MICROCOSM: UK> Quick Preview of Final MPC Meeting of 2019

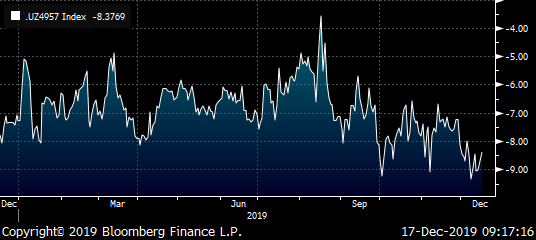

BoE's MPC Meets Today at Noon London Time – no press conference scheduled.

- UK Base rates currently at 0.75%, O/N Sonia at 71bps with repo G/C right around there. Consensus is for NO CHANGE to base rates.

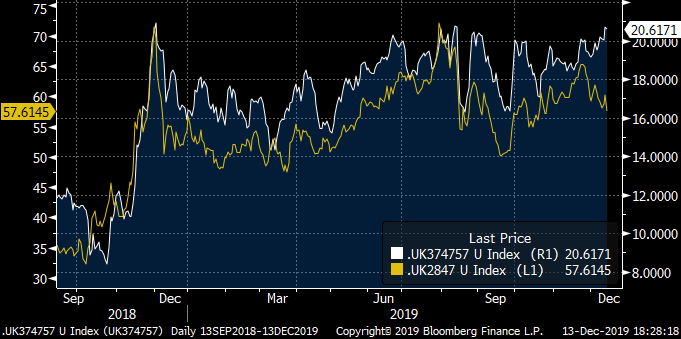

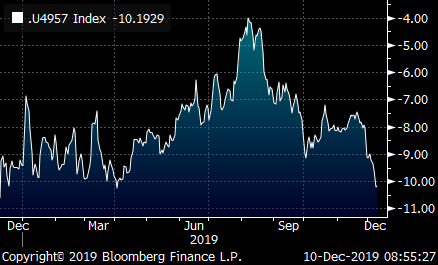

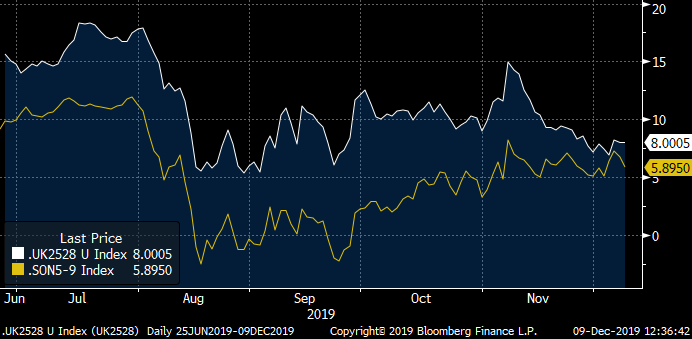

- The last meeting (Nov 7) was the first time since Jun '18 where there were two dissenters, 7 voting for no move, Haskel and Saunders arguing for a 25bps cut. This dissention coincided with a divergence between Cable and SONIA (as the chart below shows), Sonia staying put while Cable rallied.

Vertical lines are MPC meetings…

- Initial market reaction to the outcome of the UK election was justifiably bearish rates and bullish for Cable as it removed considerable political uncertainty. However, Johnson’s insistence that the UK-EU trade deal is completed by the end of 2020 has the market on edge again, even before Brexit’s official. The press jumped on a bandwagon with a ‘this ain’t gonna be easy’ message that sparked a reversal in GBP and a sticky SONIA curve that prices in a 30-40% chance of a 25bps rate cut from the MPC in the next 18mos.

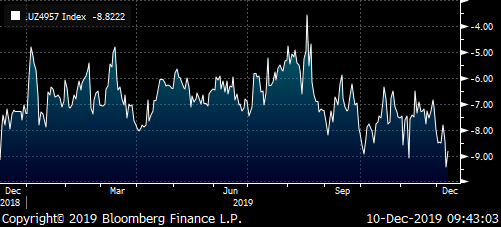

- As you can see from this screen-grab, the market thinks the MPC is indeed ‘in-play’. What’s also worth pondering is whether Carney’s imminent departure opens the door for more dissension among MPC members. We should learn who the new Governor is by tomorrow evening (ahead of the Queen’s speech), however, while a rate cut is highly unlikely (especially with the FED and ECB on hold), another 7-2 or even 6-3 vote will keep the SONIA curve richer than one would have expected given recent events.

- To be frank, the gilts curve has been all over the place since the end of November. The combination of a ‘pancake-flat’ Z-sprd curve from 2023s to 2028s, the richness of the 1F28s and 0S29s into G Z9-G H0 sprd activity and the whipsaw in the long-end into and out of the election has made curve RV a tad treacherous. We maintain the view that while the threat of a No-Deal Brexit is certainly real, especially in light of Johnson’s remarkable majority in Parliament, there is a great deal of wood to chop before we need to panic about the post-Brexit outlook.

- Into today, we’re watching the 1.310 level in Cable, the 0.82% level in UKT 0S29s and SONIA’s Dec 20 MPC level…

Stay tuned!

