Bloomberg Bond News Summary > Thu Jan 23rd

Business Briefing

1) Stocks Slide on Virus-Impact Concerns; Bonds Rise: Markets Wrap

(Bloomberg) -- Stocks, crude oil prices and the yuan slumped on Thursday on concerns about the impact of the new China virus on corporate sales and economic growth. The yen edged up with Treasuries. On the last trading day in China before the nation’s epic travel season for the lunar new year holidays begins, the country’s stocks tumbled about 3%. With China moving to shut ...

2) Euro Can Look to Yuan to See Tariffs Mean Declines: Markets Live

3) Follow Bank Indonesia’s Rate Decision in TOPLive

(Bloomberg) -- Bank Indonesia is seen to leave its key interest rate unchanged. Of the 34 economists surveyed by Bloomberg, 29 predict the central bank will keep the key rate unchanged at 5%, with the rest forecasting a 25 basis-point cut.

- You can follow our TOPLive blog here

- For preview: Bank Indonesia Seen on Hold as Currency Rallies: Decision Guide

4) TOPLive Starts: Follow Bank Indonesia’s Monetary Policy Decision

5) China Virus Triggers Wuhan Travel Ban Ahead of Holiday (4)

(Bloomberg) -- Chinese officials halted travel from Wuhan, essentially locking down the city of 11 million people as they try to stop the spread of a new SARS-like virus that’s already killed 17 and infected hundreds. The coronavirus, which first appeared last month in the central China city of Wuhan, has spread from the mainland to places including Hong Kong and the U.S. ...

World News Briefing

6) Trump Is Portrayed as Danger to Democracy in Impeachment Trial

(Bloomberg) -- House Intelligence Chairman Adam Schiff presented the U.S. Senate with a dark portrait of a deeply flawed, even dangerous president as he argued that Donald Trump should be removed from office. Leading off the House prosecution of Trump on Wednesday, Schiff cited evidence at the heart of accusations in the articles of impeachment to describe a president who ...

7) China Bans Travel From City of 11 Million to Contain Virus

(Bloomberg) -- The Chinese city at the center of a widening respiratory-virus outbreak suspended outbound flights and rail service, as China ramps up efforts to contain an illness that’s killed at least 17 people and infected hundreds. The travel halt by the city of Wuhan was reported by state broadcaster CCTV. The city of 11 million people also suspended travel by bus, ...

8) Brexit Deal Clears Parliament, Paving U.K.’s Way to Leave the EU

(Bloomberg) -- Prime Minister Boris Johnson’s Brexit deal cleared its final hurdles in Parliament, bringing the crisis that paralyzed U.K. politics since the country voted to leave the European Union almost four years ago to a close. The passage of the law vindicates Johnson’s gamble to call an election last month in which he asked voters to back his blueprint for leaving ...

9) Bezos Hack Began With Saudi Goodwill Tour, Intimate Dinner

(Bloomberg) -- In the spring of 2018, Saudi Arabia’s crown prince, Mohammed Bin Salman, arrived in the U.S. for a three-week cross-country tour to pitch a progressive vision for his kingdom, including an economic plan less reliant on oil, and to charm America’s elite. He visited MIT and Harvard, talked space travel with Richard Branson and hobnobbed with celebrities, ...

10) Trump Weighs Plan to Expand Controversial Ban on Travel to U.S.

(Bloomberg) -- President Donald Trump is reviewing a Homeland Security Department recommendation that he expand one of the most controversial policies of his administration by banning people from an additional seven countries from traveling to the U.S. The department suggested the White House expand the travel restrictions to Tanzania, Belarus, Eritrea, Kyrgyzstan, Myanmar, ...

Bonds

11) Amateur Investors Risk Losing Everything in Hunt for Yields

(Bloomberg) -- After years of falling debt yields and new technologies enabling one-click purchases of complex financial products, mom and pop investors around the world are making bets that put them at danger of getting burned. In South Korea, regulators are investigating sales of derivative-linked products that caused individuals to lose almost all their invested money. Chinese savers ...

12) Japan Goes Looking for 6% Yields as Funds Buy Record Asian Bonds

(Bloomberg) -- Japanese investors bought the most emerging-Asian bonds on record last year, and their appetite is growing, money managers said. They snapped up almost 1 trillion yen ($9 billion) of Asian debt in the first 11 months of 2019, according to the latest balance-of-payments data. Even though it’s one month short of a year, that’s a record in data going back to ...

13) Bank CoCo Yields Hit Record Low After Plunging by Half: Chart

(Bloomberg) -- Yields on European lenders’ contingent convertible bonds, or CoCos, are at a record-low 3.76% after falling by about half since the start of last year, according to a mixed-currency Bloomberg Barclays bond index. Investors are flocking to the deeply subordinated notes because negative interest rates and enhanced bank capital buffers have bolstered the appeal of their high coupon payments. The ...

14) Trump Should Look Stateside for Buyers of Negative-Yielding Debt

(Bloomberg) -- U.S. President Donald Trump’s trip to Europe this week led him to wonder aloud just who’s buying the region’s negative-yielding debt. He might be surprised to hear that there’s plenty socked away in American retirement accounts. “I want to know who are these people that buy,” Trump said Wednesday in an interview on CNBC from Davos, Switzerland, where he was ...

