m decay = +2.7bps for this structure

1y2y 1x2 payer spread

Atm = 1.29%

Otm + 27.5 bps for zero cost = 1.565%

Trade makes money as long as 2y rate is below 1.84% at expiry

3m decay = +2.4bps for this structure

Vol Stats Here:

1m z-scores are elevated for vol and skew (using atm +25bps as a proxy)

Please let us know your thoughts, your feedback is much appreciated.

Best regards,

Mike

![]() image003.jpg@01D57AD2.CB892020">

image003.jpg@01D57AD2.CB892020">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7989-854-611

Email: mike.ohr @astorridge.com

Website: www.astorridge.com

This commentary was prepared by Mike Ohr at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

USD Front end: buy 6m2y 1 x 2 payer spread @ zero cost

Hi guys,

I did a quick writeup on this…

__________________________________________________________________

So I’ve been racking my brain looking for the best way to make money near term on the back of the Fed’s continuing liquidity operations.

For me, this is the best expression:

- We now know that Fed will continue bill purchases $60bn per month until April, and expect them to taper to $30bn in May and June.

- Fed also announced that they will extend their repo operations (Term OMOs) at least through April to ensure excess supply of reserves beyond their stated $1.5trn floor.

My view is that the Front end is pegged at least til April (3 months) and I would argue for a lot longer than that.

After much consideration, I think that 1x2s payer spreads are the best way to take advantage of this.

I looked at many expiries but 6m2y and 1y2y came out best. (1y2y gives a little extra cushion (higher otm strike) but sacrifices optimal 3m decay)

6m2y 1x2 payer spread

Atm = 1.343%

Otm + 18 bps for zero cost = 1.523%

3m decay = +2.7bps for this structure

1y2y 1x2 payer spread

Atm = 1.29%

Otm + 27.5 bps for zero cost = 1.565%

3m decay = +2.4bps for this structure

Please let us know your thoughts, your feedback is much appreciated.

Best regards,

Mike

![]() image003.jpg@01D57AD2.CB892020">

image003.jpg@01D57AD2.CB892020">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7989-854-611

Email: mike.ohr @astorridge.com

Website: www.astorridge.com

This commentary was prepared by Mike Ohr at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

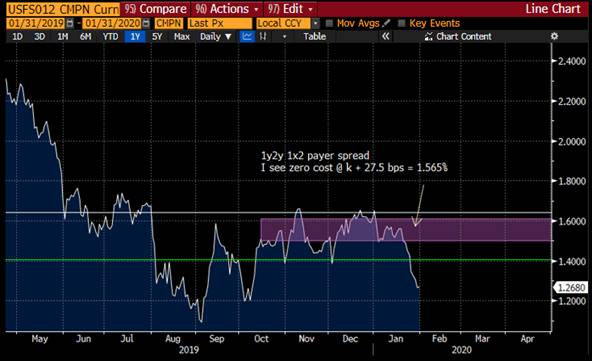

** PLEASE READ ** MARKET UPDATE : BOND YIELDS LOWER AND NOW STOCKS TOO!

MARKET UPDATE : BOND YIELDS LOWER AND NOW STOCKS TOO! (MORE CONTENT IN THE PDF).

BOND YIELDS, IT DOES APPEAR THAT INTO MONTH END AND WHILST STOCKS REMAIN VULNERABLE THE BOND DAILY OVER STRETCHED RSI’S ARE IRRELEVANT.

BOND YIELDS CONTINUE TO REPLICATE 2011-2012.

WATCH GILTS, THEY LED THE RALLY BUT ARE FAILING TODAY ON A HIGH RSI.

STOCKS REMAIN VERY OVER BOUGHT WHILST I BELIEVE THE EFFECTS ECONOMICALLY OF THE CORONAVIRUS REMAIN DRASTICALLY UNDER ESTIMETED. MILLIONS OF PEOPLE CANNOT TRAVEL EVEN THOUGH IT IS CHINESE NEWYEAR, GROWTH IS BOUND TO SUFFER.

- BOND YIELDS LOWER? YIELDS CONTINUE TO GRIND LOWER WITH GERMANY BREACHING MAJOR LEVELS, TIME TO REPLICATE THE 2011-2012 SCENARIO.

- STOCKS LOWER NOW, MANY EUROPEAN MONTHLY CHARTS HAVE BREACHED CRITICAL LEVELS AIDED BY THE HANG SENG.

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, WHILST GERMANY BREACHED BACK INTO THE LONGTERM DOWNTREND YIELD CHANNEL. ADDITIONALLY THE DBR 46’S HAVE BREACHED THEIR SIGNIFICANT MOVING AVERAGE.