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

Trade Radar - James Rice, Dec 17th

Trade Radar – Euro RV

Italy

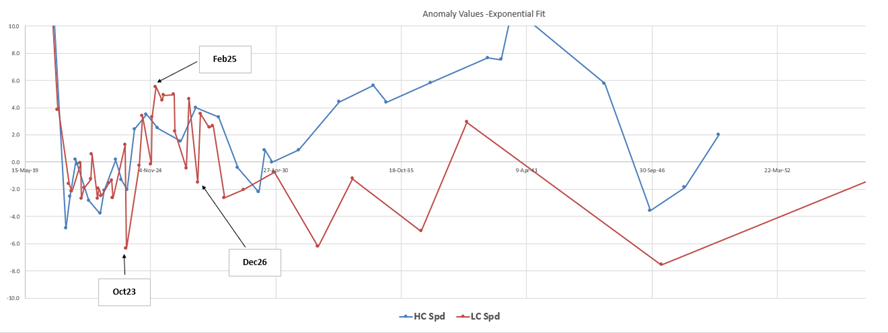

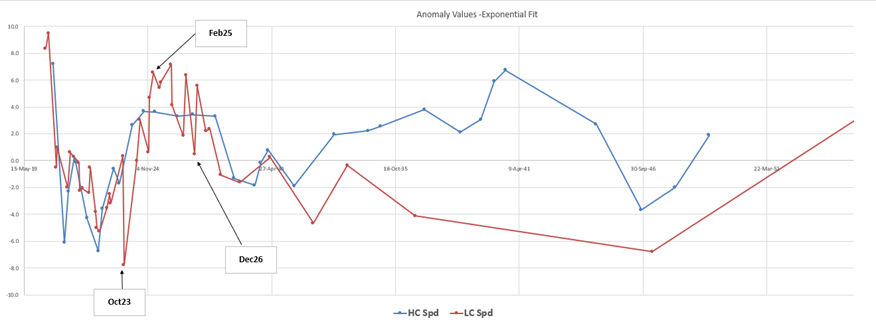

-LCoct23 +feb25 -dec26

receive the belly

@+13.3bp

like it here, recent high > +15bp

Potential to roll to < +5bp in medium term

Anomaly Values on Fitted curve

BBG History

200 * (YIELD[BTPS 0.35 02/01/25 Corp] - 0.5 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.5 * YIELD[BTPS 1.25 12/01/26 Corp])

2)

UK

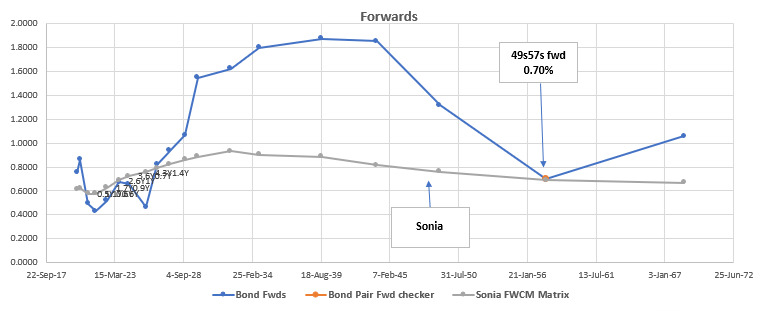

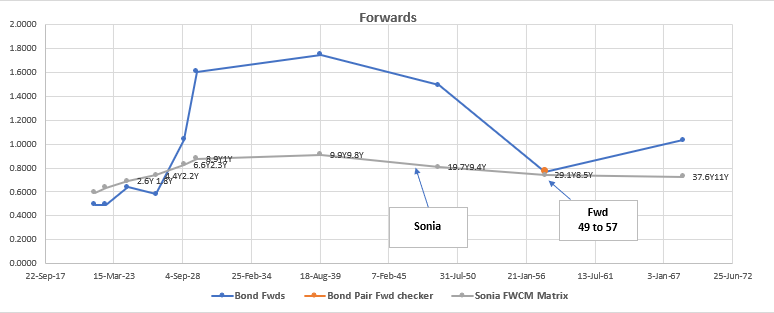

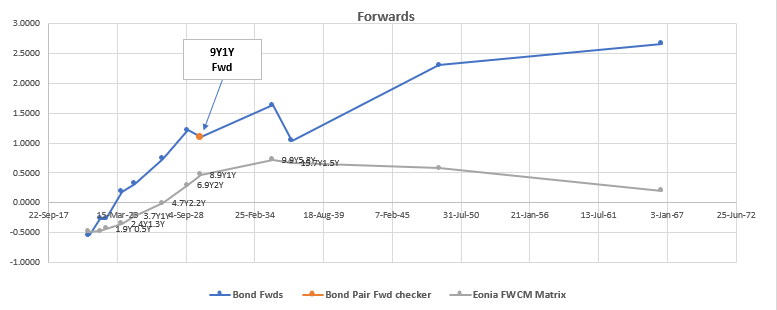

+1t49 -1t57 vs Sonia

Yield spread is so inverted that the forward is approximately flat to the Sonia Curve yet other bonds are Sonia Plus

Currently: +8.3bp

Looking for close to +9bp

UKT Forwards Curve…

UK Bond Curve – Bonds Vs Sonia

History of swap spreads

(SP037[UKT 1.75 07/22/57 Corp] - SP037[UKT 1.75 01/22/49 Corp])

3)