15) Lebanon to Decide on March Bond Next Week, Finance Chief Says

(Bloomberg) -- Lebanon’s incoming Finance Minister Ghazi Wazni said the fate of a $1.2 billion Eurobond maturing March 9 will be the new government’s top priority when it meets next week, as investor concerns intensify that the country could default. “This is a priority and will be the first item to be discussed,” Wazni said Wednesday in his first interview with an ...

16) Aussie Gains on Jobs While Virus Fears Boost Yen: Inside G-10

(Bloomberg) -- Australia’s dollar gained against all major peers after better-than-expected jobs data damped expectations for a rate cut. The yen rose with Treasuries as deepening worries about a SARS-like virus from China spurred haven demand.

- AUD/USD climbed as much as 0.5% to 0.6879 before paring gains to trade at 0.6860

- Employment rose 28,900 in December, beating economists’ estimates of a 10,000 gain. The ...

Central Banks

17) Turkish Rate Guidance Intact After Five Cuts Went ‘Bit Deep’ (1)

(Bloomberg) -- Turkey’s central bank is standing by its promise of a positive real rate of return to investors despite five interest-rate cuts that Governor Murat Uysal conceded “were a bit deep.” Speaking Wednesday in interviews with Turkish TV at the World Economic Forum in Davos, Switzerland, Uysal said returns will run above zero based on the projected path of slowing ...

18) Pound Forecasters Tune Out BOE Rate-Cut Calls to Sound Upbeat

(Bloomberg) -- The risk of an interest-rate cut as early as this month seems no impediment to a stronger pound. The currency is predicted to steadily climb for most of 2020, ending the year 3% stronger than current levels against the dollar. That argument is based on a relatively smooth U.K. exit from the European Union, drawing capital inflows into sterling assets, and ...

Economic News

19) ECB Hopes Economic Calm Buys Reflection Time: Decision Day Guide

(Bloomberg) -- European Central Bank President Christine Lagarde can consider herself fortunate -- the euro-area economy has brightened just in time to allow her to focus on a strategic review that could last the rest of the year. The Governing Council’s policy decision on Thursday will be dominated by the announcement of the first appraisal of its inflation goal since ...

20) If Merkel Wants to Fix the German Economy, She Needs to Hurry Up

(Bloomberg) -- Angela Merkel is running out of time to reset the German economy before her era as chancellor draws to a close. The Group of Seven’s longest-serving leader weathered the financial crisis and Europe’s debt turmoil. But in the final full year of her tenure, as Germany’s economic problems fester, lawmakers are starting to ask if she has the vision and energy to ...

21) Circular Economy Lures BlackRock, Google as a Davos Darling

(Bloomberg) -- When British yachtswoman Ellen MacArthur was promoting the idea of the circular economy on the sidelines of Davos in 2012, the big attraction was curiosity about what she was up to after her sailing career. Eight years on, MacArthur’s vision is taking hold at the World Economic Forum’s annual gathering, and firms such ...

22) ECB’s Lagarde Finally to Air Scope of Strategy Review: Economics

(Bloomberg Economics) -- European Central Bank President Christine Lagarde will reveal today the most comprehensive outline yet of the monetary strategic review -- scheduled to be published in about a year. The broad guidelines will probably be scoured for hints on how monetary policy could potentially be changed, though we don’t expect enough detail to emerge to draw conclusions about future stimulus. ...

23) Three Perspectives On the Biggest Issues at Davos (Podcast)

These are the issues that are front-of-mind for attendees of this week’s World Economic Forum in Davos, Switzerland. On a special episode direct from the conference, Stephanie Flanders dives in with a leader from each field. ...

European Central Bank

24) Five Years of ECB Stimulus Stokes Relentless Credit Rally: Chart

(Bloomberg) -- Five years after the European Central Bank announced its historic quantitative easing program, the bull market in company debt is stronger than ever. Anyone who invested 100 euros in investment-grade bonds at the start of the stimulus cycle has netted a 12% gain -- no mean feat for what’s supposed to be a boring asset class.

25) TRANSLATION: Böersen-Zeitung: ECB criticizes institute protection

26) GERMANY DAYBOOK: ECB Strategic Review, Hochtief, Lufthansa Unit

(Bloomberg) -- Christine Lagarde kicks off the ECB’s strategic review today. Officials plan a two-part approach that breaks out inflation targeting, people familiar said. WHAT TO WATCH:

- Top News:

- ECB Hopes Economic Calm Buys Reflection Time: Decision Day Guide

- If Merkel Wants to Fix the German Economy, She Needs to Hurry Up

- Hochtief Sees Full Year Nominal Net EU660 Mln after unit CIMIC Exits Middle East and ...