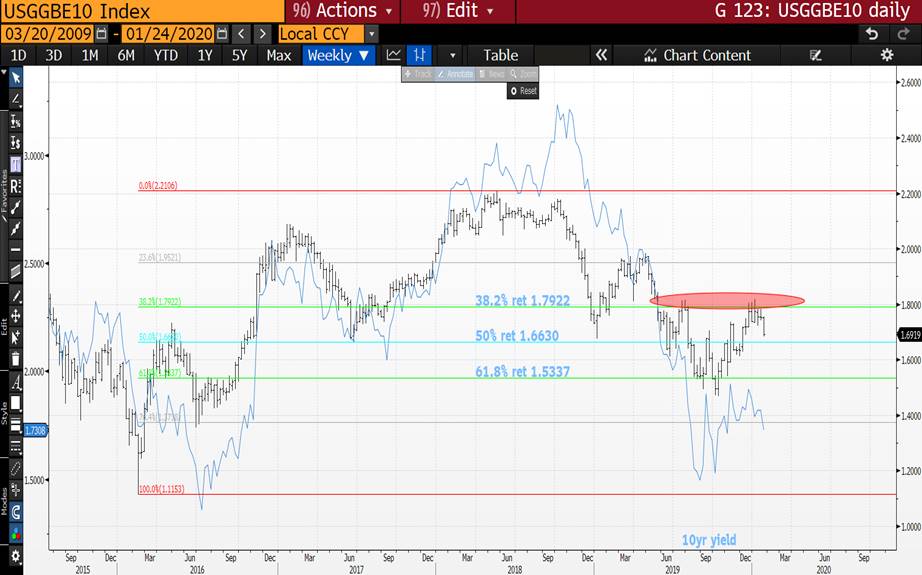

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

EQUITIES : STOCKS NOW LOOK VERY VULNERABLE, THE WORST IS YET TO COME.

**A LOT DEPENDS ON STOCKS AS I THINK WE NEED THEM FOR FURTHER BOND YIELD FALLS**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

** BOND DILEMA ... SHORTTERM UPDATE.. ** . FOR THE FIRST TIME IN A WHILE WE HAVE OVER STRETCHED DAILY RSI’S.

BOND DILEMA ... SHORTTERM UPDATE... FOR THE FIRST TIME IN A WHILE WE HAVE OVER STRETCHED DAILY RSI’S.

THIS GOING TO MAKE MONTH END INTERESTING.

DESPITE THE LONGTERM CHARTS REPLICATING 2011-2012 MOVE LOWER MANY FUTURES RSI’S ARE OVR BOUGHT, THIS HAS NOT BEEN THE CASE FOR SOME TIME.