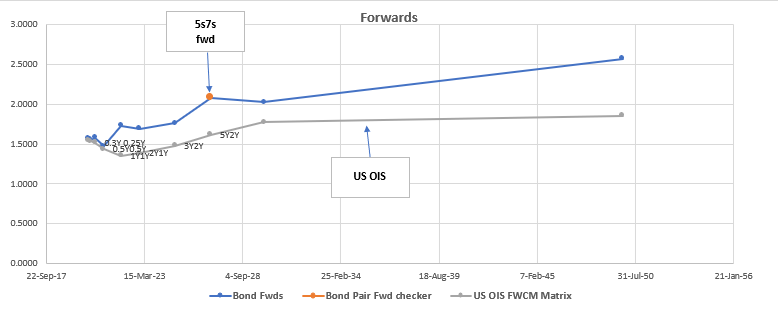

US

-5s +7s -10s

Underperformance of the 7yr point leaves forward looking at little out of what and the 7y cheap

Forwards curve…

History of constant Maturity Bonds (Bloomberg)

100 * (2 * RV0001P 7Y BLC Curncy - RV0001P 5Y BLC Curncy - RV0001P 10Y BLC Curncy)

More details on levels, etc on request

Best

James

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

UKT 30yr belly too cheap now - UPDATED

Conservative victory has bear flattened the UK long end:

Despite the abatement of steepening risk that would have resulted from a Labour coalition government, the 30yr point remains very cheap on the 20s30s40s bfly.

UKT 20s30s40s has recently decoupled from 10s30s:

Yellow – 10s30s (UKT 28s47s)

White – UKT 37s47s57s fly

We are now testing multiple resistance at 21 bps (first reached during the massive 10s30s steepening in Nov 2018, during mass defections by Theresa May’s cabinet).

Supply: We have just digested UKTi 30yr linker (48s) supply on Wednesday. The upcoming supply calendar favours the belly of the fly:

21st Jan – New 20yr auction (41s)

4th Feb – 20yr linker auction (36s)

11/17th Feb – Nominal syndication (likely 54s or 71s)

The next 30yr auction (49s) will not take place until 17th March.

Trade:

Buy belly of UKT 37s47s57s fly at +20.4 bps

Target: 16-18 bps

Stop: 22 bps

Regards,

Jim

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 245 Park Ave 39th Fl, New York NY 10167

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

BONDS, BREAKEVEN AND EQUITIES : TODAY COULD BE A VERY SIGNIFICANT STATEMENT IF YIELDS AND STOCKS CLOSE HIGHER ON THE WEEK.

BONDS, BREAKEVEN AND EQUITIES : TODAY COULD BE A VERY SIGNIFICANT STATEMENT IF YIELDS AND STOCKS CLOSE HIGHER ON THE WEEK. WE HAVE BEEN IN A PERIOD OF STAGNATION BUT FINALLY IT LOOKS LIKE BOND YIELDS WILL HEAD HIGHER.

** THE ONLY REQUIREMENT IS THAT YIELDS CLOSE THE WEEK ON THEIR HIGHS.**

BONDS :

WE HAVE HAD A PERIOD OF STAGNATION BUT BOND YIELDS SEEM TO BE ON THE MOVING HIGHER, TODAYS EARLY BREAK OUTS NEED TO BE CONFIRMED LATER TODAY. ONE GIVE AWAY HAS BEEN GERMANY AND THAT IS WELL ABOVE ITS 200 DAY MOVING AVERAGE.

US BREAKEVENS AND USGGT :

BREAKEVENS DO STILL SEEM TO WANT TO BOUNCE AND MOVE HIGHER.

EQUITIES : I THOUGHT EQUITIES MIGHT WANE DURING THE QUITE BOND PERIOD BUT ALL HAVE HELD SOLID SUPPORT AND POISED TO HEAD HIGHER. AGAIN WE NEED STRONG CLOSES TO NEGATE FALSE BREAK!

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

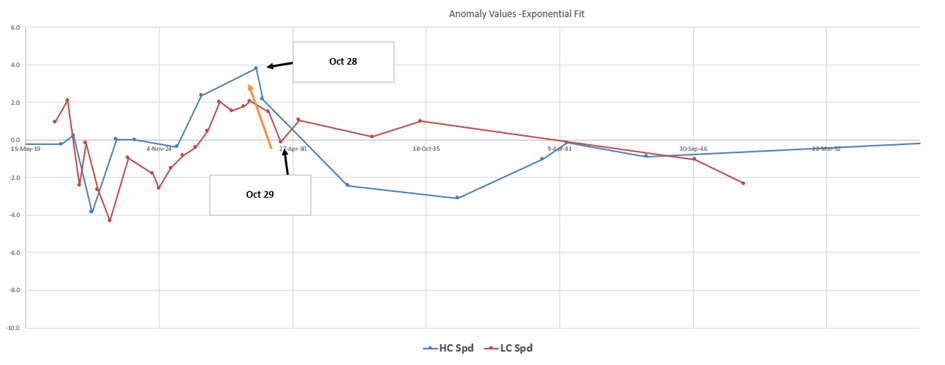

Trade Radar - Euro RV Dec 10th, James Rice @Astor Ridge

Euro RV – like this trade in Italian RV & UK Sonia Trade

Trade Radar – 1

Italian 5years remain cheap

Trade Structure

{IT} Italy

-LowCpn Oct23 / +feb25/ -Dec26

Weights (2x middle) : -.5 / +1 / -.5

Levels

Current Fly level: +14.2bp

Entry: +13.5bp

Add: +17bp

Target short term: +6bp

Target long term: -5bp

Rationale

- Feb25 and 5yrs in general trading cheap ahead of Xmas and light dealer inventories