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

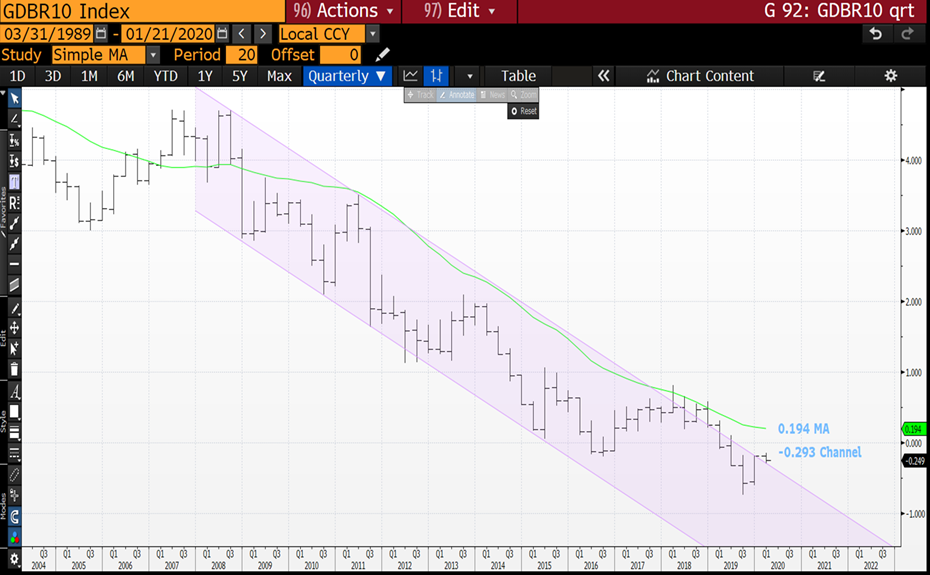

BOND YIELDS CONTINUE TO GRIND LOWER REPLICATING THE MOVE OF 2011-2012, THIS WITHOUT EQUITIES DESPITE, MANY IN A VERY OVER BOUGHT STATE.

BOND YIELDS CONTINUE TO GRIND LOWER REPLICATING THE MOVE OF 2011-2012, THIS WITHOUT EQUITIES, DESPITE MANY IN A VERY OVER BOUGHT STATE. A KEY RUN INTO MONTH END.

DEPITE THE LACK OF EQUITY MOVEMENT ALL YIELD CHARTS HAVE FAILED TO BOUNCE THUS SHOULD HEAD LOWER SHORTLY.

- BOND YIELDS LOWER? YIELDS CONTINUE TO GRIND LOWER WITH GERMANY POISED TO BREACH MAJOR LEVELS, TIME TO REPLICATE THE 2011-2012 SCENARIO.

- COMMODITES HIGHER. GOLD HAS BROKEN THE RECENT HIGHS AND REMAINS A FIRM FAVOURITE AS AN INSURANCE POLICY FOR ESCALATING TENSIONS.

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, WHILST GERMANY IS ATTEMPTING TO BREAK BACK INTO THE LONGTERM DOWNTREND YIELD CHANNEL.

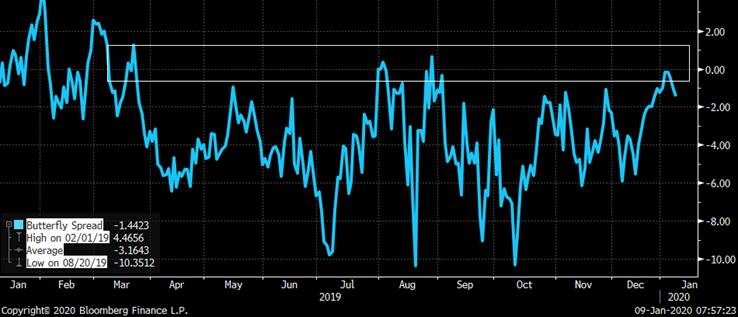

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

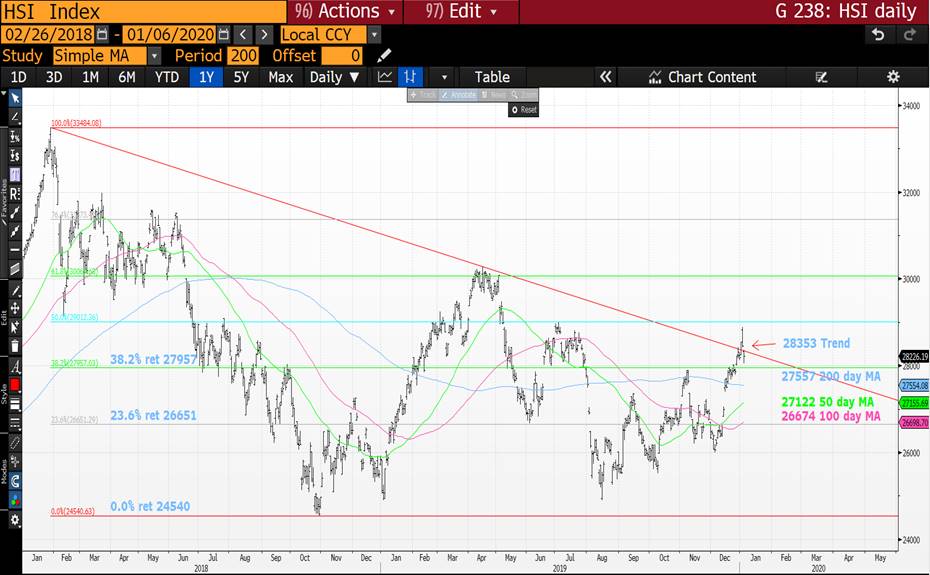

EQUITIES : NOT TOO SURE WHY BUT IT DOES NOW FEEL MANY STOCK RALLIES HAVE GONE TOO FAR. EXAMPLES ARE UNITED TECHNOLOGY AND APPLE, BOTH IN OVER BOUGHT TERRITORY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

DESPITE THE SUSPENSION OF HOSTILITIES BETWEEN IRAN AND THE USA BOND YIELDS REMAIN POISED TO REPLICATE THE MOVE OF 2011-2012, I.E. YIELDS LOWER. EQUITIES ALSO SEEM CLOSE TO A TOP ESPECIALLY IN THE USA! A KEY WEEKLY CLOSE.