IT COULD BE WORTH REDUCING LONG BOND EXPOSURE.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

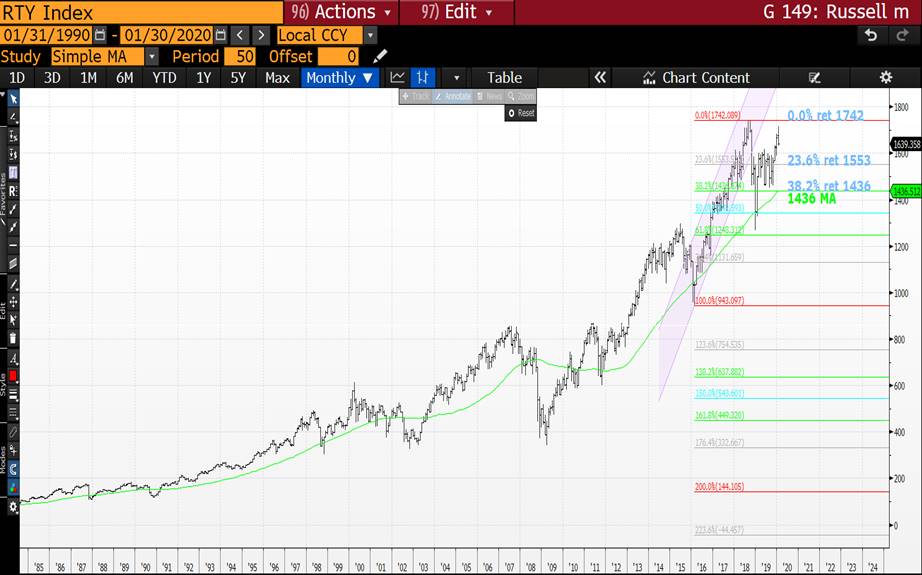

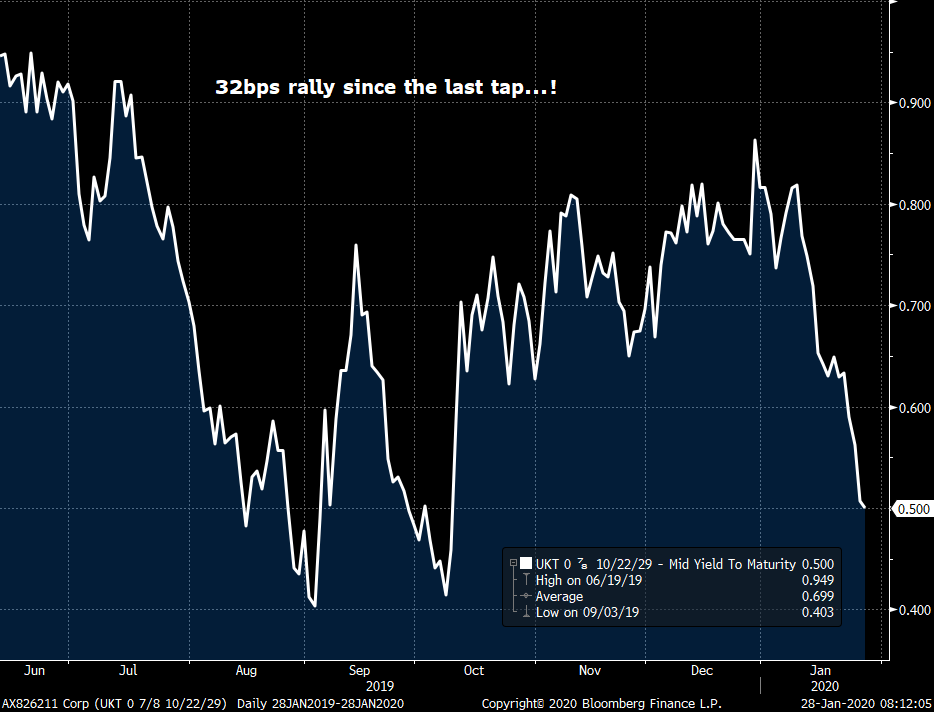

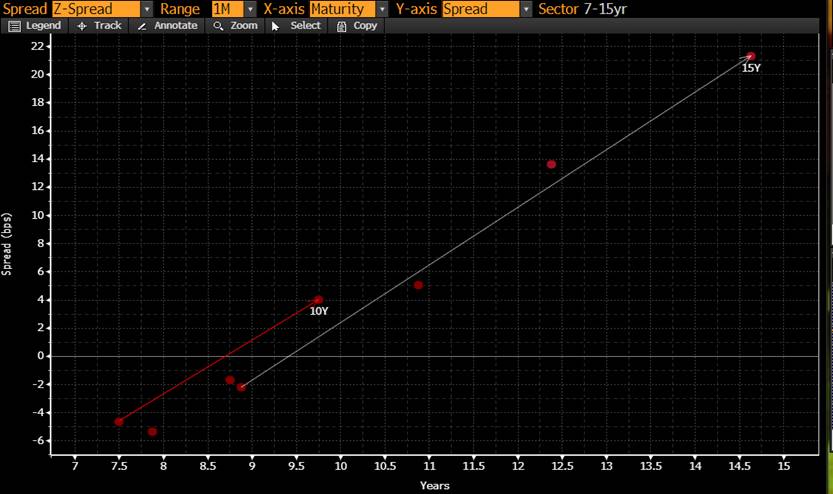

MICROCOSM: UKT 0S29s Tap THIS AM > Rundown

GILTs... 0S29s Tap @ 10:30

> We're expecting today's £2.75bn will be the penultimate tap as it'll take them over £24bn and the 1F28s are £27bn.