- Low coupon Oct23 now represent an anomaly that is as rich as the 2yr sector

- Previously sought after low coupons (oct23 and dec26) can be supplanted by recent low coupons in a default/widening scenario

- The relative forwards suggest this anomaly is among the most extreme in the context of the curve

Carry and Roll

Carry: +0.4bp @ 5bp repo spread

Roll: 0bp

Cix (2x middle, x100 to make it basis points):

(YIELD[BTPS 0.35 02/01/25 Corp] - 0.5 * YIELD[BTPS 0.65 10/15/23 Corp] - 0.5 * YIELD[BTPS 1.25 12/01/26 Corp])

BBG History

Italian anomaly curve fit

Italy Forward Curve

Unadjusted yields – looks more extreme when we compensate for coupon

Risks

- As a tap bond the feb25 stay offered

- The oct23 and dec26 stay rich as anomalous and well-placed issues

- The repo on the short sides gets sticky over yr end or beyond

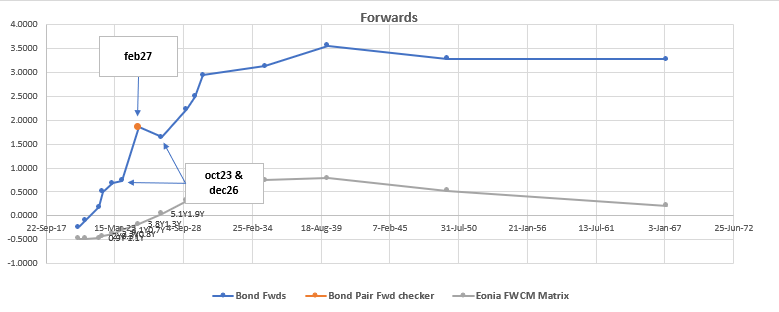

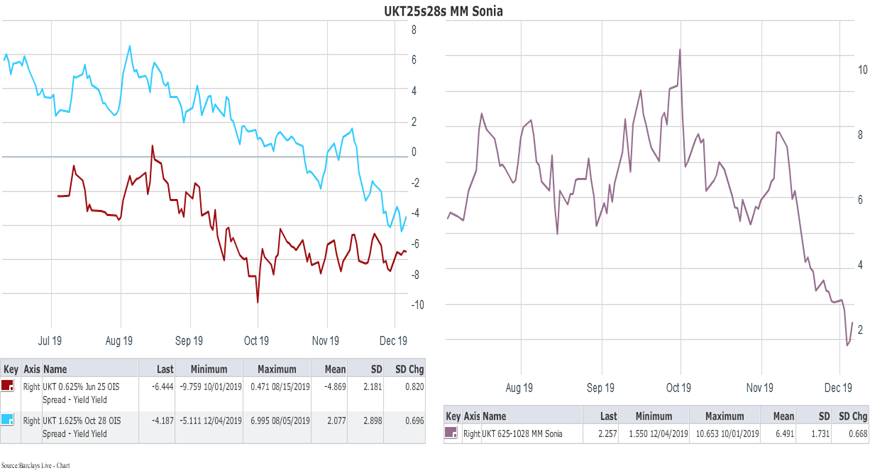

UK – 30s40s looks too inverted, forcing the forward to Sonia levels

Trade Structure

{GB} UK

+UKT 1.75% 49 / -UKT 1.75% 57

vs MMS (Sonia)

Weights : +1 / -1

Levels

Current Spd vs MMS: +9bp

Entry: +8.5bp

Add: +11bp

Target: +4bp

Rationale

- 57s have outperformed in yield and swap space with buying in that sector

BBG spread history +57s -49s

(YIELD[UKT 1.75 07/22/57 Corp] - YIELD[UKT 1.75 01/22/49 Corp])

- The 57s are so rich now that the forward (29Y8.5Y) is now down to Sonia levels – fwd. 0.77%, Sonia for that term is 0.74% (+3bp to Sonia)

- The 57s roll to ma much cheaper part of the curve (30yrs) – for example the 20Y10Y is +68bp to Sonia

- The relative forwards suggest this anomaly is among the most extreme in the context of the curve –

- The spread of spreads history is at the best levels

(SP210[UKT 1.75 07/22/57 Corp] - SP210[UKT 1.75 01/22/49 Corp])

*sp210 is BBG code for swap spread

- There is some talk of a new 65 in feb or reopening 71s via syndication, which could re-steepen the bond curve