DESPITE THE SUSPENSION OF HOSTILITIES BETWEEN IRAN AND THE USA BOND YIELDS REMAIN POISED TO REPLICATE THE MOVE OF 2011-2012, I.E. YIELDS LOWER. EQUITIES ALSO SEEM CLOSE TO A TOP ESPECIALLY IN THE USA! A KEY WEEKLY CLOSE.

DEPITE THE LACK OF EQUITIY MOVEMENT ALL YIELD CHARTS HAVE FAILED TO BOUNCE ABOVE CRITICAL LEVELS THUS SHOULD HEAD LOWER SHORTLY.

- BOND YIELDS LOWER? YIELDS CONTINUE TO GRIND LOWER WITH GILTS LEADING THE WAY TODAY, TIME TO REPLICATE THE 2011-2012 SCENARIO.

- COMMODITES HIGHER. GOLD HAS BROKEN THE RECENT HIGHS AND REMAINS A FIRM FAVOURITE AS AN INSURANCE POLICY FOR ESCALATING TENSIONS.

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 YIELD SCENARIO ESPECIALLY IN THE US, WHILST GERMANY IS ATTEMPTING TO BREAK BACK INTO THE LONGTERM DOWNTREND YIELD CHANNEL.

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

EQUITIES : NOT TOO SURE WHY BUT IT DOES NOW FEEL MANY STOCK RALLIES HAVE GONE TOO FAR. EXAMPLES ARE UNITED TECHNOLOGY AND APPLE, BOTH IN OVER BOUGHT TERRITORY.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

MICROCOSM: EGB Supply Barrage Resumes > 15bn from Spain and France this AM

FRTR and SPGBs THIS AM

- Another wave of bond supply kicks off this am with €15bn coming from Spain then France, their first auctions of 2020.

- Spain will come with up to €5.5bn of their SPGB 10/21s, 7/24s and 7/35s.

- As noted earlier this week, the Spanish curve from 10s-30s is remarkably flat and although the 7/35s trade a touch cheap on the curve, they're still just Eur 11.3bn so will be tapped several more times and will likely remain cheap this qtr. At a push, the 10/29-7/35-7/41 fly has cheapened 3.5bps to +19.5bps, near it's cheapest since mid-Oct which could be enough to attract a bit of demand.

- The SPGB 10/21s look cheap on a micro-basis which will attract domestic interest. The SPGB 7/21-10/21 sprd (yld and Z-sprd) has steepened nicely into this am's tap and the 1/21-10/21-10/22 fly is holding it's even yield resistance on the chart back to early 2019.

SPGB 7/21-10/21 sprd

SPGB 1/21-10/21-10/22 fly

- In a similar fashion to the SPGB 10/21s, the SPGB 7/24s have also cheapened on the curve of late. The SPGB 7/23-7/24 sprd has steepened back to the +11.5bps area from 5bps in Oct and the SPGB 10/22-7/24-4/26 fly is at its cheapest level in the past year. So, if one needed an excuse to lift these SPGBs, you’ve got one.

SPGB 7/23-7/24

SPGB 10/22-7/24-4/26 fly

- Spain has opened 2020 with a modest spread tightening vs most of the EGB universe so those looking for opportunities to add SPGB risk cheaply will struggle a bit. That said, carry and roll on the SPGB curve is still better than most of the OATs curve, especially in the front-end. Spreads like the FRTR 0 3/24 into SPGB 0.25 7/24 gain about 2.5bps in C&R over 3 mos and we’re ~6bps off the sprd lows we saw in Oct/Nov…

- France’s AFT will be issuing up to Eur 9.5bn of the FRTR 0 11/29, FRTR 1.25 5/36 and FRTR 1.5 5/50s, considerably more risk than Spain’s supply 20mins earlier. From our perspective, there don’t appear to be any glaringly obvious freebies among these 3 taps.

- The FRTR 0 11/29s are still a very young issue as this is only their second tap since their Oct introduction and, as such, they should trade with a bit of ‘juice’ in them. So far, however, they’ve held in well with the FRTR 5/29-11/29 sprd in a stable 4.0-4.5bps range since mid-Nov. Just beyond them, the FRTR 2.5 5/30s look a bit cheaper but again, we’re splitting hairs as these are micro sprds. More broadly, OATs yields have risen back above zero and we would agree with some of our dealers who assert that OATs look cheap to OLOs into this am’s supply.

BGB 6/29 v FRTR 11/29s > 5 mos of curve in there but should OATs should probably be closer to even yield at worst.

- More to come!

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

** FOLLOW UP ** CHART IMPRESSIONS POST MR TRUMPS ACTIONS AS WE AWAIT THE IRANIAN REPRISALS : THERE ISNT GOING TO BE AN EASY SHORT-TERM FIX.

** FOLLOW UP ** CHART IMPRESSIONS POST MR TRUMPS ACTIONS AS WE AWAIT THE IRANIAN REPRISALS : THERE ISNT GOING TO BE AN EASY SHORT-TERM FIX.

BOND YIELDS LOWER?

****BOND PERFORMANCE TODAY HAS FORMED MAJOR SIMILARITIES TO THAT OF 2011-2012 I.E. LOWER IN YIELD, INITIATING THE NEXT LEG. ****

- YIELDS OPENED LOWER BUT STEADILY GIVEN BACK FROM THE INITIAL MOVE, WE DO NEED TO SEE YIELD CONTINUE LOWER AGAIN TO ENABLE THE MARKET TO REPLICATE THE 2011-2012 SCENARIO.