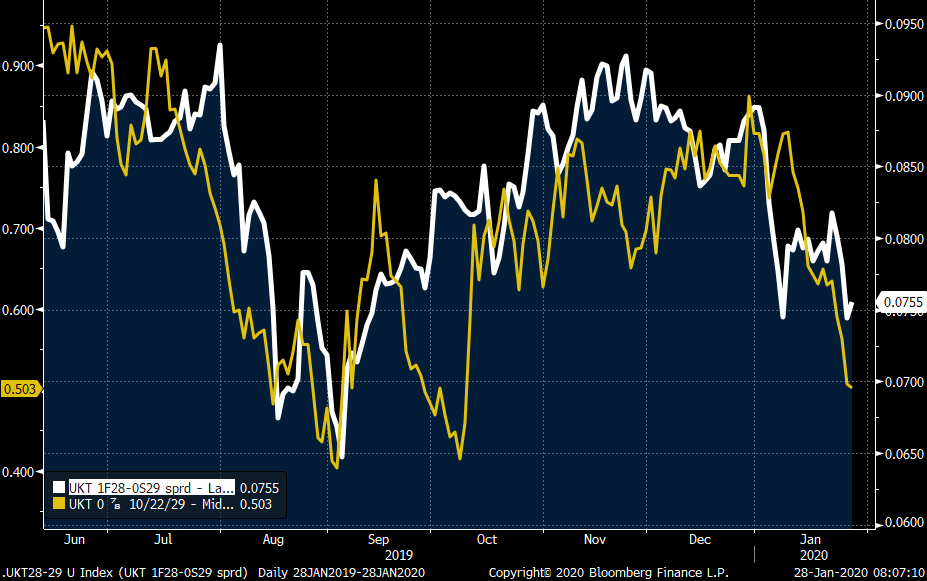

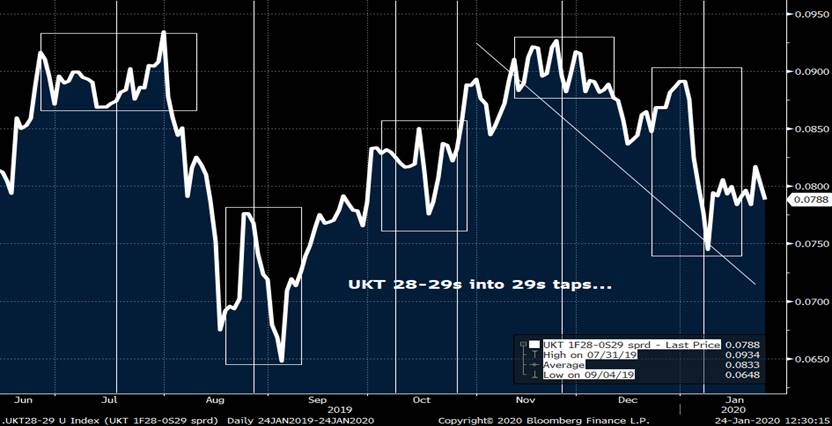

> In our auction preview last Friday (attached), we highlighted the richening of the 29s on the curve since Nov and our hopes for a cheapening on the curve similar to the move into the Jan 7th tap (where 29-30s dipped to 1.7bp before popping back to 2.7bp by day's end).

> The rally of the last 4 sessions has made a concession tough to come by as demand for 10yr gilts has been impressive.

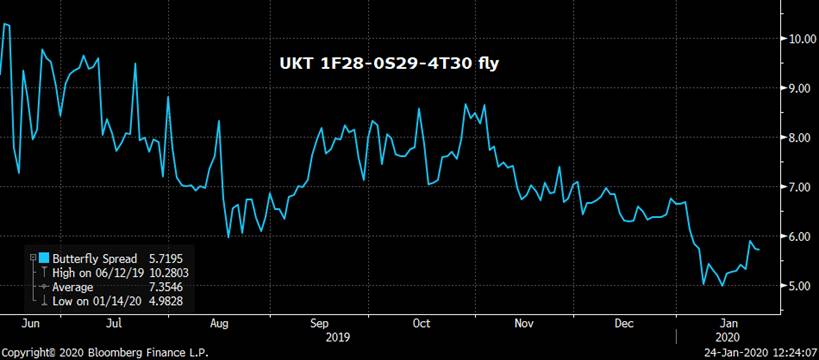

The UKT 28-29-30 fly closed at +5.35bps last night, just .35 off the Jan lows.

> Given the persistent lack of a repo bid for the 4T30s and how rich they trade on Z-sprd within the sector, it seems there's still room for these 29s to richen on the curve, even if location doesn't look ideal. Z-sprd chart shows the 28s still trade through the low-cpn curve of 1Q27-1F28-0S29 and 29-30s is virtually flat, despite a 14mo maturity sprd.

> The 29-30s sprd has come back from +2.9 to 2.1 this am, about as much as we can hope for so we like this steepener. In addition, 28-29s is still a bp off the Sep lows so a bit of room there too.

Either way, we expect this tap to go well.

Mark

About as much concession as can be expected….?