Risks

- 57s stay anomalously rich

- The 49s stay offered

- The repo on the short sides gets sticky over yr end or beyond

Any feedback, always grateful

Thanks

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

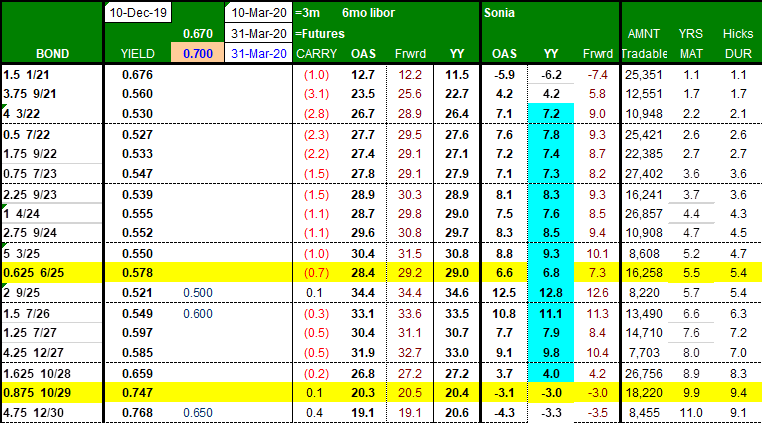

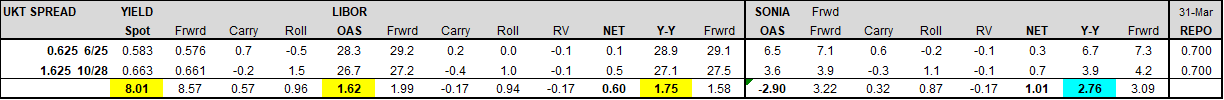

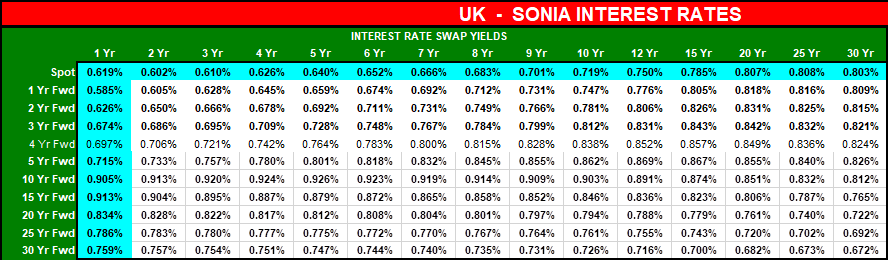

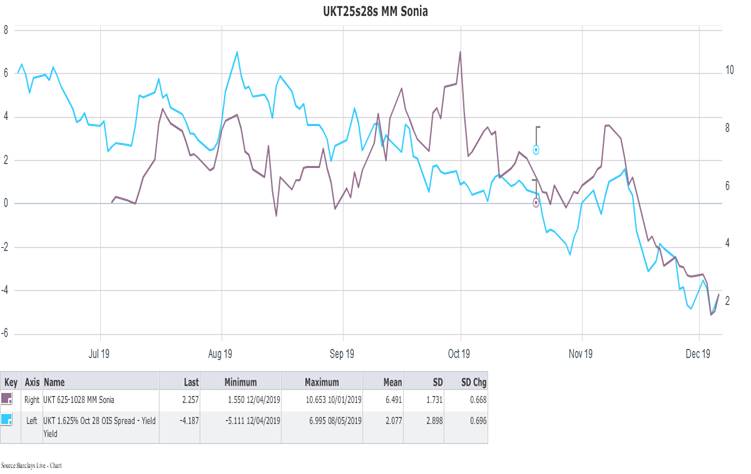

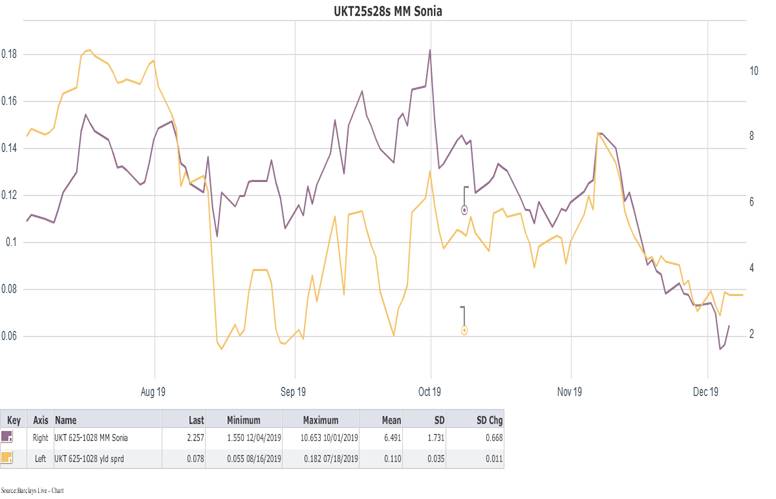

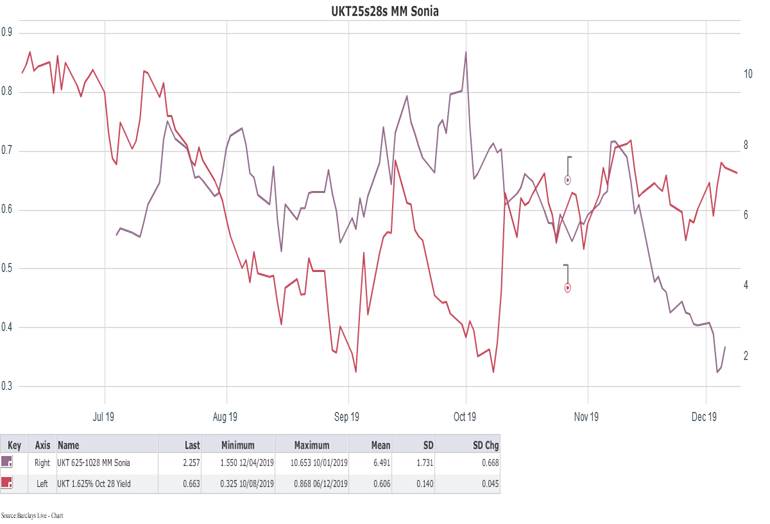

UKT ASW curve

The Gilt Sonia ASW curve out to 10yrs has become very flat:

The 0.625 6/25, while still likely to have 3-4 more taps, rolls positively while cheap on the Sonia ASW curve.