- COMMODITES HIGHER. GOLD HAS BROKEN THE RECENT HIGHS AND REMAINS A FIRM FAVOURITE AS AN INSURANCE POLICY FOR ESCALATING TENSIONS.

DESPITE LACKING FRESH NEWS-ACTIONS FROM IRAN BOND YIELDS HAVE PRINTED NEW YIELD LOWS WHILST GOLD HAS POPPED, SHOULD STOCKS WEAKEN THEN THE 2011-2012 SITUATION WILL PAN OUT NICELY.

** THE ONLY REQUIREMENT IS THAT BOND YIELDS CONTINUE WEAKER TOMORROW.**

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 SCENARIO ESPECIALLY IN THE US, WHILST GERMANY IS SET TO RE-ENTER THE LONGTERM DOWNTREND CHANNEL.

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

EQUITIES : THESE COULD OFFER SO MUCH TO THE BOND ARGUMENT BUT AS YET HAVE NOT, THAT SAID IRAN WONT TAKE LONG TO REPLY TO MR TRUMP AM SURE.

**PLEASE READ ** CHART IMPRESSIONS POST MR TRUMPS ACTIONS : THERE ISNT GOING TO BE AN EASY SHORT-TERM FIX. 1.BOND YIELDS LOWER? 2.COMMODITES HIGHER.

CHART IMPRESSIONS POST MR TRUMPS ACTIONS : THERE ISNT GOING TO BE AN EASY SHORT-TERM FIX.

- BOND YIELDS LOWER?

****BOND PERFORMANCE TODAY HAS FORMED MAJOR SIMILARITIES TO THAT OF 2011-2012 I.E. LOWER IN YIELD, INITIATING THE NEXT LEG. ****

- COMMODITES HIGHER.

DESPITE MR TRUMPS DRASTIC ACTIONS THE ONLY TWO MAJOR “POP UPS” ARE THAT BOND YIELDS HEAD LOWER AND COMMODITIES HIGHER. STOCKS SEEM TO BE SHRUGGING ALL OF THE BAD NEWS, HOWEVER AM SURE THE RETRIBUTION WONT ALLOW THAT PERFORMANCE TO SUSTAIN.

** THE ONLY REQUIREMENT IS THAT BOND YIELDS OPEN WEAKER MONDAY.**

BONDS :

THERE ARE MANY KEY CHARTS TO BACK UP THE REPLICATION OF THE 2011-2012 SCENARIO ESPECIALLY IN THE US, WHILST GERMANY IS SET TO RE-ENTER THE LONGTERM DOWNTREND CHANNEL.

US BREAKEVENS AND USGGT :

BREAKEVENS COULD BE POISED TO TOP OUT.

COMMODITIES : VERY LITTLE GROUND HAS BEEN GIVEN BACK ON LAST YEARS RALLY WITH GOLD REMAINING IN VERY POSITIVE TERRITORY.

EQUITIES : AS EVER THE TREND PREVILS AND BUYERS ARE IN ON THE DIP, BUT THIS IS NOT A SITUATION THAT WILL BLOW OVER QUICKLY.