UKT 28-29s – Extension interest has increased as G H0 rallied…

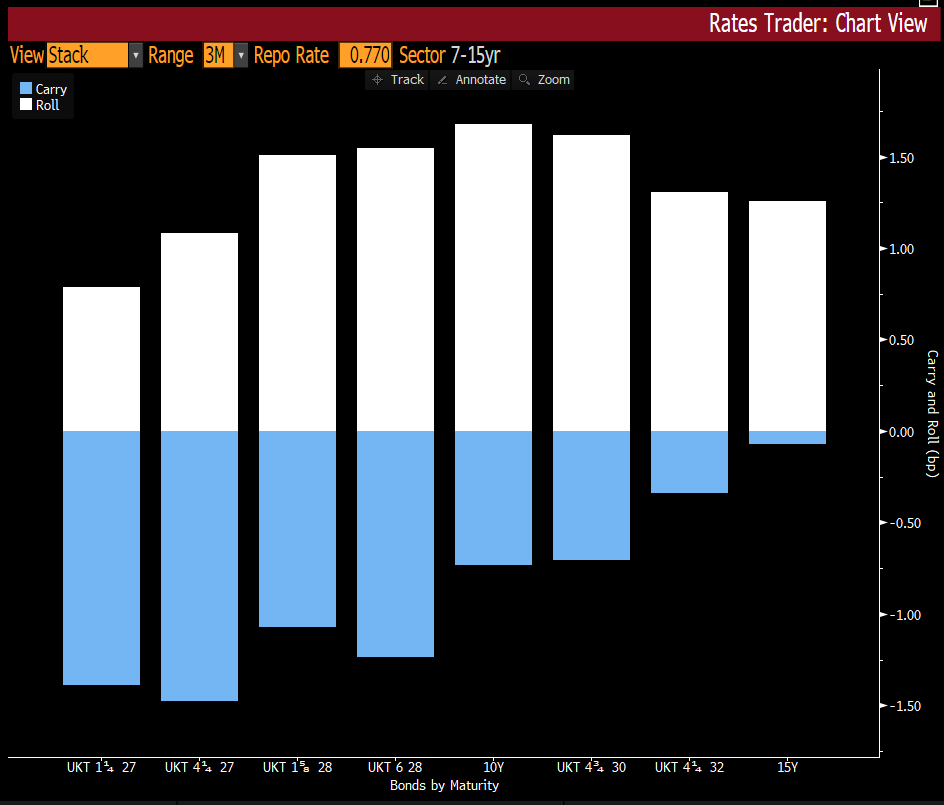

C&R still supports the 0S29s…

Tough to suggest they’re a bargain…!

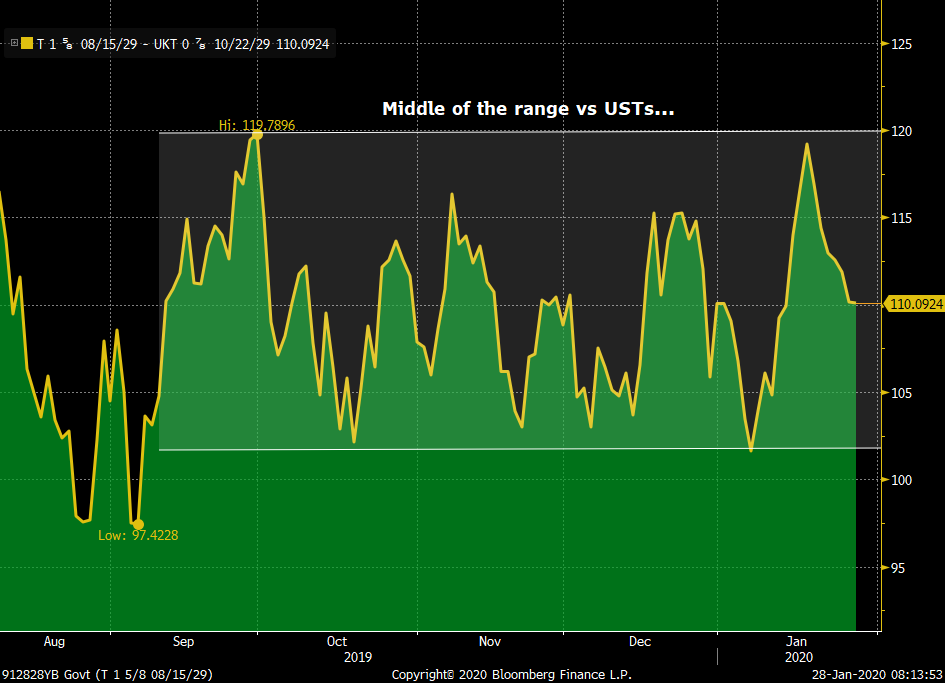

UKT-UST 10yrs…

More to come!