TRADE:

Buy UKT 0.625 6/25 vs UKT 1.625 10/28 on Sonia MMS @ 2.5 bps or better:

Left – UKT 10/28 MM Sonia (blue), UKT 6/25 MM Sonia (Red)

Right – UKT 6/25-10/28 MM Sonia Spread

Target: 10 bps

Add: 0

Stop: -2 bps

RATIONALE: Recently the 5s10s Gilt and Sonia curves have been moving in the opposite directions, with Gilt flattening / swaps steepening:

White – UKT 6/25-10/28 yield spread

Yellow – Sonia 5s9s curve

Swap steepening has appeared long overdue – taking a look at the Sonia forward yield matrix below, there isn’t one point on the rates surface that is pricing even one rate hike:

Horizontal axis – swap yields

Vertical axis – forward start dates

What is more perplexing is the Gilt curve out to 7 years is even flatter than the Sonia curve.

DRIVERS:

Spread levels – Given the 0.625 6/25 is already trading on top of the Repo-Sonia spread and rolls relatively flat, the 1.625 10/28 Sonia ASW trades with a much higher beta and drives the ASW box, i.e. the trade has a bearish bias on ASW spreads:

Blue – UKT 28s MM Sonia ASW (left axis)

Purple – UKT 25s28s MM Sonia spread

Curve – The Cash curve has recently exhibited a higher beta than the sonia curve; as a result the ASW box is more likely to work in a curve steepening environment:

Yellow – UKT 25s28s yield curve (left axis)

Purple – UKT 25s28s MM Sonia spread

Level of yields – The ASW box has shown little recent correlation to the level of yields, with the box continuing to flatten despite the recent 35 bps sell-off:

Red line – UKT 1.625 10/28 yield (left axis)

Purple line – UKT 25s28s MM Sonia spread

Catalysts:

Elections – Both main parties are promising fiscal stimulus, whether it be in higher spending, lower taxes, or both. Higher borrowing is inevitable, which ceteris paribus should cheapen Gilts vs Sonia, steepening the ASW box. Moreover, the market will likely demand more term premium given higher borrowing requirements and inflationary implications of fiscal stimulus, which should steepen both the Gilt curve and the ASW box.

Jim Lockard

Founder / Managing Partner

![]() image001.jpg@01D21F14.8E7A1C60">

image001.jpg@01D21F14.8E7A1C60">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 EAST 49th Street, New York NY 10017

Office: +44 (0) 203 -143 - 4172

Mobile: +44 (0) 7795-027-865

Email: jim.lockard@astorridge.com

Website: www.astorridge.com

This commentary was prepared by Jim Lockard, a Managing Partner at Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and it should be treated as a marketing communication even if it contains a research recommendation. A history of his commentary can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge does not engage in market making or proprietary trading, and has no position in any security discussed in this e-mail. The views in this e-mail are those of the author(s) and are subject to change.. Any recommendations contained herein reflect solely those of the author and were prepared independently of Astor Ridge or its affiliates. This publication does not constitute personal investment advice and may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate recommendations discussed herein. Actual investment returns may fluctuate as a result of changes in economic and market conditions (including market liquidity). Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by us is owned by us.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

EQUITIES : IT STILL FEELS THEY HAVE A PART TO PLAY SOON GIVEN CHINA REMAINS HEAVY AND RECENT US PERFORMANCE IS TOO LOFTY.

EQUITIES : IT STILL FEELS THEY HAVE A PART TO PLAY SOON GIVEN CHINA REMAINS HEAVY AND RECENT US PERFORMANCE IS TOO LOFTY. BONDS ARE LOOKING FOR DIRECTION AS MOST RSI’S ARE IN A NEUTRAL STATE. WE SHALL SEE BUT DON’T INGORE STOCKS FAILING.

THE HANG SENG REMAINS A FIRM FAVORITE TO WATCH GIVEN IT REMAINS CLOSE TO BREACHING A SIGNIFICANT MULTI YEAR 23.6% RET 25601.22.

THESE COULD BECOME A CONCERN GIVEN MANY DISLOCATED RSI’S.

FTSE COULD BE THE CHART TO WATCH GIVEN THE HISTORICAL TOP BEING ESTABLISHED.

ASTOR RIDGE : Independent Ideas, Research, Liquidity, Anonymity and Trusted Experience.

- UK: 14-16 Dowgate Hill, London EC4R 2SU

- US: 245 Park Ave, 39th Floor, NY, NY, 10167

- Office: +44 (0) 203 143 4174

- Mobile: +44 (0) 7980708683

- Email: chris.williams@astorridge.com

- Web: www.AstorRidge.com

- • I provide our research notification below for your convenience:

- •

- • Research Unbundling:

- •

- • Astor Ridge does not provide independent research. We have no dedicated or paid strategists, research portals, or research subscriptions. However, you may receive unsolicited marketing communications from our Introducing Brokers from time to time, which may refer to specific trade recommendations. These recommendations are based solely on the opinion of the author, and are not official research recommendations of Astor Ridge.We have considered guidance from ESMA, and any written material from our Introducing Brokers that might fall within the scope of the rules will be provided for free, and made publicly available on our website, to any EU Investment firm that registers for it.

- •

- • If you are a MiFID firm and do not agree with our approach, and instead believe that you must pay for written commentary or trade recommendations, then Astor Ridge will accept payments determined by you.