** HAPPY NEW YEAR **

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

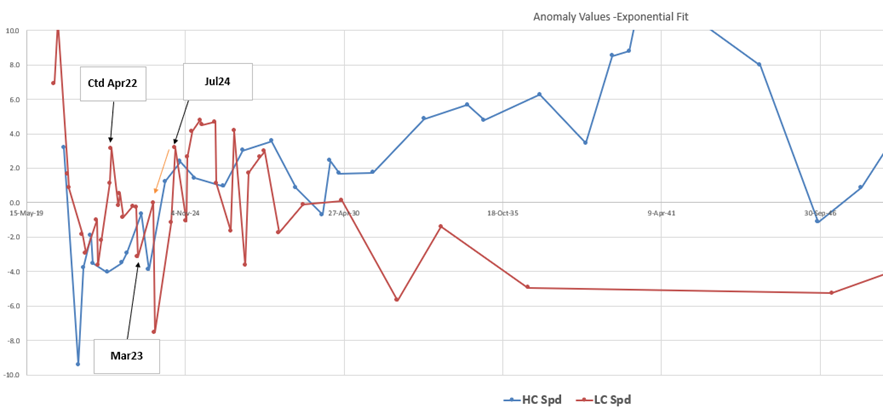

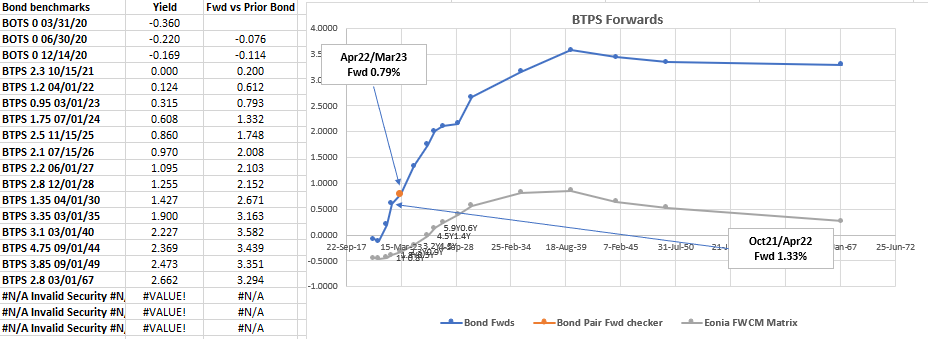

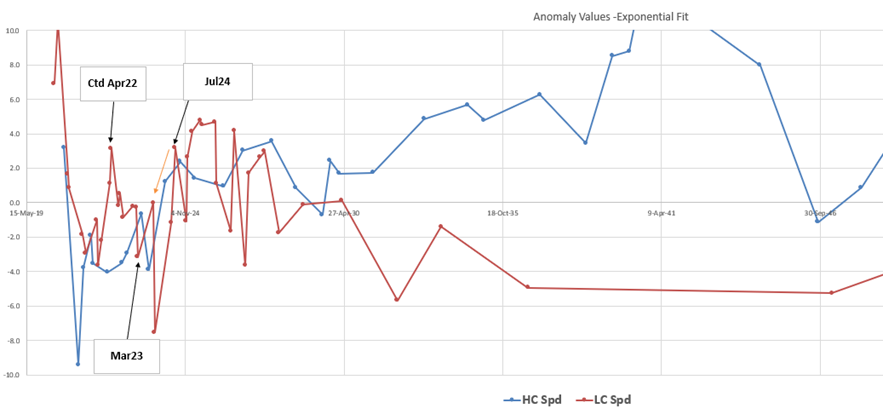

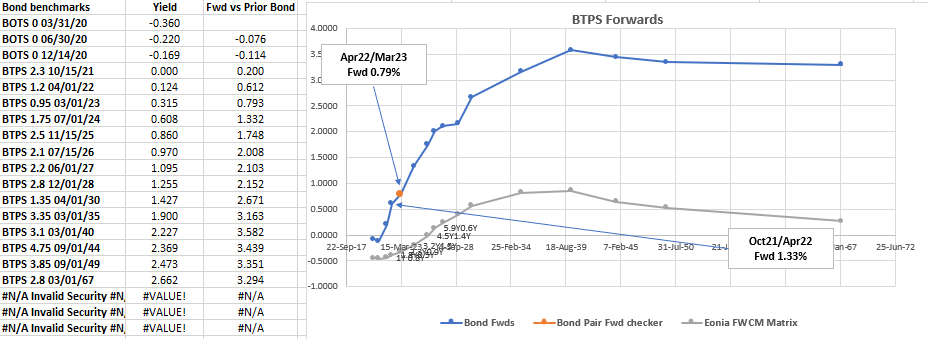

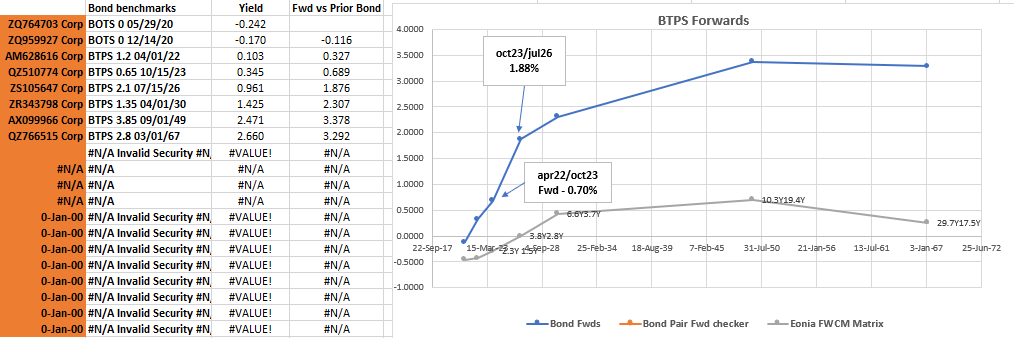

FW: Trade Radar - Italy announces Q1 New Issues - James Rice @Astor Ridge

Amendment: Oct21/Apr22 fwd is 0.612% as per the table

Italy announces two New Issues for Q1 2020….

New bonds to be issued The Ministry of Economy and Finance announces that during the first quarter of 2020 the following new securities will be issued:

BTP 3 years - maturity 06/15/2023 Minimum final outstanding: 9 billion Euros

BTP 10 years - maturity 08/01/2030 Minimum final outstanding: 12 billion Euros

Trade:

Fade the richness of old 3y, Mar23 vs cheap Italian 2y contract (BTSA)

Graph:

-2 X Mar23 +Apr22 +Jul24

200 * (YIELD[BTPS 0.95 03/15/23 Corp] - 0.5 * YIELD[BTPS 1.2 04/01/22 Corp] - 0.5 * YIELD[BTPS 1.75 07/01/24 Corp])

Structure:

Sell -€157MM (€50k /01) Btps 0.85% Mar-01-23

&

Buy +997 contracts of BTSA (€25k /01) (Italian 2y, CTD Btps 1.2% Apr22)

Buy €55MM (€25k /01) Btps 1.75% Jul24

Levels:

Current: @-14.5bp (Pay the belly)

First Target: -9bp (‘fair on forwards curve’)

Add: -17bp

Rationale:

- Apr22 CTD to 2y Italy are cheap due to hedging pressure in sell-off – this has to be unwound and is not a permanent diminution of its value

- Mar23 are rich and surf into cheap sector of Btp curve

- New Jun23 issue this quarter will be hedged with further selling in the old 3y Mar23

- The Jul24 are an old 5yr that roll well into untapped sector

Anomaly Graph (Btps):

Roll & Carry:

Carry: +0.2bp /3mo @-5bp repo spread

Roll: flat

Risks:

- Mar23 stay anomalous

- The Bts contract stays cheap

- An strong bid for Italian debt causes all bullets to outperform wings

Forwards:

Implied Forwards between Italian Bonds

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - Italy announces Q1 New Issues - James Rice @Astor Ridge

Italy announces two New Issues for Q1 2020….