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

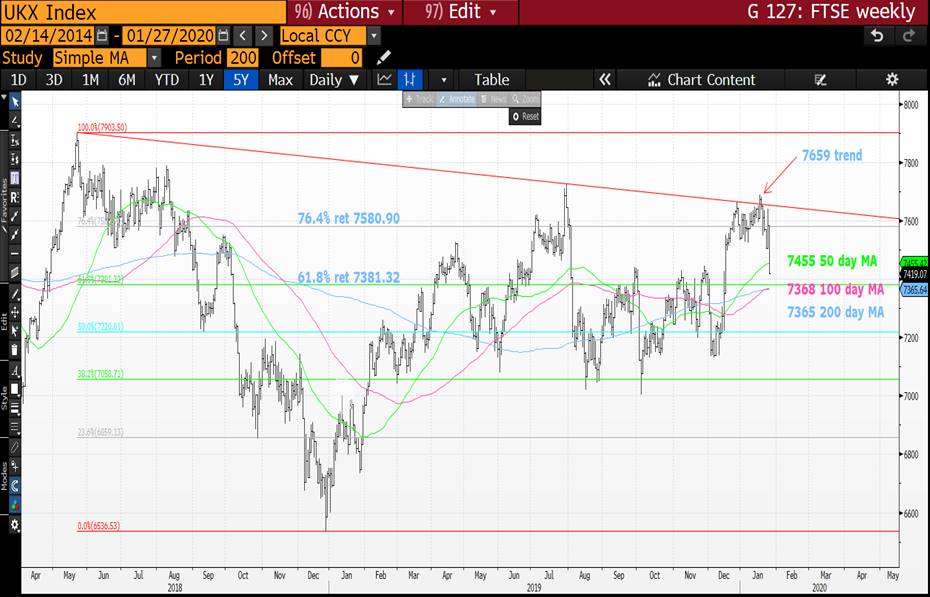

*** EQUITY SPECIAL *** OPEN PDF FOR MORE CONTENT.

EQUITIES : THE FIRST REAL PULL BACK DAY AND AM SURE WILL BE SUPPOTED BY MANY DIP BUYERS, THIS TIME MIGHT EVENTUALLY BE DIFFERENT.

APPLE A SOLID STOCK NOW LOOKS EXTREMMLY OVERBOUGHT THUS COULD BE TIME IT TOPS SO A VERY KEY WEEK.

SOME MONTH END CLOSES MIGHT PRESENT MAJOR PROBLEMS.

THESE COULD BECOME A CONCERN GIVEN MANY DISLOCATED RSI’S.

FTSE COULD BE THE CHART TO WATCH GIVEN THE HISTORICAL TOP BEING ESTABLISHED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge. We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

** UPDATE ** BOND YIELDS AND STOCKS ALL NOW HEADING LOWER IN SOME STYLE, SADLY SINCE THE CORONAVIRUS CLAIMS MORE VICTIMS.

BOND YIELDS AND STOCKS ALL NOW HEADING LOWER IN SOME STYLE, SADLY SINCE THE CORONAVIRUS CLAIMS MORE VICTIMS.

BOND YIELDS DEFINITELY REPLICATING THE MOVE OF 2011-2012 AS WE APPROACH MONTH END. MANY STOCKS COULD GAP LOWER THIS MORNING GIVEN THEIR VERY OVER BOUGHT STATE. MANY IN EUROPE SUB THEIR 50 DAY MOVING AVERAGE.

- BOND YIELDS LOWER? YIELDS CONTINUE TO GRIND LOWER WITH GERMANY BREACHING MAJOR LEVELS, TIME TO REPLICATE THE 2011-2012 SCENARIO.

- COMMODITES HIGHER. GOLD HAS BROKEN THE RECENT HIGHS AND REMAINS A FIRM FAVOURITE AS AN INSURANCE POLICY.

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, WHILST GERMANY BREACHED BACK INTO THE LONGTERM DOWNTREND YIELD CHANNEL. ADDITIONALLY THE DBR 46’S HAVE BREACHED THEIR SIGNIFICANT MOVING AVERAGE.

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

EQUITIES : STOCKS ARE LIKELY TO GAP OPEN THIS AFTERNOON AND INITIATE A SIZEABLE REVERSAL GIVEN THE OVER BOUGHT STATE OF MANY.

**A LOT DEPENDS ON STOCKS AS I THINK WE NEED THEM FOR FURTHER BOND YIELD FALLS**

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

WE ARE ON OUR WAY TO MUCH LOWER BOND YIELDS! BOND YIELDS CONTINUE TO GRIND LOWER REPLICATING THE MOVE OF 2011-2012 AS WE APPROACH MONTH END

WE ARE ON OUR WAY TO MUCH LOWER BOND YIELDS!

BOND YIELDS CONTINUE TO GRIND LOWER REPLICATING THE MOVE OF 2011-2012 AS WE APPROACH MONTH END, THIS WITHOUT EQUITY HELP. MANY STOCKS REMAIN IN A VERY OVER BOUGHT STATE. A KEY RUN INTO MONTH END.

DEPITE THE LACK OF EQUITY MOVEMENT ALL YIELD CHARTS HAVE FAILED TO BOUNCE THUS SHOULD HEAD LOWER SHORTLY.