- •

- •

- •

- • I also direct you to our disclaimer on our email footer:

- • This marketing was prepared by Christopher Williams, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

- •

- • You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

- •

- • Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

- • Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

- • Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

- • Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

- • Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

- •

- •

- • If there is anything else you require from us to continue receiving our market communications, or prefer a different medium for access (e.g. publicly available password protected access on the Astor Ridge website), please do let me know.

- •

- • Otherwise, if you are more comfortable to deem consent by simply acknowledging receipt of this email, and continuing our trading relationship under our updated terms of business below, without registering your disapproval, we are happy to proceed on that basis.

- •

- • Many thanks,

- •

- • Chris

Trade Radar - Euro RV Dec 5th, James Rice @Astor Ridge

Trade Radar - 1

Spanish 9yr oversold, high coupon funds well… cheap vs 10y

Trade structure

Buy Spgb 5.15% Oct28

Sell Spgb 0.6% Oct 29

vs MMS

Trade level

Current: -1bp

Target -5bp

History

BBG 28s 29s vs MMS

Rationale

- The high coupon oct 28 is oversold in terms of anomaly

- The forward 9Y1Y forward (between the two bonds) now looks too low in the context of the yield curve

- The high coupon Oct28 funds positively relative to the LC on the run 10y, which could be tapped again in the new yr (issue size €19bln, prior 10y €21bln)

Spain anomaly curve fit

(* Yields adjusted for coupon by subtracting swap spread and adding z spread)

Spain Forward Curve

Unadjusted yields – looks more extreme when we compensate for coupon

Risks

- The oct28 as a high coupon less liquid bond stay offered

- The Oct29 stay bid as a benchmark over the year end

- The repo gets tight on the Spgb Oct29

James Rice

![]() image001.jpg@01D21F13.B69A4950">

image001.jpg@01D21F13.B69A4950">

UK: 14-16 Dowgate Hill, London ec4r 2su

US: 12 East 49th Street, Suite 10-125, NY, NY, 10017

Office: +44 (0) 203 - 143 - 4178

Mobile: +44 (0) 754 - 011 - 7705

Email: James.Rice@AstorRidge.com

Web: www.AstorRidge.com

This marketing was prepared by James Rice, a consultant with Astor Ridge. It is not appropriate to characterize this e-mail as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a trade recommendation. A history of marketing materials and research reports can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains opinions or recommendations, those opinions or recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the those who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of, and income from, any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

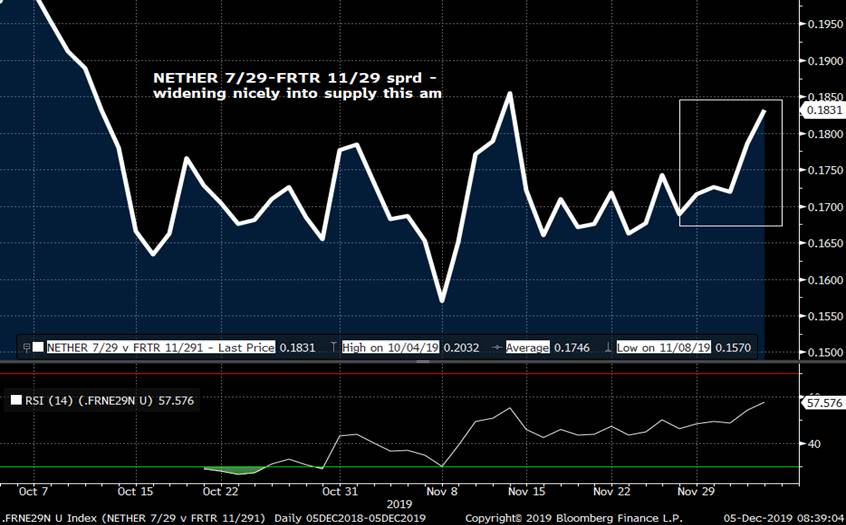

MICROCOSM: Quick Preview - SPGBs and FRTRs supply this morning...

- BUSY morning for EGBs supply with the following on tap:

- SPAIN taps their SPGB 0.25% 7/24, SPGB 0.6% 10/29 and SPGB 2.7% 10/48s for a modest Eur 3bn combined (about 29k RXH0s)

- FRANCE taps the FRTR 0.75% 5/28, FRTR 5.5% 4/29 and FRTR 4.0% 4/60s, also a modest 4.0-5.0bn for France (about 75k RXH0s)

- Broadly speaking, the aggregate risk we’re getting this morning is on the light side, however, it is Dec 5th and risk appetites are on the lighter side of normal. Add that to quiet Dec PSPP demand and spreads that were at/close to the year’s tightest to DBRs and we’re looking at a bit of a juggling act. Not sure whether the AFT’s decision to tap some more obscure off the run issues is much help, either, especially the high cpn FRTR 5.5% 4/29s.

- As you’ll have read by now, there’s a seasonality to OATs spreads to DBRs/NETHER, widening in December after bullish Oct/Nov cash flows drive a spread narrowing. January tends to be a busy month for OATs supply too, encouraging dealers and leveraged players to unwind OATs longs. We’ve seen a nice little widening of the NETHER 7/29-FRTR 11/29 spread into this morning’s supply – which will likely prompt a bit of short covering in OATs.

- We’ve seen a nice steepening in the belly of the SPGBs curve, the SPGB 4/26-4/28 sprd (boxed vs swaps) 6bps wider since the start of Nov. Looks a bit overdone to us.