New bonds to be issued The Ministry of Economy and Finance announces that during the first quarter of 2020 the following new securities will be issued:

BTP 3 years - maturity 06/15/2023 Minimum final outstanding: 9 billion Euros

BTP 10 years - maturity 08/01/2030 Minimum final outstanding: 12 billion Euros

Trade:

Fade the richness of old 3y, Mar23 vs cheap Italian 2y contract (BTSA)

Graph:

-2 X Mar23 +Apr22 +Jul24

200 * (YIELD[BTPS 0.95 03/15/23 Corp] - 0.5 * YIELD[BTPS 1.2 04/01/22 Corp] - 0.5 * YIELD[BTPS 1.75 07/01/24 Corp])

Structure:

Sell -€157MM (€50k /01) Btps 0.85% Mar-01-23

&

Buy +997 contracts of BTSA (€25k /01) (Italian 2y, CTD Btps 1.2% Apr22)

Buy €55MM (€25k /01) Btps 1.75% Jul24

Levels:

Current: @-14.5bp (Pay the belly)

First Target: -9bp (‘fair on forwards curve’)

Add: -17bp

Rationale:

- Apr22 CTD to 2y Italy are cheap due to hedging pressure in sell-off – this has to be unwound and is not a permanent diminution of its value

- Mar23 are rich and surf into cheap sector of Btp curve

- New Jun23 issue this quarter will be hedged with further selling in the old 3y Mar23

- The Jul24 are an old 5yr that roll well into untapped sector

Anomaly Graph (Btps):

Roll & Carry:

Carry: +0.2bp /3mo @-5bp repo spread

Roll: flat

Risks:

- Mar23 stay anomalous

- The Bts contract stays cheap

- An strong bid for Italian debt causes all bullets to outperform wings

Forwards:

Implied Forwards between Italian Bonds

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

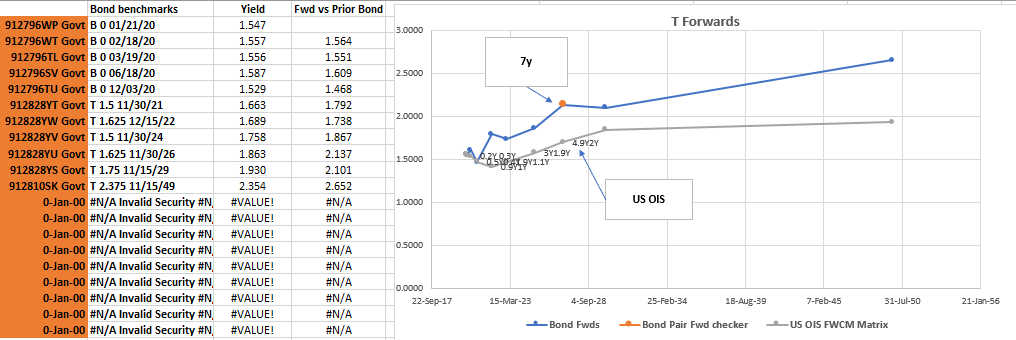

Trade Radar - James Rice @Astor Ridge, Xmas and the New Year

Trade Radar – Just a few things worth fading….

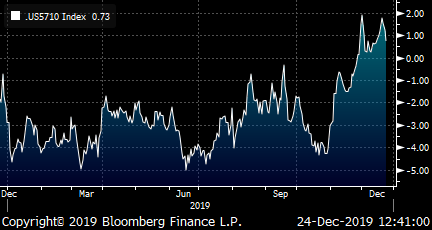

US 5s7s10s – Receive 7y

Forwards

History:

2 * 7y - 5y - 10y

100 * (2 * RV0001P 7Y BLC Curncy - RV0001P 5Y BLC Curncy - RV0001P 10Y BLC Curncy)