- BOND YIELDS LOWER? YIELDS CONTINUE TO GRIND LOWER WITH GERMANY BREACHING MAJOR LEVELS, TIME TO REPLICATE THE 2011-2012 SCENARIO.

- COMMODITES HIGHER. GOLD HAS BROKEN THE RECENT HIGHS AND REMAINS A FIRM FAVOURITE AS AN INSURANCE POLICY FOR ESCALATING TENSIONS.

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, WHILST GERMANY BREACHED BACK INTO THE LONGTERM DOWNTREND YIELD CHANNEL. ADDITIONALLY THE DBR 46’S HAVE BREACHED THEIR SIGNIFICANT MOVING AVERAGE.

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

EQUITIES : NOT TOO SURE WHY BUT IT DOES NOW FEEL MANY STOCK RALLIES HAVE GONE TOO FAR. EXAMPLES ARE UNITED TECHNOLOGY AND APPLE, BOTH IN OVER BOUGHT TERRITORY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: GILTS - Another 0S29s Tap Next Tuesday > RV Rundown/Ideas

- TRADE IDEAS:

- Play the auction concession on either leg as it’s proven a buy at the last few auctions – 28-29s back to +8.5, 29-30s below 2.0bps.

- Or buy the belly of the 1F28-0S29-4T30 fly above 6.5bps.

GILTS... 0S29s Tap Tues

- We're closing in on the last few taps of these 29s before their successor is auctioned next fiscal year.

- Typically, this is the time in the cycle when benchmarks remove some/all of their new issue cushion vs the curve. We can see from the charts below that much of that convergence has already happened. The 28-29-30s fly tightened from +10.2 to +5.0bps before cheapening a touch to 5.7 this am. Much of that tightening happened post the Z9-H0 calendar sprd action and post- 1F28s delivery. Add to that a rather humble start for the 4T30s performance as CTD into G H0 and one could argue that for an issue that didn’t have a lot going for it (non-ctd sandwiched between the old and current CTDs) they’ve done well.

UKT 28-29s sprd… Over the last few months the trajectory has been flatter and modest steepening moves into taps were buying opportunities.

On the other side is the 29s-30s leg. Into the last tap on Jan 7th, the 29-30s sprd flattened to 1.7bps before steepening back to 2.7 by day’s end. Again, the steepening trajectory has reflected not only how poorly the 4T30s have traded but the progression of the auction cycle. A move through 2.0bps will attract buyers of 0S29s.

- After Tuesday’s tap, the 0S29s will be roughly £24.5bn and, barring a dramatic shift in gears at Javid’s budget announcement on Mar 11th, the Feb 25th tap will likely be its last as the issue will be ~£27bn, the same size as the 1F28s.

- While these 0S29s are unlikely to have much of a repo bid given their large float and non-CTD status, they’re still an important source of 10yr liquidity and with a 102 handle, they’re over 40 points cheaper to buy than their neighbour, the 4T30s, not to mention their higher duration and the same convexity.

- The March APF operation is set to begin on Monday March 9th. As you’ll have read in previous notes of ours, the surprise tap of the 4T30s announced for March 10th (£3.5bn in cash or ~£2.5bn notional at current prices) will make them eligible for the intermediates operations from March 18th onwards as the additional £2.5bln takes them back below the BoE’s 70% ownership threshold. Back at the last APF following the maturity of the UKT 3T19s, the 0S29s were still quite young at just ~£10bn which meant the BoE ignored them in favour of the 1Q27s, 1F28s and 4H34s. Going into March, we’re going to have the biggest intermediates bucket by issues and available liquidity for quite a while with the 1Q27s, 1F28s, 0S29s, 4T30s and 4H34s providing ample liquidity at an available notional of around ~£50bn. Good news for the BoE, not so good for the RV community who are keen to play the scarcity card. In an even playing field where there’s little repo value we’re supposed to buy the cheap stuff and sell the rich stuff with little regard for repo specials. This can change (we hope), but our assessment now is the belly of the curve could be a bit sleepy at the Mar APF…