We’ve also seen a nice cheapening of the SPGB 4/26-4/28-7/30 fly…

More to come…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796

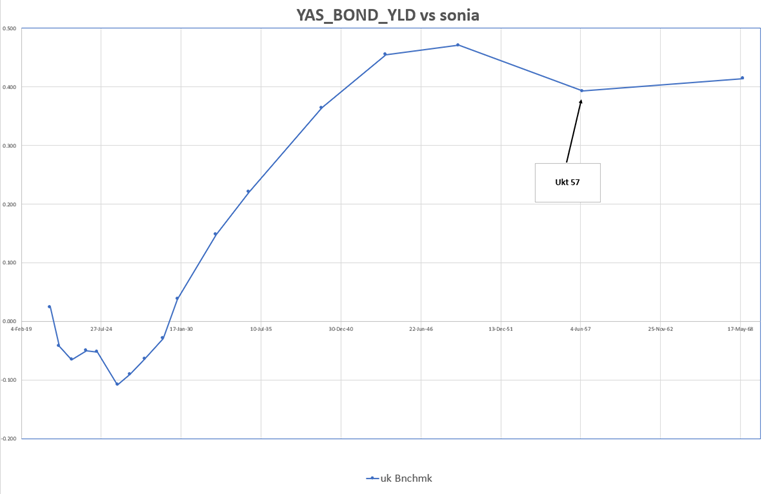

MICROCOSM: GILTS - 1T49s TAP - TRADES WE LIKE

- DMO Taps the UKT 1T49s this morning at 10:30 in £2bn, the last scheduled tap until March 17, 2020 (barring a revision to the current borrowing levels).

- Today’s tap takes the issue just above ~£15bn, which is about 2/3 through their auction cycle based on the size of the 1H47s (£24.4bn).

- If you’ve been reading our GILTS updates over the past couple weeks, you’ll know that we like these 1T49s here. The issue looks cheap on the curve to us (see charts below) and with a new UKT 2041 coming on Jan 21st, followed by a ultra-long conventional tap in mid-February, there will be ample RV motivation to overweight the 30yr point.

- From a more macro perspective, the 10-30s spread remains a fairly directional trade, steepening in a rally, however, the December 7th coupon payments are tilted towards the 15-30yr sector which has real money extending out the curve a tad early, front-running their cash flows. Of the £2,515bn in cash hitting the market, 53% of the cash (£1,343bn) will be paid to June and December gilts. While this cash flow is supportive, it’s market impact will be well behind us when the Brits hit the polls on Dec 12th, which is more than likely the reason these 1T49s continue to trade cheap on the curve.

- From a tactical perspective, there are two ways to play this – short-term and medium-term. From a short-term perspective, we’d advocate a more micro approach, buying the 1T49s vs 1H47s and 3T52s. Or, maintain a modest steepening bias - long 1T49 vs 3T52. Medium-term, the above-mentioned supply calendar suggests a long 1T49s vs 4Q40 and 1T57 fly makes a lot of sense and, as we can see from the chart below, we’re at a level that has proven a great entry level for this fly over the last year.

- Charts:

Inverse correlation of the sprd vs 4T30 yields was very high until breaking down in Aug/Sep. Correlation resuming now it seems…

UKT 1H47-1T49-3T52 fly looks cheaper than where 49s yields say it should be. Looks to be turning now…

UKT 4Q40-1T49-1T57 fly is back to a key entry level to get long 49s…

More to come…

Mark

![]() image003.jpg@01D58404.6834BD00">

image003.jpg@01D58404.6834BD00">

Mark Funsch

O: +44 (0) 203 - 143 - 4177

M: +44 (0) 789 - 996 - 4051

UK: 14-16 Dowgate Hill, London UK EC4R 2SU

US: 245 Park Ave, 39th Floor, NY, NY, 10167

This research was prepared by Mark Funsch. He is a consultant with Astor Ridge. A history of his marketing commentaries can be provided upon request in compliance with the European Commission’s Market Abuse Regulation. Astor Ridge takes no proprietary trading risk, has no market making facilities, and has no position in any security we discuss in this e-mail. The views in this e-mail are those of the author(s) and are subject to change, and Astor Ridge has no obligation to update its opinions or the information in this publication. If this e-mail contains recommendations, those recommendations reflect solely and exclusively those of the author, and such opinions were prepared independently of any other interests, including those of Astor Ridge and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Astor Ridge recommends that investors independently evaluate each issuer, security or instrument discussed herein, and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results.

You should not use or disclose to any other person the contents of this e-mail or its attachments (if any), nor take copies. This e-mail is not a representation or warranty and is not intended nor should it be taken to create any legal relations, contractual or otherwise. This e-mail and any files transmitted with it are confidential, may be legally privileged, and are for the sole use of the intended recipient. Copyright in this e-mail and any accompanying document created by Astor Ridge LLP is owned by Astor Ridge LLP.

Astor Ridge LLP is regulated by the Financial Conduct Authority (FCA): Registration Number 579287

Astor Ridge LLP is Registered in England and Wales with Companies House: Registration Number OC372185

Astor Ridge NA LLP is a member of FINRA/SIPC: CRD Number 282626

Astor Ridge NA LLP is a member of the National Futures Association (NFA): Firm ID Number 0499303

Astor Ridge NA LLP is Registered in England and Wales with Companies House: Registration Number OC401796