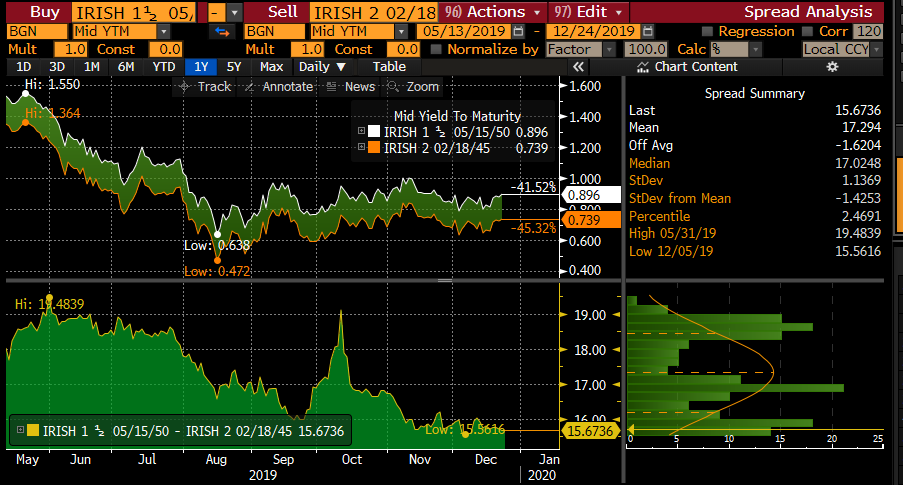

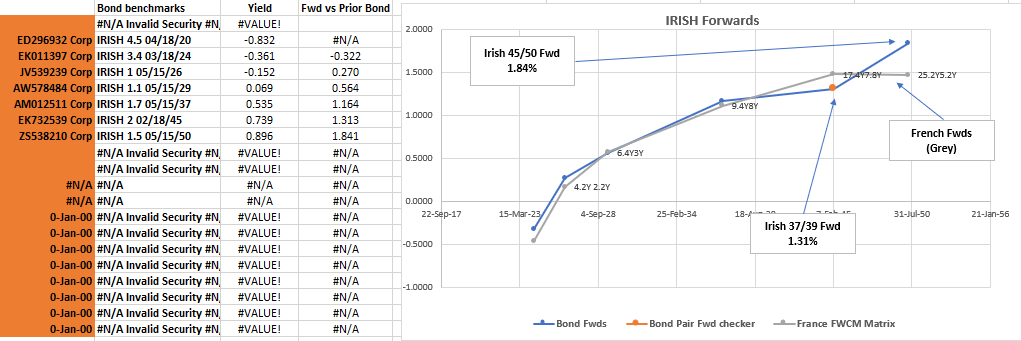

Irish Flattener 45s50s

Irish 45s50s forward still over France equivalent whereas close to flat elsewhere

As Ireland has compressed to France in Spot and Forward space - the anomaly Irish 45s into Irish 50s looks too steep (fwd too high – 45s rich)

This trade has moved flatter – but go with this momentum…

And Forwards suggest it’s still too steep…

Vs France…

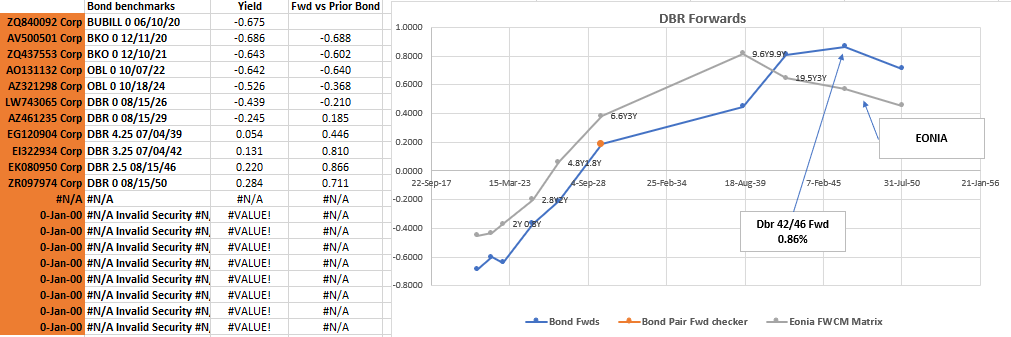

- German Flattener 42s 46s – long forwards suggest that the 20s25s segment of the curve is still too steep – the Eonia/swap curve has seen a decent inversion in longer tenors, which implies a strong bid for convexity

Supply…

With only the 2044s, 2048s and the 2050s planned to be tapped next year – the 42s 46s spread is a decent way to play this – spread is on the low but I think relative to the rest of the curve this could move lower – vs MMS it may insulate from generic curve moves

Yield Spread

Vs MMS

Forwards vs Eonia…

Let me know!!!!

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

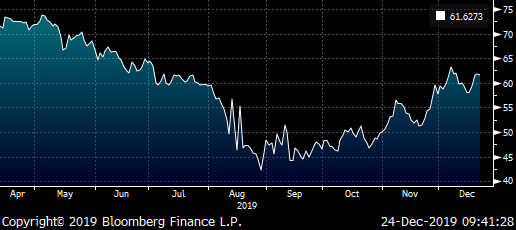

Trade Radar Italy flattener 4s7s- James Rice @Astor Ridge, Xmas and the New Year

Trade Radar – Xmas and New Year & beyond

Italy – 5y and 10y supply

€ 4.5Bln approx. 5s & 10s coming on Monday 30th December – fade the steepening in Italy 4s7s

Trade

Flattener, Sell Btps LC 0.65% Oct23 to Buy Btps 2.1% Jul26

Graph

100 * (YIELD[BTPS 2.1 07/15/26 Corp] - YIELD[BTPS 0.65 10/15/23 Corp])

Levels

Current: @ +61.5bp

Entry: @ +64bp

Carry & Roll

Carry: -0.3bp /3mo @same repo

Roll: -0.9bp /3mo

Rationale

- Forwards starting to look high in the 4y3y and with Year end on the agenda the roll is starting to look interesting

- The entry level is chosen at a level where the forwards look even more dislocated

- The 4y3y forward is 1.88% (feb25/jul26), which rolls to 1.20% (2y3y,Apr22/feb25) in 2 years’ time

- The LC Oct23 trades rich on both yield and default space

- Further widening in Italy could be at the detriment of shorter maturities relative to longer tenors. As credit fears could return despite yield value in the long end

Forwards

Friction

Full Bid offer on screens showing at 3bp

Entry on an order, estimate 1.5bp – 2bp friction on exit when trading terms

Risks

- Oct23 may stay bid

- Jul26 as an old 7y remain offered sue to ongoing supply in that sector

- Repo on Oct23 goes expensive vs GC

More to follow…

But have a great Chrimbo and drop me a note if you’re around!

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796