7-15yr Gilts Z-sprds – white line high cpns, red line low cpns…

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

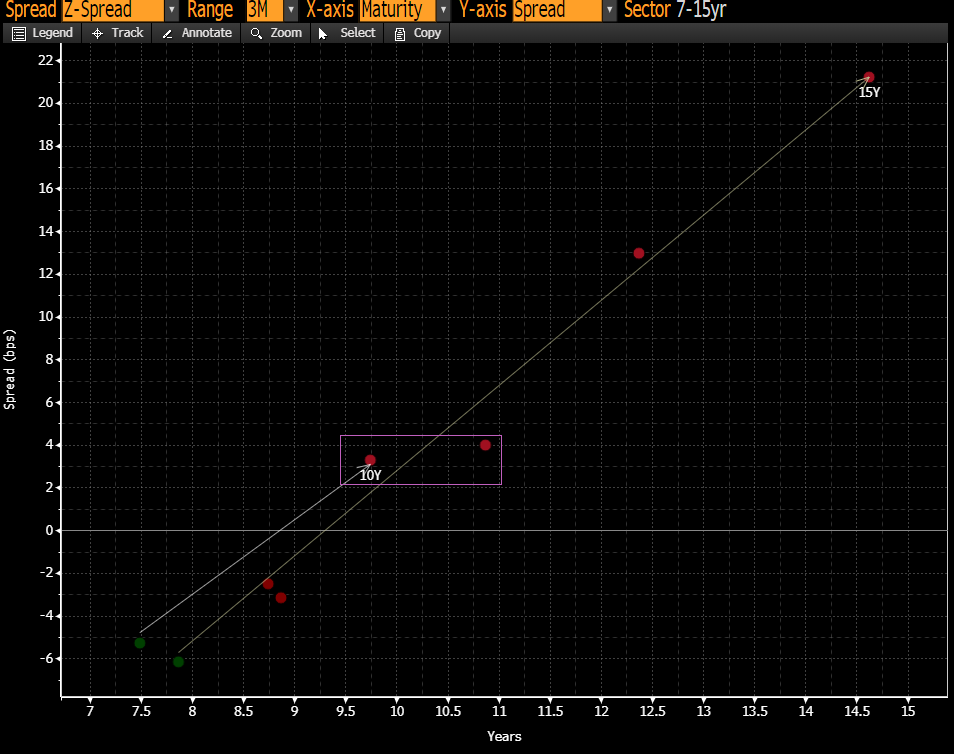

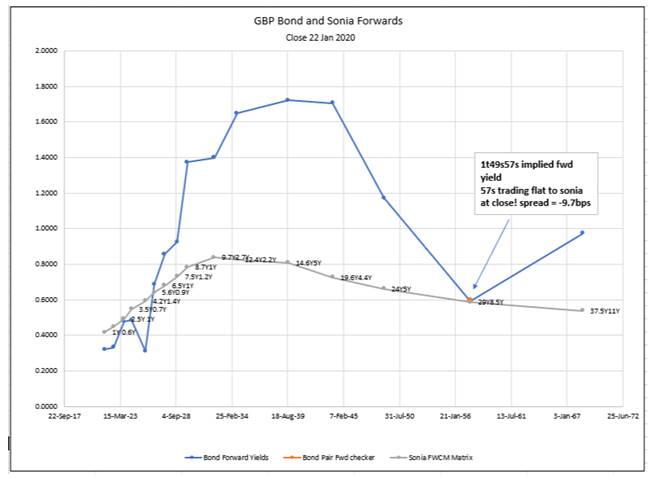

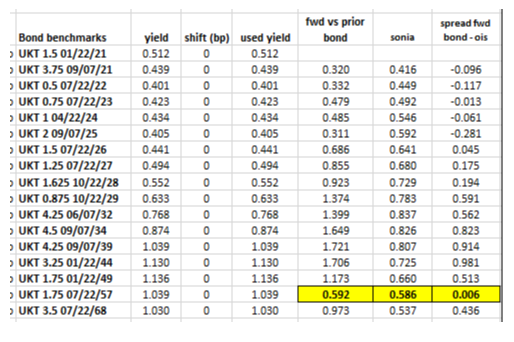

Trade idea: UKT 1.75 1/49s vs. UKT 1.75 7/57s steepener @ -9.5bps or better

Trade = Buy UKT 1.75 1/49 vs Sell UKT 1.75 7/57 @ -9.5 bps

Carry and Roll = + .17 bps per 3 months

Target = -4.5 bps

Add = @ -10.5 bps

Stop = @ -12.5 bps

UKT 57s are and have been very rich on the curve.

Using the closing levels from last night for the spread at -9.7bps, this puts the implied forwards of the 57s flat to Sonia.

These current levels are close to the range low for inversion.

There are 2 near term catalysts to this trade.

- Today’s linker 48 tender will clear out selling pressure on the UKT 1.75 49s as it is the hedge bond for that issue.

- Ultra long syndication coming week of 10th of February.

Please feel free to share any thoughts, feedback much appreciated.

Best,

Mike

![]() image003.jpg@01D57AD2.CB892020">

image003.jpg@01D57AD2.CB892020">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4171

Mobile: +44 (0) 7989-854-611

Email: mike.ohr @astorridge.com

Website: www.astorridge.com

This commentary was prepared by Mike Ohr at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796